Hotcoin Research | When Macroeconomic Factors Become the Pricing Logic: A Forward-Looking Analysis of Macroeconomic Variables in the 2026 Crypto Market

TechFlow Selected TechFlow Selected

Hotcoin Research | When Macroeconomic Factors Become the Pricing Logic: A Forward-Looking Analysis of Macroeconomic Variables in the 2026 Crypto Market

This article will analyze the mechanisms and transmission channels through which macroeconomic factors affect the cryptocurrency market, outline the key macroeconomic variables likely to influence the cryptocurrency market in 2026, and forecast the potential evolution of these variables and their impact on cryptocurrency market trends.

Author: Hotcoin Research

Introduction: The Importance of Macro Factors to the Crypto Market

Current volatility in the crypto market can no longer be explained solely by “narrative momentum” or “on-chain innovation.” Cryptocurrencies are increasingly behaving like “macro-sensitive risk assets,” repeatedly pulled in different directions by interest rates, inflation, U.S. dollar liquidity, regulatory frameworks, geopolitical developments, and institutional capital inflows and outflows. You’ll see identical on-chain data interpreted as “capital returning” amid rising rate-cut expectations—but as “risk contraction” when tariff threats and geopolitical tensions escalate. Similarly, ETF inflows may signal long-term incremental growth when regulatory pathways are clear, yet become short-term panic exits amid heightened policy uncertainty. Macro variables are no longer background noise—they are the core engine driving market trends, drawdown depth, and structural shifts.

This article analyzes the mechanisms and transmission channels through which macro factors influence the crypto market, outlines the key macro variables likely to shape the crypto market in 2026, and explores their potential evolution and impact on crypto market dynamics. Our aim is to provide retail investors with a clearer framework: in 2026—a year marked by intensifying macro noise—how to identify where trends originate, why volatility occurs, why capital favors assets with greater certainty, and which variables, once they shift, demand immediate portfolio and risk exposure adjustments.

I. Historical Review: How Macro Variables Have Influenced the Crypto Market

In the early days of crypto, macro factors had limited influence; crypto assets were primarily driven by internal supply-demand dynamics and technological progress. However, as market capitalization expanded and institutional participation increased, cryptocurrencies gradually came to be viewed as high-risk investments—and their price fluctuations became increasingly correlated with the broader macro environment. Below are the typical transmission paths through which major macro variables affect the crypto market:

