Variant Researcher: Visualizing 2025's Hottest Crypto Market Trends

TechFlow Selected TechFlow Selected

Variant Researcher: Visualizing 2025's Hottest Crypto Market Trends

New users can now start their on-chain exploration more easily than ever before.

Author: Alana Levin

Translation: TechFlow

Note: Images in the article have been translated for text-heavy sections. For full details, view the complete report.

Excited to release my 2025 Crypto Trends Report!

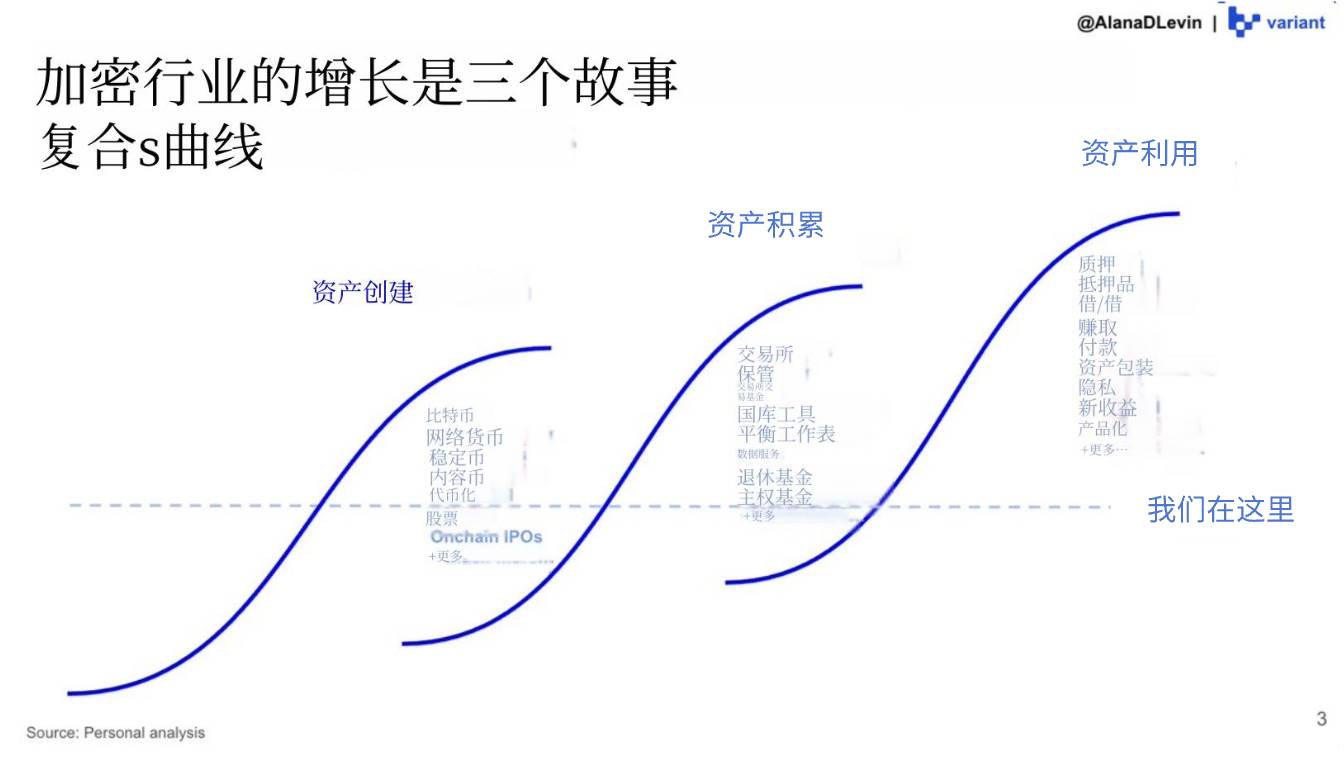

The report frames the growth of the crypto industry as three overlapping S-curves: asset creation, asset accumulation, and asset utilization.

Through this lens, it forecasts the industry’s trajectory across five key thematic areas—macroeconomics, stablecoins, centralized exchanges (CEXs), on-chain activity, and frontier markets.

Our position on each curve helps identify remaining startup opportunities and foreseeable favorable trends.

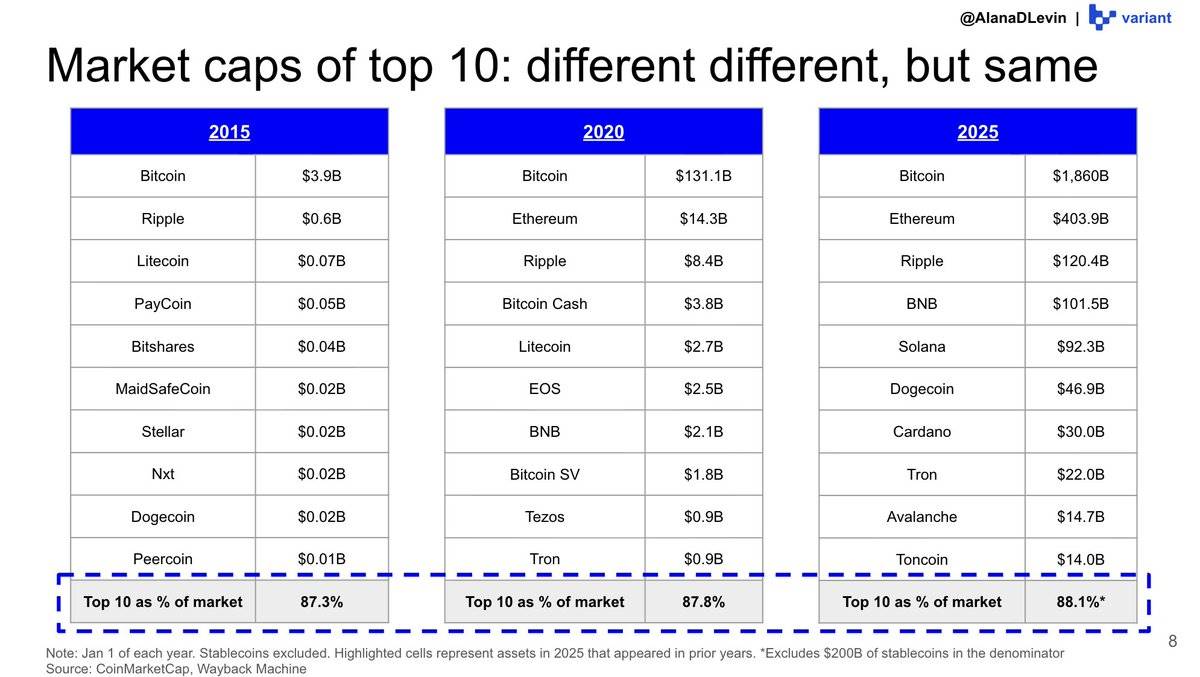

From a macro perspective, the scale of major crypto assets continues to expand. Despite a record number of tokens in the market, the value concentration among the top ten crypto assets has remained remarkably stable.

