À l'approche de la mise à niveau de Cancún, OP pourra-t-il redevenir « optimiste » ?

TechFlow SélectionTechFlow Sélection

À l'approche de la mise à niveau de Cancún, OP pourra-t-il redevenir « optimiste » ?

Le nouveau récit d'OP Mainnet est vaste et en cours de mise en œuvre concrète.

I. Introduction

Since its inception, OP Mainnet (*formerly Optimism) has enjoyed exceptional resources and constant attention. Born from Ethereum core developers, this "phoenix" of Ethereum was created to solve the ecosystem's most pressing scalability challenges. However, its development path has been rocky—initially prioritizing rapid expansion with EVM-compatible OVM 1.0, which required extensive custom development for L2 protocols and applications. Subsequently, significant effort was invested in upgrading toward full Ethereum equivalence. Unfortunately, this transition sacrificed the "optimistic proofs," rendering the term "Optimistic Rollup" somewhat misleading. Arbitrum One, another Optimistic Rollup solution, launched its token nine months after OP Mainnet but has since surpassed it in both popularity and user engagement.

Nevertheless, OP Mainnet is now pursuing a broader narrative and strategic roadmap. On June 6, 2023, it completed the Bedrock upgrade, laying the foundation for accelerated future growth. The next major milestone will be the implementation of the next-generation fault proof system, Cannon. Meanwhile, the upcoming Ethereum developer conference confirmed that the highly anticipated Dencun upgrade, centered on EIP-4844, will roll out in the second half of the year. The macro environment is also shifting rapidly: initial panic caused by SEC lawsuits against Binance and Coinbase has been counterbalanced by top-tier traditional Wall Street institutions investing in new U.S.-based crypto exchanges. As these transformations unfold, can OP rediscover true optimism? This article explores that question.

II. The Advantages of OP Mainnet

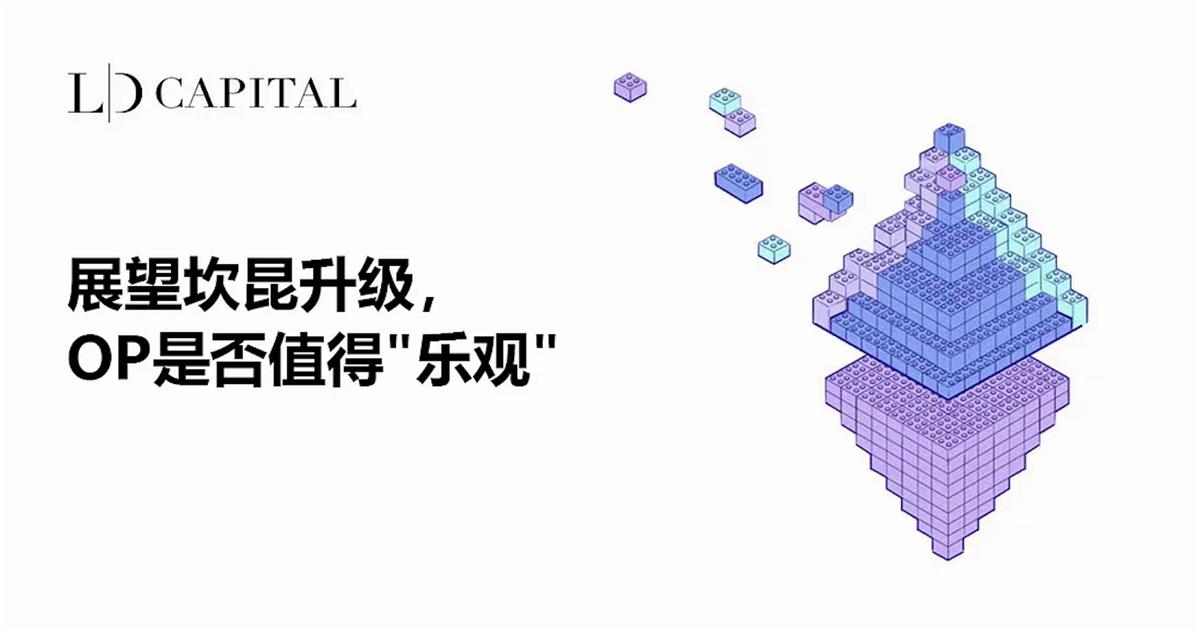

1. Exceptional Core Team and Investors

In 2017, Vitalik Buterin and Joseph Poon co-authored the paper "Plasma: Scalable Smart Contracts," one of the earliest proposals addressing Ethereum’s scalability issues. This proposal resonated with three Ethereum core developers, who formed the non-profit research group Plasma Group to explore scaling solutions. Eventually abandoning the Plasma architecture, they proposed the Optimistic Rollup model and demonstrated a decentralized application (dApp) prototype with Uniswap at Devcon. Shortly thereafter, top-tier VCs such as Paradigm approached them, providing $3.5 million in funding alongside IDEO. With this support, Plasma Group transitioned into a for-profit startup—Optimism was officially born (*On June 24, 2023, the OP Foundation rebranded the blockchain network as OP Mainnet to distinguish it from other uses of "Optimism").

The team behind OP Mainnet consists of core Ethereum developers and researchers, backed by elite venture capital firms like Paradigm and a16z. After raising $178.5 million across three funding rounds, its valuation reached $1.65 billion. Notably, Coinbase joined as a core development partner, launching Base—an L2 network built on the OP Stack architecture—further solidifying OP Mainnet’s position among the industry’s most resource-rich projects.

