Controlled decay: When finance itself becomes the economy

TechFlow Selected TechFlow Selected

Controlled decay: When finance itself becomes the economy

Nominal growth can be manufactured, but real productivity requires restoring the connection between capital, labor, and innovation.

Author: arndxt

Translation: AididiaoJP, Foresight News

The market does not self-correct; government has once again become a key element in the production function.

The endgame is not collapse, but possibly a controlled downturn—a financial system surviving on reflexive liquidity and policy scaffolding rather than productive reinvestment.

The U.S. economy is entering an era of managed capitalism:

-

Equities are retreating

-

Debt dominates

-

Policy becomes the new growth engine

-

And finance itself has become the dominant sector of the economy

Nominal growth can be manufactured, but real productivity requires restoring the link between capital, labor, and innovation.

Without this, the system may persist, but no longer generates compounding returns.

Structural Shift in Capital Composition

The stock market was once the core engine of American capitalism, but it now fails to systematically provide accessible capital for broad segments of U.S. businesses. The result has been a mass shift toward private credit, which now acts as the allocator of capital across much of the middle market and capital-intensive industries.

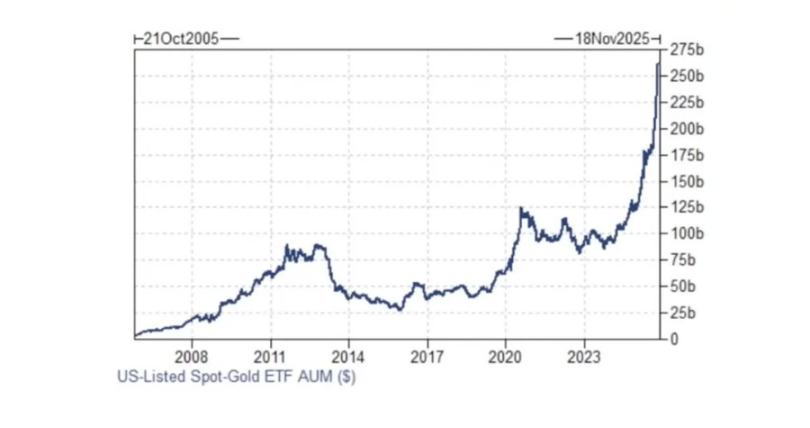

Public equity issuance remains near multi-decade lows, while assets under management in private debt have surpassed $1.7 trillion—mirroring the late stage of financialization. Companies are increasingly favoring debt over equity not because their creditworthiness has improved, but because public market structures are broken: low liquidity, concentration of passive investing, and punitive valuation multiples for asset-heavy business models make going public a suboptimal choice.

This creates an anomalous incentive loop: nobody wants a balance sheet. Asset-light, rent-extractive business models dominate valuation frameworks, while capital-intensive innovation lacks equity funding. Meanwhile, private credit has embraced an "asset capture" model: lenders win in any outcome—earning high spreads when companies succeed, seizing hard assets when they fail.

The Era of Financialization

This trend marks the peak of a forty-year hyper-financialization experiment. With interest rates structurally below growth rates, investors pursue returns not through productive investment, but via financial asset appreciation and leveraged expansion.

Key consequences:

-

Households substitute rising asset values for stagnant wage growth.

-

Corporations prioritize shareholder primacy, outsource production, and pursue financial engineering.

-

Economic growth decouples from productivity, sustained by asset inflation to maintain demand.

This dynamic of "debt without productive use" hollows out the domestic industrial base and creates an economy optimized for capital returns rather than labor returns.

Crowding-Out Effects and Credit Reflexivity

The post-pandemic fiscal regime exacerbates this issue. Record sovereign issuance crowds out private borrowers in public credit markets, pushing capital into private lending structures.

Private credit funds now price loans based on artificially compressed public spreads, creating a reflexive feedback loop:

-

Falling public issuance

-

Mandatory buyers chasing limited high-yield supply

-

Tighter spreads

-

Private credit repricing lower

-

More issuance shifting to private markets

-

Reinforcing the cycle

Meanwhile, since 2020 the Federal Reserve's implicit support for corporate credit has distorted the informational value of spreads themselves. Default risk is no longer priced by markets, but managed by policy.

