Neobank Yearbook: A Quick Guide to the Current State of Neobanks

TechFlow Selected TechFlow Selected

Neobank Yearbook: A Quick Guide to the Current State of Neobanks

As the neobank ecosystem matures, they will become the operational layer of the digital economy.

Author: Stacy Muur

Compiled by: TechFlow

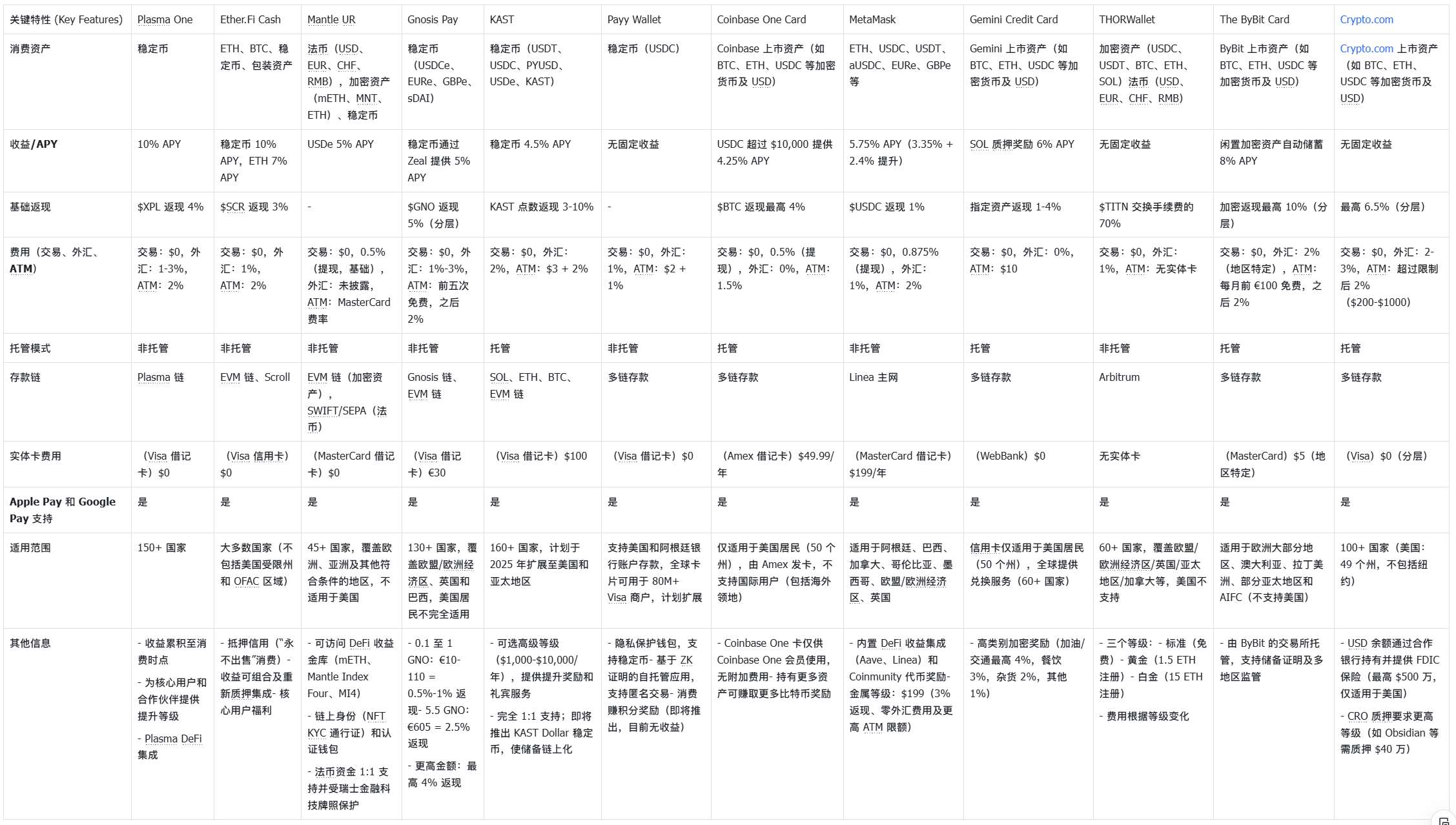

This is one of the most detailed articles I’ve published on X or Substack. Initially, my goal was to map out the rapidly growing crypto neobank industry comprehensively and compare all major players, helping my readers choose the best crypto neobank for their needs.

I believe I have achieved that goal.

Welcome to my panoramic guide to crypto neobanks.

Special thanks to @exagroupxyz and @Defi_Warhol for their input and suggestions.

There was a time when managing your crypto assets meant switching between multiple wallets, navigating complex exchanges, paying high fees for conversions, and struggling to spend them in the real world.

Today, a new generation of crypto neobanks is completely rewriting this experience. From a single app, you can hold interest-bearing stablecoins, spend them at merchants, and transfer funds globally with near-zero friction.

Some crypto neobanks operate like fintech banks built on crypto infrastructure; others are fully on-chain, integrating stablecoins, decentralized finance (DeFi) protocols, and self-custody wallets into one ecosystem.

This report will explore the current state of crypto neobanks, how they work, what services they offer, and which ones lead in user experience, yield, and adoption.

Source: https://www.stacymuur.com/neobanks

Compiled by: TechFlow

Leading Crypto Neobanks

Plasma One

@Plasma One is a stablecoin-first crypto neobank and crypto debit card platform combining savings, spending, transfers, and digital dollar yields.

