JustLend DAO Enhances Ecosystem Rewards: Over 1 Billion JST Burned Across Two Rounds, Accelerating Deflationary Progress

TechFlow Selected TechFlow Selected

JustLend DAO Enhances Ecosystem Rewards: Over 1 Billion JST Burned Across Two Rounds, Accelerating Deflationary Progress

JST cumulative burn amount exceeds 1.08 billion tokens, accounting for 10.96% of the total token supply; JustLend DAO drives JST token value growth through real ecosystem earnings.

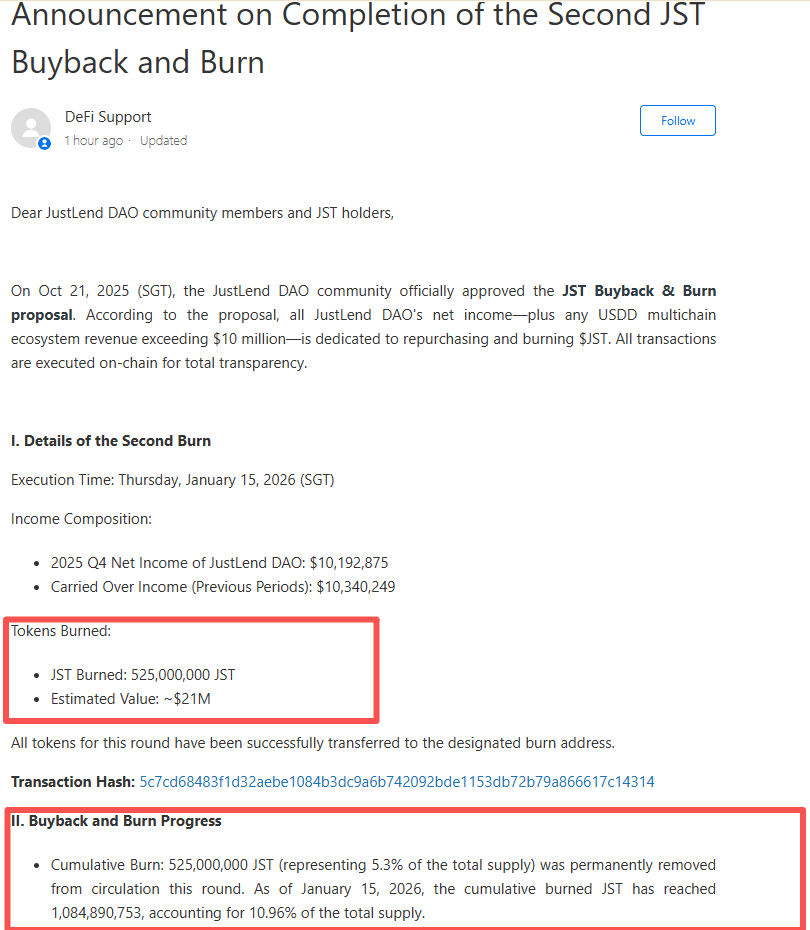

On January 15, JustLend DAO, the core DeFi lending protocol within the TRON ecosystem, announced major positive developments: it has successfully completed its second large-scale JST token buyback and burn, accelerating the release of deflationary benefits.

According to official announcements, this round saw the burning of as many as 525 million JST tokens—worth over $21 million—accounting for approximately 5.3% of the total JST supply, further strengthening the token’s structural deflationary foundation.

When combined with the first round of burns, since the launch of the JST buyback and burn program in October last year, cumulative JST token destruction has surpassed 1 billion, representing around 11% of total supply. Achieving such a scale of token reduction in less than three months is exceptionally rare in the industry and has injected strong confidence into an otherwise subdued market.

The successful completion of this JST buyback and burn not only demonstrates consistent and effective execution of the burn plan but also accelerates the realization of deflationary rewards. More importantly, it validates at a fundamental level that JustLend DAO possesses robust and sustainable real-world profitability.

Exceeding Expectations: Over 1 Billion JST Burned Across Two Rounds, Deflation Momentum Accelerates

As of January 15, 2026, JustLend DAO has completed two large-scale rounds of JST buybacks and burns, destroying a total of over 1.08 billion tokens (specifically 1,084,890,753), or 10.96% of total supply, equivalent to more than $38.7 million in value. Both in terms of deflationary scale and operational efficiency, this achievement ranks among the top in the DeFi sector.

