Who as Fed Chair Would Be Most Beneficial for the Crypto Market? Analysis of Candidates and Key Timeline

TechFlow Selected TechFlow Selected

Who as Fed Chair Would Be Most Beneficial for the Crypto Market? Analysis of Candidates and Key Timeline

Fed Chair Transition Rattles Global Markets: Hassett in Lead Could Spark Crypto Christmas Rally, While Hawkish Walsh Appointment May Prove Biggest Bearish Factor

Author: Yuuki, TechFlow

Current Federal Reserve Chair Powell's term is set to expire in May 2026. Yesterday, U.S. Treasury Secretary Bessent revealed that Trump is likely to announce the nominee for the next Fed chair before Christmas. The monetary policy stance of the next Fed chair will significantly influence the pace and terminal level of future rate cuts. As the market most sensitive to liquidity and interest rates, the cryptocurrency market will be profoundly affected by whether the next Fed chair adopts a dovish or hawkish posture. This article examines the policy positions of leading candidates, their potential impact on the crypto industry, likelihood of nomination, and key upcoming timelines.

1. Kevin Hassett: Most Dovish Candidate, Trump Economic Advisor (Most Bullish)

Hassett is former Chair of the White House Council of Economic Advisers and a core economic advisor to Trump, making him the candidate best positioned to bring Trump’s desire for lower rates into the Fed. He has publicly supported deeper and faster interest rate cuts to stimulate economic growth. He also holds a favorable view of crypto markets, seeing Bitcoin as a hedge against inflation, and may push for regulatory easing. If Hassett becomes Fed chair, it would be unequivocally positive for the crypto market—highly sensitive to interest rates—potentially ushering in a liquidity-driven bull market for risk assets through rapid and substantial rate cuts.

2. Kevin Warsh: Most Hawkish Candidate, Supports CBDC and Opposes Decentralization (Most Bearish)

Warsh is a former Fed governor and Hoover Institution fellow whose monetary policy views have long been hawkish, favoring tighter rates and prioritizing inflation control (and advocating for shrinking the central bank's balance sheet). If appointed, he could delay or limit a swift decline in interest rates, thereby suppressing valuations and capital inflows into crypto risk assets. Additionally, Warsh has publicly supported U.S. development of a CBDC (central bank digital currency), which would be negative for crypto purists who value decentralization and censorship resistance.

3. Christopher Waller: Moderate Candidate, Supports Stablecoins (Neutral)

Waller is a current Fed governor with a moderately dovish stance, supporting gradual rate cuts. He has stated in public forums that digital assets can complement payment systems and believes stablecoins can strengthen the U.S. dollar if properly regulated. His steady-handed approach may prevent aggressive monetary easing. If he is appointed, the future path of interest rates will depend heavily on the composition of the broader FOMC voting members.

4. Rick Rieder: Slightly Dovish, Positive for BTC and Major Crypto Assets (Bullish)

Rieder is BlackRock’s Chief Investment Officer of Global Fixed Income, directly overseeing trillions in asset allocation. His monetary stance is neutral-to-dovish, emphasizing that the Fed should remain cautious and flexible once reaching neutral interest rates. He argues that in an environment where traditional assets are increasingly correlated, cryptocurrencies offer unique hedging and safe-haven value, calling Bitcoin “gold for the 21st century.” If appointed, his leadership could attract institutional capital into crypto markets, reduce volatility, and benefit major assets like BTC.

5. Michelle Bowman: Hawkish Candidate, Rarely Comments on Crypto Markets (Bearish)

Bowman is a current Fed governor with a hawkish stance even more pronounced than Warsh’s. Despite broad market expectations for rate cuts and pressure from the Trump administration, she has consistently advocated for maintaining high rates for longer and has repeatedly stated she does not rule out further rate hikes. Her appointment would undoubtedly be materially bearish for crypto and risk assets.

