After the tide recedes: which Web3 projects are consistently making money?

TechFlow Selected TechFlow Selected

After the tide recedes: which Web3 projects are consistently making money?

They mostly revolve around two things: one is trading, the other is attention.

Author: Viee, Core Contributor at Biteye

After the bubble bursts, what defines a crypto project's survival底线?

In an era when anything could spin a story and command high valuations, cash flow didn't seem necessary. But now things are different.

VCs are retreating, and liquidity is tightening. In such a market environment, whether a project can generate revenue and achieve positive cash flow has become the first filter to test its fundamentals.

In contrast, some projects have weathered cycles through stable income. According to DeFiLlama data, in October 2025, the top three highest-earning crypto projects generated monthly revenues of $688 million (Tether), $237 million (Circle), and $102 million (Hyperliquid) respectively.

In this article, we’ll discuss these projects with real cash flows. Most revolve around two core activities: trading and attention. The two most fundamental sources of value in the business world apply equally in crypto.

01 Centralized Exchanges: The Most Stable Revenue Model

In crypto, it’s no secret that “exchanges make the most money.”

Main revenue streams for exchanges include trading fees and listing fees. Take Binance as an example—it consistently captures 30–40% of global spot and futures trading volume. Even during the coldest market period in 2022, annual revenue reached $12 billion, and will only be higher during this cycle’s bull market. (Data from CryptoQuant)

In one sentence: as long as people trade, exchanges earn.

Coinbase, as a publicly listed company, offers clearer financial disclosures. In Q3 2025, Coinbase reported $1.9 billion in revenue and $433 million in net profit. Trading revenue was the largest contributor, accounting for over half, while the rest came from subscription and service fees. Other major players like Kraken and OKX are also steadily profitable—Kraken reportedly earned around $1.5 billion in 2024.

The biggest advantage of these CEXs is that trading naturally generates income. While many projects still struggle to prove their business models, CEXs are already earning real fees from services.

In other words, at a time when storytelling is getting harder and hot money is drying up, CEXs are among the few players that can survive without fundraising—entirely self-sustaining.

02 On-chain Projects: PerpDex, Stablecoins, and Public Chains

According to DefiLlama data as of November 27, 2025, the top ten on-chain protocols by revenue over the past 30 days are shown below.

First, Tether and Circle firmly dominate the top ranks. Leveraging U.S. Treasury yield spreads behind USDT and USDC, these two stablecoin issuers earned nearly $1 billion in a single month. Close behind is Hyperliquid, solidly holding its title as “the most profitable on-chain derivatives protocol.” Additionally, Pumpfun’s rapid rise reaffirms the old adage—“trading tokens isn’t as good as selling them; selling picks isn’t as good as selling tools”—still holds true in crypto.

Notably, emerging projects like Axiom Pro and Lighter, though smaller in total revenue, have already achieved positive cash flow.

2.1 PerpDex: Real Earnings for On-chain Protocols

This year, Hyperliquid has been the strongest performer among PerpDex platforms.

Hyperliquid is a decentralized perpetual contract platform built on its own chain with native matching engine. Its growth was sudden—just in August 2025 alone, it processed $383 billion in trading volume and earned $106 million in revenue. Moreover, the project uses 32% of its revenue to buy back and burn its platform token. According to @wublockchain12's report yesterday, the Hyperliquid team unlocked 1.75 million HYPE ($60.4 million), with no external funding or sell pressure—the protocol funds token buybacks through its own revenue.

For an on-chain project, this approaches the revenue efficiency of CEXs. More importantly, Hyperliquid actually earns money and feeds it back into its token economy, directly linking protocol revenue to token value.

Now consider Uniswap.

Over the past few years, Uniswap has been criticized for extracting value from token holders—for example, charging a 0.3% fee per trade but giving all of it to LPs, leaving UNI holders with zero income.

It wasn’t until November 2025 that Uniswap announced plans to introduce a protocol fee sharing mechanism and use part of historical revenue to buy back and burn UNI tokens. Estimates suggest that if implemented earlier, the funds available for burning in just the first ten months of this year would have reached $150 million. Upon announcement, UNI surged 40% that day. Although Uniswap’s market share has dropped from a peak of 60% to 15%, this proposal could still reshape the fundamental logic of UNI. However, after the announcement, @EmberCN detected a UNI investment firm (possibly Variant Fund) transferring millions of $UNI ($27.08 million) into Coinbase Prime, possibly indicating a pump-and-dump maneuver.

Overall, the old DEX model driven purely by airdrop hype is becoming increasingly unsustainable. Only those projects that generate stable revenue and complete a commercial loop can truly retain users.

2.2 Stablecoins and Public Chains: Earning Passive Interest

Beyond trading-related projects, a group of infrastructure players continue to generate consistent profits. Among them, the most notable are stablecoin issuers and high-traffic public chains.

Tether: The Printing Giant

Tether, the company behind USDT, has a simple revenue model: whenever someone deposits $1 to mint USDT, Tether invests that dollar in low-risk assets like U.S. Treasuries and short-term bills, keeping the interest. As global interest rates rose, so did Tether’s earnings. Net profit reached $13.4 billion in 2024, with projections exceeding $15 billion in 2025—rivaling traditional financial giants like Goldman Sachs. @Phyrex_Ni recently noted that despite a credit rating downgrade, Tether remains a cash cow, earning passively from over $130 billion in collateralized Treasury holdings.

