Huobi Growth Academy | Cryptocurrency Market Macro Research Report: TACO Trading and Macro Analysis & Market Outlook After the 1011 Crash

TechFlow Selected TechFlow Selected

Huobi Growth Academy | Cryptocurrency Market Macro Research Report: TACO Trading and Macro Analysis & Market Outlook After the 1011 Crash

The key variables for the fourth-quarter market performance still lie in the direction of macro policies and regulatory signals; if the U.S. dollar liquidity environment does not improve significantly, the market may continue its volatile downward trend.

Summary

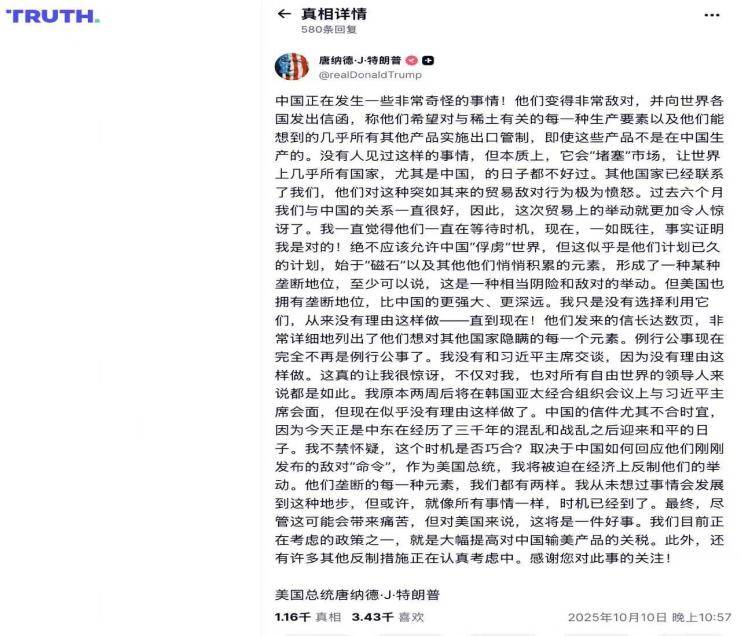

The cryptocurrency market crash on October 11, 2025—dubbed the "1011 Incident" within the industry—saw over $19 billion in liquidations in a single day, more than ten times the previous historical peak. Bitcoin plummeted from $117,000 to below $102,000, marking the largest one-day drop in nearly three years. Unlike the liquidity crisis triggered by the pandemic on March 12, 2020 ("312"), or the regulatory-driven sell-off on May 19, 2021 ("519"), this event was sparked by a macro-political shock: Trump’s announcement of 100% tariffs on Chinese imports. However, the real destructive force stemmed from the crypto market's inherent leverage fragility. The much-discussed "TACO trade" (Trump Anticipated China Outcome trade) that emerged during the event was essentially speculative positioning based on anticipated policy signals from Trump. Market participants widely believe Trump leverages extreme rhetoric and surprise policies to generate price volatility and indirectly manipulate market expectations. The incident not only devastated the Meme sector and undermined confidence in digital asset treasury (DAT) companies but also subjected Perp DEXs to their largest-ever on-chain liquidation stress test, highlighting how deeply embedded crypto markets have become within global finance and geopolitics. The 1011 Incident may represent crypto’s “Lehman Moment,” with aftershocks and confidence recovery potentially taking weeks or even months to resolve. Looking ahead to Q4 2025, the market is likely entering a phase of “risk repricing” and deleveraging, with overall volatility remaining high. BTC and ETH may seek bottoming near key support levels, while high-risk assets like Memes are unlikely to regain momentum in the short term. DAT firms and related U.S. equities could continue facing downward pressure. In contrast, stablecoin liquidity, blue-chip DeFi protocols on major blockchains, and staking derivative assets with stable cash flows might serve as temporary safe havens for capital. The core drivers of Q4 performance will remain macroeconomic policy directions and regulatory signals; without significant improvement in USD liquidity conditions, the market may continue its volatile search for a bottom.

