When Steam Meets Web3: How 9bit Turns 3 Billion Players into Shareholders?

TechFlow Selected TechFlow Selected

When Steam Meets Web3: How 9bit Turns 3 Billion Players into Shareholders?

This time, The9 does not want to be an agent anymore, but rather become a rewriter of the game value distribution rules.

By: TechFlow

Is GameFi dead?

The once-hyped "Play-to-Earn" projects have now become cautionary tales in the crypto space. Once labeled as Ponzi schemes, that stigma sticks firmly in people's minds.

But is there truly no future for combining gaming with Web3?

In this market cycle, projects still pushing forward in this direction are taking a different path:

Rather than struggling to build low-quality blockchain games from scratch, why not let already successful game economies embrace Web3?

Outside the crypto world, Steam integrates game distribution, purchasing, management, and community operations. Every year, its parent company Valve takes a 30% cut from every game transaction, while players get nothing beyond the game itself.

What if Steam’s economic model were tokenized? What if every purchase didn’t just grant you a game, but also a share of ownership in the platform?

This vision of building a “Web3 Steam” is now being pursued by a company you might have long forgotten.

Ninth City (The9 Limited, Nasdaq: NCTY), a name once etched into China’s gaming history through its stewardship of World of Warcraft, is returning after 15 years of obscurity—with its new 9BIT platform.

From 2005 to 2009, The9 reigned over China’s gaming industry, earning over 2 billion RMB annually thanks to World of Warcraft. After losing the franchise, The9 struggled through self-developed titles, publishing deals, and even mining ventures, never regaining its former glory.

Now, in 2025, it has launched 9BIT. This time, The9 doesn’t want to be just a distributor—it wants to rewrite the rules of value distribution in gaming.

9BIT’s Core Logic: Turning Real Game Spending Into Investment

To understand what 9BIT is doing, first consider the current state of Steam—the most successful gaming platform outside crypto.

Steam’s problem is simple: one-way value flow.

Every year, players spend tens of billions of dollars on Steam—buying games, making in-game purchases, and paying for DLCs—but that money disappears after the transaction.

Player reviews help sell more games, user-created mods extend game lifespans, and community activities sustain player interest—all valuable contributions made for free.

What if every purchase wasn’t just spending, but investing? That’s exactly what 9BIT aims to do.

9BIT calls this concept “spend-to-mine.” It sounds very Web3, but the actual experience feels remarkably Web2.

Visit 9BIT’s official website and you won’t see flashy ads promoting play-to-earn grind. Instead, you’ll find familiar AAA titles like Street Fighter 6, Resident Evil, and Monster Hunter—Capcom’s flagship games.

You can directly purchase and play these major titles on 9BIT. Registration is surprisingly simple: just enter your email and set a password.

