Restructuring consensus in the crypto market

TechFlow Selected TechFlow Selected

Restructuring consensus in the crypto market

Speculative changes that once seemed distant are now being implemented with clear direction.

Author: Heechang

Translation: Block unicorn

Key Takeaways

Until 2025, many on-chain assets were still speculative ideas. Now, they are moving toward clear directions and gradually becoming reality. Structural transformations are happening simultaneously across three dimensions of money: its form, meaning, and use.

First transformation: The form of money is diversifying. Stablecoins, tokenized bank deposits, and central bank digital currencies (CBDCs) will coexist in different roles. Fiat on/off ramps, payment infrastructure, and IT platforms are rapidly adopting stablecoins to expand post-issuance business landscapes and usage ecosystems at an accelerated pace.

Second transformation: The concept of money is broadening. Tokenization is transforming not only physical and financial assets but also intangible elements such as attention and predictions into assets. This breaks down the boundary between money and assets, redefining both toward a world where "everything we own" becomes a liquid unit of value.

Third transformation: The use of money is expanding. Centralized exchanges (CEXs) are evolving beyond simple trading venues, building full-stack financial ecosystems that include derivatives, risk-weighted assets (RWA), on-chain debit/credit cards, on-chain decentralized finance (DeFi), and even their own networks. As a result, real-world blockchain use cases are increasingly diversifying around exchanges as central hubs.

All finance will eventually run on blockchains.

This was precisely my original motivation for entering the blockchain industry. Even if crises like the Terra collapse happen again, I cannot imagine an ideal financial system—an efficient, transparent, and programmable one—being realized without blockchain at its core. Personally, I believe the most advanced financial infrastructure can only be built on-chain, and over time, existing systems will inevitably converge toward this structure.

2025 is the year this transformation becomes tangible. With regulatory frameworks maturing, financial institutions, fintech companies, and governments are no longer debating whether to adopt blockchain. The question has now completely shifted from "when to adopt" to "how to participate."

Changes that once seemed distant and speculative are now materializing with clear direction. The essence of money—its form, its concept, its use cases—is undergoing structural transformation across three dimensions simultaneously.

Now, let’s explore how these transformations are unfolding and identify the key forces driving them.

1. First Transformation: Stablecoins Drive Diversification of Money's Form

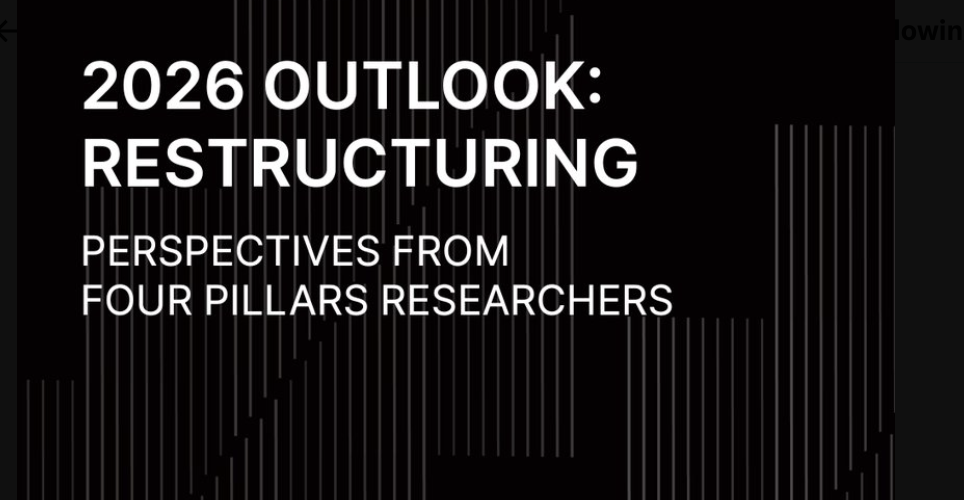

Source: "The Network Model of Money" — Luca Prosperi

The core of money lies in being the benchmark asset we use to measure value. When purchasing or exchanging goods, we price them in our local fiat currency. Historically, only two types of institutions issued and operated this money: central banks and commercial banks. Central banks manage the total supply and stability of money, while commercial banks operate channels for fund flows between institutions and retail users.

Stablecoins add an entirely new layer on top of this. They allow any company to create its own form of money and build financial infrastructure around it, creating particularly strong synergies with digital platforms. This does not mean stablecoins will replace central banks or commercial banks. Rather, just as PayPal and Stripe reshaped payments and Robinhood changed how people invest, save, and spend, stablecoins introduce a new type of money specifically designed for the digital world.

Three major trends emerged in 2025.

Stablecoins, Tokenized Bank Deposits, and CBDCs Will Coexist Long-Term

Source: "State of Crypto 2025: The Year Crypto Goes Mainstream" – a16z crypto

In the U.S., the first comprehensive federal-level stablecoin bill—the GENIUS Act—passed both houses of Congress and was signed into law on July 18. The act introduces licensing regimes for banks and stablecoin issuers and mandates that reserves must be held 1:1 in cash or short-term government bonds.

