OFRfund Partner: The Chaos of NFT NYC, Revisiting NFT Value and Future Trends

TechFlow Selected TechFlow Selected

OFRfund Partner: The Chaos of NFT NYC, Revisiting NFT Value and Future Trends

Finding an opportunity for disruptive innovation is difficult; sometimes it's really just luck.

Written by: jxblock.eth, Partner at OFRfund

Part.1 Reflections on NFT NYC

1. Don't buy main conference tickets

The main conference was extremely disorganized:

There was no agenda posted onsite or online, so we had no idea about the daily speaking schedule or speaker backgrounds;

No ticket checks at the main venue—anyone could enter freely. Paying over $1000 for a ticket was a complete waste;

Too many speakers, resulting in a large volume of low-quality, inefficient presentations; panelists often didn’t know each other and hadn’t rehearsed.

In short, skip the main conference.

2. Too many side events—exhausting and ineffective

There were countless after-parties and side events hosted by projects and funds. The NFT community seems oblivious to the bear market winter—events were packed every night. It’s crucial to plan which ones to attend in advance. You don’t need to go to every event, and definitely avoid hopping between 3–4 events in one night (which I did). This drains your energy, leads to aimless socializing, and most attendees are the same people anyway.

Make sure to register for tickets or RSVP early, and arrive about 10 minutes before start time. Otherwise, you risk being turned away by security while waiting in long lines or trying to find someone to vouch for you. (This doesn’t apply to women—they practically have built-in access passes, if you know what I mean.) Of course, if the market gets even worse next year, maybe queues won’t be an issue.

3. Holder-only events are must-attend

Blue-chip projects like BAYC, Doodles, Cool Cats, Azuki, etc., all hosted exclusive holder events. Attendance required NFT ownership plus registration, with entry determined by lottery. These events were generally high quality, featuring diverse formats—Doodles’ launch event, Azuki’s “Enter the Alley,” and BAYC even brought out Snoop Dogg and Eminem (missing Eminem still makes me tear up days later). Attendees were mostly seasoned NFT veterans, making these far more valuable than typical after-parties.

I recommend closely monitoring Twitter and Discord channels of blue-chip or favorite projects at least two weeks before NFT NYC starts. This ensures you can register immediately when sign-ups open, significantly increasing your chances of being selected. If you don’t get in, consider trading your own “add one” invite with others who did.

Overall, Doodles had the best-organized event, BAYC spent the most lavishly, Azuki had the strongest Eastern aesthetic, and GoblinTown was the most cult-like. CloneX, as a major blue-chip, failed to host a decent event—by far the biggest disappointment. Also notable is that Solana-based NFTs were collectively absent, reflecting to some extent that Solana’s NFT teams still lack long-term planning and ability to reach mainstream audiences.

These are my takeaways from attending NFT NYC for the first time. Compared to veteran attendees, I fell into many traps and ended up exhausted. Hope this helps others.

Part.2 Revisiting NFT Value and Future Trends

Looking back at NFT development, NFTs initially emerged as in-game assets, starting with CryptoKitties and early blockchain games incorporating NFT elements. This lineage evolved into two branches: one led by Axie Infinity with various play-to-earn (P2E) games where NFTs serve as tools for earning; the other includes Decentraland and Sandbox, focused on selling virtual land that currently doesn’t generate direct returns.

Later, platforms like SuperRare expanded NFTs beyond gaming into digital collectibles and art. Art is inherently a niche luxury good with high barriers to entry, limiting art-based NFTs to small circles. However, auction events involving Beeple and others proved one key point—NFTs can command high price points. While liquidity remained low, the emergence of high-value NFTs boosted overall market trading volume.

Few anticipated that the real breakout use case for NFTs would be PFPs (profile picture avatars), primarily because PFP value is rooted in Web2 applications—apps like WeChat, Twitter, Telegram, Instagram, etc., where we actually use avatars.

The value unlocked by PFPs lies in previously unmonetized Web2 social value. Before PFP NFTs, there was no mechanism allowing social media profile pictures to become monetizable—a new, untapped frontier for monetizing social relationships within apps.

