From chasing viral moments to focusing on conversion, crypto marketing is changing in 2026

TechFlow Selected TechFlow Selected

From chasing viral moments to focusing on conversion, crypto marketing is changing in 2026

To stay ahead, the key is to constantly monitor industry trends, draw inspiration from beyond the crypto space, and start from first principles.

Author: Emily Lai

Translation: TechFlow

The crypto industry is moving fast, attention spans are short, and trend lifecycles are getting shorter. At g(t)m con 1 last Sunday (November 16), I delivered a keynote sharing observations and lessons from the past 12 months, along with predictions for 2026.

The core message of this talk was to explore, together with fellow founders, growth leads, and marketers, what my team at @hypepartners believes about the future of the industry, what that means for your marketing strategy, and how to stay ahead.

Ten months can change everything

Since my keynote at EthDenver in February 2025, we’ve witnessed the following shifts:

-

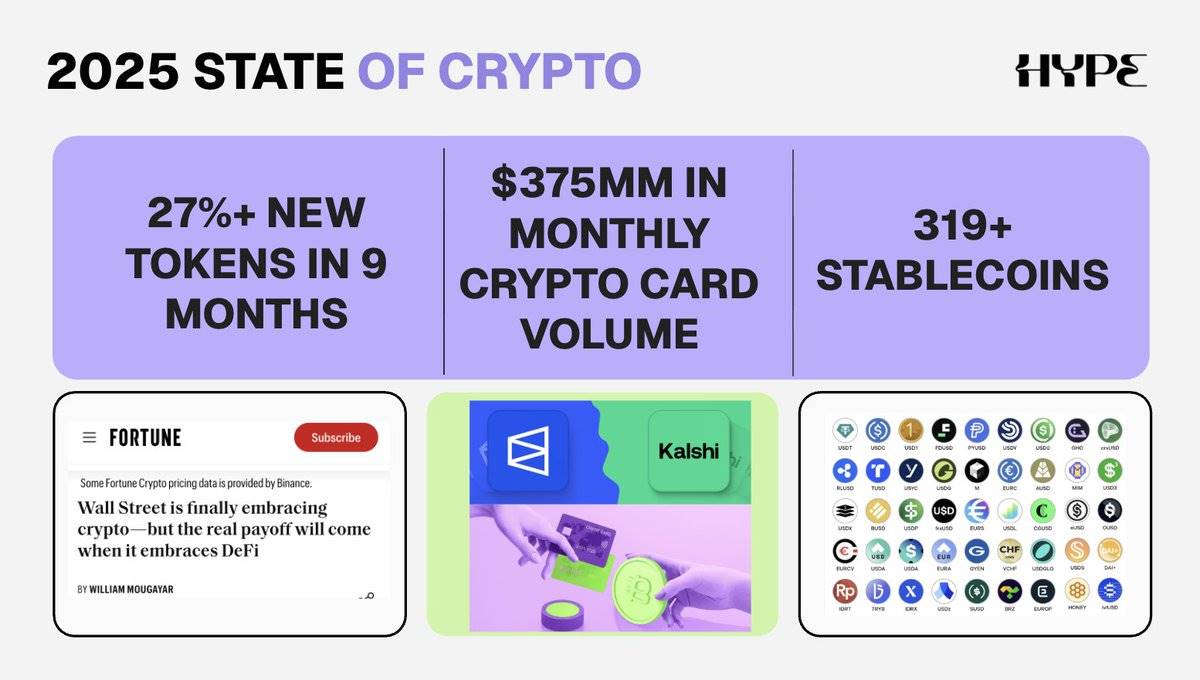

Over 319 new stablecoins launched (source: @DefiLlama, link: https://defillama.com/stablecoins).

-

Institutional and Wall Street adoption via enterprise blockchains, DATs (digital asset tokens), ETFs, and fintech giants embracing stablecoins.

-

Regulatory easing following the passage of the GENIUS Act and the inauguration of a "crypto-friendly" U.S. president.

-

New token issuance grew over 27%, reaching 567 million to date (source: @Dune, link: https://dune.com/senlonlee/jia-mi-shi-chang-dai-bi-de-zong-liang-tong-ji).

-

A surge in crypto payment card options—$375 million in tracked payment card transactions on visible blockchains in October 2025 alone.

-

Prediction markets like @Kalshi and @Polymarket hit new trading volume highs, with new platforms emerging.

-

Ongoing launches of blockchain-powered digital banks and mobile-first fintech apps (notably @aave’s heavyweight mobile app launch this week).

Crypto marketing in 2024 vs. today

Last November, g(t)m con took place in Bangkok. Key trends then included team-led marketing, founder branding, AI agents, interactive “reply guys,” mascot marketing, airdrops, intern-run accounts, and the InfoFi-driven concept of “mindshare.” But in just one year, these have significantly evolved. From APAC liquidity focus to ICO revival and “CT Leads” (Crypto Twitter leads), the pace of change in crypto has been remarkable.