I. Background and Analysis

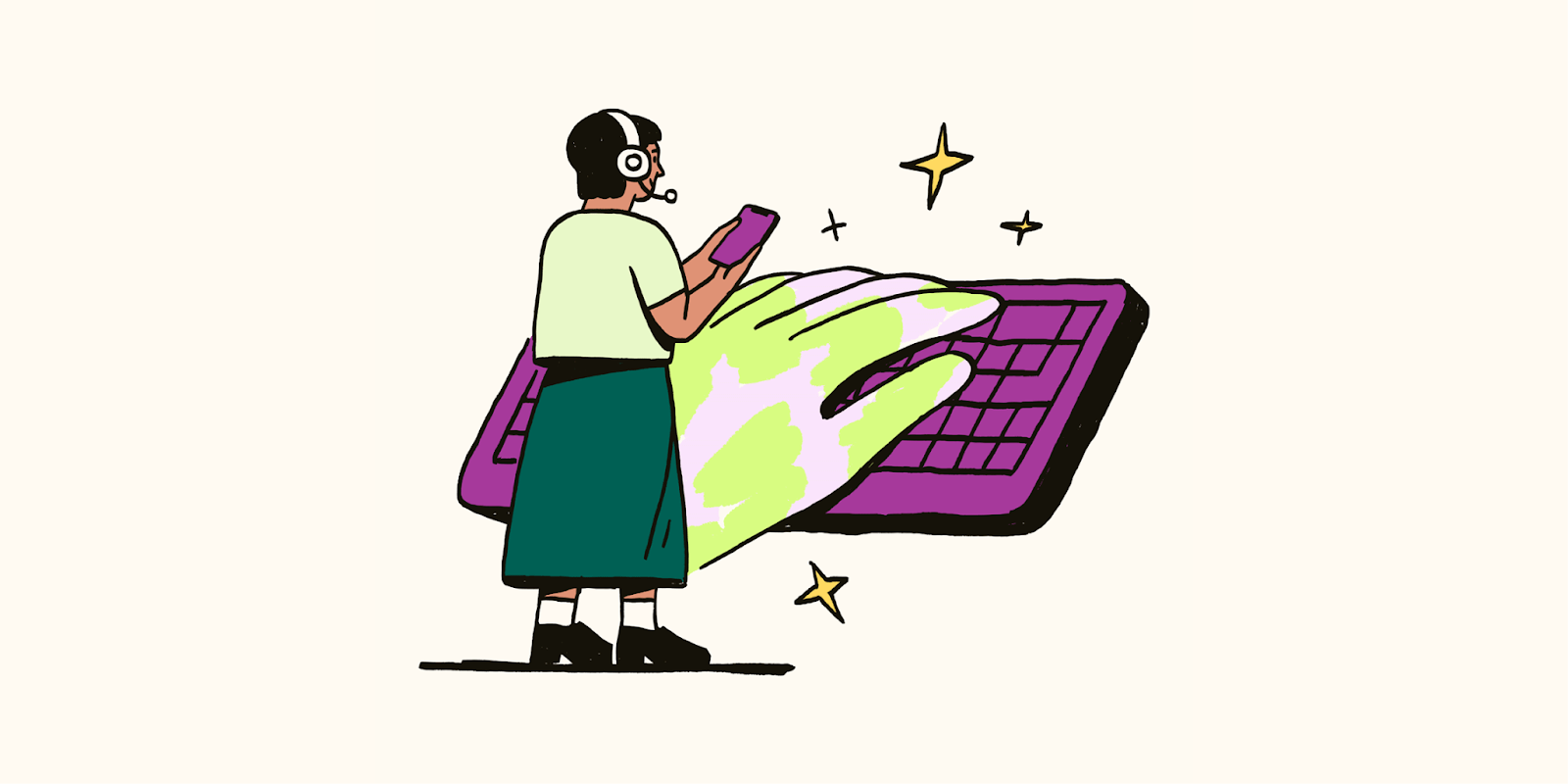

The market turmoil on October 11, 2025, has been widely labeled the "1011 Incident." This extreme event—featuring over $19 billion in same-day liquidations and a $15,000 intraday plunge in Bitcoin—is not an isolated occurrence but rather the result of converging macro-political shocks, structural market fragility, and localized triggering mechanisms. Its complexity and severity evoke comparisons to the 2008 global financial crisis and the collapse of Lehman Brothers. Below, we analyze the deep logic behind this crisis from five angles: macro backdrop, market vulnerability, trigger mechanism, transmission chain, and liquidation mechanics. Global Macro: Trump’s Tariff Policy and U.S.-China Trade Conflict. In the second half of 2025, the global economy was already under severe strain. After multiple rounds of rate hikes and fiscal expansion, concerns mounted over U.S. fiscal sustainability, with the dollar index persistently elevated and global liquidity tightening. Against this backdrop, late on October 10 (U.S. Eastern Time), Trump abruptly announced 100% tariffs on all Chinese imports—an action far exceeding market expectations and escalating U.S.-China trade tensions from "structural friction" to "full-scale economic confrontation." This policy instantly shattered hopes for Sino-American de-escalation. Asian equity markets reacted first, followed by sharp pre-market declines in U.S. futures. More critically, the pricing logic for global risk assets was completely disrupted. For crypto assets—highly dependent on dollar liquidity and risk appetite—this constituted a systemic shock. In essence, the macro environment delivered the external "black swan" that ignited the 1011 Incident. Yet, whether any external shock escalates into a full-blown crisis depends heavily on the market’s internal fragility.