The Problem with Passive Investing

The rise of passive investing further undermines price discovery. Index-driven flows dominate equity trading volume, concentrating ownership in a handful of trillion-dollar asset managers whose incentives are homogenized and benchmark-constrained.

Results:

-

Small and mid-cap public companies suffer structural illiquidity.

-

Equity research coverage collapses.

-

The IPO market shrinks, replaced by late-stage private financing rounds (Series F, G, etc.) inaccessible to public investors.

Market breadth and vitality have been replaced by oligopolistic concentration and algorithmic liquidity, generating volatility clusters when flows reverse.

Squeezing Out Innovation

Financial homogeneity is mirrored in the real economy. A healthy capitalist system requires heterogeneous incentives: entrepreneurs, lenders, and investors pursuing diverse goals and time horizons. Instead, today’s market architecture compresses risk-taking into a single dimension: return maximization under risk constraints.

Innovation historically flourished at the intersection of diverse industries and capital structures. The collapse of an ecosystem where "everyone lends, no one invests" is reducing serendipitous innovation and long-term productivity growth.

The Need for a New Industrial Policy

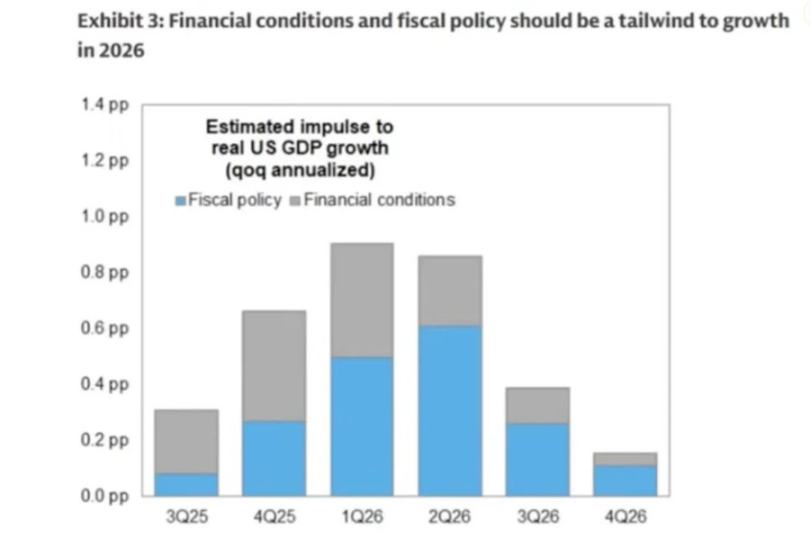

As this structure erodes organic growth potential, the state is re-emerging as a primary economic actor. From the CHIPS Act to green subsidies, fiscal industrial policy is being deployed to compensate for failures of private capital.

This represents a partial inversion of U.S.-China models: the U.S. now uses targeted public-private partnerships to re-anchor supply chains and generate nominal growth, while China leverages state-owned enterprises and manufacturing to assert global dominance.

Yet execution remains uneven, constrained by politics, inefficient in resource allocation, and geographically mismatched (e.g., building semiconductor plants in water-scarce Arizona). Nevertheless, the philosophical shift is decisive:

Social Contract and Political Reflexivity

The consequences of four decades of financialization are evident in the widening gap between asset wealth and wage income. Housing and equities now account for a record share of GDP, while real wages remain stagnant.

If opportunity is not redistributed—not through transfers, but through ownership—political stability will erode. The rise of populist and protectionist movements, from tariffs to industrial nationalism, is a symptom of economic disenfranchisement. The U.S. is not immune—it is leading this experiment.

Outlook: Stagnation, State Capitalism, and Selective Growth

Unlike a singular "Minsky moment," this regime implies gradual erosion: declining real returns, slow de-equitization, and policy-managed intermittent volatility.

Key themes to watch:

-

Public credit dominance: persistent deficits will intensify crowding-out effects

-

Onshoring industry: government-driven nominal growth via subsidies

-

Private credit saturation: eventually leading to margin compression and idiosyncratic defaults

-

Stock market stagnation: P/E multiples face a decade-long compression as capital chases certainty over growth

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News