Hong Kong moved faster. The Legislative Council passed the Stablecoin Ordinance in May 2025, making stablecoin issuance a regulated and licensed activity effective August 1, with approvals expected by early 2026.

Building on revisions to Japan’s Payment Services Act in 2023, eligibility for stablecoin issuance was clarified, and large-scale issuance began in the second half of 2025. JPYC launched a yen-backed stablecoin whose reserves are fully held in domestic Japanese deposits and government bonds and are fully redeemable into yen. Japan’s framework strictly limits issuers to licensed financial institutions and allows trust structures to enhance investor asset segregation.

Among commercial banks, JPMorgan continues to expand deposit tokenization and real-time settlement via its private blockchain network Kinexys. JPM Coin allows corporate clients to convert U.S. dollars in their JPMorgan accounts into on-chain tokens usable for instant transfers between global subsidiaries or large-value settlements.

I believe stablecoins are not here to replace the existing monetary system; instead, they will coexist with central bank money, bank deposits, and new digital assets—each playing distinct roles. Let’s review these roles.

Central banks play the role of controllers. They issue fiat currencies like the U.S. dollar, manage money supply, and provide ultimate backing during financial stress.

Commercial banks act as coordinators. Under central bank oversight, they operate deposit accounts, extend credit, and facilitate fund flows between savers and borrowers. In short: if central banks issue dollars, commercial banks create deposit forms like “JPMorganUSD.”

Stablecoins serve as catalysts. Backed by cash or short-term sovereign debt, stablecoins are not intended to replace central banks or commercial banks. Instead, they enable businesses to build digitally native financial ecosystems and allow funds to circulate faster and more widely across services.

In the end, the future is not about replacement but coexistence. Central bank digital currencies (CBDCs) will strengthen monetary sovereignty and macro-level stability. Tokenized deposits will preserve regulated financial intermediation. Stablecoins will compensate for the slower speed of central and commercial banks while meeting the digital economy’s demands for speed, programmability, and interoperability.

Each form of money will play a complementary role in an increasingly on-chain financial system.

Companies Controlling the “Next Layer” of Stablecoin Issuance Will Rise Rapidly

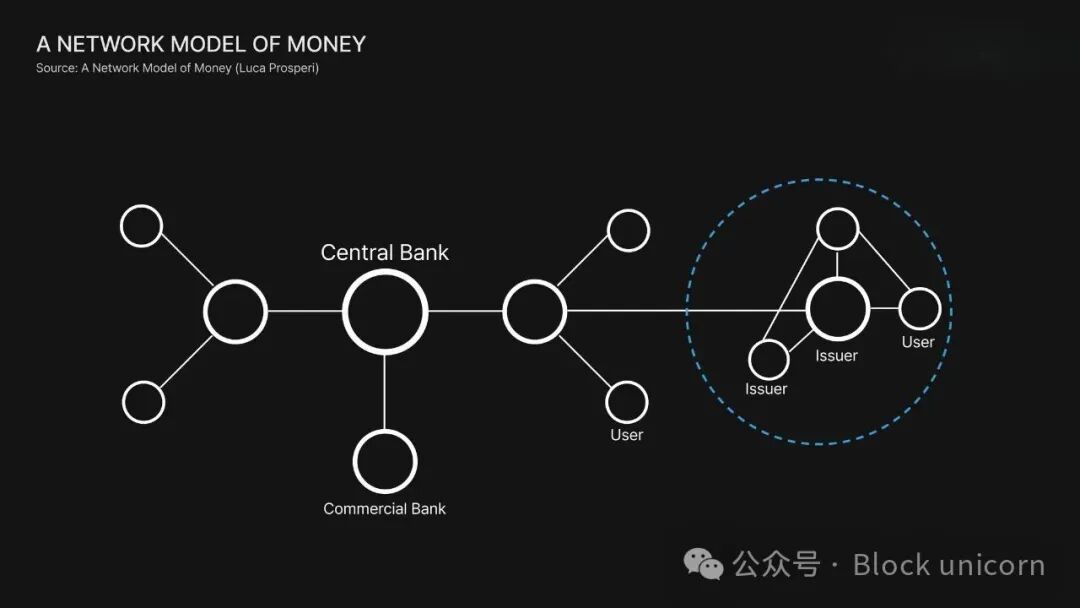

For stablecoins to achieve real-world adoption, issuance is essential. But for them to function in daily life or business operations, another critical step is required: converting stablecoins into local currency and vice versa. In 2025, numerous companies began integrating the infrastructure needed for these on/off-chain payment processes.

Yellowcard, Africa’s largest cryptocurrency payment gateway, has become a regional hub connecting stablecoins with local currencies while fully complying with national regulations. Bridge, acquired by Stripe for $1.1 billion, plays a similar role. Companies like Zero Hash and BVNK—reportedly under consideration for acquisition by Mastercard and Coinbase at around $2 billion—now provide backend infrastructure enabling enterprises, exchanges, and fintech platforms to deploy stablecoins at scale.

These services offer secure payment settlement and anti-money laundering / know-your-customer (AML/KYC) workflows, allowing businesses to accept stablecoins and convert them into local currency without bypassing domestic payment regulations. This architecture shows that stablecoins are deeply integrating into the existing financial system rather than operating outside it.