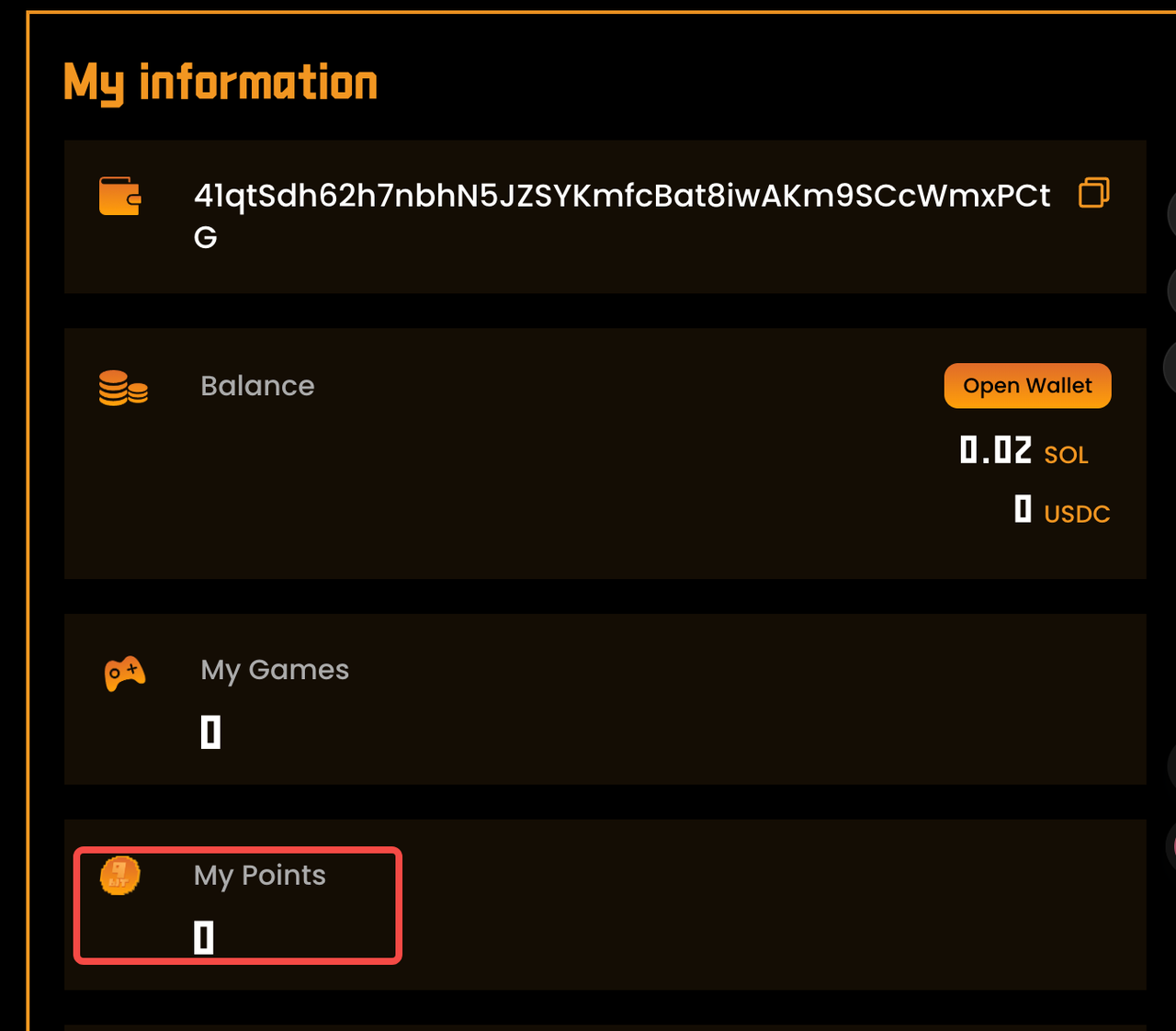

No seed phrases or complex wallet setups. Behind the scenes, Particle Network automatically generates a wallet, but users don’t need to interact with any technical details.

The experience is nearly identical to creating a Steam account and buying games.

When purchasing a game, payment options include both cryptocurrencies like USDC and traditional credit cards.

Paying with USDC feels as smooth as shopping on any mainstream e-commerce site. After payment, you receive a game activation code to redeem on Steam or Epic Games Store.

This reveals 9BIT’s clever approach: it’s not trying to replace Steam, but to become Steam’s crypto payment and incentive layer:

Players still enjoy games on familiar platforms; 9BIT simply adds extra value to the payment process. The points credited to your account represent this added value.

Here’s a more concrete example.

When you top up 648 yuan for Genshin Impact via traditional channels, you get exactly 6,480 Primogems—and that’s it.

On 9BIT, besides the Primogems, your account also earns corresponding points.

If you write a guide in the community helping others beat a tough level, that contribution also translates into points. These points quantify your value creation for the platform.

And naturally, these points correspond to 9BIT tokens.

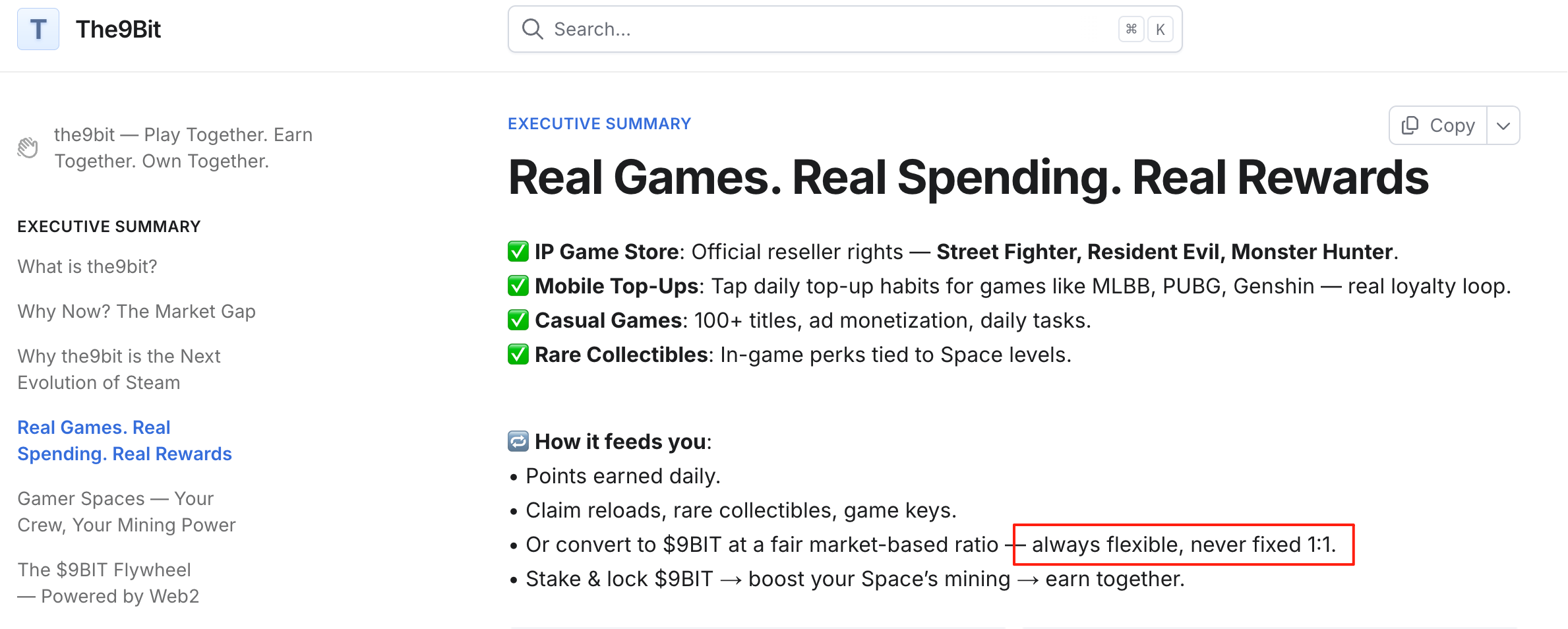

According to public information, the function to convert points into 9BIT tokens will launch in Q4 alongside the token listing. As stated in the whitepaper, exchange rates won’t be fixed but dynamically adjusted based on market conditions, preventing distortions in the economy.

More importantly, points aren’t only for swapping into tokens.

You can use them to redeem in-game items, top-up vouchers, or even limited-edition collectibles. Non-speculative players who avoid crypto altogether can still benefit from the system.