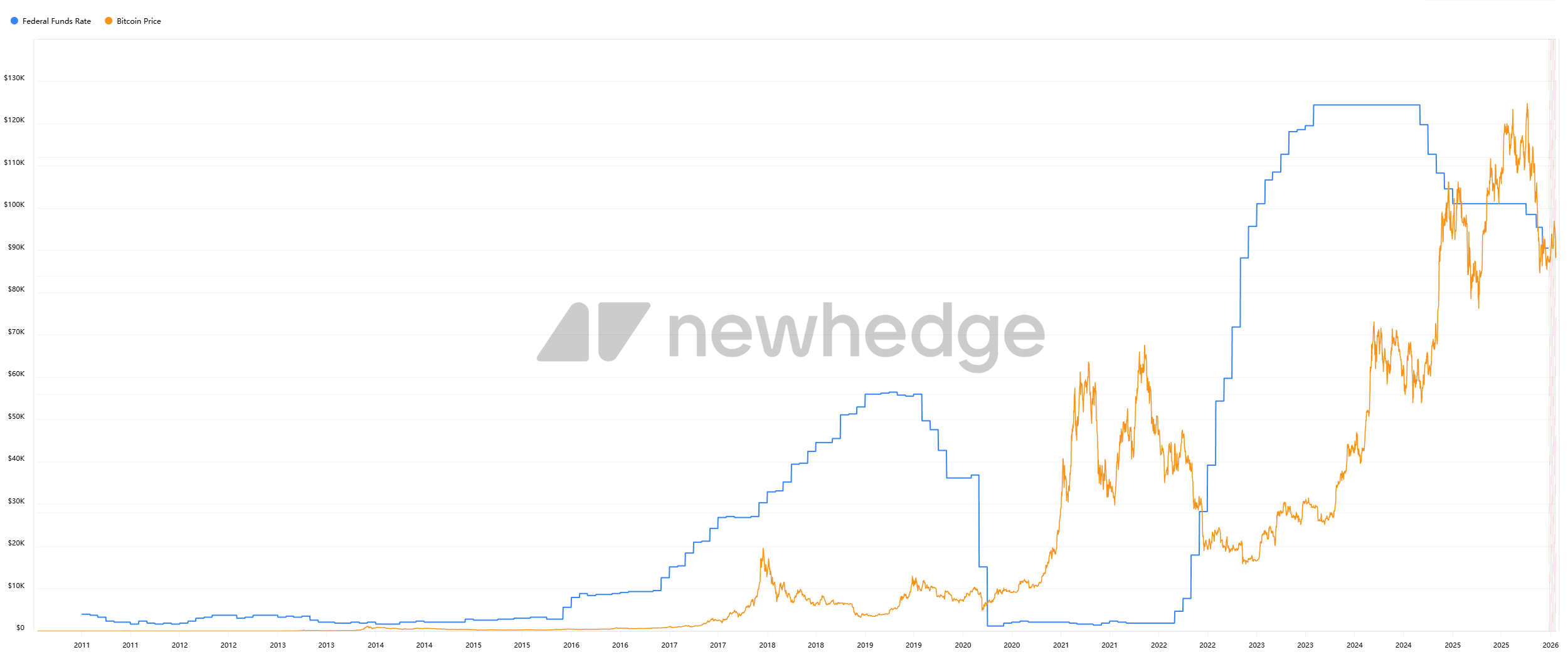

- Interest Rates and Liquidity: Interest rates determine the tightness or looseness of monetary conditions, thereby influencing global liquidity and risk appetite. When rates decline or liquidity expands, investors grow more willing to allocate capital to higher-risk assets—including equities and crypto—diverting funds from low-yield bonds and similar instruments. Conversely, in high-rate environments, rising risk-free yields weaken the incentive to allocate to crypto. Ultra-low rates during 2020–2021 fueled a broad risk-asset rally; the rapid rate hikes beginning in 2022—pushing the federal funds rate above 5%—sharply tightened liquidity and weighed heavily on the crypto market. The Federal Reserve began its easing cycle in H2 2024, lowering rates to the 3.5–3.75% range by end-2025, with markets expecting a further gradual decline to ~3.25% in 2026. Interest rates and liquidity have thus been among the most influential macro drivers of the crypto market in recent years.

Source: https://newhedge.io/bitcoin/bitcoin-vs-federal-funds-rate

- Inflation and Economic Growth: Inflation levels shape central bank policy direction and directly affect fiat currency purchasing power and investor sentiment. High inflation often triggers monetary tightening—a dynamic that pressured the crypto market in 2022. Yet inflation itself also prompts some investors to view Bitcoin as “digital gold” for hedging inflation risk. However, this safe-haven property failed to materialize immediately during the high-inflation period of 2021–2022, instead being overshadowed by the negative impact of tightening policies. Meanwhile, economic expansion or recession indirectly influences crypto investment via effects on corporate and household wealth and overall risk appetite. The crypto market’s slump during 2022–2023 stemmed partly from policy tightening amid elevated inflation, and partly from slowing global growth and rising recession fears—which dampened speculative appetite. Overall, inflation and the economic cycle exert medium-term influence on crypto market performance by shaping both policy environments and risk sentiment; their effects frequently intertwine with interest-rate policy.

- Regulatory Policy and Legal Environment: Regulatory developments significantly impact the crypto market by altering behavioral norms for market participants, channels for capital inflows/outflows, and expectations around legality. Positive regulation—such as clarifying legal status or approving new investment vehicles—often boosts investor confidence and attracts incremental capital. Conversely, aggressive enforcement actions—like banning trading or prosecuting industry leaders—can trigger sell-offs and risk-off sentiment. Between 2021 and 2023, U.S. regulators’ enforcement actions against select crypto projects and delays in ETF approvals temporarily weighed on market sentiment. By contrast, the progressive regulatory frameworks introduced across jurisdictions between 2024 and 2025 delivered notable tailwinds: Europe’s MiCA regulation entered into force in 2025, establishing unified supervisory standards; the U.S. passed the GENIUS Act (a stablecoin bill) in 2025 and created standardized approval pathways for exchange-traded products (ETPs). These steps enhanced compliance and transparency, widely perceived as long-term positives. Regulatory impacts manifest in the short term via news-driven shocks but profoundly reshape industry structure and capital allocation over the long term—making regulation, alongside monetary policy, another decisive variable.