The platform is built on Plasma’s Layer-1 blockchain and is marketed as the world’s first neobank fully designed around stablecoins, primarily targeting global users—especially those in emerging markets relying on USD-backed stablecoins for daily financial activities.

Plasma One is well-funded, backed by notable investors including Peter Thiel’s fund and Tether’s CEO, having raised $24 million and completed a $373 million token sale through its native token $XPL, which was oversubscribed.

Core Features

-

Non-custodial stablecoin wallet: Users hold their private keys without needing seed phrases.

-

High-yield savings: Up to 10%+ APY on $USDT balances, with earnings accruing continuously even while spending.

-

Visa Debit Card (virtual + physical): Spend stablecoins directly at over 150 million merchants across 150+ countries.

-

4% cashback on spending: Paid in $XPL, with higher reward tiers for frequent users and partners.

-

Instant stablecoin payments: Free on-chain $USDT transfers worldwide (ideal for cross-border teams).

-

Seamless DeFi integration: Yield sources connected to EtherFi and other liquid staking strategies.

Fees

-

$0 transfer or spending fees

-

$0 monthly or maintenance fees

-

No top-up requirements: Spend directly from yield-bearing balances

-

Foreign exchange conversion: Handled by Visa network at standard rates

-

Withdrawal fees: Only charged if imposed by third-party partners

Additional Information

-

Coverage: Available in 150+ countries where Visa operates

-

Supported stablecoins: Initially supports $USDT (Tether), with more to follow

-

Backed by: Peter Thiel’s Founders Fund and other Tether executives

-

Card issuer: Issued by Signify Holdings, a Visa partner

-

Security: Hardware-backed keys, encrypted storage, continuous audits, and real-time fraud detection

Ether.fi Cash

Ether.fi Cash ($ETHFI) is a non-custodial crypto neobank and Visa card platform allowing users to spend, borrow, and earn on $ETH, $BTC, and stablecoins while maintaining full control over their assets. Designed for crypto-native individuals and organizations, it combines DeFi yield strategies with real-world financial functionality, enabling access to staking, restaking, and credit-based liquidity without selling tokens. If you plan to start using @ether_fi, use my referral link to get a $20 welcome bonus: https://www.ether.fi/refer/68d6564d

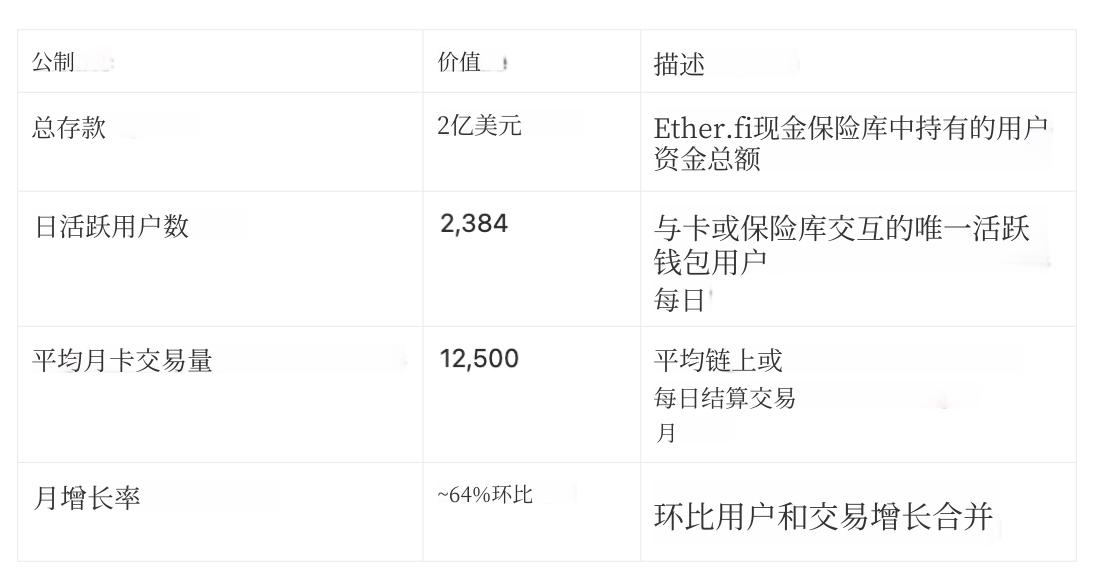

Ether.fi Cash Ecosystem Metrics (as of October 20, 2025)

Data source: Dune Analytics, DeFiLlama

Since its mid-2025 launch, Ether.fi Cash has become one of the most active crypto card products on the market.

According to Dune Analytics, the platform manages over $200 million in deposits, supports about 12,500 card transactions monthly, and has over 2,300 daily active users.

The product has a significant total addressable market (TAM) and an abstraction layer designed to attract both professional investors and everyday users, who are likely to flow into other Ether.fi products.

