Huobi Growth Academy | Cryptocurrency Market Macro Report: U.S.-Europe Tariff TACO Trade Reemerges, U.S. and Japanese Treasury Yields Rise, Short-Term Pressure on Crypto Markets

TechFlow Selected TechFlow Selected

Huobi Growth Academy | Cryptocurrency Market Macro Report: U.S.-Europe Tariff TACO Trade Reemerges, U.S. and Japanese Treasury Yields Rise, Short-Term Pressure on Crypto Markets

From the perspectives of macro environment, capital structure, and market institutions, the cryptocurrency market is not experiencing a "collapse," but rather a revaluation process interrupted by exogenous shocks.

Executive Summary

In early 2026, the crypto market entered a volatile phase, undergoing a stress test driven by escalating geopolitical tensions and global liquidity disruptions. The U.S. and Europe clashed over Greenland's sovereignty, with former President Trump initially threatening tariffs before softening his stance and withdrawing those threats—once again enacting a classic Trump-style TACO trade. Simultaneously, rising long-term government bond yields in both Japan and the United States are pressuring global risk assets through three channels: interest rates, liquidity, and risk appetite. Bitcoin failed to act as a "safe-haven asset" during this shock, instead being hit hardest due to its high dependence on dollar liquidity. It is important to emphasize that this downturn reflects a period of re-pricing amid heightened macro uncertainty, not a systemic deterioration in the crypto market’s fundamentals. From the perspectives of macro conditions, capital structure, and market institutions, what the crypto market is experiencing is not a collapse, but rather a revaluation process interrupted by external shocks.

1. From Greenland to Global Markets: The Return of Trump-Style TACO Trading

Unlike previous tariff disputes centered on trade imbalances, industrial subsidies, or currency disagreements, the core pricing mechanism of this U.S.-Europe friction is not economic—it lies in sovereignty and geopolitical control. Tariffs are merely the tool; territorial influence and strategic depth are the true objectives. The immediate trigger was a joint military exercise conducted by eight countries—Denmark, Norway, Sweden, France, Germany, the UK, the Netherlands, and Finland—on Greenland. The Trump administration framed this as a challenge to U.S. Arctic strategic interests and swiftly weaponized tariffs, politicizing and sovereignty-izing them by presenting a binary ultimatum: “sell the island or pay the tax.” This linked trade measures directly to territorial demands, setting clear and firm deadlines: a 10% punitive tariff on these European nations starting February 1, potentially increasing to 25% by June 1—unless an agreement was reached allowing the U.S. to purchase or gain long-term control over Greenland. In response, Europe amplified the uncertainty. Denmark reaffirmed Greenland’s sovereignty as non-negotiable, the EU launched emergency consultations, and prepared retaliatory measures, most notably wielding a formal €93 billion countermeasure list—a structured “anti-coercion toolbox,” not just a temporary emotional reaction. Thus, markets now face not a localized dispute, but a potentially rapidly escalating transatlantic confrontation framework. Both sides are laying down cards, but their博弈 isn’t about short-term trade gains—it concerns alliance order, resource control, and strategic presence.

Then, on Wednesday, Trump announced he had reached a Greenland cooperation framework with NATO and withdrew the tariff threats against the eight European countries. Speaking at the World Economic Forum in Davos, Switzerland, Trump called for “immediate negotiations” to acquire Danish territory in Greenland, asserting only the U.S. could ensure its security—while also hinting he would not use military force to seize the island. Once again, a textbook Trump TACO trade unfolded. U.S. equities rebounded broadly, and crypto markets saw a modest recovery, though they failed to fully recoup prior losses.

