Crypto industry sees wave of mergers and acquisitions: giants are buying the dip, Web3 ecosystem is being reshaped

TechFlow Selected TechFlow Selected

Crypto industry sees wave of mergers and acquisitions: giants are buying the dip, Web3 ecosystem is being reshaped

While small projects are struggling with fundraising and token issuance for their next round, giants are already using cash to buy time and acquisitions to secure the future.

Author: Gu Yu, ChainCatcher

In 2025, the crypto world is witnessing an unprecedented wave of mergers and acquisitions.

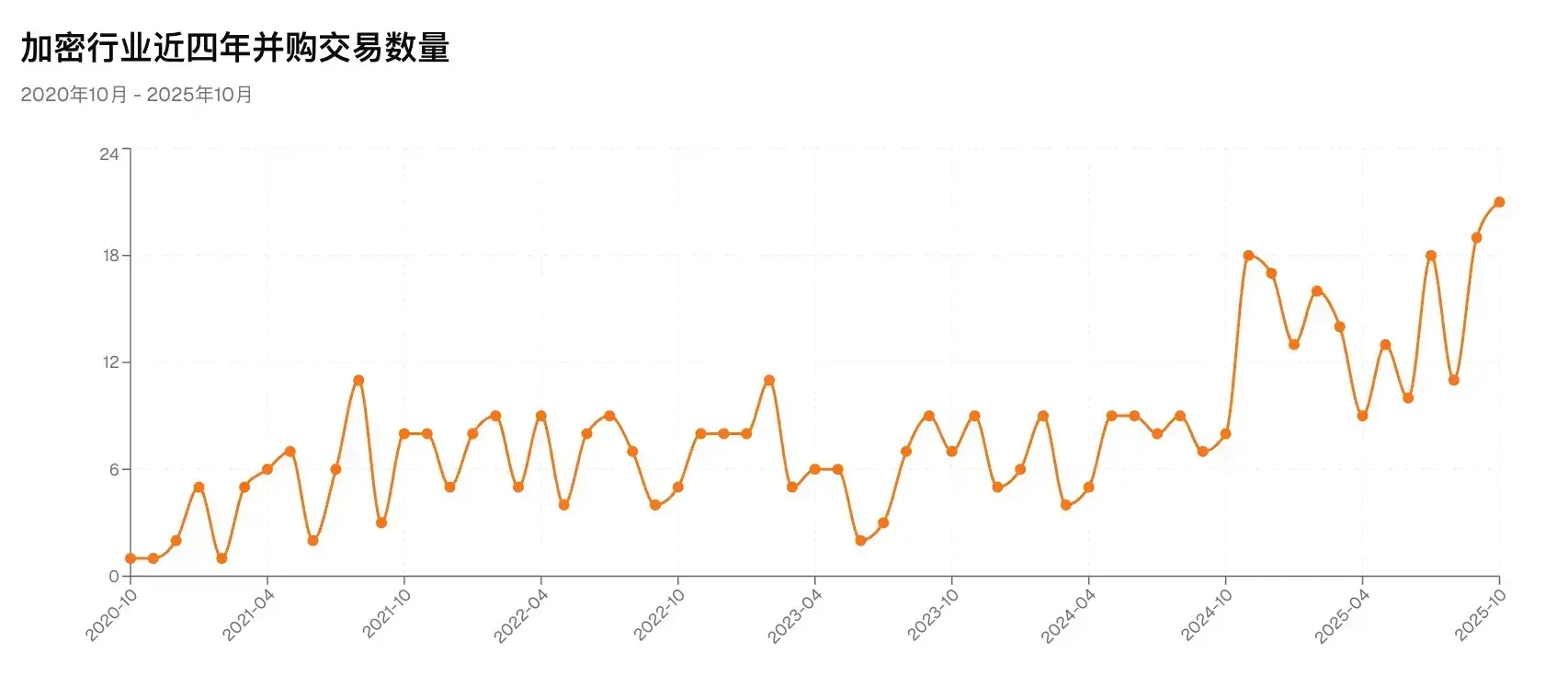

From DeFi protocols to asset management firms, from payment companies to infrastructure providers, new M&A deals are emerging almost daily. Kraken acquired futures trading platform NinjaTrader for $1.5 billion, while Coinbase recently made consecutive moves by acquiring derivatives exchange Deribit and on-chain fundraising platform Echo. According to RootData, there have been 143 crypto-related M&A deals in 2025 so far—setting a new historical record and representing a 93% increase compared to the same period last year.

Why are major players so keen on acquisitions amid a sluggish market? And what impact will this accumulation of M&A activity have on the industry?

