The Protagonist's Trading Code: The Journey from Bystander to Trendsetter

TechFlow Selected TechFlow Selected

The Protagonist's Trading Code: The Journey from Bystander to Trendsetter

Separate outcomes from decision quality; a losing bet can still be a good decision.

Written by: tradinghoe

Translated by: AididiaoJP, Foresight News

Confidence is the most important trait of a successful trader. You must be able to act on your beliefs, either with or against the market.

Don't Be the Denominator

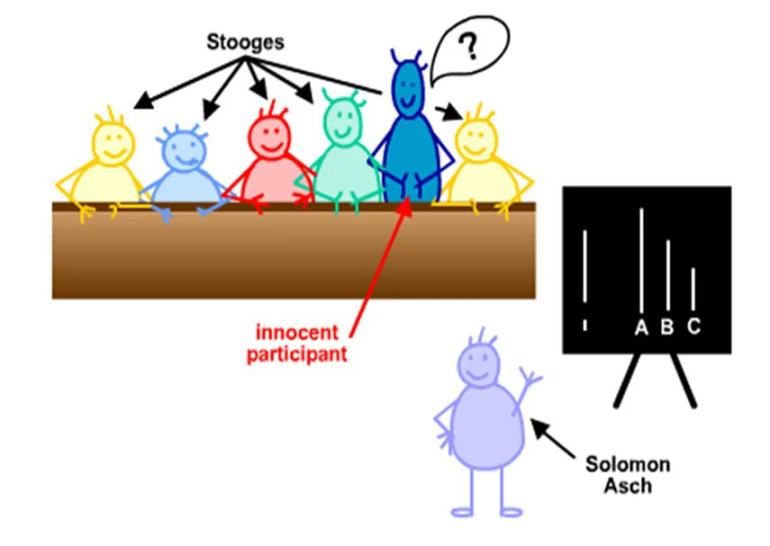

Going back to the 1950s, Solomon Asch conducted a series of experiments on how individuals change their opinions to conform with the group.

In these experiments, actors would pretend that lines of different lengths were equal, observing whether an individual non-actor participant would follow the group consensus despite knowing it was clearly wrong. In about 33% of cases, participants accepted the obviously false claim made by the actors. The experiment aimed to show how easily we humans are influenced by consensus, even when we know the truth contradicts it.

Clearly, this experiment has many parallels with trading.

