Crypto Market Weekly Outlook (11.17-11.24): Market Continues to Decline, May Enter Recovery Amid Rising Rate Cut Expectations

TechFlow Selected TechFlow Selected

Crypto Market Weekly Outlook (11.17-11.24): Market Continues to Decline, May Enter Recovery Amid Rising Rate Cut Expectations

Bitcoin price fluctuated significantly due to a reversal in expectations of Fed rate cuts, with the market remaining in extreme fear for 12 consecutive days, ETF funds continuing to outflow, altcoin markets sluggish, and investor trading enthusiasm declining.

Author: Yuuki, TechFlow

I. Overall Performance

1. Macro Events:

Last week's market was significantly affected by macro liquidity developments, with BTC price fluctuating sharply around expectations of a Fed rate cut.

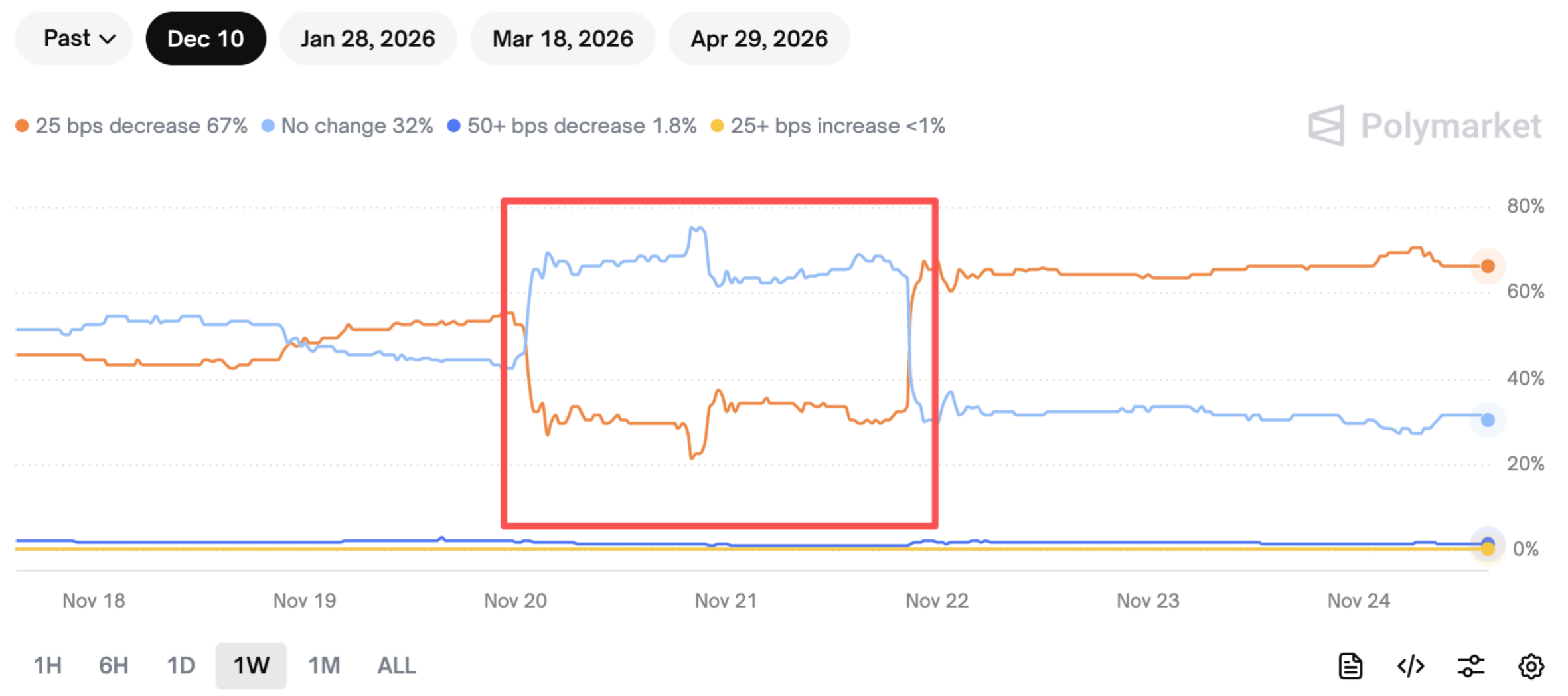

In the early hours of November 20 (Beijing time), the Federal Reserve released its October meeting minutes containing hawkish language. Subsequently, JPMorgan stated that the Fed would not cut rates in December. As a result, market expectations for a December rate cut continued to decline, falling as low as 22%, while BTC dropped up to 13% over two days, reaching a weekly low of 80,600.

However, following dovish comments from Fed official John Williams on the evening of November 21, market expectations for a December rate cut saw a dramatic reversal. (John Williams is President of the New York Fed and the only regional Fed president with permanent voting rights, widely regarded as the de facto second-in-command at the Fed. His historically hawkish stance made this sudden shift to dovish rhetoric particularly impactful.)

