NFTFi Sector Overview: Which Protocols Are Worth Watching?

TechFlow Selected TechFlow Selected

NFTFi Sector Overview: Which Protocols Are Worth Watching?

NFT finance is one of the narratives I am extremely bullish on, and recent Sudoswap is just the beginning.

Author: BurstingBagel

Compiled by: TechFlow

NFT finance is one of the narratives I am extremely bullish on, and recent developments like Sudoswap are just the beginning. Below, I’ve compiled the NFT financial projects I’ve been watching over the past few months. To keep things organized, I’ll categorize them into four distinct groups:

- Lending;

- Liquidity;

- Derivatives;

- Valuation;

NFT Lending

Most existing NFT financial products today are NFT lending and borrowing markets. These platforms facilitate loans through different models: peer-to-peer (P2P), pool-to-peer (P2Pool), and protocol-to-peer (P2Protocol).

Peer-to-Peer (P2P)

NFTFi and Arcade are peer-to-peer NFT lending markets where lenders and borrowers negotiate loan terms individually, giving lenders greater flexibility in risk tolerance.

Metastreet goes further by providing liquidity bootstrapping and scaling solutions for P2P NFT-backed lending platforms. They transform P2P NFT-backed loans into total-return debt pools, making it easier for NFT owners to access financing.

Pool-to-Peer (P2Pool)

BendDAO, Drops DAO, PineLoans, and ZhartaFinance (no token issued) use a pool-to-peer lending model, where lenders deposit funds into pools that any NFT holder can borrow against.

The P2Pool model generally offers better capital utilization since borrowers gain instant liquidity instead of waiting for individual lenders. This means higher returns for lenders but also increased risk exposure.

Protocol-to-Peer (P2Protocol)

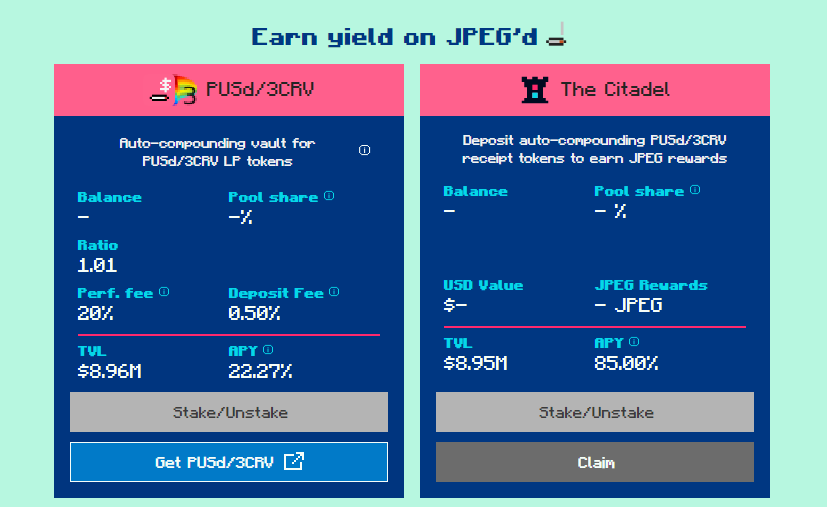

JPEGd is a protocol-to-peer NFT lending platform. On JPEG Punk, BAYC, MAYC, and EtherRock holders can mint the platform’s stablecoin $PUSD at low interest rates using their NFTs as collateral, with attractive APRs available on Curve.

Unlockd Finance (no token issued) is a cross-chain, capital-efficient NFT lending market. They calculate a conservative base LTV for NFTs used as collateral but allow users to appraise their NFTs to increase the LTV up to 85%.

SpiceFinance (no token issued) is an aggregator and liquidity protocol for NFT lending markets. Users can allocate their capital, set a risk threshold, and Spice will automatically route it to optimally risk-adjusted lending pools.

Cyan・BNPL and Pawn NFTs are introducing down payment mechanisms, allowing users to pay an initial deposit and repay the balance within three months—making NFTs and metaverse assets accessible to more people.