Major exchanges like Binance, Bybit, and OKX are also expanding their own payment gateway capabilities, either developing in-house or outsourcing fiat rails to specialized partners. Payment firms such as Banxa, Mercuryo, and OpenPayd play core roles in this ecosystem, providing fiat gateways that seamlessly integrate with stablecoin transaction flows.

All of this points to a clear shift: the definition of stablecoins is no longer limited to issuance but increasingly includes empowering individuals and businesses to use them.

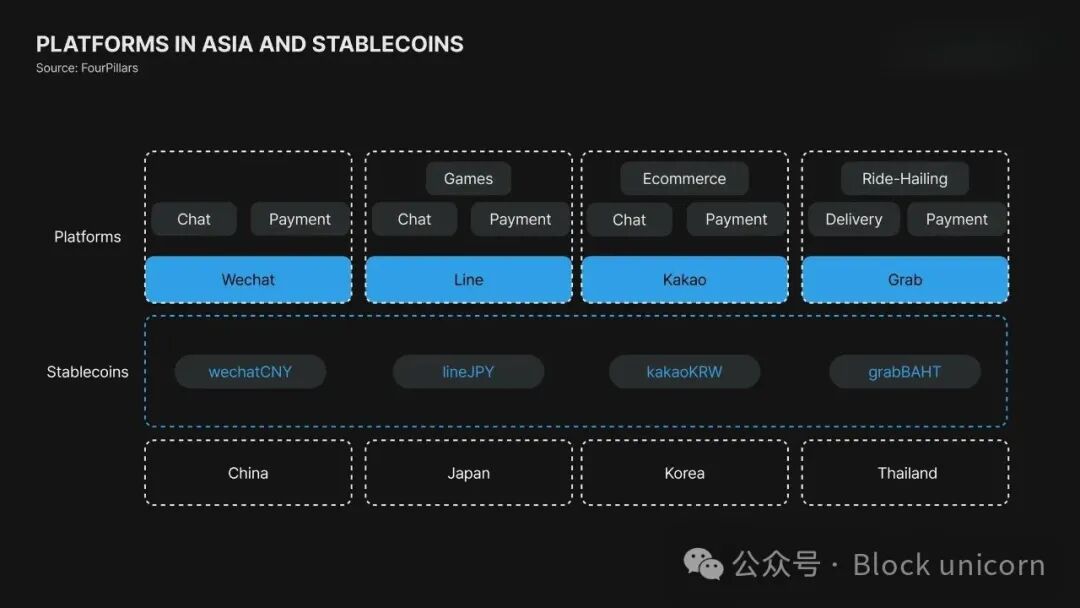

IT Platforms Will Begin Fully Embracing Stablecoins

IT platforms, central to everyday consumer activities and enterprise operations, are becoming the most powerful hubs for expanding stablecoin adoption. Asia’s “super apps,” which integrate instant messaging, shopping, payments, and financial services, have already created massive user engagement and transaction volumes through their (non-crypto) digital wallets. By internally integrating stablecoins, these platforms can build their own native financial ecosystems and significantly boost user participation.

By 2025, both PayPal and Cloudflare had launched stablecoin initiatives aimed at making them mainstream payment and internet infrastructure.

PayPal integrated PYUSD into remittance, commerce, and e-commerce settlement services and recently invested in Stable, a Layer 1 blockchain optimized for USDT-based payments, further streamlining PayPal’s global payment infrastructure.

Cloudflare launched Net Dollar, a stablecoin designed to enable AI agents to autonomously settle API fees and cloud usage costs, effectively embedding programmable money into internet services.

This marks a broader shift: stablecoins are becoming foundational units of account in platform economies. Whether platforms issue their own stablecoins or partner with external issuers like Circle and Tether, stablecoins are beginning to function as standard currencies within these digital ecosystems.

2. Second Transformation: Tokenization Expands the Concept of Money

Through tokenization, asset ownership is transferred onto the blockchain. In the past, ownership records were kept in paper documents, bank accounts, or centralized databases.

On-chain, ownership can be divided into fractions, transferred under specific conditions, automatically distributed as yields, or deposited and traded via smart contracts.

This structure greatly expands asset accessibility. Historically, markets for assets like stocks, bonds, or private credit were accessible only to institutions or high-net-worth individuals. Once tokenized, however, the same asset can be split into thousandths and traded in real time. Individuals can now participate through fractional ownership, opening up entirely new investment and consumption models.

Ultimately, tokenization expands the very definition of money.

What we traditionally call “money”—a medium of exchange, store of value, and unit of account—is no longer limited to fiat currency. Increasingly, assets themselves begin to perform monetary functions. Government bonds, money market funds, investment funds, real estate, and even corporate equity are becoming programmable forms of money that can be coded and used.