The JST burn initiative began in October 2025 when the JustLend DAO community passed a proposal to allocate all surplus earnings from the JustLend DAO protocol—including existing reserves, future net income, and any portion exceeding $10 million from the USDD multi-chain ecosystem—to repurchase and permanently burn JST tokens. All buyback transactions are executed transparently on-chain, ensuring full traceability and auditability.

In terms of funding sources, the JST buyback mechanism relies on two main pillars: (1) JustLend DAO's accumulated and ongoing net profits; and (2) excess revenue beyond $10 million generated by the USDD multi-chain ecosystem. At the start of the program, JustLend DAO allocated over 59.08 million USDT from its reserves, adopting a phased strategy—“30% burned immediately, 70% deployed into yield-generating strategies before being burned quarterly”—to balance short-term deflation with long-term value accumulation.

The first burn was completed in October 2025, utilizing 30% of the funds to destroy 560 million JST tokens (5.6% of total supply). The remaining 70% was deposited into the SBM USDT lending market on JustLend DAO to earn interest over four quarters prior to subsequent burns.

On January 15, 2026, JustLend DAO released its “Announcement on Completion of the Second JST Token Buyback and Burn,” marking the successful conclusion of the second major phase. This round burned 525 million JST tokens—approximately $21 million worth—representing 5.3% of total supply.

Thus, both phases of the JST buyback and burn have now been fully executed:

First Round (October 2025): Approximately 556 million JST burned (~$17.72 million), accounting for 5.66% of total supply

Second Round (January 2026): 525 million JST burned (~$21 million), representing 5.3% of total supply

Notably, the second round significantly exceeded expectations. Despite potential market volatility, the capital allocation did not decrease—it increased counter-cyclically, surpassing initial projections and generating significant excitement and positive sentiment across the community.

To date, over 1.08 billion JST tokens have been burned—10.96% of total supply—with cumulative investment exceeding $38.7 million. Such a high-intensity deflationary effort and substantial financial commitment rank among the most aggressive in the global DeFi space.

Moreover, all JST buyback and burn operations were carried out in a decentralized manner via the community-governed Grants DAO. Every fund transfer and token burn is immutably recorded on-chain, ensuring complete transparency. Users can verify each burn batch, transaction hash, and execution process in real time through the Grants DAO dashboard and the "Transparency" financial metrics page on the JustLend DAO website, reinforcing trust and support within the ecosystem.

JustLend DAO Profitability Reaffirmed: Q4 2025 Net Earnings Surpass $10 Million

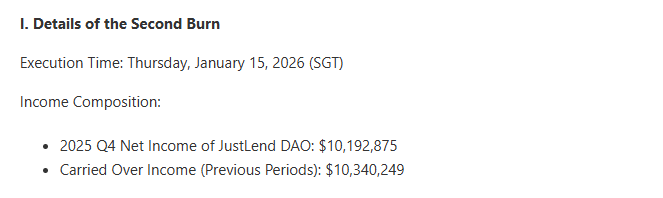

The successful execution of this second burn is not just a routine fulfillment of the burn plan—it reflects JustLend DAO’s strong operational capabilities and sustainable profitability, providing critical backing for the long-term viability of the deflationary mechanism.

Based on the original plan, the 70% reserve from prior earnings was expected to be distributed over four quarters at roughly $10.34 million per quarter. However, the actual amount deployed in this round exceeded $21 million—more than double the projected figure.

This increase in capital deployment amid regular quarterly burns highlights JustLend DAO’s intrinsic earning power, fundamentally differentiating it from so-called “pseudo-deflation” models that rely on fundraising or token inflation.

As disclosed in the burn announcement, the entire $21 million used in the second round came directly from JustLend DAO’s platform revenues. This includes the scheduled quarterly reserve of ~$10.34 million plus newly generated net earnings of ~$10.19 million from Q4 2025.

This dual-source funding model—"existing reserves as base + new net earnings as booster"—not only accelerates the pace of JST buybacks and burns but also provides concrete proof of the protocol’s financial health and liquidity strength, effectively eliminating market concerns about potential funding shortfalls in future burns.