NFT Liquidity

NFT liquidity is my most exciting niche within NFT finance. NFTs are inherently illiquid assets, creating challenges around composability and price discovery.

Here are some projects working on NFT liquidity:

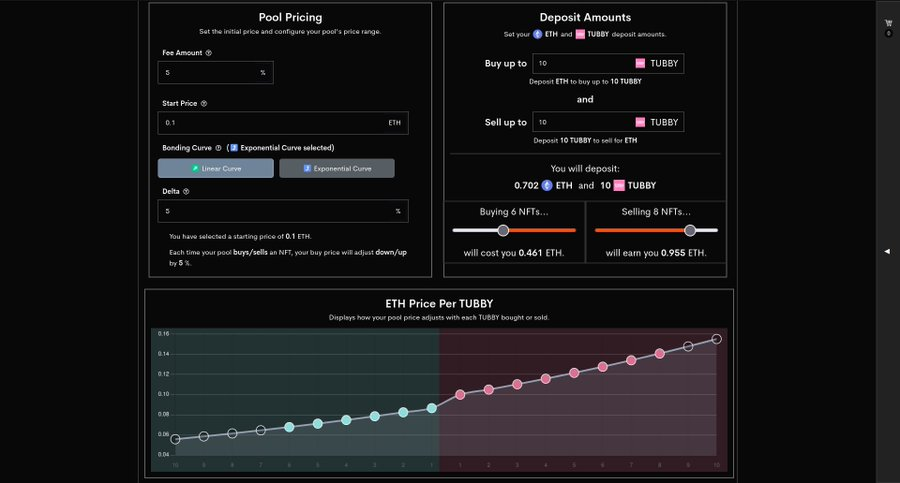

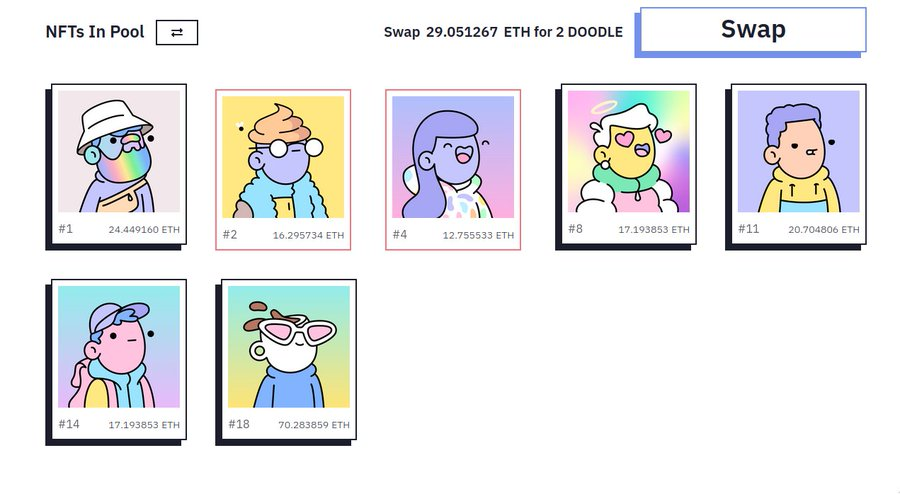

Sudoswap is paving the way for NFT financial products. It is a fully on-chain, efficient decentralized NFT marketplace. What sets Sudoswap apart is its customizable bonding curves powered by liquidity providers, enabling buyers and sellers to trade seamlessly.

AssetMerge (no token issued) is an AMM that enables instant sales of any NFT, uniquely pricing each NFT based on its non-fungible nature and general demand for the collection. Additional features include limit orders and flash swaps to arbitrage NFTs across markets.

DanuFinance (no token issued) enables P2P trading of NFTs with added liquidity pool functionality, such as Sudo—where sellers can instantly access liquidity. Traders can also place targeted buy orders for specific feature sets.