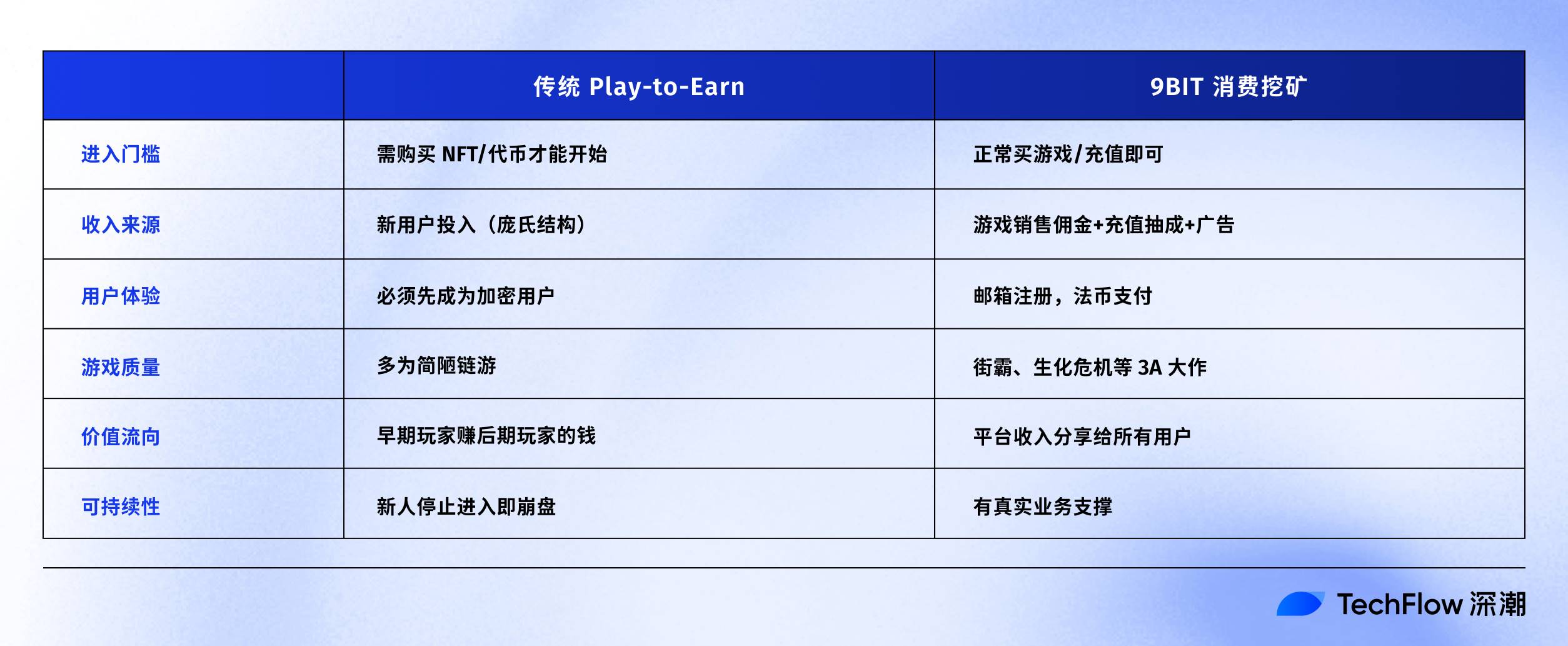

This highlights the fundamental difference between 9BIT and traditional GameFi.

Traditional Play-to-Earn requires you to pay upfront—buying NFTs or staking tokens—essentially asking you to invest before earning returns.

With 9BIT, users were already planning to buy games or top up anyway—these are essential expenses—while points and tokens serve as bonus rewards.

The key distinction lies in value flow.

Traditional P2E operates as a zero-sum game—early players profit at the expense of later ones. 9BIT enables positive-sum outcomes: revenue earned from game publishers is shared with contributing users. This isn't internal redistribution—it’s real external value flowing in.

But since we’re discussing revenue, the next natural question is:

How real are 9BIT’s so-called “real revenues”? Can they support a sustainable token economy?

Finding a Moat in Real Revenue From Game Publishing

To be honest, when someone mentions GameFi today, most people instinctively turn away.

This reflexive rejection is understandable—most blockchain games lack positive externalities or real income streams, relying solely on funds from new entrants to pay early adopters—a classic Ponzi structure.

So when 9BIT claims to be different, skepticism is inevitable. How is it different? Where does the money come from?

Let’s do the math.

First, commissions from game sales.

On the 9BIT platform, a "Resident Evil Bundle" (including remakes of RE2–RE4) sells for $89.

Under standard game distribution agreements, platforms typically earn 10–15% commission. A simple calculation shows 9BIT earns $8–13 per sale.