Asch conformity line experiment

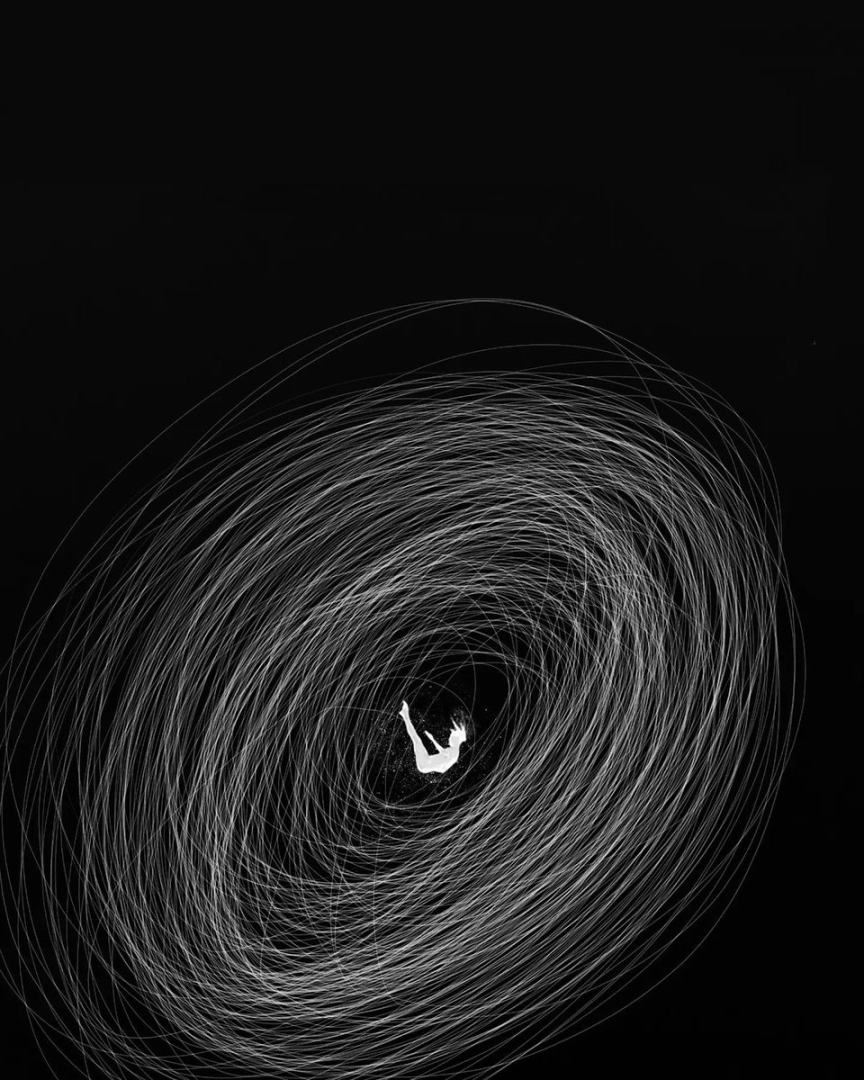

The Downward Spiral: When Confidence Cracks

The loss of confidence does not arrive with a single catastrophic moment—it erodes gradually.

You begin doubting trades you'd previously trust without hesitation. You see the opportunity early; the charts look good, the narrative is forming, fundamentals align, and the crowd still backs it—but something holds you back. Then you watch the move unfold while you're left behind.

You fall into a spiral of self-doubt.

This creates a vicious cycle that looks like this:

Missed opportunity → Weakened confidence → Increased hesitation → More missed opportunities → Further erosion of confidence

You're not making bad trades—you're avoiding trades altogether. Or worse, your positions are so small that even when you're right, they have little impact on your account value. You become a spectator in your own trading journey, watching others jump into opportunities you spotted first.

What's most painful? You know the trade was valid, the narrative existed, it was a shiny new thing. Your analysis was sound, but you simply couldn't trust yourself enough to act.

Confidence → Belief → Capital

A chain reaction separates successful traders from perpetual spectators:

Confidence breeds belief.

Without confidence, you cannot commit. The opportunity is there, everything lines up, you've seen this play out the same way before—but you just can't pull the trigger.

Your hand hovers over the buy button, then you talk yourself out of it. "Maybe I'll wait for confirmation." "Let me see if others are talking about it." "What if I'm wrong?"

Confidence separates signal from noise.

When you trust your judgment, you can hold through early development stages while most of crypto Twitter hasn't noticed yet; you're waiting for them to catch up to the new narrative.

You're early because you act based on conviction while others hesitate.

Being early is everything. And what most traders don’t realize is: most narratives don’t appear fully formed. They don’t emerge out of thin air with a neat bow tied around them.

Someone Has to Step Up First

Narratives are born through a simple formula:

Shiny new thing + First confident voice + Opportunistic traders = Narrative formation.

Look back at any major narrative that moved the market—AI Meta (e.g., GOAT), meme coins on Solana/BSC, RWA plays, gaming ecosystems (e.g., footballdotfun), or even the current x402 tokens.

Each began with someone discovering a token, posting about it on X or their channel, and having the confidence to say “this is it” when no one else cared.

That pioneer didn’t have more information than you. They had no insider knowledge.

They had more confidence.

They were willing to be publicly wrong, to jump ahead of everyone on an argument that wasn’t obvious yet.

Market cycle figures are forged through public trades

Look at the figures who define each cycle—the ones people follow for alpha, the ones widely respected, whose mere mention of a ticker can move markets.

Most built their reputation through one absolutely legendary public trade—calling a move early and riding it all the way for massive gains.

They bought it, talked about it, were right—and suddenly everyone wanted to know what they’d buy next.