Core Features

-

Visa Credit Card: Backed by crypto collateral

-

Instant cashback: 3% on all spending (up to 20% during promotions)

-

Direct spending: Spend directly from DeFi yield vaults ("earn while you spend")

-

High-yield DeFi vaults: ~10% APY on stablecoins, ~7% APY on $ETH

-

Fully non-custodial: Users retain full control of assets

-

Auto-repayment options: Repay via staking/restaking rewards automatically

-

Card compatibility: Virtual and physical cards support Apple Pay and Google Pay

-

Corporate card system: Designed for DAOs and crypto teams with spending controls

Fees

-

No card issuance or monthly fees

-

Foreign transaction fee: 1%

-

ATM withdrawal fee: 2%

-

0% interest during promotion period (later based on DeFi rates)

-

No hidden or inactivity fees

Additional Information

-

Coverage: Available in most countries (excluding U.S. restricted states and OFAC regions)

-

Blockchain: Built on Scroll Chain

-

Cashback payment: Paid in crypto ($SCR or $ETHFI), credited automatically per transaction

-

Security: All vaults and logic are on-chain and audited

-

Card issuer: Issued by a U.S. banking partner authorized under the Visa network

-

Optional DeFi insurance: Provided via Nexus Mutual

Mantle UR

Mantle UR, launched by @Mantle_Official, is the world’s first fully blockchain-based neobank aiming to unify fiat and crypto finance within a single account. @UR_global connects traditional finance (TradFi) with decentralized finance (DeFi) through a borderless smart financial app, enabling seamless spending, saving, and off-ramping. It offers a fully compliant, Swiss-regulated account where users can earn on-chain yields, access fiat on/off ramps, and spend crypto globally.

If you choose UR as your neobank, start here with my referral link: https://get.ur.app/login?code=qayz5d

