The Truth Behind the "Trump Trade": From Threats to Concessions, Who's Driving Bitcoin and Nasdaq Volatility?

TechFlow Selected TechFlow Selected

The Truth Behind the "Trump Trade": From Threats to Concessions, Who's Driving Bitcoin and Nasdaq Volatility?

The real watershed is not in the strength or weakness of events, but in market positioning and leverage structure.

Author: NDV

TL;DR

📌 What is TACO?

TACO is an abbreviation for "Trump Always Chickens Out", describing a typical pattern in U.S. President Trump's trade policy: he first exerts pressure by publicly threatening high tariffs (e.g., against China or other trade partners), causing short-term plunges in global stock and financial markets; then, due to economic pressure or negotiation needs, he often softens his stance, delays, or cancels these tariffs, triggering a rapid market rebound.

📌 What is the TACO Trade?

The TACO trade is an investment strategy based on this pattern. Investors buy stocks, cryptocurrencies, or other risk assets (such as U.S. equity index funds, Bitcoin, etc.) at low prices during market panic caused by Trump’s tariff threats, then sell for profit when Trump "backs down" and releases conciliatory signals. This trade essentially bets that Trump’s policies often make “a lot of noise but little rain,” capturing short-term opportunities from market fear to recovery. However, it should be noted that the essence of the TACO trade is not betting on whether someone will “back down,” but rather on the idea that market overreaction to “policy uncertainty” eventually corrects itself toward a more rational level.