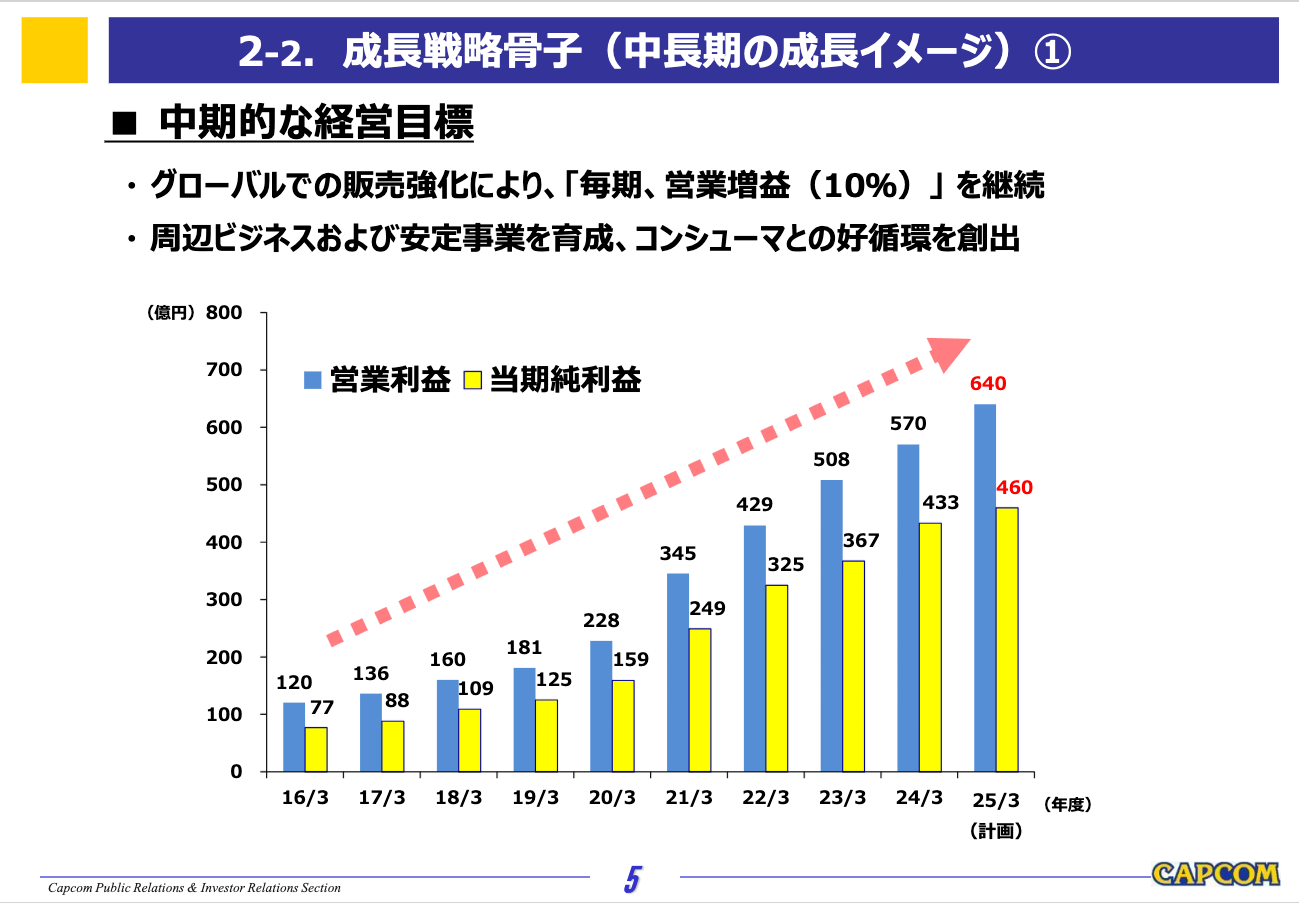

This may not seem like much, but considering Capcom generated over $360 million in game sales during FY2024, capturing just 1% of that volume—which isn’t an aggressive target for a distribution channel—would yield theoretical annual revenue of $3.6 million.

And Capcom is just one publisher. With more publishers and major IPs onboarded, this figure could grow significantly.

The second revenue stream is even more interesting: mobile game top-up fees.

Southeast Asia leads globally in mobile game spending. For example, Genshin Impact consistently generates over $20 million monthly in the region. Popular titles like Mobile Legends and PUBG Mobile see even larger recharge volumes.

As a top-up channel, 9BIT typically earns 5–10% in referral fees.

A critical detail: 9BIT’s partner Vocagame is already one of Southeast Asia’s largest game recharge platforms. This means 9BIT isn’t building a recharge network from scratch, but adding a Web3 incentive layer to an established business.

A single active community of 1,000 users, each averaging $20 in monthly top-ups, would generate $1,000–$2,000 in monthly channel revenue. Scale this across dozens or hundreds of communities, and the numbers become substantial.

The third source is advertising revenue.