Common analyses often attribute PFP NFT value to status signaling, social recognition, or cultural identity—but this is inaccurate. Social and cultural belonging are outcomes of PFP NFTs having value, not the root cause. The true driver is that NFTs tapped into residual, previously unexploited value within Web2 social graphs.

So, what’s the next big NFT application?

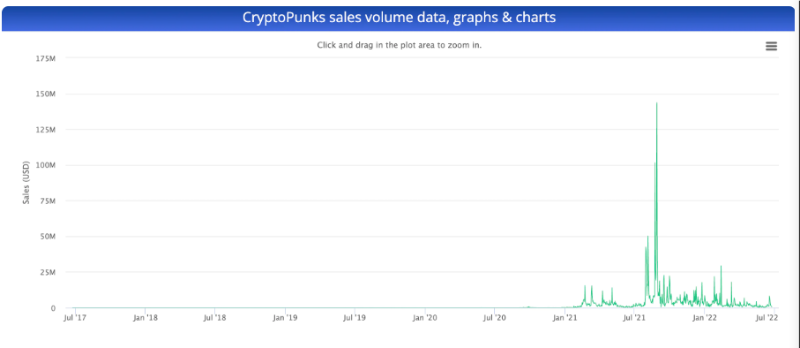

Let’s step back and ask another question: Why did CryptoPunks—the original NFT PFP project—appear in 2017, yet individual Punk prices didn’t exceed $1,000 until January 2021?

Historical Price Chart of CryptoPunks

The answer is simple: Initially, CryptoPunks were treated purely as NFT art pieces, no different from works by Beeple or Pak—there was no such thing as a “PFP NFT” category. Below is an excerpt from a New York Times article dated March 11, 2021:

After rare Punks were hyped up as crypto artworks, their prices rose, lifting even common Punks along with them. More importantly, since Punks were already avatar-style images, buyers naturally began using them as profile pictures on social platforms. When users changed their avatars, it triggered secondary virality across their networks, increasing visibility and demand. Therefore, I believe the emergence of the PFP category was largely accidental—an unintended consequence rather than deliberate design.

In hindsight, we can say the necessary conditions were scale and pricing converging at the right point: scale from Web2 social graph value; pricing driven by NFT art auctions and speculation. But these alone aren’t sufficient. Hence, finding disruptive innovation opportunities is hard—sometimes it really comes down to luck.

Of course, building projects can’t rely solely on luck. We may have missed the CryptoPunks moment, but the successes of BAYC and Azuki followed identifiable paths—clear branding, high-quality artwork, tightly managed community culture. There's already plenty written on this, so I won’t repeat it here.

Back to the original question: What’s the next big opportunity beyond PFPs?

Just throwing out some ideas:

1. Category Evolution

Top-tier NFTs carry high price tags. Technically, fractionalization has been proposed to mimic fungible token trading, but the problem is that fractional tokens aren’t the NFT itself—people aren’t buying the actual NFT, but fractions of it.

I think this issue can be approached differently: make NFT granularity as fine as possible. For example, mint 10^8 units per collection. Each individual NFT becomes very cheap. Using next-gen bulk trading tools like Gem/Genie, the trading experience could resemble that of fungible tokens.

Then the key question becomes: what should these massive-volume NFTs represent?

It certainly can’t be avatars—there aren’t nearly enough people on Earth to justify billions of avatar NFTs. It must represent something else with enormous inherent quantity. Maybe musical notes? Code snippets? Pixels? Addresses?

What does each individual NFT signify? Does combining them create meaning—or is meaning irrelevant? I don’t have answers yet.

2. Expanding Use Cases

As traced earlier, NFTs succeeded by unlocking previously unmonetized social value.

Are there other everyday activities that remain unmonetized?

For instance, the short videos we watch daily, chat messages, tweets we scroll through, or maps we use—can NFTs be naturally integrated into any of these?

This topic is too complex to explore fully now.

But this also explains why I’m skeptical of most current music NFT products. Simple sales models merely replicate already-monetized content, offering little real innovation.

In summary, these are my thoughts and notes from NFT NYC—shared in hopes of sparking discussion among fellow thinkers and builders.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News