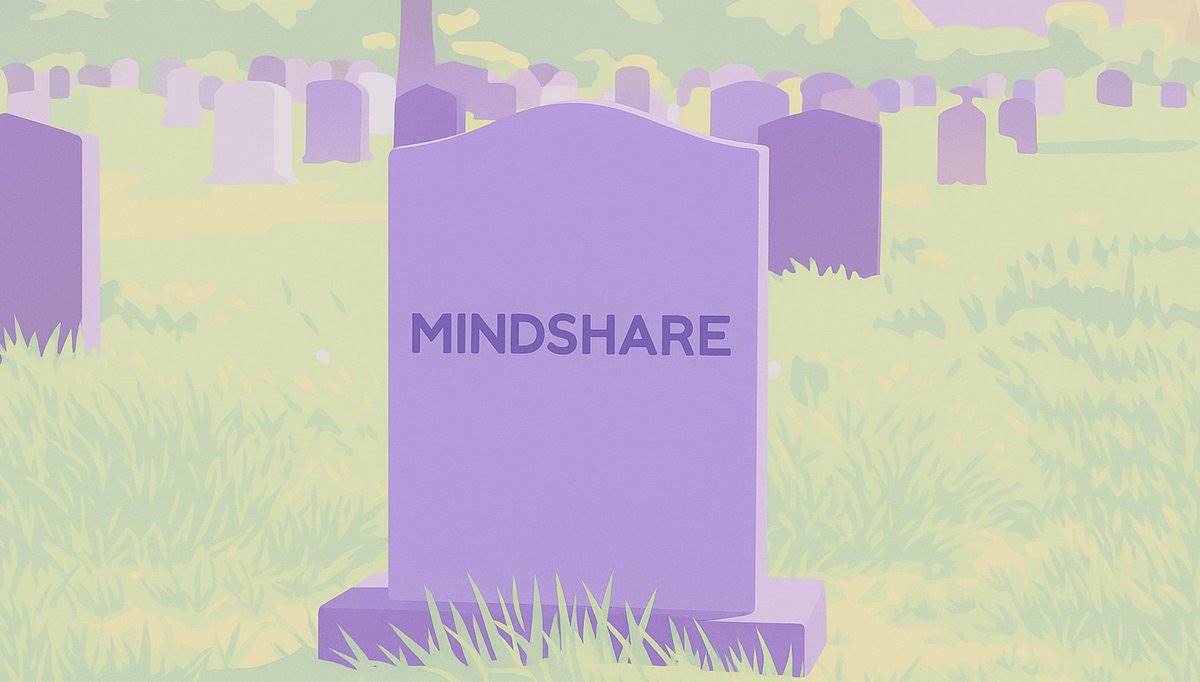

Goodbye mindshare: Mind ≠ Growth

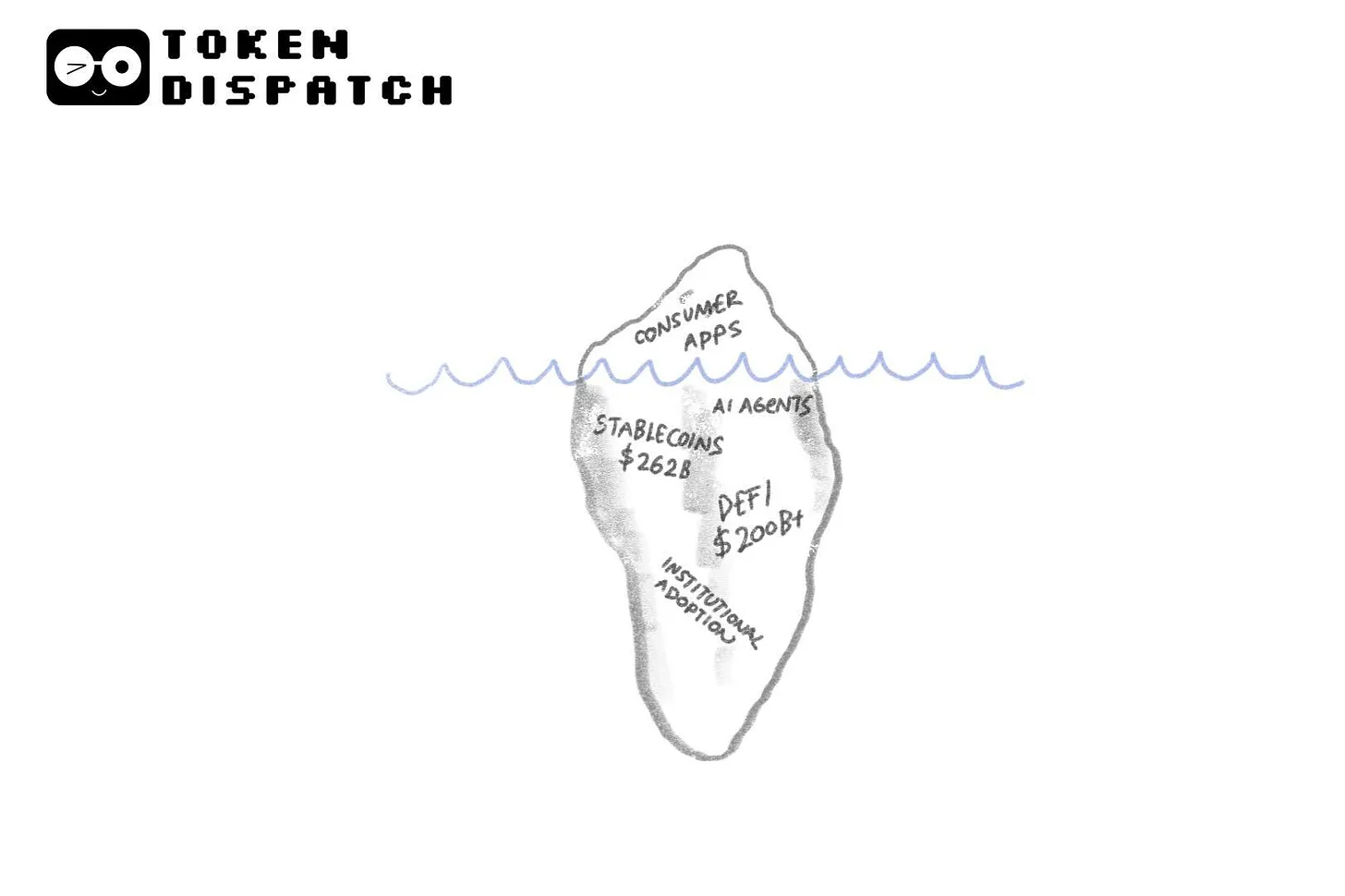

Over the past year, multiple highly anticipated token generation events (TGEs) revealed that despite peak brand “mindshare,” demand dried up as price performance failed to meet Crypto Twitter expectations. From a KPI perspective, the industry has refocused on user acquisition (B2B and B2C) and retention. Narratively, ecosystems and apps are now promoting revenue and buyback stories. Internally, teams are discussing how token strategy, tokenomics, and incentive design can reduce sell pressure.

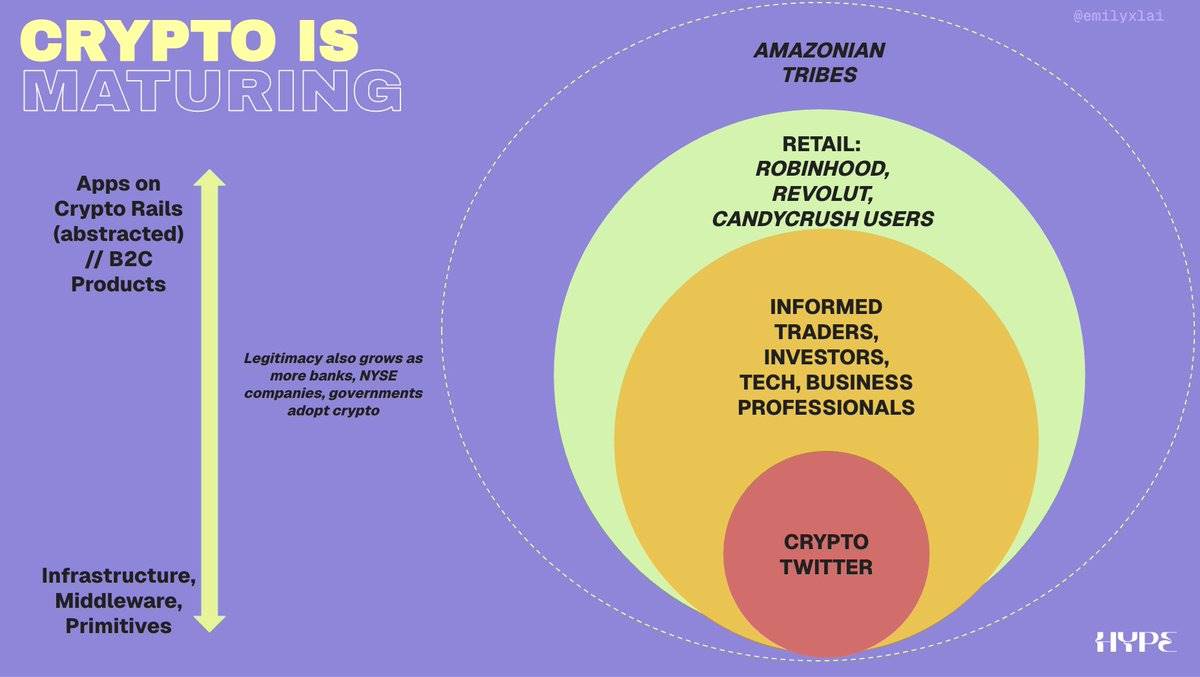

As industry infrastructure, primitives, and middleware mature, ecosystems and blockchains are shifting focus toward applications. When traditional institutions deploy capital and fintech apps with millions of users adopt blockchain, it brings legitimacy to crypto—and opens access to audiences beyond Crypto Twitter. With improved UX, new apps, and growing trust, our total addressable market (TAM) and convertible audience are expanding. This also means user acquisition strategies that once showed negative ROI/ROAS in Web2 marketing are becoming viable again.