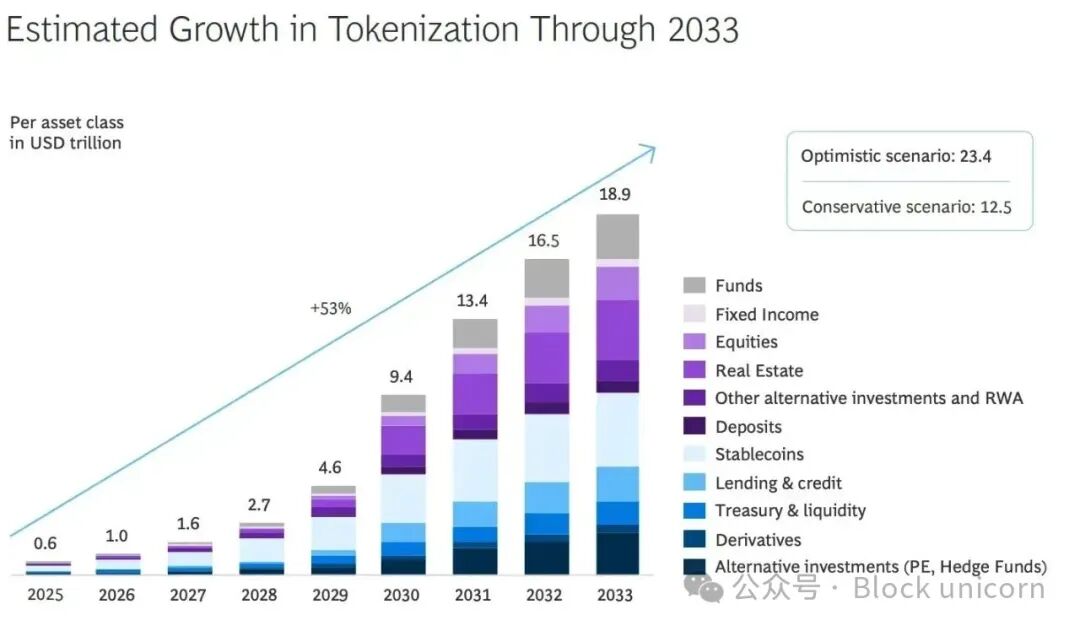

Tokenized Asset Markets Will Accelerate Growth

Source: RWA News: Ripple and BCG report tokenized real-world assets could reach $18.9 trillion by 2033

Just five years ago, the stablecoin market was worth $20 billion. Today, it exceeds $300 billion, while the tokenized real-world asset (RWA) market has grown from $13 million to $34.7 billion. Digital dollars, tokenized treasuries, and tokenized money market funds have become tangible investment and settlement tools for institutional and individual investors.

The driving force behind this trend is global financial institutions. BlackRock offers on-chain exposure to U.S. Treasuries through its tokenized money market fund BUIDL. Apollo tokenized private credit funds, opening new liquidity channels for traditionally illiquid assets. Securitize, which provides infrastructure for these products, now tokenizes funds, equity, and alternative assets and is even seeking a U.S. IPO. Tokenization has moved far beyond blockchain startups to encompass global financial giants.

According to a joint report by Boston Consulting Group (BCG) and Ripple, the tokenized market is expected to grow 30-fold over the next eight years, reaching approximately $18.9 trillion by 2033.

The direction is clear: tokenized assets are becoming one of the fastest-growing areas in the global financial system.

Even Intangible Things Will Be Tokenized

Source: Kalshi founders Tarek Mansour and Luana Lopes Lara on turning events into assets

This year, Kaito pioneered a new concept. Kaito uses a unit called “yap” to measure and quantify mentions or promotions of a topic on Twitter, introducing the idea of an attention economy. In short, public attention is transformed into a measurable unit of value.

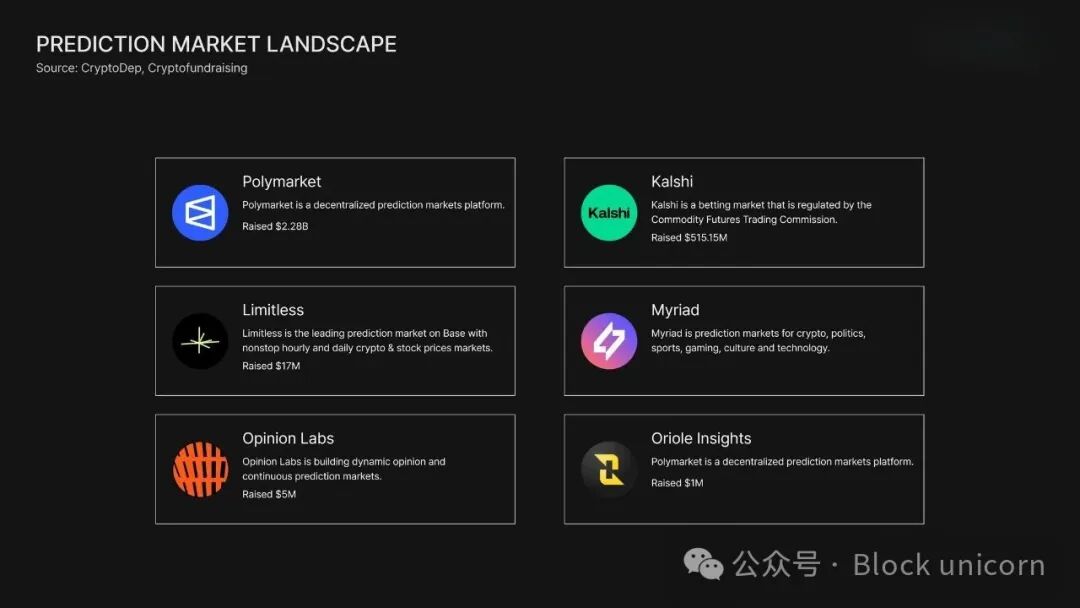

Prediction markets have also gained significant traction. Strictly speaking, prediction markets differ from tokenization, but they are conceptually similar—both transform non-financial information or future events into tradable assets.