The over-$10 million in net earnings generated in Q4 2025 reaffirms JustLend DAO’s genuine profit-making ability. It shows clearly that the JST burn program is not detached from the ecosystem but deeply rooted in real business growth. The protocol’s profit resilience ensures the deflationary mechanism remains viable over the long term.

Notably, JustLend DAO still holds approximately $31.02 million in reserved earnings, which will be gradually allocated toward future buybacks and burns. Combined with ongoing growth in protocol-level net income, this creates a solid foundation for continued JST reductions.

This means the JST buyback and burn initiative is not a one-off marketing stunt but a sustained, long-term value-enabling program anchored to protocol performance. It establishes a clear and durable deflationary loop—fundamentally distinct from the short-lived, "flash-in-the-pan" buybacks seen elsewhere in crypto—and provides strong support for JST’s long-term stability and appreciation.

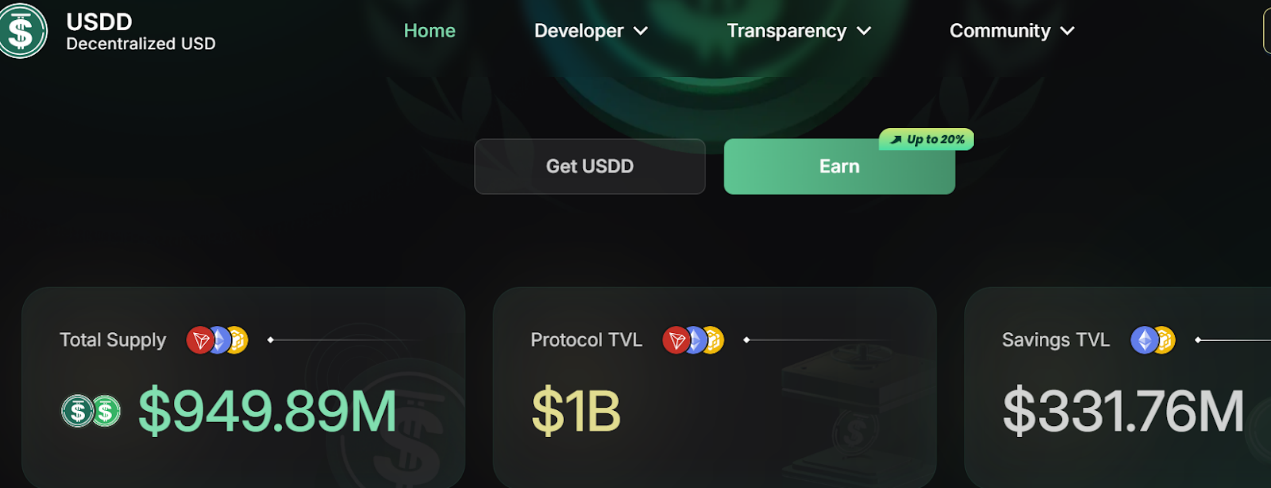

Another key potential funding source for JST buybacks—the USDD stablecoin ecosystem—is entering a golden period of rapid growth, building substantial momentum for future deflationary reinforcement. USDD has achieved successful cross-chain deployment across major public chains including Ethereum and BNB Chain. As of January 15, USDD’s total supply has reached $960 million, while the total value locked (TVL) across related platforms has surpassed $1 billion. With continued expansion of the USDD ecosystem, its future excess earnings will serve as a growing source of incremental funding for JST buybacks, further amplifying deflationary pressure and driving upward price momentum.

In summary, the JST deflationary mechanism extends far beyond a simple linear logic of “token burn → reduced supply.” Instead, it is built upon the real, sustainable revenues generated by two thriving ecosystems—JustLend DAO and USDD. By tightly linking deflation intensity to actual earnings, it overcomes the common industry pitfall of “meaningless deflation without revenue backing,” establishing a solid, irreversible foundation for JST’s long-term value growth.

JustLend DAO’s Growing Ecosystem Revenue Fuels Deflation, Driving JST Value Appreciation

Leveraging real ecosystem earnings as its core engine, JustLend DAO continues to intensify JST token buybacks and burns, deepening the deflationary effect. This has successfully established a virtuous cycle: increased ecosystem activity → higher protocol earnings → stronger buyback and burn → greater token scarcity → enhanced ecosystem attractiveness—a self-reinforcing growth flywheel.