- Institutional Capital Flows and Market Structure: As regulated investment vehicles such as ETFs open up, and corporations and institutional investors deepen participation, the crypto market’s capital composition and pricing mechanisms are undergoing transformation. Institutional capital—typically large in scale and favoring mainstream assets—amplifies market trends when entering or exiting. For example, the launch of the first U.S. spot Bitcoin ETFs in 2024–2025 drove massive inflows. According to estimates, Bitcoin ETFs and corporate Bitcoin-buying programs (e.g., MicroStrategy) contributed nearly $44 billion in net buying demand in 2025 alone. Institutional involvement has also reshaped market structure: Bitcoin’s dominance within total crypto market cap rose above 60% in 2025—significantly higher than peak levels in prior cycles—indicating greater concentration of capital in top-tier assets like Bitcoin.

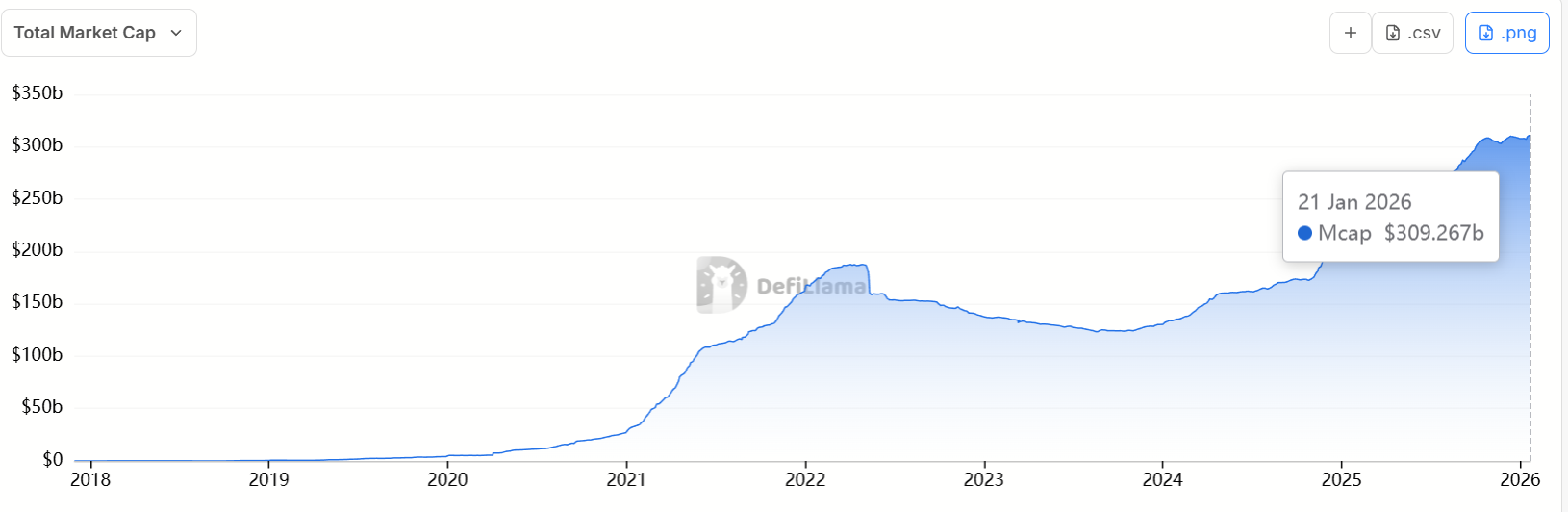

- Stablecoins and Capital Flows: Stablecoins serve as critical infrastructure in the crypto ecosystem; their issuance and circulation volume directly reflect the “reservoir” of on-chain capital—and are themselves influenced by macro conditions. During bull markets, capital inflows push stablecoin market caps sharply upward; during bear markets, stablecoin demand declines and total supply contracts. Changes in stablecoin supply often lead—or at least closely track—market-level capital flows. For instance, during the 2020–2021 bull run, USDT, USDC, and other stablecoin supplies surged from under $30 billion to over $150 billion by end-2021. In the 2022 bear market, total stablecoin market cap receded slightly, stabilizing near $130 billion in early 2023. Entering the new cycle in 2024–2025, the stablecoin market expanded again—global stablecoin market cap now exceeds $300 billion, representing ~75% growth year-on-year.