Figure: Core Team

Figure: Funding Information

2. Early Token Launch with Strong Narrative: OP Tokenomics and Governance Vision

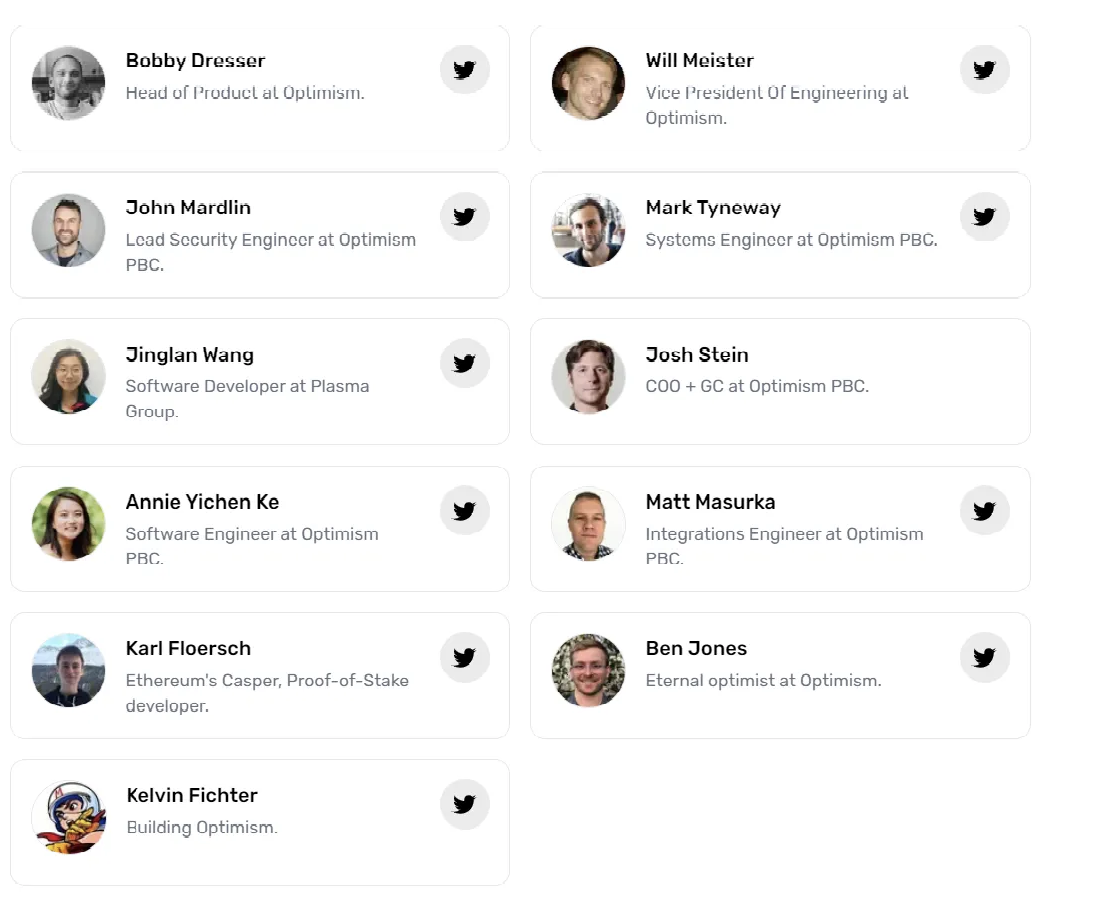

OP Mainnet operates through two key entities: OP Labs, responsible for technical development, and Optimism Collective, focused on governance. The vision of Optimism Collective is to foster a thriving, valuable ecosystem through sustainably funded public goods, driven by a three-step value creation flywheel.

Figure: Ecosystem Flywheel

The ecosystem includes three key roles: token holders, contributors/builders, and users/community members. As an L2 project, OP's primary goal in tokenomics is to provide an efficient, stable, and low-cost network environment. The economic engine of OP stems from ownership of the OP Mainnet and the value generated by its block space; demand for OP block space generates revenue.

Within the flywheel mechanism, OP Mainnet first builds infrastructure and deploys applications. A centralized sequencer generates revenue, which accumulates in The Optimism Foundation for redistribution: token holders who meet certain criteria can become citizens of OP Collective and vote on allocating funds via Retroactive Public Goods Funding (RetroPGF) (*Note: RetroPGF supports not only OP-based projects but also ETH ecosystem initiatives, reflecting OP’s vision of symbiosis with Ethereum). These public goods may distribute tokens through airdrops, while users and builders utilize OP tokens. All usage occurs on the OP blockchain, supported by the Sequencer—a closed loop.