Asset accumulation is a self-reinforcing cycle: the more people who hold an asset, the faster its value grows, increasing its chances of benefiting from the "Lindy Effect" (the longer something exists, the more likely it is to continue existing).

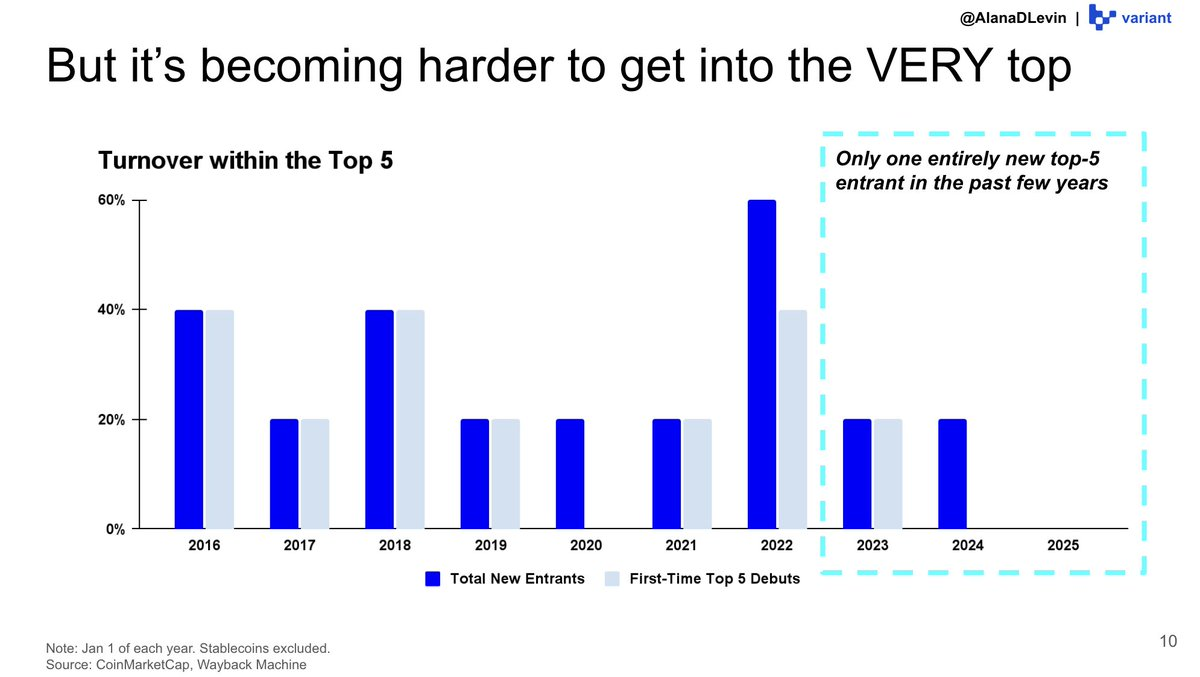

This trend is especially evident among the top five crypto assets—few new entrants have joined this tier in recent years.

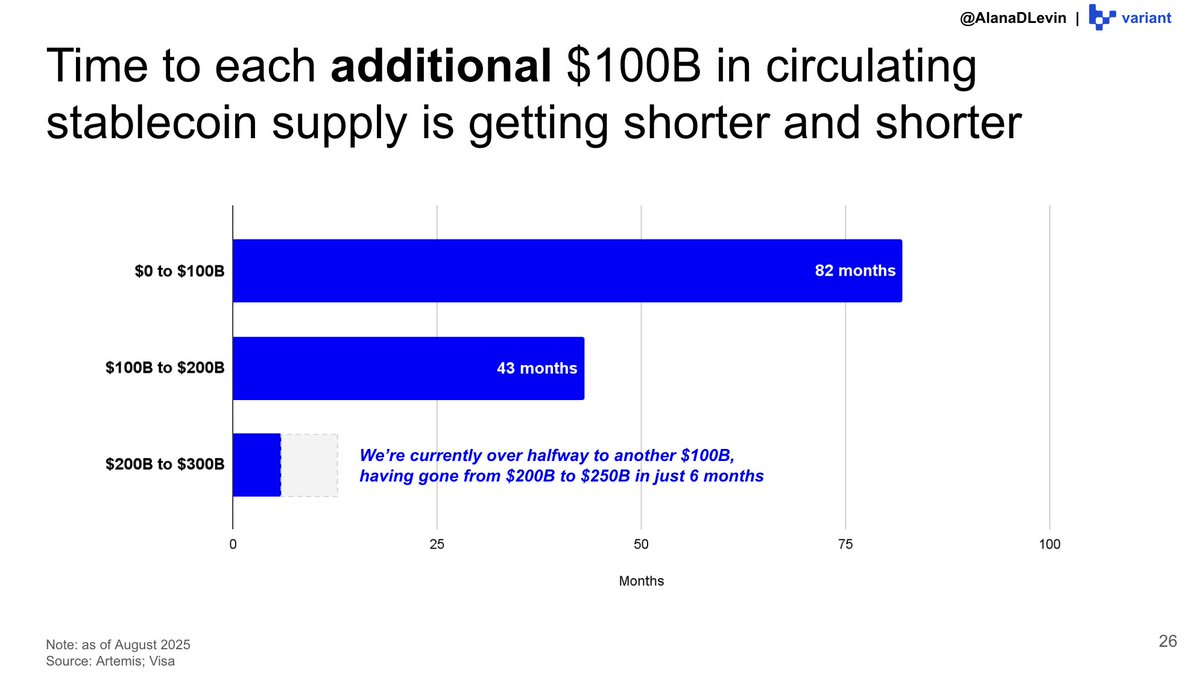

However, one asset class not included in the above charts is stablecoins.

New stablecoins are emerging at a record pace.

The first $100 billion in supply took over 80 months; the second $100 billion took over 40 months. Now, we expect the third $100 billion to be reached in under 12 months.

