“Extreme Fear” — Trap or Treat? Decoding the Probability and Path of a Rebound

TechFlow Selected TechFlow Selected

“Extreme Fear” — Trap or Treat? Decoding the Probability and Path of a Rebound

This week’s sharp market decline was not caused by a single factor, but rather by a “perfect storm” driven primarily by macroeconomic policy shocks and compounded by internal market fragility.

Cryptocurrency Market Performance

Currently, the total cryptocurrency market capitalization stands at $2.24 trillion, with BTC accounting for 58.4%—$1.3 trillion. The stablecoin market cap is $30.51 billion, down 0.48% over the past seven days; USDT represents 60.64% of that total.

Among the top 200 projects on CoinMarketCap, nearly all posted losses this week: BTC fell 20.22% over seven days, ETH dropped 30.04%, SOL declined 30.27%, while HYPE bucked the trend with a 12.71% gain, and SKR rose 49.47%.

This week, U.S. spot Bitcoin ETFs recorded net outflows of $358 million; U.S. spot Ethereum ETFs saw net outflows of $170.4 million.

Market Outlook (Feb 9–Feb 15):

BTC: $67,000–$82,000

ETH: $1,900–$2,200

SOL: $86–$120

The current RSI stands at 33.03 (in the weak zone), the Fear & Greed Index at 10 (extreme fear), and the Altcoin Season Index at 41 (neutral—unchanged from last week).

This week’s sharp market decline was not triggered by a single factor but rather constituted a “perfect storm” driven primarily by macro policy shocks compounded by internal market fragility. Key causes include:

- Former Fed Governor Kevin Warsh’s nomination as the next Federal Reserve Chair sparked widespread panic. Known for his staunchly hawkish stance, Warsh’s potential appointment is widely interpreted as signaling continued global liquidity tightening—a severe blow to risk assets dependent on loose monetary conditions, such as cryptocurrencies and tech stocks.

- Prior to the crash, markets had accumulated substantial highly-leveraged long positions. Once prices breached critical support levels—e.g., Bitcoin falling below $65,000—it triggered cascading, large-scale forced liquidations. This “decline → liquidation → further decline” feedback loop was the primary technical driver amplifying the magnitude of the drop.

- On February 6—the same day as the sharp downturn—the People’s Bank of China issued a notice explicitly prohibiting unauthorized issuance of stablecoins pegged to the RMB. Though aimed domestically, this move intensified global investor concerns about tightening regulatory scrutiny amid already fragile market sentiment.

Next week, markets are expected to continue digesting macro pressures, remaining in a broad-range consolidation phase as they search for bottom support. With the market now in “extreme fear” territory—a historically reliable contrarian signal suggesting proximity to a short-term bottom—confirmation will require sustained ETF inflows and continued stablecoin growth.

If key support levels break, deeper declines may follow:

- A newly appointed Fed Chair delivers unexpectedly hawkish remarks, or key inflation/employment data surprises strongly upward—pushing market expectations toward higher and longer-lasting interest rates.

- Capital continues exiting: accelerating outflows from Bitcoin ETFs signal persistent institutional retreat.

- Black swan events: e.g., major exchange/project failures, geopolitical crises.

In summary, while the market remains in a downtrend, the recent sharp declines have created both technical demand and room for a rebound—not a straight-line collapse.

Understanding the Present

Weekly Recap of Major Events

- On Monday, February 2, the USD/JPY strengthened early in Asian trading, while Asian stock index futures broadly declined and U.S. equity index futures fell 1%. This underscored market fragility following a turbulent prior week. Spot gold plunged 3.5%, silver dropped nearly 9%, and WTI crude oil fell 4%. The previous Friday, precious metals’ steep declines combined with Trump’s nomination of Kevin Warsh as next Fed Chair drove the dollar to its largest single-day gain since May last year.

- On Saturday, February 1, renowned trader and chart analyst Peter Brandt—who accurately predicted Bitcoin’s 2018 crash—posted a chart indicating BTC could fall to $58,000, showing price near the lower boundary of a logarithmic channel and implying bearish continuation. Two days earlier, Brandt had forecast Bitcoin would bottom in August–October before surging upward.

- On Monday, February 4, President Trump signed the government funding bill in the White House Oval Office, ending a partial federal government shutdown. Earlier that day, the U.S. House of Representatives passed appropriations legislation covering multiple federal agencies through September 30—the end of the fiscal year—and allocated two weeks of funding to the Department of Homeland Security amid ongoing controversy and protests over immigration enforcement policies, enabling continued negotiations on departmental reform.

- On Tuesday, February 5, Trump stated “Warsh would’ve been out long ago if he’d pushed for rate hikes,” while Treasury Secretary Bessent remarked the president can influence the Fed.

- On February 5, Bitcoin dipped below $74,000 during U.S. pre-market hours, quickly erasing the prior day’s rebound; renewed tech stock selloffs weighed heavily on crypto sentiment. The Nasdaq-100 continued weakening, with software stocks plunging sharply—intensifying concerns about AI-driven industry disruption.

- On February 5, Kyle Samani, Co-Founder of Multicoin Capital, announced his departure to explore new directions in technology, though he remains Chairman of the largest SOL treasury company.

