When a foreigner starts learning Chinese to trade cryptocurrencies

TechFlow Selected TechFlow Selected

When a foreigner starts learning Chinese to trade cryptocurrencies

How should "Binance Life" actually be translated?

By: BUBBLE

Binance Life has finally become the first Chinese-language coin to be listed on Binance perpetual contracts.

If you're involved in the Chinese crypto space, it's impossible not to have heard of this term over the past two weeks. Since its emergence as a "ticker," it has been both a joke and an aspiration. Even CZ admitted he didn't expect that a simple reply would trigger such a chain of events.

It first sparked discussion from OKX CEO Star, then ignited a wave of Chinese tickers for Tron and Solana. A few days ago, the founder of limitless publicly revealed so-called "listing terms," triggering a standoff between two blockchains and exchanges—until Jesse ended the conflict with one phrase: "Enable Binance Life mode on Base."

Yet what lies behind this may represent not just a single ticker, but a deeper cultural shift. This could be the first time a series of high-market-cap memecoins are driven by Chinese rather than English—and what meme culture do they represent?

This time, we spoke with 0xBarrry, co-founder of WOK Labs—a Polish trader who runs a community of hundreds. When foreigners start trading Chinese memes, what are they really thinking?

A Conspiracy Community Meets Chinese Conspiracy Coins

To ordinary traders, this wave has appeared both mysterious and thrilling.

Polish trader and WOK Labs founder Barry recalled: "I was shocked the first time I saw a coin with a Chinese label surpass $20 million in market cap—realizing immediately that these conspiracy coins still had huge potential. When it surged to $60 million, even $100 million, the European groups were in an uproar. Many rushed to deposit funds into BSC chains simply because prices were rising, without understanding why."

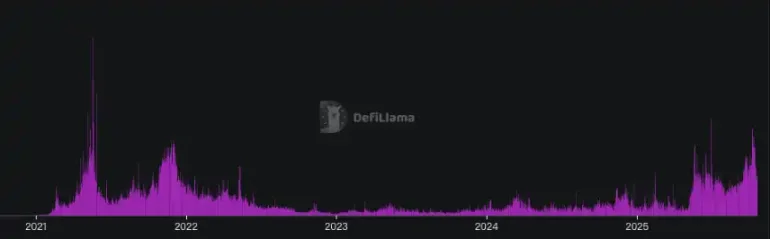

This market sentiment wasn’t isolated. Defillama’s on-chain data shows that on October 8, BSC chain volume spiked to $6.05 billion, reaching levels last seen during BSC’s 2021 meme-coin mania—but this time led by Chinese memecoins.

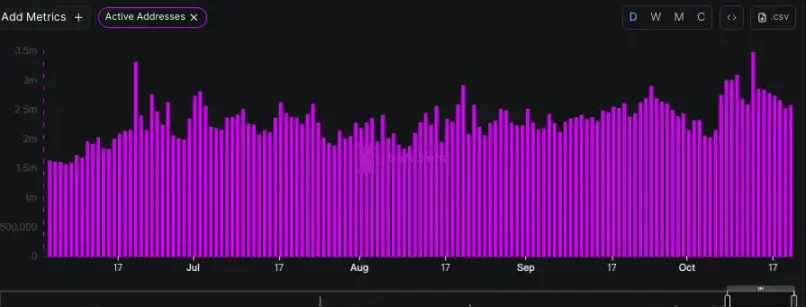

On that day, over 100,000 new traders joined the memecoin frenzy, nearly 70% of whom made profits. This genuinely attracted many "foreigners" to participate in BSC on-chain activity, with active addresses increasing by nearly 1 million compared to the same period last month.

Western investors rushed in only after prices soared, many realizing the truth only after scrambling to "check Chinese." Cultural and traditional trading differences caused Western players to lose out for the first time.

"Previously, European meme investments followed American internet culture—self-deprecating and rebellious humor. Suddenly, Chinese memes taking center stage left many Westerners disoriented," said Barry.