NDV Research Focus

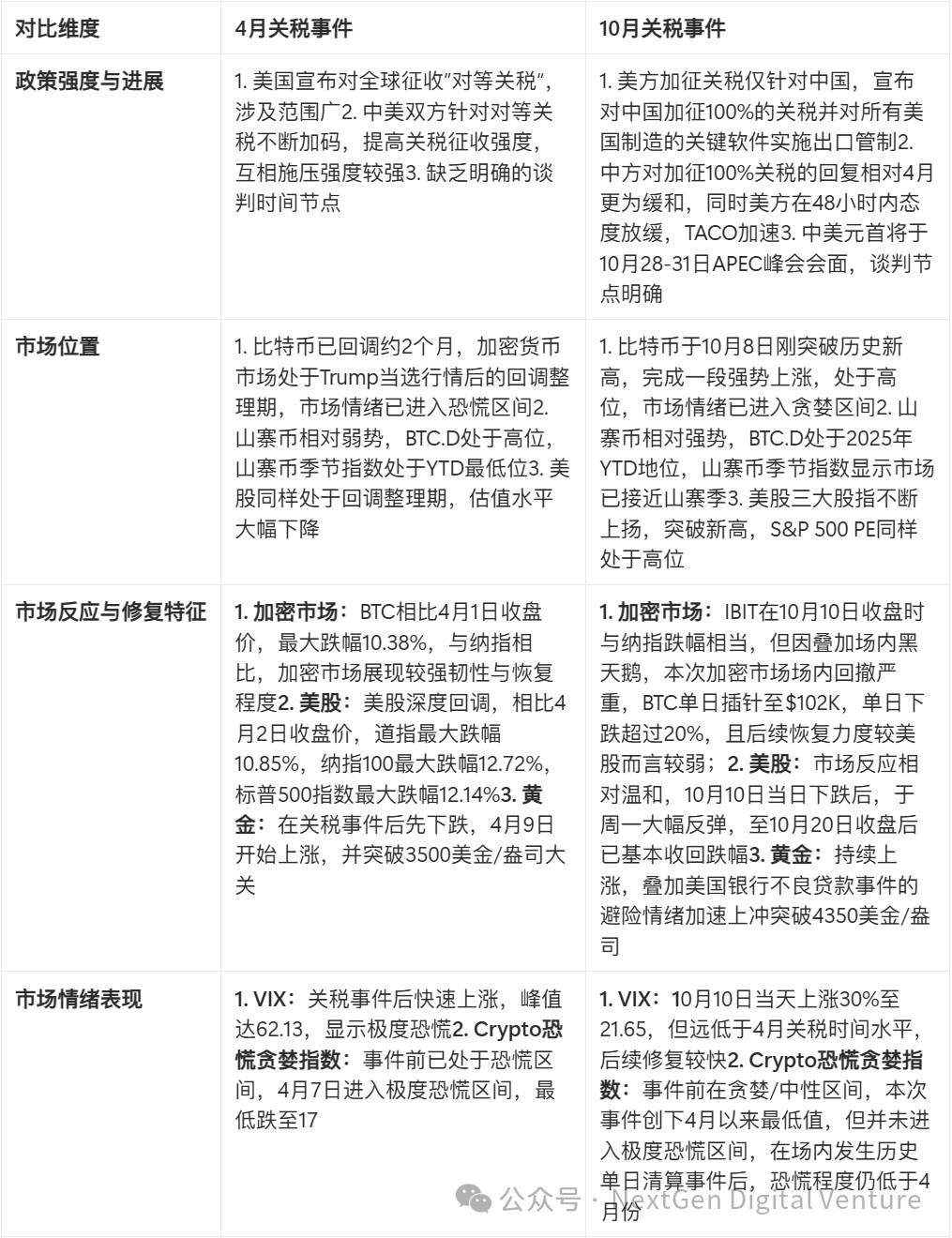

Our research team has conducted a detailed review of two typical TACO events (the China-U.S. trade tensions on April 2 and October 10), attempting to analyze why, even with similar types of events, market reactions differ under varying event developments, macro backgrounds, market positions, and sentiment conditions.

Core Comparison of Two TACO Events

Although both China and the U.S. have released signs of easing in this tariff incident, the entire TACO episode has not yet concluded. NDV will closely monitor subsequent dialogues and meetings between the two sides and continue updating our market observations.

Timeline of the TACO Event

April 2: U.S. imposes "reciprocal tariffs" on China

April 2, 2025 (Event Start: Announcement of Reciprocal Tariffs)

Trump announced reciprocal tariffs targeting China and other partners, imposing a 10% baseline tariff plus additional adjustments based on trade deficits. The baseline tariff took effect on April 5, while higher "reciprocal tariffs" were set to take effect on April 9. On April 1, Treasury Secretary Beasant informed lawmakers that the April 2 tariffs would represent the "upper limit," aiming to leave room for negotiations to reduce actual tariff levels.

April 4, 2025 (Initial Chinese Retaliation)

The Tariff Commission of China's State Council announced 34% tariffs on U.S. imports in response to U.S. "reciprocal tariffs," covering agricultural products, automobiles, and others.

April 7, 2025 (U.S. Escalation)

Trump announced an additional 50% tariff on China in response to China’s 34% countermeasure.

April 8, 2025 (Further Escalation)

Trump signed Executive Order 14259, raising reciprocal tariffs on China from 34% to 84%, and adjusting tariffs on low-value imports. The measure was effective on April 9. On the same day, China also raised tariffs on U.S. goods to 84% and announced export controls on medium-heavy rare earth items, precisely targeting U.S. military and semiconductor industries.

April 10, 2025 (Peak Escalation and Partial De-escalation)

Trump signed Executive Order 14266, further increasing tariffs on China to 125% (approximately 145% total including prior tariffs), effective immediately. Meanwhile, tariffs on 75 other countries were suspended for 90 days and reduced to 10%. On April 11, China announced it would raise tariffs on U.S. goods to 125% and stated it would ignore any further U.S. tariff hikes, marking the peak of the first round of maximum pressure.

May 2, 2025 (Public Signal for Consultations)

China's Ministry of Commerce confirmed multiple U.S. attempts to negotiate, with the U.S. emphasizing current tariffs as "unsustainable." Both sides agreed to hold face-to-face talks in Geneva. Trump publicly stated, "I hope to reach an agreement with China."

May 12, 2025 (De-escalation Completed: Geneva Talks)

After high-level economic and trade talks in Geneva, China and the U.S. reached a "ceasefire agreement," announcing the cancellation of previously imposed 91% punitive tariffs, retaining only a 10% tariff and suspending a 24% tariff for 90 days. The trade war temporarily eased.

Resurgence of China-U.S. trade war in October

October 3–9, 2025 (Background Prior to Event)

On October 3, the U.S. announced it would impose high "port maintenance fees" on Chinese-owned, operated, or built vessels entering U.S. ports starting October 14. On October 9, China's Ministry of Commerce issued a series of announcements imposing export controls on super-hard materials, certain rare earth equipment and raw materials, five types of medium-heavy rare earths, lithium batteries, and artificial graphite anode materials, effective November 8. Among them, export controls on overseas rare earths and rare earth technologies were particularly strict, seen as cutting off U.S. supplies at their source.

October 10, 2025 (U.S. Escalation Threat)

On the evening of October 10 (Beijing time), Trump expressed dissatisfaction via Truth Social about China’s export controls on rare earth products, stating he was considering significantly raising tariffs on Chinese goods entering the U.S. He later continued posting on Truth Social, announcing plans to impose 100% tariffs on Chinese imports and export controls on all key U.S.-made software, with measures expected to take effect on November 1.

