TechFlow news, on January 16, according to Jinshi Data, gold and silver prices fell on Friday as the U.S. dollar strengthened following weaker-than-expected U.S. initial jobless claims data. Additionally, U.S. President Trump's softened stance toward Iran further reduced safe-haven demand for precious metals. Analysts said this pullback was linked to the U.S. Dollar Index rising to 99.49, the highest level since early December last year. Market observers noted that although gold and silver have recently declined, ongoing domestic unrest in Iran and geopolitical risks related to Venezuela and Greenland continue to support safe-haven demand for precious metals, with these uncertainties keeping investors focused on precious metals as a hedge against risk. Analysts expect gold and silver prices to remain volatile this week, primarily influenced by fluctuations in the U.S. Dollar Index, while the market awaits a major ruling from the U.S. Supreme Court on a tariff case, which could further impact precious metals price movements.

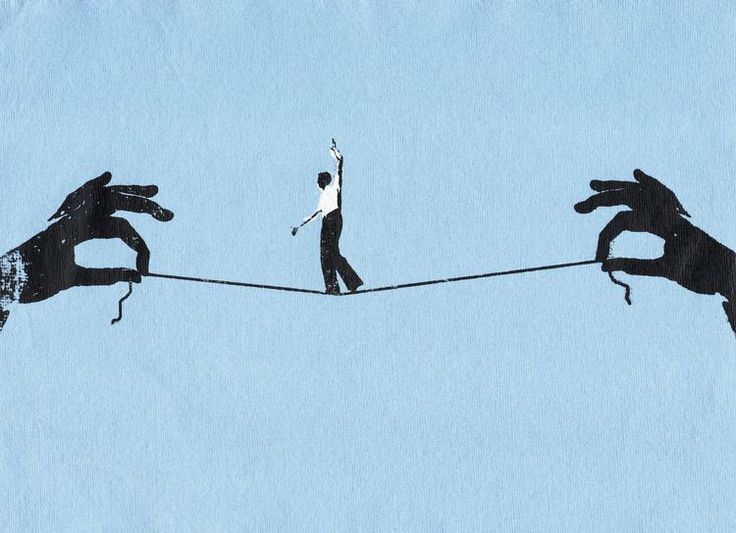

Navigating Web3 tides with focused insights

Contribute An Article

Media Requests

Risk Disclosure: This website's content is not investment advice and offers no trading guidance or related services. Per regulations from the PBOC and other authorities, users must be aware of virtual currency risks. Contact us / support@techflowpost.com ICP License: 琼ICP备2022009338号