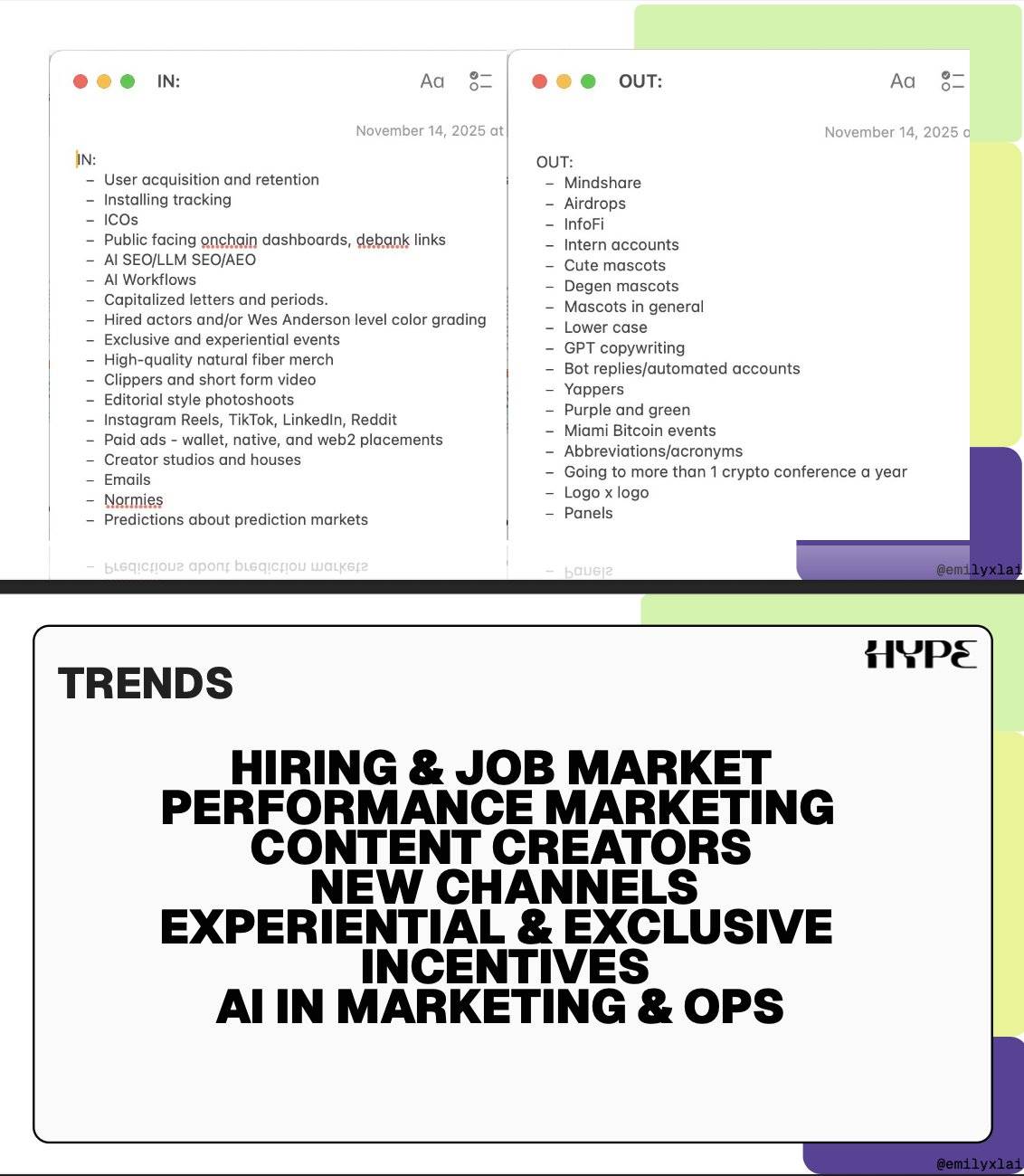

Hot & Not: Trend roundup

Here’s a subjective and incomplete “hot & not” list. Initially compiled by me, it was later refined through input from my circle of crypto VCs, crypto marketing groups (gc), and Crypto Twitter (CT).

I then distilled these trends and insights into seven key themes. Below is a high-level summary of my learnings and observations from 2025. Though originally scheduled for 25 minutes, thanks to @clairekart’s generosity, I ended up speaking for 45 minutes.

-

Hiring & job market for growth roles

Browse the new marketing jobs section by @safaryclub.

As the industry matures, later-stage companies and Web2 firms are seeking more specialized crypto marketing talent—not just generalist “marketing heads.” Recruiters report rising demand for senior or leadership marketing roles (e.g., CMO), reduced remote flexibility, and greater openness to Web2 marketers. For junior marketers without Web2 experience, the bar is higher than ever, as more crypto-native talent floods the market (think of talent released from failed or defunct ecosystems over the past four years).

-

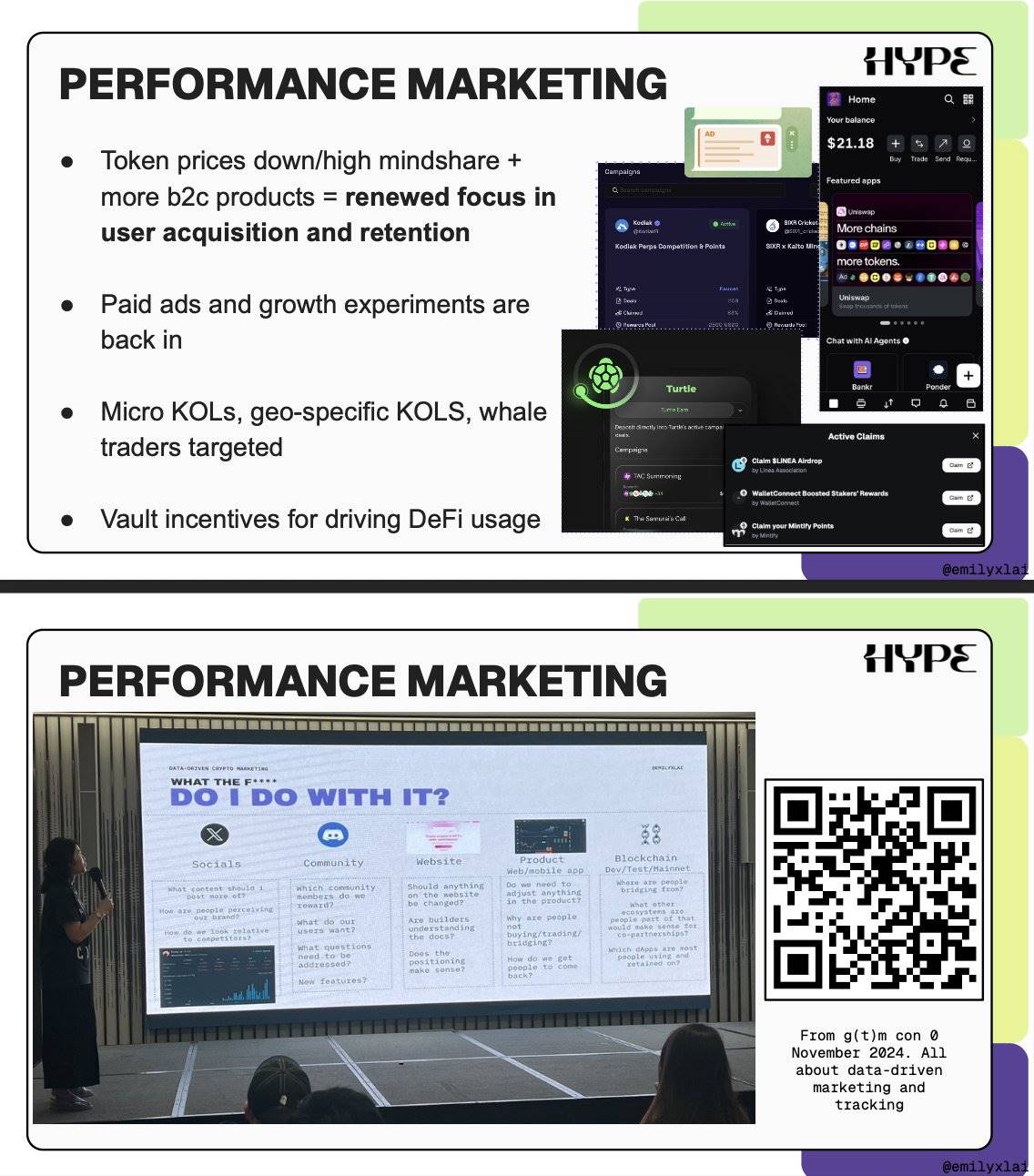

Performance marketing

At g(t)m con in Bangkok last November, I discussed data-driven marketing funnels and key tracking metrics. Today, those ideas feel even more relevant. You can watch the recorded session.