The crypto market in 2025 stood at a precarious juncture: First, liquidity was strained—Fed balance sheet contraction and high interest rates led to tight USD funding. Stablecoin issuance slowed, arbitrage channels between on- and off-chain became inefficient, and on-chain liquidity pools visibly thinned. Second, leverage was excessive—with BTC surpassing $100,000 and ETH reclaiming a $1 trillion market cap, market sentiment reached fever pitch. Perpetual contract open interest hit record highs, and aggregate leverage exceeded even the peak of the 2021 bull run. Third, sentiment was exhausted—the Meme sector’s parabolic rise and associated capital frenzy pulled in retail and institutional investors alike, all betting on a perpetual bull market. Any reversal would thus be devastating. The market had become a “house of cards built on leverage,” needing only a spark to collapse. Trigger Mechanism: USDe, wBETH, BNSOL Depegging. What ultimately detonated the crisis was the simultaneous depegging of three critical assets: USDe (a new over-collateralized stablecoin) briefly fell below $0.93 due to delayed liquidation of reserve assets, sparking panic; wBETH (a liquid staked ETH derivative) saw its discount widen to 7% amid illiquidity and forced selling; BNSOL lost its peg under cross-chain bridge fund withdrawals, trading nearly 10% below parity. These assets were widely used as collateral and trading pairs. When their prices rapidly diverged from fair value, liquidation engines misjudged risk, collateral values collapsed, amplifying the cascade of forced liquidations. In short, the failure of these “core liquidity assets” served as the fuse that set off the market’s self-destruction. Crisis Transmission Chain: From Depegging to Liquidation. The sequence unfolded as follows: depegging eroded collateral → margin deficiencies triggered liquidations → CEXs and DEXs raced to close positions → price freefall → further collateral devaluation, creating a positive feedback loop. Especially under “unified margin account models,” where user funds are pooled, the sharp decline in USDe and wBETH directly compromised overall account health, leading to widespread non-linear liquidations. This flaw proved to be the most fatal structural risk in the 1011 Incident. Differences Between CEX and DEX Liquidation Mechanisms. Centralized exchanges (CEXs) typically use auto-deleveraging (ADL) and forced liquidation systems—once margin thresholds are breached, positions are closed automatically. During high volatility, this often exacerbates “crowd crushing.” Platforms like Binance and OKX, with concentrated user bases, experienced massive liquidation volumes. Decentralized exchanges (DEXs), relying on smart contracts for liquidations, offer transparency but suffer from limited on-chain settlement speed. Price slippage and gas congestion reduce liquidation efficiency, sometimes leaving positions “unable to close promptly,” distorting prices further. On October 11, the combination of CEX and DEX liquidation mechanisms created a “dual stampede effect.” Collateral Risk: The Fatal Flaw of Unified Margin Models. The now-popular “unified margin model” (cross-margin with shared collateral) in crypto markets aims to enhance capital efficiency by allowing different assets to share margin. But in extreme scenarios, it magnifies risk: devaluation of USDe and wBETH → reduced total account equity → deteriorating margin ratios → cascading forced liquidations → selling pressure further depressing collateral prices. This self-reinforcing loop turns minor collateral depegs into systemic blow-ups.

The 1011 Incident was not a singular black swan, but the convergence of macro shock + leverage fragility + collateral failure + flawed liquidation design. Trump’s tariff announcement was the spark; excessive market leverage and unified margin models were the accelerants; the depegging of USDe, wBETH, and BNSOL provided the immediate trigger; and CEX/DEX liquidation mechanisms acted as amplifiers accelerating the collapse. This crisis reveals a harsh truth: crypto markets have evolved from “isolated risk pools” into complex systems tightly coupled with global macroeconomics and geopolitics. In such a landscape, any external shock can propagate through leverage and collateral structures, triggering chain reactions culminating in a “Lehman-style” liquidity meltdown.