Creation → Accumulation + Utilization

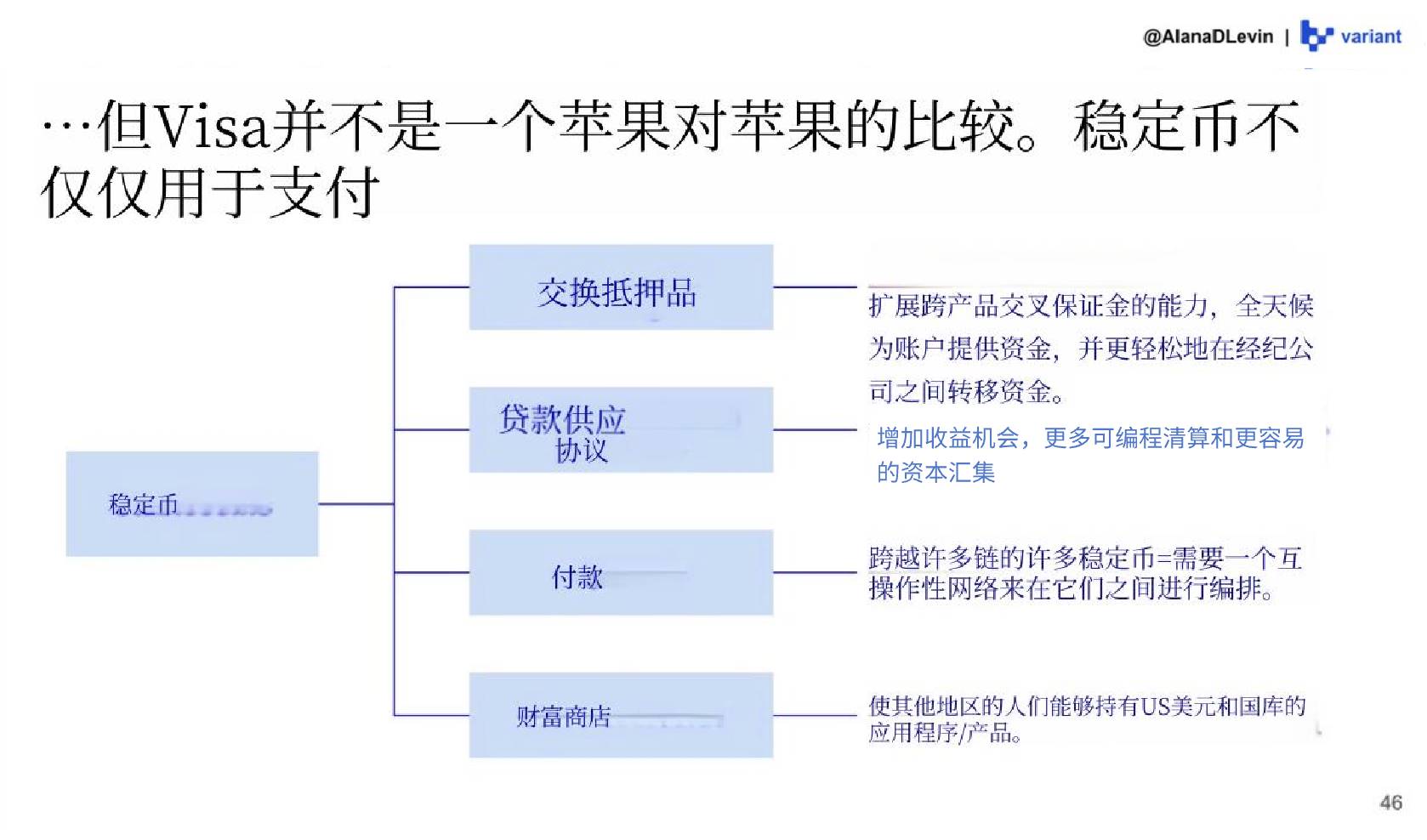

Stablecoins are being widely adopted across various products and use cases, including payments, lending protocols, exchanges, and even as stores of wealth.

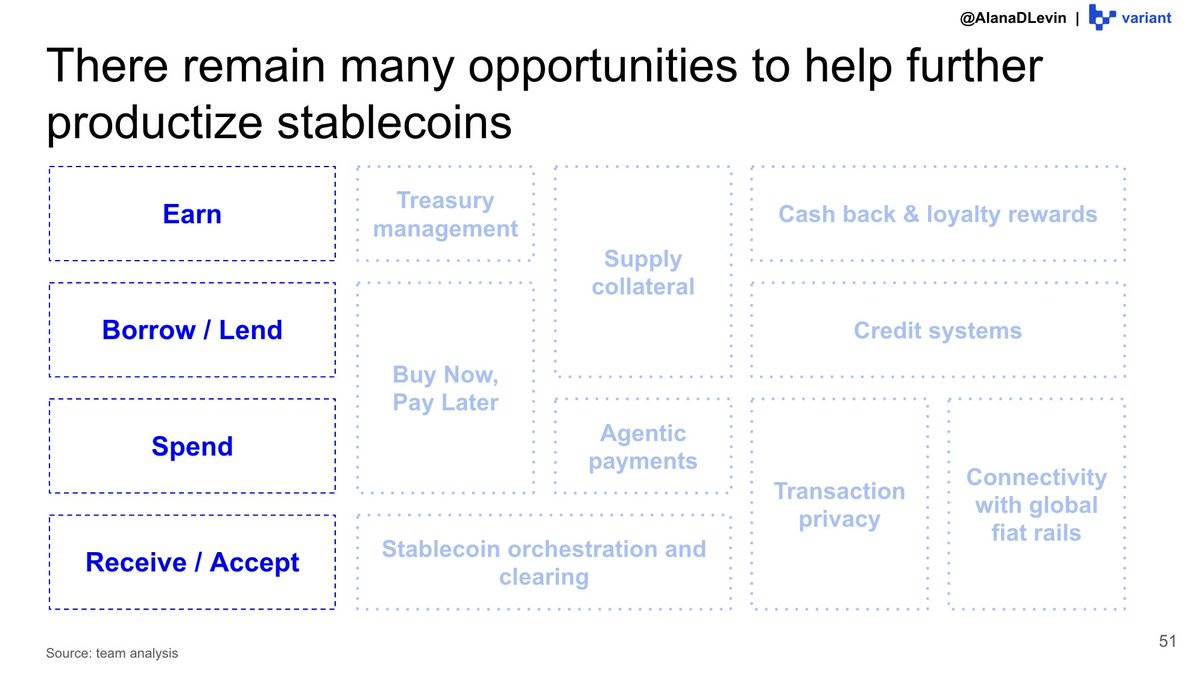

Stablecoin utilization remains a massive opportunity for startups.

We’re already seeing early signs of productization—yield products, lending, consumer payments, and payment acceptance—but this is just the beginning!

Future directions for stablecoin productization include credit systems, private transactions, capital coordination, buy-now-pay-later (BNPL), and more.