1. Giants Trade Capital for Time

Mergers and acquisitions are the most direct means for giants to expand their battlefield and enhance competitiveness.

In recent years, centralized exchanges and other giants primarily thrived on trading fees. However, as the secondary market turned bearish and regulations tightened, simple transaction-based revenue became insufficient to sustain growth—especially with Web2 giants eyeing the space aggressively. As a result, they’ve turned to acquisitions to broaden their scope—either filling ecosystem gaps or securing compliance resources.

Through M&A, giants can bypass lengthy periods of independent R&D and market cultivation, quickly bringing competitors or complementary teams under their umbrella. This allows them to rapidly expand their product matrix—from spot to derivatives, from trading to payments and custody—enhancing end-to-end service capabilities.

More importantly, by acquiring entities that already possess regulatory approvals or mature compliance frameworks, platforms can gain faster access to certain markets—obtaining “identity credentials” such as licenses, compliance procedures, or clearing channels in specific jurisdictions. This saves significant time compared to building compliance teams from scratch—an especially critical advantage in the heavily regulated and geographically fragmented crypto landscape.

Coinbase serves as a prime example. Since 2025, its acquisition strategy has been nearly "full-stack": spanning derivatives exchanges, on-chain funding platforms, and compliant custodians, covering multiple segments including trading, issuance, payments, and asset management. An industry insider close to Coinbase revealed: “They’re building the Goldman Sachs of crypto—not relying on token prices, but on service systems.”

Kraken’s moves follow similar logic. NinjaTrader was a veteran player in traditional finance; by acquiring it, Kraken effectively purchased a U.S. regulatory-recognized compliance channel, enabling it to bring traditional futures clients and tools into its ecosystem. Going forward, Kraken won’t need workarounds to offer comprehensive derivatives and futures trading services.