Source: https://defillama.com/stablecoins

II. Analysis of Macro Variable Impact Strength on the Crypto Market

Variable 1: Global Interest Rates, Inflation, and Liquidity Outlook

Monetary Policy Trajectory – Impact Strength: ★★★★★

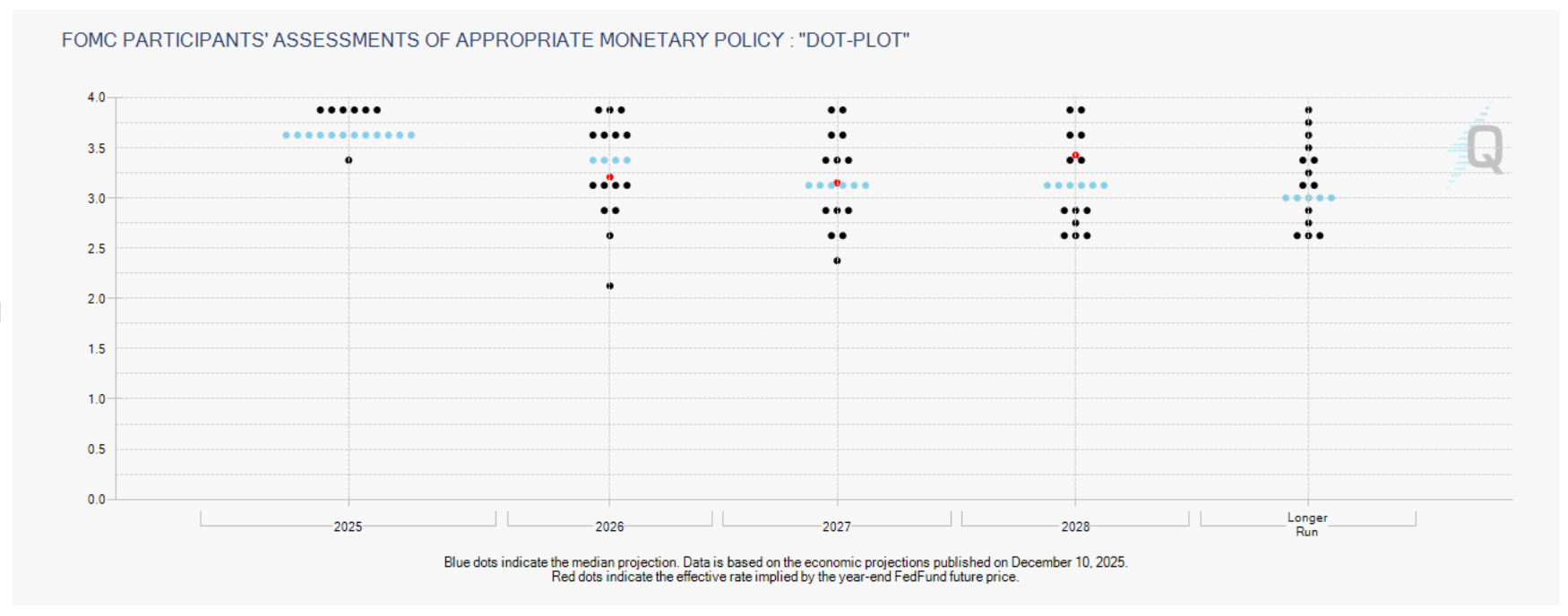

Entering 2026, the global monetary policy environment stands at a critical inflection point. The U.S. Federal Reserve completed a pivot from tightening to easing during 2024–2025: after successive hikes pushed the federal funds rate peak to 5.25%, it began gradual rate cuts at the end of 2024. In 2025, the Fed cut rates three times, bringing them down to the 3.5–3.75% range—the lowest level in three years. For 2026, the Fed is expected to continue modest easing—but with restrained pace: the Fed’s dot plot indicates an end-of-year federal funds rate of ~3.25%. Notably, Chair Jerome Powell’s term expires in May 2026, introducing potential leadership transition and associated policy uncertainty. Overall, barring major inflation surprises, the U.S. monetary environment in 2026 will be significantly more favorable than over the past two years. Though signs of renewed quantitative easing (QE) remain absent, liquidity will at least stop contracting—supporting risk-asset valuations.