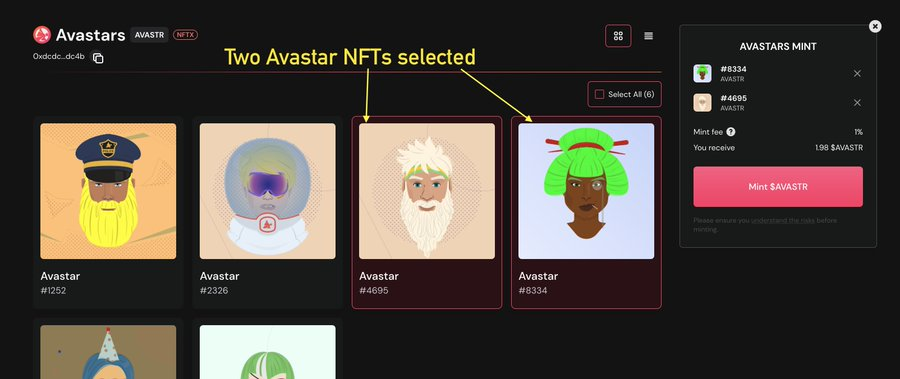

NFTX was a pioneer in creating instant liquidity for NFTs. Instant liquidity is achieved by depositing underlying NFTs into NFTX vaults, in return for which depositors receive ERC-20 tokens that can be traded on decentralized exchanges.

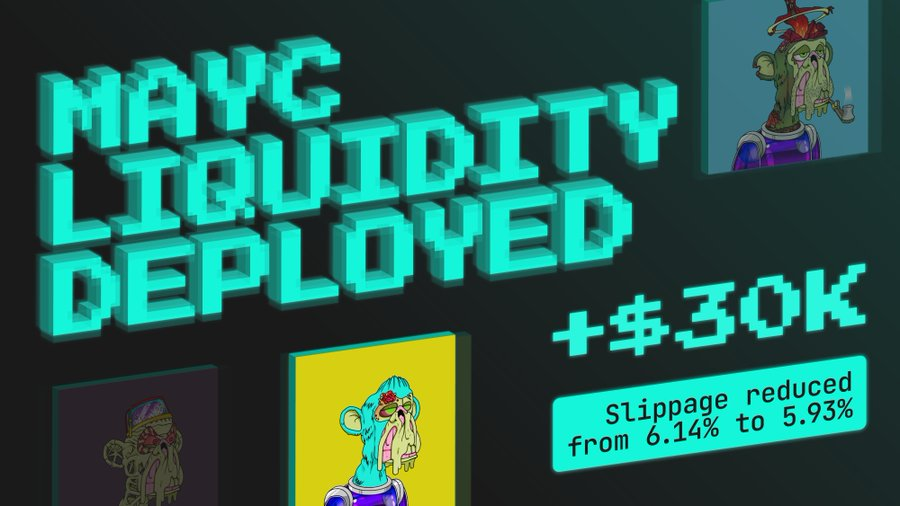

FloorDAO enhances the liquidity of NFTX vaults, resulting in better yields and tighter spreads. This is achieved through OlympusDAO-inspired bonding and protocol-owned liquidity. They plan to expand support to Sudoswap in the coming months.