- On Wednesday, February 6, global risk assets slid again: Bitcoin hit the $60,000 threshold and Ethereum broke below $1,800. U.S. equity index futures widened losses—S&P 500 futures down 1%, Nasdaq futures down 1.6%, and Dow futures down nearly 0.6%. Precious metals tumbled: spot gold fell to $4,660/oz (-2.51% intraday); spot silver crashed 9.00% to $64.38/oz; spot palladium dropped 4.00% to $1,574.96/oz. Japan’s Nikkei 225 slipped below 53,000 (-1.57% intraday), and South Korea’s KOSPI 200 futures plunged 5%, triggering a five-minute circuit breaker.

- On February 5, Antpool data indicated that, based on current Bitcoin mining difficulty and an electricity cost of $0.08/kWh, several miners—including the Antminer S19 XP+ Hyd, Whatsminer M60S, Avalon A1466I, and select Antminer S21 models—had reached their shutdown price points. Meanwhile, high-hashrate models like the Antminer U3S23H and Antminer S23 Hyd face shutdown thresholds above $44,000, while the S21 Pro and S21+ Hyd hover near $65,000–$69,000.

Macroeconomic Developments

- On February 4, U.S. private-sector job growth for January missed expectations, reinforcing signs of a slowing labor market at the start of the year. ADP’s Wednesday report showed just 22,000 jobs added—below forecasts—and revised downward the prior month’s figure.

- On February 5, the Bank of England held its benchmark rate steady at 3.75%, in line with consensus. Five members voted to hold, four favored a cut. The BoE signaled rates may fall further.

- On February 5, initial U.S. jobless claims for the week ending January 31 totaled 231,000—above the 212,000 forecast and up from the prior week’s revised 209,000.

- On February 7, CME’s “FedWatch” tool showed a 12% probability of a 25-basis-point rate cut at the March FOMC meeting, and an 82.3% chance of holding rates steady. Through April, the odds stand at 66.4% for unchanged rates, 30.2% for a cumulative 25-basis-point cut, and 3.4% for a cumulative 50-basis-point cut.

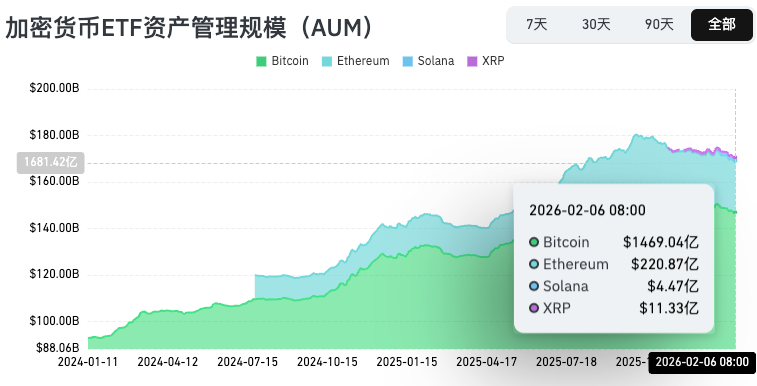

ETF Updates

From February 3–9, U.S. spot Bitcoin ETFs recorded net outflows of $358 million. As of February 6, Grayscale’s GBTC had cumulatively lost $25.832 billion and now holds $11.17 billion; BlackRock’s IBIT holds $53.511 billion. Total U.S. spot Bitcoin ETF market cap stands at $92.399 billion.

U.S. spot Ethereum ETFs posted net outflows of $170.4 million.

Anticipating the Future

Industry Conferences

- Consensus Hong Kong 2026 will be held in Hong Kong, China, on February 11–12;

- ETHDenver 2026 will take place in Denver, USA, on February 17–21;

- EthCC 9 will be hosted in Cannes, France, from March 30 to April 2, 2026. The Ethereum Community Conference (EthCC) is one of Europe’s largest and longest-running annual Ethereum events, focused on technical innovation and community development.

Project Updates

- Stablecoin protocol Cap will conduct its Initial Token Offering (ITO) via Uniswap on February 9, offering 10% of its total supply for sale, with an initial FDV of $150 million;

- Trust Wallet’s security incident compensation application deadline is February 14. Trust Wallet advises affected wallets should no longer be used; users must upgrade to the latest app version and immediately migrate funds.

Key Economic Releases

- February 10 at 21:30 ET: U.S. December Retail Sales MoM;

- February 11 at 21:30 ET: U.S. January Unemployment Rate;

- February 12 at 21:30 ET: U.S. Initial Jobless Claims (week ending Feb 7);

- February 13 at 21:30 ET: U.S. January CPI YoY (unadjusted).

Token Unlock Schedule

- Linea (LINEA): 138 million tokens unlock on February 10, valued at ~$4.58 million—5.96% of circulating supply;

- Aptos (APT): 11.28 million tokens unlock on February 10, valued at ~$12.07 million—0.69% of circulating supply;

- Avalanche (AVAX): 1.67 million tokens unlock on February 11, valued at ~$14.33 million—0.32% of circulating supply.

About Us

Hotcoin Research, the core research arm of Hotcoin Exchange, transforms professional analysis into actionable trading tools. Our weekly “Insight Reports” and in-depth research papers dissect market dynamics; our exclusive “Hotcoin Select” program—powered by AI plus expert curation—identifies high-potential assets to reduce trial-and-error costs. Each week, our analysts also host live sessions on Hotcoin Live to unpack trending topics and forecast market direction. We believe that empathetic guidance paired with rigorous expertise empowers more investors to navigate cycles and capture value opportunities across Web3.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News