October 12, 2025 (Short-Term Easing)

U.S. Vice President Vance sent easing signals, stating in a media interview: "Trump is willing to be a reasonable negotiator with China," implying "everything is negotiable" and avoiding immediate full implementation. Following Trump’s latest tariff threats, some calming signals emerged. Trump later posted mildly on Truth Social: "Don't worry about China, it will all be fine."

October 17, 2025 (Trump's Statement)

When asked whether he would maintain high tariffs on China, Trump responded: "NO."

October 18, 2025 (Trump Speaks Again)

Trump mentioned that if no trade deal is reached before November 1, China could face 155% tariffs ("China’s paying 55% and a potential 155% come November 1st unless we make a deal.")

Key Future Dates

Late October: APEC summit in South Korea from October 28 to 31. Watch interactions and statements between China and the U.S. before the summit, and whether there will be a meeting between the two leaders during the summit.

November 1: Whether the U.S. 100% tariff takes effect as scheduled is a "hard indicator" for judging the direction of the trade war.

Mainstream Market Performance During Two TACO Events

Crypto Market

BTC Price

First, we examine BTC’s price reaction during the two events and its market position prior to each event. Before the April 2 tariff announcement, BTC had undergone about two months of consolidation, falling from a high of $109,588 to around $85K on April 1—this correction followed the post-election rally, with a decline of nearly 30%. On April 2, the day of the tariff announcement, BTC dropped about 3%. As both sides escalated tariffs, BTC fell over 6% on April 6. Prices began steady gains after easing on April 9 and remained in an upward trend until the Geneva talks on May 12.

The October 10 tariff event differed from the April situation. BTC had experienced a strong breakout rally and just hit a new all-time high on October 8, surpassing the 126,000 mark. After the tariff news on October 10, BTC closed down over 7%, hitting a low of 102,000 due to large liquidations—over 20% below the opening price. Subsequently, due to relatively calm attitudes from both sides—especially easing signals from the U.S.—BTC slightly recovered to around 115,000, but then retested and broke below the 107,000 support level.

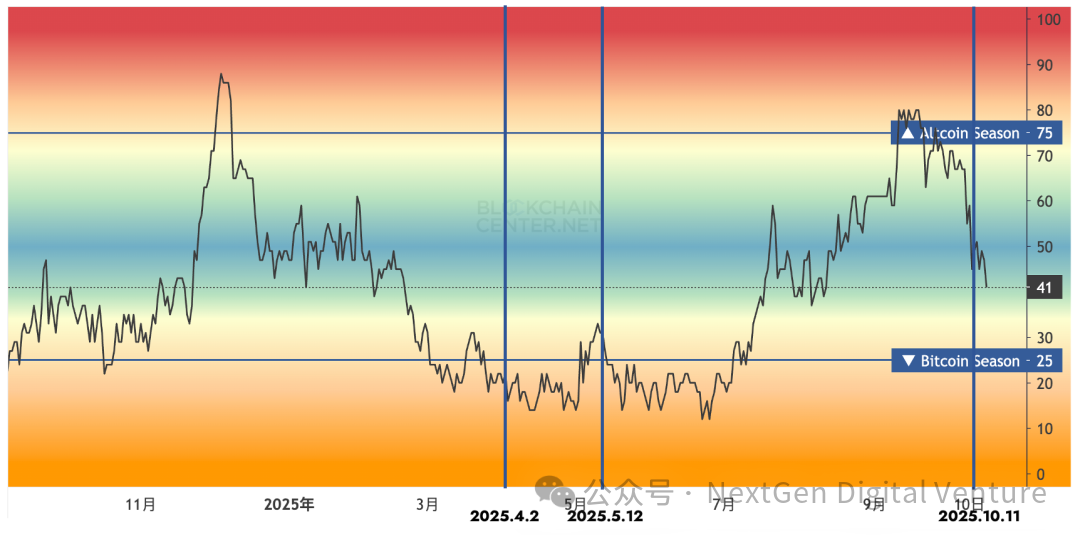

Sentiment Index

The Crypto Fear & Greed Index similarly reflects differences in market positioning. During the April 2 tariff event, the market had already entered the fear zone due to prior corrections, plunging into extreme fear by April 6. Before this tariff event, the market hovered between greed and neutral zones following its breakout to new highs. After the tariff announcement and an internal black swan liquidity shock, sentiment plummeted. As of October 18, the Fear & Greed Index had dropped to 25—the lowest since the April tariff event—but still above April’s lows and not yet in extreme fear territory.