However, what truly amplified market volatility wasn’t the specific numbers—10% or 25% tariffs—nor the familiar pattern of threat followed by retreat, but the institutional uncertainty it represents: the trigger for conflict is clear (a tariff timeline), yet the endpoint remains ambiguous (sovereignty issues have no “reasonable price”); execution can be swift (via executive order), while negotiations may drag on (requiring alliance coordination and domestic politics); and there exists a recurring rhythm of “maximum pressure → partial compromise → renewed pressure.” As a result, asset pricing must now incorporate significantly higher risk premiums. For global markets, such events first elevate volatility via expectations: firms and investors reduce risk exposure and increase cash and safe-haven allocations before assessing whether policies actually materialize. If the conflict persists, supply chain costs and inflation expectations feed into interest rates and liquidity, eventually spreading pressure across equities, credit, FX, and crypto—all domains highly sensitive to shifts in risk appetite. In other words, this is not a conventional trade war, but a geopolitical sovereignty conflict leveraged through tariffs. Its greatest harm lies in transforming negotiable economic issues into intractable political ones—when uncertainty becomes the primary variable, price swings shift from “sentiment noise” to “structural premium,” which is precisely the current pricing backdrop facing global assets.

2. The Starting Point of Rate Shocks: Synchronized Rise in U.S. and Japanese Treasury Yields

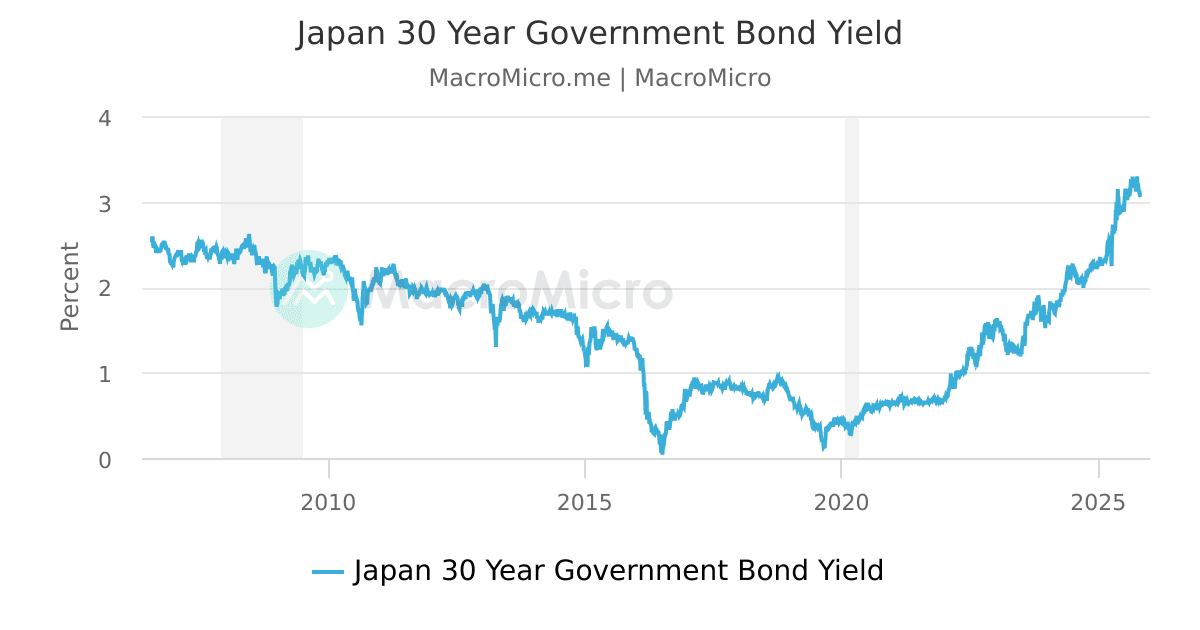

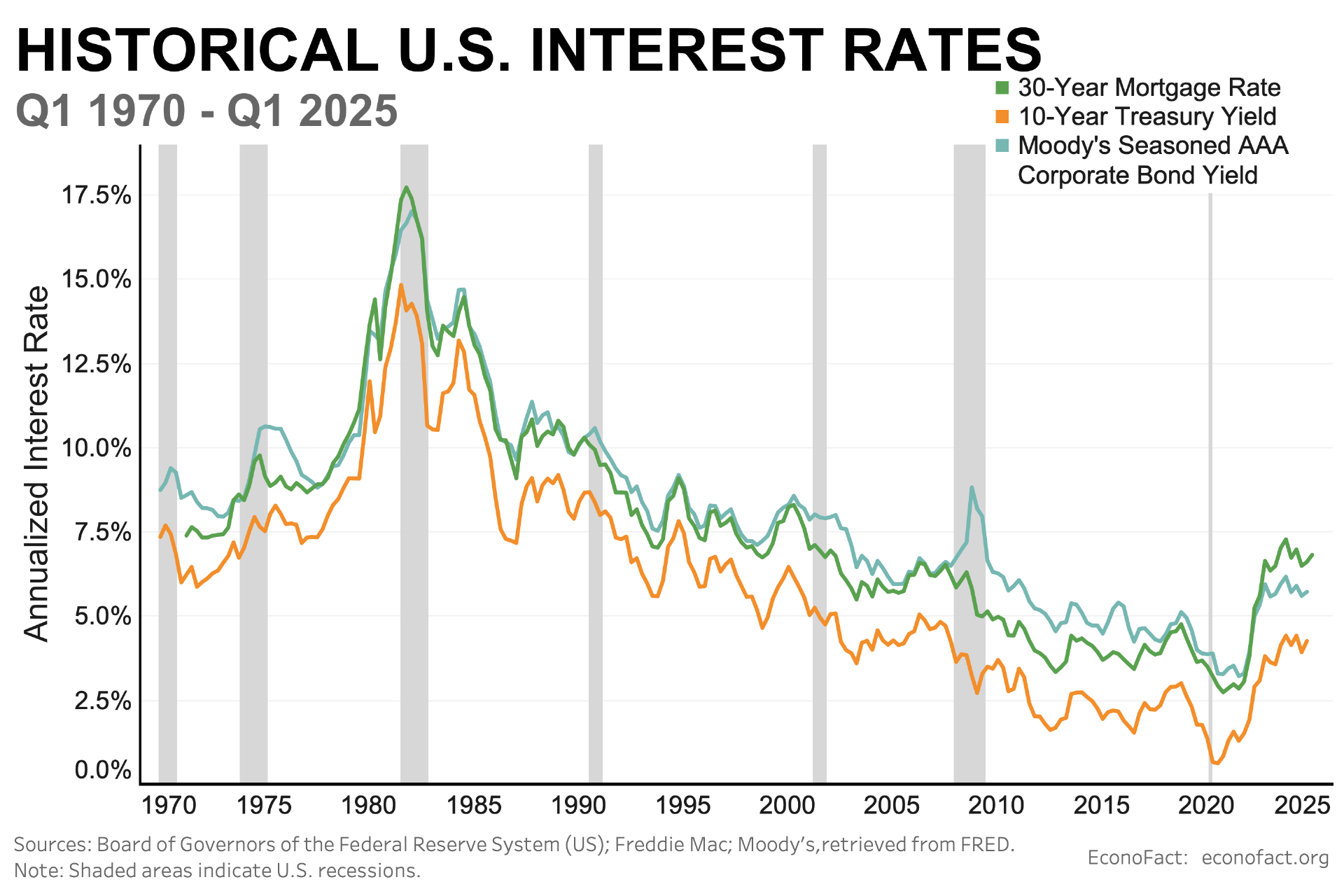

As geopolitical risks were rapidly repriced, global bond markets delivered the most direct and systemically significant signal. In mid-January, Japan’s 30-year government bond yield surged over 30 basis points in a single day, peaking at 3.91%—a 27-year high. Almost simultaneously, the U.S. 10-year Treasury yield climbed to 4.27%, reaching a four-month peak. For global markets, this synchronized rise in long-end yields across the U.S. and Japan is not mere short-term volatility, but a structural shock capable of altering the foundation of asset pricing—with implications far beyond the bond market itself. First, it must be understood that Japan has long served not just as a sovereign bond issuer, but as the anchor of low-cost global liquidity. For over two decades, Japan’s persistently ultra-loose monetary policy exported vast volumes of extremely cheap yen funding, forming the bedrock of global carry trades and cross-border investment flows. Whether emerging market assets, Western credit instruments, or high-risk equities and crypto, many implicitly rely on the hidden financing structure of “borrowing yen to invest in higher-yielding assets.” Therefore, when Japan’s long-term bond yields spike sharply, the implication goes well beyond “Japanese bonds becoming more attractive”—it signals something deeper: the loosening of the most stable and cheapest source of funding in the global financial system.