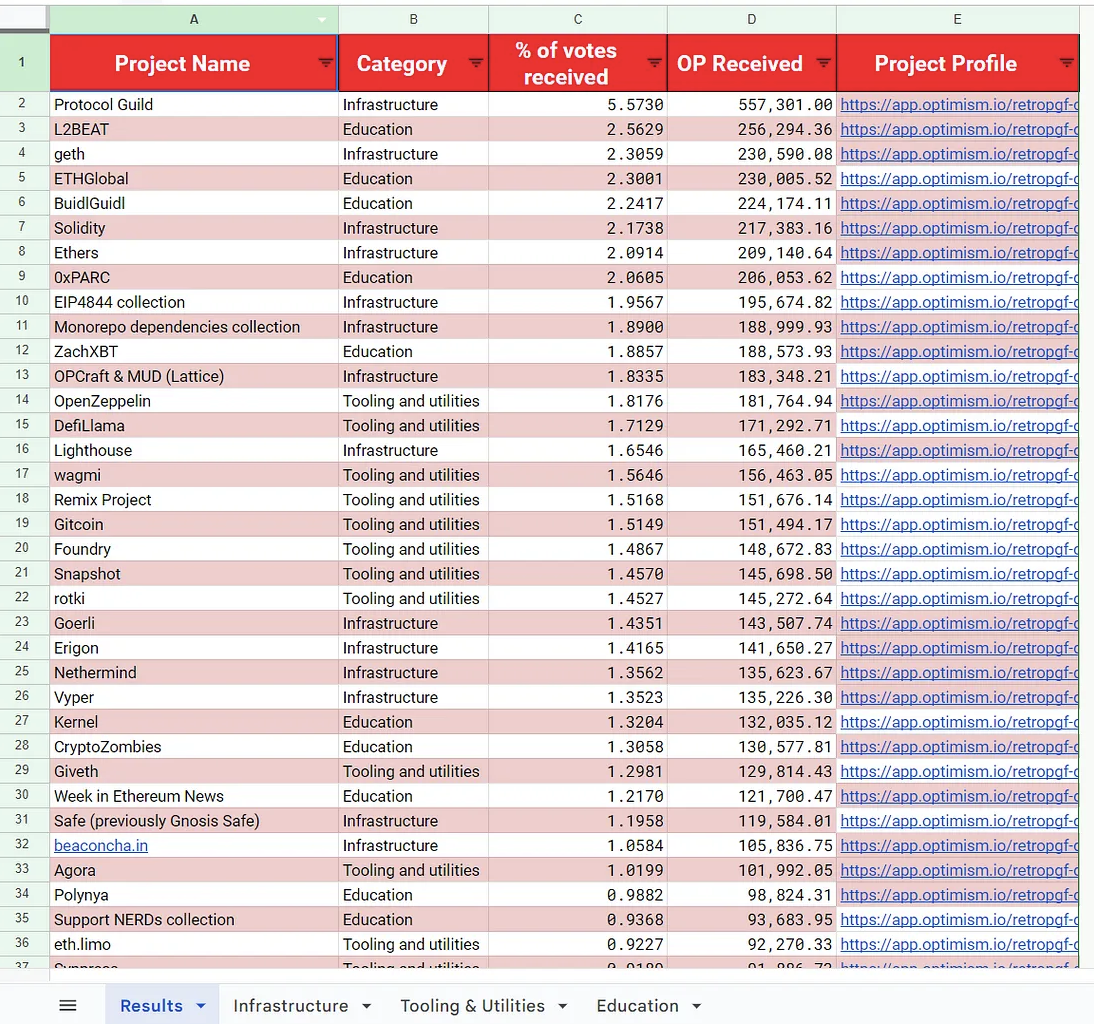

Figure: RetroPGF Round 2 Funding Results

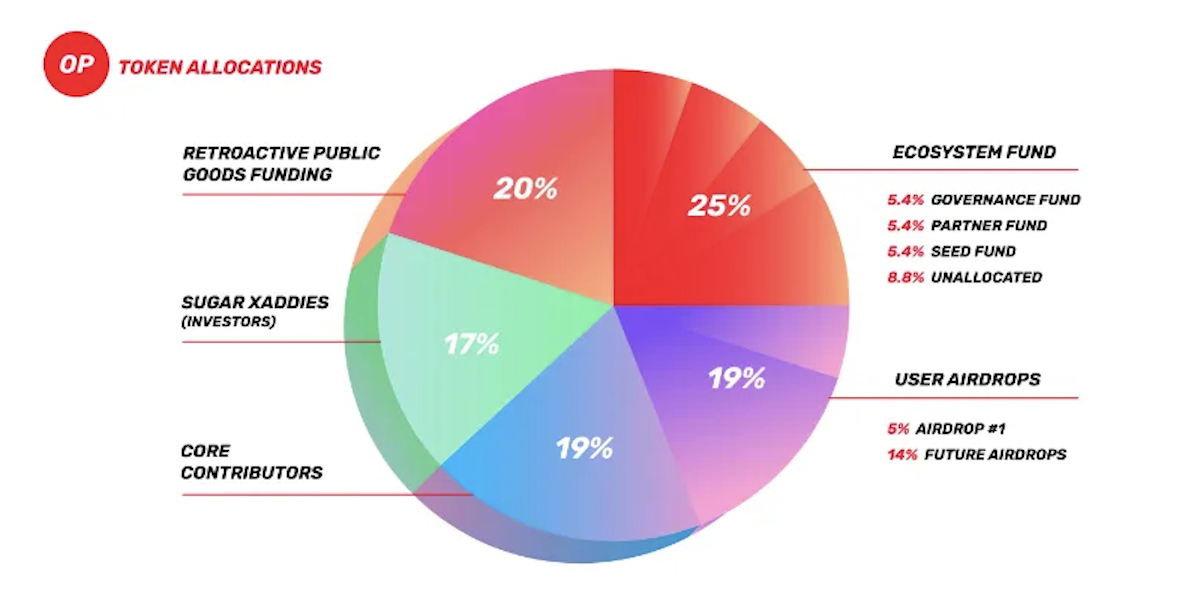

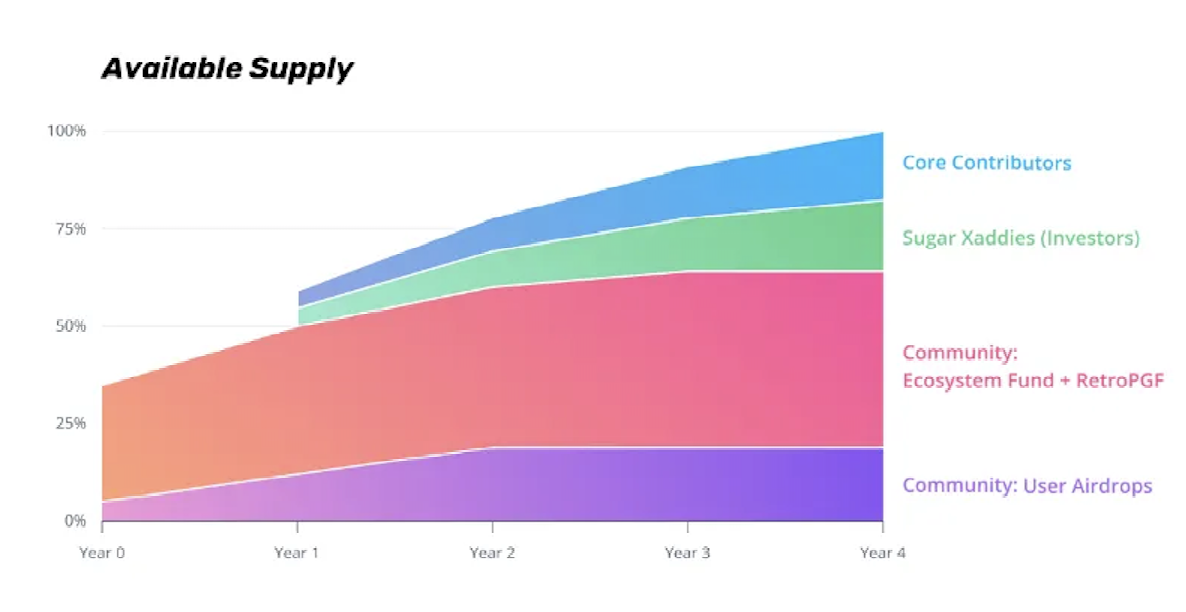

A well-designed token economy acts as a “nuclear weapon” accelerating project growth. Following the announcement of its tokenomics, OP launched on June 1, 2022, with an initial supply of 4,294,967,296 OP tokens, expanding annually at a 2% inflation rate. Allocation included 25% to the ecosystem fund, 20% to RetroPGF, 19% to user airdrops, 19% to core contributors, and 17% to investors. Within the first year post-launch, 64% of tokens were distributed to the community (*investor and contributor tokens unlock fully after one year). The initial airdrop allocated 5% to users (*248,699 addresses), generating short-term buzz. However, due to a lack of competitive native dApps compared to other chains, OP’s momentum lagged behind ARB during quieter periods without new events or incentives.

Figure: OP Token Distribution Framework

Figure: OP Token Unlock Schedule

Through initiatives like RetroPGF, OP demonstrates commitment to funding public goods that strengthen the broader ecosystem (*Round 2 funded projects including L2BEAT and EIP-4844). On June 22, RetroPGF announced Round 3, allocating 30 million OP tokens to ecosystem builders and projects.

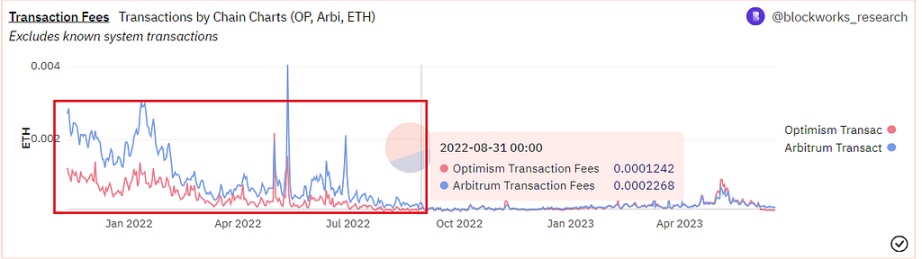

3. Significant Reduction in On-chain Fees

Since launch, OP Mainnet has dramatically reduced Ethereum transaction costs—by over 90%. In early stages, OP Mainnet achieved greater fee savings than Arbitrum One. Future technological upgrades will either narrow or widen this gap further.

Figure: Transaction Costs

Figure: Cost Savings Relative to Ethereum L1

III. Challenges Facing OP Mainnet

1. Centralized Sequencing

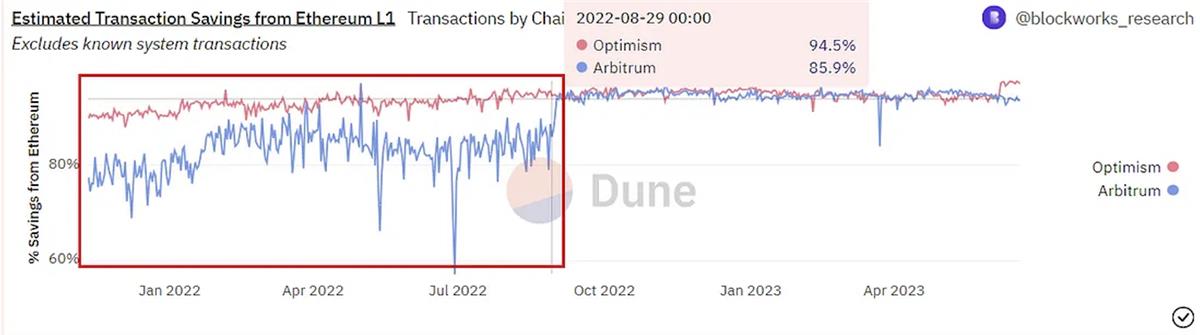

OP’s architecture comprises four key components: Sequencer, Verifier, CTC (Canonical Transaction Chain), and SCC (State Commitment Chain). Among these, Sequencer and Verifier are physical Layer 2 nodes forming the backbone of the L2 node network, while CTC and SCC are smart contracts deployed on Ethereum.

Figure: Four Key Modules in Architecture

The Sequencer functions as a centralized mining pool, responsible for ordering transactions and producing blocks on L2 (*similar to mining). In a healthy system, sequencing should eventually be decentralized, with verifiers able to challenge invalid behavior and enforce penalties. Currently, however, the Sequencer is operated solely by the Optimism team, posing serious centralization risks inconsistent with blockchain principles (*Decentralization of the sequencer is targeted for Milestone 10 in Optimism’s roadmap).

2. Disabled Fraud Proofs – Users Must Trust the Sequencer

In standard Optimistic Rollup designs, the L2 Sequencer initially assumes all transactions are valid. After submitting rollup data to L1, there is a challenge period during which anyone can submit fraud proofs to dispute incorrect results. If fraud is successfully proven, the protocol re-executes the transaction and updates the rollup state accordingly.

However, as a trade-off for achieving Ethereum equivalence, OP Mainnet temporarily disabled its fault proof mechanism. This means users must currently trust the Sequencer to publish correct state roots to Ethereum. For several months, OP Mainnet has operated under a misnomer—"Optimistic Rollup"—because no one can verify whether fraud has occurred (*This issue will be resolved with the upcoming Cannon upgrade).

