Looking back at the golden age of crypto: The wealth-making frenzy is over, and now there's no opportunity for dumb money

TechFlow Selected TechFlow Selected

Looking back at the golden age of crypto: The wealth-making frenzy is over, and now there's no opportunity for dumb money

Relive the historic moments of wealth creation.

Author: IcoBeast

Compiled by: TechFlow

For nearly the past decade, a defining characteristic of cryptocurrency (excluding Bitcoin specifically) has been that any ordinary person with internet access, some free time, and roughly six functioning brain cells could quickly turn a small sum of money into a large fortune.

Since 2016–2017, the crypto industry has gone through three to four broad "gold rush" cycles. These cycles shared a common trait: a mainstream asset on some blockchain was extremely cheap but had massive compounding potential, and its value subsequently skyrocketed.

Each time, the "dumbest person" you knew in the space would make an insane amount of money, then tell their friends, who would bring in even more people. After all, "If that idiot can turn $100 into $100,000, why can't I?"

Let’s take a look back at these historic wealth creation moments…

Looking Back at History

2017 – The ICO Boom (Post-Ethereum ICO)

In my view, this was essentially the "golden age" of the crypto industry. Almost every day, a new project would appear, complete with a whitepaper and a flashy gradient logo—despite having almost no actual functionality—and people would rush to dump their ETH into it for token allocations. Then, once these tokens listed on exchanges, market participants would swarm in to buy the new tokens, driving prices up rapidly. You could make a huge profit and then swap your gains back into ETH.

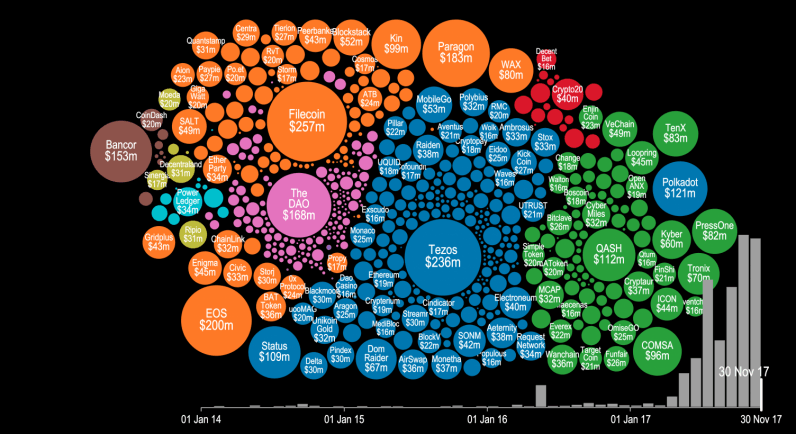

The ICO boom: The chart says it all

It was amazing. At the time, there were only about 100–200 tokens in existence, practically none of which were usable or meaningful. The entire game was simply dumping ETH into various ICOs and walking away with massive returns—it was basically "free money." Everyone was trading the same few tokens, aiming solely to accumulate more ETH… It was incredibly straightforward. People would share this "wealth formula" with friends, who would then join in too. Eventually, though, we all got humbled by the market, as the crypto space began to collapse and entered a two-year bear market.

2020–2021: The DeFi "Yield Farming + Food-Pyramid Scheme" Craze

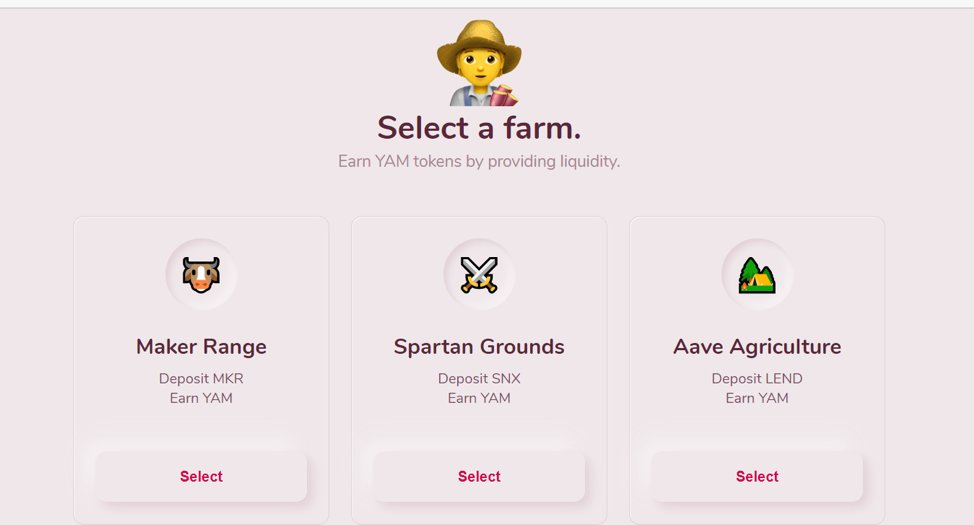

I didn’t participate much personally in this wave (due to real-life commitments), but its essence was the launch of some "real" DeFi products (kicked off by Compound's COMP token distribution). This sparked various liquidity mining games and Ponzi-like models… Once again, people rushed into a handful of select tokens, still aiming to maximize their ETH holdings.

Many early Crypto Twitter influencers rose to prominence during this phase. At the time, the market attracted massive new capital because no one truly understood how to play the game, and the tools for maximizing yields weren’t widely accessible yet. Additionally, ETH’s price started rising rapidly, further inflating everyone’s PnL and drawing in even more speculative capital.