The next section focuses on centralized exchanges (CEXs):

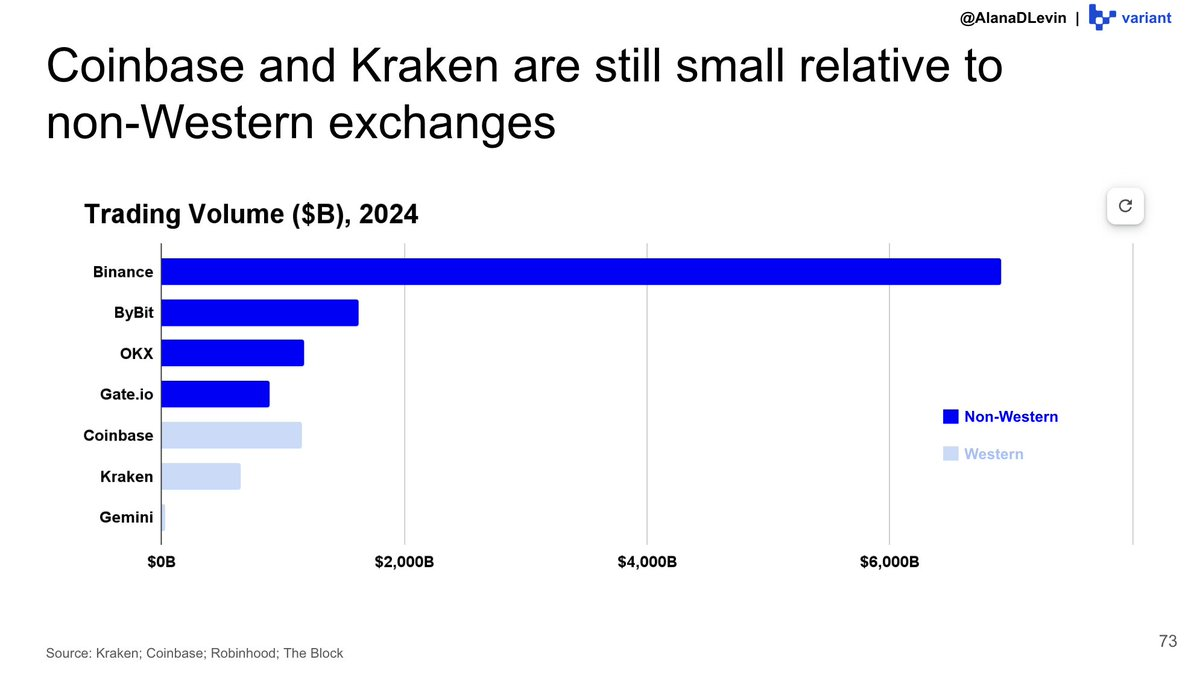

Centralized exchanges have greatly benefited from the tailwinds of "accumulation." As more people want to buy, sell, and hold crypto assets, they often turn to CEXs, driving trillions of dollars in trading volume.

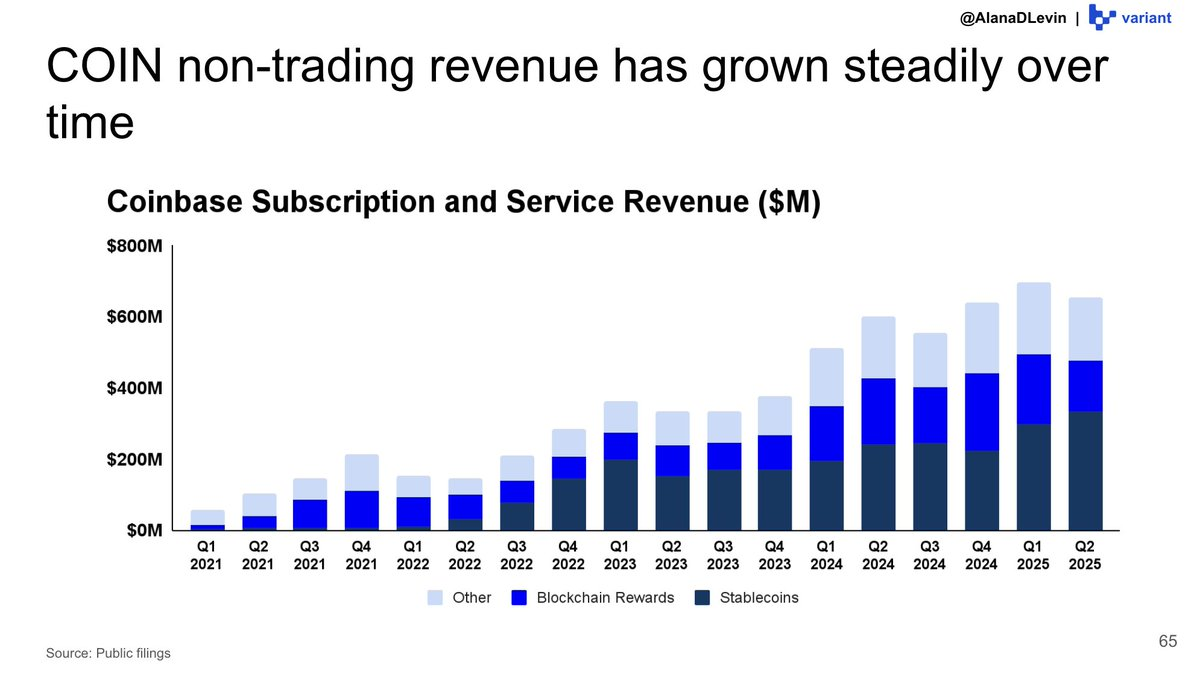

Exchanges are compound businesses. Companies like @Coinbase have built strong business lines around secondary user needs, such as custody, staking, and yield products.

Many new ways to use crypto assets will be built directly on-chain but may achieve broad distribution through centralized exchanges like @Coinbase, @RobinhoodApp, and @krakenfx.

So why will the future of asset utilization be built on-chain?