With renewed focus on user acquisition and retention, performance marketing is making a strong comeback. This means deploying tracking tools (on-chain, product/website, distribution channels), running growth experiments, combining paid and organic media, evolving from social quests to liquidity quests, and executing targeted KOL campaigns.

We’re seeing increased use or demand for tools such as:

-

@spindl_xyz, @gohypelab, and @themiracle_io for native wallet ad placements

-

@tunnl_io and @yapdotmarket for precise micro-KOL incentives

-

@turtledotxyz and @liquidity_land for liquidity campaigns

More tailored strategies are also emerging. I spoke with teams from perpetual DEXs who are guiding users through “white-glove” experiences—direct-messaging whales or leveraging APAC trading KOLs to drive initial traffic (often with incentives). Meanwhile, Web2 paid ad channels are being reused: paid social ads, search ads, and out-of-home (OOH) advertising. Telegram ads remain underutilized. As LLMs and AI ecosystems like OpenAI begin building ad suites, entirely new ad formats will emerge.

-

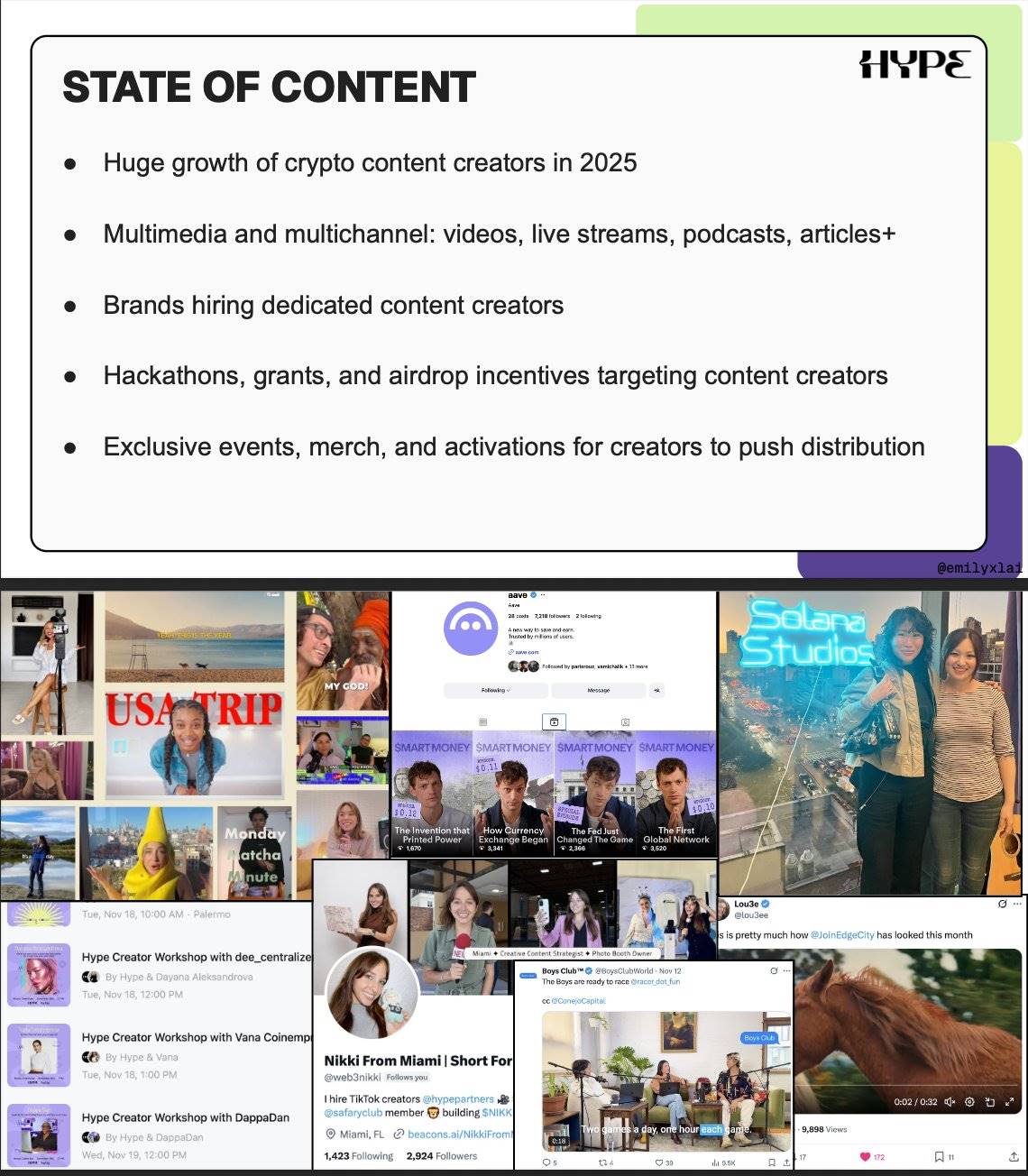

Content, content, content

This year, timelines are flooded with creators and videos. Content formats have diversified—from vloggers, short-form video makers, technical explainers, streamers, to cinematic storytellers. InfoFi platforms have also driven the rise of “endorser” accounts—users who actively post (“yap”) about projects hoping to profit. However, I don’t believe this trend will last; “yappers” are now on my “not” list.

When I left DevConnect last week, I joked that DJI’s revenue must have skyrocketed:

Some creators are freelancers making content for brands they love, like @coinempress and @DAppaDanDev. Others see brands hiring in-house content creators to produce videos, vlogs, host Spaces, and leverage personal brands (e.g., @alexonchain). @dee_centralized stands out as a leader in the short-form crypto wave.

Six weeks ago, I visited @solana’s New York office and met @justsayuluvjo at Solana Studio—a dedicated space for creators and founders (like @bangerz and @jakeclaychain) to create content.