2021–2022: The Wild Era of the NFT Bubble

Back then, the pandemic brought the world to a standstill. People received government stimulus checks while losing their jobs (or having their businesses shut down), so they spent their days glued to Clubhouse and Twitter Spaces.

At that moment, a group of people began minting NFTs. Among them, Bored Apes became the industry’s "kingmaker" (even though the mint window was long enough for anyone to participate). With the success of Bored Apes, the floodgates opened. You could mint the ugliest-looking image for 1 ETH and wake up the next day to sell it for 20 ETH… then watch it climb to 50 ETH. None of it made sense—no one genuinely wanted these JPEGs, nor did anyone truly believe they were worth such absurd prices. But everyone wanted to make money and keep playing the game.

This insane wealth effect allowed people to flip a few images with minimal ETH and eventually accumulate vast amounts of ETH… almost effortlessly, simply because "they showed up." Unsurprisingly, this drew massive attention, pushing NFTs into the mainstream. However, the bubble eventually burst, and most participants were wiped out by the market.

This wealth effect was briefly replicated during the Ordinals craze in early 2023. As Bitcoin prices plummeted, early Ordinals presented a wild "cooking" opportunity: you could turn a tiny amount of BTC into a large pile of BTC very quickly. Then, Bitcoin’s price went parabolic. (Meanwhile, those who held onto their JPEGs were ultimately "liquidated" by the market.)

January 25, 2023: The Wealth Surge of Meme Season

This may have been the longest-lasting period of wealth creation in crypto’s "dumb money" cycle—the meme coin frenzy on both ETH and Solana. Strictly speaking, it traces back to the explosion of BONK after FTX collapsed at the end of 2022, but I prefer to mark the true starting point as the rise of PEPE (on ETH) in April 2023 and WIF (on SOL) in November 2023, launching over a year of wild token action.

These completely useless, planless, purely vibes-driven shitcoins saw their market caps soar into the billions. Especially early on, buying $1,000 worth of just about any random token almost guaranteed a 10x return overnight… and this pattern persisted for weeks.

Over time, the game became harder: bots got smarter, arbitrage tools became more efficient, developers grew better at cashing out when they rug-pulled, and overall entry barriers gradually increased. People started taking money out of the "casino" instead of throwing more in after seeing a friend make $20,000 in 17 minutes with a token named "pepefartsockinu69420." Meanwhile, new trading pairs emerged daily, allowing you to steadily accumulate more ETH or SOL.

Then came the "9/11" of meme coins: TRUMP, MELANIA, and finally the last nail in the coffin—Hayden Davis’s LIBRA. That changed everything. Deep down, everyone realized the game was "cooked." When one party could steal over $100 million from the collective pool in a single second, the game was no longer worth playing… After all, what could possibly be crazier than the U.S. President secretly launching a token and seeing its FDV (Fully Diluted Valuation) shoot up to $70 billion overnight?

This is where we stand today. About nine months have passed since that fatal blow. While there have been some standout opportunities along the way (especially solid performance from major assets since April), we haven’t seen another compounding wealth event that rapidly multiplies native or mainstream assets in both speed and scale.

To be honest, I don’t know if such conditions will ever return. NFTs? Already "solved"—now there are probably only about 17 people left in the world who still care about trading or flipping NFTs. Meme coins? Also "solved"—it’s clearly safer and simpler to be a 24/7 token deployer, profiting risk-free. On-chain Ponzi schemes? Most people now understand how they work… Only the "sharks" remain, and you must time your exit perfectly or get eaten alive. Maybe ICOs will make a comeback? Monad looks promising. We’ll see.

Over the past year, we’ve seen almost no simple, "dumb money"-driven wealth creation opportunities. That’s why everyone is so frustrated. They’ve grown accustomed to always catching one of these waves, but for the past nine months, all we’ve seen is a wasteland (unless you held significant amounts of major assets, especially Bitcoin).

Recently, I mentioned on my timeline that nothing currently available on-chain particularly inspires me—much of it feels somewhat stale. However, a few teams building interesting "new" things reached out to me, and I plan to dive deep into their prototypes and document my testing and findings (alongside plenty of updates on Kalshi-related crypto developments).

One of these teams is @zigchain, who offered to sponsor this article—something I’d actually intended to write weeks ago.

They’re building what they describe as a Wall Street–like platform on-chain, offering tokenized RWA (Real World Assets) yield products. These products aim to give regular users access to higher-yield investment opportunities with much lower capital requirements, breaking away from traditionally high-barrier investments that have long excluded retail participants.

While I’m generally bullish on RWAs (such as equity perps, tokenized stocks, etc.), I remain skeptical of most current RWA projects in the market. However, the @zigchain team claims their first product (Zignaly) already has over 400,000 real users, so I intend to test it myself and see how it performs.

Whether RWA products can deliver the kind of extreme wealth creation we’ve been missing—who knows? But I’m ready to get back into the theoretical trenches, try something new, and share my experience. It’s been far too long without exploratory content like this—we need more things that spark interest and curiosity on our timelines.

If you made it this far, thank you for reading. I truly appreciate it—I still think one of the coolest things in the world is having a group of people online willing to spend their time reading what I write. I hope this piece offered you some value (whether entertainment or otherwise), and more content is coming soon.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News