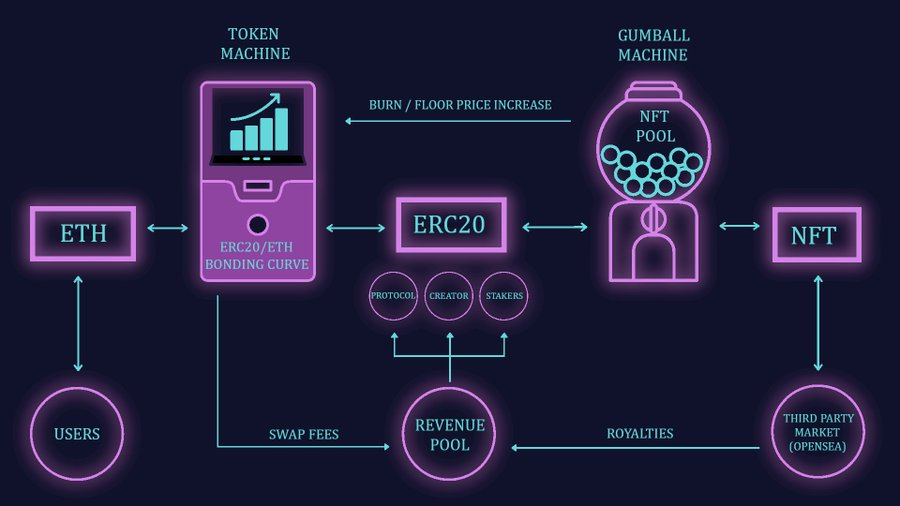

GumBallProtocol (no token issued) is a launchpad for new NFT collections and a liquid NFT marketplace. Users can instantly sell, swap, or borrow against their NFTs—enabled by their Gumball token.

Protecc (no token issued) aims to become the go-to market maker in the NFT space. They plan to boost NFT liquidity through partnerships with other NFT financialization protocols such as Abacus and Blur.

NFT Valuation

When each NFT consists of hundreds of unique traits, how do you determine its value? Accurate NFT valuation will unlock greater composability and capital efficiency across NFT financial products.

Abacus (no token issued) is building a valuation system for NFTs. Designed for maximum composability, it drives value accrual to the $ABC token.

Guzzolene (no token issued)—if you’re familiar with Curve and Convex, then Guzzolene is to Abacus what Convex is to Curve. That’s the simplest way to put it.

NFT Derivatives

Believe it or not, contracts, options, and credit default swaps are coming to NFTs. Here's the current state and future direction of NFT derivatives:

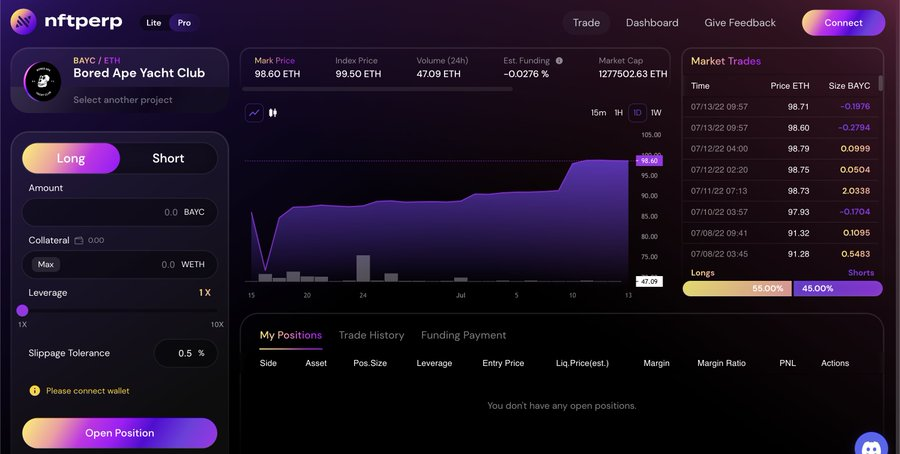

Nftperp (no token issued), does exactly what the name suggests. It offers perpetual contracts for NFTs on Arbitrum. Finally, there’s a simple way to go long or short on NFTs and hedge positions.

