After an 80% loss, a crypto trader's darkest hour

TechFlow Selected TechFlow Selected

After an 80% loss, a crypto trader's darkest hour

Maybe you've lost your "coins," but you still have your "experience points" (XP).

Author: Alexander Choi

Translation: TechFlow

"I sacrificed everything for this... and it came down to this..."

Just last week, your portfolio dropped 80% from its all-time high (ATH).

You start reflecting on what you could have done differently. How you should have assessed risk better, respected crypto as a highly volatile asset class. And of course, those sleepless nights spent trading—time that could have been spent with friends, family, or learning new skills.

For me, this moment happened in the summer of 2024, during a post-halving market panic (FUD).

Prior to that, I had been stuck at break-even or losing for six straight months. Sometimes grinding in the markets up to 18 hours a day while also keeping up with school (I was still a student at the time).

Then, in May 2024, I turned my last $500 into $104,000 in under two weeks. But within the following month, I lost it all the way back down to $18,000.

This experience plunged me into one of the worst phases of my life. I temporarily stepped away from crypto, started going out drinking every other day, stayed up late watching Game of Thrones, and played League of Legends.

Image: Once reached Emerald 1

Even after such a major drawdown, I now sit more steadily. But anyone who has been through—or is going through—something similar knows that the real damage from a portfolio "blowup" isn't just financial; it's the hit to your confidence as a trader.

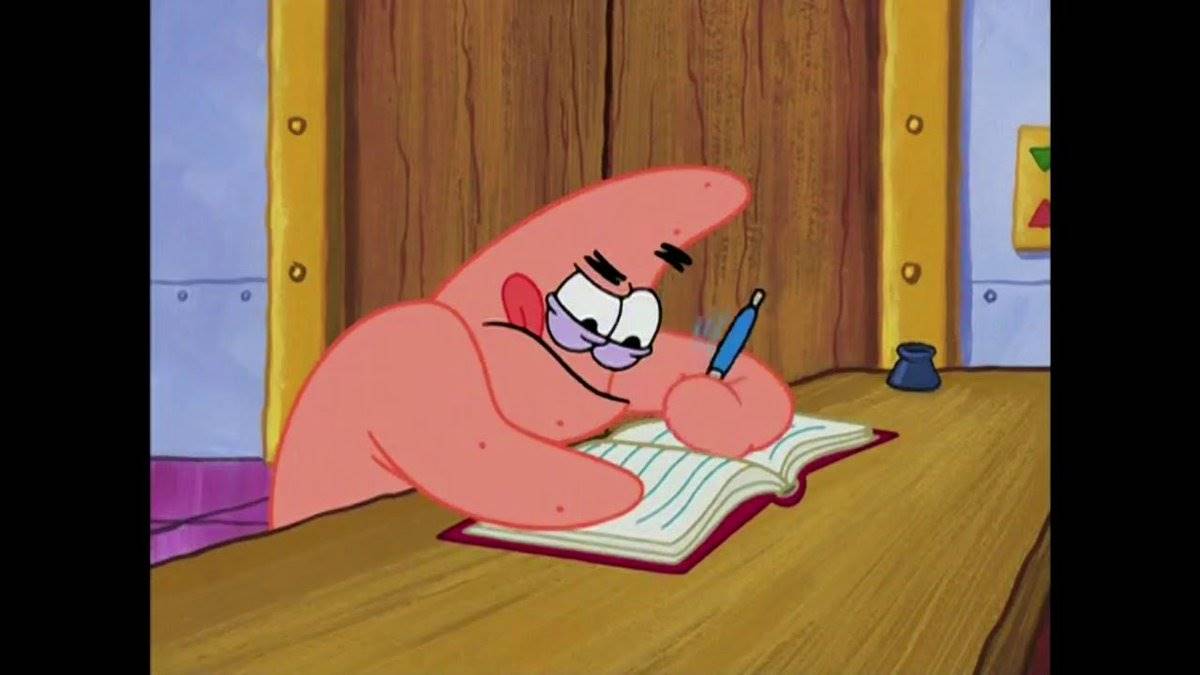

You begin questioning yourself:

"Was I just lucky...?"

Image: "Was it all just luck?"

And worst of all, you fall into a vicious cycle of self-doubt, desperately trying to trade your way back with the next position.

What should I do?

Remember, every great trader has endured multiple 80% portfolio drawdowns.

What makes them great is how they rise afterward. And to help you get through this, I want you to remember one thing:

"If I did it once, I can do it again."

Say this to yourself every morning when you wake up. Look back and find the strength that inspires you.

I've seen people suggest detaching yourself from your portfolio's all-time high (ATH), saying it was never really "you" anyway. But I disagree.