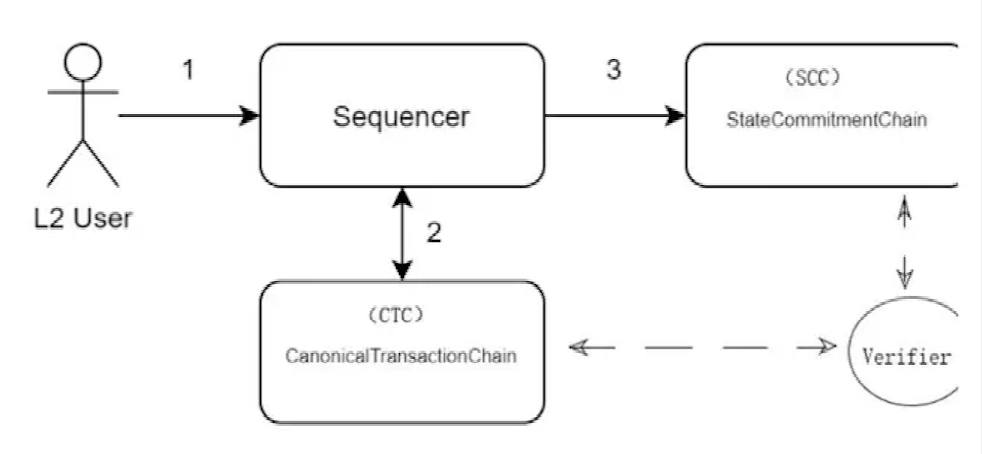

3. Lack of Native Killer Apps; Lagging Key Metrics vs. Arbitrum One

Among L2 solutions, Arbitrum One and OP Mainnet dominate, collectively holding over 83% of the market share. Yet OP Mainnet lags significantly behind Arbitrum One, with TVL around just 40% of Arbitrum’s.

Figure: TVL Across L2 Ecosystems

Comparing individual projects, those on Arbitrum One generally have higher TVL than their counterparts on OP Mainnet. Arbitrum hosts several high-profile native dApps such as GMX, Radiant, Camelot, and Arbdoge AI. In contrast, OP Mainnet lacks similarly popular native applications. Leading projects like Velodrome and Synthetix have TVL amounts roughly 50% or less than equivalent-ranked projects on Arbitrum.

(*Note: L2BEAT and DefiLlama differ in TVL calculation methodology. L2BEAT includes all assets locked in Ethereum contracts, including native L2 governance tokens like ARB and OP. DefiLlama focuses only on assets actively engaged within specific network dApps. Thus, L2BEAT’s figures tend to be higher.)

Figure: DeFi Project TVL on Arbitrum One

Figure: DeFi Project TVL on OP Mainnet

Across other key metrics, OP Mainnet consistently underperforms relative to Arbitrum One, primarily due to fewer high-quality projects attracting users and activity. This contributes to OP’s lower market cap compared to ARB. Based on MC/TVL and FDV/TVL ratios, ARB currently shows stronger growth potential. That said, OP Mainnet benefits from lower fees thanks to the recent Bedrock upgrade. It retains a competitive edge in technical potential and cost efficiency, but must focus on attracting superior projects and users going forward.

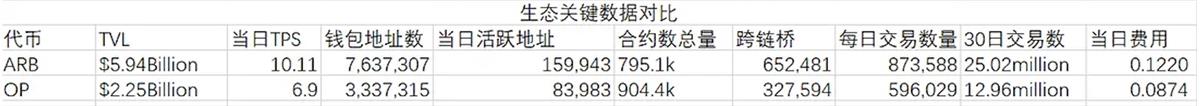

Figure: Comparison of Key Ecosystem Metrics (*Data as of June 27, 2023; missing daily values replaced with nearest available date)

Figure: Token Metric Comparison (*Data as of June 27, 2023; TVL calculated using L2BEAT standards)

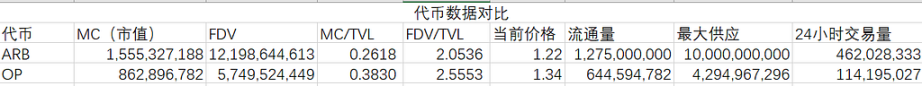

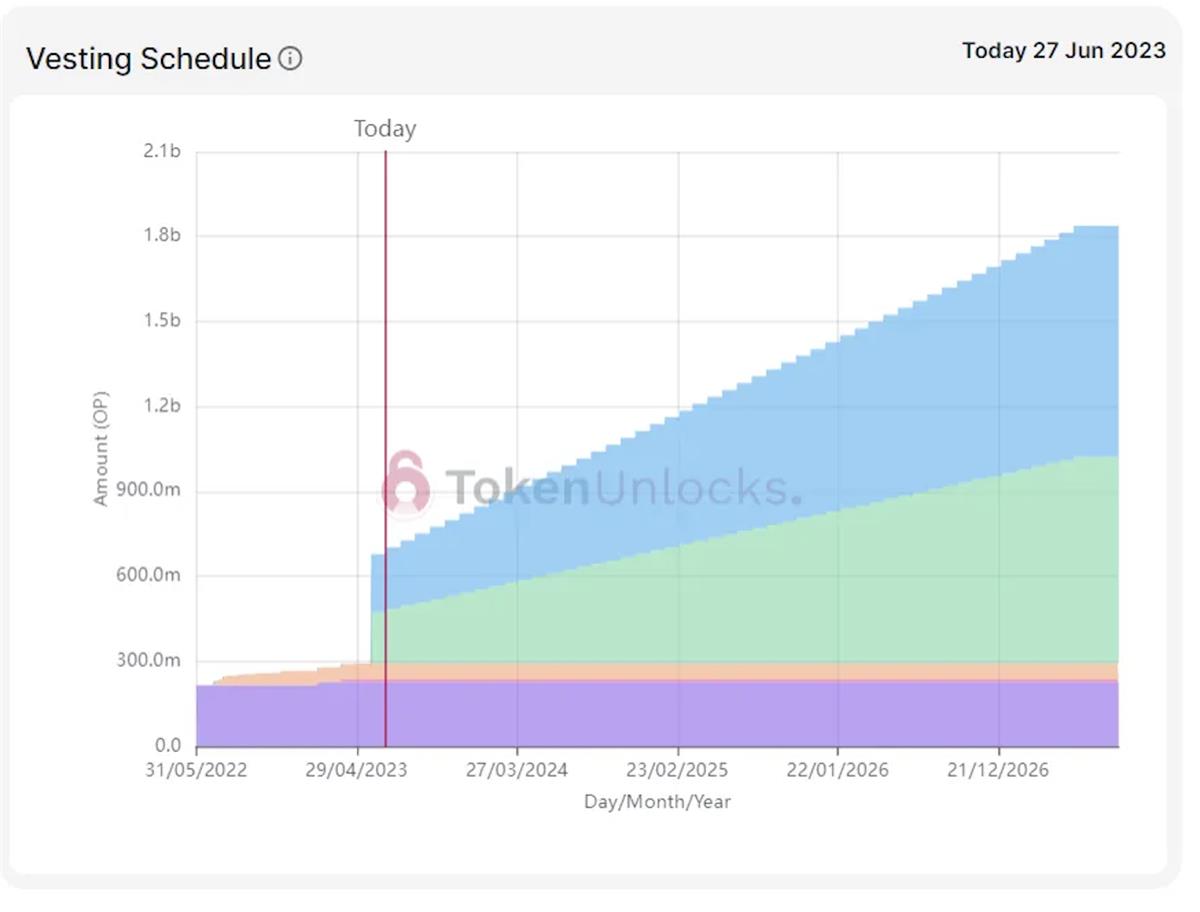

Regarding token unlocks, investor and core contributor tokens have begun vesting, releasing 0.562% monthly (~24 million OP per release), creating ongoing selling pressure.

Figure: Token Unlock Schedule

Figure: Next Release Plan

IV. New Narratives

1. Modular OP Stack Technology Stack

OP Stack is a universal development framework for building L2 blockchain ecosystems. Embracing modularity, it provides a suite of interoperable modules that work together to form coherent, reliable blockchains—the foundation powering OP Mainnet’s next-generation architecture. The recently completed Bedrock upgrade marks the first official version of OP Stack.