Circle, issuer of USDC, operates at a slightly smaller scale in both circulation and net profit, but still generated over $1.6 billion in total revenue in 2024, with 99% coming from interest income. It should be noted that Circle’s profit margin isn’t as high as Tether’s, partly due to revenue sharing with Coinbase. Simply put, stablecoin issuers are printing machines—they don’t rely on storytelling to raise funds, but on users willingly depositing money into their system. During bear markets, these savings-oriented projects often thrive even more. @BTCdayu also believes stablecoins are a great business—printing money and collecting interest globally—and views Circle as a top-tier passive earner in the stablecoin space.

Public Chains: Monetizing Traffic, Not Incentives

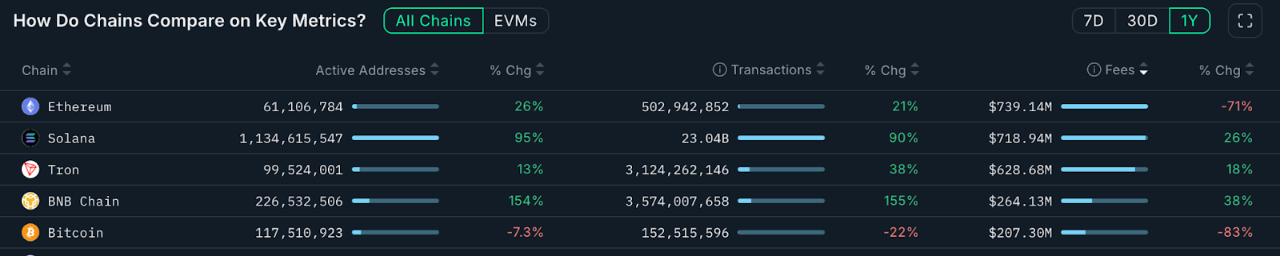

Looking at mainnet public chains, the most direct monetization method is gas fees. Data below from Nansen.ai:

Over the past year, examining total transaction fee revenue reveals which chains have truly generated usage value. Ethereum earned $739 million annually, remaining the primary source, but down 71% year-on-year due to Dencun upgrades and L2分流. In contrast, Solana earned $719 million annually, up 26% YoY, significantly boosting user activity and interaction frequency amid Meme and AI Agent trends. Tron generated $628 million, up 18%. Bitcoin earned $207 million, largely affected by declining interest in inscription transactions, resulting in a clear overall drop.

BNB Chain earned $264 million annually, up 38% YoY—the fastest growth rate among major public chains. While revenue still trails ETH, SOL, and TRX, combined with rising transaction volume and active addresses, it shows expanding on-chain use cases and a more diversified user base. BNB Chain demonstrates strong user retention and genuine demand. This steady revenue growth provides clearer support for continued ecosystem evolution.

These public chains act as “water sellers”—no matter who is mining gold in the market, they always need to use the water, electricity, and roads provided by these chains. While lacking explosive short-term growth, such infrastructure projects win through stability and counter-cyclicality.

03 The KOL Business: Monetizing Attention

If trading and infrastructure represent the visible business models, then attention economics is the “hidden business” of the crypto world—such as KOLs and agencies.

This year, crypto KOLs have become centers of attention and traffic.

Influencers active on X, Telegram, and YouTube leverage personal influence to build diversified revenue streams: paid promotions, community subscriptions, course sales, and other traffic-based businesses. Industry rumors suggest mid-tier and above crypto KOLs can earn $10,000 per month from promotions alone. At the same time, audience expectations for content quality are rising, so KOLs that survive across cycles are typically creators who’ve earned user trust through expertise, judgment, or deep engagement. This subtly drives ecosystem reshuffling during bear markets—superficial players exit, long-term builders remain.

Worth noting is the third layer of attention monetization: KOL rounds. This allows KOLs to directly participate in early-stage investments—acquiring project tokens at discounts, taking on marketing exposure tasks, and securing “early stakes via influence.” This model effectively bypasses VCs.

A full suite of intermediary services has also emerged around KOLs. Agencies now act as traffic brokers, matching projects with suitable KOLs—making the entire process increasingly resemble an advertising platform. If you’re interested in the business models of KOLs and agencies, refer to our previous in-depth article “Uncovering the KOL Round: A Wealth Experiment Driven by Traffic” (https://x.com/BiteyeCN/status/1986748741592711374) for a deeper look at the underlying incentive structures.

In essence, attention economics is about monetizing trust—and trust becomes scarcer in bear markets, raising the bar for monetization.

04 Conclusion

Projects maintaining cash flow during crypto winters largely validate two foundational pillars: “trading” and “attention.”

On one hand, whether centralized or decentralized trading platforms, as long as there is consistent user trading activity, they can generate ongoing revenue through fees. This direct business model enables self-sufficiency even as capital retreats. On the other hand, KOLs focused on capturing user attention monetize that value through ads and services.

The future may bring more diverse models, but ultimately, projects that accumulate real revenue during downturns will be best positioned to lead the next wave. Conversely, projects relying solely on narratives without any ability to generate internal revenue may experience short-term hype but eventually fade into obscurity.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News