What's behind Buidlpad's rise—four projects launched, all listed on Binance?

TechFlow Selected TechFlow Selected

What's behind Buidlpad's rise—four projects launched, all listed on Binance?

All projects launched by Buidlpad have been listed on Binance spot trading, or have become one of the top choices for project teams to directly list on Binance and other major exchanges.

By: Chloe, ChainCatcher

From late last year into this year, the ICO market—long dormant—has seen a revival. Fueled by the approval of Bitcoin ETFs, the Trump administration’s crypto-friendly policies, and the onset of a new bull cycle, public token sale platforms have once again become focal points for projects, retail users, and investors.

In this new cycle, CoinList—the former leader in ICOs—has gradually faded, replaced by emerging platforms such as Buidlpad, Echo, and LEGION rapidly rising to prominence. Take Buidlpad as an example: launched just one year ago, it has already helped four projects complete public sales and list on Binance Spot, with participants achieving returns of up to nearly 10x—effectively overtaking CoinList’s position as the dominant player in the space.

In this article, ChainCatcher analyzes in detail the background and reasons behind Buidlpad's rise, and interviews multiple deep participants in public sale platforms to explore from various perspectives: why Buidlpad?

Filling CoinList’s Void

@PandaZeng1, a long-time participant across multiple launchpad platforms, offers systematic observations on ICO/IDO/IEO platforms. He notes that the mechanics of all platforms are fundamentally similar; the key lies in the performance of the first few projects. If the first or second project fails, it creates a negative ripple effect, discouraging future participation.

Regarding CoinList’s decline, he identifies another major issue: poor user experience. For Asian users, the need to queue during U.S. time zones means staying up late, with no guarantee of securing a spot. Although CoinList later introduced a Karma points system (requiring trading or swapping activity on the platform to earn points), this failed to reverse user attrition.

In contrast, the success of newer platforms like Echo and Buidlpad stems from strong early project performances that quickly built their reputations. For instance, Echo’s launch of Sonar for Plasma established user expectations. He emphasizes that the crypto market runs on expectations—when rational, it's valuation-driven; when irrational, dream-driven—and ultimately what matters is the "dream-to-value ratio."

@0xhahahaha shares similar insights on CoinList’s decline: a vicious cycle caused by the breakdown of wealth-generation effects. She participated in five or six CoinList presales and points out that the core problem was declining project quality. Projects began to be of mediocre caliber, failing to list on major exchanges (like Binance or Coinbase), instead landing only on smaller exchanges with weak liquidity, dominated by sellers rather than buyers. Harsh terms—such as one-year lockups—meant even immediate post-TGE gains were uncertain.

Projects conducting public sales on CoinList between 2023 and 2024 mostly saw sharp price drops upon listing, with typical declines ranging from 70% to 98%, including ARCH (-98%), FLIP (-73%), ZKL (-93%), and NIBI (-78%). Most also had FDVs below $100 million.

The 2017 success of Filecoin established CoinList’s image of high returns. While investors hoped CoinList could keep replicating that success, shifts in market cycles, regulation, and evolving user demands made sustained performance difficult.

Today, due to unresolved issues—unfriendly platform experience, low-quality projects, and most importantly, poor returns—community dissatisfaction has intensified, leading to user loss and creating space for platforms like Echo, LEGION, MetaDAO, and Buidlpad to emerge and fill the void left by CoinList’s decline.