With the JST buyback program progressing steadily and a large reserve fund continuously releasing deflationary benefits, supported by the expanding footprint of the JustLend DAO ecosystem, the value proposition of JST is becoming increasingly robust, with market performance beginning to reflect its long-term potential.

In terms of deflation impact, over 1.08 billion JST tokens have already been removed from circulation—10.96% of total supply—resulting in a direct, rigid contraction of circulating supply. Under a fixed maximum supply model, each burn permanently reduces available tokens, progressively enhancing scarcity and placing JST firmly on a long-term upward value trajectory.

JST’s value potential has already gained broad market recognition. On January 8, CoinMarketCap data showed JST’s market cap surpassing $400 million, with 24-hour trading volume surging 21.92%, and a monthly price gain of 10.82%. The simultaneous growth in trading volume and market cap vividly reflects strong market confidence in the development prospects of the JustLend DAO ecosystem.

As the buyback program advances, the circulating supply of JST will continue to shrink, making scarcity-driven value increasingly apparent and potentially triggering a new wave of price appreciation. More importantly, the profitability of both the JustLend DAO and USDD ecosystems continues to strengthen, meaning future deflationary pressure on JST will intensify, with the underlying drivers of value growth becoming ever more powerful.

As a lasting engine behind the JST deflation mechanism, JustLend DAO consistently reinforces buyback efforts with real, organic revenue generated through product enhancements and healthy operational growth.

As a core financial infrastructure in the TRON ecosystem, JustLend DAO has evolved from a single-purpose lending protocol into a comprehensive, full-stack DeFi solution integrating asset lending, liquid staking, energy rental, and gas optimization—building a diversified product suite that fuels multiple streams of revenue growth:

- SBM Lending Market: The foundational service enabling users to deposit assets for yield or borrow against collateral, optimizing capital efficiency;

- sTRX Liquid Staking: The preferred TRX staking gateway in the TRON ecosystem, allowing users to stake TRX and receive sTRX, a liquid staking derivative;

- Energy Rental Service: Offers flexible “rent-as-you-go” energy leasing, significantly lowering barriers to on-chain interactions;

- GasFree Smart Wallet: Enables fee payment directly from transferred tokens and, with platform subsidies, allows users to send USDT for approximately 1 USDT in fees—greatly improving transaction usability.

Driven by this diversified product matrix, key metrics across core services—including liquid staking and lending demand—are experiencing strong growth. According to DeFiLlama, JustLend DAO now ranks third globally in the lending sector, trailing only multi-chain giant Aave and Morpho, which spans over thirty chains. Notably, JustLend DAO operates on a single chain yet stands out in a competitive multi-chain landscape—highlighting its dominant position and user trust within the TRON ecosystem.

As of January 15, the total value locked (TVL) on JustLend DAO reached approximately $7.038 billion. The platform has distributed over $192 million in incentives to the community and served more than 480,000 users worldwide with secure and efficient DeFi services. Within the SBM lending market, supplied assets exceed $4.2 billion, with borrowed assets reaching $200 million—demonstrating industry-leading levels of capital activity and scale.

