Hotcoin Research | Macro policies under pressure, crypto market hitting bottom

TechFlow Selected TechFlow Selected

Hotcoin Research | Macro policies under pressure, crypto market hitting bottom

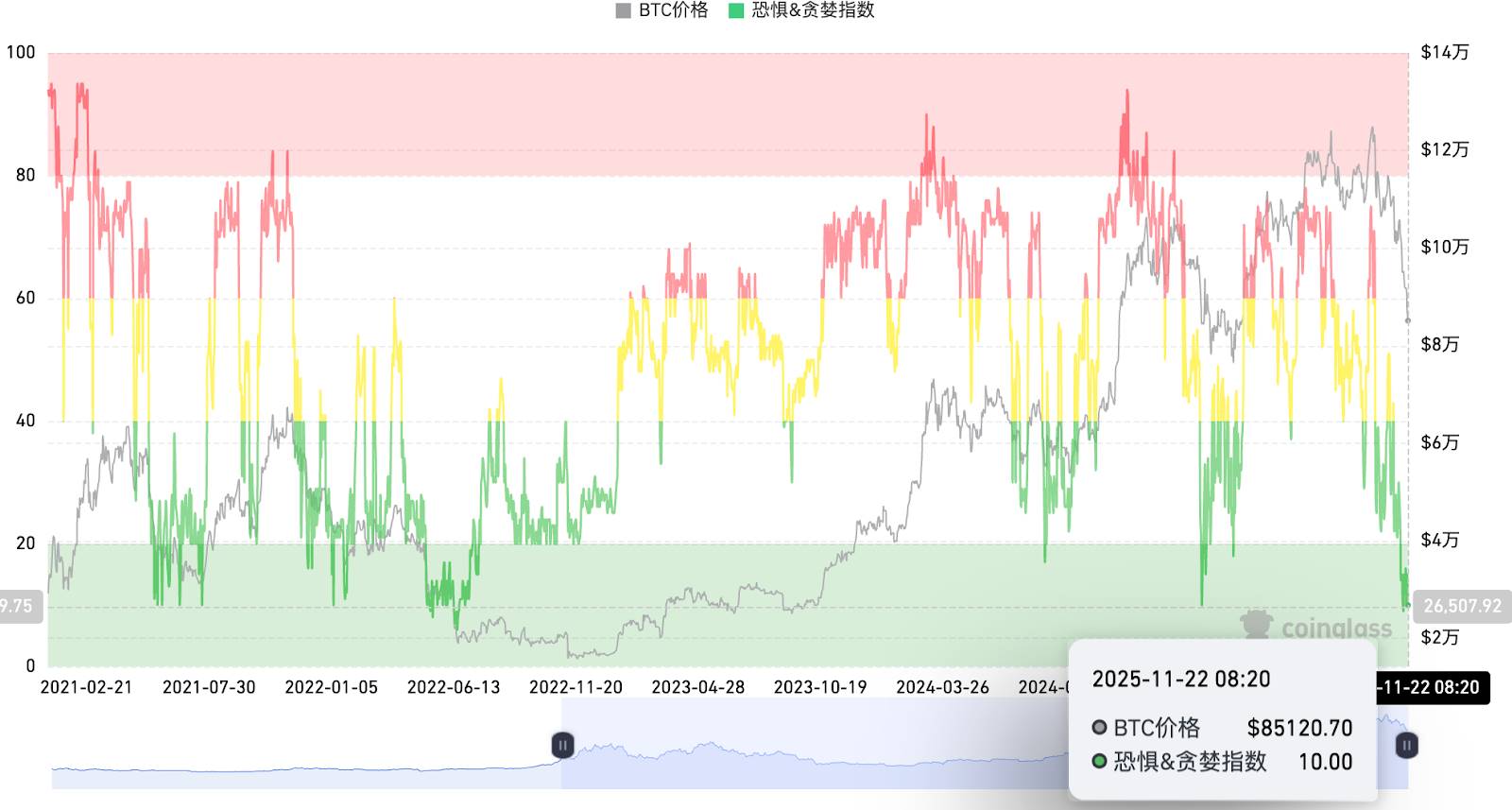

The crypto market is currently in a state of extreme fear, with most tokens experiencing significant declines this week (BTC down 13.15%), and ETFs seeing continuous outflows. A mild downward trend may persist in the short term. Investors should proceed cautiously and gradually position according to their risk tolerance.

Crypto Market Performance

Currently, the total market capitalization of cryptocurrencies is $2.89 trillion, with BTC accounting for 58.3%, at $1.68 trillion. The stablecoin market cap is $302.8 billion, down 0.68% over the past seven days. Notably, stablecoin supply has seen negative growth for four consecutive weeks, with USDT making up 60.93%.

Among the top 200 projects on CoinMarketCap, most declined while a few rose: CC dropped 32.32% over 7 days, IP fell 29.88%, ICP declined 29.03%, BTC fell 13.15%, and ETH dropped 14.13%. The crypto world was once drenched in red, a grim sight.

This week, U.S. Bitcoin spot ETFs saw net outflows of $1.211 billion; U.S. Ethereum spot ETFs had net outflows of $500 million.

Market Outlook (Nov 24–Nov 28):

The current RSI stands at 34.42 (weak zone), the Fear & Greed Index is at 15 (up from last week but still in extreme fear), and the Altseason Index is at 43 (neutral, higher than last week).

BTC core range: $85,000–89,000

ETH core range: $2,800–3,100

SOL core range: $128–156

Market sentiment: The market is currently very fragile and is undergoing an unstoppable "slow decline." Any slightly negative news can severely impact the market, which may continue to fall further. This reflects investor flight due to uncertainties around the "four-year cycle," the U.S. economy, and government policies, as they prioritize capital preservation. This week’s downturn was driven by stronger-than-expected U.S. jobs data, reduced odds of a December rate cut, BlackRock's selling, and continued AI-driven liquidity drain. A mild downtrend is likely in the short term. BTC prices have now reached the shutdown level for some miners, with Strategy’s cost basis at $74,080. Whether the market stabilizes or sees a "Christmas rally" will depend on post-shutdown U.S. economic data, December rate cut expectations, and signs of major institutions resuming buying.

For conservative investors: Current prices offer better value for long-term allocation. Consider small, staggered purchases near key support levels to lower average costs. This is not yet the market bottom—avoid rushing into large positions.

For active traders: Within this clearly defined consolidation range, consider light long positions near support and reducing exposure or going short near resistance. Always set stop-losses.

Understanding the Present

Weekly Recap

1. On November 18, the mNAV of major crypto treasury (DAT) companies all fell below 1:

Strategy (MSTR)’s mNAV (enterprise market cap vs. held BTC value ratio) is now 0.937. Strategy’s market cap dropped to $56 billion, holding 649,870 BTC worth $59.9 billion.

Metaplanet’s mNAV is now 0.912. Metaplanet’s market cap fell to $2.61 billion, holding 30,823 BTC worth $2.84 billion.

Bitmine (BMNR) leads institutional ETH holdings, currently holding about 3.51 million ETH valued at ~$

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News