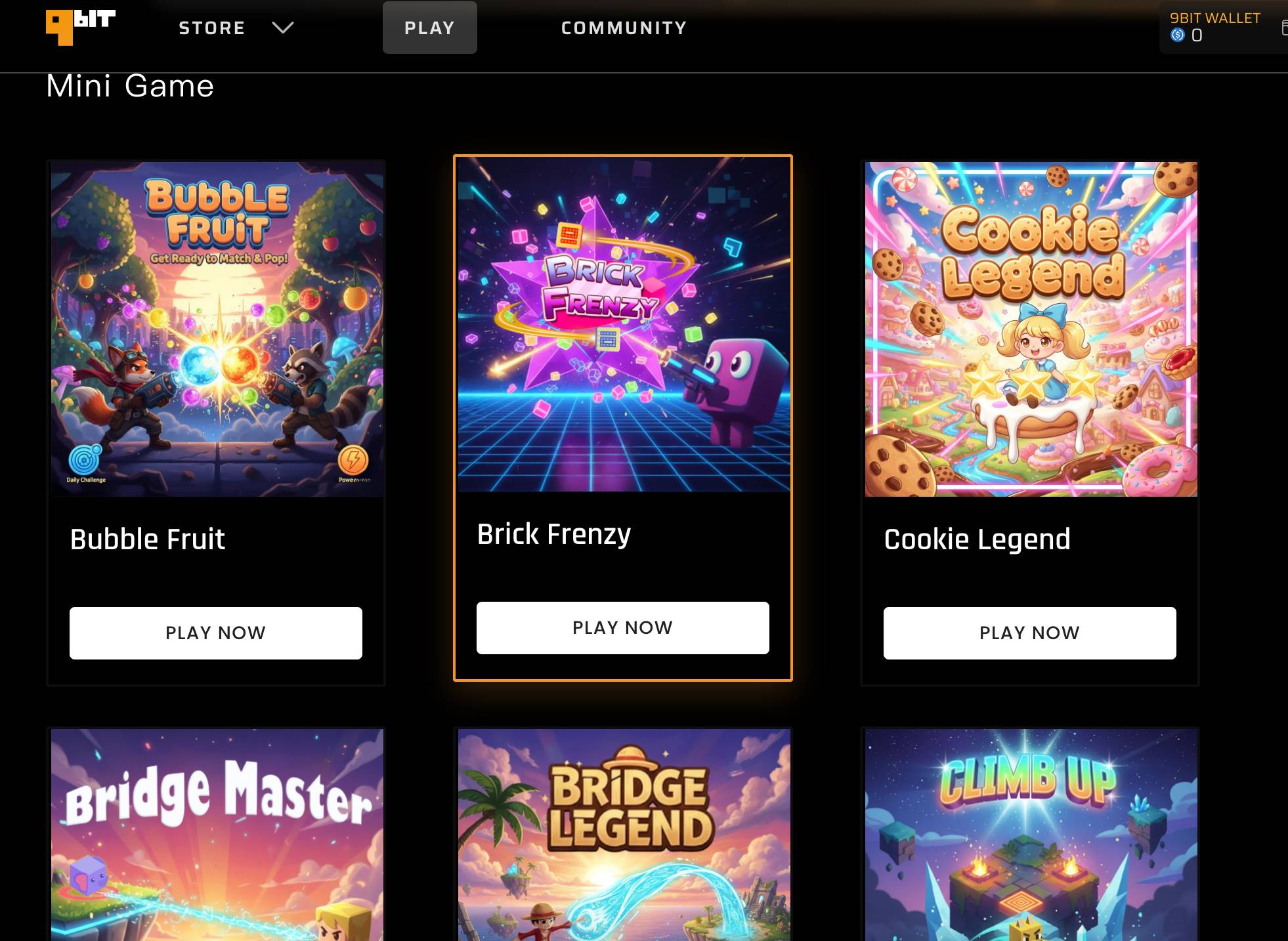

The platform already hosts over 50 casual games—simple, easy-to-play mini-games. These support classic rewarded video ad models, where players watch ads to earn in-game rewards.

These represent 9BIT’s known revenue streams. Additionally, a P2P in-game item marketplace launching in Q4—charging a 2.5% fee similar to OpenSea—will add another income line. Other planned sources include staking pool management fees and esports sponsorship revenue.

According to the team’s latest public figures, the platform launched on August 1st this year and has already surpassed 5 million registered users, generating over $1.8 million in revenue.

This number may not sound staggering, but the source matters:

No token presales, no NFT launches—this revenue comes purely from real game purchases and top-ups. In contrast, most GameFi projects report zero revenue before token launch, surviving entirely on VC funding.

Notably, Ninth City (The9) is a Nasdaq-listed company, meaning 9BIT’s financial results will eventually appear in The9’s quarterly financial reports—an unusual level of transparency in the Web3 space.

Even more important is sustainability. Even if the 9BIT token price crashes, players will still buy games and top up—these core activities won’t disappear.

Users come for games, not for “mine, dump, and sell”—which ensures longer user lifecycles.

In an ideal scenario, as the game library expands and user base grows, network effects will make 9BIT increasingly attractive to game publishers, creating a virtuous cycle.

Spaces: Communities as “Mining Pools”

With real revenue as a foundation, the next question is: how do we fairly distribute earnings to contributors?

Behind every successful game is an active Discord server—hundreds of thousands gathering to discuss strategies, share tips, and organize events.

Yet apart from occasional shoutouts and rare “community contributor” badges, dedicated members often receive nothing tangible.

This is standard across the gaming industry: communities create value, but platforms capture all the benefits. 9BIT’s Spaces feature aims to change that.

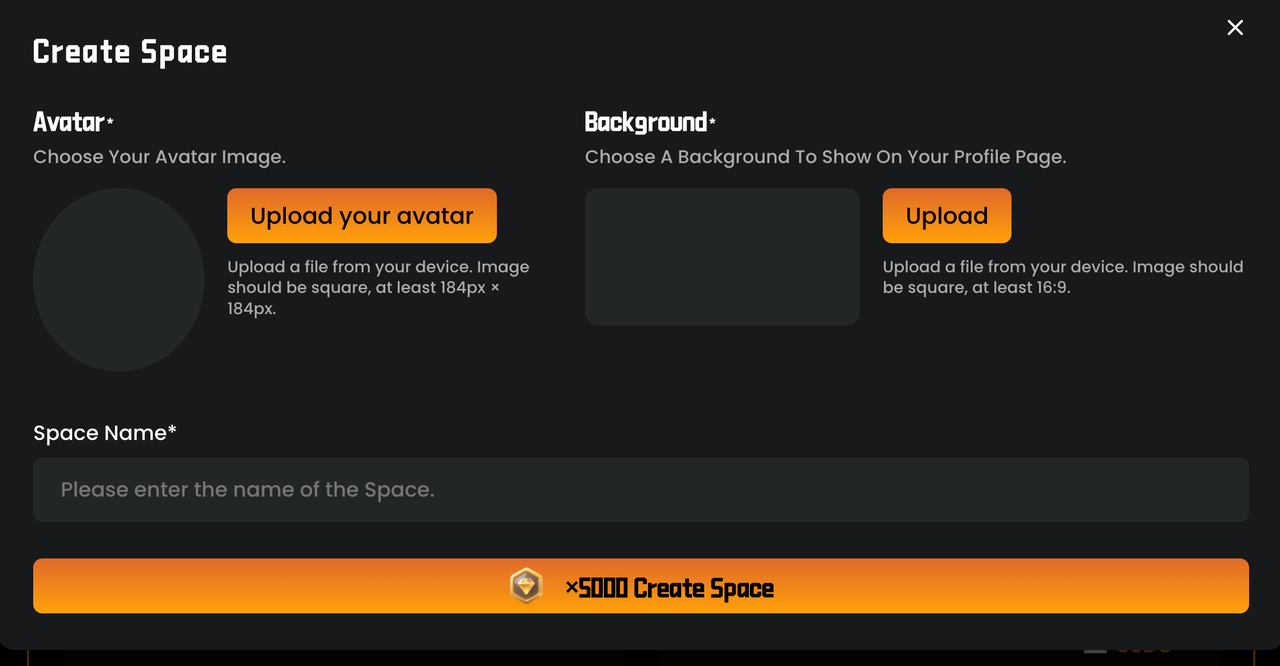

Spaces resemble Discord, but differ fundamentally. Each Space functions like a small economy—members aren’t just chatting, they’re working together toward a measurable goal: mining rewards.