Tokenization converts tangible assets or financial products like government bonds, real estate, and funds into on-chain tokens. Prediction markets turn future possibilities—such as “Will a candidate win the election?”—into tradable contracts.

In other words, tokenization grants ownership of existing assets, while prediction markets assign value to probabilities.

Platforms like Polymarket and Kalshi issue each event as “yes/no” tokens. After the event concludes, the winning side receives a $1 settlement payout. Unlike tokenized assets, which rely on collateral or legal trust structures for redemption, prediction markets settle using oracles and verified data, depending on the “truth of the outcome.”

Yet both systems follow a core principle: they transform inherently non-tradable subjects into market-native assets with price and liquidity.

In the end, prediction markets represent the tokenization of belief and information, shifting focus from “what do you own?” to “what do you believe, and how do you value it?”—thus expanding the scope of assets in the blockchain world.

Source: X user — Crypto_Dep

Tokenization Will Radically Change Our Understanding of Money

The essence of tokenization is not merely moving assets onto the blockchain—it changes how assets operate. Traditionally, “money” (dollars, euros, etc.) and “assets” (bonds, stocks, real estate) were seen as separate domains. Tokenization merges these two into a unified system.

Government bonds, venture capital funds, even real estate, can now be represented as programmable, interoperable tokens that can be instantly transferred and directly integrated into various services. Once tokenized, assets can be used, stored, and priced in real time. This breaks down the line between what we own and what we can use, erasing historical barriers that separated financial products from liquidity.

Our traditional financial mindset is linear: we earn → save → invest → spend. Tokenization blurs the distinction between “money” and “assets.” Everything we own becomes a fluid expression of value.

3. Third Transformation: The Rise of Centralized Exchanges (CEXs) and the Expansion of Money’s Use

Source: Gate Research: "Ecosystem Landscape and Convergence Trends of Centralized and Decentralized Exchanges"

“How much did it go up?”

For a long time, this simple question has driven the cryptocurrency market. News of Bitcoin rising 1000%, Ethereum surging, or new tokens spiking always captures public attention. Price volatility became the market’s focal point, and trading became the center of everything.

And centralized exchanges are precisely at the heart of this trading activity.

Binance, founded in 2017, now handles around $100 billion in daily trading volume, making it one of the most liquid exchanges in global financial markets. Bybit (2018) and OKX (2017) follow closely, while exchanges like Upbit and Coinbase have become primary gateways to crypto in their respective markets.