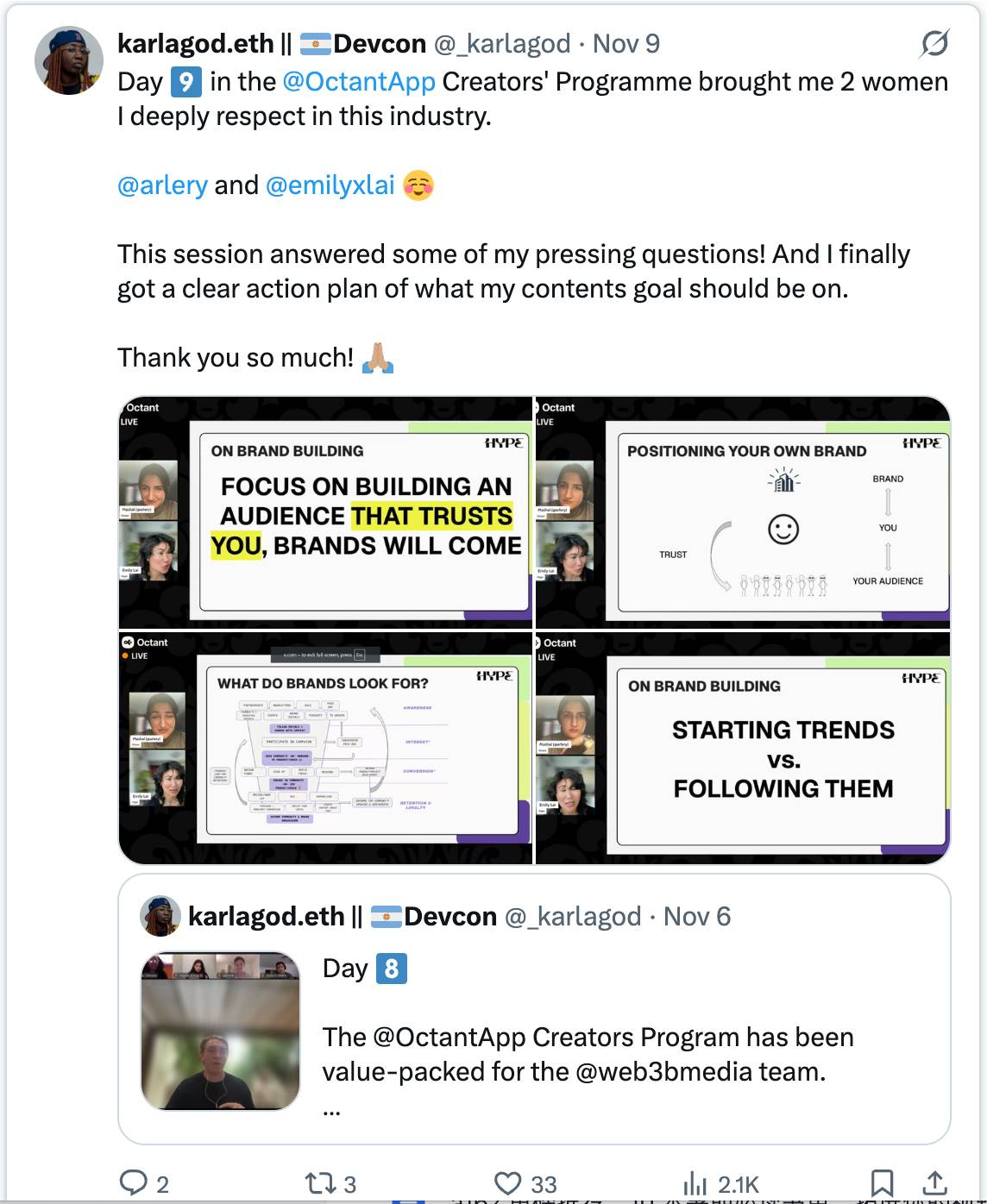

We’re also seeing brands hire actors, Hollywood-grade production crews, and photographers to create high-quality content and ads. For example, @aave led content creation on Instagram (smartly prepping for its retail mobile app), while @ethereumfnd brought in narrative-focused creators like @lou3ee. Formats are diversifying—beyond text and video, we now see live series (@boysclubworld), static content series, podcasts, short clips, 3D, and/or AI-generated announcement videos. @OctantApp offers creator grants. Recently, I hosted a workshop for aspiring and existing creators on the psychology behind what brands want. Check it here:

Below are slides from the talk, thanks to @_karlagod’s compilation:

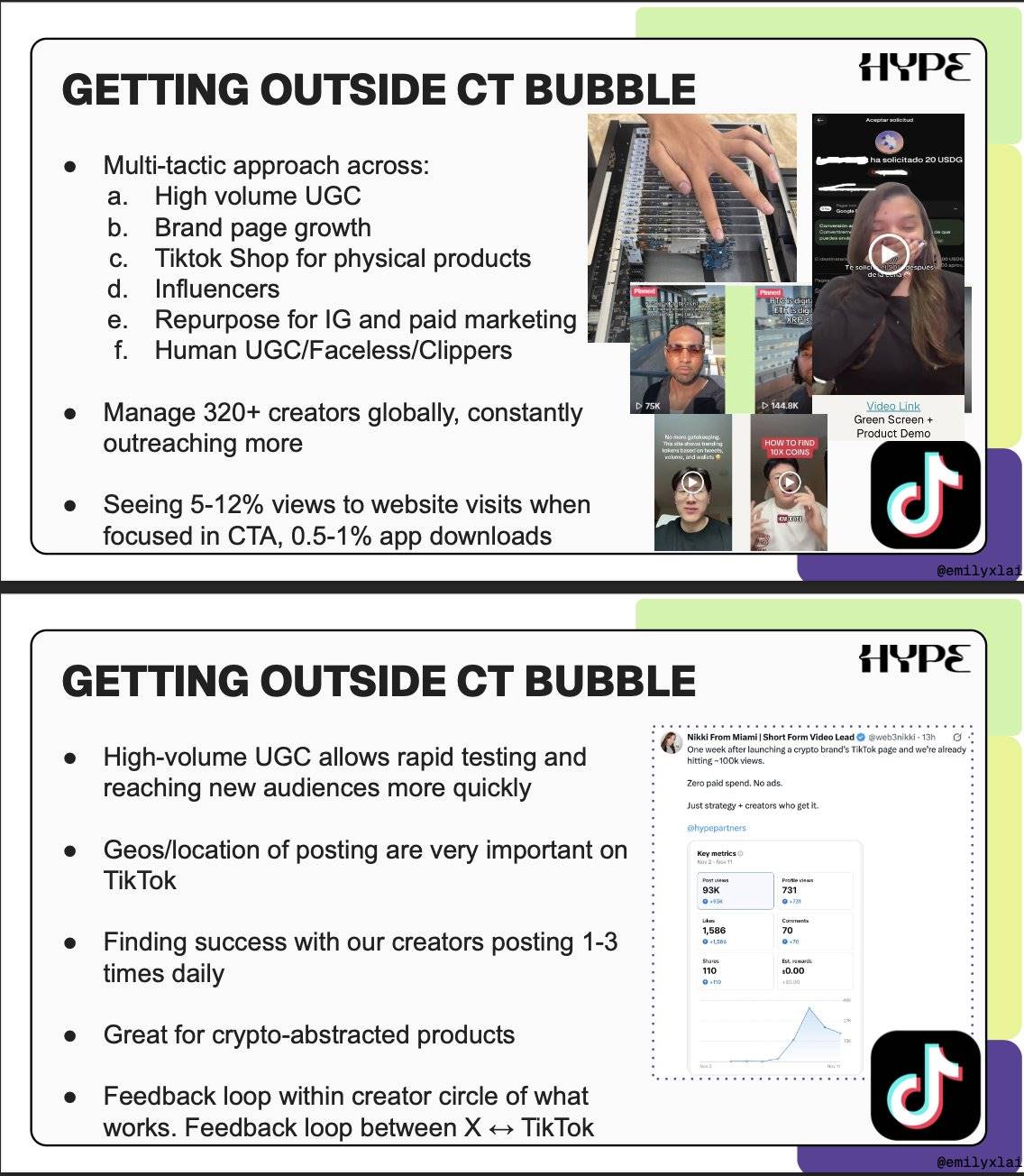

At Hype (@hypepartners), we hosted four creator workshops during DevConnect week and brought in @web3nikki in January to lead our new short-form video division. The space is saturated and will remain so—making quality, depth, and production value more critical than ever. Equally important is stepping outside Crypto Twitter (CT) to capture new audiences.

The world beyond X (Twitter)

This year, we explored (or re-explored) new channels at Hype: YouTube, Reddit, AI search optimization (e.g., Perplexity, GPT), Instagram, and Whop. In the talk, I focused on two key platforms: LinkedIn and TikTok.