The mechanism is straightforward. A fixed amount of 9BIT tokens—say, 100,000 per day—is distributed network-wide, allocated among all Spaces based on performance.

According to the whitepaper, 50% of mined tokens can be withdrawn immediately, while 50% are locked for 12 months. This provides instant incentives while reducing sell pressure.

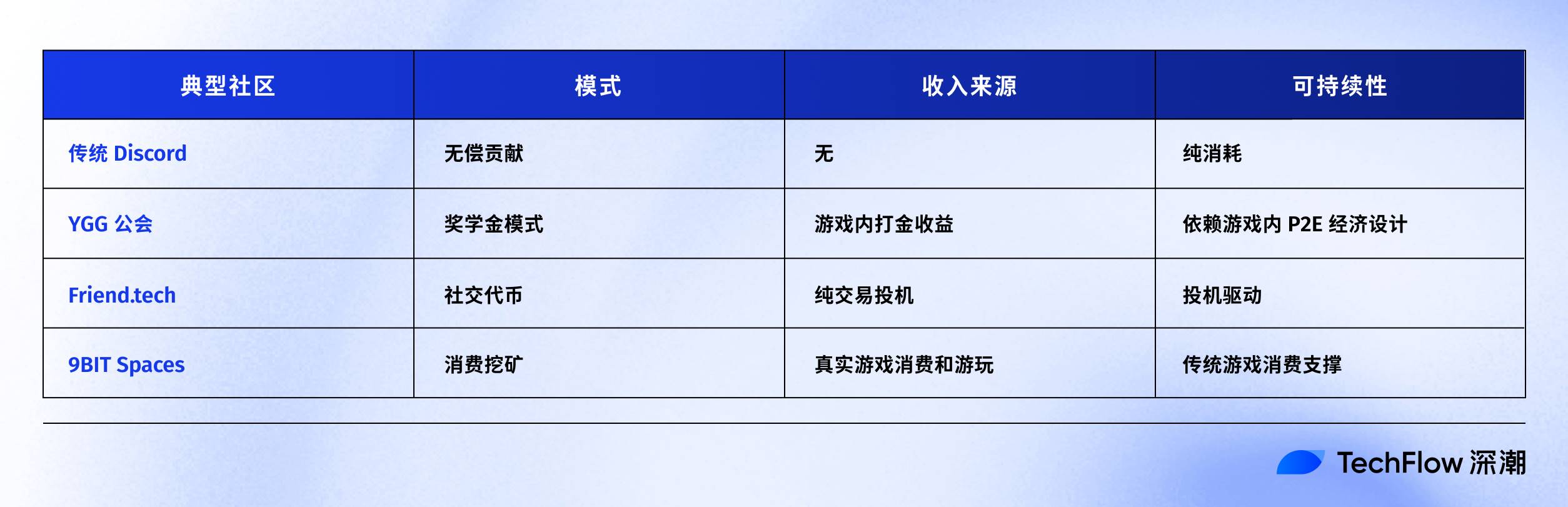

It’s easy to see how this differs from traditional guilds in blockchain games and conventional Web2 gaming communities:

This design solves two major pain points for Web3 projects.

First, customer acquisition cost. Traditional projects spend heavily on user growth—airdrops, subsidies, etc.—but users leave once the money runs out. 9BIT avoids this: each Space naturally recruits new users because higher membership and activity mean greater mining rewards—a self-sustaining growth model.

Second, user retention. Joining a Space isn’t just about finding gaming buddies—it’s about shared economic interests.

Over time, top-tier Spaces may gain brand value—being a member of “XX Space” could become a status symbol, with room for NFTs and other digital assets.

That said, challenges remain.

Preventing spam, balancing interests between large and small Spaces, and ensuring long-term incentive effectiveness are real issues 9BIT must address.

Still, 9BIT offers a viable framework—one where community contributions are quantifiable, incentivized, and sustainable.

$9BIT Tokenomics

Token allocation, vesting schedules, and real value capture reveal a project’s true intentions.

9BIT has a total supply of 10 billion tokens, deployed on the Solana blockchain using the SPL-20 standard.

Choosing Solana over Ethereum clearly prioritizes low transaction costs and high speed.