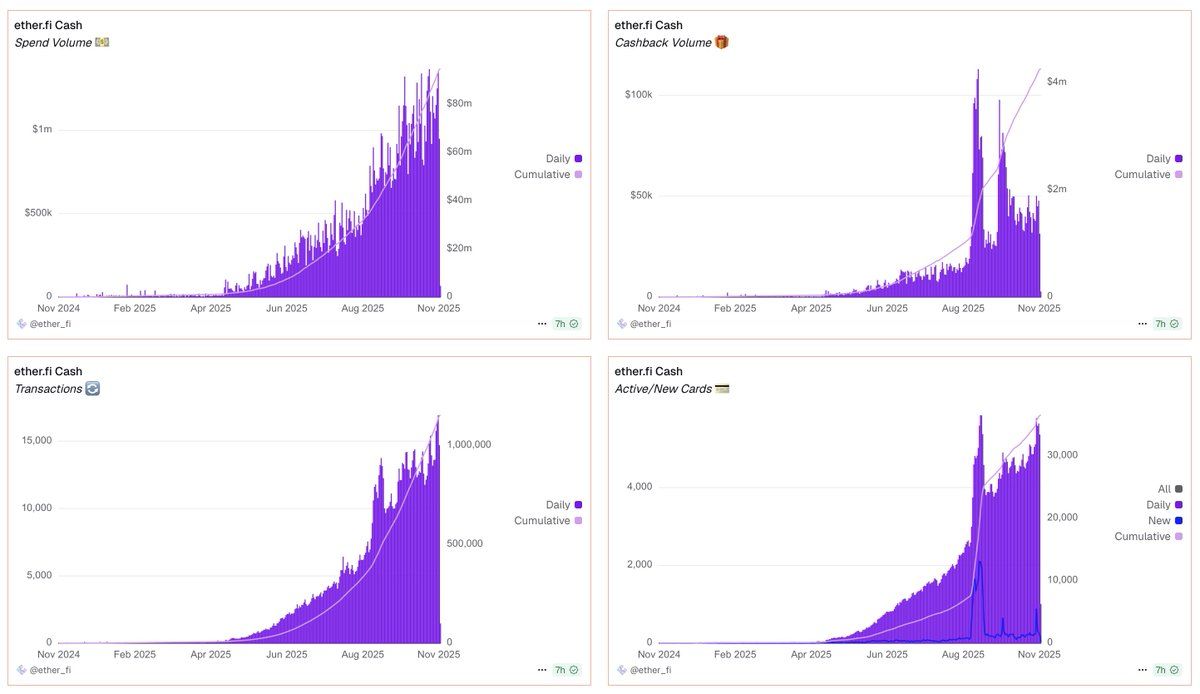

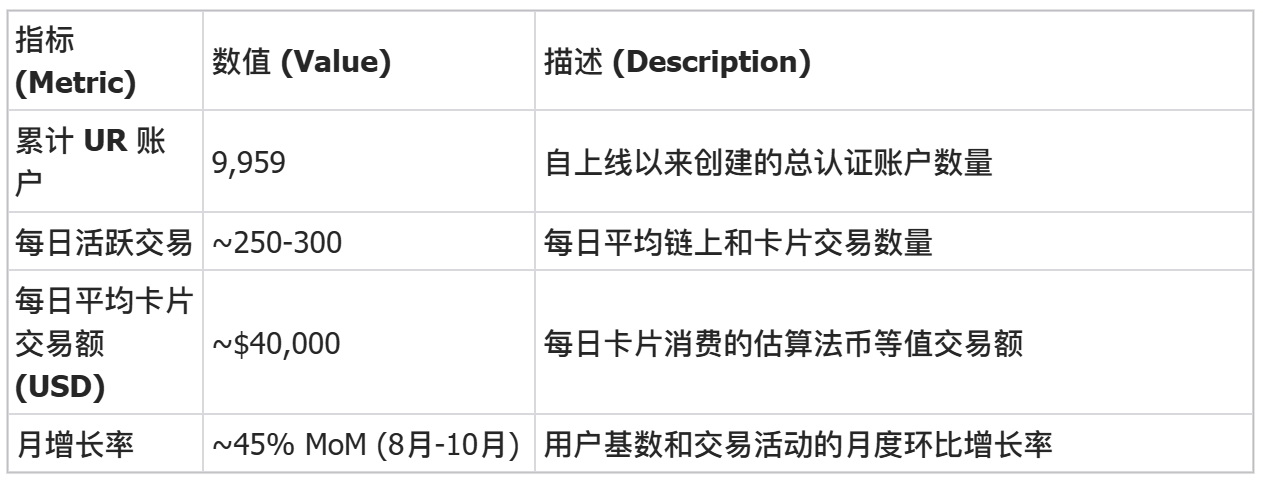

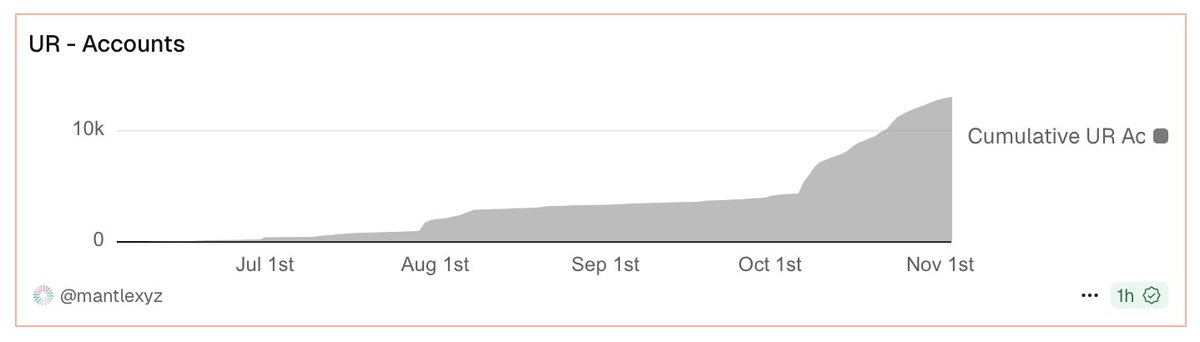

Data source: Dune Analytics - Mantle UR Dashboard (@mantlexyz) | Data as of October 23, 2025

Since its mid-2025 launch, UR has shown strong early momentum, nearing 10,000 cumulative accounts with growing ecosystem activity. Daily transaction volume remains steady between 250–300, and average daily card spending exceeds $40,000 on key assets.

Data source: Dune Analytics - Mantle UR Dashboard (@mantlexyz)

Backed by Mantle’s treasury of over $2.3 billion and strategic partners like Bybit, UR leverages Mantle’s infrastructure to integrate stablecoin yields, regulated banking services, and global payments, positioning itself as a “liquidity chain” for institutional and retail users.

Core Features

-

Multi-currency Swiss IBAN account: Supports USD, EUR, CHF, RMB, and more

-

Self-custody smart wallet: Integrated with fiat

-

5% APY native yield: Powered by Ethena’s USDe integration

-

Access to DeFi yield vaults: Including mETH, Mantle Index Four (MI4)

-

Mastercard Debit Card: Virtual and physical cards usable in 40+ countries

-

Crypto-backed credit line: Supported by mETH and FBTC

-

On-chain identity: NFT KYC pass and verified wallet

-

Payment integrations: Supports Apple Pay, Google Pay, Alipay, and WeChat Pay

-

Mantle Rewards Hub: Earn $MNT token rewards

Fees

-

Basic account: 0.5% withdrawal fee; Professional account: 0% (exact terms undisclosed)

-

USDe → Fiat conversion: No withdrawal fees

-

Stablecoin deposits & internal transfers: 0% fee

-

Competitive FX spreads: No hidden foreign currency markup

-

ATM withdrawals: Standard third-party ATM fees may apply via Mastercard

Additional Information

-

Coverage: Available in 45 countries across Europe, Asia, and Latin America; not available in the U.S.

-

Fiat fund protection: 1:1 backed and protected under Swiss fintech license

-

Regulation: Regulated by Swiss Financial Market Supervisory Authority (FINMA) via SR Saphirstein AG

-

Backing: Supported by Mantle DAO (formerly BitDAO) with a multi-billion-dollar treasury

Gnosis Pay

@gnosispay launched in 2023 as a self-custody payment network on Gnosis Chain, bridging traditional finance (TradFi) and decentralized finance (DeFi).

The platform offers a Visa debit card directly linked to Gnosis Safe smart accounts, enabling users to spend stablecoins like cash at over 80 million merchants globally. As neobank infrastructure, it focuses on B2B solutions for wallets, exchanges, and fintech companies to launch branded stablecoin card programs. Consumers access the service through partner apps such as Zeal Wallet or Rebind.