Outstanding Performance

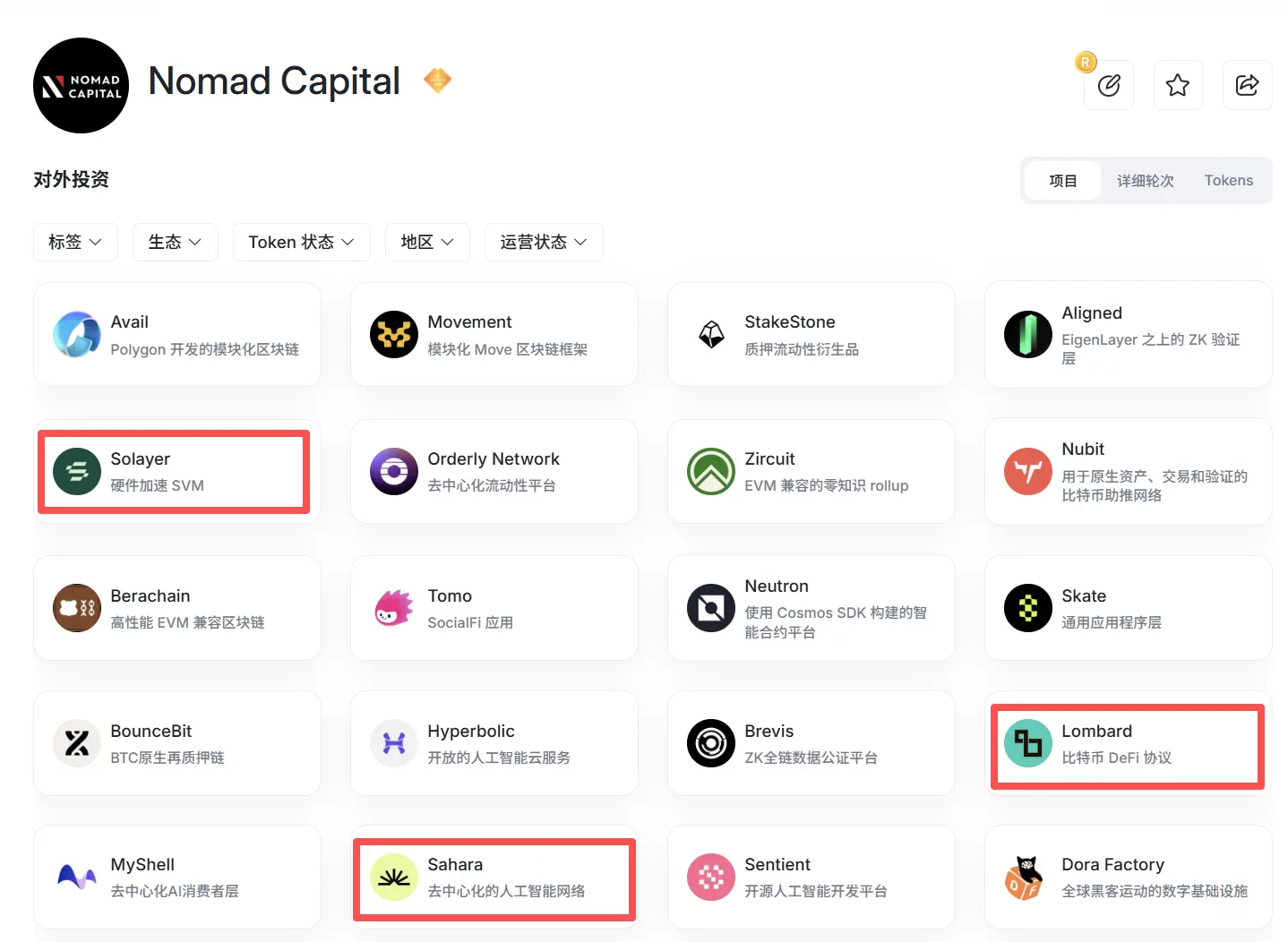

Taking Buidlpad as an example, the platform has supported Solayer, Sahara AI, Lombard Finance, and Falcon Finance in completing public sales and listing on Binance Spot. Looking at Buidlpad’s track record: its first project, Solayer, conducted a public sale at a $350 million valuation, with a token price of $0.35, peaking at $3.43—delivering nearly 9.77x returns to early participants. Sahara AI raised funds at a $600 million valuation, with a token cost of $0.06, reaching a high of $0.15—achieving 2.68x returns, oversubscribed by 8.8x, with total subscriptions amounting to $75 million.