Among other major central banks, the European Central Bank (ECB) and the Bank of England (BoE) also concluded their hiking cycles in 2024–2025 and are likely to enter a wait-and-see or easing phase in 2026—though their pace may lag behind the Fed. Japan stands apart: its policy rate had remained zero or even negative for years, and though it was raised modestly in 2025, it remains low; Japan may maintain a relatively independent stance in 2026. Globally, interest rates are entering a downward trajectory in 2026—with rate cuts in dominant economies like the U.S. releasing additional liquidity and lowering the opportunity cost of risk assets. Persistent elevated inflation, however, remains a latent threat: if inflation proves stickier than anticipated, central banks may remain constrained by price pressures and unable to ease aggressively.

Source: https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

Inflation and Economic Outlook – Impact Strength: ★★★★☆

The mainstream consensus for 2026 is that inflation in major economies will continue converging toward—and possibly dip slightly below—target levels. For example, the Fed’s latest forecast projects U.S. PCE inflation falling to ~2.4% in 2026, nearing its 2% long-term target. This disinflationary trend allows central banks to halt rate hikes—a major tailwind for risk assets including crypto. If inflation remains benign or even falls modestly below expectations in 2026, central banks could gain room to deliver surprise rate cuts or liquidity support, further boosting market valuations. For instance, when late-2025 inflation data came in slightly better than expected, both Bitcoin and U.S. equities rallied simultaneously.

On economic growth, global GDP expansion in 2026 is projected to be modest. The IMF forecasts ~2% growth for major advanced economies in 2025–2026, with the U.S. potentially edging ahead of Europe. A low-growth-but-not-recession environment generally supports accommodative policy and stable market confidence. J.P. Morgan’s 2026 outlook similarly assumes steady or slightly above-potential growth across major economies. However, should a major financial shock occur unexpectedly in 2026, it would likely hit risk assets—including crypto—in the initial phase. Historically, however, recessions prompt central banks to ease policy more aggressively—potentially sowing the seeds for a new bull market.

Risks requiring ongoing monitoring include: energy price spikes or geopolitical conflict reigniting inflation; leadership transitions or poor communication at major central banks triggering volatility. If these risks are avoided, the supportive monetary backdrop will serve as a key pillar for the crypto market in 2026.

Variable 2: Regulatory Trends and Market Structure Evolution

Regulatory and Legal Environment – Impact Strength: ★★★★☆

2025 has been dubbed the “Year of Crypto Regulation,” as major jurisdictions rolled out or implemented landmark regulations—accelerating crypto’s transition from a gray area toward full regulatory compliance. In 2026, regulatory developments will remain a focal variable for the crypto market. Overall, global regulation is moving toward greater clarity and standardization—improving long-term market expectations—yet disparities in implementation pace across regions may trigger short-term capital flows and sentiment swings during the transitional phase.

U.S. Perspective: In July 2025, the U.S. enacted its first federal stablecoin law—the GENIUS Act. Under the Act, regulators must issue detailed implementing rules by July 2026. Well-designed rules would greatly enhance stablecoin transparency and banking-sector participation—expanding stablecoin supply and overall crypto market capacity—and could foster a more diversified market structure. Currently, USDT’s market share has declined from 86% in 2020 to ~58% in 2025, while USDC’s share rose to 25%; newer entrants like USD1 and PYUSD have also risen rapidly. Beyond stablecoin legislation, Congress advanced discussion of the “Clarity for Digital Assets Regulation and Innovation Act” (CLARITY Act) in 2025, aiming to clearly distinguish security tokens from commodity tokens. In 2026, attention will focus on whether such legislation becomes law. Although political uncertainty remains around CLARITY’s passage, market anticipation is high—and its enactment could catalyze a new round of price appreciation.

At the agency level, the U.S. Securities and Exchange Commission (SEC) underwent a significant shift in 2025. Its new Chair launched “Project Crypto,” a comprehensive reform initiative for crypto securities regulation. In September 2025, the SEC approved universal listing standards for spot commodity ETFs—substantially lowering legal barriers to launching crypto ETFs. In 2026, we expect a wider array of crypto ETF/ETP products—including multi-asset crypto basket ETFs and spot Ethereum ETFs—to emerge, enriching investor toolkits and signaling crypto’s integration into mainstream portfolios. That said, the SEC’s and CFTC’s stances toward DeFi and altcoins remain ambiguous. Should 2026 bring regulatory constraints targeting specific tokens or decentralized protocols, related asset prices could face pressure. However, until the CLARITY Act resolves classification issues, enforcement is expected to remain cautious.

