Ways to Unlock Capital Efficiency—A Closer Look at NFT Collateral Lending Protocols

TechFlow Selected TechFlow Selected

Ways to Unlock Capital Efficiency—A Closer Look at NFT Collateral Lending Protocols

Financialization will be one of the strongest trends for NFTs this year.

Author: Nicole Cheng (OFR Investment Manager)

Advisor: JX (OFR Partner)

Note: Article written on June 6, 2022

Over the past year, we have witnessed explosive growth in the NFT space. However, an undeniable fact has also emerged: the more NFTs one accumulates, the lower the liquidity of their portfolio becomes. As NFT technology spreads and novel applications emerge, demand for NFT financialization is growing stronger to maximize capital efficiency.

In reality, NFTs are illiquid assets, much like real estate. In the physical world, property is often used as collateral for loans. Imagine NFT-backed lending as analogous to mortgage loans—users can borrow against these illiquid assets by pledging them as collateral. The medium enabling this process is NFT collateral lending protocols. This article focuses on such protocols, particularly their pricing mechanisms and lending models for different types of participants.

To qualify as collateral, NFTs must achieve sufficient consensus on value and be widely perceived as unlikely to depreciate rapidly. This requires both high trading volume and strong reputation from the creators—both are indispensable. Widely accepted collateral in the market includes CryptoPunks, BAYC, MAYC, Azuki, and Doodles—so-called 'blue-chip' NFT collections. If we compare these blue-chip NFTs to mortgages, they represent central cities, with the rarest ones equivalent to luxury neighborhoods within those cities.

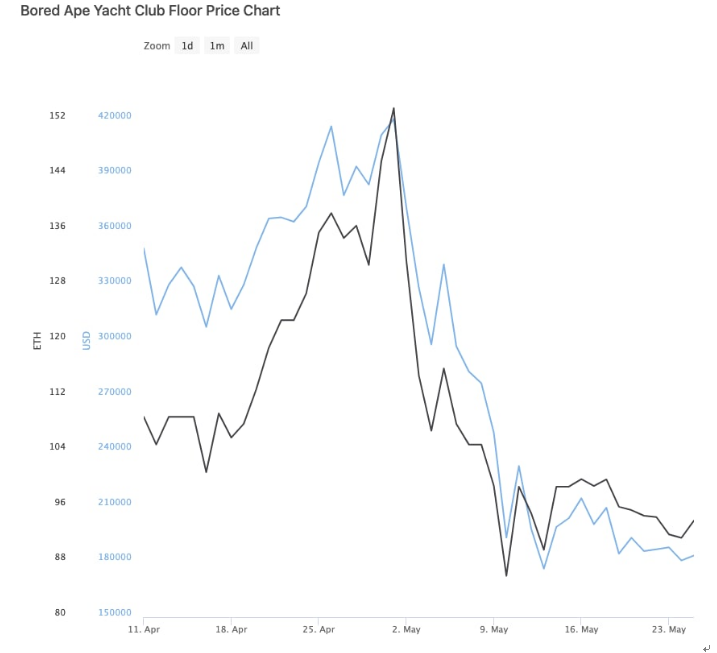

Yet NFTs are highly volatile assets—even “blue-chip” collections can experience dramatic value fluctuations. Before the launch of Otherdeed, BAYC hit an all-time high in ETH terms, only to drop over 50% afterward. A key challenge when designing collateral lending protocols is: how to fairly price NFT collateral? Existing solutions include:

● Time-Weighted Average Price (TWAP)

Oracles like Chainlink publish time-weighted average prices based on sales data and floor prices, combining them into a composite valuation for NFTs. By averaging multiple data points over a set period, this model mitigates the impact of outliers and reduces the risk of manipulation.

However, using TWAPs for NFT valuation has clear limitations—it only works well for active markets with high trading volumes and resistance to oracle attacks. Capital efficiency is also relatively low, as protocols tend to set conservative loan-to-value (LTV) ratios to avoid risks during extreme market conditions.

Examples: BendDAO, JPEG'd, Drops DAO, Pine Protocol, DeFrag

● Peer Assessment

Peer assessment refers to users evaluating NFTs and predicting their value. This method applies to most NFT collections and does not impose the same quality constraints as TWAPs. Through incentive mechanisms—either individual or curated committee-based—peer assessment helps uncover NFT value and enables fair pricing of collateral. However, the cost of valuation via incentives is significantly higher than other methods, the process is less efficient, and outcomes may lack accuracy.

