SBF Lands on the Cover of Fortune Magazine: The Next Buffett?

TechFlow Selected TechFlow Selected

SBF Lands on the Cover of Fortune Magazine: The Next Buffett?

U.S. business magazine Fortune interviewed SBF on August 2 exclusively, titling the feature "The Next Buffett."

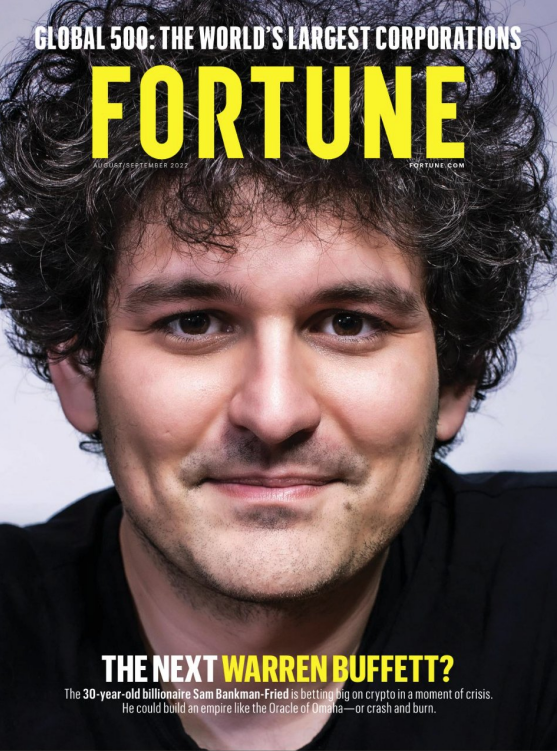

On August 2, Fortune, one of the world's most influential business magazines, published an exclusive interview with FTX founder Sam Bankman-Fried (SBF), featuring him on its cover with the headline "The Next Buffett."

U.S. business magazine Fortune interviewed SBF on August 2, titling the feature "The Next Buffett" and placing him on the cover—a symbolic recognition that FTX has become the most influential crypto company globally, and that SBF is now a defining figure in the industry.

Below is a summary of the interview:

The Afro-Wearing Nerd + White Knight

Fortune describes SBF as a kind, disheveled nerd with an afro who enjoys playing League of Legends (LOL) and spinning fidget spinners—traits that make him hardly look like the most powerful person in the cryptocurrency industry. Yet beneath this unassuming exterior, SBF founded Alameda Research, one of the most successful crypto quant firms, and FTX, hailed as the “best crypto derivatives exchange ever built.”

Besides being a crypto billionaire (worth approximately $11.5 billion), SBF has recently taken on a new role: the white knight of the crypto industry, rescuing several startups facing liquidation crises.

Liquidation Is Positive; Bitcoin Could Fall to $10,000

SBF admitted he foresaw the bear market but didn’t expect it to unfold through massive liquidations—and certainly not this badly. Still, he believes two-thirds of the crypto downturn stems from global macroeconomic conditions, while only one-third comes from internal issues within the crypto market itself.

"The worst is behind us. There could still be more liquidations, but nothing as bad as before. I think this bear market has been a healthy shakeout for the crypto industry. People will rethink how they value assets and become more grounded."

While he believes the worst is over, SBF sees macroeconomic factors as the bigger uncertainty.

He estimates that if the Nasdaq drops by 25% and the Federal Reserve raises interest rates to 7%, the global economy could face about two and a half years of recession.

If that happens, Bitcoin could fall to between $10,000 and $15,000. Another wave of liquidations might follow.

When Others Are Fearful, I Am Greedy?

It’s well known that SBF has recently invested in several struggling companies, including BlockFi and Voyager Digital. Fortune views these moves as embodying Warren Buffett’s famous maxim: “Be fearful when others are greedy, and greedy when others are fearful.”

SBF explained his equity acquisition strategy:

His top priority is whether users can recover their assets. The second consideration is whether the deal can prevent a chain reaction of liquidations. Only third does he consider whether FTX receives a “decent return” from the transaction.