@0xhahahaha first encountered Buidlpad through Falcon Finance, adopting the same mindset as most users: “go where the money-making opportunities are.” She attributes Buidlpad’s success to its strict project selection—all projects successfully listed on major exchanges (such as Binance Spot)—and this consistent wealth-generation effect has drawn users away from CoinList and toward Buidlpad.

On Buidlpad’s rise, @PandaZeng1 summarizes several key factors: first, Buidlpad selects projects with relatively high valuations, and listings are essentially grand slams—landing on both Binance and Upbit—excelling at delivering value to users. Projects generally offer 2–10x return potential, and compared to Echo, the entry barrier is lower, making it more accessible for retail investors.

Buidlpad has developed its own narrative rhythm and selection criteria in project evaluation, quality control, and distribution mechanisms. Beyond comprehensive due diligence and research into business model viability and execution capability, Buidlpad deploys anti-Sybil technologies using KYC verification, compliance checks, and security measures to prevent fake accounts and bot farms from participating en masse—ensuring fairer token distribution.

As of September 2025, the platform has secured over $320 million in subscription commitments across its first four events, attracting more than 30,000 verified real users. The latest project, Momentum Finance, has also launched its public sale on the platform in October, aiming to raise $4.5 million.

Additionally, Buidlpad introduced the Squad system, which builds on the existing staking model by offering extra incentive rewards for content creation. This helps projects build communities early while encouraging participants to contribute beyond mere capital investment.

Notably, all projects launched via Buidlpad have listed on Binance Spot, making it an ideal springboard for projects aiming directly for Binance and other major exchanges—a fact closely tied to founder Erick Zhang’s background.

Clear Ties to Binance

According to Erick Zhang’s LinkedIn profile and public activity, he holds a master’s degree from Carnegie Mellon University and a bachelor’s from the University of Macau. His early career details are sparse, with his earliest known role being Vice President at Citibank from 2013 to 2015. Shortly after Binance’s founding, he joined the company as an executive—an early signal of sharp career judgment.

During his tenure at Binance, he served as head of Binance Research and Binance Launchpad, gaining extensive experience in project research and selection, and played a role in establishing the exchange’s listing framework. Under his leadership, Binance Launchpad successfully facilitated ICOs for over 20 projects, raising more than $100 million cumulatively—including now-industry giants such as Polygon and Axie Infinity. The wealth-generation effect of Launchpad tokens made Binance Launchpad a benchmark product in the industry. Later, he became CEO of CoinMarketCap under Binance, transitioning from a vertical business lead to full responsibility over an independent business unit.

After accumulating rich experience in data analysis, team management, and industry connections, Erick Zhang left Binance in December 2022 to found Nomad Capital. A few months later, Binance Labs announced an investment in the crypto venture fund Nomad Capital, maintaining close ties with Binance. At the end of last year, Erick launched Buidlpad.

Notably, among the four projects Buidlpad has launched so far, three received investments from Nomad Capital. After these project tokens listed on Binance Spot, Binance Labs—as a primary LP in Nomad Capital—also stood to gain significantly.

Clearly, Buidlpad’s close relationship with the Binance ecosystem is one of the most critical factors behind its current success. Meanwhile, the market红利 left by CoinList’s decline and Buidlpad’s unique project selection mechanism have further paved the way.

With Buidlpad’s main competitor Echo recently acquired by Coinbase, token fundraising platforms are becoming new battlegrounds for pricing power in the primary market. From CoinList’s decline to the rise of Buidlpad and Echo, this shift fundamentally reflects the evolution of ICO structures. As short-term hype cools, public token sales are increasingly bridging the gap between user demand and platform mechanisms.

On one hand, they serve as vital channels for projects to acquire early users and initial liquidity; on the other, they reinforce the platform’s status as investors’ go-to destination for alpha. Even during prolonged market downturns, these investment opportunities remain highly attractive.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News