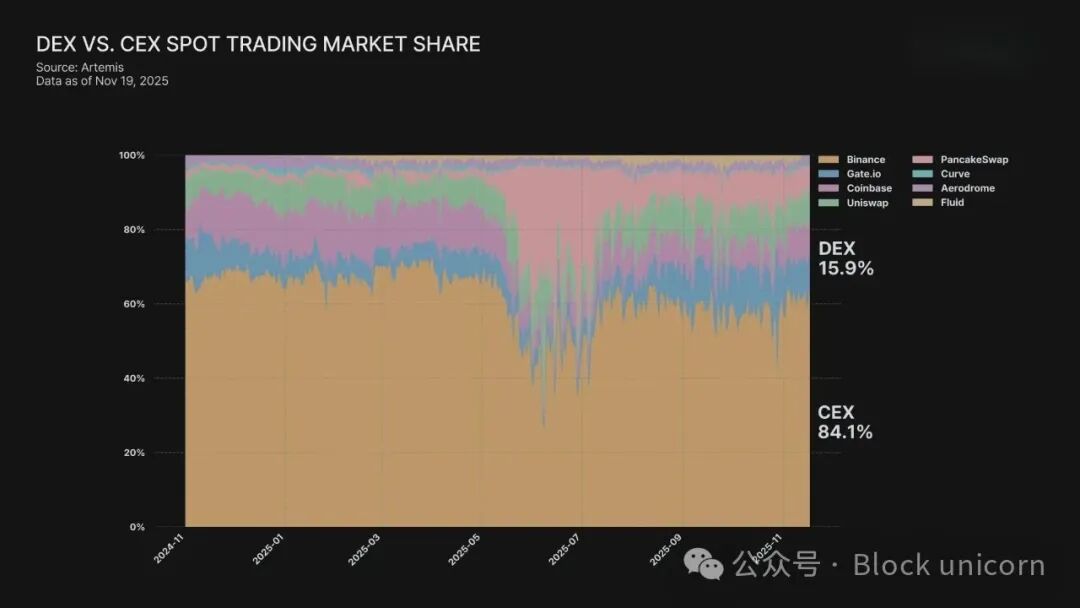

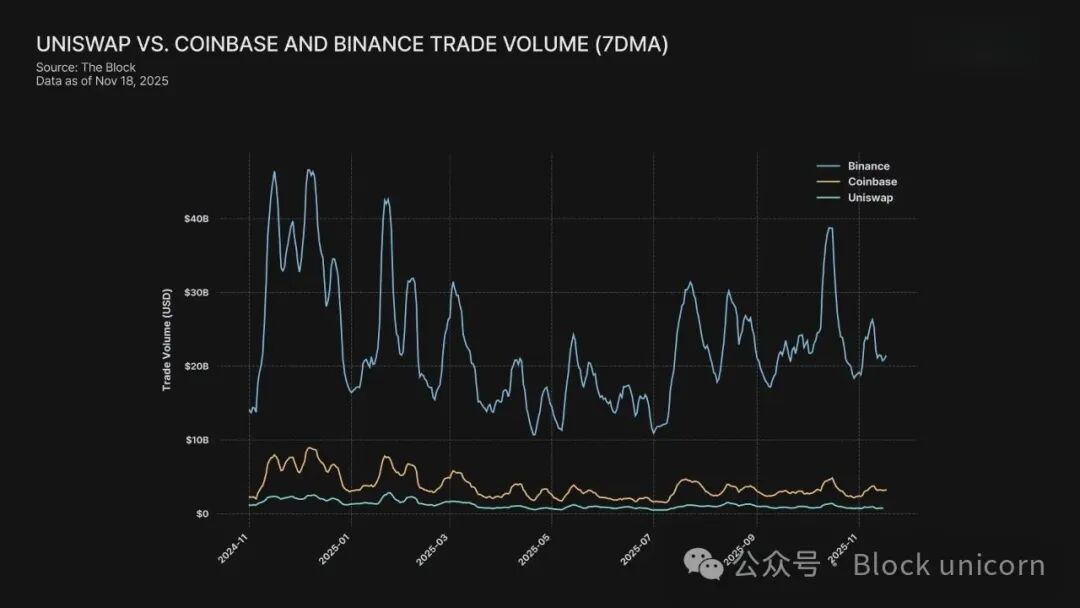

Although decentralized exchanges are growing rapidly, the vast majority of trading volume still occurs off-chain, within centralized platforms.

In regions like South Korea, Japan, and Taiwan, regulatory restrictions and user perception limit on-chain activity to only a subset of users. Migrating users from centralized exchanges to decentralized ecosystems requires not just technological change but also psychological shifts—a transition far from easy.

Centralized exchanges remain the primary entry point for most users into cryptocurrency, shaping how capital flows, trades, and circulates in the digital economy.

Source: Uniswap vs. Coinbase and Binance trading volume comparison (7-day average)

These platforms are no longer just cryptocurrency exchanges—they are evolving into comprehensive digital asset financial ecosystems.

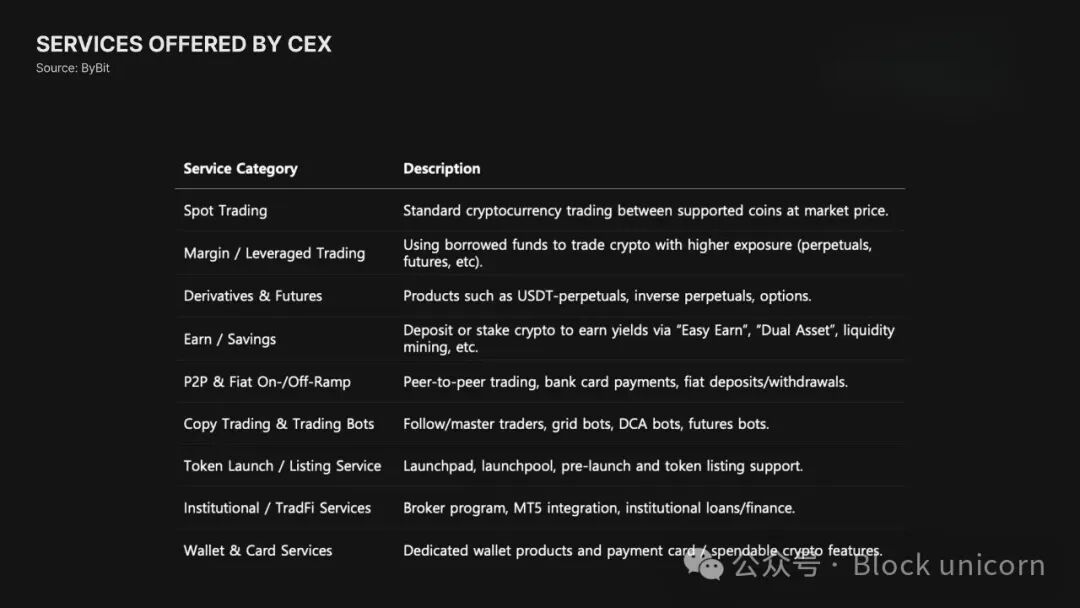

Today’s exchanges offer far more than simple spot trading. They now provide perpetual contracts, options, various structured derivatives, and recently even support trading of tokenized stocks and risk-weighted assets (RWA).