However, due to his early collaboration with Chinese teams in founding WOK Labs, Barry already understood how Chinese communities operate—the role of personal networks, emotional resonance, and other factors. He began spreading Chinese narratives within European communities, explaining these differences to more Western traders.

Moreover, differences in how communities engage with memecoins are clear. European traders tend to favor conspiracy-style meme projects, mostly relying on the Ethereum ecosystem, where well-known KOLs or teams manipulate large positions to pump prices. These communities form slowly, but when major KOLs or teams hold large bottom positions, there's also significant selling pressure—this is why building long-term value in Western markets is difficult.

In contrast, Chinese communities form more easily. They emphasize emotion and storytelling (or leader-driven coins). Project teams and meme communities rally support through WeChat groups by sharing stories and creating emotional alignment. In theory, this emotionally driven, "fair-launch" model can foster more sustainable communities.

Especially in this cycle, it's relatively easy for Chinese players: just buy what feels hot (or follow influential figures) and you can "print money at will." One retail investor focused solely on Chinese coins rotated through 65 different BNB-chain Chinese memecoins in seven days—starting with broad $100–300 bets, then doubling down on standout performers, netting around $87,000 in a week. This

This high-frequency "spray-and-pray" strategy reflects the speculative style of most Chinese retail investors toward new trends. Meanwhile, Western players are gradually abandoning small-cap memecoins around $500,000 and shifting toward more certain targets starting at $5 million market cap.

This also makes agencies like Barry—who bridge China, Korea, Japan, and Western markets—increasingly active, helping Asian projects gain Western trust and assisting European teams entering Asia.

He believes this culture gap, exposed through personal experience, might be nurturing new cross-community collaboration opportunities.

From Dogecoin to Chinese Memecoins: From Satirical Meme to Ideological Meme

From a broader perspective, the memecoin trend stems from collisions between different cultural genes. The Western prototype was Doge, created in 2013 by two programmers as a joke.

Doge initially mocked Bitcoin's serious tone with humor, but eventually reached a market cap peak of $88.8 billion in May 2021, thanks to celebrity influence (like Musk) and sustained community enthusiasm.

Pepe followed a similar path. Born from 4chan's online culture, the coin exploded in early 2023, briefly surpassing $1 billion in market cap. Pepe relied entirely on internet hype—no presale, no team allocation, no roadmap—and the team explicitly stated the coin had "no intrinsic value, for entertainment only."

This philosophy dominated many subsequent Solana memecoins: nihilistic ones like Fartcoin and Uselesscoin, or Neet, reflecting Western internet culture's love for subverting real-world values with dark humor. Or TikTok-famous memes like 67—Solana memecoins captured investor imagination through image macros and rebellious spirit, dominating attention economics for years. This also caused regions dominated by Chinese speakers to lack "cultural valuation" of these tokens, leading to misjudgments.

Chinese memecoins, however, show distinct traits—they often stem from shared identity and emotional projection. Tokens like "Humble Xiao He" and "Customer Service Xiao He" use self-mocking humor about blue-collar struggles to comment on social reality. The "Cultivation" series reflects Chinese netizens' escapist fantasies. "Binance Life" directly embodies the dream of overnight wealth in crypto markets. And notably, they all share a connection to official entities.

This represents a cultural mindset difference. For Chinese users, this means "expanding your options," while for most Western players, such names imply their upside depends entirely on whether the system chooses to pump them.

But the explosion of Chinese memecoins like "Binance Life" actually benefited directly from this emotional resonance. Its slogan draws a parallel between "Binance Life" and the previously popular "Apple Life"—a narrative innovation clearly different from Doge’s satire, appealing more to loyalty and sentiment.

When enough people understand this association, the ticker becomes tied to the system. Then, when it's mocked publicly, the official party "must pump it"—perhaps the belief held by those who held through washouts.