Altcoin Index & BTC.D

The Altcoin Index and BTC.D reflect altcoins’ performance beyond BTC during the two TACO events. Before the April 2 tariff event, both indicators showed relative weakness in altcoins. After the April 2 drop, BTC.D rose rapidly until sharply declining just before May, reflecting market-wide risk-off sentiment toward altcoins. Prior to this tariff event, BTC.D had fallen to its lowest level since 2025, after ETH-led rallies boosted altcoins broadly, and several major project TGEs increased altcoins’ market cap share. This time, first, due to sharp declines in altcoins, BTC.D spiked to 63% on October 10—up over 4% from the previous day. Then, during market recovery on October 11 and 12, altcoin market cap recovery outperformed BTC, mainly driven by oversold bounce-backs from massive altcoin liquidations. Additionally, the Altseason Index dropped rapidly from around 65 to 41 by October 18 due to excessive altcoin liquidations.

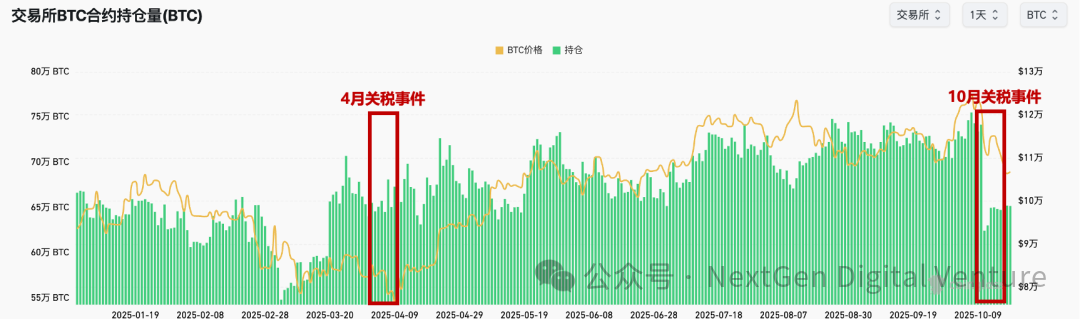

Market Leverage Situation

Compared to April, this tariff event triggered a more thorough leverage cleanout. On one hand, altcoins generally plunged suddenly, leading to massive deleveraging. On the other hand, even for BTC, the degree of leverage reduction was far more significant than in April—during the April 2 event, the initial drop did not cause a notable decline in BTC-denominated OI (open interest). After this event, however, OI dropped sharply from 741,500 BTC on October 10 to 624,400 BTC on October 11—a decrease of about 18%, returning to March 2025 levels.

U.S. Stock Market

Performance of Three Major U.S. Indices and IBIT

The table and chart below show price changes in the three major U.S. indices and IBIT during the two TACO events. In the table, we compare price movements over six trading days following each event. Currently, U.S. stocks are down less than during the April tariff event, but IBIT has declined more deeply and recovered less. Although IBIT’s drop on October 10 was close to that of the Nasdaq, it continued falling in subsequent trading days without meaningful recovery.

S&P 500

Nasdaq 100

Dow Jones

IBIT

Before reviewing IBIT’s price movement, we briefly discuss the differing perspectives reflected by BTC versus IBIT, and why IBIT warrants separate analysis despite tracking BTC. IBIT trades during U.S. market hours and overlaps more with institutional and U.S. equity investors. It also isolates extreme drops caused by internal crypto market liquidity shocks—making IBIT a useful lens to observe how crypto and U.S. equities move together. After the April 2 tariff event, IBIT dropped about 5.75% on April 3 and another 7.21% on April 7, then rebounded 7.43% on April 9.

In this tariff event, IBIT fell 3.70% on October 10 and has not recovered effectively. As of October 17, it remains in a downtrend, having broken key support near $61, down 12% from its October 9 closing price.

Valuation Level: S&P 500 PE

The S&P 500 PE Ratio also highlights differences in market positioning. Before the April 2 tariff event, U.S. stocks had already corrected for some time, placing valuations at a relatively low interim level. At the time of this tariff event, the PE ratio had reached its highest point since 2022—meaning U.S. stocks were not only at price highs but also valuation highs.