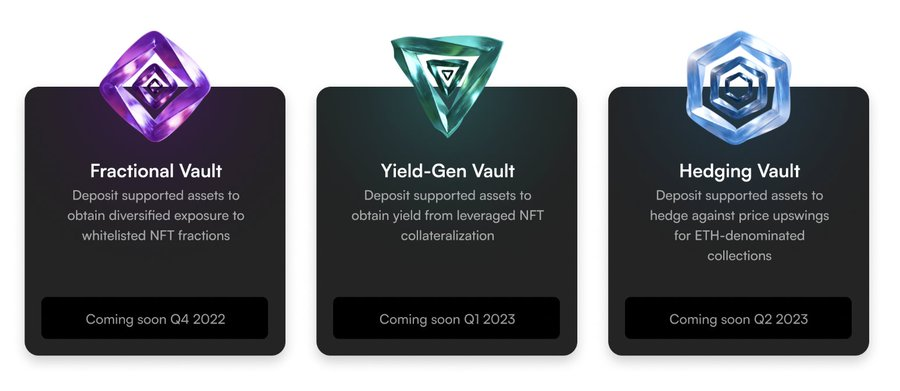

Insrtfinance (no token issued) provides sophisticated NFT financing strategies, unlocking billions of dollars trapped in illiquid NFTs with one click. They plan to offer structured products such as NFT infrastructure indices.

MimicryProtocol (no token issued) is a prediction market for NFTs operating on a global collateral pool, enabling infinite liquidity and zero slippage.

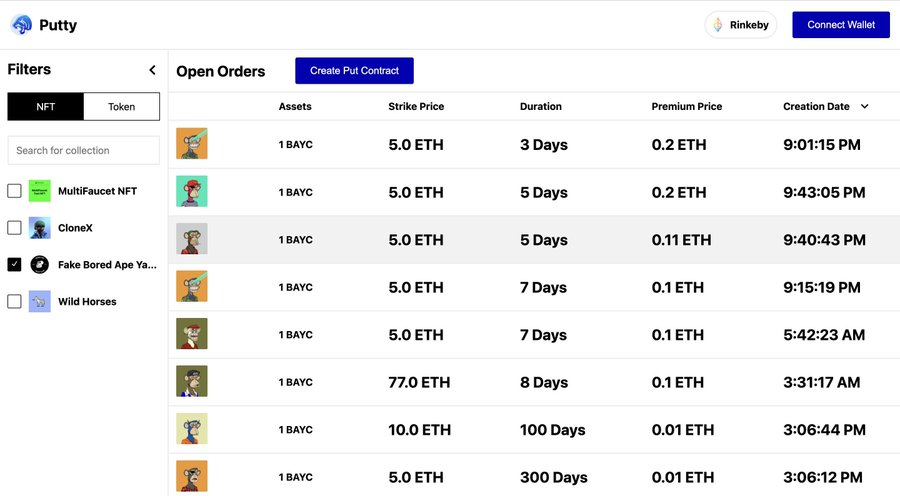

Puttyfi is a peer-to-peer options market where users can buy/sell options on single assets or baskets of NFTs and ERC20 tokens. The “insurance” provided by put options allows users to protect their NFT holdings.

jpeX Finance (no token issued) is another on-chain NFT options exchange and a winner of the 2022 hackathon. Users can speculate on NFTs or hedge expensive NFT exposures by trading call and put options.