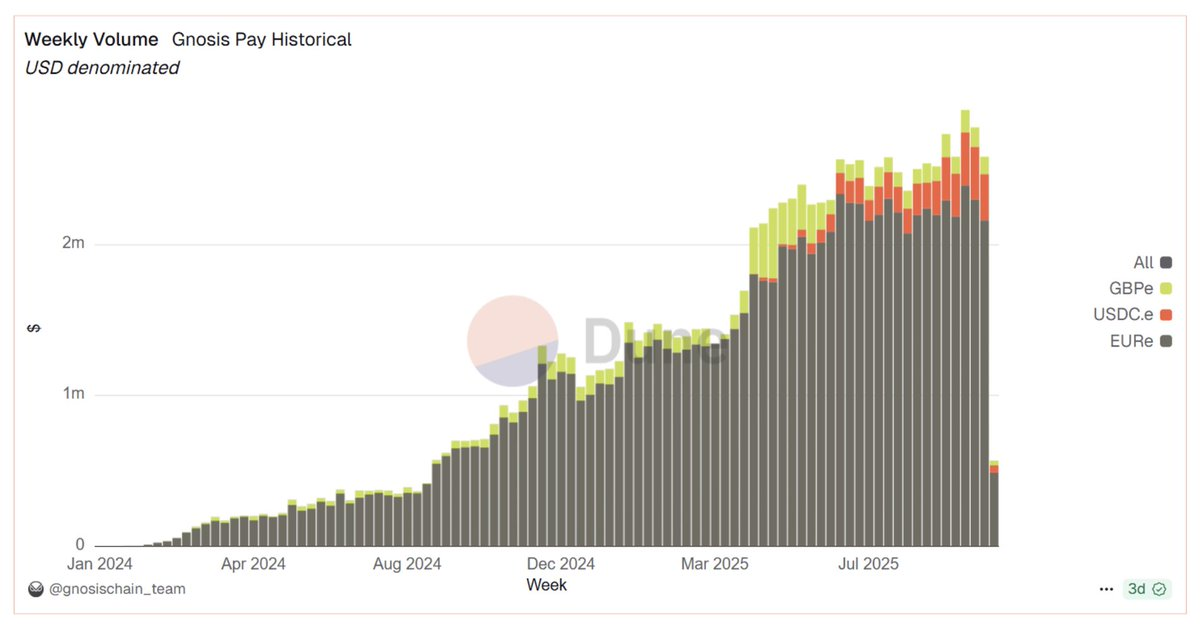

Source: Dune Analytics — Gnosis Pay Analytics (@gnosischain_team) | Data as of October 23rd, 2025

Since launch, Gnosis Pay has processed over 1.7 million payments totaling more than $1.7 million, with steady growth in transaction volume and active users.

Currently, Gnosis Pay supports over 21,000 funding addresses, averaging ~$2.5 million in weekly settlements, primarily driven by EURe spending from European users.

Core Features

-

Visa Debit Card: Virtual and physical cards accepted at 80 million merchants across 130 countries

-

Self-custody security: Asset custody via Gnosis Safe — "Your keys, your coins"

-

Direct crypto spending: Supports EURe, GBPe, and USDCe (on Gnosis Chain)

-

Up to 5% cashback: Paid in $GNO, tiered by $GNO holdings, with +1% extra for OG NFT holders

-

Personal IBAN (SEPA) account: Enables bank transfers via Monerium

-

Payment integrations: Supports Apple Pay, Google Pay, and global ATM withdrawals

-

Instant on/off ramps: No gas fees paid by users during card spending

-

Programmable spending controls: Set daily limits, allowed tokens, and whitelist merchants

-

DeFi-compatible wallet: Connect external yield, DEXs, or lending protocols for flexible fund management

Fees

-

No monthly or annual fees: Free card usage

-

Physical card issuance fee: One-time €30.23

-

No FX markup or transaction fees

-

ATM withdrawals: First 5 per month free, then 2% fee

-

Gas fees: Covered by Gnosis Pay for card transactions

Additional Information

-

Inactive balance yield: No built-in APY; users can deploy funds to external DeFi strategies via Gnosis Safe

-

Coverage: Live in EU, EEA, UK, and Brazil (via local partners); expanding to LatAm and APAC; waitlist elsewhere

-

Restricted jurisdictions: Not available in sanctioned or high-risk regions

-

Security module: Delay module adds ~3-minute buffer to cancel suspicious transactions

-

Network: Runs on Gnosis Chain

KAST

@KASTcard launched in 2025 by a Singapore-based fintech company as a Visa-powered stablecoin crypto card and neobank platform. It combines traditional USD banking with crypto spending and staking, offering users a global USD account, stablecoin spending (debit card usable at 150M+ merchants and ATMs), and high yields via Solana staking. With compliance in Singapore and UAE, KAST aims to be a "stablecoin super app," delivering secure asset management and global convenience.

Core Features

-

Global Visa Debit Card: Usable at 150M+ locations across 160+ countries

-

Multi-chain stablecoin support: Hold and spend USDT, USDC, PYUSD, USDe, and KAST Dollar

-

Cashback rewards: 3%-10% cashback in KAST Points (redeemable for rewards or token utilities)

-

Upcoming “Grow” savings account: ~4.5% APY on stablecoins

-

Integrated fiat rails: Supports ACH, SEPA, PIX, SWIFT for deposits and withdrawals

-

Solana staking integration: Up to 21% APY (SOL + KAST rewards)

-

Payment integrations: Supports Apple Pay and Google Pay for direct “tap-to-pay” with stablecoins

-

Real-time transaction alerts: Instant in-app card controls and notifications

-

Card options: Virtual and metal cards, including gold and LED-lit premium versions

Fees

-

Free account creation and virtual card issuance

-

Zero base currency transaction fees

-

Foreign transaction fee: 2% on non-USD spending

-

ATM withdrawal fees: $3 + 2% of amount withdrawn

-

Optional premium membership: $1,000–$10,000/year for enhanced rewards and concierge services

-

Stablecoin top-ups: No deposit or transfer fees

Additional Information

-

Coverage: Available in 160+ countries, planning U.S. and APAC expansion in 2025

-

Custody model: Partnered with licensed entities and regulated reserve custodians

-

Stablecoin backing: Fully 1:1 reserved; future KAST Dollar will have on-chain reserves

-

Security: Managed via Visa’s global network with bank-grade encryption and anti-fraud protection

-

Supported blockchains: Solana, Ethereum, Tron, BNB Chain, Arbitrum, Polygon, XRPL

-

Backed by: Major fintech partners including HongShan (Sequoia China), Peak XV, Stripe’s Bridge

Payy Wallet

@payy_link is an Ethereum Layer 2 network designed for private, compliant, and gas-free stablecoin transactions. Built on ZK-validium architecture and a UTXO state model, it combines cryptographic privacy with usability, allowing users to send and receive stablecoins (like $USDC) privately, with zero gas fees and optional compliance.

