Huobi HTX New Asset Weekly Review (11.10–11.17): BANK surges 97%, L1 and L2 sectors rebound simultaneously

TechFlow Selected TechFlow Selected

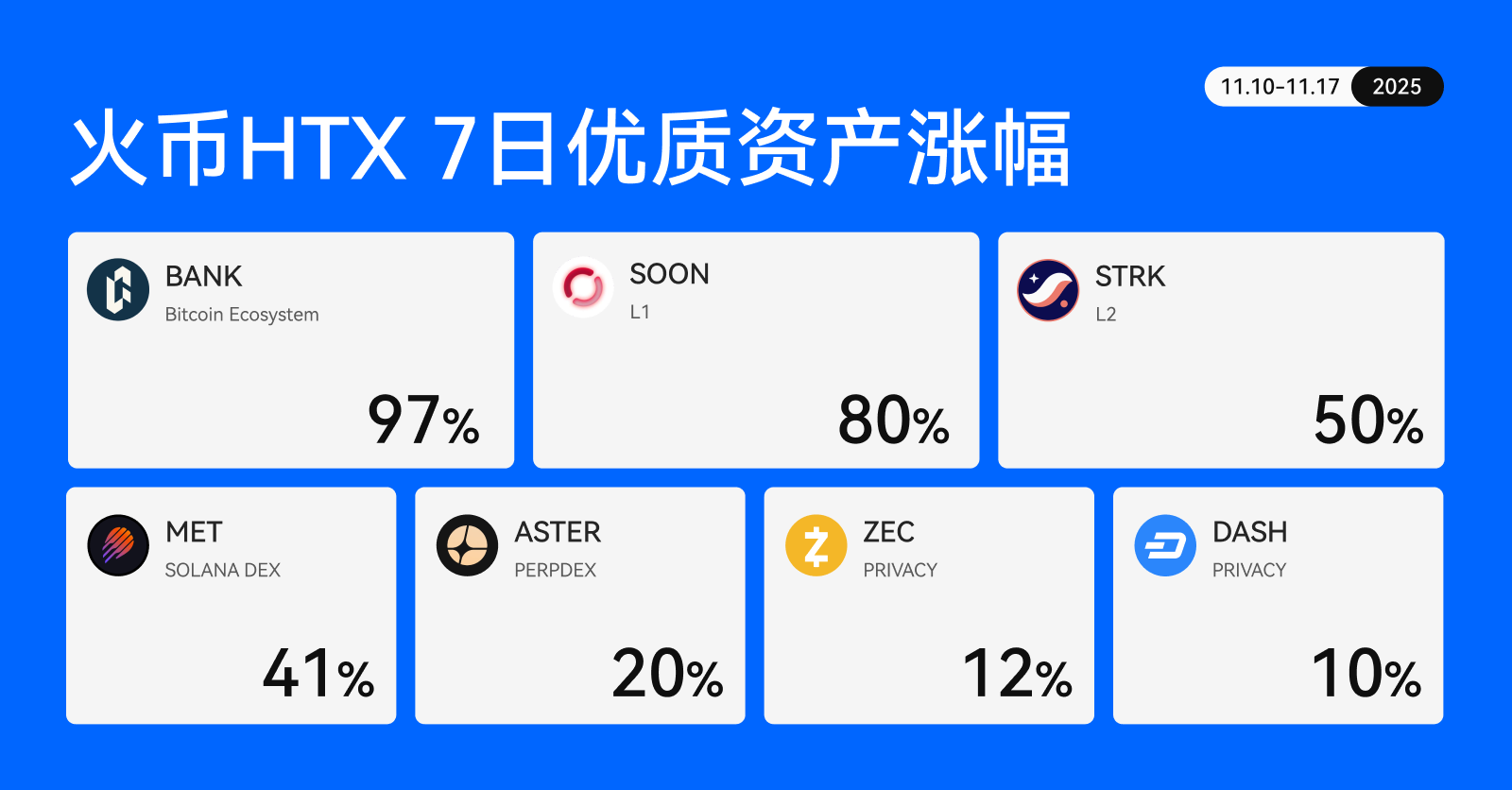

Huobi HTX New Asset Weekly Review (11.10–11.17): BANK surges 97%, L1 and L2 sectors rebound simultaneously

Bitcoin ecosystem leads the way!

Last week in the crypto market, macro sentiment and sector热度 showed a clear divergence. BTC continued its oscillation, with bulls and bears locked in a stalemate around key levels, while capital favored structural opportunities—particularly within the Bitcoin ecosystem, Solana DEXs, and L1/L2 scaling sectors.

According to data from HTX market行情, high-quality assets across multiple sectors performed strongly between November 10 and November 17, with BANK surging 97% over the week.

Bitcoin Ecosystem: BANK Leads Strongly with 97% Weekly Gain

The Bitcoin ecosystem was undoubtedly the strongest theme this week. Momentum in the Bitcoin ecosystem has been building throughout Q4, driven both by strengthening narratives around BTC Layer 2 solutions and active support for ecosystem assets from major centralized exchanges. BANK’s standout performance reflects high market expectations for the "next breakout point in the Bitcoin sector."