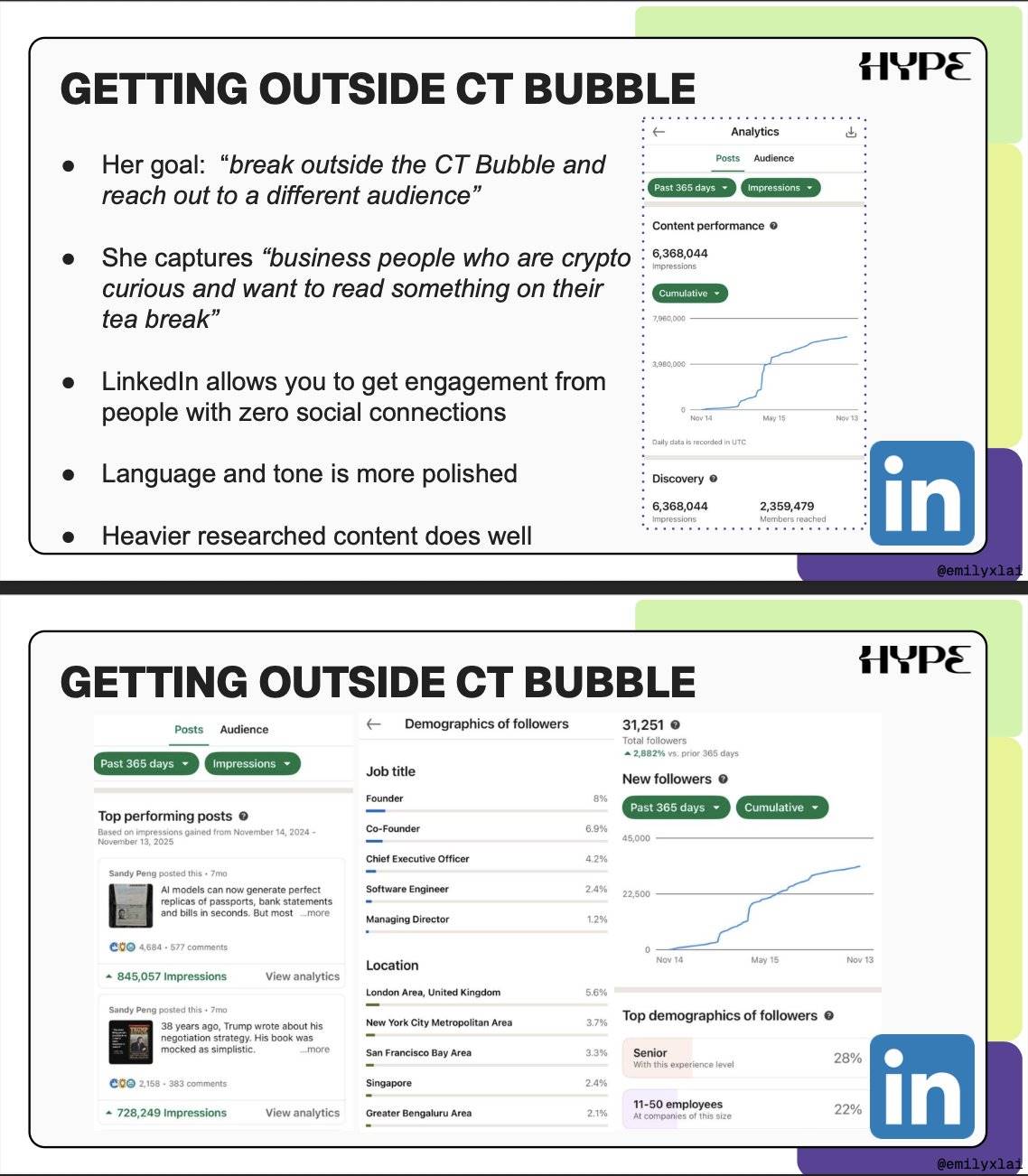

Take @Scroll_ZKP co-founder @sandypeng on LinkedIn. For those unfamiliar, she consistently posted in 2025, growing from zero to 6.3 million views and 31,000 followers.

She also shared exclusive insights and data (first-time public! Thanks Sandy):

Sandy Peng (Scroll co-founder)’s LinkedIn stats, tips, and goals.

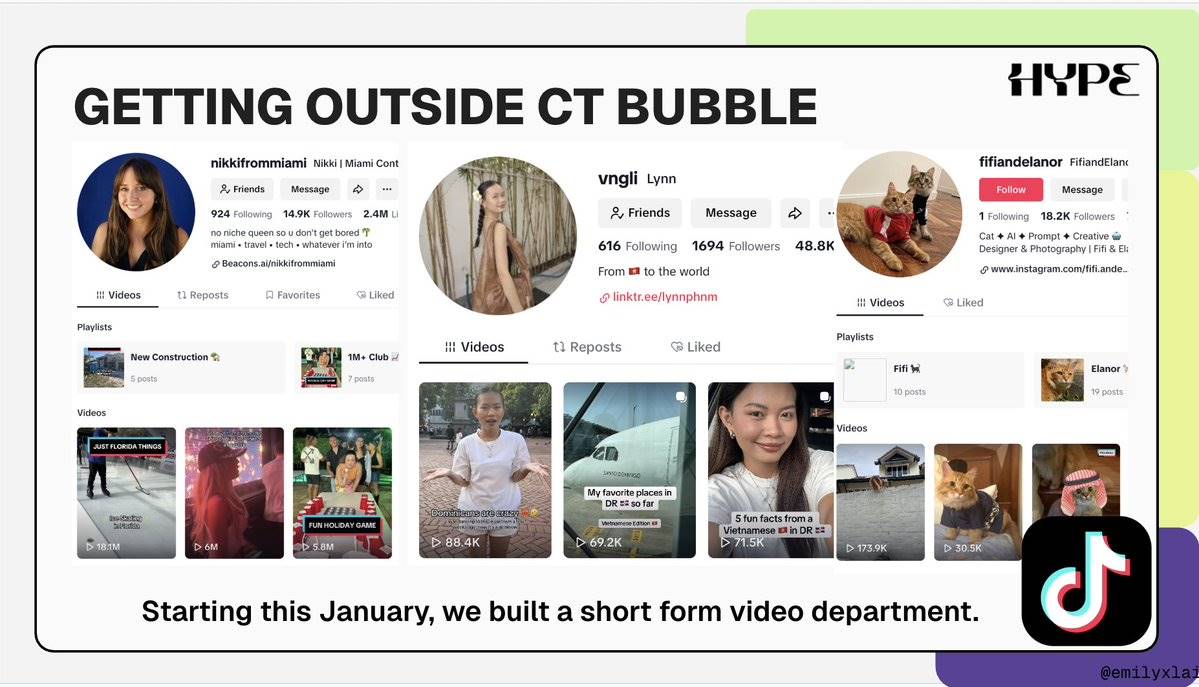

In January 2025, we noticed rising demand for Instagram, YouTube, and TikTok. So we brought in @web3nikki and formed a short-form video team focused on brand growth and user acquisition, especially on TikTok. The team consists entirely of TikTok-native users skilled in algorithmic reach, platform-specific tactics, and adapting content for a crypto lens.

Hype’s current SFV team is fully composed of TikTok-native users.

Since launching, we’ve worked with 12 clients and gathered significant insights:

