Frontline Coverage | Web3 Lawyer Explains Latest Changes in U.S. Stock Tokenization!

TechFlow Selected TechFlow Selected

Frontline Coverage | Web3 Lawyer Explains Latest Changes in U.S. Stock Tokenization!

Tokenization of U.S. stocks won't fundamentally change how Wall Street operates in the short term, but it has already become a key item on the agenda for U.S. financial infrastructure.

On December 15, 2025, U.S. time, Nasdaq formally submitted Form 19b-4 to the SEC, applying to extend trading hours for U.S. equities and exchange-traded products to 23/5 (23 hours per day, five days per week).

However, Nasdaq's proposed trading hours are not simply an extension, but rather a restructuring into two formal trading sessions:

Daytime session (4:00–20:00 Eastern Time) and nighttime session (21:00–4:00 next day Eastern Time). Trading will be suspended between 20:00 and 21:00, during which all unexecuted orders will be canceled uniformly.

Many readers reacted with excitement upon hearing this news, wondering if this signals that the U.S. is preparing for 24/7 tokenized stock trading? However, after carefully reviewing the filing documents, TechFlow advises caution—Nasdaq explicitly stated in the document thatmany traditional securities trading rules and complex order types do not apply during the nighttime session, and certain functionalities will be limited.

We have been closely following equity tokenization in the U.S., one of the most important real-world asset tokenization targets, especially given the Securities and Exchange Commission’s (SEC) increasing number of official actions recently.

This application has renewed market expectations about U.S. equity tokenization, as it suggests the U.S. aims to align its securities trading hours closer to the 24/7 nature of digital asset markets.However, upon closer inspection:

Nasdaq’s filing does not mention tokenization at all—it pertains solely to reforms within the traditional securities framework.

If readers wish for a deeper analysis of Nasdaq’s move, TechFlow can write a separate article. But today, we’d like to focus on a more concrete development related to U.S. equity tokenization—

The SEC has officially “allowed” a major U.S. securities depository infrastructure provider to experiment with offering tokenization services.

------【Divider】------

On December 11, 2025, U.S. time, staff from the SEC’s Division of Trading and Markets issued aNo-Action Letter (NAL)to DTCC, later published on the SEC’s official website. The letter clearly states thatprovided specific conditions are met, the SEC will not take enforcement action against DTC for providing tokenization services related to the securities it custodies.

At first glance, many readers interpret this as the SEC officially “exempting” the use of tokenization technology for U.S. equities. However, the actual situation is far from that.

So,what exactly does this letter say, and how far has U.S. equity tokenization actually progressed?Let’s start by introducing the key player in this letter:

1. Who are DTCC and DTC?

DTCC, short for Depository Trust & Clearing Corporation, is a U.S.-based financial services group overseeing various institutions responsible for securities custody, stock clearing, and bond clearing.

DTC, or Depository Trust Company, is a subsidiary of DTCC and the largest centralized securities depository in the United States. It is responsible for holding stocks, bonds, and other securities, as well as settlement and transfer operations. Currently, DTC oversees and records over $100 trillion in securities assets,making DTC essentially the ledger administrator for the entire U.S. stock market.

2. What is DTC’s role in U.S. equity tokenization?

Remember the news in early September 2025 when Nasdaq applied to the SEC for issuing tokenized stocks? DTC was already involved in that proposal.