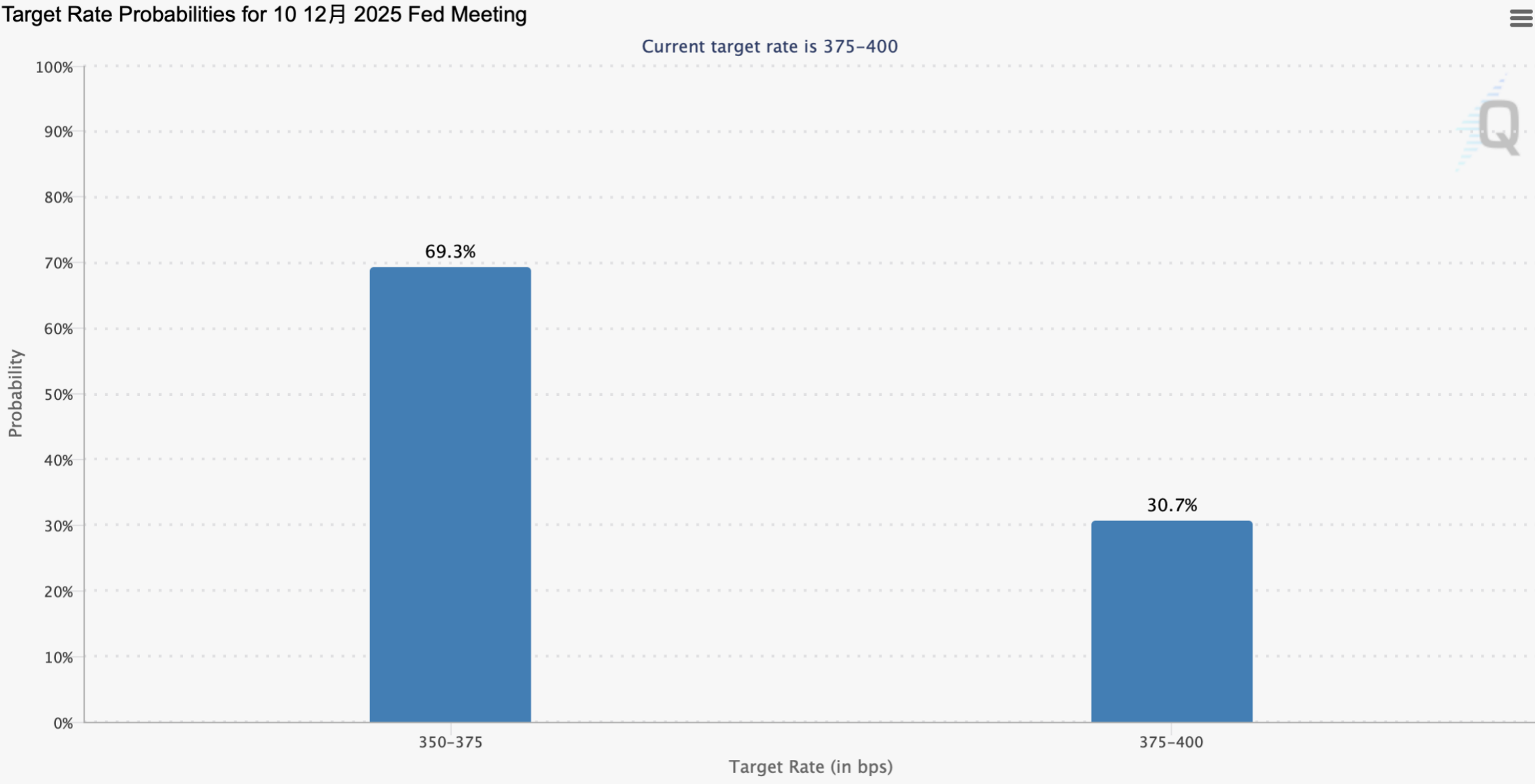

According to CME Group data, the current probability of a 25 basis point rate cut in December stands at 69.3%. Both BTC and U.S. equities have since entered a recovery phase. The Fed will enter its pre-rate-cut blackout period on December 29. Key liquidity indicators to watch include Japanese government bond yields, private credit default rates, the end of QT on December 1, and the pace of TGA spending.

NVIDIA reported earnings last Thursday, exceeding growth expectations, yet failed to stabilize its stock price. Investor pessimism toward U.S. equities continues to grow, highlighting risks of a broader market downturn.

Chart: Probability of a 25 bps Fed rate cut in December rises to 69.3%

Data source: CME Group

Chart: Dramatic reversal in rate cut expectations between Nov. 20–21, mirrored by BTC price movements