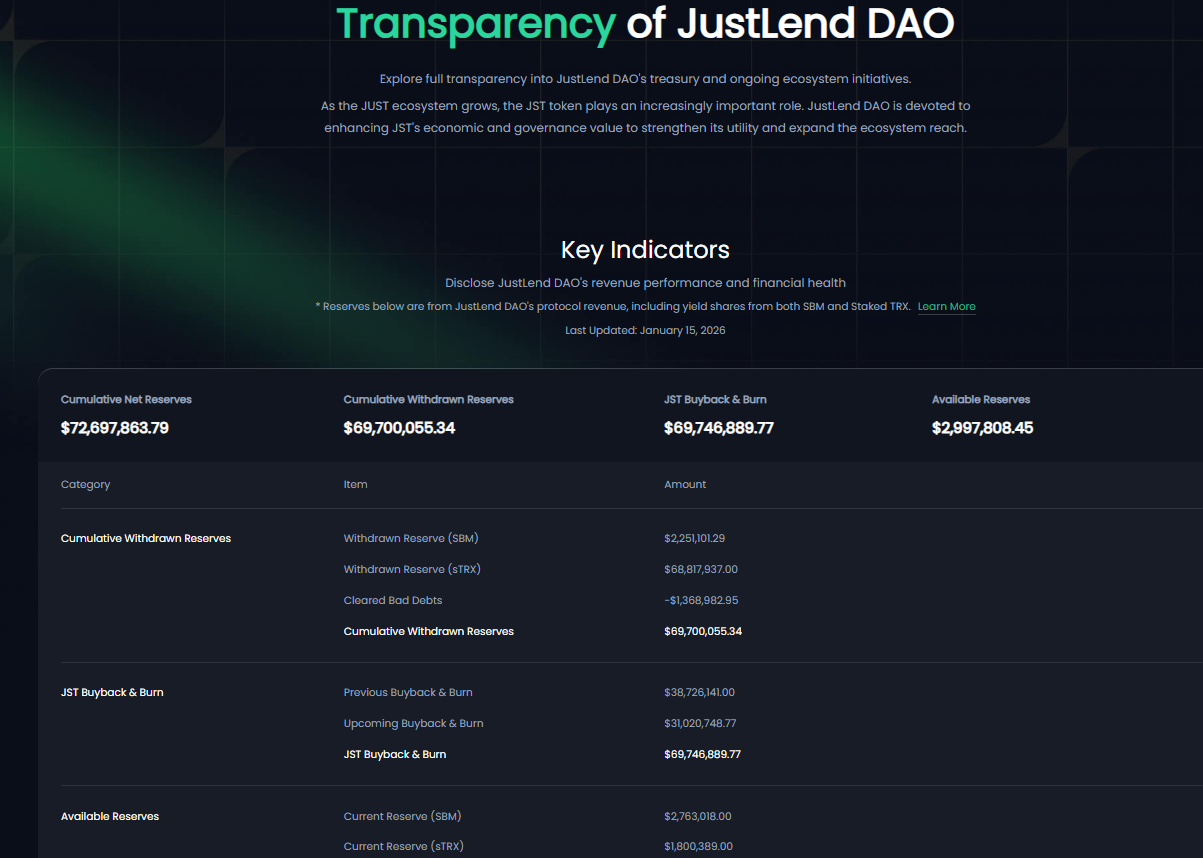

On the revenue front, according to the Transparency financial dashboard, JustLend DAO has generated over $72.69 million in cumulative net earnings. Of this, $69.7 million has been withdrawn, with $2.99 million retained on the balance sheet—indicating a healthy and stable financial structure that ensures reliable funding for future buybacks and burns.

Currently, JustLend DAO’s net earnings come solely from two business lines: the SBM lending market and sTRX liquid staking—with sTRX serving as the dominant revenue pillar. Of the $69.7 million withdrawn, $68.81 million originated from sTRX staking, while the SBM lending market contributed approximately $2.25 million.

With sTRX staking volume continuing to grow, its revenue contribution is expected to rise further. Latest data shows over 9.3 billion TRX staked via sTRX, with participation from more than 13,500 addresses, offering an annualized yield of 7.23%—all indicators showing steady upward trends. The SBM lending market also performed strongly, generating approximately $2.2 million in interest fees during Q4 2025 alone (from borrower-paid interest), setting a new record and reflecting ongoing lending growth.

Meanwhile, Energy Rental and GasFree Smart Wallet—two high-frequency, essential-use services—are emerging as new engines of ecosystem growth. On January 9, the base fee for Energy Rental was sharply reduced from 15% to 8%, making it highly cost-effective—for example, renting 100,000 energy units now costs only about 6.21 TRX (equivalent to staking 10,674 TRX), sufficient for two contract interactions. The number of participating addresses has grown to 73,000. Meanwhile, the GasFree Smart Wallet has processed over $46.3 billion in transaction volume, serving more than 2.5 million accounts and saving users $3.64 million in fees.

Going forward, revenues from Energy Rental, GasFree, and other services will gradually be incorporated into JustLend DAO’s overall revenue reporting system, forming new growth vectors for ecosystem income and expanding the funding pool for JST buybacks. As diverse revenue streams feed into the buyback mechanism, both deflationary intensity and JST value will rise in tandem, continually raising the ceiling for long-term token appreciation.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News