Other Regions: The EU fully implemented its Markets in Crypto-Assets (MiCA) regulation in 2025, and its regulatory environment is expected to remain stable and progressively compliant in 2026. Beyond MiCA, the EU adopted revisions to its anti-money laundering (AML) framework in 2025—requiring crypto transactions to comply with the “Travel Rule”—enhancing transaction transparency and aiding illicit fund tracking, albeit pressuring non-compliant platforms. Major Asian economies also strengthened crypto regulatory frameworks in 2025: Japan refined exchange and custody rules; South Korea advanced legislation for its “Digital Asset Basic Act”; Hong Kong issued additional exchange licenses and introduced stablecoin oversight in 2025; Singapore launched its crypto licensing regime under the Financial Services and Markets Act in 2025, entering routine supervision in 2026. Additionally, emerging markets—including the Middle East and Latin America—introduced crypto-friendly policies or attracted crypto firms in 2025 (e.g., UAE, El Salvador), positioning them as potential beneficiaries of crypto capital outflows in 2026.

In summary, regulatory variables in 2026 will likely exert a net positive influence on the crypto market: clear rules remove obstacles to industry development, though policy trajectories still warrant close monitoring—as regulatory developments in any jurisdiction can rapidly transmit through global markets and impact prices.

Variable 3: Institutional Investment and Market Structure Evolution

Institutional Capital and Investment Instruments – Impact Strength: ★★★★☆

2026 may mark a year of substantially accelerated “institutionalization” for crypto assets. First, with U.S. spot Bitcoin ETFs and Ethereum futures/smart-contract ETFs now live, traditional financial institutions are incorporating crypto into their asset allocations at an unprecedented scale. ETFs lower the barrier to entry, enabling conservative institutions—including insurers, pension funds, and university endowments—to gain exposure via ETFs or small-scale trial allocations. Statistics show U.S.-listed Bitcoin ETFs injected ~$30 billion into Bitcoin in 2025 alone. In 2026, this figure is expected to rise further—and asset coverage is set to expand beyond BTC and ETH to include crypto-basket ETFs and DeFi ETFs. Massive inflows from equity markets via ETFs will provide sustained buying pressure on Bitcoin and major altcoins. At a deeper level, ETFs are transforming capital structure—spreading holdings across numerous institutional portfolios and reducing systemic risk.

Second, corporate Bitcoin accumulation and balance-sheet accounting have become established trends. As of January 21, 2026, MicroStrategy held 709,715 BTC—representing 3.38% of Bitcoin’s total supply. More companies adding crypto to their balance sheets enhances market credibility. Emerging “Digital Asset Treasury” (DAT) firms went public in 2024–2025, injecting meaningful buying pressure—and are poised for continued growth in 2026. That said, one must watch for profit-taking or partial divestment by these holders when prices surge, creating marginal selling pressure. Overall, growing institutional holdings reinforce Bitcoin’s store-of-value function and market stability—but also introduce cyclical behavior: institutions may buy low and sell high, moderating extreme volatility.

Market Structure Shifts: Institutional participation also alters market structure and volatility patterns. In 2025, Bitcoin’s dominance rose above 60%, accompanied by lower volatility—partly attributable to institutional preference for blue-chip assets, concentrating capital in top-market-cap coins like BTC and ETH rather than speculative altcoins. Simultaneously, derivatives market maturation and options-based hedging strategies have helped suppress some short-term volatility. In 2026, Bitcoin’s institutional ownership ratio is expected to climb further, while Ethereum is likely to sustain steady growth. For mid- and small-cap tokens, 2026 may be a tale of two extremes: On one hand, macro recovery may lift overall market cap, sparking an “altcoin season” led by Bitcoin. On the other, regulatory clarity presents a double-edged sword for altcoins—so 2026 may not witness the blanket euphoria seen in 2017 or 2021, but rather a bifurcation: high-quality, fundamentally sound projects benefit from industry growth, while low-tier and high-risk tokens remain subdued.

In sum, propelled by institutionalization, the 2026 crypto market may be dominated by institutional and compliant capital—with blue-chip tokens and quality projects at its core—and speculative bubbles relatively contained.

