The irreversible changes in the crypto market in 2025

TechFlow Selected TechFlow Selected

The irreversible changes in the crypto market in 2025

2025 is a turning point for the crypto space: transitioning from speculative cycles to foundational, institution-grade infrastructure.

Author: Stacy Muur

Translation: TechFlow

Summary:

-

Institutions become marginal buyers of crypto assets.

-

Real-world assets (RWAs) evolve from narrative concepts into asset classes.

-

Stablecoins emerge as both a "killer application" and a systemic vulnerability.

-

Layer 2 networks consolidate into a "winner-takes-all" landscape.

-

Prediction markets evolve from toy applications into financial infrastructure.

-

AI × Crypto transitions from hype narrative to actual infrastructure.

-

Launchpads industrialize, becoming internet capital markets.

-

High fully diluted valuation (FDV), low circulating supply tokens prove structurally uninvestable.

-

InfoFi experiences boom, inflation, and collapse.

-

Consumer crypto returns to mainstream attention, but through neobanks rather than Web3 apps.

-

Global regulation gradually normalizes.

In my view, 2025 marks a turning point in the crypto space: a transition from speculative cycles to foundational, institutionally scaled structures.

We have witnessed reallocations of capital flows, restructurings of infrastructure, and the maturation or collapse of emerging sectors. Headlines about ETF inflows or token prices are merely surface-level phenomena. My analysis reveals the deep structural trends underpinning a new paradigm in 2026.

Below, I will break down each of these 11 transformative pillars, supported by specific data and events from 2025.

1. Institutions Become the Dominant Force in Crypto Capital Flows

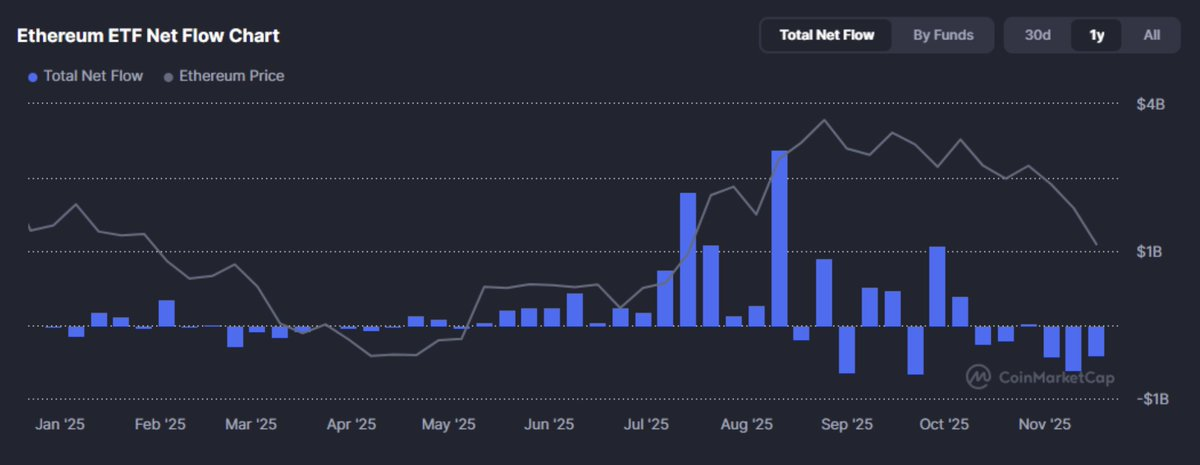

I believe that 2025 marked institutions' full control over liquidity in the crypto market. After years of observation, institutional capital has finally surpassed retail investors as the dominant market force.

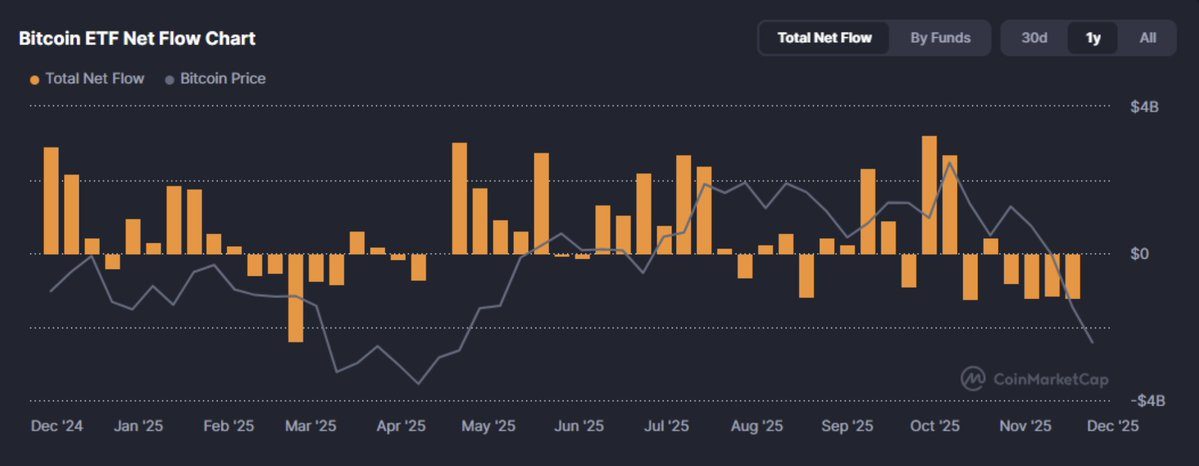

In 2025, institutional capital didn't just "enter" crypto—it crossed a critical threshold. For the first time, marginal buyers of crypto assets shifted from retail traders to asset allocators. In Q4 alone, weekly inflows into U.S. spot Bitcoin ETFs exceeded $3.5 billion, led by products such as BlackRock’s IBIT.