This meme wave wasn’t purely organic; it was also carefully cultivated by the Binance ecosystem. From He Yi’s offhand joke, CZ’s reply, a series of official interactions from Fourmeme, to Binance launching its MemeRush platform—step-by-step, timed releases of positive news managed high-market-cap memecoin breakout phases, mid-term liquidity, and long-term sustainability. This brought order to what was once chaotic memecoin issuance, making the frenzy more organized and keeping market attention locked on the BSC chain.

The excitement spread from individual projects to the entire BSC ecosystem, further fueling the degenerate psychology that "the next trade could make you a millionaire." This "upward ladder" expectation explains why, at the start of this rally, multiple hot projects emerged without obvious liquidity competition between them.

This is a visible ladder-like wealth effect created jointly by official platforms and communities. It validates the existence of structured listing expectations behind Chinese memecoins—and market consensus reaching such heights would have been unthinkable just months ago.

In contrast, Western memecoins are more about luck-based community parties or orchestrated efforts by hidden groups. But this BSC ecosystem, driven by founders, platforms, and communities, has turned the frenzy into an overt "wealth creation campaign."

Exchange PR Wars: Listing Fees and U.S.-China Thaw

Meanwhile, this storm triggered fierce PR battles between exchanges. On October 11, 2025, Jesse tweeted calling for resistance against centralized exchanges charging 2%–9% listing fees.

Three days later, on October 14, CJ Hetherington, founder of Coinbase-backed prediction market project Limitless Labs, leaked on X that during negotiations with exchanges, listing on Binance required staking 2 million BNB plus high costs—including 8% of total tokens for airdrops and marketing, plus a $250,000 deposit.

He contrasted Binance with Coinbase, claiming Coinbase valued project fundamentals while Binance operated like a "listing fee" model. In response, Binance quickly denied the claims as "entirely false and defamatory," insisting it "never charges listing fees" and threatening legal action over CJ’s release of internal conversations.

Later, Binance issued a more restrained statement, acknowledging its initial reaction was excessive but reaffirming it does not charge any listing fees.

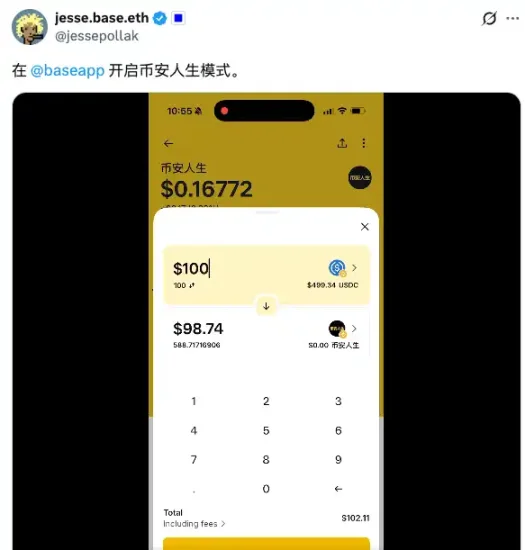

As the debate intensified, Coinbase responded swiftly. Jesse Pollak, head of the Base blockchain, publicly stated on social media: "Getting a project listed on an exchange should be zero cost."