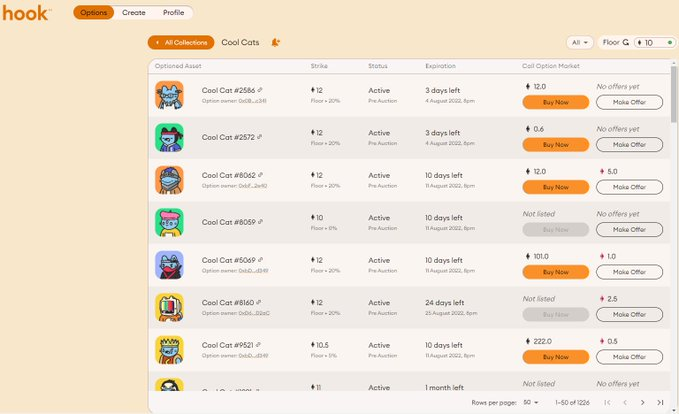

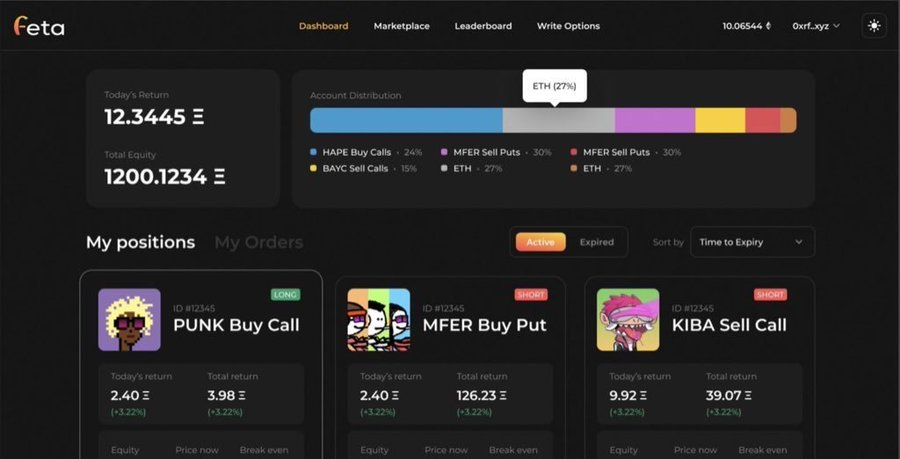

HookProtocol and FetaMarket (both no token issued) are two additional on-chain NFT call options markets. NFT holders can write and sell covered call options to earn premium income on their holdings, while traders can buy calls to bet on rising collection values.

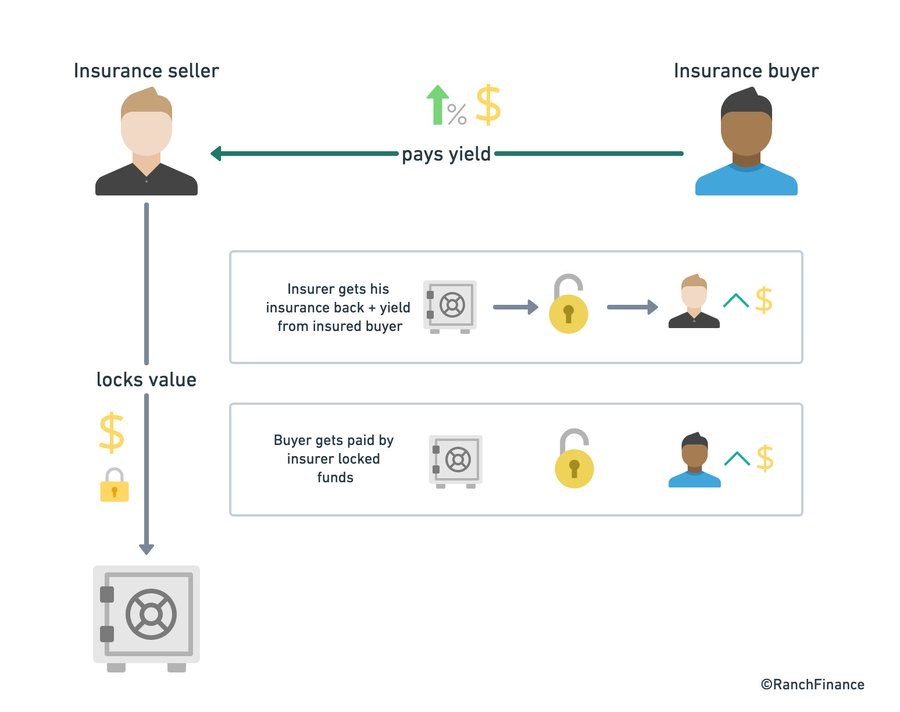

RanchFinance (no token issued) lets you go long or short on bundles of NFT-backed loans. Users can provide insurance for yield generation or purchase insurance against loan bundles in case of defaults. They also have a tranching rating system (A, B, C) for NFT loan bundles.

GradientFinance (no token issued) offers credit derivatives for NFT-backed loans. Lenders can amplify their loan yields, hedge against default losses, cap bad debt risk, and even speculate on others’ loans.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News