Data source: Polymarket

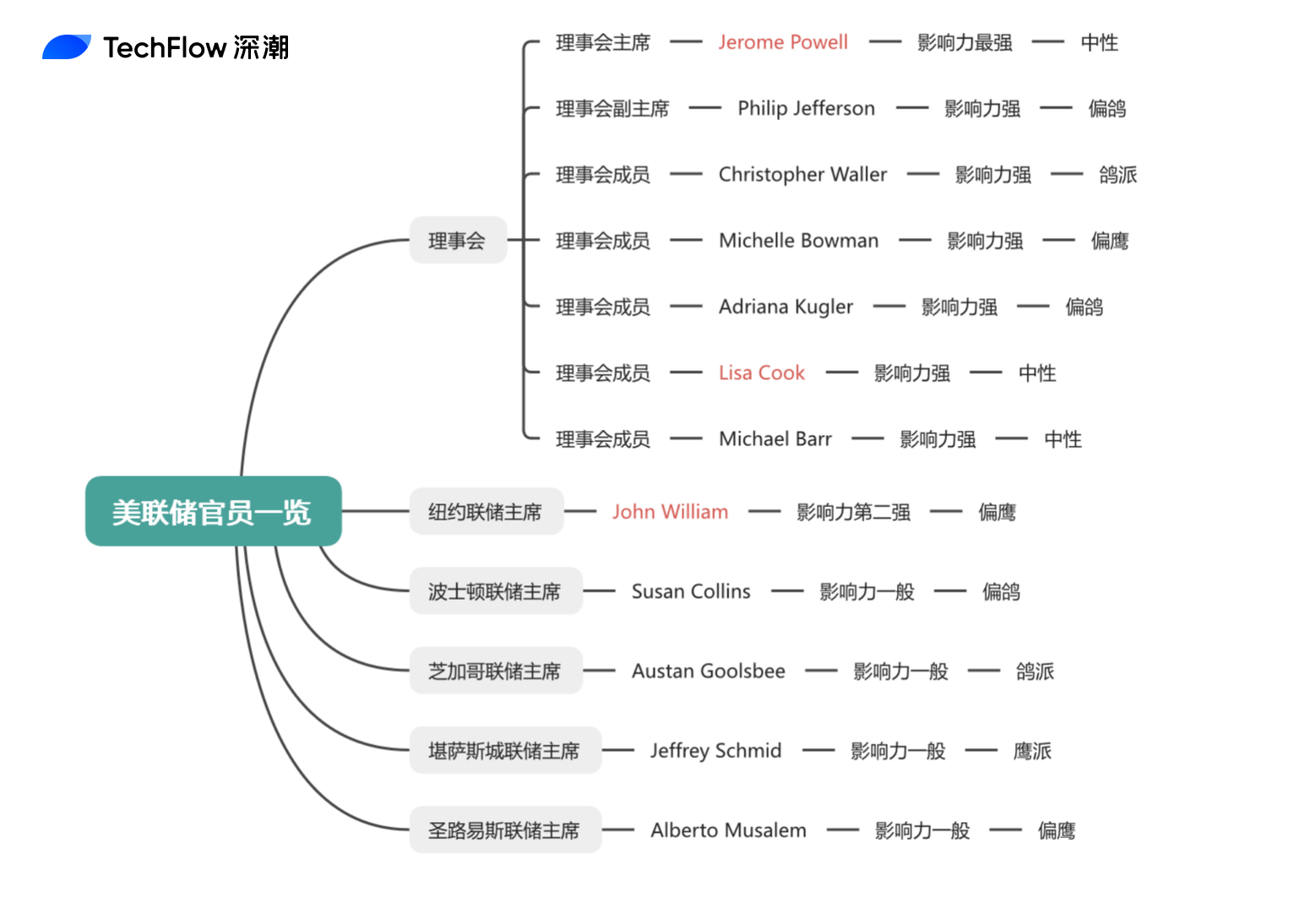

The chart below summarizes the influence and historical hawk/dove positioning of current Federal Reserve officials. Powell and Williams hold the greatest influence. Beyond them, based on current statements, Cook’s vote may become pivotal in determining whether the Fed cuts rates in December.

Chart: Influence and hawk/dove positioning of current Fed officials

Data source: TechFlow compilation

The yield on 10-year Japanese government bonds has risen to 1.78%. If this trend continues alongside yen appreciation, investors should be cautious about potential unwinding of yen carry trades, which could tighten dollar asset liquidity. The narrow definition of yen carry trade exposure (Japan's short-term foreign debt) is approximately $350 billion, while the broader definition—including institutional overseas investments—exceeds $1 trillion.