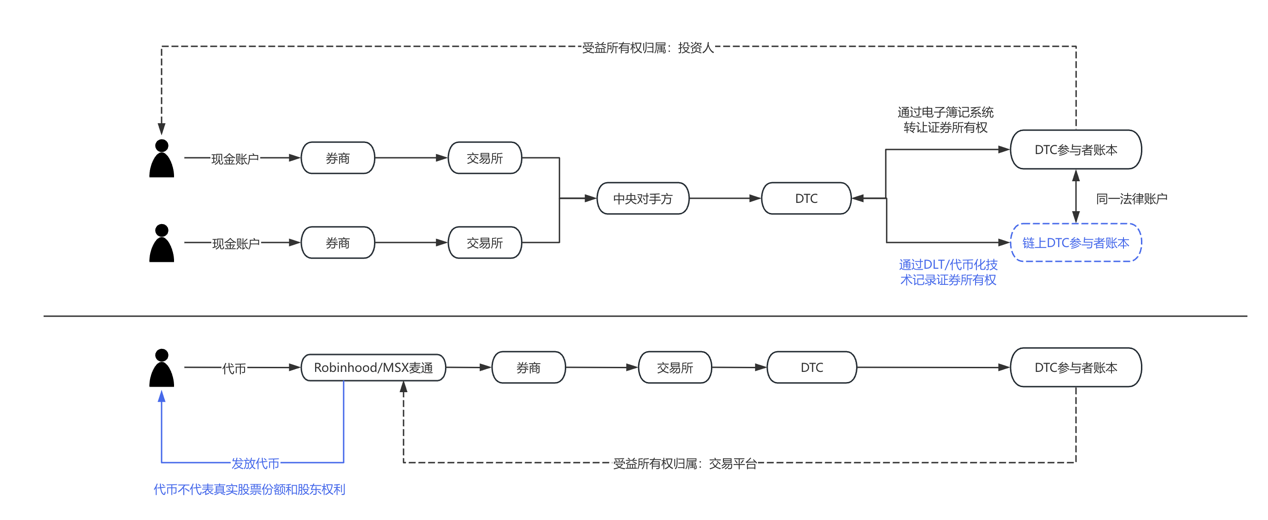

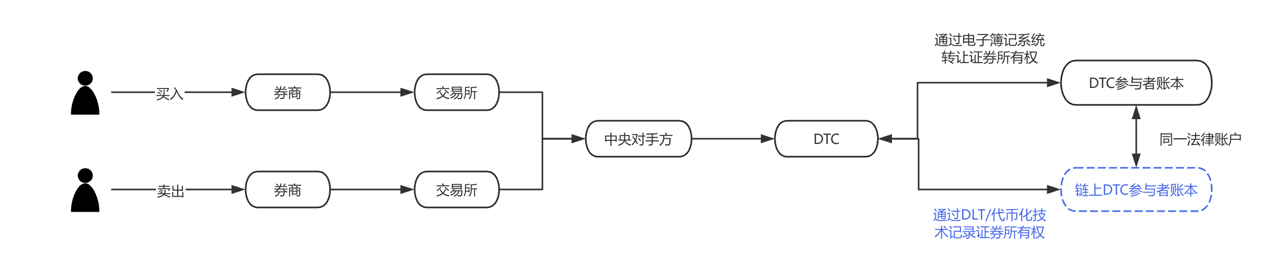

Nasdaq stated that the only difference between tokenized and traditional stocks lies in DTC’s order clearing and settlement process.

(Image source: Nasdaq’s application proposal)

To make this easier to understand, we’ve created a flowchart below—the blue section indicates the part Nasdaq proposed to change in its September filing. Clearly, DTC is a key operational and implementation body for U.S. equity tokenization.

3. What does the newly released No-Action Letter say?

Many people directly equate this document with the SEC approving DTC to use blockchain for U.S. stock accounting, but this interpretation is inaccurate. To properly understand this, we must examine a provision in the U.S. Securities Exchange Act:

Section 19(b) of the (Securities Exchange Act of 1934) states that any self-regulatory organization (including clearing agencies) must submit rule changes to the SEC for approval when modifying rules or making significant business adjustments.

Both of Nasdaq’s proposals were submitted under this provision.