These capital flows are not random but represent structurally authorized reallocations of risk capital. Bitcoin is no longer seen as a curiosity-driven asset, but as a macro tool with portfolio utility—digital gold, a convex hedge against inflation, or simply an uncorrelated exposure.

However, this shift brings dual consequences.

Institutional capital is less reactive but more sensitive to interest rates. It compresses market volatility while tying crypto markets more closely to macroeconomic cycles. As one CIO put it: “Bitcoin today is a liquidity sponge wrapped in compliance.” Its status as a globally recognized store of value significantly reduces narrative risk; yet interest rate risk remains.

The implications of this capital flow shift are profound: from exchange fee compression to reshaping demand curves for yield-bearing stablecoins and real-world asset tokenization (RWAs).

The next question is no longer whether institutions will enter, but how protocols, tokens, and products can adapt to capital demands driven by Sharpe ratios rather than market hype.

2. Real-World Assets (RWAs): From Concept to Genuine Asset Class

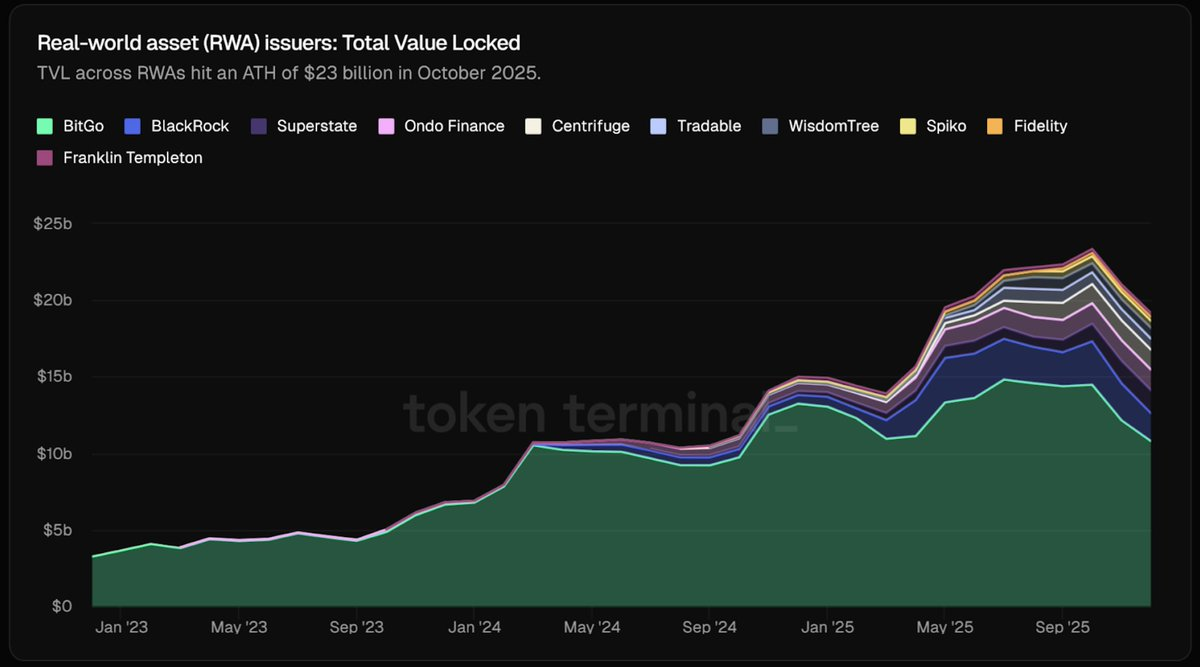

In 2025, tokenized real-world assets (RWAs) evolved from concept to core infrastructure in capital markets.

