WEEX Labs: What are the key issues that will significantly impact the crypto market by 2026?

TechFlow Selected TechFlow Selected

WEEX Labs: What are the key issues that will significantly impact the crypto market by 2026?

It is anticipated that new spot ETFs such as LTC and DOGE, along with multi-asset and leveraged crypto ETFs, will be launched in 2026 to attract more off-market capital.

Author: WEEX

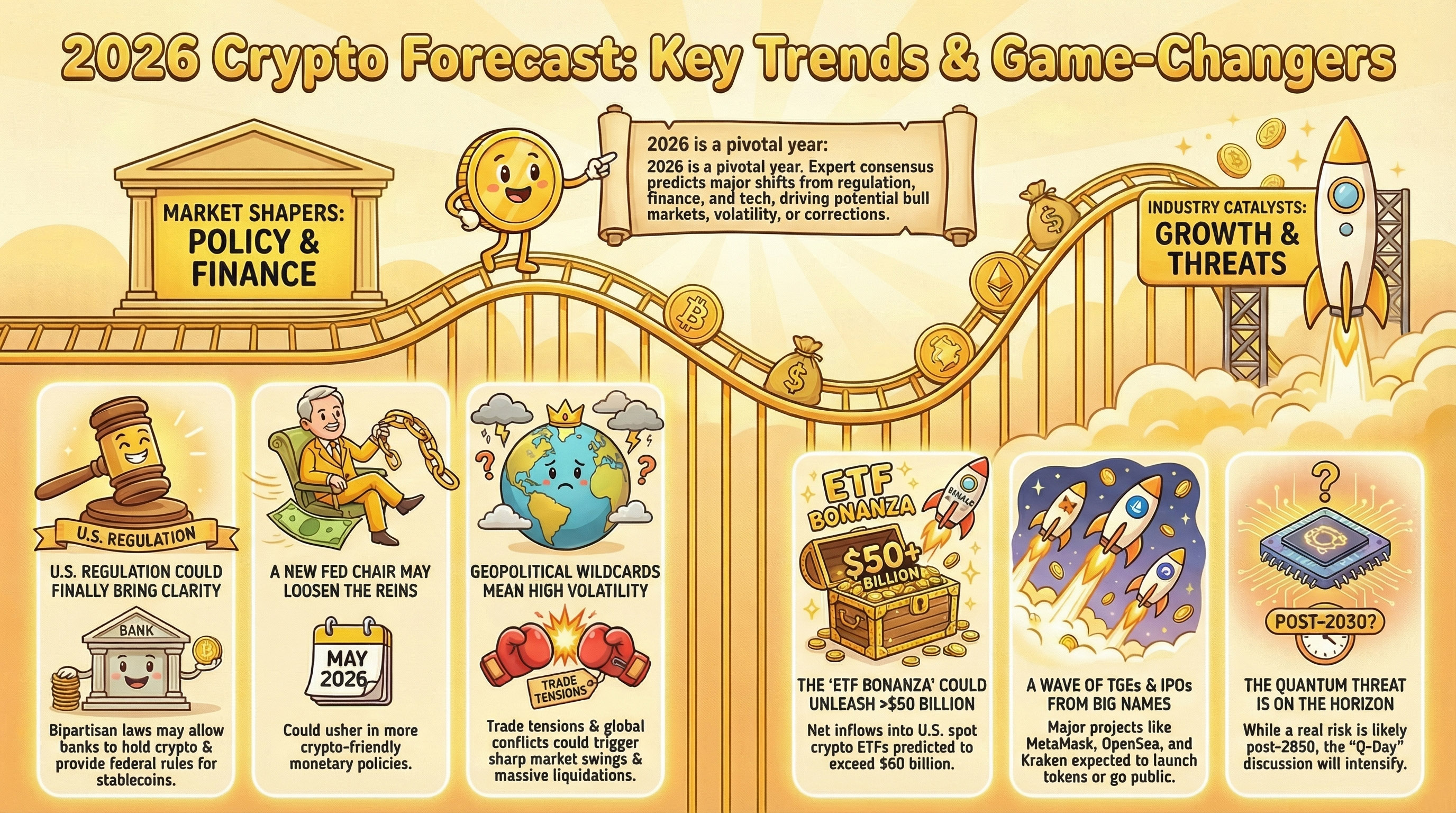

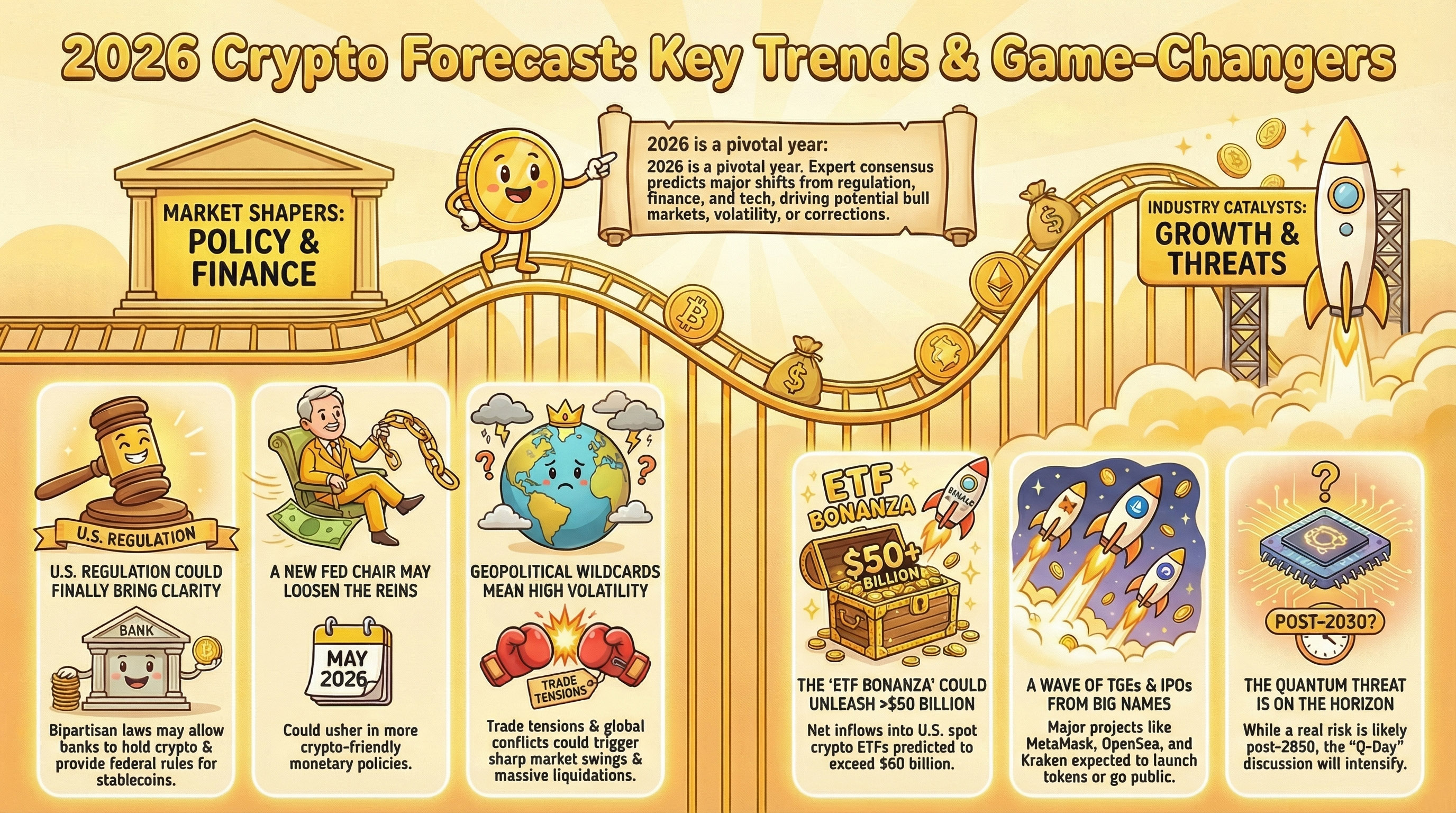

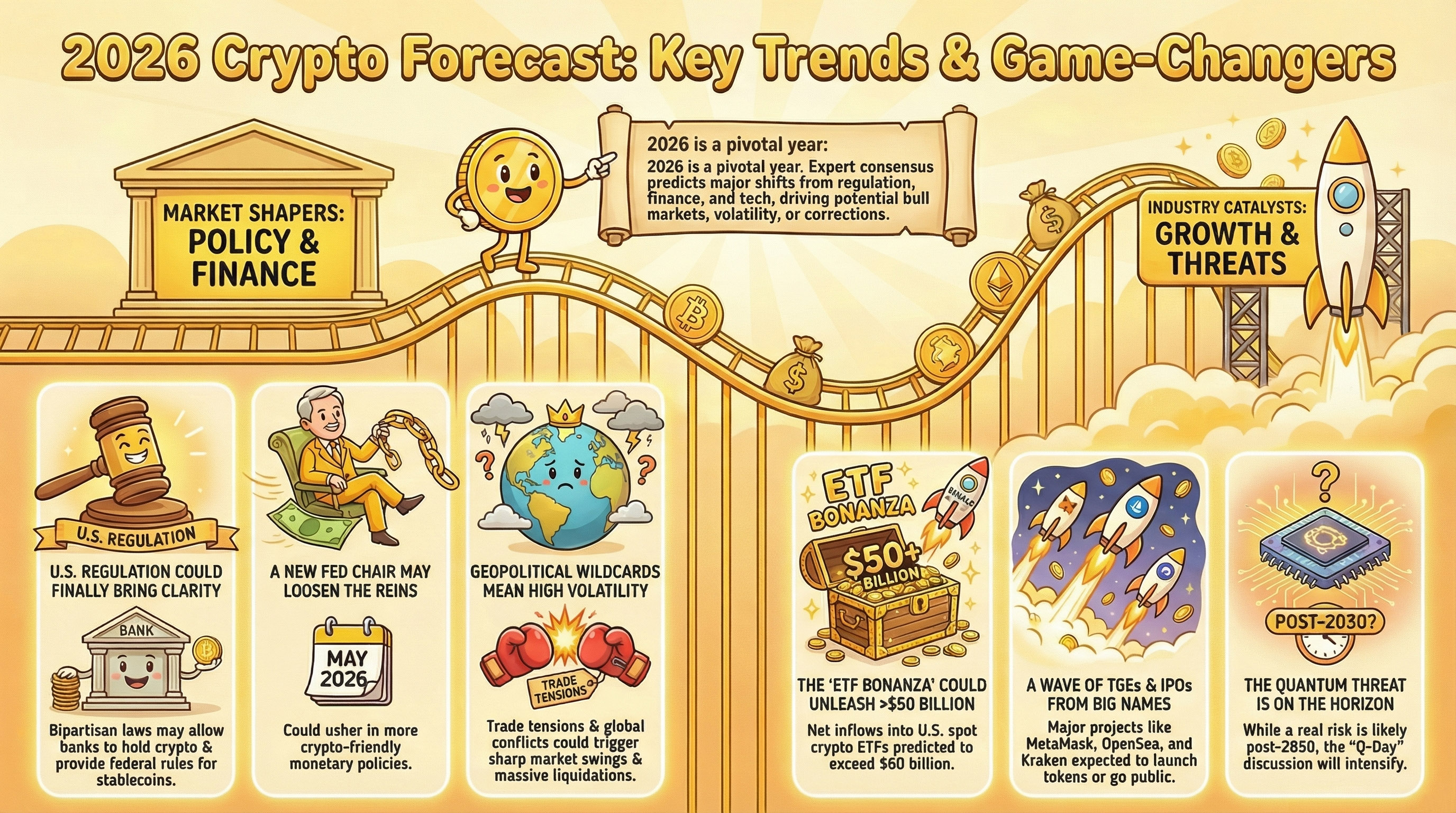

As we pointed out in the article "WEEX Labs: Looking Ahead to 2026, What Significant Opportunities Are People Bullish On?", 2026, as a pivotal turning point year for the cryptocurrency market, may witness a comprehensive transformation ranging from regulatory clarity to deep institutional integration.

Consequently, we have compiled some events that could significantly impact the crypto narrative and forward-looking trends, sharing them with you as follows. Please note that these events are not deterministic predictions but rather speculations based on existing market consensus and emerging trends, which could lead to a continuation of the bull market, severe volatility, or localized adjustments.