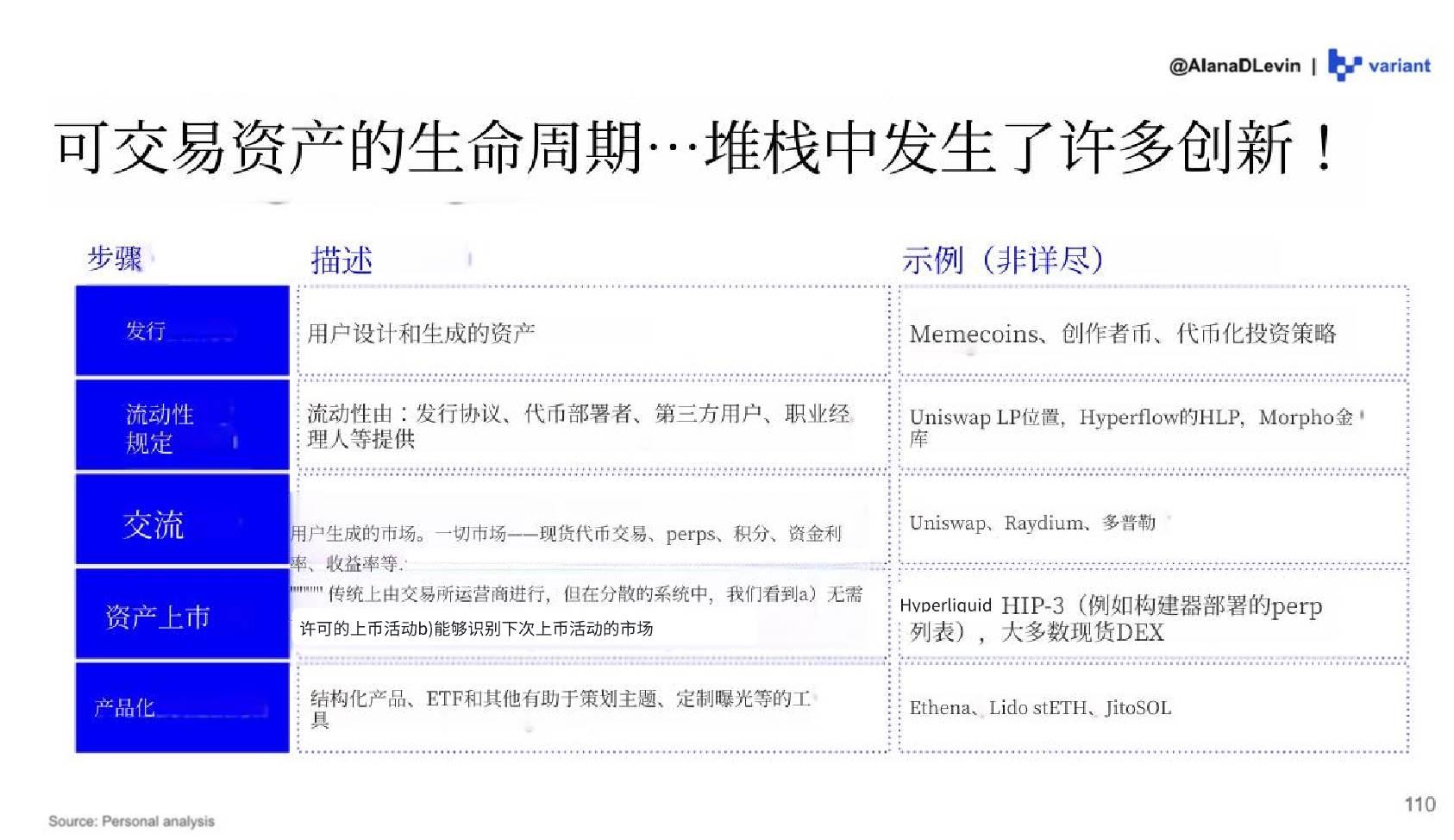

On-chain activity is a breeding ground for innovation. Every stage of an asset's lifecycle can be experimented with on-chain, whereas in traditional finance these steps are often restricted and permissioned.

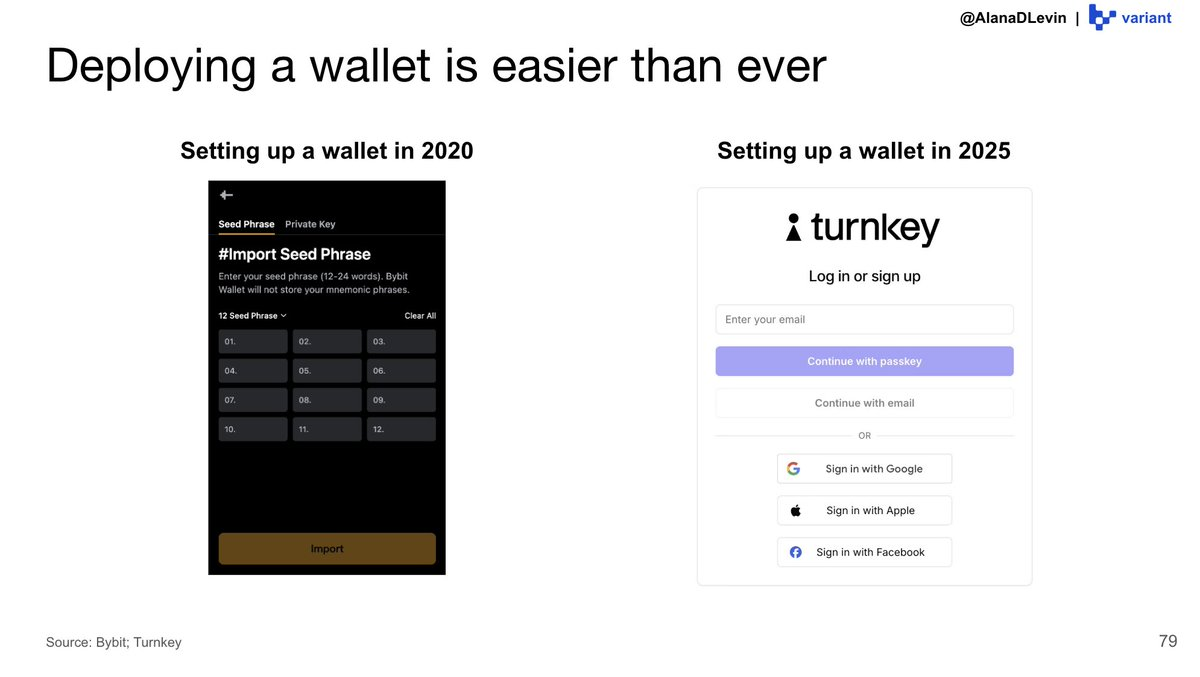

Moreover, it's now easier than ever for new users to start exploring on-chain—meaning anyone, anywhere, regardless of age, can begin creating, accumulating, and utilizing crypto assets.

