Zero-knowledge proofs, OpFi, AI... What narratives are worth watching beyond liquid staking?

TechFlow Selected TechFlow Selected

Zero-knowledge proofs, OpFi, AI... What narratives are worth watching beyond liquid staking?

5 DeFi narratives that could take off in early 2023 in a similar manner.

Written by: Thor Hartvigsen

Compiled by: TechFlow

Liquid staking derivatives (LSD) have seen explosive growth:

- $LDO +114%

- $RPL +89%

- $SWISE +128%

- $FIS +74%

- $SD +165%

Are you feeling FOMO? But don't buy at the peak of this narrative. Instead, we should identify the next emerging trends.

Here are five DeFi narratives that could take off in early 2023 in a similar fashion.

zk-EVM (and zk-rollups)

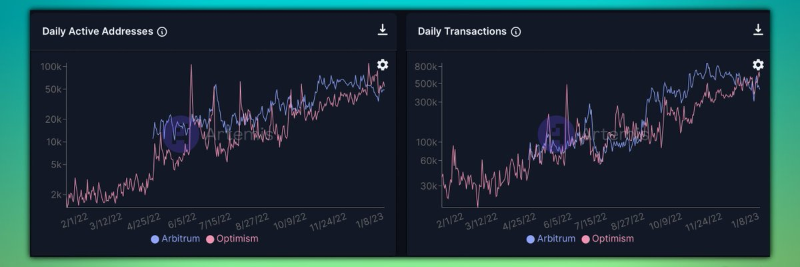

2022 was the year of Optimistic Rollups. Compared to alt-L1s, Arbitrum and Optimism rapidly grew in TVL and user dominance.

zk-EVM leverages zero-knowledge proofs and thus holds similarly strong scaling potential.

Recent hype around the upcoming launch of zkSync, along with their ability to raise nearly $500 million in funding during a bear market, clearly reflects the excitement surrounding this space.

I'm personally watching closely:

-

The incoming ecosystem (new project launches, potential airdrops, and protocol migrations);

-

zkSync token release;

-

Developments across other zk-EVMs.

OpFi (Decentralized Options in DeFi)

GMX led the wave of decentralized perpetual trading in 2022. Many native tokens in this sector saw gains exceeding 300% last year.

Decentralized options are inherently more complex but may see significant adoption in 2023.

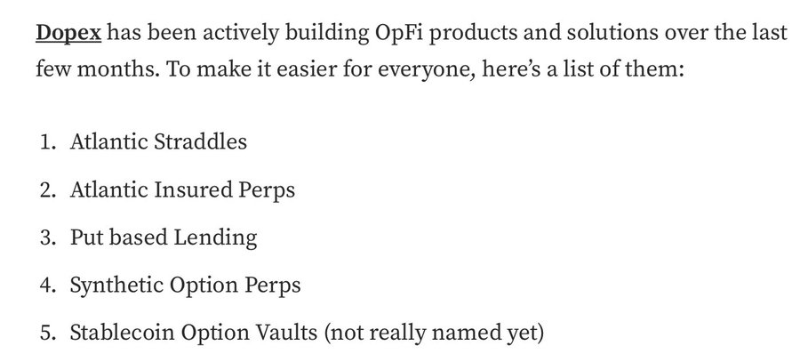

"OpFi" refers to using options as backend infrastructure for DeFi, rather than as TradFi-like market trading instruments.

OpFi = option-driven DeFi infrastructure. The Dopex team is actively developing multiple OpFi products.

Stablecoins

Stablecoins remain one of the largest sectors in crypto. Decentralized stablecoins were the biggest narrative in the first half of 2022, but an unfortunate event paused the entire story.

In the coming years, stablecoins will likely continue evolving. Thus, there's significant upside potential for protocols capable of launching robust, liquid stablecoin solutions.

These protocols include:

✥ Fraxfinance: Strong liquidity due to its $CVX position and a suite of DeFi products like Fraxlend and frxETH. $FXS is worth watching in 2023.

✥ CurveFinance: Upcoming $crvUSD — uses LLAMMA (Lending-Liquidating AMM algorithm) with over-collateralized liquidity pools.

✥ Aave: Upcoming $GHO (also over-collateralized).

✥ Redactedcartel: Upcoming $DINERO (over-collateralized by ETH LSD). They've also launched their own $ETH LSD.

✥ Dopex: Upcoming $dpxUSD (collateralized by $rDPX and $dpxETH from their upcoming $ETH LSD).

Real Yield

Although I believe this term was overused in 2022, GMX’s success proves that those who stayed in crypto genuinely care about tokenomics—token inflation, fees, revenue models, etc.

If the broader market remains bearish, protocols with real demand, actual income, and token value accrual may outperform. The main issue with this model (fee-distributed revenue) is that it closely resembles securities—potentially attracting regulatory scrutiny.

AI

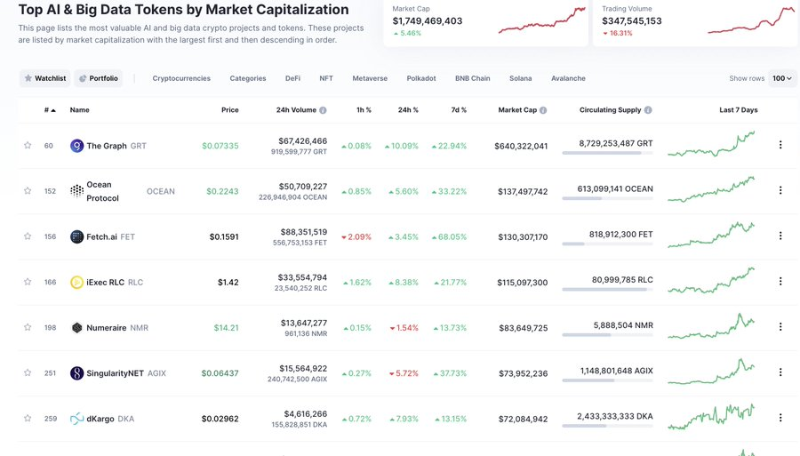

I wasn’t a fan of the late-2021 metaverse bull run, and I similarly believe many AI tokens are approaching price ceilings.

However, this technology is still in its infancy, and given crypto’s accessibility, this narrative is worth monitoring closely.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News