AWS Cloud Crisis: The Exposure of Centralized Encryption

TechFlow Selected TechFlow Selected

AWS Cloud Crisis: The Exposure of Centralized Encryption

AWS went down, and half of the crypto industry collapsed.

Author: Rekt

Translation: TechFlow

October 20, 2025: AWS US-EAST-1 region in Virginia, USA, goes down.

Coinbase freezes trading, Robinhood crashes, Infura cuts off MetaMask connections.Polygon, Optimism, Arbitrum, Base, Linea, Scroll and other Layer 2 networksgo offline within minutes.

ManFromHell put it bluntly: "AWS went down and half the crypto industry collapsed. The 'decentralized' vibe today is absolutely electric."

Ethereum kept producing blocks, while Bitcoin kept running smoothly.

The blockchains themselves didn't crash — but exchanges went offline, wallet connections were severed, and users were locked out of 'decentralized' finance due to a DNS failure at a single cloud provider.

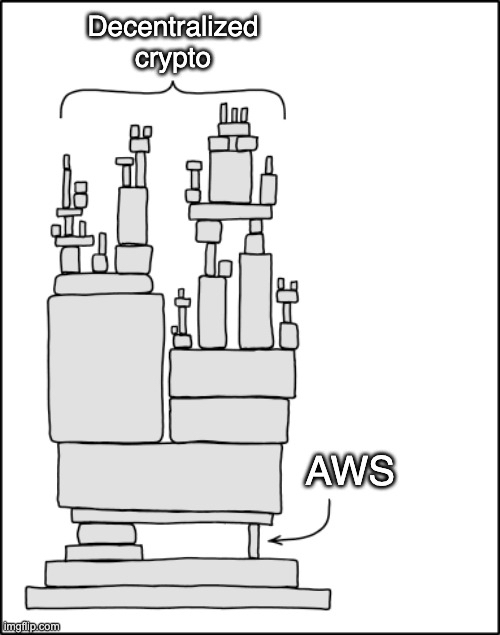

An industry built to eliminate trust in third parties just proved it cannot survive without relying on Jeff Bezos to keep things running.

When your so-called 'censorship-resistant revolution' grinds to a halt because Amazon's servers failed, who truly holds the power?

Sources: AWS, CryptoSlate, ManFromHell, Skipper, The Register, Decrypt, Ethernodes, CoinTelegraph, statista, FinanceFeeds, U Today, Vet, Lefteris Karapetsas, MattFlint, Carla, Gracy Chen, LexisNexis, Concept Board, Akash, ICP

Infura, the Consensys-backed infrastructure service that connects MetaMask to blockchains,reported outages across Polygon, Optimism, Arbitrum, Linea, Base, and Scroll when AWS failed.

At 3:11 AM ET, when DynamoDB endpoints in Amazon’s US-EAST-1 region suffered a DNS resolution failure, Infura’s status page instantly turned red with alerts.

Ethereum mainnet JSON-RPC API: down. Polygon: down. Optimism, Arbitrum, Linea, Base, Scroll: all completely down.

Six so-called "decentralized" Layer 2 networks simultaneously crippled because they all rely on the same centralized pipeline to connect to users.

During the AWS outage,MetaMask users lost access to Ethereum and Layer 2 networks, causing transactions to stall and dapp interfaces to freeze.

This wasn’t due to problems on-chain — validators kept validating, blocks kept being produced — but because the path to those chains depends on servers owned by a single company operating on Amazon’s infrastructure.

Coinbase and its Base application highlight the centralization irony in crypto.

During the AWS outage,the Coinbase app and Base both became temporarily inaccessible, preventing users from logging in, buying, selling, or withdrawing cryptocurrency.

The company acknowledged the issue, saying it was actively “re-architecting services” to prevent similar disruptions — effectively admitting its infrastructure isn’t as decentralized as advertised.

In the meantime, around 2,368 Ethereum execution nodes run on AWS infrastructure, accounting for nearly 37% of the network.