Core Features

-

Privacy-focused wallet: Designed for secure stablecoin transactions.

-

Visa Debit Card: Offers virtual and physical cards (with glowing logo) for spending.

-

Instant zero-fee transfers: Private transfers via payment links with no fees.

-

On/off ramps: Supports deposits/withdrawals via bank, Apple Pay/Google Pay, and crypto wallets.

-

Self-custody app: Uses zero-knowledge proofs (ZK Proofs) to ensure transaction privacy and anonymity.

-

Security: Upcoming “Guardian” feature for added protection.

Fees

-

No fees: No transaction, deposit, gas, or monthly fees.

-

No FX fees: Non-USD transactions handled via Visa calculator.

-

Core services free: Emphasizes fully free core features.

-

Spending rewards: Upcoming rewards program (currently no yield mechanism).

Additional Information

-

Deposit support: Accepts deposits from U.S. and Argentine bank accounts.

-

Global payments: Cards usable at 80 million Visa merchants worldwide, with plans to expand.

Coinbase One Card

@Coinbase One Card is Coinbase’s crypto-based credit card and neobank service, merging traditional banking with the crypto ecosystem. Paired with Coinbase’s subscription service (“Coinbase One”), it integrates a rewards credit card (issued via American Express network) with the financial needs of crypto users, offering a comprehensive financial solution.

Core Features

-

Visa/Amex Credit Card: Up to 4% $BTC cashback on every purchase.

-

High-yield savings: 4.25% APY on USDC deposits (up to $10,000).

-

Staking reward boost: Extra 5% rewards on staked $ETH, $SOL, etc.

-

Fee-free crypto trades: Up to $500/month fee-free trading on basic Coinbase One plan.

-

Crypto repayment: Pay credit card balance directly with crypto.

-

Premium support and protection: Amex travel/consumer protections and priority customer support.

-

On-chain usage subsidy: Includes Base network gas fee credits.

-

Full integration: Deeply integrated with Coinbase exchange and wallet infrastructure.

Fees

-

No annual fee: The card itself has no fee, but requires Coinbase One subscription ($49.99/year for basic).

-

No fees: No FX, crypto spending, or ATM withdrawal fees.

-

Standard APR: Standard credit card interest applies if balance isn’t paid in full (APR not disclosed).

-

Crypto repayment fees: Standard Coinbase conversion spread applies.

Additional Information

-

Custody model: All assets held by Coinbase, a publicly listed U.S. company.

-

FDIC insurance: USD deposits FDIC-insured; crypto assets are not.

-

Availability: Only for U.S. residents (all 50 states, issued by Amex); not available internationally or in U.S. territories.

-

Security: 2FA, biometric login, address whitelisting, and card freeze controls.

-

Issuer: Co-issued by Amex and Cardless.

-

User profile: Not for credit building; designed for creditworthy, active crypto users.

MetaMask Card

@MetaMask Card is a self-custody crypto debit card developed by Consensys with Mastercard and Baanx (Crypto Life), designed for DeFi-native users. It allows users to pay with crypto directly from their MetaMask wallet anywhere Mastercard is accepted, featuring real-time on-chain conversion, yield on stablecoin balances, and crypto cashback rewards. It perfectly blends bank-grade functionality with wallet sovereignty.

Core Features

-

Global virtual and physical Mastercard debit card: Linked to MetaMask wallet.

-

Multi-asset spending: Pay directly with ETH, USDC, USDT, aUSDC, EURe, GBPe on Linea.

-

Self-custody model: Funds stay in user wallet until payment execution.

-

Real-time on-chain to fiat conversion: No pre-loading required; conversion at point of sale.

-

Integrated payments: Supports Apple Pay and Google Pay “tap-to-pay”.

-

Crypto cashback rewards: Earn 1%-3% USDC per spend (up to 13% with chain-linked reward partners).

-

Yield-bearing stablecoins: Supports aUSDC and Aave Boost (potential 4%-8% APY).

-

Built-in DeFi yield integration: Includes Aave, Linea, and Coinmunity token rewards.

-

Real-time management: In-app spending limits, instant freeze/unfreeze, and controls.

Fees

-

Standard card fees: No monthly or issuance fees.

-

On-chain gas fees: ~$0.01–$0.02 per transaction (Linea network).

-

Crypto conversion fee: 0.5%-0.875% depending on asset.

-

FX fee: 1% (waived for Metal tier).

-

ATM withdrawal fee: 2% (Metal tier gets $1,200 free monthly withdrawals).

-

Metal tier subscription: $199/year for 3% cashback, no FX fees, higher limits.

-

Other fees: No pre-load, custody, or transfer fees.

Additional Information

-

Availability: Argentina, Brazil, Canada, Colombia, Mexico, EU/EEA, UK, and pilot in U.S. and Switzerland.

-

Custody model: 100% self-custody; users fully control funds.

-

Security: Mastercard-level fraud protection, on-chain spending limits, full wallet control.

-

Supported blockchains: Initially Linea; plans to expand to Ethereum, Arbitrum, Polygon.

-

Issuer: Issued by Baanx (Crypto Life), a UK FCA-regulated e-money institution (EMI).

-

Eligibility: Requires KYC; open to global users, with expanded coverage expected in 2025.

Gemini Credit Card

@Gemini Credit Card is a crypto rewards credit card for U.S. users, launched by Gemini (a regulated crypto exchange) in partnership with WebBank. It targets everyday spending, letting users earn crypto rewards on fiat purchases—rewards that can appreciate or be staked—and features themed card designs.