For example, Bybit integrated tokenized stocks via xStocks, enabling 24/7 trading of tokenized equities; Binance expanded through derivatives and Launchpad, becoming a platform covering the entire token economy.

Exchanges are also building complete financial stacks, connecting trading → deposits → lending → spending.

As centralized exchanges transform into comprehensive financial infrastructure, it’s important to examine the strategies they’re deploying and how they’re preparing for the next phase of on-chain finance. Let’s delve deeper into these strategies.

Exchange Services Will Continue to Expand

Exchanges are evolving from mere trading venues into “financial super apps.”

In the past, users could only trade listed tokens. Today, with the launch of presale platforms, users can even participate before a token generation event (TGE). This allows direct involvement in early-stage projects with high growth potential, equivalent to pre-IPO funding opportunities on-chain.

Launchpad platforms are also rapidly evolving as a way for new projects to distribute tokens before listing on exchanges. Binance, Bybit, and OKX all operate their own Launchpads, attracting millions of participants and serving as key drivers of user acquisition. In this model, users are no longer just traders—they become early stakeholders in projects.

Exchanges are also expanding beyond crypto into tokenized real-world assets (RWA).

Bybit’s xStock is a prime example: users can trade tokenized global stocks and ETFs 24/7, signaling the rise of “decentralized access to traditional assets.” Demand for on-chain access to real-world investments is steadily increasing.

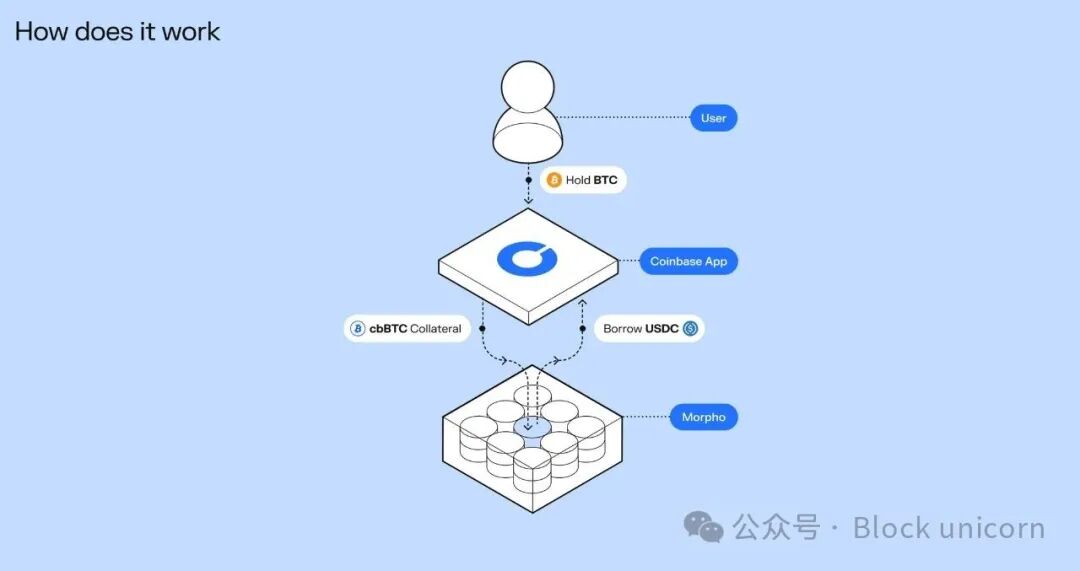

Coinbase launched Bitcoin-backed lending through integration with lending protocol Morpho; Robinhood is experimenting with prediction markets, further integrating new financial primitives directly into its platform.

Beyond trading, exchanges are building full-service ecosystems designed to maximize the utility of customer assets across yield, credit, and spending.

Yield products like staking and interest-bearing vaults offer attractive returns on assets held within exchanges. On the spending side, products like Bybit Card and Coinbase Card link crypto balances directly to everyday real-world payments.

In other words, exchanges are no longer just intermediaries for buying and selling tokens.

They are becoming integrated on-chain financial platforms where saving, investing, borrowing, and spending all happen within the same ecosystem.

Mature On-Chain Services Will Be Integrated into Exchanges

Source: Morpho’s Bitcoin-backed loans

Exchanges are no longer confined to closed ecosystems but are expanding user capabilities by directly integrating on-chain financial services.

A typical example is Bybit integrating Ethena’s USDe into its trading pairs and yield products. This allows users to add a yield-generating synthetic dollar, fully created and managed on-chain, to their portfolios. It shows exchanges increasingly treating decentralized protocols as modular service components rather than external partners, directly embedding them into their platforms.

Coinbase pushed this trend further. By linking its main exchange app with the Base app, Coinbase now supports DEX trading and offers access to millions of on-chain assets. The line between centralized and decentralized exchanges is becoming increasingly blurred.

Users maintain familiar CEX interfaces while gaining direct access to on-chain liquidity, pushing exchanges toward hybrid CEX/DeFi models.