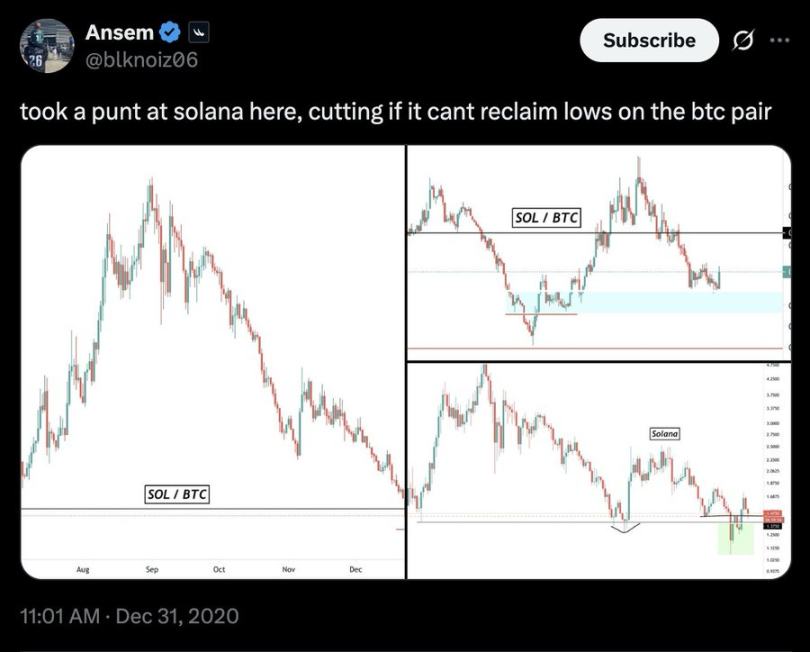

Take Ansem and His Call on Solana as an Example

Ansem was one of the earliest to recognize Solana’s potential and became known for relentlessly calling it.

When you hear about someone who bought SOL at $1 and held it to $200, you immediately think of Ansem.

Ansem's $1 call on Solana

Ansem didn’t just quietly buy SOL and hope he was right. He kept talking about it, promoted his position, publicly laid out his thesis, and took on the social risk of being wrong when nearly everyone else was bearish.

He didn’t trade in the shadows.

SOL went from single digits to over $200, Solana’s meme ecosystem exploded, early tokens he called surged 50x, 100x, some even more—and Ansem became one of the most watched traders of that cycle; not because he was smarter, but because he had belief and loudly voiced it when things weren’t obvious yet.

This is how icons are made: one public trade, immense conviction, willingness to be wrong in plain sight.

Meanwhile, most traders open positions but stay silent, wondering why they’re losing money without even being able to explain what they bought or why.

They trade in the dark, following those icons, gaining none of the benefits that come from publicly establishing belief.

If you can’t explain your thesis to someone else, do you really have a thesis? Or are you just spraying and praying?

Someone Has to Shill Their Own Bag

Here’s an uncomfortable truth: sometimes you have to buy a coin, then tell others about it.

Because if they don’t know, how will they buy?

Narratives need momentum, momentum needs attention. Attention requires someone willing to step up first, speak loudly, and risk saying “this is it” when it’s not obvious yet.

If @0xmert_ can shill ZEC to his entire timeline, what stops you from talking about what you’ve bought?

The difference between a token you bought that went nowhere and one that becomes a narrative isn’t always fundamentals. Sometimes it’s simply that no one talked about it, no one created social proof, no one put it on other traders’ radar.

You keep missing narratives early because you’re waiting for others to create them, not realizing you could be that person.

Think about it—every random moonshot token had a first buyer, a first person to tweet about it, a first trader who took a risk on an unproven idea and said “I think this might be something.”

The real question isn’t whether you can find good trades. It’s whether you have the belief to be first, to be loud, and to accept the consequences regardless.

That’s your edge.

Confidence Controls Your Position Size

Here’s an invisible advantage that separates great traders from mediocre ones: knowing when to size up and when to scale back.

It doesn’t come from spreadsheets or Kelly criterion calculators. It comes from pattern recognition developed through experience—and the confidence to act on it.

After hundreds of trades, after seeing tokens go 10x and also rug, after being early and late, after winning big and losing big on large positions—you develop an intuition. You know in your bones what conviction feels like.