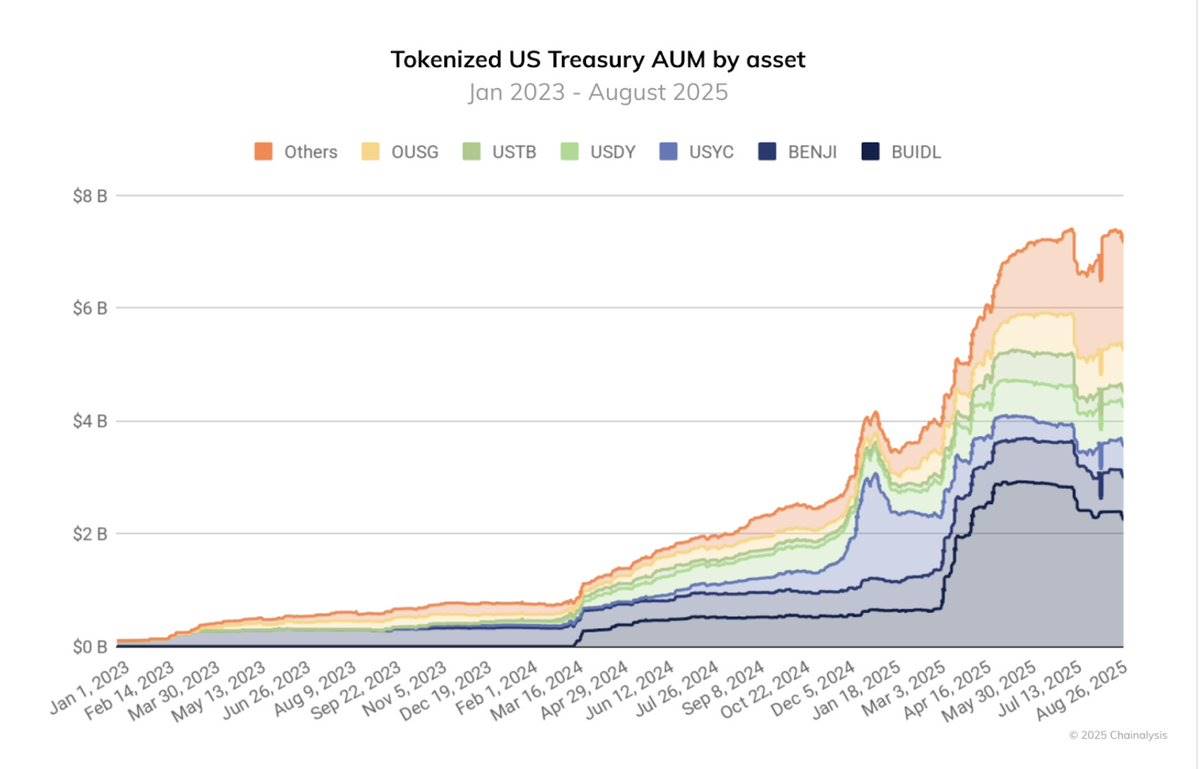

We now see tangible supply growth: By October 2025, the total market cap of RWA tokens surpassed $23 billion, nearly quadrupling year-on-year. About half of this consists of tokenized U.S. Treasuries and money market strategies. With institutions like BlackRock issuing $500 million in Treasury-backed BUIDL, this is no longer marketing gimmickry—it represents on-chain insured debt vaults backed by real collateral, not unsecured code.

Meanwhile, stablecoin issuers began backing reserves with short-term paper, and protocols such as Sky (formerly Maker DAO) integrated on-chain commercial paper into their collateral pools.

Treasury-backed stablecoins are no longer niche players—they form the foundation of the crypto ecosystem. The AUM of tokenized funds nearly quadrupled within 12 months, growing from approximately $2 billion in August 2024 to over $7 billion by August 2025. At the same time, RWA infrastructure from institutions like JPMorgan and Goldman Sachs moved officially from testnets to production environments.

In other words, the boundary between on-chain liquidity and off-chain asset classes is eroding. Traditional finance asset allocators no longer need to buy tokens representing real-world assets—they now directly hold assets issued natively on-chain. This shift from synthetic representations to actual asset tokenization is one of the most impactful structural advances of 2025.

3. Stablecoins: Both “Killer App” and Systemic Weakness

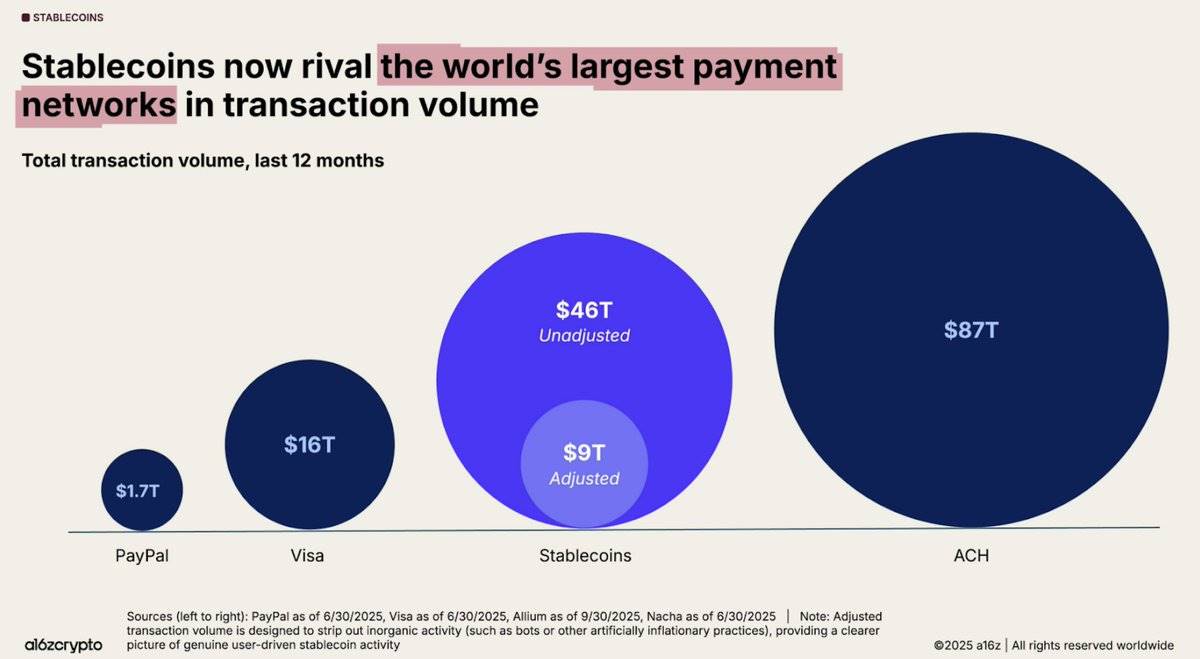

Stablecoins delivered on their core promise: programmable dollars at scale. Over the past 12 months, on-chain stablecoin transaction volume reached $46 trillion—an increase of 106% year-over-year—with an average of nearly $4 trillion per month.

From cross-border settlements to ETF infrastructure and DeFi liquidity, these tokens became the financial backbone of crypto, making blockchains truly functional dollar networks. However, stablecoin success also revealed systemic vulnerabilities.

In 2025, risks associated with yield-generating and algorithmic stablecoins were exposed—especially those relying on endogenous leverage. Stream Finance's XUSD collapsed to $0.18, wiping out $93 million in user funds and leaving $285 million in protocol-level debt.

Elixir’s deUSD failed due to a large loan default. USDx on AVAX fell amid allegations of manipulation. These cases consistently showed how opaque collateral, recursive rehypothecation, and concentrated risk could lead to stablecoin de-pegging.