Each layer of OP Stack features well-defined APIs, enabling developers to easily modify existing modules or create new ones tailored to specific applications. This modular design will seamlessly support OP’s ambitious vision of a "Superchain."

Figure: OP Stack Architecture

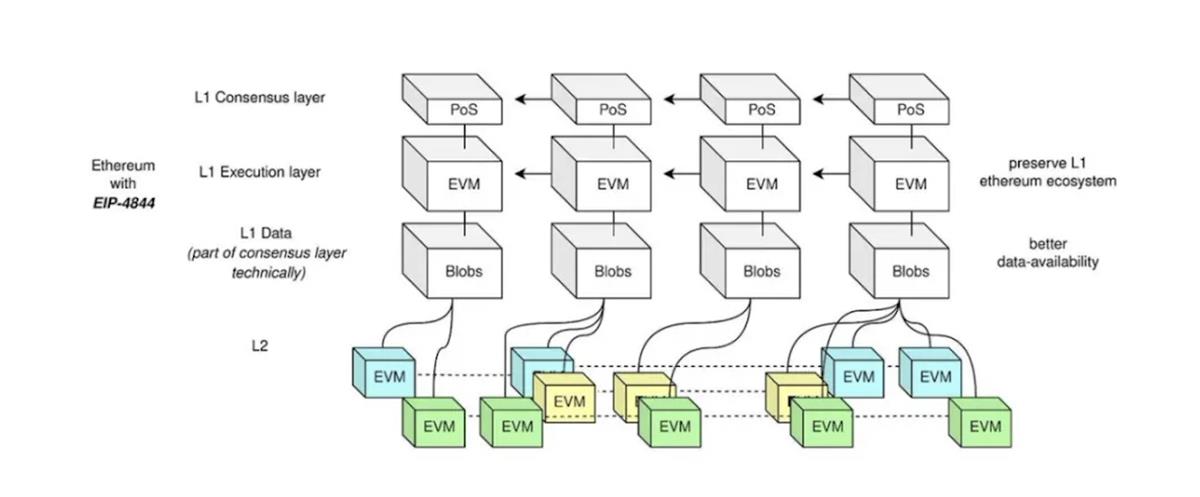

Breaking down each module: At the base is the Data Availability (DA) layer, defining where raw inputs for OP Stack chains are published. Chains can use one or more DA modules. Currently, Ethereum DA is the most widely used, serving as the foundation for all L2s. When using Ethereum DA, source data can come from any information accessible on Ethereum—including call data, events, and EIP-4844 blobs. The architecture diagram specifically highlights EIP-4844, signaling strong compatibility once implemented.

Above the DA layer sits the Sequencing layer, responsible for collecting user transactions and publishing them to the chosen DA module (*the role currently filled by the Sequencer). This layer holds great promise for the Superchain concept, though today’s Sequencer remains centralized and represents a critical area for improvement.

-

Derivation Layer: Processes raw data from the DA layer into structured inputs, mainly handling data packaging—for example, preparing rollup batches before submission to the sequencer and DA layer.

-

Execution Layer: Defines the state structure and state transition function within the OP Stack system. State transitions are triggered when inputs arrive via the Engine API from the derivation layer. Responsible for cross-layer data transformation, often mirroring Ethereum Virtual Machine semantics.

-

Settlement Layer: Acts as the verification component, crucial for consensus. Once transactions are published and finalized on the underlying DA layer, they are considered settled on the OP Stack chain. Unless the DA layer itself is compromised, these cannot be altered or deleted. This section references OP’s upcoming fault proof system, Cannon, and hints at potential ZK-proof compatibility with OP Stack.

-

Governance Layer: A collection of tools and processes for managing system configuration, upgrades, and design decisions—such as voting and token-based governance. This abstract layer governs OP Stack itself and may influence mechanisms on third-party chains integrated into the stack.

With this modular stack now live, developers can easily abstract and customize blockchain components by swapping modules. For instance, transforming an Optimistic Rollup into a ZK Rollup simply requires replacing the fraud proof module with a validity proof module in the settlement layer. This architectural flexibility opens vast possibilities for innovation within the OP Mainnet ecosystem (*provided OP successfully completes decentralization of the sequencer and implements Cannon).

2. Next-Gen Fault Proof — Cannon

As a side effect of achieving Ethereum equivalence, OP lost its core fraud proof capability. According to the roadmap, the next step after Bedrock is deploying Cannon—the next-generation fault proof system—to restore this functionality. Cannon is still under construction and testing, with considerable work remaining before production deployment.

According to official documentation, Cannon will be the world’s first EVM-equivalent fault proof method. Instead of reimplementing the EVM on L2, it leverages the existing EVM by introducing minigeth—a minimal, modified subset of go-ethereum (*without JSON-RPC, PoW)—compiled into MIPS. This simple abstraction allows the fault prover to access any content within L1 or L2 states, with on-chain overhead independent of state size. Other L2 implementations, like Arbitrum’s AVM, require rebuilding state management from scratch to achieve similar results.

Cannon promises the lowest possible ETH-calldata gas costs, benefiting from OP Mainnet’s EVM equivalence. Post-Bedrock, it will further reduce L2 transaction fees and serves as a cornerstone of the OP Stack architecture. Its timeline and actual deployment warrant close monitoring.

Figure: OP Roadmap

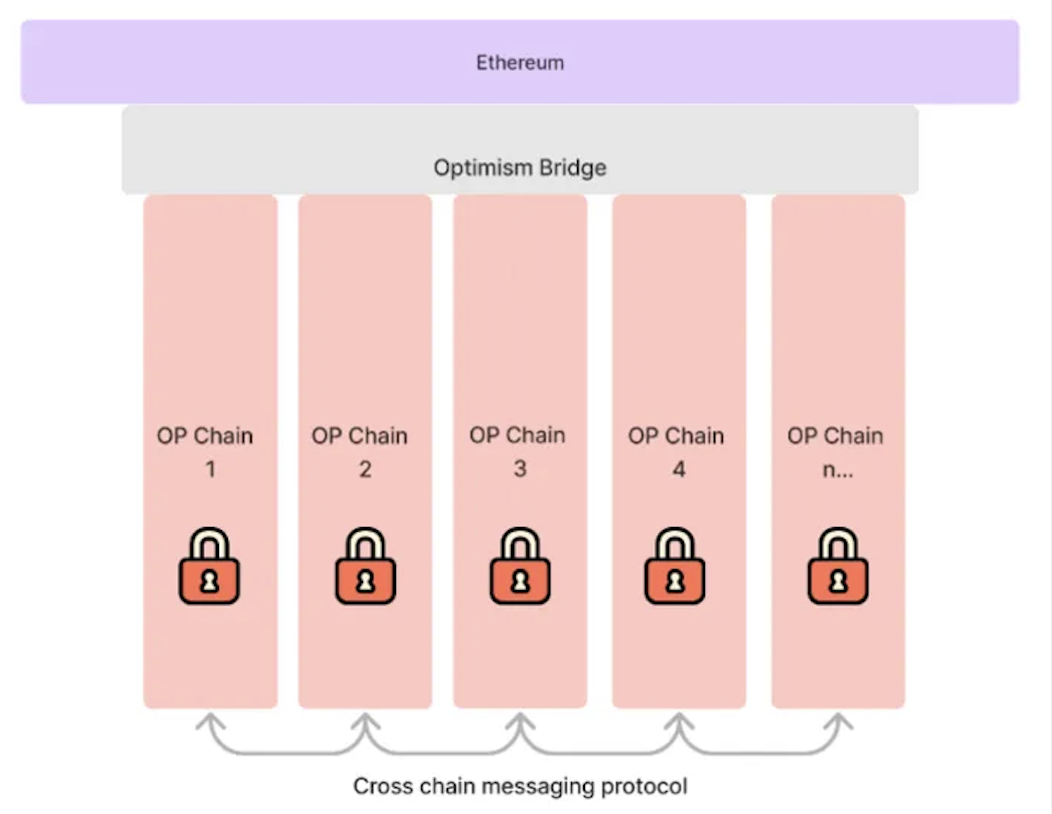

3. Becoming a Platform for Multiple Chains — The Superchain

Leveraging the OP Stack architecture, OP envisions an ambitious narrative: the Superchain. Conceptually, this is a horizontally scalable network of chains sharing security, communication layers, and open-source development stacks, designed to accommodate explosive growth across L2 and L3 ecosystems.