Variable 4: Geopolitics and Global Capital Flows

Geopolitical Events and Macro Risks – Impact Strength: ★★★☆☆

Beyond economic and regulatory factors, geopolitical developments and major macro risk events can indirectly impact the crypto market by affecting investor risk appetite and capital flows. Key areas to watch in 2026 include:

- International Tensions and Conflicts: Geopolitical uncertainty—such as armed conflicts or trade friction—often triggers short-term global risk-off sentiment, channeling capital into traditional safe havens like the U.S. dollar and gold, while pressuring high-risk assets like equities and crypto. Yet prolonged, severe geopolitical risks—such as sanctions on certain nations or sharp currency devaluations—can paradoxically spur localized crypto demand, as citizens seek asset relocation and inflation hedges. For example, after Russia’s invasion of Ukraine, the ruble collapsed and local Bitcoin trading volumes surged. Potential 2026 risks include escalating tensions in Eastern Europe and the Middle East, renewed U.S. sanctions on Venezuela or Greenland, great-power competition leading to tighter capital controls, and uncertainty surrounding the U.S. midterm elections—all of which could elevate global risk aversion and weigh on crypto in the short term. Long-term, however, crypto’s “neutral” and “borderless” attributes may position it as a liquidity outlet amid global financial fragmentation—highlighting its value as a hedge against traditional systemic risks.

- Exchange Rates and the U.S. Dollar: The U.S. Dollar Index (DXY) often exhibits an inverse relationship with crypto markets. Sharp dollar strength typically triggers capital flight from emerging markets and tightens global liquidity—hurting non-dollar assets like crypto. Conversely, a weakening dollar tends to boost crypto’s relative appeal. If the Fed eases while Europe lags, the dollar could soften modestly in 2026—reducing FX concerns for non-U.S. investors and strengthening crypto allocation incentives. Should currency crises erupt in certain countries in 2026, regional crypto capital flows could undergo structural shifts: residents or businesses in high-inflation economies may increase crypto holdings to preserve wealth, while crypto markets may gain new users and capital from those regions.

- Global Capital Controls and Tax Policies: India previously imposed heavy taxes and strict regulations on crypto trading, causing trading volumes to shrink. If India relaxes its stance in 2026, vast latent demand could be unleashed. Conversely, if crypto-friendly jurisdictions tighten policies, corresponding markets may contract. Another dimension: cross-border capital flow regulation—including AML and anti-tax-evasion measures—is becoming stricter globally. Crypto may serve legitimate, compliant cross-border transfers (e.g., stablecoin-based remittances) or be abused by bad actors. In 2025, multiple countries intensified crypto AML enforcement—and such efforts will become routine in 2026. Short-term, this may reduce demand for privacy-focused or anonymity-oriented tokens.

Overall, geopolitical and macro risk events exert sudden, short-lived impacts that are difficult to predict precisely. Investors should maintain risk-mitigation plans—for instance, holding mature, relatively stable assets like gold and Bitcoin as hedges.

III. Outlook for the 2026 Crypto Market Amid Multiple Macro Variables

Synthesizing our analysis of macro variables, we offer a forward-looking perspective on the 2026 crypto market. Of course, the future remains uncertain—these scenarios aim to provide a structured analytical framework, and investors should adjust expectations based on real-time data.

Base Case (Macro Stability and Accommodation): Global economic growth remains modest; major central banks—including the U.S. Fed—cut rates modestly and hold them near 3% thereafter; inflation stays close to target. No major regulatory setbacks occur, and newly enacted regulations roll out smoothly with strong market adaptation. Under this scenario, the crypto market could extend the 2025 uptrend into a mature growth phase. Bitcoin may surpass its 2025 highs, powered by persistent ETF inflows and gradually emerging supply scarcity effects—delivering annual gains that, while narrower than in 2025, remain substantial. Ethereum is expected to benefit from technical upgrades and increased institutional allocation, potentially outperforming Bitcoin in select months but remaining broadly correlated. Within the mainstream altcoin segment, projects with clear utility and strong regulatory prospects will attract demand, whereas purely speculative altcoins—even amid broad market rallies—may experience only brief, limited upside. Stablecoin market cap is expected to climb further, breaching $400 billion. Investor sentiment will be generally optimistic yet rational, with volatility moderate and extreme euphoria or panic rare.