The profit-seeking frenzy of 2025 further amplified these vulnerabilities. Capital flooded into yield-bearing stablecoins, some offering annual yields of 20%–60% via complex vault strategies. Platforms like @ethena_labs, @sparkdotfi, and @pendle_fi absorbed billions in capital as traders chased structured yields based on synthetic dollars. Yet, following the collapses of deUSD and XUSD, it became clear that DeFi had not matured—it had instead become centralized. Nearly half of Ethereum’s TVL was concentrated in @aave and @LidoFinance, while the rest clustered around a few yield-bearing stablecoin (YBS)-linked strategies. This created a fragile ecosystem built on excessive leverage, recursive fund flows, and shallow diversification.

Thus, while stablecoins power the system, they also amplify its stress points. We are not saying stablecoins are “broken”—they remain vital to the industry. But 2025 proved that stablecoin design is as important as functionality. As we move into 2026, the integrity of dollar-denominated assets becomes paramount—not only for DeFi protocols, but for all participants allocating capital or building on-chain financial infrastructure.

4. L2 Consolidation and the Rollup Stack Disillusionment

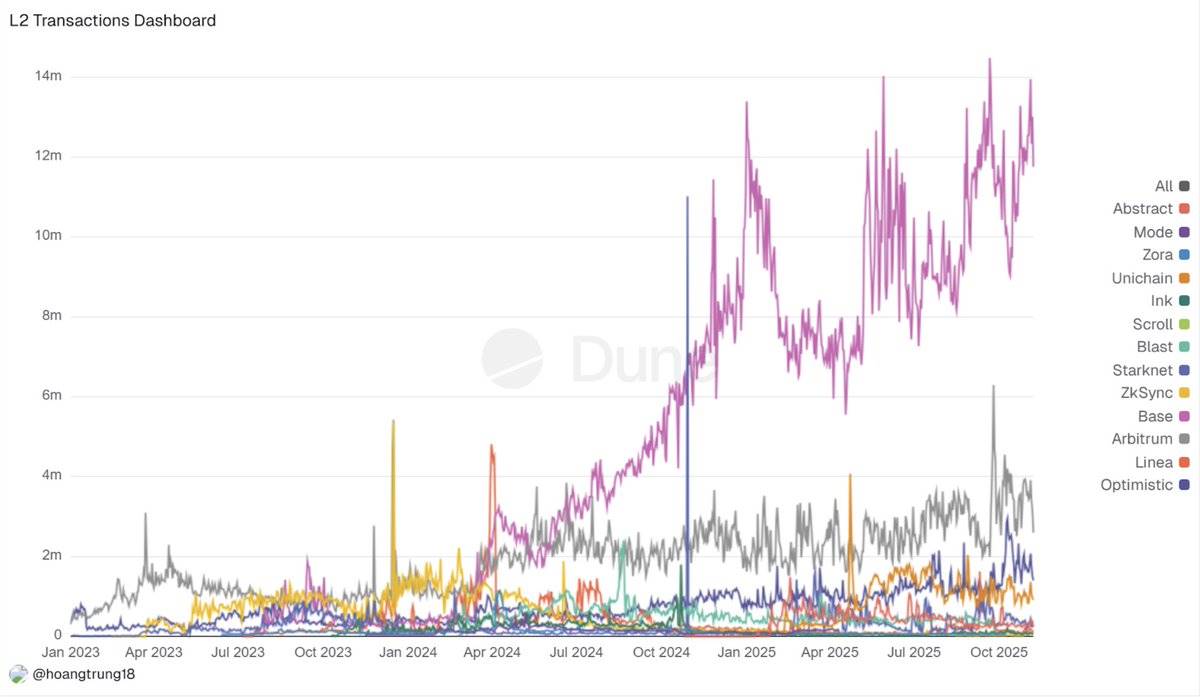

In 2025, Ethereum’s “rollup-centric” roadmap collided with market reality. What was once dozens of L2 projects on L2Beat evolved into a “winner-takes-all” landscape: @arbitrum, @base, and @Optimism captured most new TVL and capital inflows, while smaller rollups saw revenue and activity drop 70%–90% after incentives ended. Liquidity, MEV bots, and arbitrageurs followed depth and tight spreads, reinforcing this flywheel effect and draining order flow from peripheral chains.

At the same time, cross-chain bridge volumes surged—reaching $56.1 billion in July 2025 alone—clearly indicating that “everything is rollups” still means “everything is fragmented.” Users continue to face isolated balances, L2-native assets, and duplicated liquidity.

To be clear, this isn’t failure—it’s consolidation. Fusaka achieved 5–8x blob throughput, zk app-chains like @Lighter_xyz hit 24,000 TPS, and specialized solutions emerged (Aztec/Ten for privacy, MegaETH for ultra-high performance)—all signs that a few execution environments are pulling ahead.

Others have entered “hibernation mode,” waiting until they can prove moats too deep for leaders to simply fork away.