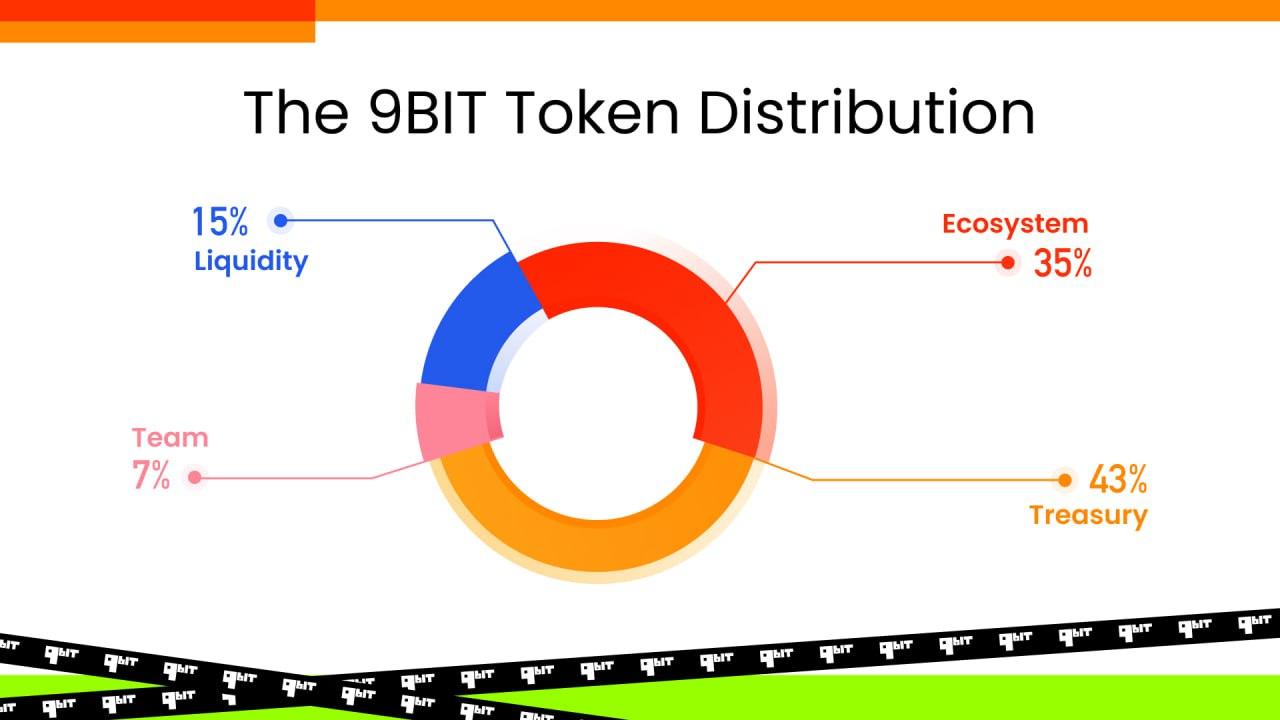

Allocation breakdown: 35% to ecosystem incentives (source of all mining rewards), 43% to treasury, 15% for liquidity, and 7% to team and advisors.

Several aspects stand out. First, the portion allocated to the community—35% ecosystem incentives plus 15% liquidity—totals 50%. This is generous by GameFi standards, where many projects allocate less than 30% to the community, reserving most tokens for VCs and teams.

The 43% treasury deserves closer inspection. Of this, 19% belongs to The9, 19% to major crypto investment firms, and 5% is reserved for future partners and strategic acquisitions.

The9’s 19% stake is particularly significant.

As a Nasdaq-listed company, these tokens will appear as assets on its financial statements. Any large-scale selling would require prior disclosure, subject to SEC and investor oversight. In this sense, this 19% may be the most stable part of the circulating supply.

While not exactly a DAT (decentralized asset treasury) setup, it provides a stabilizing anchor for a Web3 gaming project.

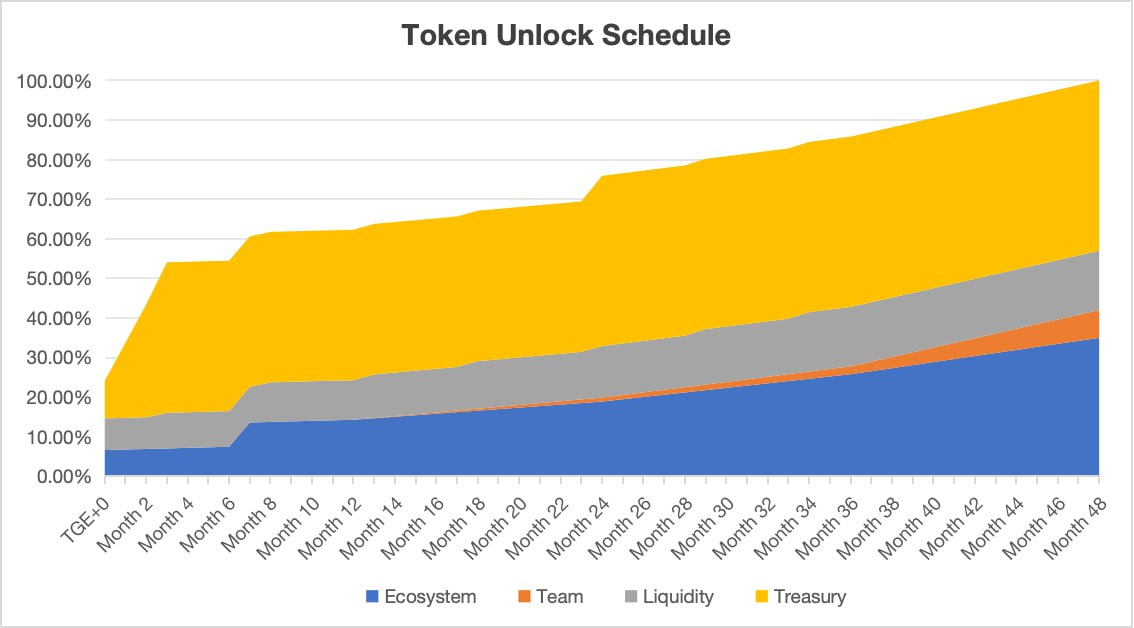

Looking at the unlock schedule: theoretically, the 35% ecosystem allocation will fully release over four years, but daily emissions have caps—and realistically, those caps are unlikely to be hit every day.

This means full release of the 35% could take 6 to 8 years—far healthier than projects dumping large token amounts upfront.

Additionally, team and investor tokens are locked for 12 to 24 months—a notably conservative approach in today’s market.

Many projects unlock large portions on TGE (Token Generation Event), leading to “sell-high-and-crash” patterns. 9BIT, at least in this regard, demonstrates a long-term mindset.

Finally, value capture mechanisms.

Per the whitepaper, the platform commits to using a portion of annual net profits to repurchase 9BIT tokens.