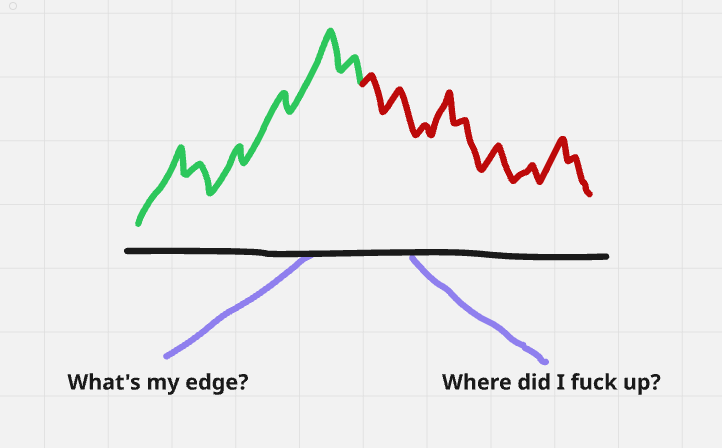

No matter what, the abilities that got your portfolio to ATH are still part of you. You don’t magically lose those skills. Instead, you may have simply overlooked certain factors or broken your own trading rules somewhere along the way. So what we need to do is simple: categorize the problem.

-

What am I good at? (How did I reach my portfolio ATH?)

-

Where did I go wrong?

Take some time to write these two things down.

Image: Simple question, complex answer

For example, when I grew $500 into $104,000, I did so entirely by aggressively buying trending new pairs on-chain. I was skilled in narrative analysis, assessing ceiling potential for new narratives, doing research, and trading high-beta assets. At that time, on-chain trading was extremely hot—and perfectly aligned with my strengths.

But where I failed was continuing to trade with the same high-risk style even after the market shifted and volume dried up. After a string of losses, I tried to recover by increasing my position size, which only led to a double blow.

You need to view cryptocurrency trading as an ongoing process. Profits and losses aren't isolated events.

After a severe drawdown, the only way to truly rebuild your confidence is to rediscover your core identity as a trader.

Image: Knowing yourself matters more than knowing the greater fool

If you haven’t already started keeping a trading journal, now is the time. This is where a trading log becomes essential. From now on, record every single trade and jot down your daily thoughts on the market. Don’t worry about format—whether it’s documents, notes, or pen and paper, use whatever feels comfortable, but actually write it down.

Ask yourself:

-

What is the narrative behind the coin I’m trading?

-

Why did I enter at that specific point?

-

Why did I hold for so long?

-

Why did I exit at that level?

-

And so on, and so on...

Image: Where exactly did I go wrong?

Writing these things down helps you contain your mistakes while reinforcing the areas you’re already strong in. When you see in your own handwriting the habits that led to your best performances, it brings clarity to your strengths.

Why are you here?

From now on, with every trade—especially as you begin climbing back—ask yourself one question: "Why am I doing this?"

Image: What is your goal?

After my first 80% drawdown, during those late-night sessions, I often sat there wondering: if I keep going like this, will my life forever remain in this state? Staying up late gaming, drinking aimlessly, achieving nothing beyond a League of Legends rank.

Only when I found my "why" did I return to consistent trading.

Why am I so desperate to succeed? Because my parents poured endless effort, sweat, and money into me—I don’t want them to end up seeing me as just a NEET obsessed with games and pretty girls.

Why am I so desperate to succeed? Because I want to give back to the family and friends who’ve supported me along the way.

Why am I so desperate to succeed? Because I don’t want to spend years studying only to become a lifelong "wage slave," working for others forever.

With every trade, I carry these "whys" with me. If your only motivation is simply "making money," without deeper meaning, those virtual numbers on your screen won’t sustain you through dark times.

So right now, try imagining—what if you were already dead?

No preparation, nothing left behind—just gone. What would your first thought be?

That you failed to leave anything your parents could be proud of?

That you lacked the ability to support your family?

Or regret not creating more experiences in life for yourself?

You probably wouldn’t think about some arbitrary number in your account. That is your "why." That is the meaning of your life right now.

Beyond any risk management advice, this is the core question: "If I make this trade, does it bring me closer to my life goals?"

Having a clear purpose will give you all the discipline you need during quiet market days.

Believe in yourself

Especially if you're young, you likely have more time than you think. Apply this long-term perspective to your trading.

Do you think this cycle is over?

Then use the bear market—when others quit—to sharpen your skills, prepare for the next cycle, and even achieve financial freedom in the next bull run.

I know this journey is hard. I know it feels like the whole world is against you, and no one in your social circle understands your struggle. But as long as you learn something from this failure and maintain discipline when others give up, you will ultimately come out ahead.

Maybe you’ve lost your "coins," but you still have your "XP."

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News