5. Prediction Markets Rise: From Niche Tool to Financial Infrastructure

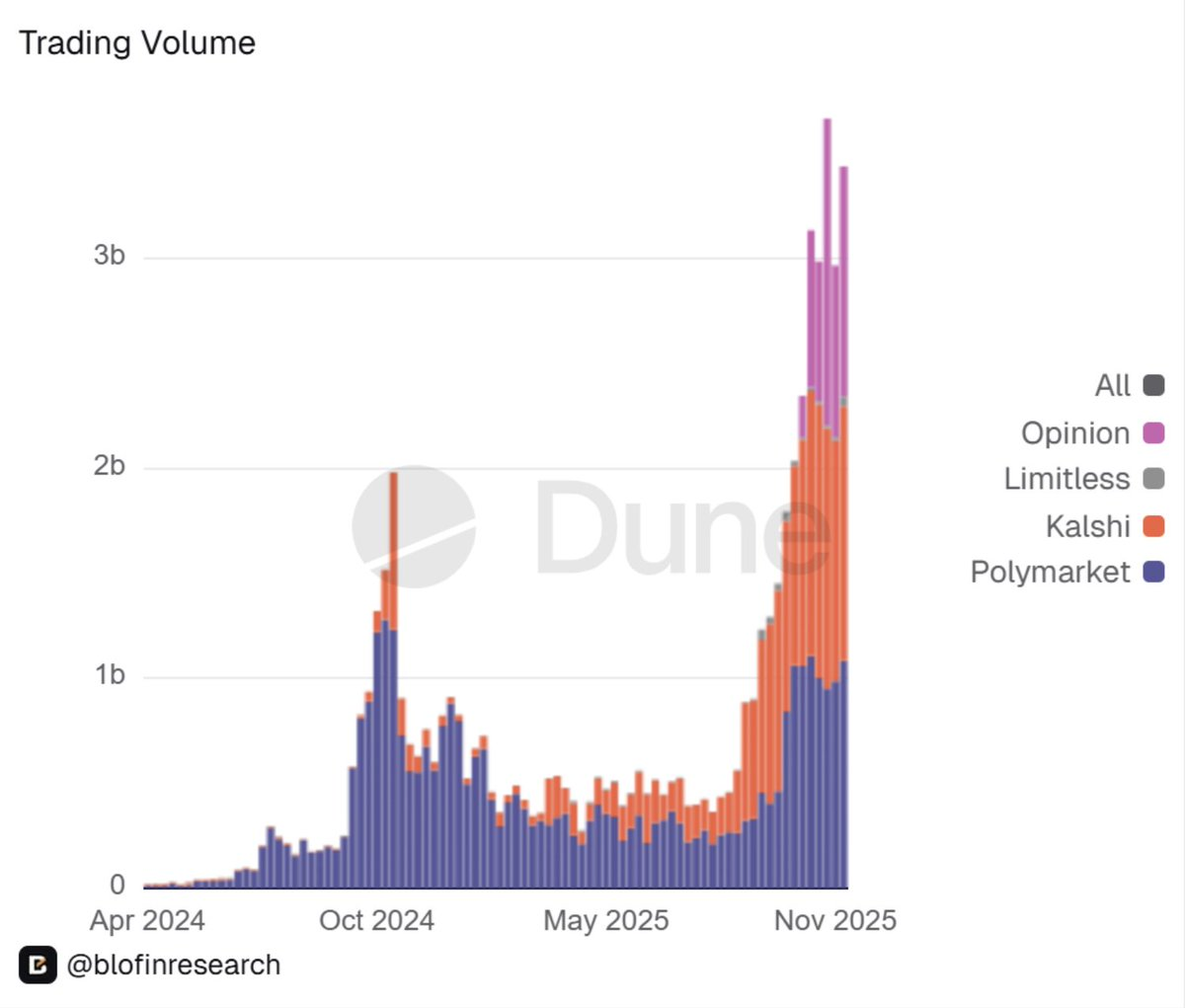

Another major surprise in 2025 was the formal legitimization of prediction markets.

Once seen as quirky niches, prediction markets are now integrating into financial infrastructure. Industry leader @Polymarket re-entered the U.S. market in regulated form: its U.S. arm received approval from the Commodity Futures Trading Commission (CFTC) as a Designated Contract Market. Reports suggest Intercontinental Exchange (ICE) invested billions, valuing the platform close to $10 billion. Capital followed accordingly.

Prediction markets leapt from “interesting curiosities” to multi-billion-dollar weekly trading volumes. @Kalshi alone processed tens of billions in event contracts during 2025.

I believe this marks a shift—from blockchain-based markets being “toys” to becoming genuine financial infrastructure.

Mainstream sports betting platforms, hedge funds, and native DeFi managers now treat Polymarket and Kalshi as forecasting tools, not entertainment. Crypto projects and DAOs are beginning to use these order books as real-time governance and risk signals.

Yet this “weaponization” of DeFi has two sides. Regulatory scrutiny will intensify. Liquidity remains highly concentrated around specific events, and the correlation between “prediction markets as signals” and real-world outcomes remains unproven under stress conditions.

Looking ahead to 2026, one thing is clear: event markets are now on institutional radar alongside options and perpetuals. Portfolios must develop explicit views on whether—and how—to allocate exposure to them.