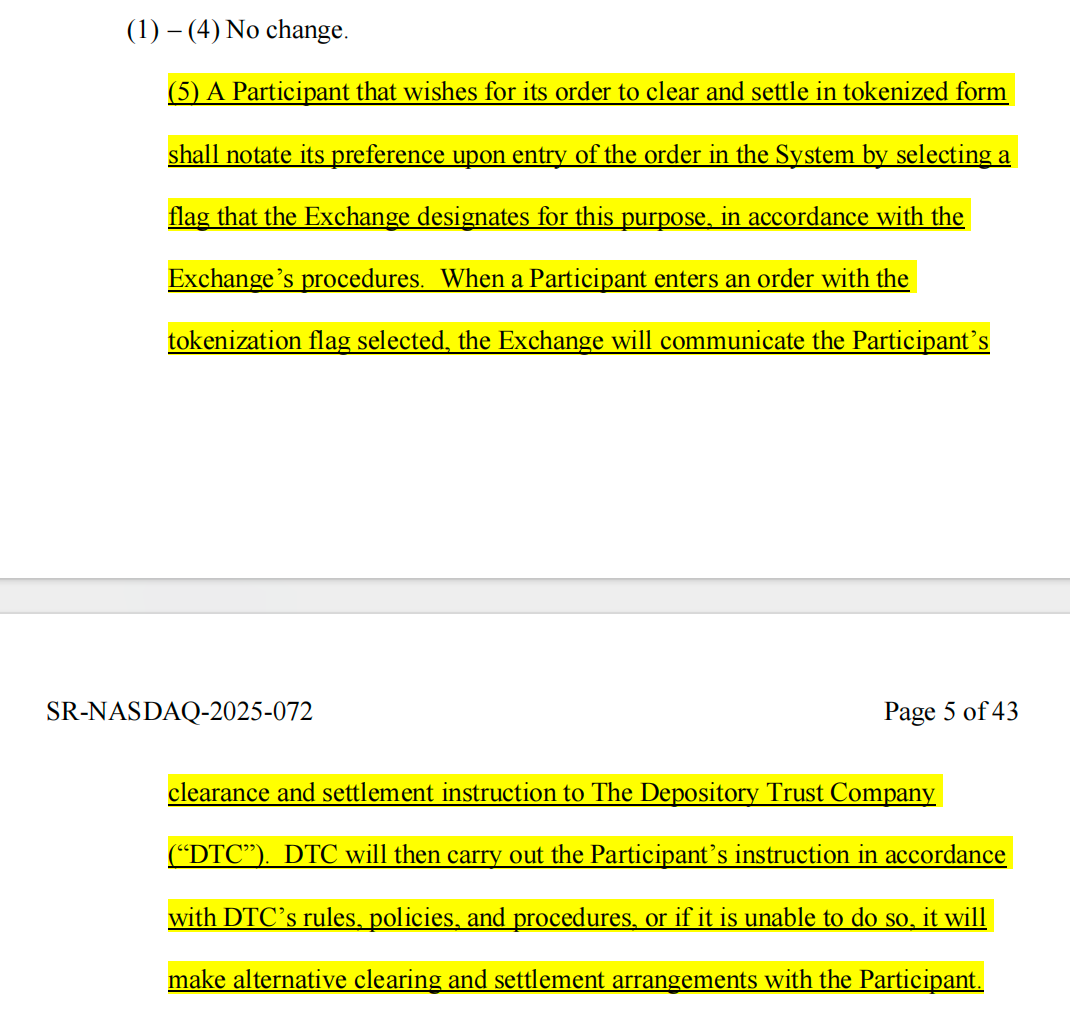

However, the rule submission process is often lengthy, potentially taking months and up to 240 days. If every small change required full approval, the time cost would be prohibitive. Therefore, to ensure its tokenization pilot program could proceed smoothly, DTC requested exemption from fully complying with the 19b reporting obligations during the trial period, and the SEC granted this request.

In other words, the SEC has merely temporarily waived certain procedural reporting requirements for DTC—not substantively approved the use of tokenization technology in securities markets.

---【Divider】---

Moving forward, how will U.S. equity tokenization develop? We need to clarify two key questions:

(1) What pilot activities can DTC conduct without prior reporting?

Currently, U.S. securities custody operates through a centralized system where brokers maintain accounts with DTC, and DTC records all stock purchases and sales in a central database. Now, DTC proposes offering brokers an option: to represent these stock holdings as blockchain tokens alongside the existing records.

In practice, participants would first register a qualified, DTC-approved wallet (Registered Wallet). When a participant issues a tokenization instruction to DTC, DTC performs three steps:

a) Move the relevant shares from the original account into a master pool;

b) Mint tokens on a blockchain;

c) Transfer the tokens to the participant’s wallet, representing their ownership rights to those securities.