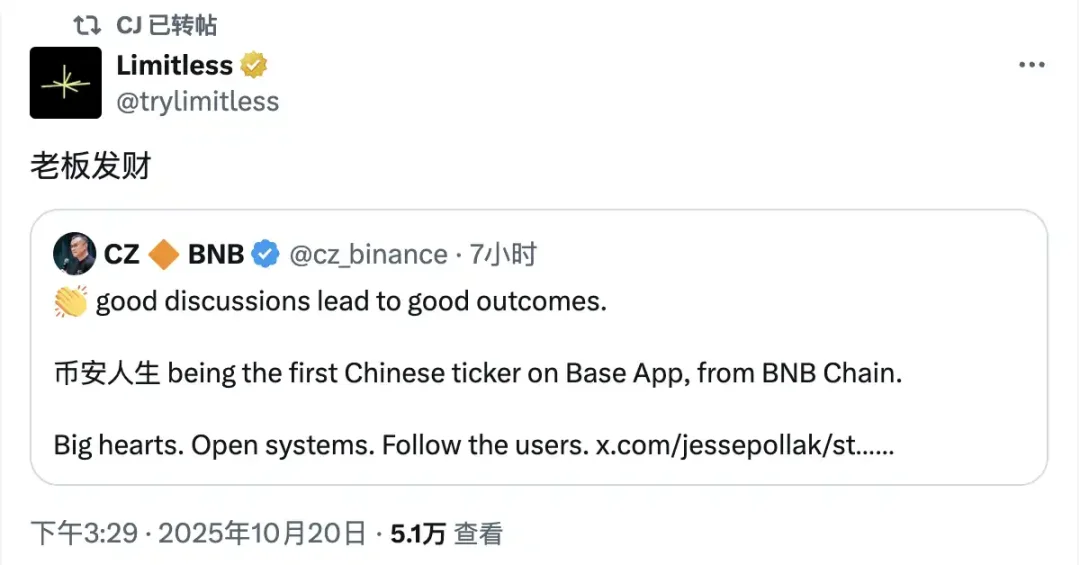

But then public opinion reversed. Coinbase seemingly "in a huff" officially announced it would add BNB to its future supported token list—the first time ever supporting a native token from a direct competitor’s mainnet. In response, Binance founder CZ welcomed the move on social media and encouraged Coinbase to list more BSC projects.

CJ, who originally "exposed" the terms, began reaching out amicably. Jesse Pollak did a complete 180-degree turn—posting a demo video of the Base App, which even used "Binance Life" as an example token. Pollak joked in Chinese: "Enable Binance Life mode on Base App," and replied under CZ’s tweet: "Binance Life + Base Life = Ultimate combo." These moves were widely interpreted as a thaw between U.S. and Chinese crypto camps—and incidentally gave the Base chain its long-awaited little golden dog.

When the trading volume and attention brought by Asian markets reach a certain scale, Western exchanges must actively approach Chinese communities. Exchange competition and cultural narratives are now deeply intertwined.

East-West Community Perception and Reaction

Mainstream Western media closely followed this event. Many Western retail investors in groups lamented, "Prices went up and we didn’t even understand why." Most scrambled to join only after the price surge. Even communities like Barry’s, with deep ties to Chinese systems, often face the problem of "knowing the words but not the meaning" when encountering culturally embedded memecoins. Clearly, for overseas investors, Chinese elements have become a new barrier to entry.

Translation tools developed by some members in Western communities to convert Chinese memecoins to English

This wave reinforced the idea that "language equals opportunity." In crypto, cultural and emotional context behind different languages itself is a layer of value. "For the first time, Western investors need to understand Chinese culture to join the feast."

A recently viral video series of foreigners learning Chinese to buy memecoins

Still, Barry believes: "I think the Chinese meme wave is nearing its end. The longer this cycle lasts, the worse the PTSD it will leave traders with. We’re already seeing these memecoins shift toward smaller caps and faster rotation across sectors."

At the same time, he adds: "English and Chinese are now the dominant forces in the meme market, and this won’t change soon. China has a larger market and is more emotionally driven. European markets tend to lag. I believe English tickers may return, but in a form increasingly fused with Asian culture. Inspired by this wave of Chinese memes, they’ll adopt more Chinese-style humor, symbolism, and aesthetics."

Going forward, capturing the next memecoin opportunity will require more than luck—it demands deep understanding of language and culture across regional communities. AI may help cross-language dissemination, such as auto-generating Chinese meme images or translating social posts to speed up information flow. But AI still can't replace deep cultural contextual comprehension.

We may see a more multipolar crypto world, with Base, Solana, and others increasingly featuring Chinese-ticker "golden dogs." There will be new trends of fusion and mutual learning between Eastern and Western communities, but also the possibility of segregated ecosystems. And in the cracks between these cultural differences may lie new opportunities.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News