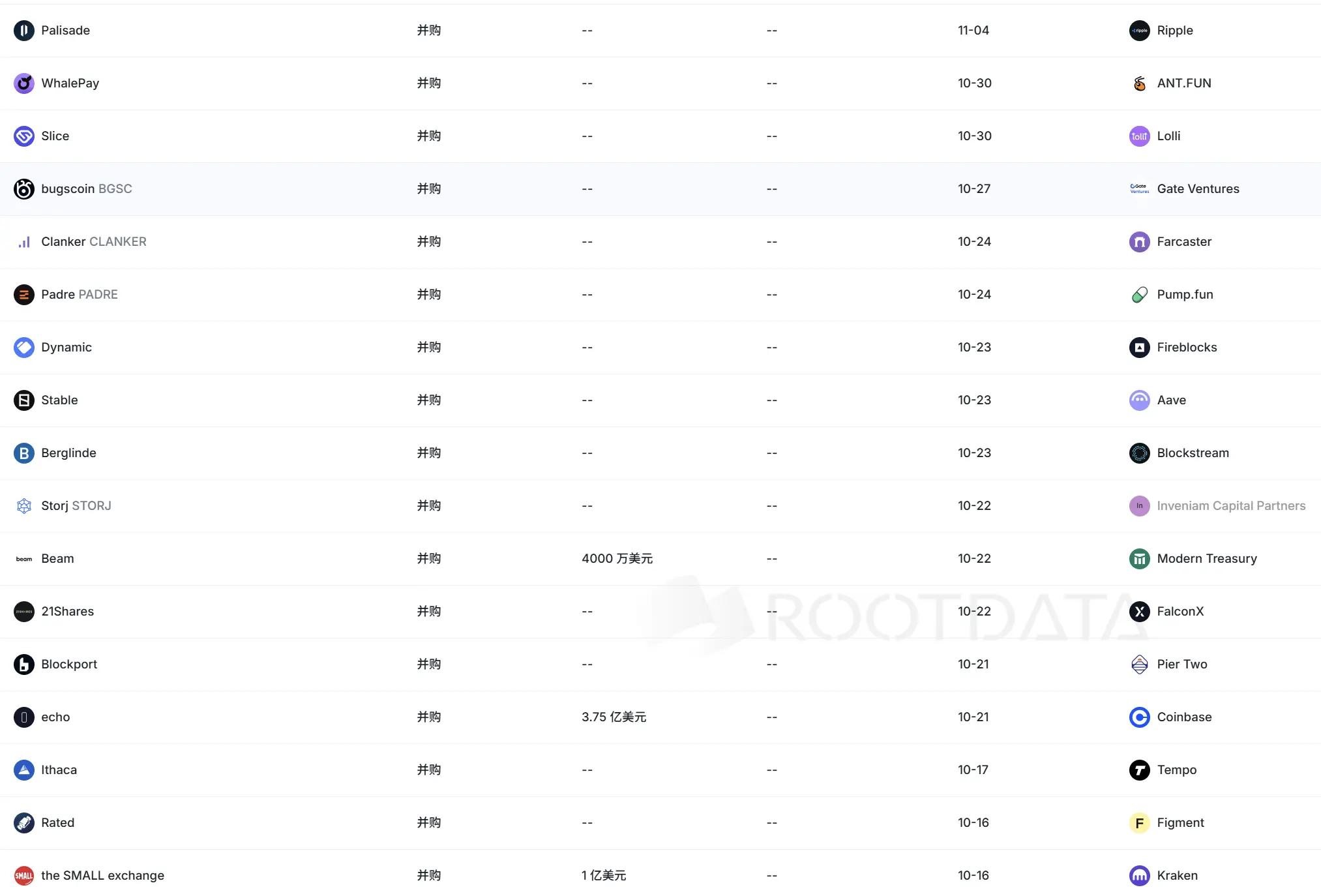

Recent M&A events Source: RootData

In short, while smaller projects struggle over fundraising rounds and token listings, giants are trading cash for time and acquisitions for future dominance.

This trend isn’t limited to Coinbase alone—Robinhood, Mastercard, Stripe, SoftBank, and other Web2 giants are also participating. This signals that Web3 is no longer just a playground for startups and retail investors; it’s increasingly drawing deep involvement from traditional capital, financial institutions, and even public companies. M&A has become their bridge into Web3.

Moreover, current market conditions provide a perfect opportunity for increased M&A investment. Today, the crypto primary market remains depressed, with most projects facing challenges in fundraising and exits—leaving them at a disadvantage in capital markets. Therefore, giants with ample cash reserves or strong capital market access can leverage their financial strength to dominate M&A pricing and deal structuring. For sellers, accepting equity swaps, partial cash plus stock, or strategic partnerships often proves more stable than gambling on a risky public token launch. Thus, financially stronger players hold a natural edge in negotiations, acquiring key technologies, users, and licenses at favorable costs.

2. Is the Golden Era for Web3 Builders Arriving?

In the past, many Web3 projects relied on the “launch token → price surge → buyback/cash-out” exit path—a model highly dependent on secondary market sentiment and vulnerable to token price volatility. M&A offers an alternative, more stable route: being integrated by strategic buyers within or outside the ecosystem, receiving cash/equity compensation, or becoming part of a larger platform’s product line. This provides smoother capitalization pathways for teams and technologies, freeing them from betting everything on token launches and exchange listings—a process often seen as exploitative.

The acquisition activities of players like Coinbase and Kraken have, to some extent, broadened the ways Web3 projects and teams can realize value. In the current capital winter, this injects much-needed confidence into early-stage crypto equity investments, offering renewed hope to crypto entrepreneurs.

The rise of M&A in the crypto industry is no accident—it's driven by market maturation, capital restructuring, regulation, and evolving user demands. M&A enables faster reallocation of technology, users, and compliance capabilities within the crypto market. Industry leaders use acquisitions to strengthen and expand their moats, while smaller projects gain relatively stable exit and development paths.

In the long run, this wave of consolidation could激励 many crypto projects to evolve from tech communities or marketing-driven ventures into truly commercial companies with solid technology and clear user applications—shifting focus back to product experience, compliance, and real-world adoption. Undoubtedly, this benefits the industry’s long-term health and accelerates mainstream integration.

Of course, M&A is not a panacea. Giants still face significant uncertainties—such as integration challenges. Successfully incorporating the acquired entity’s strengths across organizational, product, compliance, and customer dimensions is complex; failure often results in “buying an empty shell.” There’s also the risk of valuation bubbles, which could negatively impact the acquirer’s cash flow and profitability.

Nevertheless, this trend represents major positive news for crypto entrepreneurs and the long-term ecosystem. The market will offer more favorable conditions for projects genuinely focused on technology and real-world use cases. Questions like “How do we exit if you don’t launch a token?” will gradually fade from founders’ and builders’ minds. Their golden era is approaching.

The crypto industry in 2025 stands at such a turning point. Rather than merely a capital game, this is an inevitable step toward maturity.

In the coming years, we may see exchanges evolve beyond mere trading venues into one-stop financial supermarkets; wallets becoming users’ gateways to on-chain finance; and stablecoins serving not just as digital cash, but as the foundational currency for cross-border instant settlements.

And it all begins with this wave of “M&A fever.”

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News