VIX

The VIX reflects panic in the U.S. stock market—the higher the VIX, the greater the market fear. From the VIX index perspective, the pre-April correction had already heightened market anxiety, with the VIX approaching 30 in March and spiking to 60 after the April tariff announcement. While this tariff event caused a rapid VIX surge to its highest level since April, it remains far below April’s peak. One reason is the relatively milder progression of this event; another is that after the “market education” of April, expectations around the TACO trade are higher and sensitivity to tariff news somewhat reduced.

Gold

In both events, gold occupied a similar market position—having just completed a rapid rally to new highs. After the April tariff event, gold declined for three consecutive trading days due to global sell-offs before resuming its upward trend. This time, gold continued rising, further boosted by bad loan revelations at two regional U.S. banks, breaking through $4,300 decisively.

Summary

Finally, here’s a summary comparing the two China-U.S. tariff TACO events:

The Event Itself

This tariff event progressed more calmly than in April. In April, the U.S. broadly raised tariffs on major trade partners starting April 2, with both China and the U.S. continuously escalating, creating a tense atmosphere over the following week, driving markets lower in tandem with tariff increases. This time, the action targeted only China, and both sides adopted relatively calmer stances. After Trump proposed higher tariffs, China did not retaliate with corresponding tariff hikes, and the U.S. quickly slowed its pace, with both sides acknowledging room for further talks. That said, although tensions have eased, we do not consider the TACO cycle complete. Further attention is needed on future rhetoric and progress between China and the U.S., as well as specific outcomes from their summit meeting in Korea.

Macro Market Environment

Compared to April, the current macro environment includes additional factors: (1) Rate cut cycle: After a 25bp cut in September, markets have fully priced in further cuts—we are now in a relatively certain rate-cutting phase; (2) U.S. government shutdown: The U.S. government has been shut down since October 1, reaching 18 days by October 18, with no short-term end in sight, adding significant uncertainty; (3) U.S. regional bank loan crisis: Loan crises at Zions Bancorporation and Western Alliance Bancorp sparked fears over regional banks in U.S. markets, raising concerns of a broader banking crisis, contributing to a U.S. market drop on October 16—especially KRX (Nasdaq Regional Banking Index), which fell 6.31%.

Market Position

The market positions of U.S. equities and cryptocurrencies differ markedly between the two events. Simply put, in April, both markets had undergone relatively sufficient pullbacks and adjustments, whereas this time both are at elevated levels—whether in price, valuation, or leverage—making them more fragile. With markets having largely priced in upcoming rate cuts, both assets lack further catalysts after breaking new highs, making the tariff event a trigger for correction.

Market Sentiment Reaction

In terms of sentiment, this event triggered the highest fear level in both U.S. equities and crypto since the April tariff event, though not as severe as April. First, because both sides maintained relatively calm stances this time, avoiding tit-for-tat actions. Second, after experiencing the April event, markets have become less sensitive to similar incidents.

NDV Viewpoint

The real dividing line isn’t event severity, but market position and leverage structure.

Looking back at the two TACO events, the biggest difference between April and October lies not in “how serious the news was,” but in the market condition at the time of the trigger.

In April, the market had already adjusted, with low leverage and cold sentiment; in October, the market was at price highs, rich valuations, and high leverage—making it more fragile and prone to “chain liquidations” upon impact.

Therefore, this round of TACO resembles a structural deleveraging rather than a simple panic-driven crash. In the short term, the crypto market’s deleveraging process is not yet complete, and the recovery path will be flatter and longer. But positively, easing signals from policy emerged earlier, and stability in U.S. equities and gold provides external support for risk asset bottoming.

Core thesis: The essence of TACO is “mean reversion of risk premium.”

The repeatable logic of such events is that markets tend to overprice risk premiums during policy threats, then gradually recover once easing signals appear. In other words, TACO is not a bet on whether an individual “backs down,” but an observation of how markets first overreact, then self-correct. Therefore, timing and structural judgment matter more than short-term sentiment.

Key points to watch ahead:

Policy tone—whether easing statements evolve into concrete actions, especially around the APEC summit;

Funding flows—whether ETF inflows and trading activity recover, and whether institutional capital returns;

Market structure—whether open interest (OI) and liquidation volumes continue to decline, and whether BTC can stabilize above key support.

These factors will determine the transition from “short-term volatility” to “trend recovery.”

NDV Perspective

For markets, TACO is not a black swan, but a recognizable, quantifiable policy-timing risk. It tests not reaction speed to news, but depth of understanding of market structure. When panic creates pricing distortions, calmness and patience become the scarcest assets.

TechFlow will continue tracking subsequent dialogues and meetings between China and the U.S., and update our assessment of this “panic-recovery” cycle in future market observations.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News