NFTPerp: When blue-chip NFT investing meets perpetual contracts

TechFlow Selected TechFlow Selected

NFTPerp: When blue-chip NFT investing meets perpetual contracts

Whether NFTPerp can lead NFTFi? Perhaps only time will tell.

By Aya

Attempts around NFTFi have never ceased since the birth of NFTs. Today, we’ve already seen impressive products like BendDAO emerge. Now, someone has once again strapped perpetual contracts—those love-hate instruments—onto the NFT bandwagon. How does this product work? Let’s take a closer look.

Understanding NFTPerp

In the crypto world, perpetual contracts are among the most well-known concepts. Regardless of bull or bear cycles, both centralized (CEX) and decentralized exchanges (DEX) offering derivatives continue to generate substantial fees from perpetual trading. Market participants can freely go long or short on cryptocurrencies and indices using perpetual contracts.

As one of the key breakout sectors in this bull market, NFTs have drawn significant attention both within and beyond the crypto community, leading to the emergence of numerous NFTFi projects.

NFTPerp is one such project. It combines NFTs with perpetual contracts, opening up a new way for NFT traders, collectors, funds, and other ecosystem participants to engage with the NFT market.

Built on Arbitrum, NFTPerp allows users to use ETH as collateral to go long or short on the floor prices of blue-chip NFTs. The protocol relies on Chainlink oracles for price feeds and uses a vAMM (virtual automated market maker) as the foundation for futures trading.

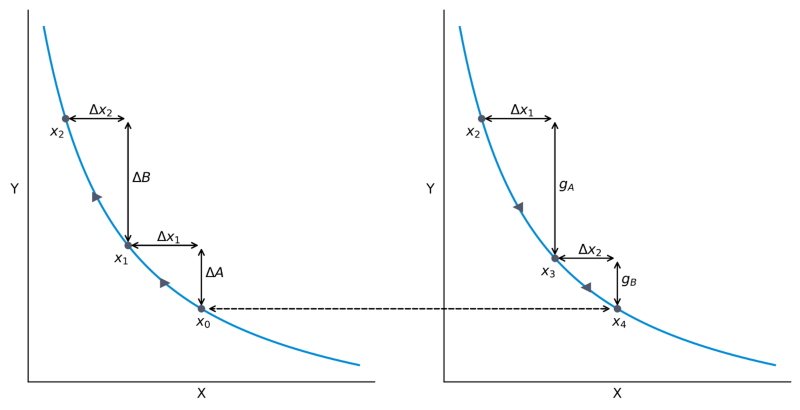

The key difference between vAMM and traditional AMM is that vAMM doesn’t require actual liquidity pools. Traders’ collateral is held securely in smart contracts, and all profits and losses are settled directly within the collateral vault. One trader’s loss becomes another trader’s gain, while pricing is determined by a dynamic curve based on open interest, minimizing slippage as much as possible.

Like many other NFTFi projects, NFTPerp focuses on mainstream blue-chip NFTs, offering investors who can’t afford full ownership a speculative opportunity. This aligns perfectly with DeFi’s core principles—equal access and low entry barriers.

For institutions and whales, the platform also enables hedging and neutral strategies, injecting further vitality into the market. As the team stated in their blog: “The introduction of so many new financial products into the NFT market will drive a resurgence in bullish sentiment and re-attract liquidity, potentially sparking another summer-like boom similar to DeFi Summer.”

Team Background and Funding

On November 25, NFTPerp announced it had raised $1.7 million in seed funding. Participating investors include Dialectic, Maven 11, Flow Ventures, DCV Capital, Gagra Ventures, AscendEX Ventures, Perridon Ventures, Caballeros Capital, Cogitent Ventures, Nothing Research, Apollo Capital, and Tykhe Block Ventures.

Project Analysis

The idea of turning blue-chip NFTs into tradable contracts isn't new—CEXs like MEXC have already taken initial steps. However, NFTPerp, built on Arbitrum, leverages Layer 2's low gas fees and fast transaction speeds to deliver a smoother, more decentralized speculation experience for blue-chip NFTs.

Whether NFTPerp can lead the next wave of NFTFi—and even the broader NFT market—remains to be seen.

Project Links

Twitter: https://twitter.com/nftperp

Website: https://nftperp.xyz/

Discord: https://discord.com/invite/m8DGMgfhMg

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News