That’s not enough to bring down the blockchain, but it is enough to lock out most users who don’t run their own nodes.

If decentralized systems depend on centralized infrastructure to function, what exactly are we decentralizing?

A Familiar Script

April 15, 2025: AWS faced "connectivity issues." Binance suspended withdrawals; KuCoin halted operations. MEXC, Gate.io, Coinstore, DeBank, Rabby Wallet — at least eight platforms reported service disruptions within minutes.

Six months later, nearly the exact same script plays out again.

AWS controls about 30% of the global cloud market, Microsoft Azure holds 20%, and Google Cloud Platform (GCP) claims 13%.

Amazon, Microsoft, and Google control 63% of internet infrastructure, including the vast majority of crypto’s so-called "decentralized" ecosystems.

Binance runs on AWS. So does Coinbase. BitMEX, Huobi, Crypto.com, and Kraken are all tightly tied to Amazon’s infrastructure to meet user demand for low-latency, high-volume transaction processing. When Amazon falters, the giants of crypto fall.

ManFromHell’s tweet isn’t hyperbole — it’s fact.

But the real difference lies in who’s actually decentralized: XRP Ledger continued producing blocks during both outages.

Validators are spread across AWS, Google Cloud, Hetzner, DigitalOcean, and independent servers, meaning no single point of failure can disrupt the network.

"This is the hard work of decentralization, especially in geographic and host distribution," contributor Vet noted.

Distributed infrastructure actually works — if you’re willing to pay for it and intentionally build it. But most projects don’t.

How many more outages will it take for "decentralization" to shift from a marketing slogan to an engineering imperative?

A Wake-Up Call for Crypto

"AWS went down and the internet broke. But blockchains never will... Wait, scratch that. This industry is a joke. Everyone talks about decentralization and censorship resistance, but in reality... it’s 100% dependent on cloud providers." — Lefteris Karapetsas, founder of Rotkiapp

"Platforms preaching 'decentralization' taken down by a centralized cloud provider. Irony level: off the charts." — MattFlint, summarizing what countless people think about Coinbase.

"If an AWS outage affects your cryptocurrency, then it’s neither decentralized nor money. Bitcoin is — not crypto." — Carla, Bitcoin maximalist, stating the truth protocol purists have been shouting for years.

Lefteris Karapetsas delivered another blow: "The entire vision behind blockchains is decentralized infrastructure, and we’ve completely failed at that."

Not "working on it," not "making progress" — failed.

Gracy Chen, CEO of Bitget exchange, during April’s AWS outage said: "Data center issues at AWS affected multiple centralized exchanges — no need to panic. This reminds us: perhaps it’s time to explore decentralized cloud services."

Six months later, that statement still stands.

Dr. Max Li, CEO of OORT, proposed a well-known but rarely funded solution: "Decentralized cloud computing offers a robust alternative by distributing data and processing across a network, reducing the risk of single points of failure."

Coinbase pushed back strongly, announcing it was "re-architecting services" to prevent future outages. In other words, they finally admitted their architecture contradicts their marketing.

This outage didn’t directly impact markets, but it shifted perceptions.

The conversation suddenly turned to alternatives — what decentralization should look like, if anyone actually builds it.

Smart investors won’t just complain about centralization — they’ll bet on alternatives.

When hype finally matches infrastructure, will anyone remember what decentralization was supposed to mean?

Why Most Take the Easy Path

Running your own nodes means buying expensive hardware, securing stable power, maintaining sufficient bandwidth, and hiring skilled technical staff.

AWS delivers the same services at minimal cost, witha 99.99% uptime guarantee backed by Amazon’s two-decade investment in infrastructure reliability.

For cash-strapped startups desperate to launch, there’s simply no comparison — the choice isn’t really a choice.

Multi-cloud strategies are more expensive; self-hosting requires expertise most teams lack; geographic redundancy introduces latency, which traders in crypto are extremely sensitive to.