Likelihood of Nomination Among the Five Candidates

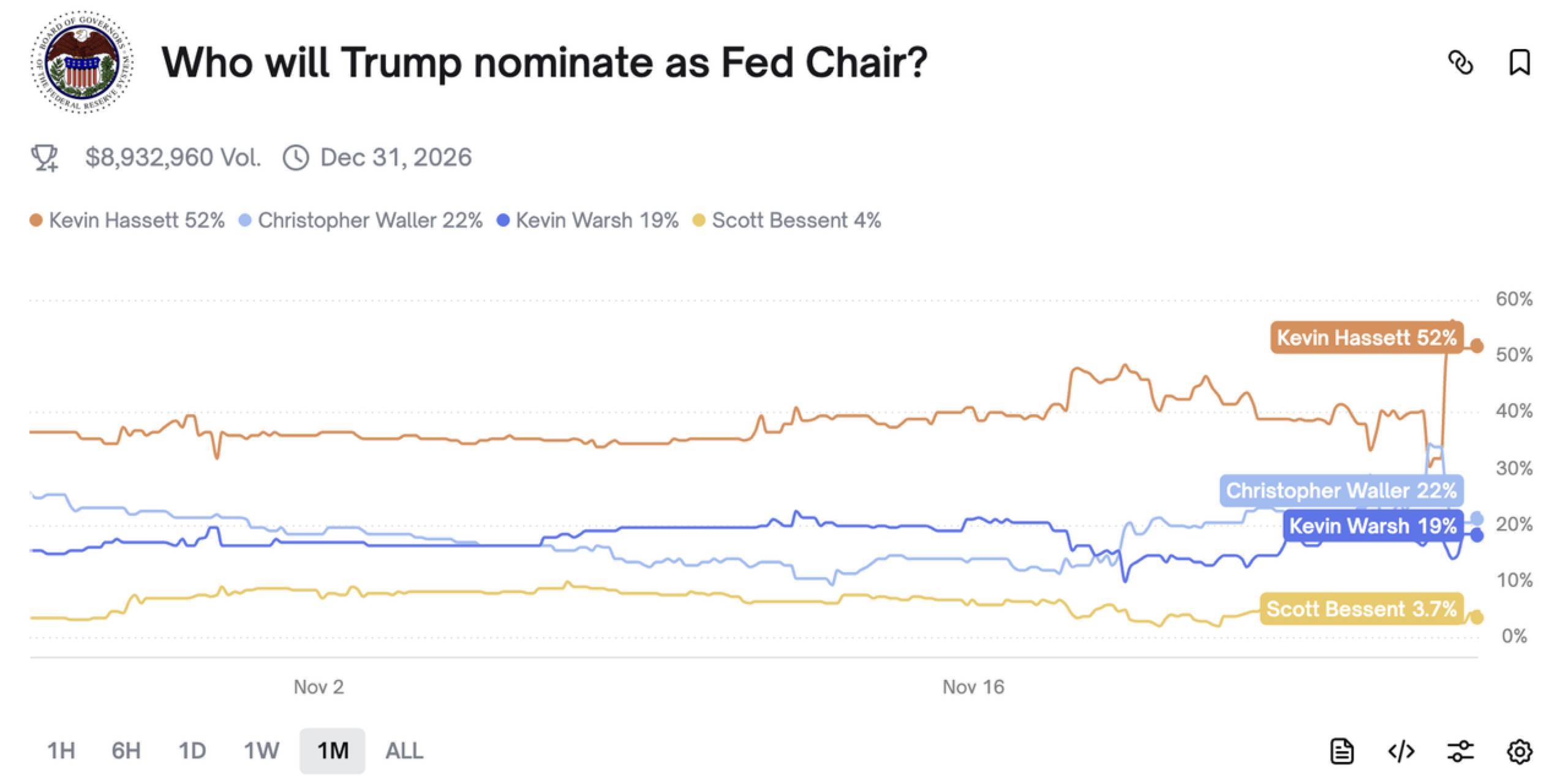

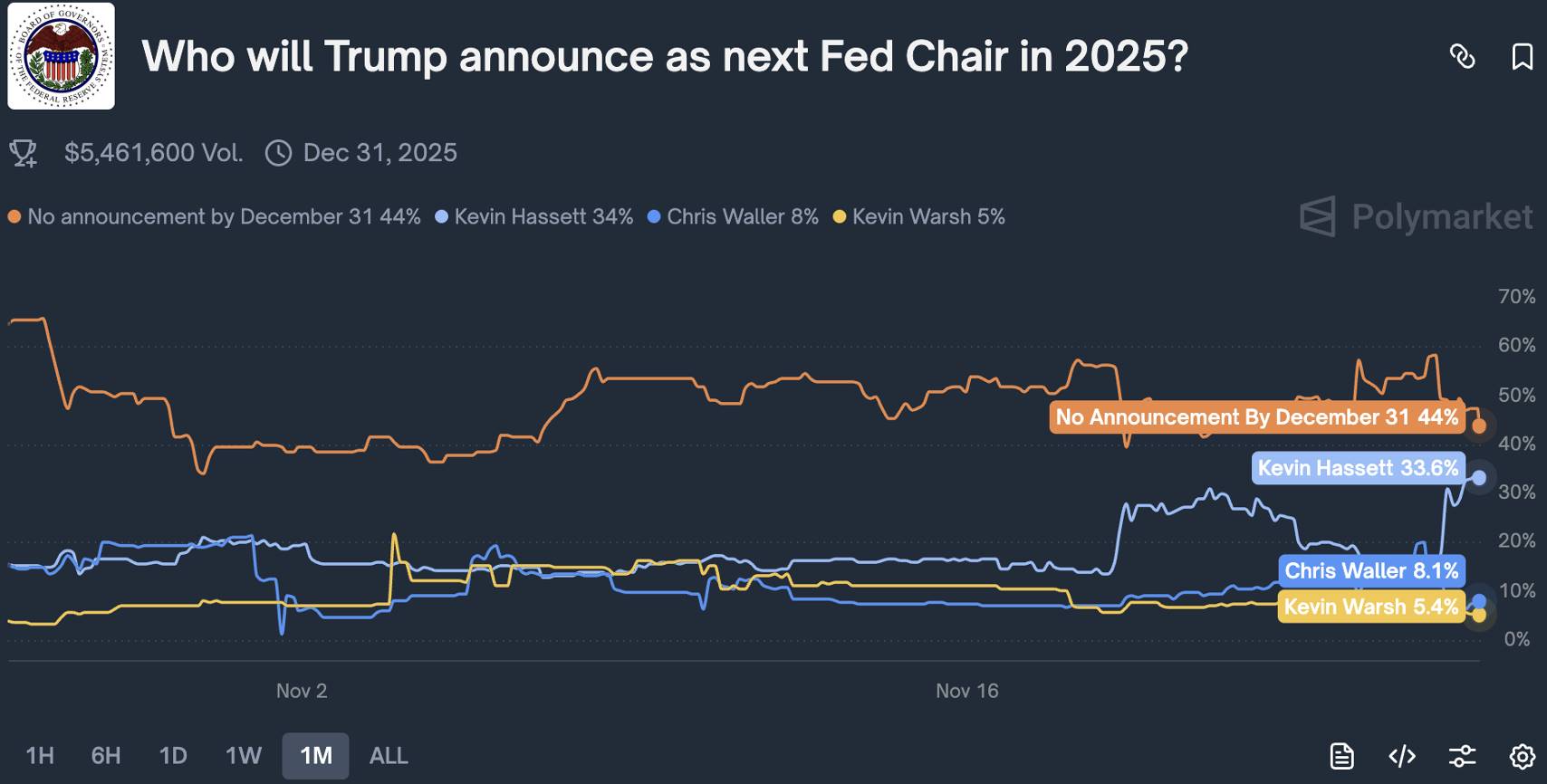

The process is currently in the presidential nomination phase. On prediction market Polymarket, Kevin Hassett leads with a 52% chance of nomination, and Bloomberg exclusively reports he is the frontrunner. Christopher Waller ranks second with 22%, followed by Kevin Warsh at 19%, Rick Rieder at 2%, and Michelle Bowman at 1%.

Key Timeline Events to Watch

The transition of the Fed chair involves two stages. The first is the Trump team interviewing and screening candidates to determine a single nominee. According to U.S. Treasury Secretary Bessent, Trump will formally announce the nominee before Christmas. If Hassett is confirmed as the nominee, the crypto market is likely to experience a "Santa Claus rally." The second stage occurs after nomination, when the Senate votes on confirmation. Hearings are expected in January–February 2026, with committee and full Senate votes scheduled for March–April. Notably, Polymarket currently assigns a 32% probability that Trump will not officially announce a nominee in December.

In summary: Hassett currently leads in nomination odds, but this sentiment has not yet reflected in bond yields or risk asset prices. Going forward, continued monitoring of developments is essential. In the short term, if Trump confirms Hassett’s nomination before Christmas, the crypto market is likely to see a seasonal rally. In the long term, the next Fed chair’s monetary policy stance will directly shape risk asset performance over the coming four years.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News