Take the first meme coin in a new ecosystem play as an example

You’ve seen this pattern unfold across multiple cycles. A new chain launches or gains traction, and within days or weeks, a meme token emerges as the cultural flagship of that ecosystem. It captures attention first and becomes synonymous with the chain itself.

Trillions on Plasma Chain

The first leading meme coin on Plasma. If you’ve gained pattern recognition from past ecosystem launches, you know this setup.

Your edge here is getting in early at low cost, or entering at a reasonable market cap while there’s still room to run.

Ping on the X402 Ecosystem

Same pattern: X402 ecosystem launches, hype builds slowly, Ping emerges as the meme coin that grabs attention.

Take the “starvation play” pattern as another example

Markets go through dry spells—no major narratives, no clear entry points, traders are hungry, bored, holding cash with nowhere to deploy.

Then something good enough appears—not perfect, but credible. Because everyone is starved for a play, liquidity floods in quickly.

$$Aster and $$AVNT are perfect examples. After a period lacking major plays, traders saw these as potential high-liquidity contenders across different chains.

It wasn’t just fundamentals—it was timing. Traders were ready to deploy capital into anything with a narrative.

First-Mover Advantage on New Tech Too

Each cycle introduces new mechanisms, new protocols, new ways to financialize things that didn’t exist before. And every time, the first credible implementation of a new technology captures massive attention and capital.

Take Token Strategy Launch

The protocol launched DATS (Decentralized Autonomous Tokens) for NFT collections—a mechanism to financialize blue-chip NFTs.

PunkStrategy was the first strategy token launched from experiments tied to CryptoPunks.

If you recognized the pattern (first credible implementation of new tech + blue-chip NFT brand + novel mechanism traders haven’t seen), you knew this warranted a significant position.

$PNKSTR reached a market cap of over ~$300 million.

Why? Because it was the first DAT from Token Strategy. It had credibility from the CryptoPunks brand. It was something new that traders could understand and rush into. By the time the second or third NFT DAT launched, the novelty had worn off and returns were significantly compressed.

Confident traders don’t always need to fully understand the tech. They just need to recognize: “This is the first credible implementation of something new—this deserves a position.”

A confident trader can instantly assess: “This is a 0.5% position” vs. “This is a 5% position, maybe more.” You’re not just gambling—you’re calibrating based on accumulated wisdom and trusting yourself to execute.

When confidence is intact, you trust your judgment.

When confidence breaks down, everything feels like the same blurry bet. You size all your positions too small (or avoid them altogether) because you no longer trust your ability to distinguish high-conviction opportunities from marginal ones.

In your mind, every trade becomes a coin flip—even when your analysis tells you otherwise.

Your edge isn’t just in finding trades—it’s in knowing how much to allocate.

Rebuilding: The Edge You Lost Before Losing Money

The market will always be there, the money will always be there—but if you lose your edge—your belief in your ability to spot opportunities and act on them—you’ve already lost the game before losing any capital.

Before fixing your P&L curve, you must rebuild your confidence:

Make small, high-conviction trades

Not to make money, but to prove to yourself that you can still execute. You’re retraining your brain to trust your judgment again.

Document your trades

Separate outcomes from decision quality. A losing trade with good process is still a good trade. A profitable trade with poor reasoning is still a bad trade. Focus on the execution itself.

Your trading journal can be a private Telegram channel just for you, or your X account where you log trades and thoughts; good examples include @DidiTrading, @onchainsorcerer, @real_y22 (the 100k to 1M challenge).

Celebrate correct execution, even if the trade loses

Your position size was appropriate. You had a thesis, managed risk. That’s a win and a lesson gained, regardless of profit or loss.

Remember, every trader you respect has been where you are now.

Each has faced confidence crises, self-doubt, and paralysis. The difference is they rebuilt their confidence.

They decided to trust their execution even when it felt uncomfortable, did the trades they’d otherwise avoid. When inner fear whispered to reduce size, they increased it. They acted early and executed their trades without waiting for crowd validation. They treated both winning and losing trades as lessons learned.

The edge you lost long before losing money is the only edge that truly matters.

Protect it as fiercely as you protect your portfolio.

Because it is.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News