Core Features

-

Personal use: For U.S. residents only, but usable globally.

-

High-category crypto rewards: Up to 4% back on gas/transit, 3% on dining, 2% on groceries, 1% on everything else.

-

Mastercard Credit Card: Physical and virtual cards with Bitcoin, XRP, and Solana themes.

-

Instant rewards: Cashback deposited directly into Gemini account for trading or holding.

-

Auto-staking: SOL rewards from Solana-themed card can be auto-staked.

Fees

-

No annual or FX fees: Free to use globally.

-

Late payment fee: Up to $8.

-

Returned payment fee: Up to $35.

-

High variable APR: 19.24%-35.24% (recommended to pay in full to avoid interest; rewards have no fee).

Additional Information

-

Availability: Credit card only for U.S. residents (all 50 states); exchange available in 60+ countries.

-

Custody model: Assets stored in offline cold wallets; hot wallet insurance provided.

-

Security: SOC 2 certified, 2FA, address whitelisting, and pass-through FDIC insurance for USD deposits.

THORWallet

@Thorwallet is a self-custody multi-chain wallet integrating a Swiss-regulated IBAN account (via Fiat24) and a virtual Mastercard, compatible with Apple Pay, Google Pay, and Samsung Pay. Users can convert crypto into funds and spend EUR, CHF, USD, and CNY globally, while retaining full non-custodial control over digital assets until transaction execution.

Core Features

-

Self-custody wallet: Multi-chain support.

-

Virtual Mastercard: Currently virtual-only; supports Apple Pay, Google Pay, Samsung Pay; spends in real-time from fiat sub-account; no pre-loading needed.

-

THORChain savings: Single-asset support (e.g., BTC/ETH), offering variable “real yield” via swap fees (paid in original asset).

-

Stablecoin vaults: Supports USDC/USDT (EVM-based), offering variable APY driven by fees.

Fees

-

Account/card fees: No monthly, annual, or inactivity fees.

-

Crypto-to-fiat top-up/FX conversion fees:

-

Standard users: 1.0% (free tier).

-

Gold users: 0.5% (one-time upgrade cost ~1.54 $ETH).

-

Platinum users: 0.25% (one-time upgrade cost ~15 $ETH).

-

Additional Information

-

Availability: 60+ countries including EU/EEA, UK, APAC, Canada; not available in the U.S. Bank/card services require KYC; wallet/DeFi functions are permissionless.

-

Limits (standard): ~$100,000/month bank transfers; ~$20,000/month card spending (~$10,000/day max). Higher for paid users.

-

Transfer method: Via SEPA/IBAN; ThorWallet charges no fees.

-

Network fees: Normal on-chain gas/THORChain fees (app optimizes some “gas-free” paths).

-

ATM function: Not supported (virtual card only).

-

Protocol staking ($TITN): Share in stablecoin yield, with boosted staking power.

ByBit Card

@Bybit_Official Card is a Mastercard-powered crypto debit card launched by global crypto exchange Bybit. It enables users to spend crypto directly at over 90 million merchants worldwide, offering real-time crypto-to-fiat conversion, high cashback rewards, and passive yield—designed for performance-oriented, crypto-native users seeking convenience.

Core Features

-

Virtual and physical Mastercard debit card: Chip, contactless, and ATM withdrawal enabled.

-

Real-time crypto-to-fiat conversion: Instant conversion at point of sale.

-

Supported assets: BTC, ETH, USDT, USDC, XRP, TON (more coming).

-

High cashback: Up to 10%, depending on Bybit VIP level.

-

Idle crypto yield: Up to 8% APY on idle crypto via auto-savings.

-

Compatibility with major platforms: Supports Apple Pay, Google Pay, Samsung Pay.

-

Security: 3D Secure, instant freeze/unfreeze, transaction alerts.

-

Extra perks: ATM withdrawals, subscription cashback (Netflix, Spotify), loyalty points.

Fees

-

No annual, monthly, or inactivity fees.

-

Crypto conversion fee: ~0.9% per transaction.

-

FX fee (non-EUR): ~0.5%.

-

ATM withdrawal fee: First €100/month free, then 2%.

-

Card fees: Virtual card free; physical card ~€5 (free for VIP users).

-

Cashback: Paid in Bybit Points, redeemable for crypto or benefits.

Additional Information

-

Availability: Most of Europe, Australia, LATAM, select APAC countries, AIFC; not available in the U.S.

-

Eligibility: For non-U.S. users; requires full KYC (ID + address proof).

-

Funds custody: Held in Bybit’s custodial accounts.

-

All-in-one functionality: Unified dashboard for yield, rewards, and spending.

-

Security & compliance: Custodied by Bybit, with Proof-of-Reserves and multi-jurisdiction regulation.

-

Target users: Active traders, advanced DeFi users, and those wanting high cashback without sacrificing liquidity.

Crypto.com

Crypto.com offers a prepaid Visa card (“Crypto.com Card”) and integrated neobank features (cash account and rewards). The card lets users spend crypto (via off-chain payments) or fiat wherever Visa is accepted, with tiered rewards paid in $CRO. Banking features include an insured USD account (with IBAN/ACH) via Green Dot Bank (U.S.), offering up to 5% APY. Together, they form a user-friendly crypto card and banking suite available in many countries.