"Our goal isn't to make shocking acquisitions. The logic here is to conduct reasonable deals—even slightly unfavorable ones we can afford."

A senior industry insider, who requested anonymity, told Fortune that SBF’s generosity has earned him significant goodwill—and many personal favors.

Beyond such expectations, SBF explained why he chooses to be so generous: trust.

Lack of trust creates huge transaction costs—an early lesson SBF learned when starting out in business.

"A big part of it comes down to trust.

In my past trading experiences, I hated worrying about whether the other party would screw me over in 20 different ways I hadn’t anticipated. Without trust, deals simply can’t happen, right?"

Therefore, in every acquisition, SBF sets clear standards for fair cooperation, signaling to counterparties that FTX won’t play dirty tricks behind the scenes.

"Think about what benefits both sides, then we can start discussing how to split the pie together."

An Atypical Crypto Hero

Crypto communities often idolize heroes—figures like Satoshi Nakamoto or Binance founder Changpeng Zhao.

While SBF appears poised to join their ranks, he does things typical “crypto bros” wouldn’t—such as donating to Joe Biden during the 2020 U.S. election.

Fortune notes that SBF is now a leader in the crypto space—but his actions may also alienate some true believers in the community.

Unlike crypto heroes who entered blockchain to “change the world” or “defy governments,” SBF got into crypto purely because he saw a profit opportunity. For him, altruism means earning as much money as possible and giving it back to society.

Fortune points out that unlike many in the crypto world, SBF doesn’t own yachts, supercars, or throw lavish parties. Instead, driven by effective altruism, he has pledged to donate the majority of his wealth.

"Let me put it this way: I want to do the right thing for those who truly believe in this industry. I believe in blockchain because the technology is genuinely useful and can concretely improve the world.

I think I represent a certain type of believer in this space—people who may have different perspectives on the industry, but share a fundamental belief in its potential."

Could the Crypto Worldview Lead to Greater Chaos?

The next question gets serious—and philosophical.

Fortune argues that today’s world is “on fire”: rising authoritarianism, climate crisis, and more. In such times, some form of collectivism is needed—where individuals prioritize collective good and make decisions accordingly.

Yet the crypto community is rooted in individualism and libertarian ideals—prioritizing self-interest.

Fortune poses the question: Could the rise of cryptocurrency lead to a decline in civil order?

SBF finds the question odd. He believes both collectivism and individualism can resist authoritarianism. Collectivists oppose authoritarianism in pursuit of group welfare, while the individualism represented by crypto fundamentally despises authority—which, in a way, also resists authoritarianism.

SBF believes a major problem in the modern world is domination and oppression of other groups—something the crypto community inherently opposes. At the same time, however, we must actively engage with and address global challenges.

"You have to participate. Cryptocurrency might solve part of the problem, but it’s not the whole answer. It’s unlikely that any single tool can fix everything."

Can Bitcoin reach $100,000 within two years?

At Fortune’s request, SBF concluded by analyzing future price trajectories for Bitcoin and Ethereum.

Ethereum is hard to predict. With the upcoming Merge, volatility will increase, but SBF cannot determine which direction prices will move.

Compared to Ethereum, Bitcoin is easier to forecast—provided macroeconomic conditions don’t deteriorate further.

SBF believes Bitcoin is gradually recovering from the large-scale liquidations, and the end of liquidations is a major bullish signal.

Additionally, regulatory frameworks around Bitcoin are becoming clearer—an external positive shock. If regulators deliver even better news next year, and if luck holds, Bitcoin could indeed hit $100,000.

"Regulation is an external shock, and it’s bullish for Bitcoin. So if there’s major positive regulatory news next year, and if we’re lucky, we might actually see $100,000 next year. But you know, it’s hard to predict.

But if you told me at year-end that Bitcoin might reach $35,000 next year, I’d say that’s definitely possible."

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News