Chart: 10-year Japanese government bond yield reaches 1.78%

Data source: TradingView

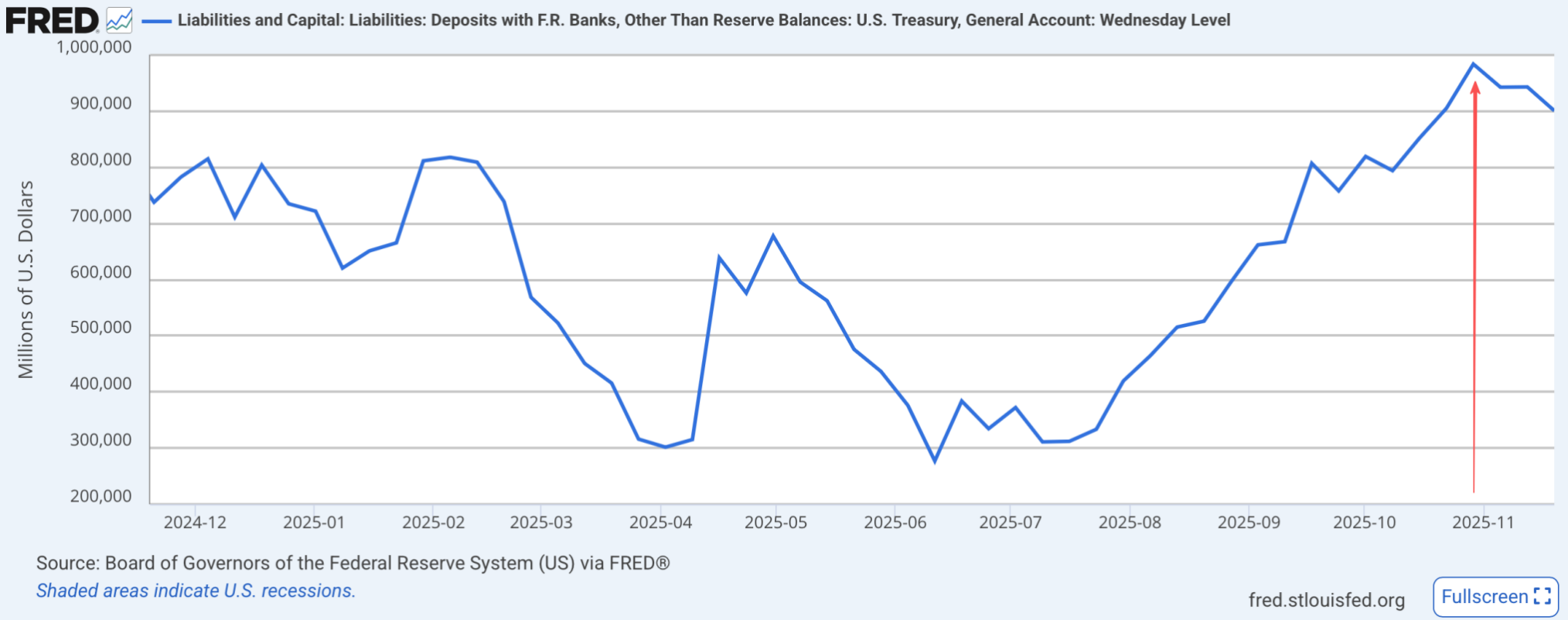

After the government shutdown ended, the balance in the TGA account has not shown a significant decline, meaning fiscal liquidity has not yet been injected into the market.

Chart: TGA account balance

Data source: FRED

2. Market Sentiment:

For all seven days last week, market sentiment remained in extreme fear. On November 21, after BTC broke down weekly support to 80,600, it began a recovery rally, and the Fear & Greed Index rose slightly—but remains within the "extreme fear" range. The market has now been in extreme fear for 12 consecutive days, the first time since July 2022. The previous instance occurred from May to July 2022, triggered by the collapse of the FTX exchange, during which the market stayed in extreme fear for two consecutive months.

