Saying goodbye to buying homes and stock trading, the younger generation is turning cryptocurrency into their main wealth battleground

TechFlow Selected TechFlow Selected

Saying goodbye to buying homes and stock trading, the younger generation is turning cryptocurrency into their main wealth battleground

Young investors such as Gen Z and millennials are more inclined to actively manage their investments and more open to non-traditional assets than any previous generation.

By: Coinbase

Translated by: Chopper, Foresight News

For decades, the path to wealth accumulation for Americans has remained largely unchanged: get a good job, buy a home, invest in stocks, and wait for compound returns over time. But our latest State of Crypto Report shows that younger generations of investors no longer believe in this traditional path and are adjusting their investment behaviors accordingly.

To understand how different generations approach the market and the role crypto plays in their portfolios, Coinbase partnered with Ipsos on a dedicated survey of 4,350 U.S. adults, including 2,005 investors with investment accounts. The key findings: younger investors, including Gen Z and Millennials, are more likely than any previous generation to actively manage their investments, embrace non-traditional assets, and view cryptocurrency as a core component of their financial future.

A Generation Locked Out of the Traditional Wealth Ladder

Younger investors are far more optimistic about the economy than older generations, but they believe the current financial system was not built for them. Survey data shows that nearly seven in ten (73%) young people say it’s harder for their generation to build wealth through traditional means compared to their parents’ generation—compared to just 57% among older generations.

They’ve seen housing costs soar, student debt pile up, and wages grow slowly. Against this backdrop, more and more young people are seeking alternative paths to wealth beyond the traditional “home equity + stock portfolio” model.

Non-Traditional Asset Allocation Three Times Higher Than Older Generations

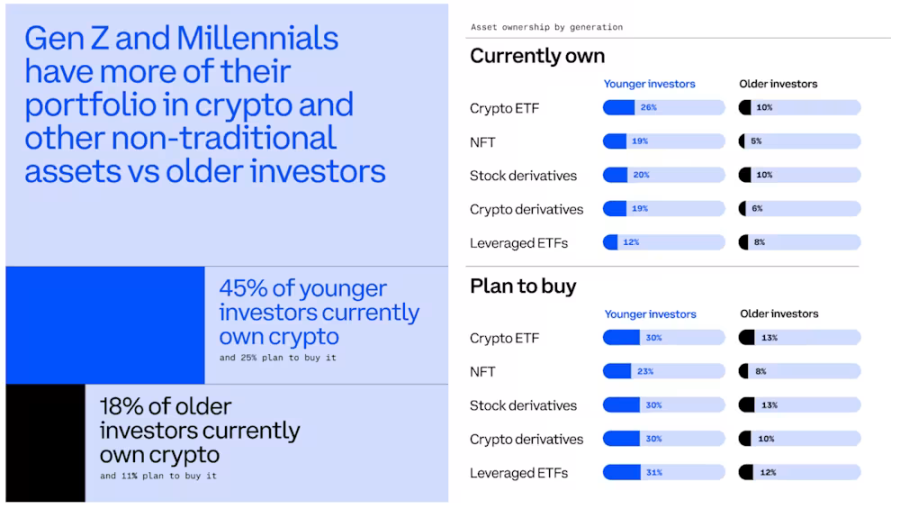

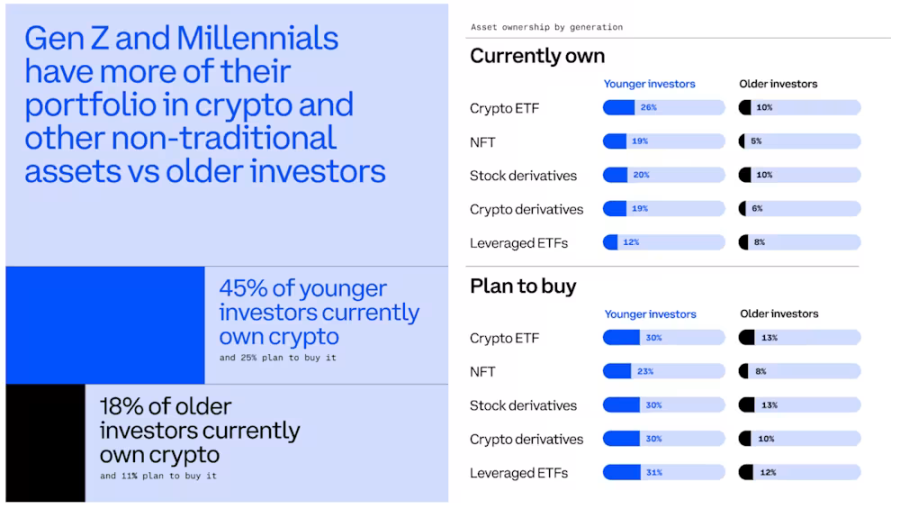

This anxiety is directly reflected in their asset allocation strategies. The survey found that young investors allocate 25% of their portfolios to non-traditional assets such as cryptocurrency, financial derivatives, non-fungible tokens (NFTs), and other emerging products—three times the share allocated by older investors, who put just 8% into such assets.

Ownership of stocks is roughly similar across generations; the key difference is that younger investors are diversifying beyond stocks. They’re actively seeking returns beyond traditional stock dividends and are more willing to experiment with new investment tools and emerging markets to close the wealth gap.

Crypto Is Not a Side Bet—It's a Core Holding

This generational shift in investment philosophy is most evident in attitudes toward cryptocurrency. The report shows that 45% of younger investors already own crypto, compared to just 18% of older investors. Additionally, nearly half (47%) of younger investors want early access to new crypto assets before they reach mainstream markets—compared to only 16% of older investors.

To younger generations, crypto is not merely speculative trading but a critical pathway to catching up financially. Eight in ten believe crypto offers their generation greater financial opportunities outside the traditional financial system; at the same time, another eight in ten believe crypto will play a significantly larger role in the future financial system. Among older investors, only about six in ten agree with this view.

The enthusiasm of younger investors for emerging markets extends beyond spot crypto holdings—they also seek exposure to a broader range of non-traditional assets. Data shows that eight in ten young investors are eager to be early adopters of new investment opportunities, compared to less than half of older investors. Young investors remain highly interested in emerging non-traditional products such as crypto derivatives, prediction markets, 7×24 stock trading, early token offerings, altcoins, and decentralized finance lending.

How This Trend Will Shape Future Markets

Young investors have clearly emerged as a distinct cohort: they trade more frequently, accept higher risk for the chance of higher returns, and allocate a significant portion of their portfolios to crypto-centric, non-traditional assets. At the same time, they are driving the financial industry toward platforms better suited to the needs of internet-native generations—platforms that operate around the clock and support diverse asset trading.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News