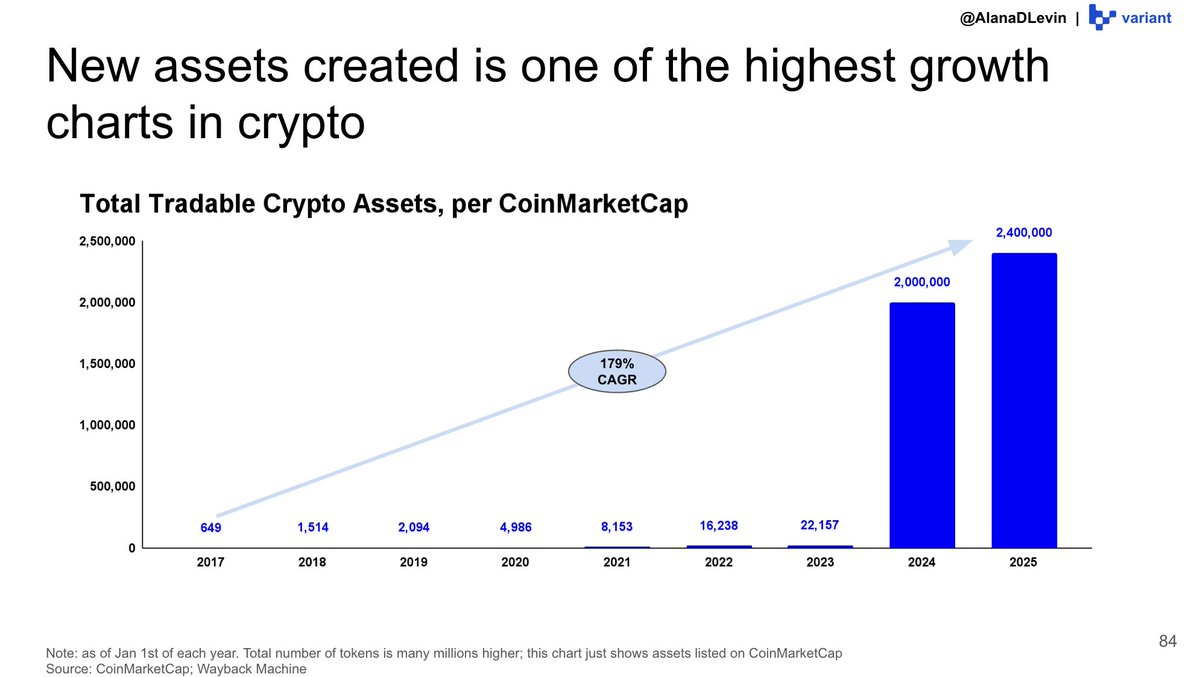

On creation: The number of newly created tokens is one of the fastest-growing charts in crypto.

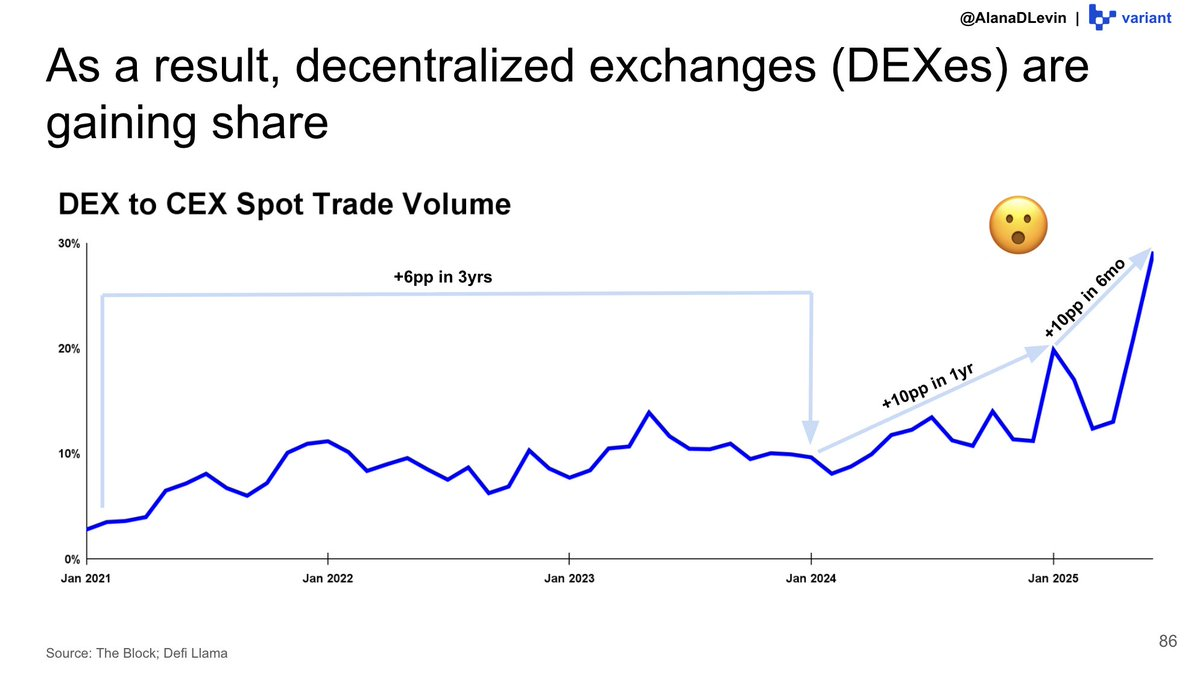

As a result, total trading volume has surged, and decentralized exchanges (DEXs) continue to grow. DEX market share gains in the first half of 2025 exceeded the combined gains from 2021–2023.