Chart: Market sentiment remained extremely fearful last week

Data source: Coinglass

3. Specific Data:

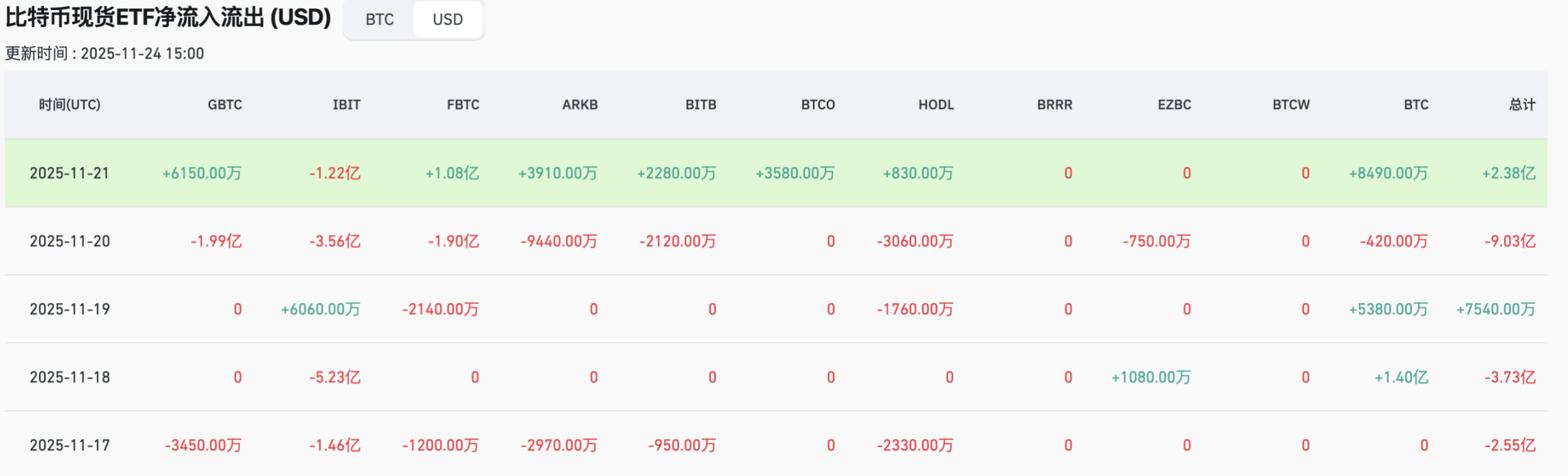

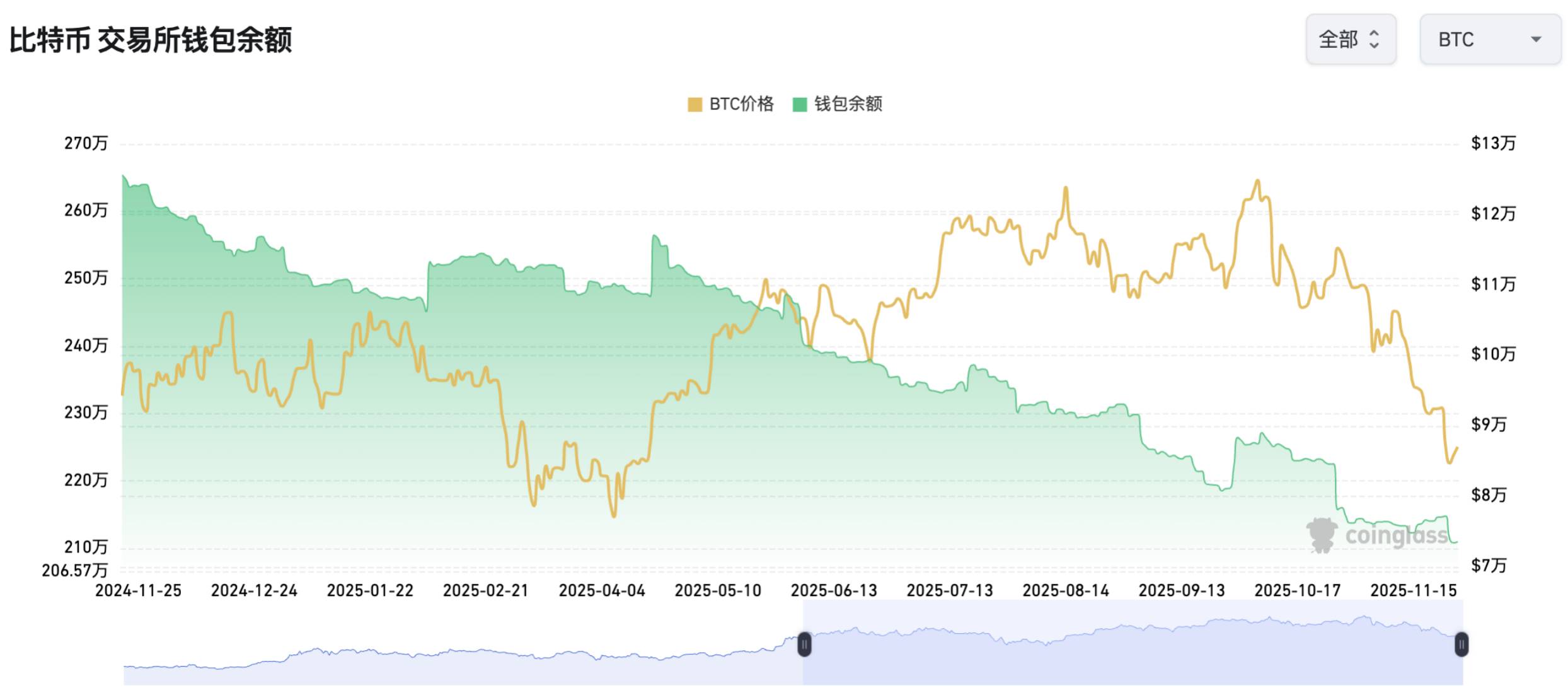

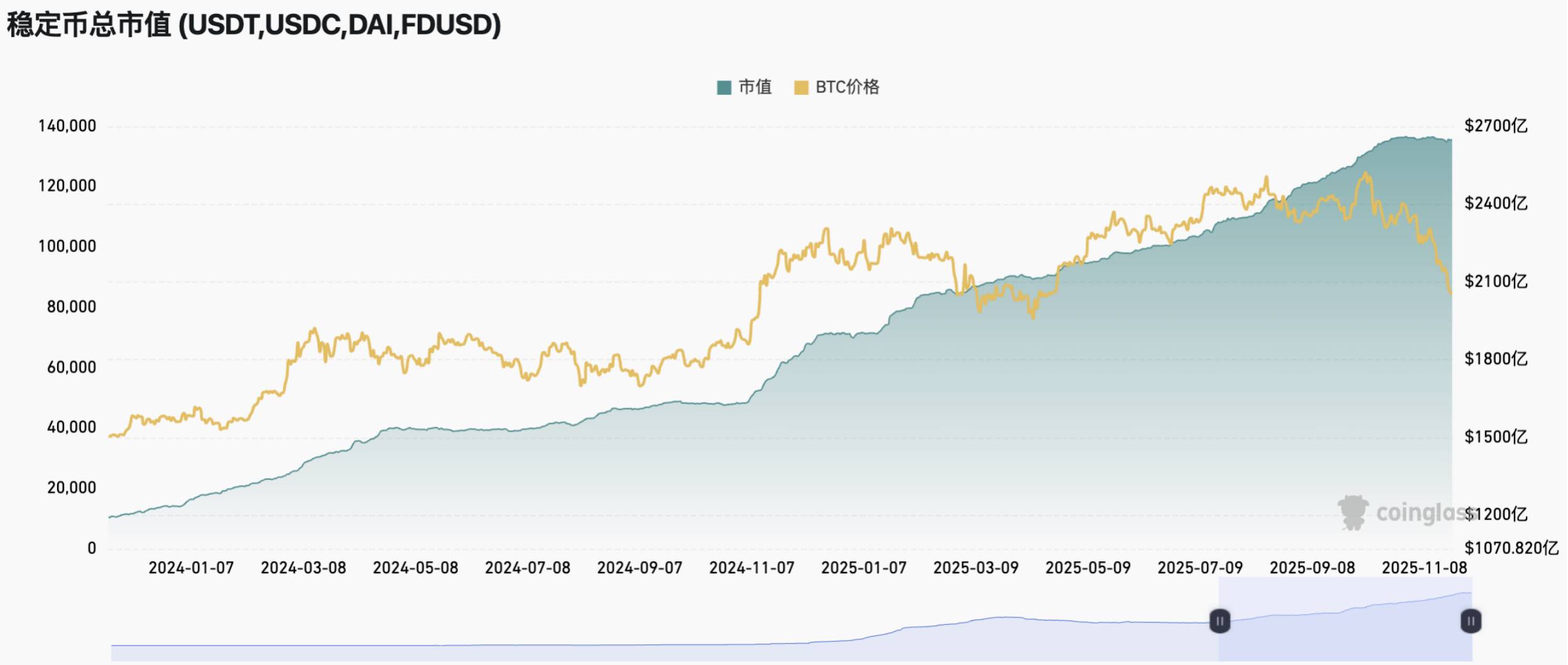

Last week, BTC ETFs saw outflows of $1.218 billion, an increase of 9.5% week-on-week; ETH ETFs saw outflows of $500 million, a decrease of 31.3% week-on-week. Currently, BTC exchange reserves stand at 2.1095 million BTC, down 1.3% week-on-week; ETH exchange reserves are at 11.7951 million ETH, down 1.76% week-on-week. Stablecoin market cap was $264.824 billion as of November 16, down 0.1% week-on-week.

Chart: BTC ETF outflows of $1.218 billion, up 9.5% week-on-week

Data source: Coinglass

Chart: ETH ETF outflows of $500 million, down 31.3% week-on-week

Data source: Coinglass