II. Historical Comparison and Analysis

On March 12, 2020, amid the spread of the pandemic and collapsing oil prices, global capital markets faced historic panic, entering what some called the “crypto Lehman moment” of the COVID liquidity crisis. U.S. equities triggered circuit breakers, dollar liquidity dried up, and risk-off sentiment led to dumping of all high-risk assets. Bitcoin crashed from around $8,000 to under $4,000 in a single day—a drop exceeding 50%—prompting widespread use of the term “crypto Lehman moment.” At its core, 312 was a case of macro liquidity shock spilling into crypto: dollar scarcity forced investors to sell all non-core assets, making stablecoin redemptions difficult. Infrastructure was weak then, DeFi was small, and liquidations were concentrated on centralized platforms like BitMEX. Leveraged positions were forcibly closed, and on-chain collateral assets faced runs. Though fierce, the crisis remained largely an external macro shock amplified by leverage, affecting a still-small market. By 2021, Bitcoin broke $60,000 and sentiment turned euphoric. In May, Chinese government crackdowns on mining and trading, combined with SEC scrutiny of exchanges, brought heavy regulatory pressure. Amid excessive leverage and optimism, over $500 billion in market value evaporated in one day, with Bitcoin dropping to around $30,000. The hallmark of 519 was the interplay between policy moves and internal market fragility. As a major hub for mining and trading, China’s regulatory actions weakened BTC network hashpower and market confidence. Meanwhile, bloated perpetual contract positions enabled rapid transmission of liquidations. Compared to 312, 519 reflected a blend of policy and structural risks, showing that as crypto entered the mainstream, it could no longer ignore regulatory variables. The “1011 bloodbath” of October 11, 2025—a “complex system event” combining macro shock, leverage, and collateral depegging—saw over $19 billion in daily liquidations, with Bitcoin falling from $117,000 to $101,800. Compared to 312 and 519, 1011 stands out for its heightened complexity and systemic nature. First, on the macro front: Trump’s 100% tariff on China escalated geopolitical friction into full economic warfare, pushing the dollar higher and pressuring all risk assets. While similar to 312, this wasn’t a pandemic black swan but a foreseeable conflict rooted in political-economic rivalry. Second, market fragility: leverage once again reached historic highs, with BTC and ETH hovering near peaks and meme mania fueling overconfidence, while liquidity weakened due to Fed tapering and slowing stablecoin growth—mirroring 519’s mix of optimism and structural weakness, but deeper. Third, the trigger: the simultaneous depegging of USDe, wBETH, and BNSOL marked a unique “internal ignition point.” As foundational collateral and trading pairs, their deviation from fair value caused the entire margin system to collapse—a phenomenon absent in 312 and 519, signaling that collateral risk itself has become a new systemic vulnerability.

All three crises reflect the recurring fate of crypto markets: “high leverage → fragile liquidity → liquidation chains.” External shocks act as triggers (pandemic in 312, regulation in 519, tariffs in 1011), while internal leverage and liquidity shortages serve as amplifiers. Each saw over 40% daily swings, massive liquidations, and severe blows to market confidence. Key differences: 312 was a singular macro shock affecting a small market with limited on-chain impact; 519 represented a resonance between regulation and leverage, demonstrating direct policy influence; 1011 combined macro, leverage, and collateral depegging, showing how crises now originate externally but destroy internal core assets—revealing greater systemic complexity. In other words, the crisis chain has lengthened: from “single macro point” → “policy叠加” → “self-collapse of internal core assets.” Across these three historic crashes, we see the evolution of crypto risk: From fringe asset to systemic coupling: 312 (2020) was mostly peripheral shock; 1011 (2025) is deeply tied to global macro and geopolitics—crypto is no longer an “isolated risk pool.” From single leverage to collateral chains: early crises stemmed from excessive contract leverage; today, instability lies in the collateral assets themselves—USDe, wBETH, BNSOL depegs are prime examples. From external amplification to internal self-destruction: 312 relied on macro sell-offs; 519 blended regulation and leverage; 1011 shows the market can now generate self-destructive loops internally. Institutional and structural gaps: unified margin models amplify risk in extreme conditions; combined CEX/DEX liquidation mechanisms accelerate stampedes—current designs prioritize “efficiency” over “resilience,” lacking adequate risk buffers. The 312, 519, and 1011 crises mark crypto’s transformation in just five years—from “fringe asset” to “systemically coupled.” 312 revealed the lethality of macro liquidity shocks; 519 exposed the double-edged sword of policy and leverage; 1011 unveiled the full eruption of collateral failure and structural risk. Going forward, systemic risk in crypto will grow more complex: it is highly dependent on USD liquidity and geopolitical dynamics, becoming a “high-sensitivity node” in the global financial system; meanwhile, internal traits like high leverage, cross-asset collateralization, and unified margining make it prone to accelerated collapse during crises. For regulators, crypto is no longer a “shadow pool” but a potential source of systemic risk. For investors, each crash is a milestone in risk understanding. The significance of 1011 is clear: the “Lehman Moment” for crypto is no longer metaphorical—it may now be real.

