SBF's Blueprint: Buy the Dip, March Globally, Expand Operations into "Securities and Crypto Lending"

TechFlow Selected TechFlow Selected

SBF's Blueprint: Buy the Dip, March Globally, Expand Operations into "Securities and Crypto Lending"

You can imagine, if FTX continues at this pace of development, who could possibly keep up?

Amid the crypto market's liquidation crisis, FTX founder Sam Bankman-Fried (SBF) has once again taken center stage due to his efforts to "bail out other institutions." Some have dubbed him SBFed—the de facto central bank of crypto—while others believe he is simply expanding opportunistically at bargain prices. Bloomberg recently mapped out SBF’s “crypto empire,” detailing both his existing investments and potential future moves.

The bear market hasn’t slowed FTX down. In June alone, FTX completed two acquisitions: Canadian exchange Bitvo and U.S. securities broker Embed. Additionally, FTX has stepped in as the crypto market’s “lender of last resort,” extending significant credit lines to BlockFi and providing large loans to rescue Voyager Digital—even though Voyager ultimately filed for bankruptcy.

Overall, SBF has set aside approximately $1–2 billion in lending capacity for crypto firms, aiming to halt the spread of the liquidation crisis and protect the broader industry and retail investors.

SBF’s Crypto Empire

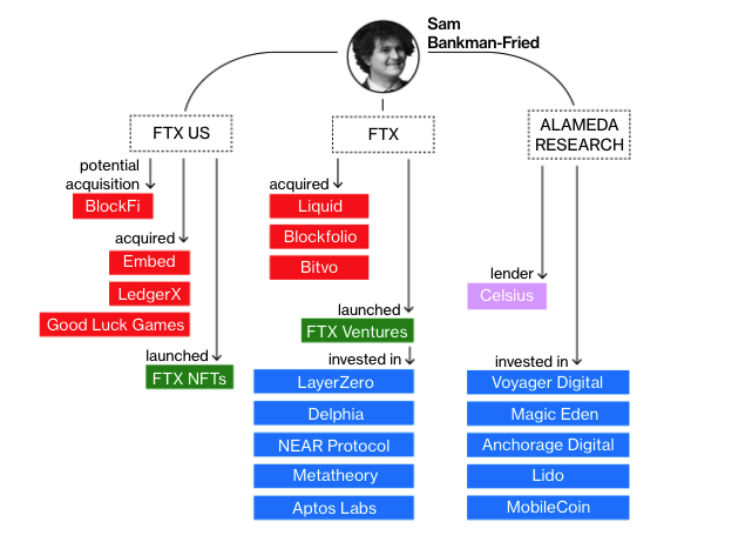

Bloomberg outlined the current investment and acquisition portfolio under SBF’s three main companies: FTX, FTX US, and Alameda Research.

FTX

The FTX exchange has acquired Japan’s Liquid, Canada’s Bitvo, and Blockfolio, using these deals to expand into Japanese and Canadian markets.

On June 3, FTX announced the launch of its compliant Japanese exchange, FTX Japan, and stated it would enter the Canadian market after completing the Bitvo acquisition. Notably, FTX has already launched FTX Australia and FTX Europe, giving it a truly global footprint.

In mid-2020, FTX acquired Blockfolio, a portfolio-tracking app with nearly 6 million global users that allows integration with exchanges to monitor account profits and losses, real-time cryptocurrency prices, and the latest market news. After the acquisition, it was rebranded as the FTX App, with added wallet and trading features such as dollar-cost averaging and fixed-income products.

Additionally, FTX Ventures, launched by FTX, has invested in several blockchain protocols, including LayerZero, Delphia, NEAR Protocol, Metatheory, and Aptos Labs.

FTX US

FTX US is FTX’s regulated exchange operating in the United States. Initially offering only spot trading, it began providing certain users with access to securities trading after acquiring LedgerX and Embed.

Embed Financial is a regulated securities brokerage firm that handles securities custody, trade execution, and clearing, and is also a member of the Financial Industry Regulatory Authority (FINRA).

LedgerX was originally a regulated U.S. derivatives exchange holding three Commodity Futures Trading Commission (CFTC) licenses: DCM (Designated Contract Market), SEF (Swap Execution Facility), and DCO (Derivatives Clearing Organization).