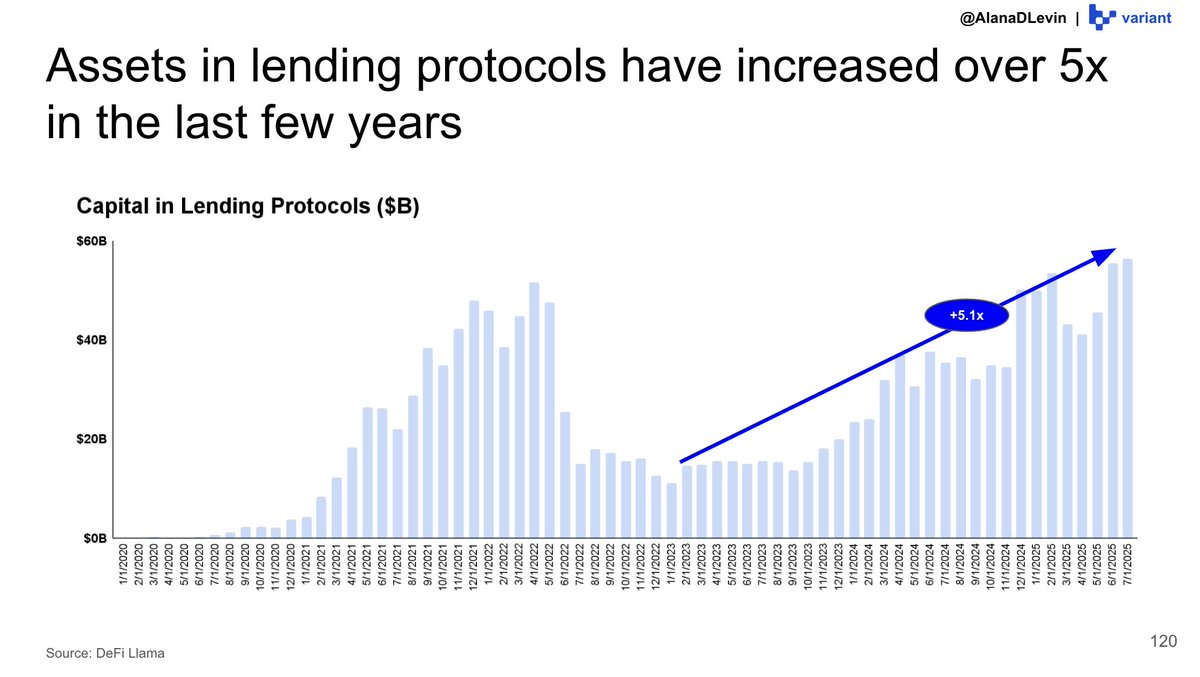

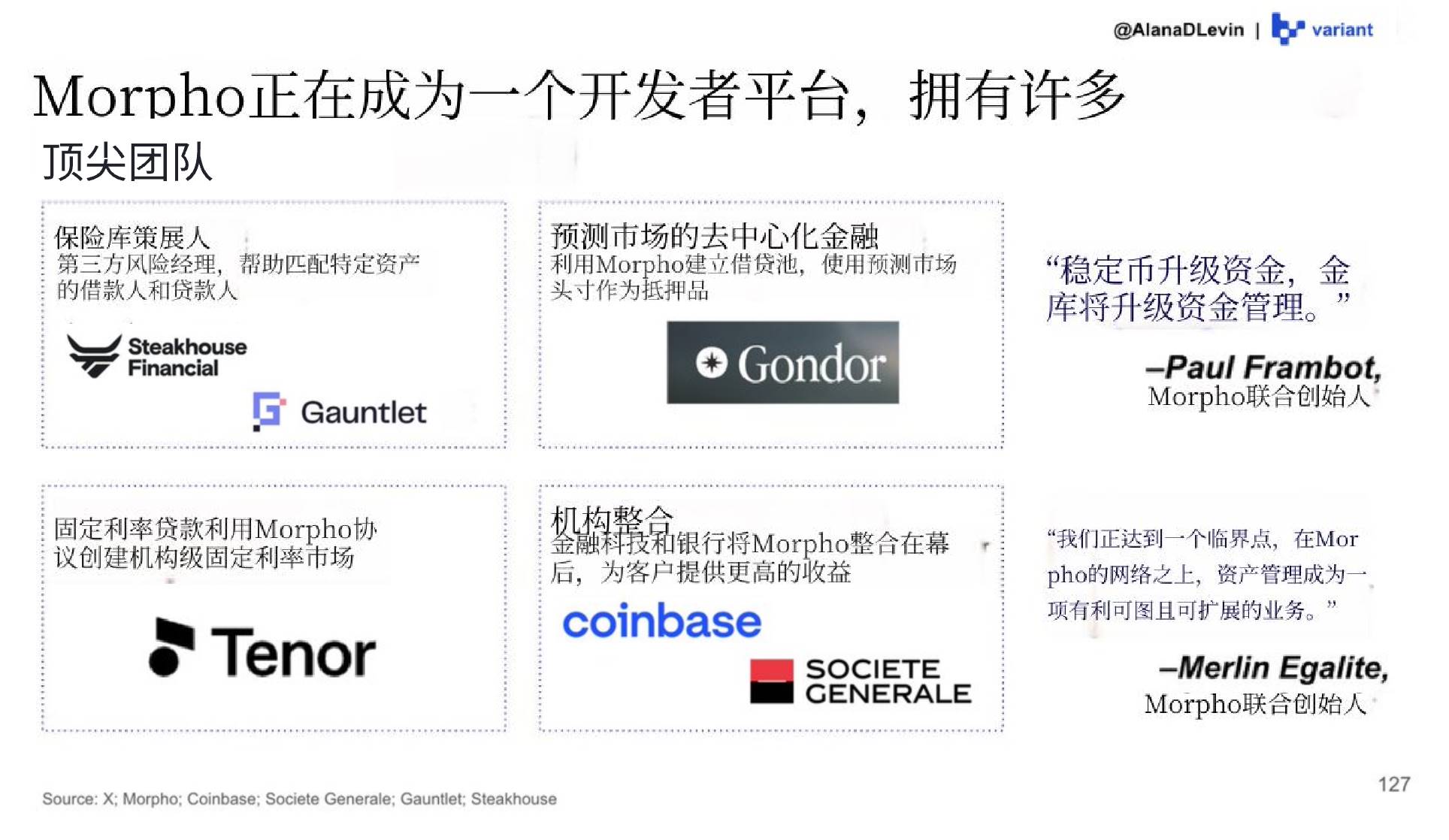

Another area showing early signs of asset utilization is on-chain lending. Assets in lending protocols (like @Morpho) have grown more than fivefold over the past few years—and are still rising!

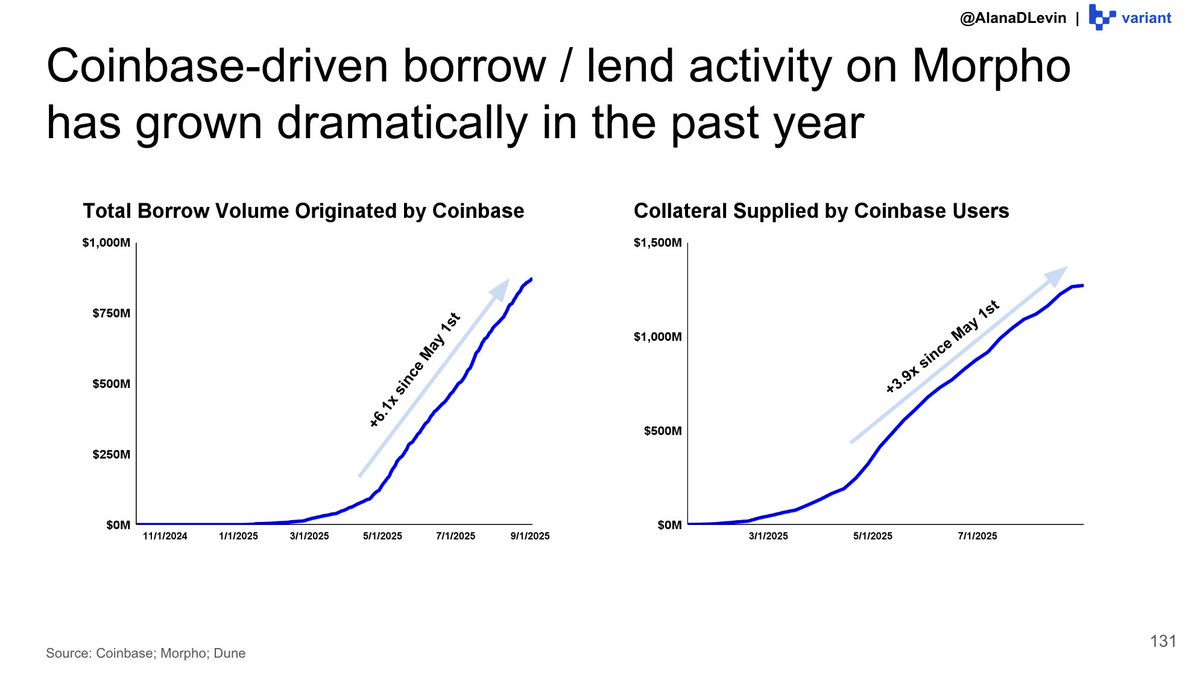

@Morpho is also a great example of the emerging trend of “building on-chain, distributing and utilizing globally.”