6. AI Meets Crypto: From Hype Narrative to Real Infrastructure

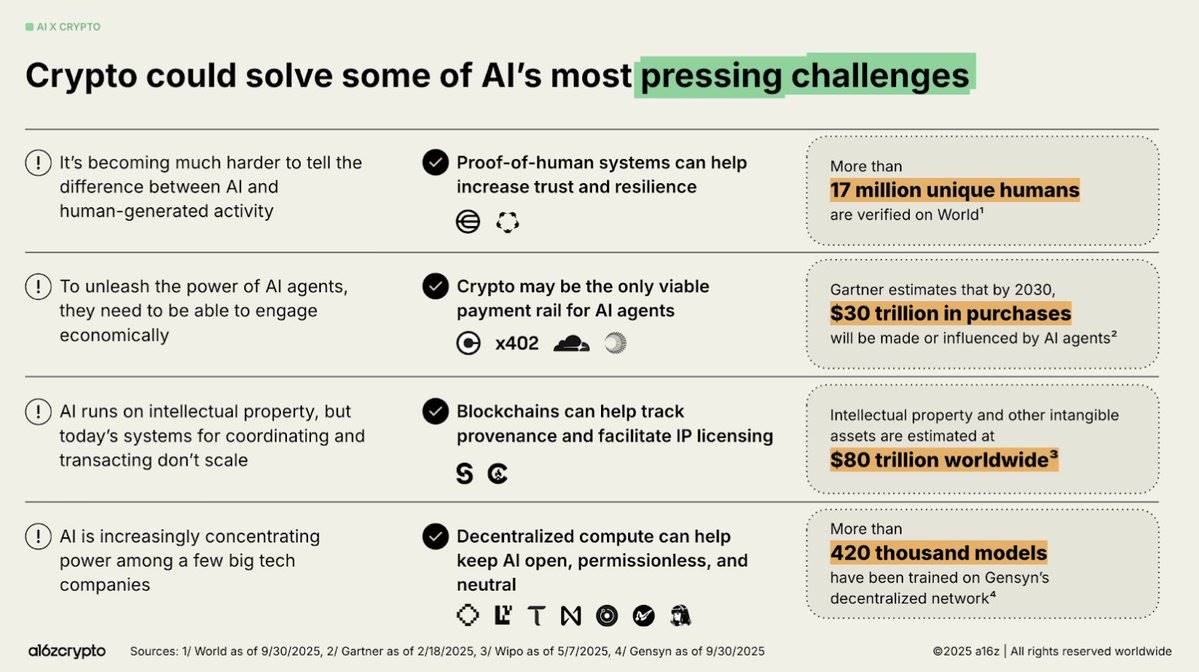

In 2025, the convergence of AI and crypto moved from noisy narratives to structured, practical applications.

I believe three themes defined this evolution:

First, the agentic economy transformed from speculative idea to operational reality. Protocols like x402 enabled AI agents to conduct autonomous trades in stablecoins. Circle’s USDC integration, along with the rise of orchestration frameworks, reputation layers, and verifiable systems (e.g., EigenAI and Virtuals), highlighted that useful AI agents require collaboration—not just reasoning.

Second, decentralized AI infrastructure became a core pillar. Bittensor’s dynamic TAO upgrade and December halving redefined it as “Bitcoin of AI”; NEAR’s chain abstraction drove real intent-based transaction volume; @rendernetwork, ICP, and @SentientAGI validated the feasibility of decentralized compute, model provenance, and hybrid AI networks. Clearly, infrastructure commands premium, while “AI-wrapped” tokens lose value.

Third, vertical integration for practical use accelerated.

@almanak deployed quant-grade DeFi strategies using AI collectives; @virtuals_io generated $2.6 million in fees on Base; bots, prediction markets, and geospatial networks became credible agent environments.

The shift from “AI wrapping” to verified agent and bot integration shows product-market fit maturing. Still, trust infrastructure remains a key missing piece, and hallucination risk looms over autonomous trading.

Overall, end-of-year sentiment is optimistic about infrastructure, cautious about agent utility, and broadly anticipates 2026 as a breakout year for verifiable, economically valuable on-chain AI.

