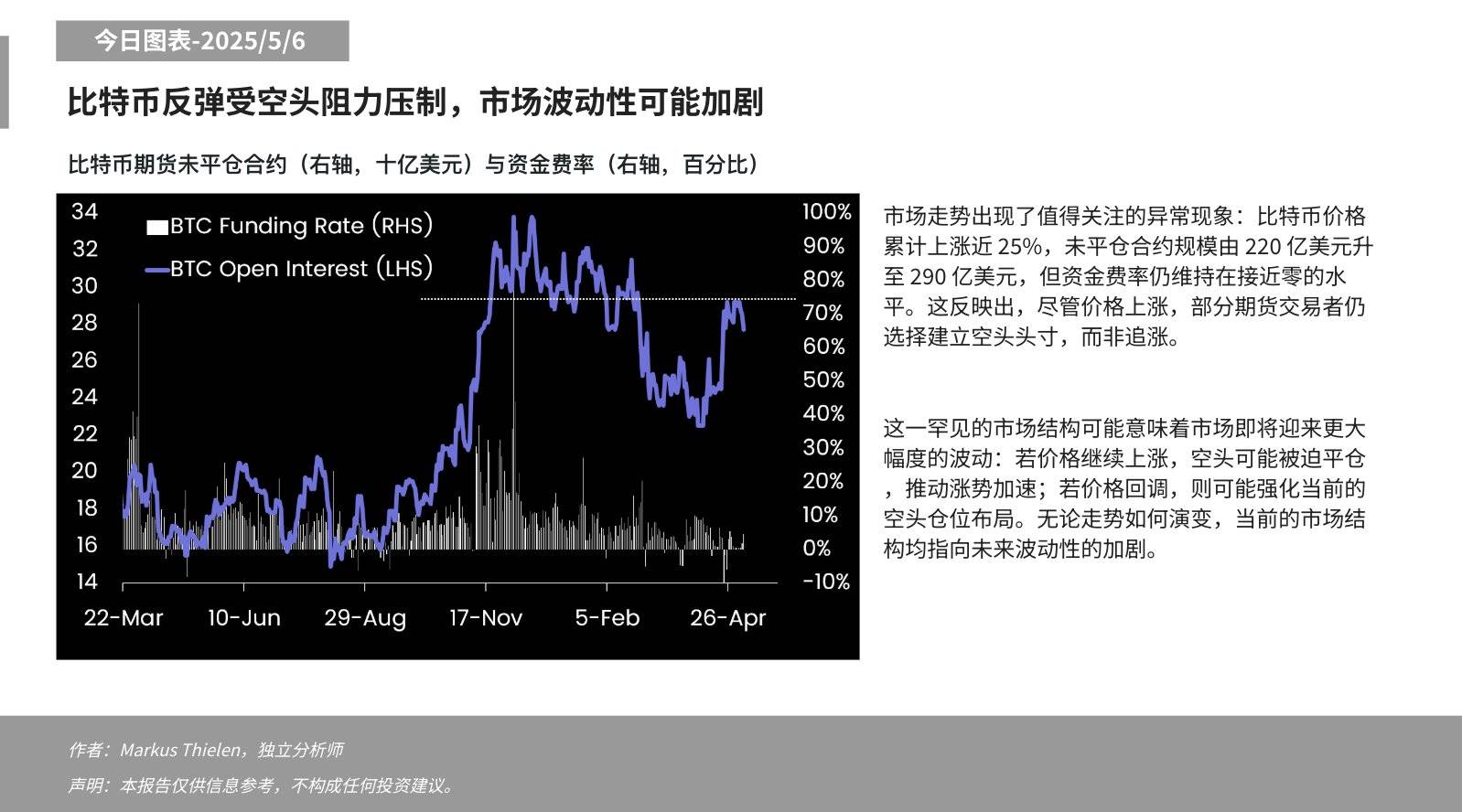

TechFlow, May 6 — Matrixport released a chart analysis today stating, "The market has shown a notable anomaly: Bitcoin’s price has risen nearly 25% cumulatively, and open interest has increased from $22 billion to $29 billion, yet funding rates remain close to zero. This indicates that despite the price rise, some futures traders are still opting to establish short positions rather than chasing the rally.

This rare market structure could signal an upcoming period of heightened volatility: if prices continue rising, short positions may be forced to liquidate, accelerating the upward momentum; if prices pull back, it could reinforce the current bearish positioning. Regardless of the direction, the present market structure points toward increasing volatility ahead."