Once Japan ceases to reliably provide low-cost funds, the risk-return profile of global carry trades deteriorates rapidly. Highly leveraged positions previously funded in yen face dual pressures: rising financing costs and magnified currency risk. Initially, such stress does not typically manifest as outright asset collapses, but rather prompts institutional investors to proactively deleverage and reduce exposure to high-volatility assets. At this stage, global risk assets exhibit a characteristic of “undifferentiated pressure”—not due to deteriorating fundamentals, but due to systemic rebalancing triggered by shifting funding sources. Second, the concurrent U.S.-Europe tariff conflict further fuels expectations of imported inflation, lending credibility to the rate hike narrative. Unlike past trade disputes focused on consumer goods or low-end manufacturing, the potential tariffs this time target high-value, hard-to-substitute sectors such as advanced manufacturing, precision instruments, medical devices, and automotive supply chains. The U.S. maintains structural dependencies on European suppliers in these areas, making tariff pass-through to end consumers nearly inevitable. At the market expectation level, this challenges the earlier assumption of a steadily declining inflation trend. Even if tariffs haven’t fully taken effect, the mere prospect of persistent, irreversible inflation risk is sufficient to lift long-term risk premia.

Third, the U.S.’s own fiscal and debt dynamics provide a structural backdrop for rising long-end yields. In recent years, growing fiscal deficits and expanding national debt have kept market concerns about long-term debt sustainability alive. Should the tariff conflict escalate further, it could not only boost inflation expectations but also lead to increased fiscal spending on subsidies, industrial support, and security—further straining public finances. Under these conditions, long-dated Treasuries enter a classic tug-of-war: on one hand, geopolitical uncertainty and risk-off sentiment drive capital into bonds; on the other, inflation and debt worries demand higher term premiums to compensate for risk. The result is simultaneous increases in both yield levels and volatility—rendering the so-called “risk-free rate” increasingly risky. The convergence of these three forces leads to a systemic upward shift in the global risk-free rate center and a passive tightening of financial conditions. For risk assets, this shift is deeply penetrating: higher discount rates compress valuation space, elevated financing costs suppress new leverage, and liquidity uncertainty heightens sensitivity to tail risks.

The crypto market is under pressure within this macro context. Importantly, Bitcoin and other major cryptocurrencies are not being uniquely targeted, but are playing their role as high-volatility, high-liquidity risk assets amid rising rates and tightening liquidity. When institutional investors face margin pressures or risk constraints in traditional markets, the first assets to be trimmed are rarely illiquid or costly-to-adjust holdings—but rather those that can be quickly liquidated and have the highest price elasticity. Crypto assets perfectly fit this description. Moreover, the rise in the risk-free rate center alters the relative attractiveness of crypto assets. In low-rate, loose-liquidity environments, the opportunity cost of holding Bitcoin is low, encouraging investors to pay a premium for its growth potential. But as U.S. and Japanese long-end yields rise in tandem, safer assets begin offering more attractive nominal returns, inevitably forcing a reassessment of crypto allocation logic. This reassessment does not imply a bearish long-term outlook, but indicates that prices must adjust downward in the short term to realign with the new interest rate environment. Thus, from a macro perspective, the synchronized rise in U.S. and Japanese bond yields is not simply a “bearish event” for crypto, but the starting point of a clear transmission chain: rising rates → tighter liquidity → lower risk appetite → pressure on high-volatility assets. Within this chain, crypto’s correction primarily reflects changes in global financial conditions, not internal fundamental deterioration. This also means that unless the rate and liquidity trends fundamentally reverse, crypto markets will remain highly sensitive to macro signals in the near term—and the true directional turning point will depend on marginal shifts in this rate shock cycle.