The Superchain relies on the modular OP Stack, allowing different chains to share and contribute to a reinforced, standardized codebase, becoming OP-chains without needing custom adapters.

Figure: OP Superchain Architecture Concept

Multiple OP-chains can share a single sequencer, enabling atomic interactions between chains. This is feasible because a single entity controls block production across all chains—no reliance on external validators is needed to include atomic transactions. OP-chains opting into the shared Sequencer Set of Optimism Collective become part of a unified system, effectively erasing boundaries between individual chains.

If OP successfully advances the Superchain vision, the OP token and ecosystem could experience explosive growth. Resources from OP Collective would extend beyond Optimism to all OP-chains plugged into the Superchain, enabling collaborative development atop OP’s foundational infrastructure. This vision amplifies OP Mainnet’s existing advantages: leading U.S. crypto exchange Coinbase has already adopted OP Stack to launch its own OP-chain called Base. On June 19, BNB announced the testnet launch of opBNB, also built on OP Stack.

Figure: opBNB Testnet Launch

4. Summary

OP’s future vision is grand: to become Ethereum itself at the L2 level, providing standardized, modular, customizable frameworks and codebases to support every chain and protocol in the Ethereum ecosystem. If OP can swiftly achieve its milestones, it may truly rise as Ethereum’s phoenix—a transformation contingent upon breakthroughs in OP Stack technology and maintaining a competitive lead over rivals.

V. Revisiting the Bedrock Upgrade

1. What Is Bedrock?

Bedrock is the name of the first official release of OP Stack, finalized on June 6. It contains the core software required to operate an L2 blockchain, built with modularity and upgradability in mind, reusing existing Ethereum code and achieving near-total (≈100%) Ethereum equivalence.

Key improvements introduced by Bedrock:

(1) Closer to EVM Equivalence: Pre-upgrade, OP’s client code differed from Ethereum by ~3,000 lines. Post-Bedrock, differences are reduced to under 500 lines.

(2) Fees Further Reduced: Bedrock implements optimized data compression strategies, eliminating all L1 execution gas and minimizing L1 data costs to theoretical minimums—reducing fees by an additional 10% compared to prior versions.

(3) Shorter Deposit Time: Bedrock adds support for L1 reorgs in node software, drastically reducing deposit confirmation time. Earlier versions could take up to 10 minutes. With Bedrock, deposits confirm in ~3 minutes.

(4) Modularized Proof System: Bedrock abstracts the proof system from OP Stack, allowing rollups to choose between fault proofs or validity proofs (*e.g., zk-SNARKs) to verify execution. This sets the stage for future integration of Cannon.

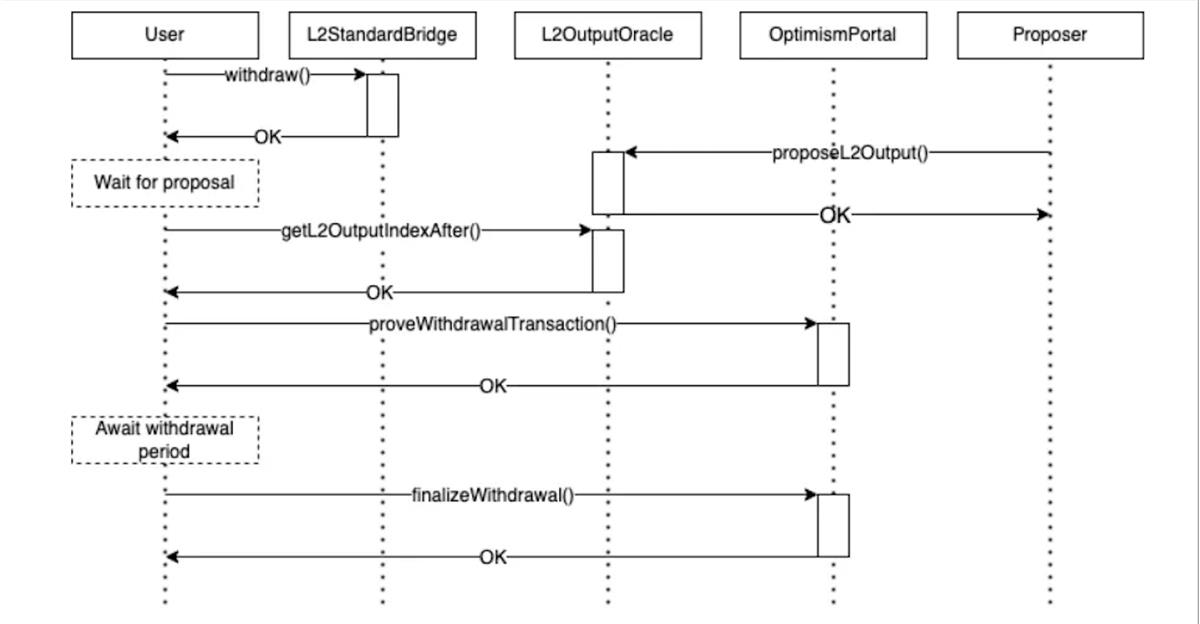

(5) Two-step Withdrawals: Introduces a pre-withdrawal step requiring users to publish withdrawal proofs in advance. Users must wait for a valid output root to be proposed so the proof can be verified on-chain. After the 7-day challenge window ends, funds can be withdrawn. Publishing proofs early gives monitoring tools time to detect fraudulent claims and intervene—ordinary users can participate too.

Figure: Visualized Flow of Optimized Withdrawals

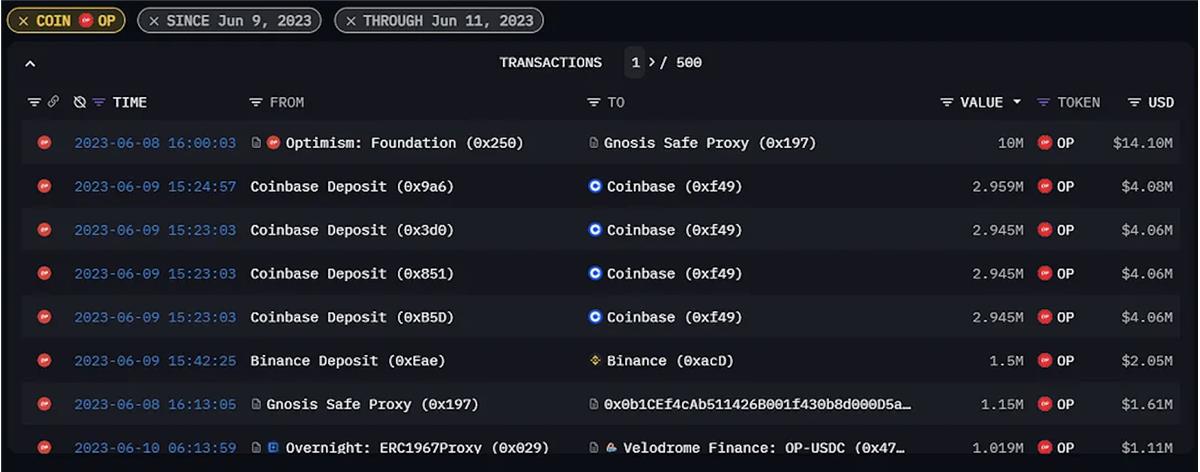

2. OP Token Performance Around Bedrock

On the day of the Bedrock upgrade, OP saw a brief price increase following large-scale token unlocks, but soon entered a prolonged decline. Prices began rising again around June 20 due to new positive developments.