US Crypto Market Structure Legislation Passes

I believe everyone remembers that in July 2025, when bills such as the "GENIUS Act," "CLARITY Act," and "Anti-CBDC Surveillance State Act" made successive progress, it triggered a wave of hype in the Ethereum, stablecoin, and PayFi sectors.

It is anticipated that in the first half of 2026, the US Congress will pass bipartisan-supported crypto market structure legislation (e.g., the CLARITY Act will enter the revision/deliberation stage). This will simplify compliance processes, allow banks to directly hold crypto assets, provide federal guidance for stablecoin issuance, and potentially trigger a second wave of hype.

New Federal Reserve Chair Takes Office

In 2025, we have seen Trump complain numerous times about the current Federal Reserve Chair Powell's slow pace of interest rate cuts.

Powell's term as Federal Reserve Chair will end in May 2026. With Trump expected to announce the Federal Reserve Chair nominee in January, if potential candidates such as Kevin Hassett or Kevin Warsh take office, they may promote more accommodative monetary policies, including adjusting bank capital requirements to allow for greater crypto exposure.

Federal Reserve's Gradual Interest Rate Cuts

According to the Summary of Economic Projections (SEP) released by the Federal Reserve on December 10, 2025, the median projection for the federal funds rate at the end of 2026 is 3.4%, with a central tendency of 2.9%–3.6%, while the current interest rate range is 3.5%–3.75%. This means the overall room for rate cuts this year is limited, possibly only 1-2 times (0.25% each time).

By convention, the Federal Reserve holds 8 FOMC meetings throughout the year (January, March, April, June, July, September, October, December). Specific decisions on rate cuts will be dynamically adjusted during these meetings based on the latest data.

Regardless, the overarching trend of Federal Reserve rate cuts is already irreversible. We have seen many observers point out that further rate cuts will inject more liquidity into the market, thereby driving rebounds in BTC and altcoins, especially in Q1-Q2.

Geopolitical Events Continue to Unfold

As we witnessed in 2025, geopolitical events can often rapidly amplify volatility in the crypto market.

- On April 2, Trump announced a 10% tariff on global imports and higher tariffs on Chinese imports, causing BTC to drop over 3%. Subsequently, Trump announced a 90-day suspension of most tariffs (except those on China), leading to a brief market rebound.

- The theme in June was the escalation of the Israel-Iran conflict, including US military action against Iran, which caused Middle East geopolitical risks to soar but did not trigger significant surges in Bitcoin and gold.

- On October 10, Trump announced a 100% tariff on all Chinese imports, driving Bitcoin's maximum intraday drop to 17%, with crypto market liquidations reaching as high as $19 billion within 24 hours. In the following days, tariff disputes eased slightly, and the crypto market experienced a brief rebound.

It is foreseeable that entering 2026, similar geopolitical uncertainties may continue to unfold. Against the backdrop of unresolved Sino-US trade tensions, Middle East conflicts, the Russia-Ukraine conflict, and other potential factors, these geopolitical risks could lead to short-term recessionary or rebound adjustments in the crypto market, warranting our continued attention.