Notably, the S-curve for asset creation still has room to grow. Where can we find such opportunities? On-chain, of course!

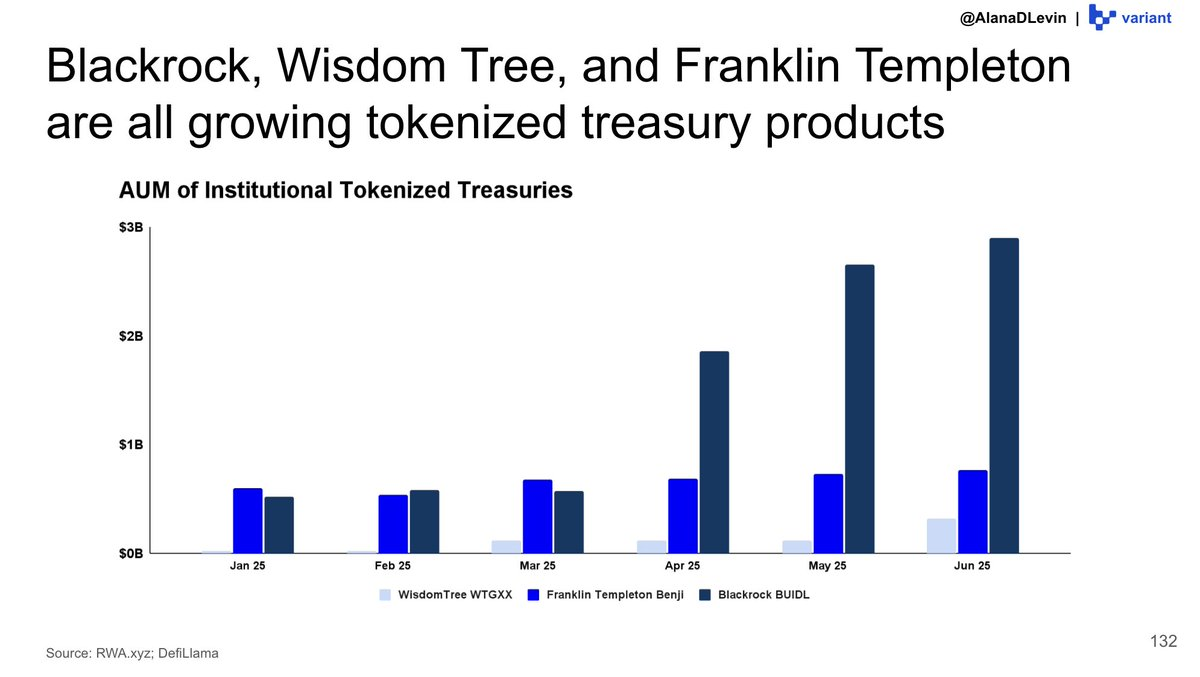

A significant new category of tokens is being created by institutions. Tokenized treasuries are among the first examples of many emerging use cases.

Likewise, we're starting to see experimental explorations of on-chain equity. Many designs are being tested, potentially leading to a diverse spectrum of tokenized equity products in the future.

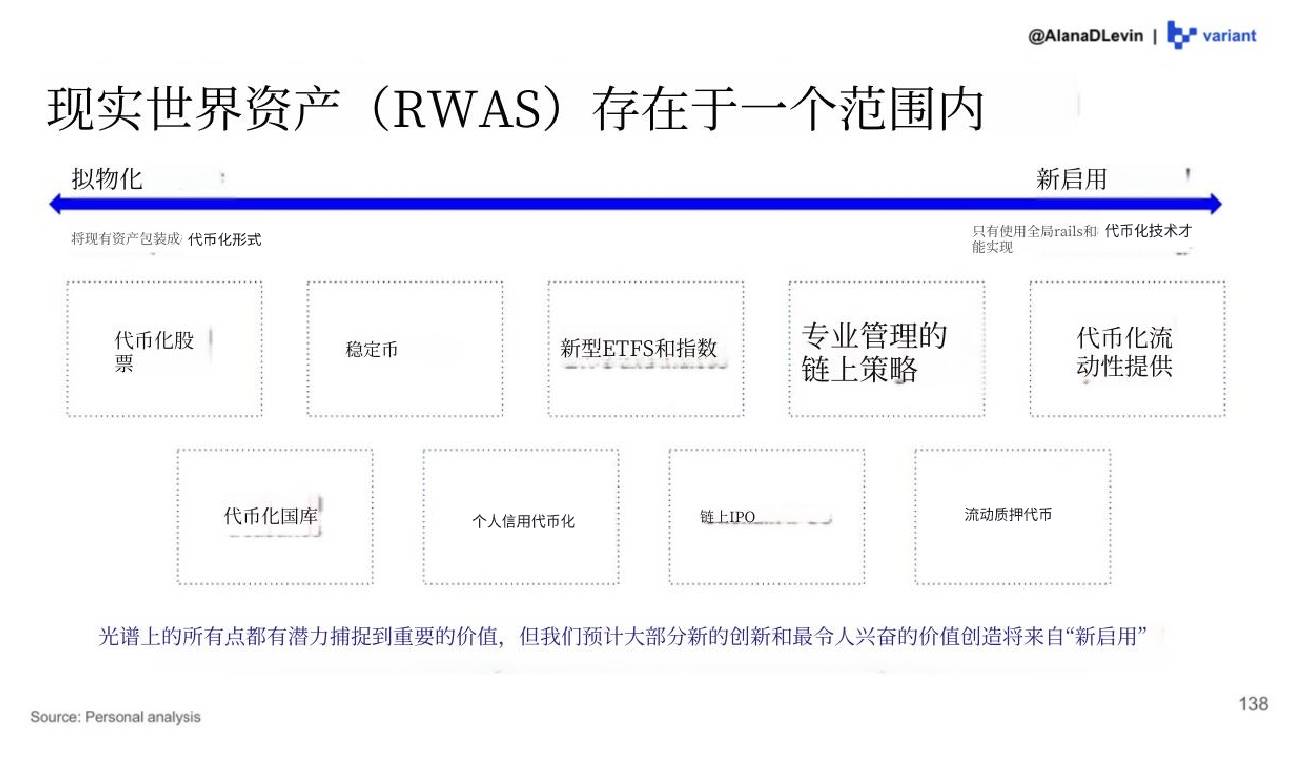

Ultimately, the term "RWA" (Real World Assets) will expand to include a broader range of product types and token construction methods than today. These new assets will not only hold intrinsic value but also catalyze new waves of demand for asset accumulation and utilization.

The final section focuses on frontier markets, where prediction markets serve as a prime example of how crypto turns products into platforms.

The ability of crypto to turn products into platforms is not new. We've seen it with perpetual contracts (e.g., @HyperliquidX) and lending protocols (e.g., @Morpho).

So if you're wondering where the future lies, start exploring on-chain! :)

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News