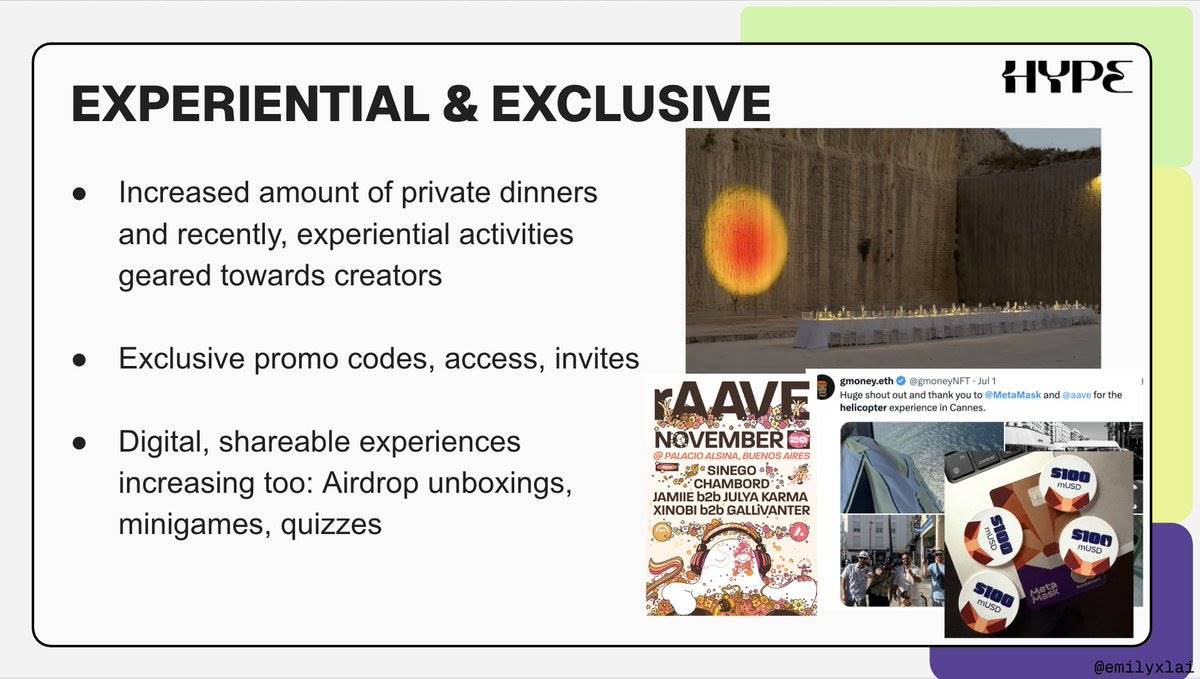

Events become more experiential and exclusive

With side event saturation (up to 500 per week), organizers are competing harder for attendance. This extends to merch—higher quality, thoughtfully designed, limited-edition giveaways are now standard. Private dinners have surged. For example, @metamask set a new benchmark at EthCC Cannes in July, hosting an invite-only event featuring speedboats, helicopters, and planes for KOLs and creators. @raave continues to lead in crypto music events, bringing world-class DJs and top-tier production. Ticket access is often tiered, limited, and rolled out through layered marketing campaigns.

This exclusivity now extends online too—airdrop unboxings, mini-games, and Buzzfeed-style personality quizzes are designed to be highly shareable. Inspiration increasingly comes from Web2 brand activations, pop-up stores, and influencer events, now adapted for crypto.

You can see highlights from our candlelight concert with @octantapp last week—an invite-only event simply because the venue couldn’t fit all 20,000 of your fans. But if you’re interested in the next one, let @cryptokwueen or me know.

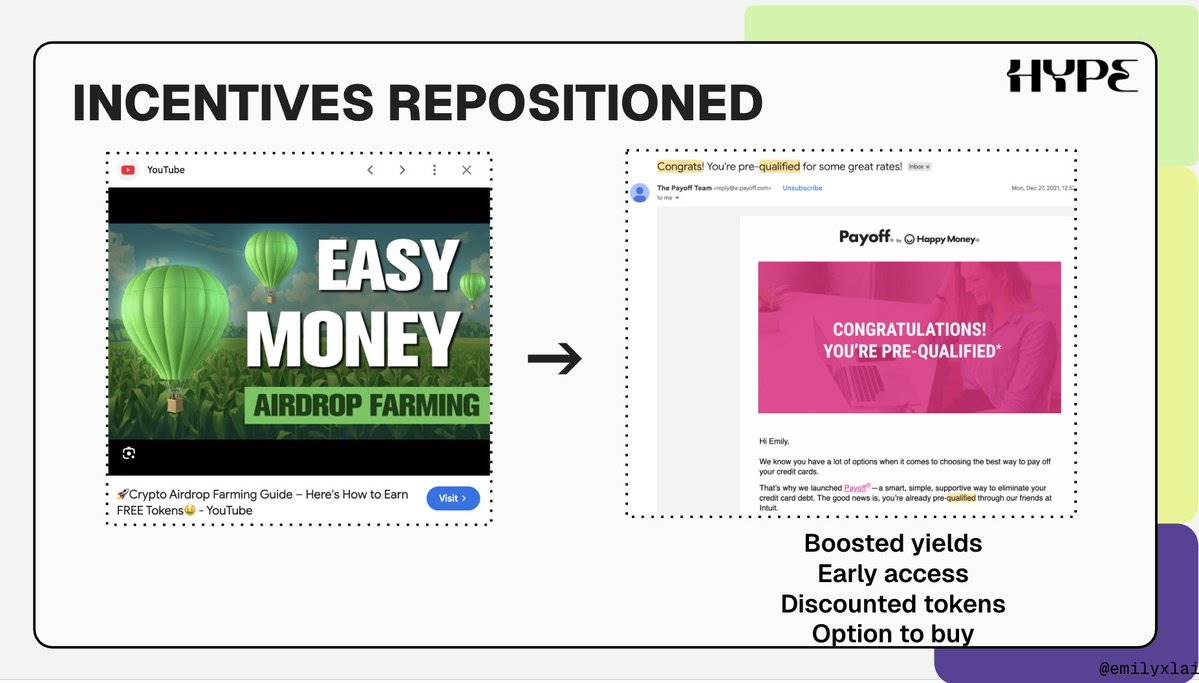

Redefining and redesigning incentives

-

This year, we’re seeing a shift from airdrops to ICOs. Some incentives are now reframed as “privileges”:

-

“Being able to buy this token is itself a privilege” (similar to 2021 NFT whitelists).

-

“If you buy now, you get privileged access at a discount.”

-

Stake now to earn boosted yields and/or points across multiple protocols.

-

To get the most airdrops, discounts, or points, you need to reach the highest tier (like airline and hotel loyalty programs).

All of this reminds me of banks and Web2 fintechs packaging product access as a privilege. For instance, I got a Chase email saying: “Congratulations! You’ve been pre-approved for a home refinance.” We’ll continue to see incentive programs evolve into loyalty and tier-based systems.

AI in marketing and operations

Insights on AI in marketing and our internal development of a context engine at Hype:

In September, we launched Hype AI, led by @antefex_moon (our VP of AI). More details from our CEO @0xDannyHype:

We’re rigorously testing AI to improve work quality, research, operations, measurement, and project management—requiring constant iteration.

Another expanded service is AI SEO/LLM SEO: ensuring your company appears in AI prompts by getting your data into the right AI training sources. Web2 tools like Ahrefs and SEMrush now show AI visibility metrics. OpenAI has officially announced exploration of an ad platform—opening new avenues for marketers.