Chart: BTC exchange reserves down 1.3% week-on-week

Data source: Coinglass

Chart: ETH exchange reserves down 1.76% week-on-week

Data source: Coinglass

Chart: Stablecoin market cap down 0.1% week-on-week

Data source: Coinglass

II. Sector Highlights

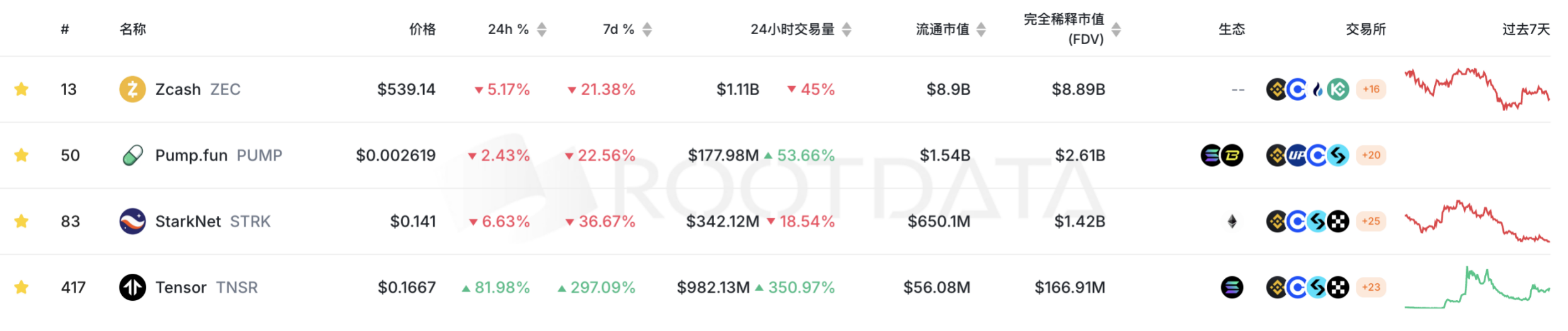

1. Overall market performance was weak last week, with privacy coins also declining: ZEC fell 18% for the week, showing high-level consolidation; STRK plunged 31%, nearly returning to its starting level; HYPE faced a large token unlock and dropped 18%; PUMP team continued selling tokens, driving the price down 26% for the week; small-cap coin TNSR surged 250% for the week, hitting an intraweek high of +800%, after the Tensor Foundation acquired the Tensor marketplace from Tensor Labs and burned 22% of TNSR tokens held by Tensor Labs.