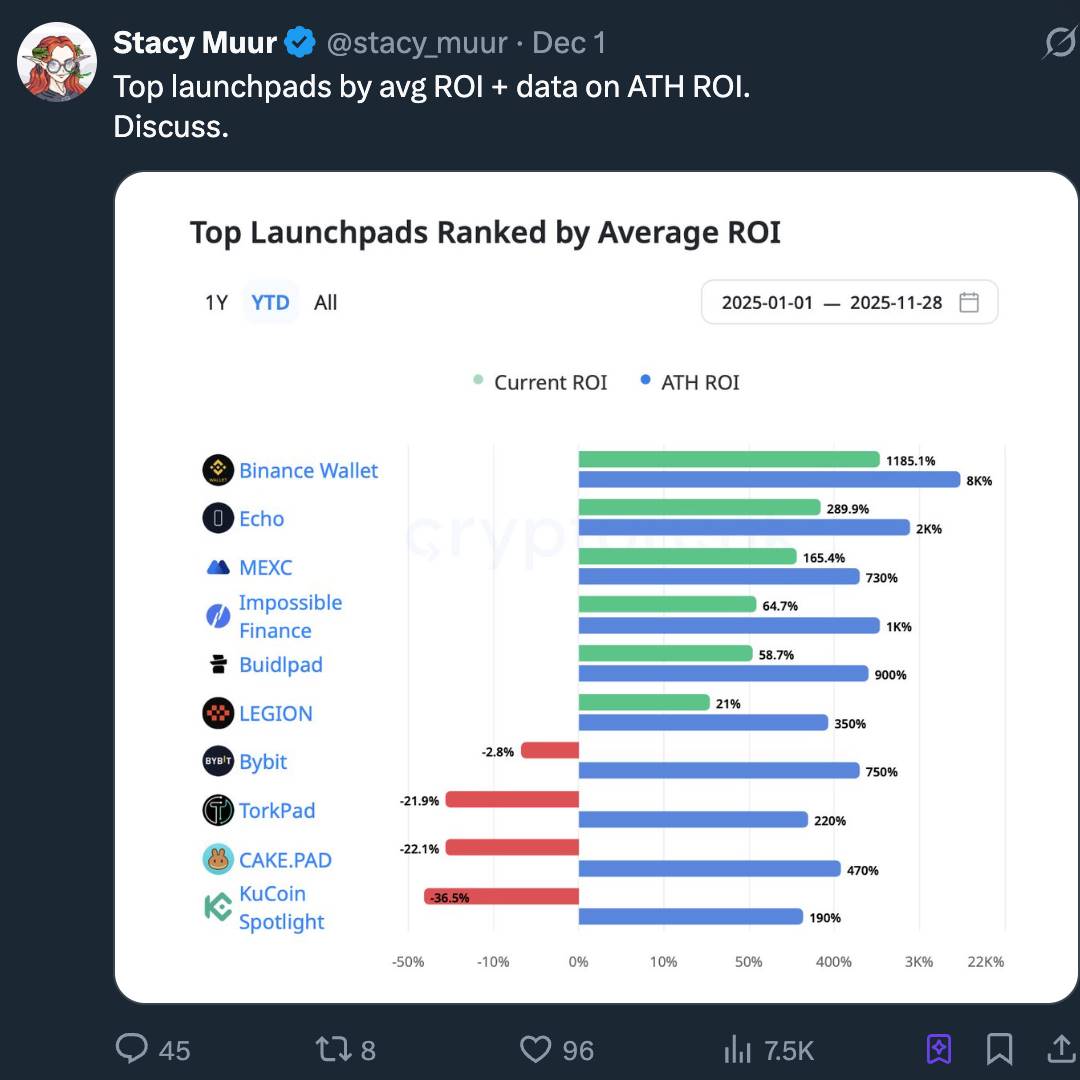

7. Launchpad Revival: A New Era for Retail Capital

We believe the 2025 launchpad boom wasn’t a return of ICOs—but the industrialization of ICOs. The so-called “ICO 2.0” is actually the maturation of crypto’s capital formation stack, evolving into Internet Capital Markets (ICM): a programmable, regulated, 24/7 underwriting track, not just “lottery-style” token sales.

The repeal of SAB 121 accelerated regulatory clarity, turning tokens into financial instruments with vesting schedules, disclosures, and recourse—beyond mere issuance. Platforms like Alignerz embedded fairness into mechanism design: hashed bidding, refund windows, vesting timelines based on lock-up duration rather than insider access. “No VC dump, no insider profit” is no longer a slogan—it’s an architectural choice.

Simultaneously, we observe launchpads consolidating with exchanges—a sign of structural change: Coinbase, Binance, OKX, and Kraken-affiliated platforms offer KYC/AML compliance, liquidity guarantees, and curated issuance pipelines accessible to institutions. Independent launchpads are forced to specialize in verticals (e.g., gaming, memes, early infrastructure).

Narratively, AI, RWAs, and DePIN dominate issuance channels. Launchpads act more like narrative routers than hype machines. The real story is that crypto is quietly building an ICM layer supporting institutional-grade issuance and long-term alignment—without reliving 2017 nostalgia.

8. High-FDV Projects Are Structurally Uninvestable

For much of 2025, a simple rule was repeatedly validated: high-FDV (fully diluted valuation), low-circulating-supply projects are structurally uninvestable.

Many projects—especially new L1s, sidechains, and “real yield” tokens—entered the market with FDVs in the billions and single-digit circulating supplies.

As one research firm noted, “high FDV, low circulation is a liquidity time bomb”; any large-scale sell-off by early buyers would obliterate the order book.

The outcome was predictable. These tokens spiked at launch, then crashed as unlock schedules arrived and insiders exited. Cobie’s famous mantra—“Say no to bloated FDV tokens”—evolved from meme to risk assessment framework. Market makers widened bid-ask spreads; retail participation dried up; many such tokens remained flat for the following year.

In contrast, tokens with real utility, deflationary mechanisms, or cash-flow linkage structurally outperformed peers whose sole selling point was “high FDV.”

I believe 2025 permanently reshaped buyer tolerance for “tokenomic theatrics.” FDV and circulation are now hard constraints, not trivial footnotes. Looking ahead to 2026, if a project’s token supply cannot be absorbed by exchange order books without disrupting price, it is effectively uninvestable.

9. InfoFi: Rise, Mania, and Collapse

I believe 2025’s InfoFi boom and bust served as the clearest cyclical stress test of “tokenized attention.”

Platforms like @KaitoAI, @cookiedotfun, @stayloudio promised to reward analysts, creators, and community moderators for “knowledge work” via points and tokens. For a brief window, this became a hot VC theme, attracting massive investments from Sequoia, Pantera, Spartan, and others.

Crypto’s information overload and the popularity of AI + DeFi made on-chain content curation seem like an obvious missing base layer.

Yet designing attention as the unit of account proved double-edged: when attention becomes the primary metric, content quality collapses. Platforms like Loud and peers were overwhelmed by AI-generated junk, bot farms, and engagement rings; a few accounts captured most rewards, while long-tail users realized the game was rigged.

Multiple tokens suffered 80–90% drawdowns, with some collapsing entirely (e.g., WAGMI Hub raised nine-figure funding before suffering a major exploit), further damaging sector credibility.

The conclusion: first-generation InfoFi attempts were structurally unstable. While the core idea—monetizing valuable crypto signals—remains compelling, incentive models must be redesigned around verified contributions, not click counts.

I believe the next wave of projects in 2026 will learn from these failures and improve.