Predictions

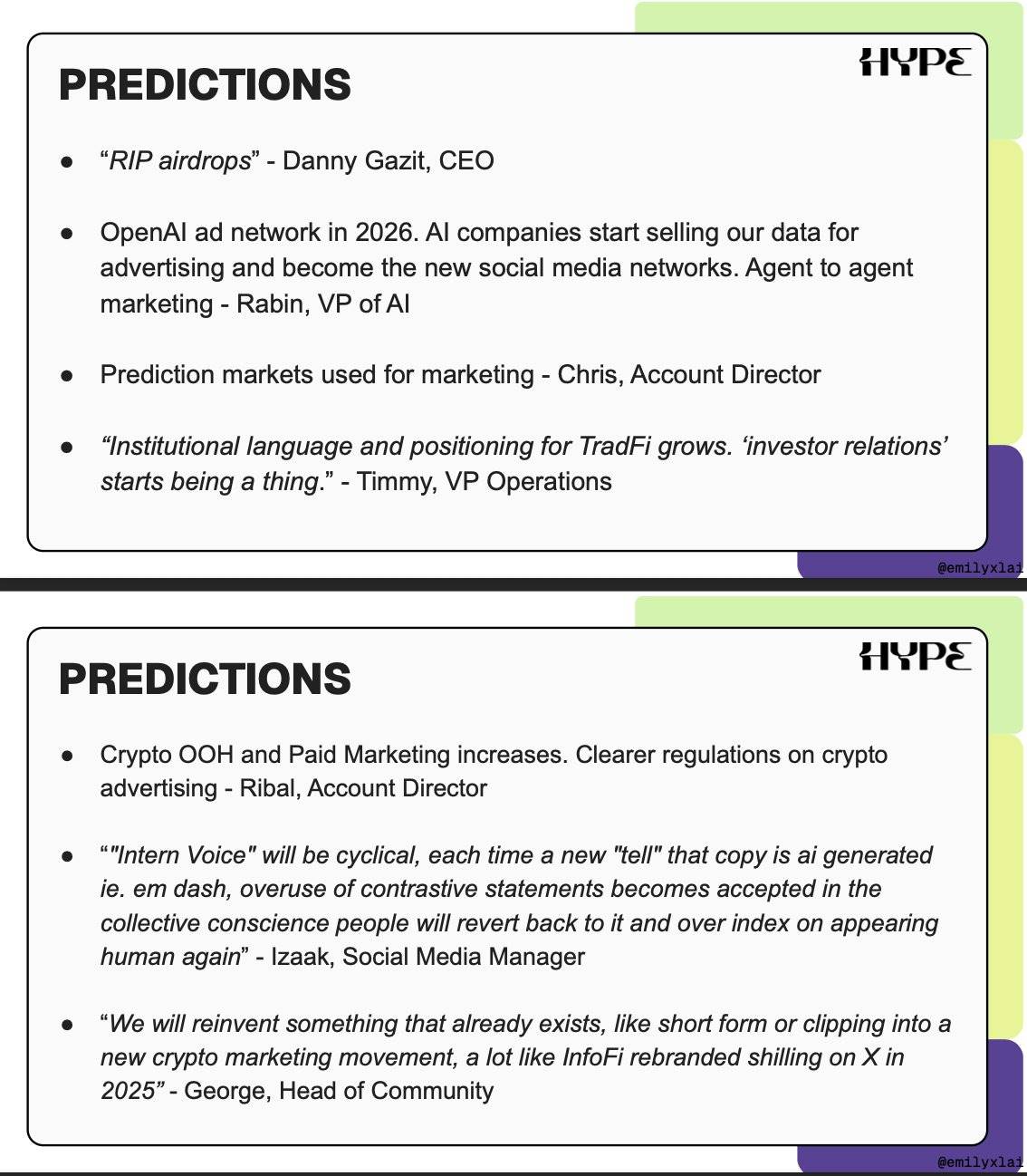

The above trends and observations have already shaped some of our business and marketing decisions at Hype. Before sharing my framework for staying ahead, I gathered predictions from the Hype team on crypto marketing. Read perspectives from @0xdannyhype, @ChrisRuzArc, @groverGPT, @izaakonx, and @Timmbo_Slice:

How to stay ahead

Trend lifecycles are shortening due to:

-

Lower barriers (e.g., AI, internet access, and tools make content creation easier than ever).

-

Limited audience size in crypto.

-

New companies constantly fighting for attention.

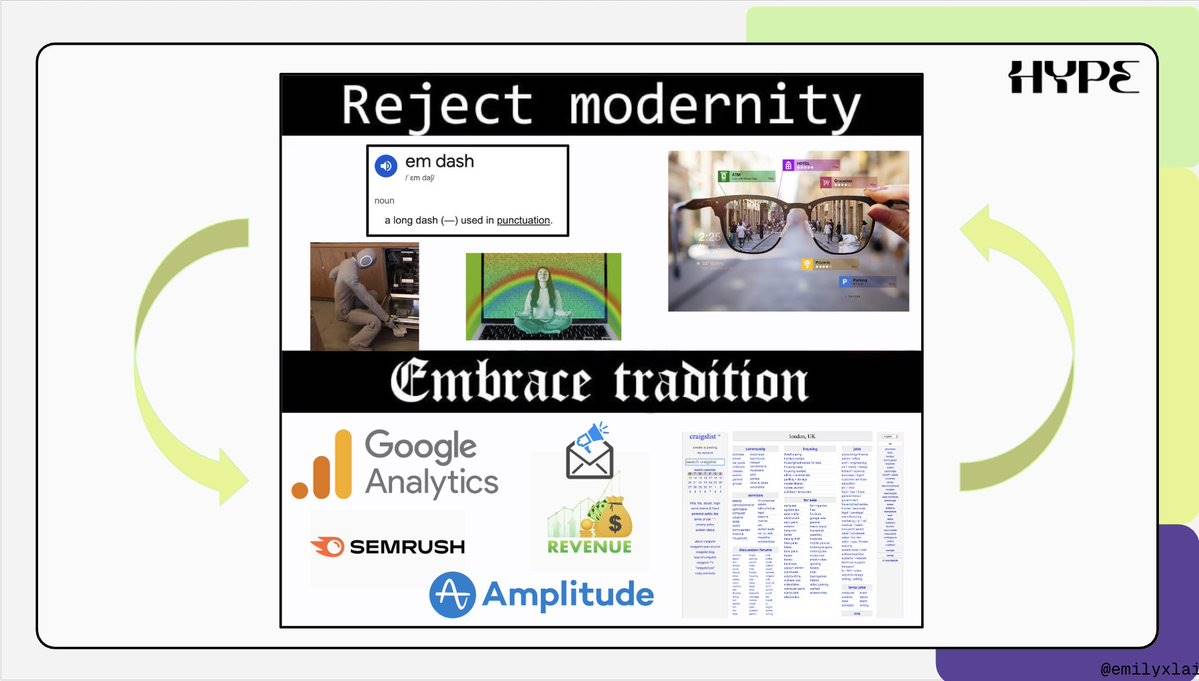

Marketing demands continuous innovation, testing, and experimentation. Tactical “first movers” can leverage novelty for brand attention until saturation. You can also revisit old strategies and aesthetics to refresh them. It’s a cyclical process.

When they rush left and right, you take a different path. When they scramble, you sit under the tree, connect to higher awareness, and explore uncharted territory. Then repeat.

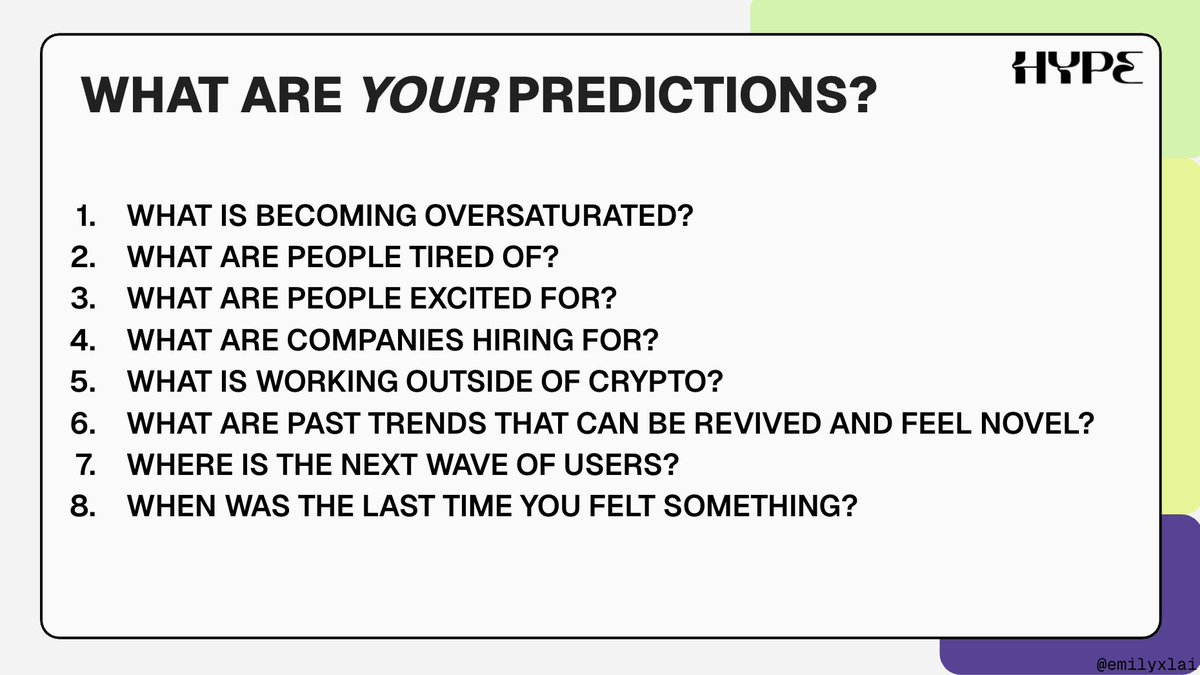

To stay ahead, stay close to industry movements, draw inspiration beyond crypto, and think from first principles (which requires brainstorming, deep thinking, and evaluation—not just copying). Here are questions to help shape your predictions and marketing strategy:

...So, what are your predictions?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News