Figure: Recent OP Price Trend

Reviewing recent price action: Per tokenomics, 286 million OP tokens unlocked on May 30, 2023, primarily held by core developers and investors, creating strong sell-side pressure. From May 29 onward, prices declined steadily over seven days, dropping nearly 25%. On June 6, news of the Bedrock upgrade triggered a 10% rally. Unfortunately, later that evening, the SEC sued Coinbase, followed by a June 8 announcement listing 19 tokens as securities (OP excluded). Amid growing regulatory fears, many U.S. institutions and investors sold off holdings, triggering a multi-day market crash. As a close partner of Coinbase, OP suffered disproportionately, losing nearly 40%. After about a week of consolidation, markets rebounded on June 20 as Wall Street launched its own U.S.-based crypto exchange. Bitcoin led a two-day rally, pushing OP back to pre-SEC levels.

Figure: Large Amounts of OP Transferred to Coinbase Post-SEC Action

3. What Changes Did Bedrock Bring to the Ecosystem?

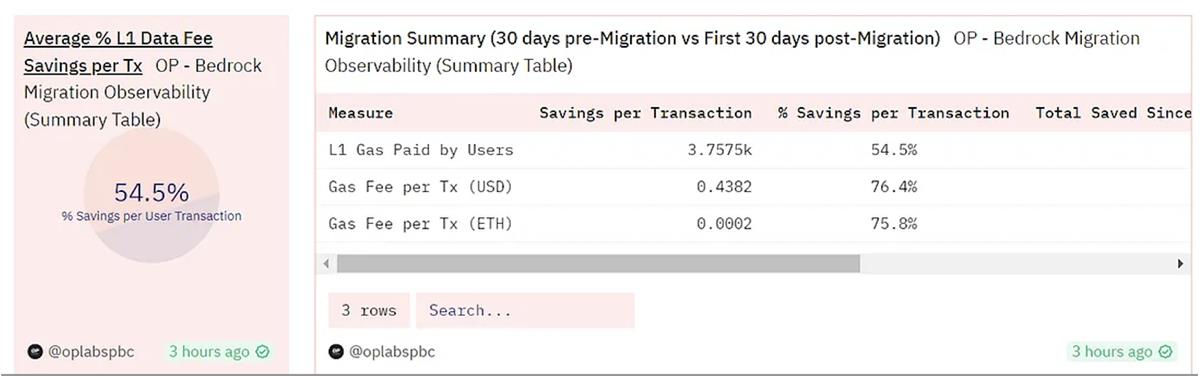

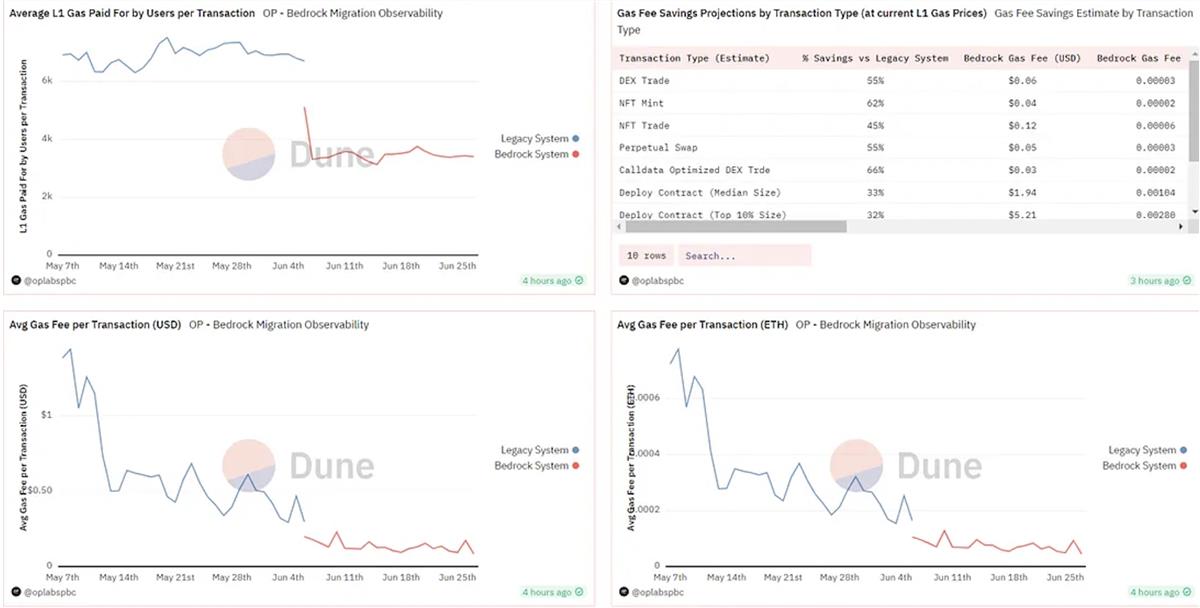

The most immediate impact of Bedrock was further fee reductions. Post-upgrade, average L1 cost savings per transaction increased by 54.5% compared to pre-upgrade levels. Specific use cases—NFT minting, ERC-20 transfers, ETH transfers, DEX trades—saw over 60% improvement in cost efficiency. Line charts clearly illustrate the upgrade’s impact on fees.

Figure: Bedrock Upgrade Impact Data 1

Figure: Bedrock Upgrade Impact Data 2

VI. Looking Ahead to the Dencun Upgrade

1. Latest Developments on Dencun

Every major Ethereum upgrade is a pivotal moment in Web3. This year’s Shanghai upgrade sparked the LSD Summer, and the latest Ethereum developer meeting (*ACDC #111, June 15, 2023) finalized the scope of the upcoming Dencun upgrade. It includes EIP-4844 (*proto-danksharding), EIP-4788, EIP-6988, EIP-7044, EIP-7045, and EIP-4788—with EIP-4844 being the centerpiece for scalability.