Note: net profits, not revenue. This means buybacks only occur when the platform is genuinely profitable.

This is far more credible than projects that fund buybacks through inflationary minting. Repurchased tokens will be partially burned—reducing supply—and partially allocated to the ecosystem fund for future development. Long-term, this creates a deflationary mechanism.

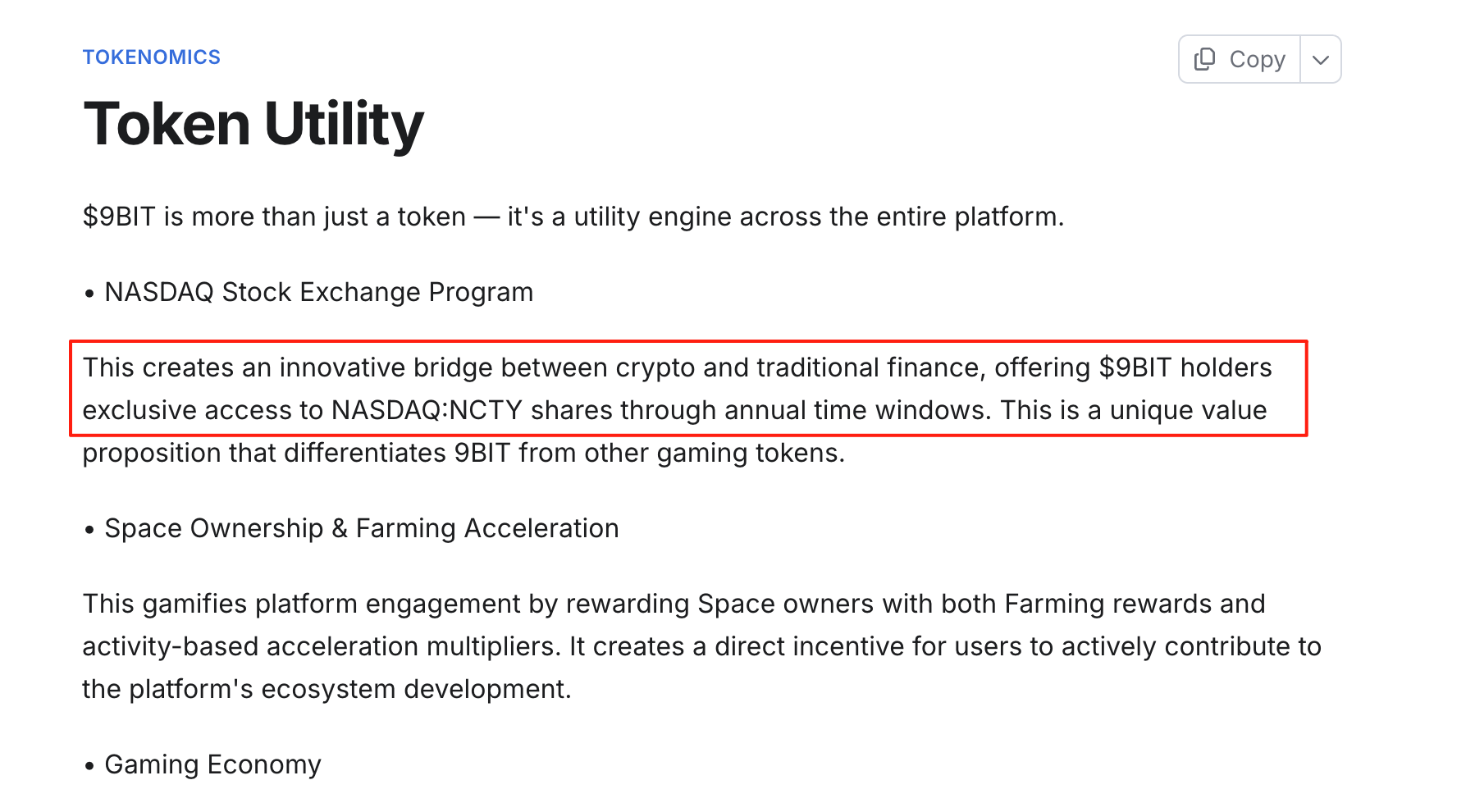

In terms of utility, 9BIT is not just a governance token for voting.

You can use it to buy games or get discounts; staking increases your Space’s mining efficiency; holding certain amounts grants access to exclusive platform events, and even opportunities to purchase The9 stock.

At minimum, the design reflects thoughtful planning by a mature team.

No wild promises, no obvious Ponzi traits—just real business underpinning and a relatively balanced distribution model.

Returning to the Essence of Gaming

After this long journey, we return to the original question: who should benefit from the value created by the gaming industry?

Steam proved, through a traditional centralized model, that a game distribution platform can become a billion-dollar business.

9BIT isn’t trying to replace Steam, but to enhance its proven model with Web3-style value distribution. Players still use familiar platforms, but now every purchase gives them partial ownership in the ecosystem.

They’re not selling hype—they’re running a traditional business: selling real games, serving real players, and earning real revenue.

In today’s GameFi landscape, where most projects fail, a model rooted in real-world economics stands out.

Market conditions are volatile, but that’s precisely 9BIT’s opportunity. While the entire GameFi sector undergoes reflection and restructuring, genuinely valuable projects have a chance to shine. 9BIT’s real-revenue foundation gives it the resilience to survive market cycles.

What is gaming really about? Joy, social connection, achievement. But in the Web3 era, gaming can also be an investment, a form of equity, a shared growth opportunity.

9BIT aims to empower players as true beneficiaries—without changing the essence of gaming.

From being a World of Warcraft distributor to pioneering a Web3 gaming platform, The9 has completed a 20-year cycle.

Today, as more people realize their contributions deserve fair compensation, 9BIT is ready with a new answer.

This marks a new chapter in gaming—and the beginning of 3 billion players becoming shareholders.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News