-

BANK (Lorenzo Protocol): A modular Bitcoin L2 infrastructure built on Babylon. By leveraging Babylon’s Bitcoin staking and timestamping protocols, Lorenzo is laying the foundation for scalable, high-performance Bitcoin application layers. Listed early on HTX in May, BANK surged 97% this week amid rising community interest and an upgraded ecosystem narrative, claiming the top spot in weekly gains.

L1/L2 Sector: Capital Returns to Mainstream, SOON and STRK Rise Steadily

L1 blockchains and Layer 2 solutions regained investor attention this week, with overall trading activity warming up. Market sentiment shifted toward "high-growth new narratives + high-elasticity assets." Compared to volatile memecoins or single-event tokens, L1/L2 projects are trending more toward "sustainable growth trajectories."

-

SOON: Up 80% for the week. SOON is a Rollup stack designed to deliver top-tier performance for all Layer 1 blockchains, aiming to create a Super Application Stack (SAS). Progress in ecosystem development and multi-chain performance upgrades boosted short-term sentiment, making SOON one of the most watched breakout L1 tokens this week.

-

STRK (Starknet): Up 50% weekly, representing one of the most prominent growth assets in the entire L2 space. StarkNet is a permissionless decentralized validity rollup (also known as a "ZK rollup") that operates as an L2 network on Ethereum, enabling any dApp to scale its computation infinitely without compromising Ethereum's composability and security.

DEX Sector: SOL Ecosystem Heat Continues, Perpetual DEX Reappears on the List

DeFi capital utilization is rebounding, and the derivatives sector has become the "home ground for high-frequency traders" on-chain, leading to renewed valuation interest in PERPDEX projects. Meanwhile, the Solana ecosystem remains one of the most followed narratives in Q4, with Solana’s TVL, DEX trading volume, and active user counts staying high, ensuring strong liquidity across the ecosystem.

-

MET (Meteora): A representative Solana DEX asset, up 41% in a single week. Meteora is a dynamic liquidity pool protocol on Solana that supports automated market making and token trading via its concentrated liquidity management mechanism (DLMM). This week’s rally can be seen as a continuation of native ecosystem value discovery.

-

ASTER (Aster): A representative player in the decentralized perpetual contracts space, up 20% this week. The PerpDEX sector is generally driven by market trading volume and volatility. As derivative markets grow more active, ASTER has gradually attracted users through its low-fee, high-leverage product design.

Privacy Sector: ZEC and DASH Showing Stable Improvement

Privacy-focused assets typically exhibit "safe-haven properties" during times of increased market uncertainty. With some regulatory environments showing signs of localized easing, this sector is regaining attention. The price increases of ZEC and DASH on HTX reflect a market preference for "steady yet progressive" investment choices.

-

ZEC (Zcash): Up 12% for the week. As one of the pioneers in the privacy coin space, ZEC continues to provide foundational support for on-chain privacy protection using zero-knowledge proof (zk-SNARKs) technology.

-

DASH (Dash): Up 10% this week. Known for its "hybrid privacy + fast payments" model, DASH holds unique advantages in payment network revitalization and on-chain settlement.

Limited-Time Benefit: HTX Random Airdrop #4 Now Live

Alongside this week’s rotation of high-performing assets, HTX has launched its fourth "Random Airdrop" promotion, offering additional incentives to spot trading users. From now until November 25 at 18:00 (UTC+8), users who trade any of the designated participating tokens (with daily trading volume ≥100 USDT) will receive one chance per day to open a mystery box airdrop, with the highest prize being $1,888 worth of $HTX tokens.

This week’s designated tokens (USDT spot pairs): XRP, ZEC, TRUMP, WLFI, MET, BANK, ZK, MELANIA, DASH. Notably, BANK, MET, ZEC, and DASH are among the top performers this week and are also included in the airdrop event, allowing users to earn extra HTX token rewards while trading—enabling dual benefits of "trading + airdrop."

Participation is simple: click "Register Now" on the event page, and eligible trades will be automatically tracked during the campaign period.

Multisector Synergy: High-Quality New Assets Continue to Drive Structural Markets

Data from HTX’s new asset review this week indicates that the crypto market is entering a phase of "multisector synergy and rapid value rotation." Breakouts in privacy coins, rebounds in PERPDEX, and localized hotspots are collectively fueling momentum shifts.

This week’s gains reaffirm: in a structural market, sector selection matters far more than chasing fleeting excitement around isolated trends. In the coming weeks, as macro conditions and on-chain fundamentals continue to improve, structural trends are expected to remain dominant. HTX will continue identifying high-quality projects across promising sectors, offering users more opportunities to access high-potential growth assets.

About HTX

Founded in 2013, HTX has evolved over 12 years from a cryptocurrency exchange into a comprehensive blockchain business ecosystem, encompassing digital asset trading, financial derivatives, research, investment, incubation, and more.

As a leading global Web3 gateway, HTX adheres to a strategic vision of global expansion, ecosystem prosperity, wealth creation, and secure compliance, delivering comprehensive, secure, and reliable value and services to cryptocurrency enthusiasts worldwide.

To learn more about HTX, visit https://www.htx.com/ or HTX Square, and follow us on X, Telegram, and Discord. For inquiries, contact glo-media@htx-inc.com.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News