All philosophical commitments to decentralization eventually collide with the harsh economics of cloud computing: centralized infrastructure is cheaper, faster, and "good enough" — until it isn’t.

Most projects choose speed over sovereignty. You can’t blame them. Try explaining to a venture capitalist why you’re spending twice as much on infrastructure for the sake of principle.

But there’s another angle few want to discuss: the CLOUD Act (Clarifying Lawful Overseas Use of Data Act).

U.S. law grants authorities the power to compel American cloud providers to hand over data, regardless of where that data physically resides.

Whether stored on European servers or Asian data centers, if hosted on AWS, Azure, or Google Cloud, U.S. law enforcement can access the data upon proper legal authorization — without needing approval from foreign courts.

This reality complicates crypto’s narrative around 'censorship resistance,' especially when much of its infrastructure relies on servers subject to U.S. government data requests.

European regulators are increasingly viewing U.S. cloud dominance as a sovereignty issue, with some authorities warning against using U.S. cloud services for sensitive data.

Decentralization promises freedom from institutional control.

Yet most crypto infrastructure ends up in the hands of three corporations — all accountable to one government.

If your "trustless" system depends on Amazon not cooperating with law enforcement, how "trustless" is it really?

The Hidden Cost of Convenience

Multi-cloud isn’t rocket science.

Spread your infrastructure across AWS, Azure, and Google Cloud. Add geographic redundancy beyond US-EAST-1.

Accept higher costs and complexity as the price of real resilience.

XRP Ledger has proven it works. Validators distributed across multiple providers kept it online while others failed.

It’s not better technology — it’s different architectural choices, and paying for redundancy.

Decentralized alternatives exist, but remain on the fringe:

-

Filecoin, IPFS, and Arweave offer decentralized storage.

-

Akash Network offers decentralized cloud computing.

-

Internet Computer Protocol (ICP) promises full-stack decentralization.

Yet these technologies remain relatively early-stage with low adoption. Developers prefer tools they know — and what they know is AWS.

Two weeks after April’s outage, Vanar launched Neutron specifically to address this dependency.

CEO Jawad Ashraf stated: "This unlocks entirely new possibilities: from storing files fully on-chain without third-party reliance, to querying and verifying actual information within files."

Possibilities. Potential. Maybe someday.

In the meantime, every project faces the same choice: rent services from tech giants and accept systemic risk, or build truly decentralized infrastructure at higher cost.

There is no middle ground. You either rely on centralized providers — or you don’t.

Most choose to rely, because it’s cheaper today, ignoring the cost tomorrow when Amazon’s DNS fails again.

How many times must hundreds of millions in assets be frozen before "temporary" becomes unacceptable?

Ethereum kept producing blocks, Bitcoin remained unaffected. On October 20, 2025, no blockchain truly crashed — protocols worked exactly as designed.

It was the access layer that failed — and that failure exposed crypto’s dirtiest secret: you can verify transactions, but if AWS controls your ability to submit them, your sovereignty is just theater.

Two major outages in six months. Same root cause, different regions.

This pattern won’t stop, because incentives haven’t changed — centralized infrastructure remains cheaper and simpler, so projects keep choosing it despite the risks.

Crypto was built on "don’t trust, verify," yet now heavily depends on trusting three companies not to go down.

An industry meant to escape institutional gatekeepers handed the keys to the largest gatekeeper on Earth.

When the infrastructure layer remains centralized, protocol-level decentralization is meaningless.

The next AWS outage is coming. Then another. And another. Each will spark the same Twitter outrage, the same promises to do better, and the same return to convenience once the crisis passes.

Either crypto adapts — adopting multi-cloud, geographic redundancy, and real decentralized alternatives — or it admits 'decentralization' was always just a slightly different skin over the same centralized systems.

When Amazon’s next DNS failure locks you out of your "self-custodied" wallet, will you still believe in "trustless" systems?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News