10. Consumer Crypto’s Return: A New Paradigm Led by Neobanks

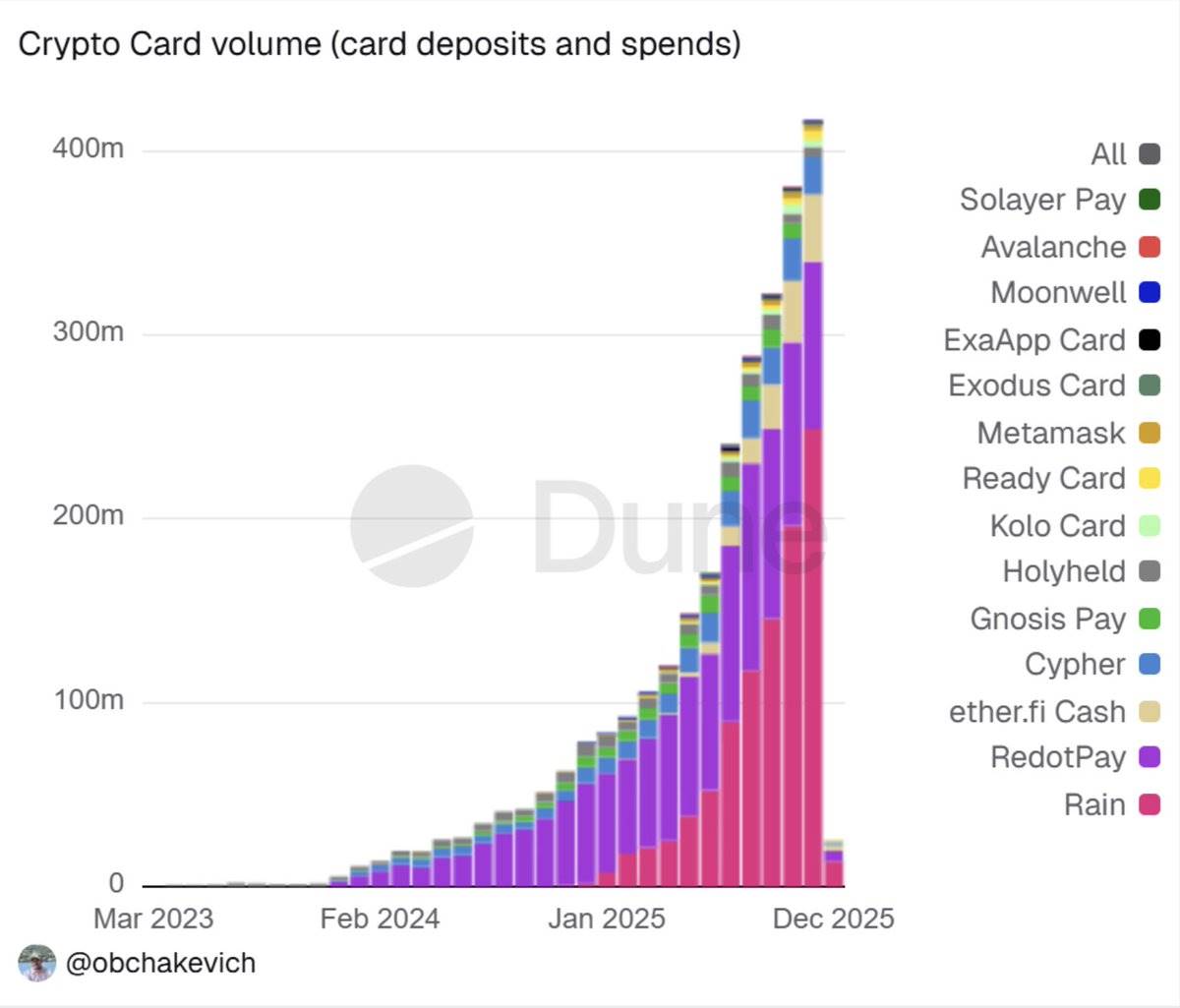

In 2025, consumer crypto’s resurgence is increasingly seen as a structural shift driven by neobanks—not native Web2 apps.

I believe this reflects a deeper insight: adoption accelerates when users onboard through familiar financial primitives (e.g., deposits, yield), while settlement, yield, and liquidity rails silently migrate on-chain.

The result is a hybrid banking stack where neobanks hide gas fees, custody, and bridge complexity, while giving users direct access to stablecoin yields, tokenized Treasuries, and global payment rails. This creates a consumer funnel capable of bringing millions “deeper on-chain” without requiring them to think like power users.

The industry consensus now sees neobanks as the de facto standard interface for mainstream crypto demand.

Platforms like @ether_fi, @Plasma, @UR_global, @SolidYield, @raincards, and Metamask Card exemplify this shift: offering instant on-ramps, 3–4% cashback cards, 5–16% APY via tokenized Treasuries, and self-custodial smart accounts—all within compliant, KYC-enabled environments.

These apps benefited from 2025’s regulatory reset: the repeal of SAB 121, stablecoin frameworks, and clearer guidance on tokenized funds. These changes reduced operational friction and expanded their potential market size in emerging economies—especially where pain points like yield, FX savings, and remittances are acute.

11. Global Normalization of Crypto Regulation

I believe 2025 was the year crypto regulation finally normalized.

Conflicting regulatory directives coalesced into three identifiable models:

-

European Model: Includes MiCA (Markets in Crypto-Assets) and DORA (Digital Operational Resilience Act), with over 50 MiCA licenses issued. Stablecoin issuers are treated as e-money institutions.

-

American Model: Includes stablecoin laws like the GENIUS Act, SEC/CFTC guidance, and the launch of spot Bitcoin ETFs.

-

Asia-Pacific Patchwork: Includes Hong Kong’s full-reserve stablecoin rules, Singapore’s licensing optimizations, and broader adoption of FATF’s Travel Rule.

This is not cosmetic—it fundamentally reshapes risk models.

Stablecoins transition from “shadow banks” to regulated cash equivalents; banks like Citi and BoA can now run tokenized cash pilots under clear rules; platforms like Polymarket can relaunch under CFTC oversight; U.S. spot Bitcoin ETFs attract over $35 billion in stable inflows without existential risk.

Compliance shifts from burden to moat: institutions with strong regtech architecture, clear cap tables, and auditable reserves suddenly enjoy lower capital costs and faster institutional access.

In 2025, crypto moved from gray-zone curiosity to regulated entity. Looking ahead to 2026, the debate is no longer “can this industry exist?” but “how should specific structures, disclosures, and risk controls be implemented?”

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News