Chart: Price and volume performance of popular assets

Data source: Rootdata

2. On Friday last week, Jesse, founder of Base, launched his namesake token "jesse" on the Base chain via the Zora platform. Its market cap peaked at $30M, yielding early snipers profits of roughly 2–3x. The token has since fallen to a market cap of $13M, roughly equal to the opening price accessible to most investors.

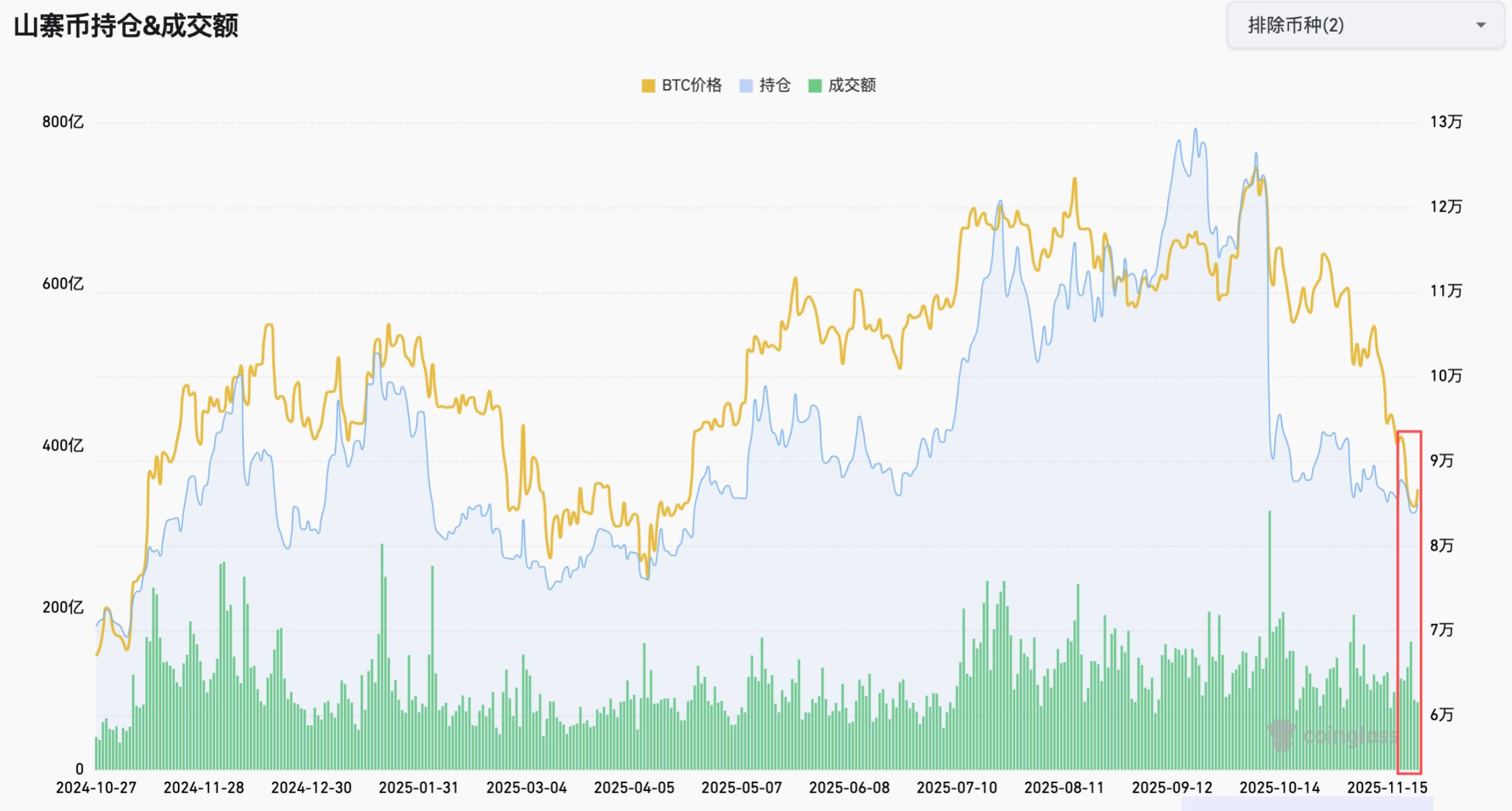

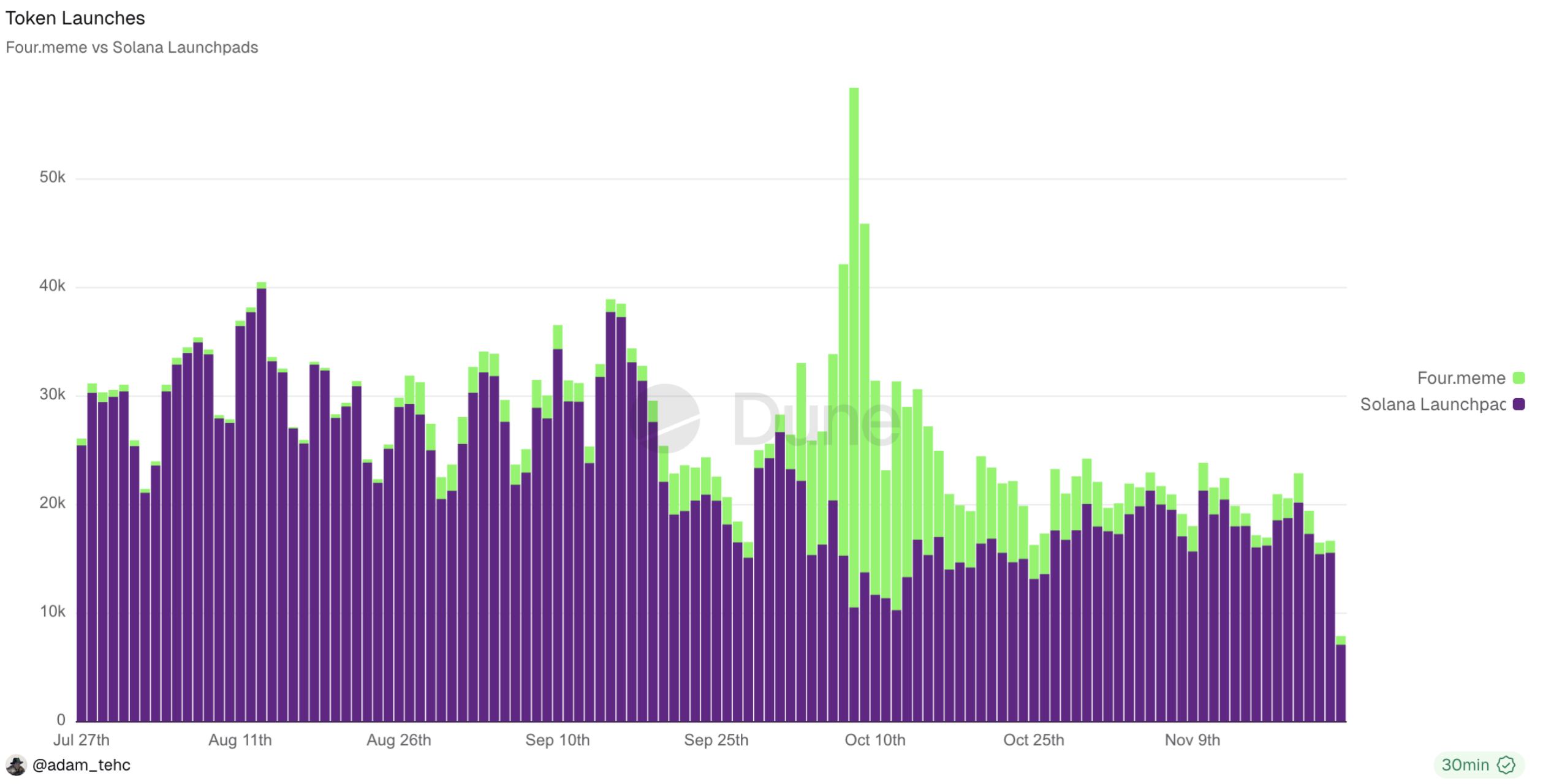

3. Last week, altcoin contract positions and trading volumes on exchanges continued to decline, reflecting weakening investor enthusiasm. Token minting activity on Solana and BSC chains remained low. Solana's official Twitter hinted at major upcoming news, but the market still lacks clear catalysts.

Chart: Altcoin contract holdings and trading volumes continue to decline

Data source: Coinglass

Chart: Token issuance on Solana and BSC remains at low levels

Data source: Dune

4. Key news from last week:

Fed's Williams: The Fed may still cut rates in the near term;

MSCI considers removing companies with over 50% digital asset exposure from its main indices;

CryptoSlate reports that multiple Wall Street institutions sold off Strategy shares in Q3, totaling approximately $5.38 billion;

Franklin Templeton's XRP ETF receives listing approval from NYSE Arca under ticker XRPZ;

U.S. Treasury Secretary Besent: Rate-sensitive sectors are going through a painful adjustment period, but improvement is expected by 2026, and the broader economy is not facing recession risks;

A U.S. Congressman introduced the "Bitcoin for America" bill, proposing to legally establish a strategic Bitcoin reserve;

Mt. Gox transferred 10,608 BTC worth $954 million;

Base co-founder Jesse launched the jesse token on November 21.

III. This Week's Watchlist

1. Macro Events:

November 25: U.S. September retail sales month-on-month, U.S. September PPI data;

November 26: U.S. weekly initial jobless claims;

November 28: Japan October unemployment rate;

December 1: Speech by BOJ Governor Kazuo Ueda.

2. Token Unlocks:

See "HYPE, SUI, XPL and other tokens face major unlocks this week, totaling over $400 million"

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News