Bullish Case (Macro Surprises and Technological Breakthroughs): Building on the base case, several additional catalysts emerge: inflation falls faster than expected—or even shows faint deflationary signs—prompting major central banks to restart QE in H2 2026; the U.S. Congress smoothly passes the CLARITY Act and other crypto legislation, with the SEC and CFTC coordinating to eliminate regulatory gray zones; tech giants launch breakthrough applications bringing blockchain technology to hundreds of millions of new users; or U.S./European pension funds begin allocating to Bitcoin. These extra tailwinds could ignite FOMO, pushing markets into an accelerated upward phase. Bitcoin’s price could exhibit parabolic rallies akin to 2017 or 2021. Top-tier assets like Ethereum would surge in tandem—and altcoins might briefly explode in value. Total market cap could exceed prior-cycle multiples, truly embedding crypto within the global financial asset class. Caution is warranted, however: such overheated conditions rarely persist—and any macro or policy reversal could spark sharp corrections.

Bearish Case (Macro Shocks and Risk Events): This scenario combines several adverse developments: U.S. inflation rebounds, halting rate cuts; a systemic crisis erupts in global financial markets; U.S. crypto legislation stalls or backtracks; Venezuela-related escalation and sanctions disrupt energy markets and inflation expectations; U.S. attempts to acquire Greenland and threatens tariffs on Europe; or U.S. 2026 midterm elections create policy whiplash. Under this bearish macro scenario, the crypto market would inevitably suffer heavy losses. Liquidity contraction and risk-off sentiment could trigger sharp Bitcoin price corrections; institutions may withdraw from crypto ETF positions due to losses elsewhere or collapsing risk appetite—leading to net capital outflows. If major industry players encounter distress, panic could intensify. In this scenario, altcoins would be hit hardest, followed by Ethereum and other majors. For long-term investors, this presents a strategic opportunity to accumulate quality assets at discounts; for short-term traders, disciplined stop-loss execution becomes essential.

The most probable path likely lies between the base and bullish cases—tilting positively. Current signals suggest a gradually improving macro environment, maturing regulatory frameworks, and accumulating internal innovation. Bitcoin’s new all-time high in 2025 did not trigger the extreme euphoria seen in prior cycles—leaving room for further upside in 2026. Market sentiment, tempered by the 2022–2023 bear market, is also more mature and rational. Absent major negative “black swan” events, the overall 2026 crypto market trend is bullish—but volatility will be milder than in prior cycles. The year may unfold as “choppy upward momentum”: Q1 could consolidate amid macro uncertainty or profit-taking; Q2–Q3 may rally on rate cuts and regulatory tailwinds; and Q4 could surge further if new technological catalysts emerge. Longer term, 2026 may lay the foundation for the next crypto cycle: regardless of price swings, the industry’s underlying foundations are stronger than ever—global user numbers keep growing, mainstream institutional acceptance is rising, legal status is clarifying, and technology continues evolving. These fundamentals will propel crypto assets onto a broader stage.

Conclusion

The crypto market in 2026 stands at a new starting point. The shifting tides of macroeconomic conditions and policy waves will continue to shape the destiny of this nascent market to a large extent. From interest-rate trajectories to regulatory statutes, from institutional capital to geopolitical currents, interconnected macro variables mean crypto markets are no longer isolated from—but integrated into—the global financial system, resonating in sync with it. On one hand, this enriches the investment logic for crypto assets, demanding macro awareness and cross-market thinking from investors. On the other, it signals crypto’s gradual maturation: its fortunes are no longer merely the domain of speculators, but intrinsically tied to the pulse of the global economy and the evolution of institutions.

For retail investors, 2026 will be a year of both opportunity and challenge. We must recognize the historic opportunities presented by warming monetary conditions and regulatory clarity—while remembering that markets remain unpredictable and risk events may strike unannounced. Prudence without losing foresight, rationality without sacrificing enthusiasm—this balanced mindset is key to navigating the complex macro landscape and capturing the essence of crypto investment. Looking ahead, the crypto market will continue its evolution: bull or bear, its innate innovative vitality and pursuit of open finance remain unwavering. Let us watch closely—and see what extraordinary chapters the crypto world writes in 2026, propelled by macro forces.

About Us

Hotcoin Research, the core research arm of Hotcoin Exchange, is committed to transforming professional analysis into your practical edge. Through our “Weekly Insights” and “Deep Dive Reports,” we dissect market dynamics; via our exclusive column “Hotcoin Select”—powered by AI plus expert curation—we help you identify promising assets and reduce trial-and-error costs. Each week, our researchers engage with you live via streaming sessions, interpreting hot topics and forecasting trends. We believe that warm, hands-on guidance paired with professional expertise empowers more investors to navigate cycles and seize Web3’s value opportunities.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News