Examples: Taker Protocol, Upshot V1

● Liquidity Pool Pricing

One drawback of peer assessment is its inability to provide real-time NFT pricing. Liquidity pool pricing avoids this issue. Each NFT deposited into the protocol is actively traded by lenders within the pool, generating a constant spot price equal to the total ETH in the pool. Once a borrower locks an NFT into the pool, traders can deposit ETH up to what they believe is the NFT’s fair value. If the NFT is overvalued, traders risk losing ETH during public auctions; conversely, if undervalued, traders will fill the pool until it reflects the NFT’s true market value, profiting upon sale. By encouraging speculation on NFT pools, pricing becomes more accurate and balanced.

Example: Abacus

While the above examples do not fall under non-financial transaction loan protocols per se, these pricing mechanisms play a crucial role in determining maximum loan amounts and triggering liquidation events. Once NFT value is established, protocols can be categorized into two types based on participant structure.

● P2P Lending

This model theoretically supports all NFTs and makes it easier to assess potential NFT value. Assuming an open marketplace exists, lending protocols act as facilitators. On one hand, NFT holders can request loans under their desired terms; on the other, capital providers can browse the platform and choose whom to lend to. Once a loan offer is accepted, a contract is created—the collateralized NFT is transferred to a protocol-secured escrow account, while the loan amount and promissory note NFT are sent to the borrower.

Lenders and borrowers agree on loan terms such as duration, LTV ratio, and APR, which limits systemic risk since defaults only affect individual pairs, not the entire system. However, because mutual agreement is required, despite being flexible and customizable, this model suffers from lower liquidity and scalability.

Examples: NFTFi, Arcade, MetaStreet

● P2Pool Lending

Unlike “bid-and-ask” style loans that may never get matched, P2Pool operates on a “market decides” principle: pooling liquidity from lenders and distributing borrower-paid interest according to supply and demand dynamics. If a borrower defaults or falling prices trigger liquidation of the NFT collateral, the protocol auctions off the NFT, returning proceeds to lenders.

With P2Pool, borrowers gain access to significantly larger capital pools and receive funds instantly without waiting for lender approval. However, this also means loan terms depend heavily on oracle-provided price data. Since long-tail NFTs are more vulnerable to price manipulation, this method is generally limited to mainstream NFTs.

Examples: JPEG’d, DeFrag, BendDao, MetaLend, Pine, Drops DAO

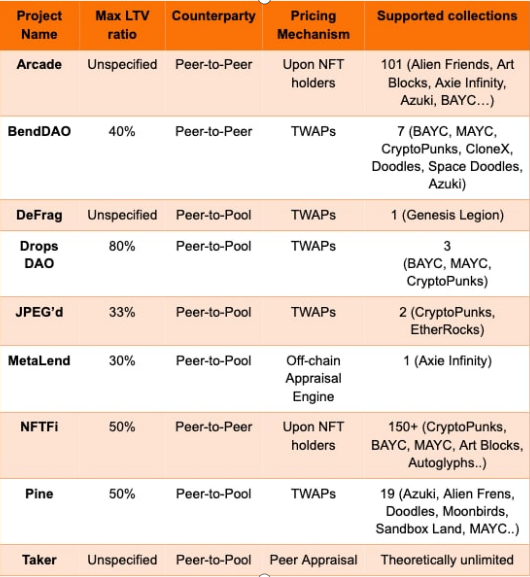

For easier comparison, I’ve compiled a table below outlining key metrics when evaluating NFT lending protocols. Some protocols cap the loan-to-value (LTV) ratio to reduce default risk, while more liquid and in-demand NFTs typically allow higher LTVs. Given that P2P protocols generally support a broader range of NFTs than most P2Pool protocols, there is a significant difference in supported collections between the two models. Notably, many protocols are continuously expanding their supported collections while refining pricing mechanisms and adjusting LTV ratios.

Despite ongoing debates around NFT collateral lending protocols, we remain optimistic that more NFT lending and financialization primitives will enter the space, offering collectors new ways to unlock greater value from their digital assets. Looking ahead, if one day these protocols lock up a sustainable volume of NFTs, they may even gain a degree of pricing power over the NFT market. The potential here remains largely untapped—and without doubt, financialization will be one of the strongest trends in the NFT space this year.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News