2. What Is EIP-4844?

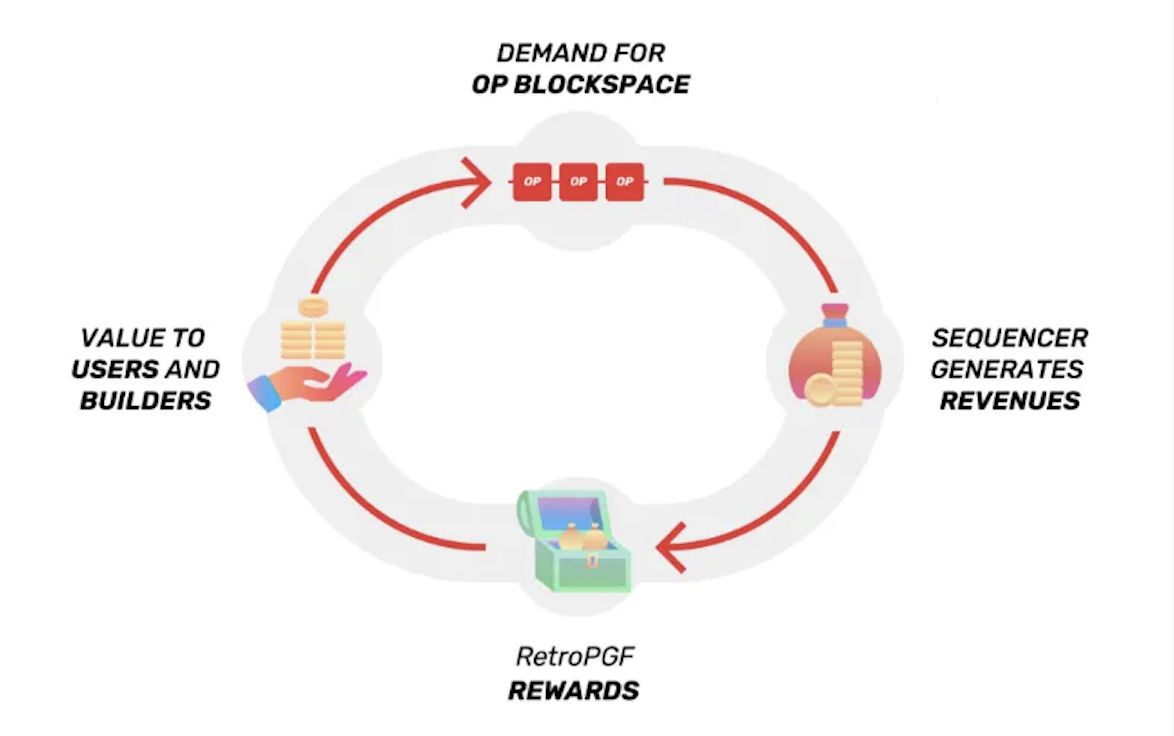

Ethereum’s biggest bottleneck remains scalability. The L2 landscape exists primarily to scale Ethereum, mainly through Rollups that compress and bundle data before posting to L1. But as networks grow and ETH prices remain high, current L2 fees still fall short of long-term needs.

To understand why, consider L2 fee composition: L2 gas fee = L1 cost + L2 cost. Since Rollups currently write transaction data to Ethereum’s calldata—processed and permanently stored by Ethereum nodes—the L1 portion remains expensive. Lowering overall L2 fees requires not just L2-side optimizations, but also L1-level improvements.

Ethereum’s long-term scaling solution is sharding, but full implementation will take years. In the interim—and likely long-term—Rollups remain Ethereum’s sole trust-minimized scaling path. Two main approaches exist: lowering calldata gas costs, or adopting a data format similar to future shards without actual sharding. Past efforts focused on the former; EIP-4844 enables the latter.

EIP-4844 introduces a new transaction type called "blob," implementing the same format intended for future shards, ensuring full backward compatibility (*avoiding major rollup overhauls later). Blobs act as temporary data containers, bypassing calldata entirely. They use a new cryptographic method to prove that nodes have verified a minimal subset of rollup data, rather than requiring full validation as today. Blobs offer larger capacity, lower costs (*with separate pricing), and automatic deletion after a fixed period (*1–3 months), drastically reducing L1 expenses.

Figure: Illustration of EIP-4844 Blob Mechanism

3. Dencun Upgrade and OP

The Dencun upgrade, centered on EIP-4844, will enhance Ethereum L1 scalability, bringing broad fee-reduction benefits across the entire L2 sector.

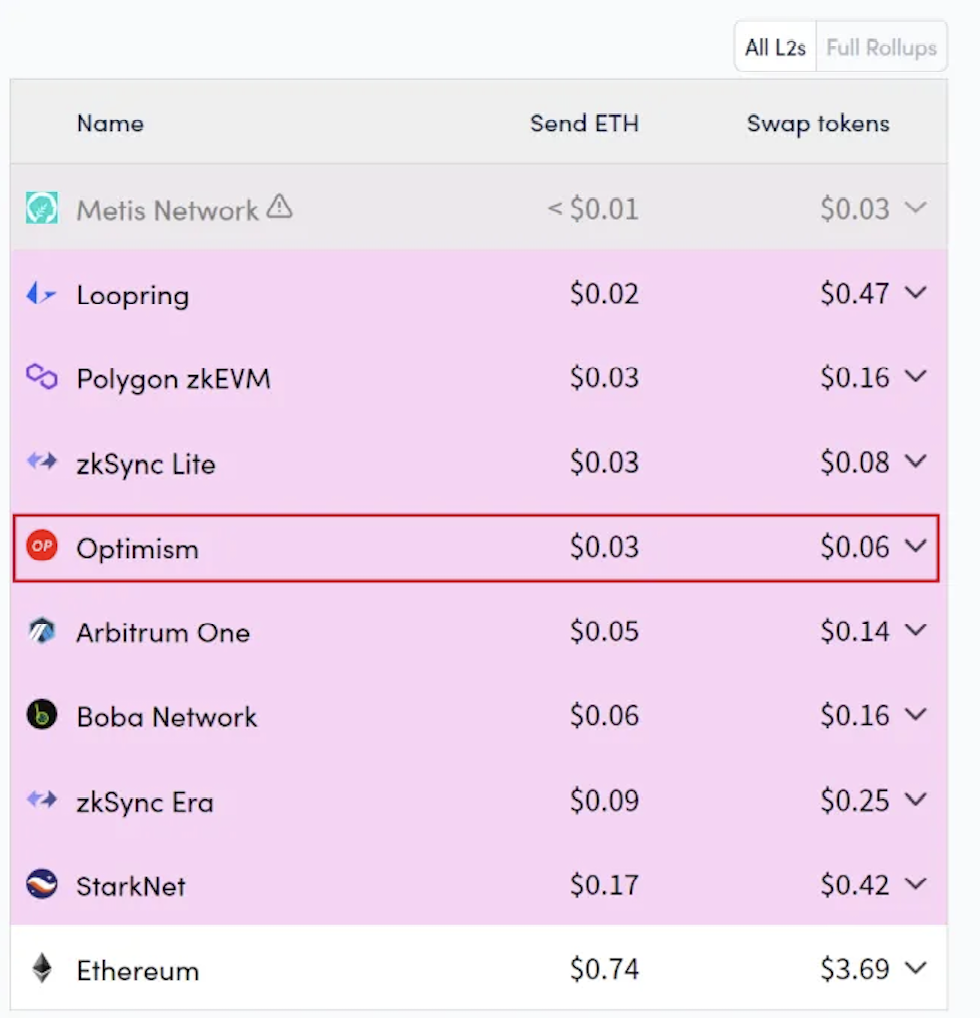

OP completed the Bedrock upgrade in June, already reducing fees to the lowest among L2s. Official documents confirm OP’s deep involvement in advancing EIP-4844, with clear architectural alignment in OP Stack. As one of the projects closest to Ethereum core developers, OP is well-positioned to quickly and efficiently adopt Dencun, potentially achieving even lower fees.

Figure: L2 Chain Fee Comparison

Other L2s, particularly ARB, also stand to benefit significantly. As the L2 leader in TVL, ARB hosts flagship apps like GMX, RDNT, and JOE—high-activity, high-volume projects with volatile tokens directly tied to end-users. The impact of Dencun on these applications may therefore be even more pronounced.

VII. Conclusion

Currently, OP Mainnet faces challenges: centralized sequencing, disabled fraud proofs, and relatively low ecosystem activity. However, its new narrative is bold and actively materializing. The roadmap indicates plans to deploy the next-gen Cannon fault proof in 2023, paving the way for network decentralization in 2024. Through RetroPGF funding and Superchain integration, OP aims to expand its ecosystem’s reach. RetroPGF is already in its third round, and both Coinbase and BNB Chain have launched OP Stack-based chains.

The recent Bedrock upgrade has advanced OP’s narrative, improving efficiency and reducing fees, prompting some market response. The upcoming Dencun upgrade will be a pivotal event for the entire L2 landscape. Let us remain optimistic about OP’s performance in this next phase.

Disclaimer

1. The content herein reflects the author’s personal research and synthesis of publicly available data and information, shared solely for discussion purposes. Under no circumstances does it constitute investment advice for any individual.

2. Under no circumstances shall the author be liable for any losses incurred by any person relying on the information contained in this article.

3. The data and information presented are believed by the author to be reliable and derived from publicly accessible sources to the best of their ability, though accuracy is not guaranteed despite best efforts.

Bienvenue dans la communauté officielle TechFlow

Groupe Telegram :https://t.me/TechFlowDaily

Compte Twitter officiel :https://x.com/TechFlowPost

Compte Twitter anglais :https://x.com/BlockFlow_News