Afterward,these tokens can be transferred directly between brokers without going through DTC’s centralized ledger each time. However, all token transfers will be monitored and recorded in real time by DTC via an off-chain system called LedgerScan, whose records will constitute DTC’s official books. Participants may at any time issue a "de-tokenization" instruction to exit the tokenized state, prompting DTC to destroy the tokens and re-register the securities back into traditional accounts.

The NAL also details technical and risk control limitations, including: tokens can only be transferred between wallets pre-approved by DTC, giving DTC the authority to forcibly transfer or destroy tokens under certain circumstances, and strict isolation between the token system and DTC’s core clearing infrastructure.

(2) What is the significance of this letter?

From a legal perspective, TechFlow emphasizes that a NAL is not equivalent to legal authorization or rulemaking—it lacks general legal force and merely reflects the enforcement stance of SEC staff under specific assumptions and conditions.

U.S. securities law does not contain a standalone prohibition on using blockchain for recordkeeping. Regulators are primarily concerned with whether existing market structures, custody responsibilities, risk controls, and reporting obligations remain intact when new technologies are adopted.

Moreover, within the U.S. regulatory framework, NALs are long regarded as important indicators of regulatory sentiment—especially when issued to systemically important institutions like DTC, where the symbolic value often outweighs the immediate operational impact.

------【Divider】------

Judging from the disclosed content, the SEC’s current exemption is based on a clear premise: DTC is not directly issuing or trading securities on-chain, but rather creating tokenized representations of existing securities within its custody system.

These tokens are essentially “ownership mappings” or “ledger expressions,” aimed at improving back-end processing efficiency, not altering the legal nature or ownership structure of the underlying securities. The service operates in a controlled environment on a permissioned blockchain, with strict limitations on participants, scope, and technical architecture.

TechFlow believes this regulatory approach is reasonable. On-chain assets are particularly vulnerable to financial crimes such as money laundering and illegal fundraising. While tokenization is a new technology, it must not become an accomplice to crime. Regulators must balance recognition of blockchain’s potential in securities infrastructure with adherence to existing securities laws and custody frameworks.

4. Current Status of U.S. Equity Tokenization

Discussions around U.S. equity tokenization are gradually shifting from “whether it’s compliant” to “how to implement it.” Examining current market practices reveals at least two parallel yet distinct pathways emerging:

· Represented by DTCC and DTC, this is a regulator-driven path to tokenization,focused on enhancing settlement, reconciliation, and asset transfer efficiency, primarily serving institutional and wholesale market participants. In this model, tokenization is nearly “invisible”—for end investors, stocks remain stocks; only the backend systems undergo technological upgrades.

· In contrast, there is the potential front-end role of brokerages and trading platforms.Platforms like Robinhood and MSX are actively exploring product innovations in crypto assets, fractional stock trading, and extended trading hours. If equity tokenization matures from a compliance standpoint, such platforms are naturally positioned to serve as user gateways. For them, tokenization doesn’t mean reinventing their business model, but rather extending the existing investment experience—enabling near real-time settlement, more flexible asset divisibility, and integration across markets. Of course, all of this depends on continued regulatory clarity. These initiatives often operate near regulatory boundaries, balancing innovation with risk. Their value lies not in immediate scale, but in validating next-generation securities market models. Realistically, they serve more as test cases for institutional evolution than direct replacements for the current U.S. equity market.

To help visualize this, consider the comparison chart below:

|

|

|

5. TechFlow Perspective

From a broader perspective, the real goal of U.S. equity tokenization isn’t turning stocks into “coins,” but rather enhancing asset transfer efficiency, reducing operational costs, and enabling future cross-market interoperability—all while maintaining legal certainty and systemic security. In this process, compliance, technology, and market structure will continue to evolve in parallel, with progress being gradual rather than revolutionary.

While U.S. equity tokenization is unlikely to fundamentally alter Wall Street’s operations in the short term, it has already become a significant item on the U.S. financial infrastructure agenda. This interaction between the SEC and DTCC resembles a policy-level “test run,” establishing preliminary boundaries for broader exploration ahead. For market participants, this may not be the end—but rather a meaningful starting point worthy of sustained attention.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News