TGE & IPO

Although the wealth-creation effect of TGEs and IPOs for large projects has shown diminishing marginal returns, it still cannot be ignored.

In 2026, the cryptocurrency market will usher in a wave of TGE activity. For example, well-known wallets like MetaMask, NFT trading platforms like OpenSea, and L2 public chains like Base may initiate TGEs.

Furthermore, prediction markets represented by Polymarket, Perp DEX markets represented by edgeX, privacy sectors represented by Brevis, and AI sectors represented by Sentient are also about to launch TGEs. These TGEs are expected to create wealth effects, attract developers and users, and promote further industry transformation towards utility.

Simultaneously, the IPO process in the crypto industry will accelerate in 2026. Following crypto companies raising $3.4 billion in 2025, it is expected that more crypto companies will go public with high profiles this year. Among them, Kraken, valued at $20 billion, plans to go public in the first half of the year; Consensys, valued at $7 billion, is collaborating with JPMorgan Chase; BitGo focuses on custody security; Animoca Brands, through a reverse merger, is valued at $6 billion; Ledger has sold over 6 million hardware wallets; Bithumb is listing in South Korea, underwritten by Samsung Securities.

In summary, TGE and IPO events for well-known crypto projects mark the evolution of the crypto market from early wild growth to mature institutionalization, potentially attracting mainstream capital injection and driving innovation in areas like TradFi, Custody, and Privacy technologies.

More Crypto ETFs Launch

According to the latest forecasts from multiple institutions, the US crypto ETF market will experience an "ETF palooza" in 2026, with new spot ETFs for assets like LTC and DOGE, as well as multi-asset and leveraged crypto ETFs expected to launch, aiming to attract more off-market funds.

For example, Galaxy Digital predicts that, based on expanded distribution channels, surging institutional demand, and tokenization integration, net inflows into US spot cryptocurrency ETFs could exceed $50 billion in 2026.

It is worth noting that we have already seen the price-boosting effect of institutional funds entering ETFs on BTC, but the performance on ETH, SOL, etc., is not as prominent. This may be due to institutional cognitive differences leading to slowed demand.

Although we are uncertain whether the marginal effects of ETF products can be reversed, there is no doubt that multi-asset, multi-functional crypto funds will become more mainstream, further testing the operational capabilities and business standards of the crypto projects themselves.

Quantum Threat

Over the past year, progress in quantum computing has primarily focused on experimental validation. Breakthroughs by companies like Google have also garnered some attention, with some reports even mentioning that Q-Day (Quantum Decryption Day) could occur around 2026-2027.

The market generally believes that quantum computing is far from sufficient to crack Bitcoin's Elliptic Curve Digital Signature Algorithm (ECDSA). For instance, a16z's report points out that quantum computers powerful enough to break BTC encryption would likely not emerge until after 2030.

However, the Bitcoin community has begun discussing upgrade paths. It is expected that the quantum threat will be a long-term topic of offense and defense. Regardless, this will strengthen the resilience of the crypto ecosystem.

About Us

WEEX Labs is the research department under WEEX Exchange, dedicated to tracking and analyzing cryptocurrencies, blockchain technology, and emerging market trends, providing professional assessments.

The team adheres to principles of objectivity, independence, and comprehensive analysis. Through rigorous research methods and cutting-edge data analysis, it aims to explore frontier developments and investment opportunities, delivering comprehensive, rigorous, and clear insights for the industry, and providing all-round construction and investment guidance for Web3 startups and investors.

Disclaimer

The views expressed in this article are for reference only and do not constitute an endorsement of any products or services discussed, nor do they constitute any investment, financial, or trading advice. Readers should consult qualified professionals before making financial decisions. Please note that WEEX Labs may restrict or prohibit all or part of its services from restricted regions.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News