Core Features

-

Personal use: Global Visa payments in 40+ countries

-

Tiered cashback: Up to 8% (Obsidian tier)

-

Prepaid Visa card: Metal cards of various tiers for shopping and ATM withdrawals

-

Integrated app: Exchange, wallet, NFT marketplace, lending

-

Crypto yield: Earn by locking assets

-

Premium perks: Spotify/Netflix rebates, airport lounge access, exclusive events

-

Custodial ecosystem: Supports payroll and deposits

Fees

-

No annual, monthly, or FX fees

-

Free ATM withdrawals (limit $200–$1,000/month by tier); 2% fee beyond limit

-

Low in-app trading fees (0.075%); free deposits and core trades

-

Higher tiers require $CRO staking (e.g., Obsidian requires $400,000)

Additional Information

-

Available in 100+ countries (U.S.: 49 states, excluding NY)

-

USD balances held via partner banks, FDIC-insured (up to $5M in U.S.)

-

Default custodial wallet; standalone DeFi Wallet for decentralized use

-

Rewards require $CRO usage; high-tier rewards need staking/locking

-

$CRO rewards paid instantly to Crypto Wallet, tradable or sellable

-

Fully KYC-compliant; regulated in U.S., EU, Singapore, UK

Conclusion

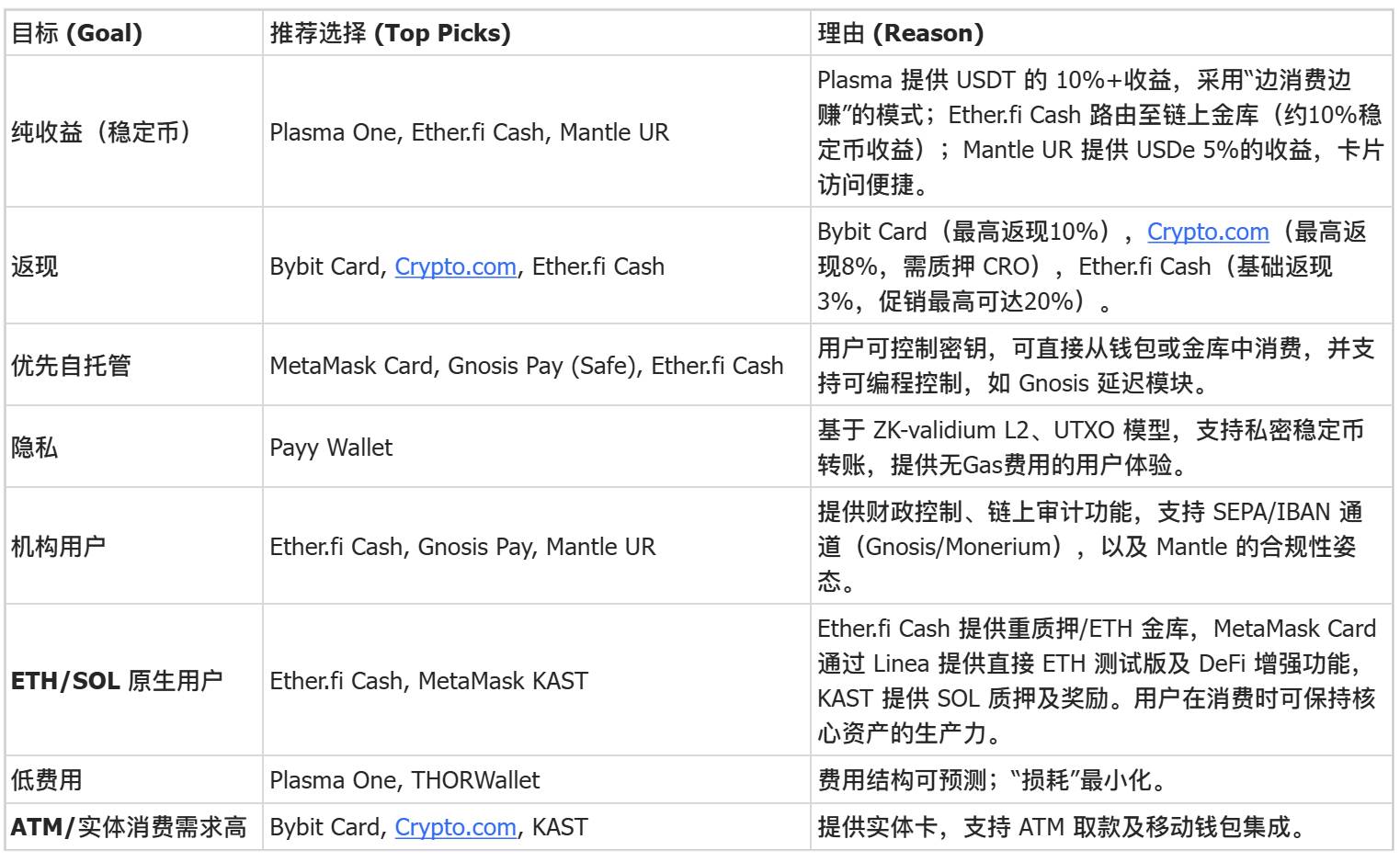

In the end, an objective decision matrix reveals each crypto card’s strengths, focusing on what truly matters to real users: tangible yields, uncompromised rewards, custody models, fees, and actual availability.

Each crypto card reflects different assumptions about DeFi’s future—whether centered on yield, rewards, compliance, or privacy—but their shared trajectory is clear: crypto-native money is converging with modern fintech usability standards. Products that strike the right balance between regulatory clarity, user control, and global accessibility—without sacrificing security and transparency—will emerge as winners.

As the neobank ecosystem matures, these platforms will become the operating layer of the digital economy. Their success depends not just on branding or token incentives, but on consistently delivering reliability, flexibility, and real-world value for global users.

Have you already become a user of “neobanks”?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News