3. The True State of the Crypto Market: Not Collapse, But Temporary Pressure

Rising interest rates do not directly “attack” the crypto market, but they trigger a clear and repeatable transmission mechanism through liquidity and risk appetite: tariff threats raise inflation expectations, which push up long-end yields, which in turn increase credit and financing costs, tighten financial conditions, and ultimately force capital to systematically reduce risk exposure. In this process, price volatility is not the cause, but the outcome—the real drivers are changes in funding sources and constraints. Here, the offshore USD market plays a critical yet often underestimated role. As U.S.-Europe tariff tensions compound with geopolitical uncertainty, risk premiums in global trade finance and cross-border settlements rise, increasing the cost of accessing offshore dollars. This shift may not show up in official policy rates, but manifests more clearly in interbank lending, cross-currency basis, and financing availability. For institutional investors, this translates into stricter margin requirements, more conservative risk management, and reduced tolerance for high-volatility assets. When traditional markets become volatile and correlations rise, institutions typically avoid selling illiquid, high-exit-cost, or heavily regulated assets—instead opting to reduce positions in assets that are **highly volatile, easily liquidated, and most “portfolio-friendly” to adjust**. Under current conditions, crypto assets embody both traits, thus serving as the primary “relief valve” during macro shocks.

It is precisely in this context that Bitcoin failed to demonstrate safe-haven qualities akin to gold during the recent turmoil. Yet this phenomenon is not anomalous—it reflects the natural evolution of its asset class. Unlike its early branding as “digital gold,” Bitcoin today behaves more like a macro risk asset highly dependent on USD liquidity. It cannot operate independently of the U.S. dollar credit system, and its price is acutely sensitive to shifts in global liquidity, interest rates, and risk appetite. When offshore USD tightens, long-end rates rise, and institutions need to quickly cover margins or reduce portfolio volatility, Bitcoin naturally becomes a prime candidate for divestment. In stark contrast, gold and silver strengthened throughout the episode—not due to short-term return chasing, but because of central bank demand, physical attributes, and their “de-sovereignized” nature that confers safe-haven premium. Amid escalating geopolitical rivalry and the repricing of sovereignty risk, such “stateless” assets attract stronger investor preference. It should be emphasized that this is not a failure of Bitcoin, but a recalibration of its market role. Bitcoin is not a crisis safe harbor, but an amplifier within the liquidity cycle; its strength lies not in hedging extreme risks, but in its high sensitivity to recovering risk appetite during periods of liquidity expansion. Recognizing this helps prevent unrealistic expectations during macro shocks.

Structurally, despite visible price corrections, the current crypto market has not repeated the systemic crises seen in 2022. There has been no credit crisis involving major exchanges or stablecoins, nor sustained cascading liquidations or on-chain liquidity freezes. Long-term holder behavior remains relatively orderly, with coin distribution reflecting rational profit-taking rather than forced dumping. While Bitcoin did trigger some liquidations after breaking key support levels, the overall scale and contagion effects were clearly smaller than in the last bear market—more indicative of portfolio rebalancing under macro pressure than internal structural breakdown. In short, this is a phase of externally driven, temporary stress—not a collapse stemming from internal imbalances within the crypto ecosystem.

4. Conclusion

The market volatility triggered by escalating U.S.-Europe trade tensions and the synchronized rise in U.S. and Japanese government bond yields is not a “single-point risk event” affecting one asset or market. Rather, it is a systemic repricing process centered on global liquidity, the interest rate center, and risk appetite. In this process, the crypto market’s decline stems not from deteriorating fundamentals or institutional or credit failures, but from its inherent role within the current financial system—as a highly liquid, elastic, and macro-sensitive risk asset that bears the brunt during tightening liquidity and rising rates. Over a longer horizon, this adjustment does not negate the ongoing structural revaluation of the crypto market in 2026. On the contrary, it clearly reveals an evolving reality: crypto assets are gradually moving beyond the early stages of “narrative-driven, sentiment-based pricing,” entering a more mature and institutionalized pricing framework. Within this new paradigm, prices are no longer primarily driven by stories, slogans, or isolated events, but are increasingly functions of macro liquidity, interest rate structures, and shifts in risk appetite. For investors, the real challenge is not predicting short-term price movements, but updating their analytical frameworks in time—to understand and adapt to this long-term transition from a “narrative market” to a “macro market.”

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News