Coinbase also directly integrated Morpho’s lending infrastructure into its exchange app. Users can deposit Bitcoin and borrow USDC using Bitcoin as collateral, with all operations backed by underlying on-chain vaults. Since its January launch, Coinbase’s Morpho-based vaults have grown rapidly, reaching $1.48 billion in deposits and $840 million in loans.

These developments point to a larger direction:

Exchanges will increasingly support battle-tested on-chain services within their apps. This gives users higher yield opportunities and greater asset utility while allowing exchanges to expand services without taking on protocol risks.

In practice, on-chain services are being integrated into the backends of centralized exchanges, and user experiences are gradually migrating seamlessly onto the chain.

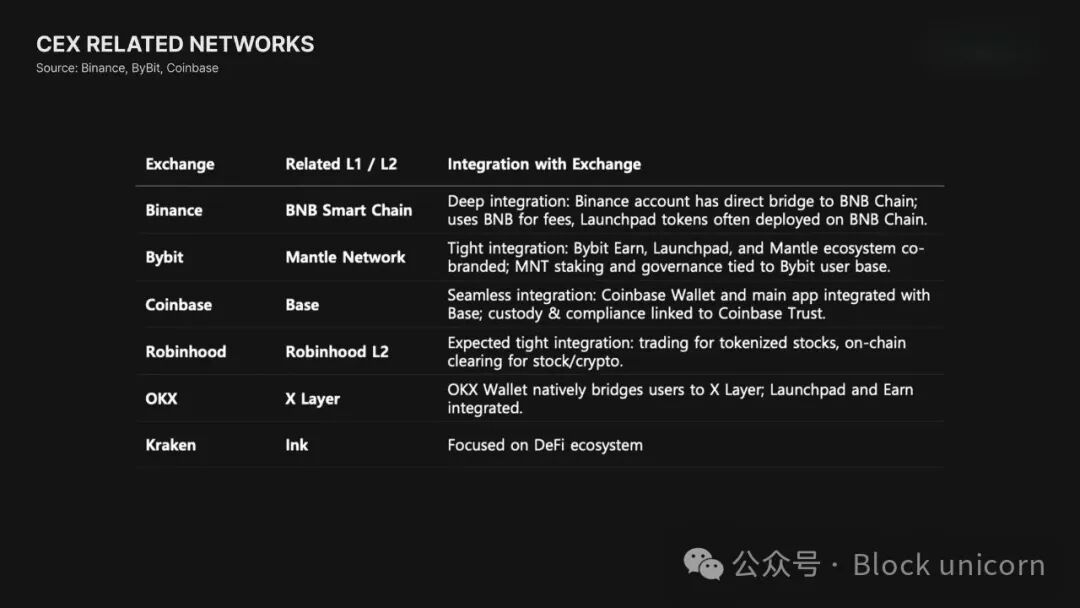

Exchanges Will Build Their Own Ecosystems

Exchanges are no longer relying solely on external blockchains. They are increasingly building their own chains or closely collaborating with blockchains that support vertically integrated ecosystems.

The most prominent example is Binance’s BNB Chain.

BNB started as a simple trading fee discount token but has evolved into a fully independent ecosystem hosting hundreds of projects spanning decentralized exchanges (DEXs), NFT markets, RWAs, and more. Binance uses this architecture to seamlessly migrate exchange users to its own on-chain services, expanding the utility and demand for the BNB token.

Bybit follows a similar strategy with Mantle. Bybit centers its trading incentives around the MNT token, guiding users through liquidity incentives and ecosystem partnerships.

Coinbase, with tens of millions of users, leverages Base to offer on-chain services to exchange customers. Base has become home to popular apps like Morpho and Aerodrome, demonstrating how blockchains operated by centralized exchanges (CEXs) can evolve into vibrant on-chain environments.

In the U.S., Robinhood is preparing to launch its own Layer 2 blockchain, aiming to process tokenized stocks, options, and cryptocurrency trades directly on-chain, effectively merging its traditional brokerage infrastructure with blockchain settlement systems.

Vertical integration enables them to control trading, liquidity, user traffic, and settlement on a unified platform, creating tightly coupled ecosystems for end-to-end circulation of digital assets.

4. Understanding Change Matters More Than Feeling It

Ethereum has existed for less than a decade. Just five years ago, the stablecoin market was worth only a few billion dollars, and tokenized markets were nearly ignored. Today, both have become multi-hundred-billion-dollar markets and new cornerstones of global financial infrastructure.

The pace of future change will be faster, and its impact more diverse. Of course, on-chain services are not yet perfect—challenges in security, usability, and regulation persist. But without understanding the current landscape, one cannot grasp the next wave of opportunity. Change is not slowly arriving from a distant future—it is accelerating from subtle shifts that already began.

Blockchain elements are no longer described in technical terms like “decentralization,” but in financial language—yield products, cross-border remittances, payments. Only when more people learn to interpret and understand the world through on-chain language can they truly grasp the transformation reshaping the financial landscape.

This year marks the beginning of that shift. I hope more people can move beyond merely “feeling” this change and start truly understanding and preparing for what comes next.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News