On May 19, FTX US launched “FTX Stocks,” offering trading services for hundreds of U.S.-listed securities, including common stocks and ETFs—though currently available only to U.S. residents. Notably, unlike traditional brokers that charge commissions, FTX US offers commission-free brokerage accounts (though transaction fees still apply), free market data, and free company fundamental data.

Alameda Research

Alameda is a well-known quantitative fund in the crypto space, managing over $1 billion in assets and averaging around $10 billion in daily derivatives trading volume. Beyond investing in crypto startups, it is also a prominent market maker.

Its investment scope is highly diversified, spanning crypto institutions, DeFi protocols, crypto wallets, and more. Bloomberg listed several startups backed by the fund, including Voyager Digital, Magic Eden, Anchorage Digital, Lido, and MobileCoin.

SBF’s crypto empire – Source: Bloomberg

Is SBF a philanthropist or an opportunist? Perhaps both!

Following the collapses of TerraUSD, Celsius, and Three Arrows Capital, the crypto market experienced its own Lehman moment. SBF has publicly stated multiple times that he feels a responsibility to prevent further contagion. He then took two major actions: providing Voyager Digital with $480 million and granting BlockFi a $400 million revolving credit facility.

According to Bloomberg, SBF has been consistently buying low throughout this year:

1. 2022/02/02: FTX acquired Japan’s regulated exchange Liquid, later renamed FTX Japan

2. 2022/03/22: FTX US acquired Good Luck Games, integrating it into FTX Gaming

3. 2022/05/02: SBF purchased $648 million worth of Robinhood shares (~7.6%)

4. 2022/06/17: FTX acquired Canadian exchange Bitvo, entering the Canadian market

5. 2022/06/17: Alameda extended approximately $485 million in loans to Voyager Digital

6. 2022/06/22: FTX US acquired Embed to enable FTX Stocks service

7. 2022/06/30: FTX US provided BlockFi with a $640 million loan, $240 million of which can be converted into equity

The outcome of the Voyager Digital loan appears negative, as the company eventually declared bankruptcy. Regarding this, SBF explained that the situation unfolded too quickly—FTX had only two days, not months, for due diligence.

“We had only two days, and our intention was to protect user assets—not to prop up Voyager’s business.”

In contrast, the loan to BlockFi turned into a win-win for both SBF and BlockFi users—even competitors agree.

Mauricio Di Bartolomeo, co-founder of Ledn, said:

“SBF could end up acquiring this $3 billion-valued company for just pennies on the dollar, which would be beneficial for FTX, BlockFi users, and even the entire industry.”

Di Bartolomeo added that regardless of whether the final outcome is an investment or full acquisition, it benefits FTX US. It strengthens brand reputation, attracts new users, and allows SBF to expand into the “crypto lending” sector.

To supporters, SBF’s actions align with his long-standing persona: altruism.

They believe that during the crypto industry’s darkest hours, SBF naturally steps forward. But to others, SBF is merely taking advantage of the chaos, using the fire sale opportunities to expand his empire—much like legendary investor Warren Buffett or banker J.P. Morgan did in past financial crises.

Yet these two narratives may not be mutually exclusive.

In a recent interview with CNN, SBF stated that while FTX is willing to lend to other companies and draw a line under the crisis, it isn’t doing so out of charity—and therefore must conduct careful evaluations.

FTX’s criteria focus on identifying companies with “solid business fundamentals” that are only temporarily facing liquidity issues. By providing targeted loans, FTX can protect users and preempt systemic collapse.

One thing is clear: SBF exercises strong capital discipline.

Investment strategy analyst Lyn Alden noted that SBF managed operations prudently during the bull market, focusing on profitability rather than unchecked growth.

“Other companies now face staffing pressures and raised funds unnecessarily in the past, allowing SBF to buy low when others face liquidation crises.”

Peer View: The Largest Crisis Financier in the Industry

SBF revealed that his team has evaluated around 10 deals, including Terra and Celsius—but walked away from both. Besides BlockFi and Voyager, he confirmed lending to other unnamed companies.

Based on media coverage and peer assessments, SBF’s influence appears to be growing rapidly. Some in the crypto industry say Alameda Research has become a powerful venture investor.

According to M&A advisory firm Architect Partners, FTX and Alameda Research could become the largest providers of crisis financing in the crypto sector in the second half of 2022. SBF’s expanding influence may also reduce competition within the crypto market.

“Just imagine—if FTX continues at this pace, who can keep up?”

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News