III. Sector Impact Analysis: Crypto Market Repricing After 1011

Meme Sector: From Frenzy to Retreat, Post-FOMO Value Collapse. The Meme sector dominated headlines in the first half of 2025. Legacy tokens like Dogecoin and Shiba Inu, alongside emerging Chinese memes, turned the space into a magnet for young users and retail capital. Driven by FOMO, individual coins saw daily trading volumes exceed tens of billions of dollars, becoming primary volume drivers on both CEXs and DEXs. After 1011, however, the structural weaknesses of Meme coins became glaring: Liquidity concentration: Overreliance on top exchanges and narrow liquidity pools meant panic triggered massive slippage. Lack of intrinsic value: Valuations rested on social narratives and fleeting attention, unable to withstand systemic liquidity runs. Capital effects reversed overnight: Retail pullback and institutional profit-taking led to swift “value disillusionment.” In short, the Meme “traffic-price-capital” loop collapsed under macro pressure. Unlike traditional assets, Memes lack verifiable cash flows or collateral logic, making them among the hardest-hit sectors during crashes. Memes are not just speculative instruments—they represent social expression for a generation. Their rise reflects collective psychology, identity, and internet subculture. But in today’s hyper-financialized environment, Meme lifecycles shorten, and capital reversals hit harder. Post-1011, the short-term narrative for Memes is bankrupt; they may revert to niche survival as “long-tail cultural tokens” or “branded memes.”

DAT Sector: Repricing Digital Asset Treasury Models. Three representative cases: MicroStrategy (MSTR): Continuously bought Bitcoin via bond issuance, exemplifying the “single-asset treasury model”; Forward: Focuses on Solana-based treasury management, emphasizing ecosystem alignment; Helius: Shifted from healthcare narrative to “Solana treasury platform,” generating cash flow via staking rewards and ecosystem partnerships. The DAT model centers on holding crypto assets as “quasi-reserves,” earning yield through staking, restaking, and DeFi strategies. In bull markets, this model commands NAV premiums, akin to “crypto closed-end funds.” After 1011, the market’s valuation logic for DAT firms contracted sharply: Asset-side shrinkage: Plummeting BTC/ETH prices directly reduced DAT net asset values (NAV). Consequences include: 1. Premium erosion: Earlier mNAV premiums (Market Cap / NAV) reflected growth and yield expectations, but vanished post-crisis; some smaller DATs now trade at discounts. 2. Liquidity divergence: Large firms like MSTR retain financing capacity and brand premium; small DATs face illiquidity and extreme stock volatility. 3. Big vs. Small: Large firms (e.g., MSTR): Can still raise capital via equity or debt offerings, exhibiting strong resilience; Small firms (e.g., Forward, Helius): Rely on token issuance and restaking yields, lack financing tools—face dual hits to cash flow and confidence during systemic shocks. Sustainability and ETF Substitution. Long-term competitive pressure on DATs comes from ETFs and traditional asset managers. As BTC and ETH spot ETFs mature, investors gain low-cost, compliant exposure, squeezing DAT premiums. Their future value hinges on: ability to generate alpha via DeFi/restaking; success in building ecosystem synergies (e.g., chain-specific integration); potential transformation into “crypto asset management firms.”

Perp DEX Sector: Restructuring the Derivatives Landscape. Hyperliquid ETH-USDT Liquidation Incident: During 1011, Hyperliquid suffered mass liquidations on its ETH-USDT contract, with temporary illiquidity causing price dislocation. This exposed the fragility of on-chain derivatives under extreme stress: Market makers withdrew capital, depth collapsed; Liquidation mechanisms depend on oracles and on-chain prices, constrained by block confirmation times; When user margins fall short, forced liquidation efficiency drops, increasing losses. ADL Mechanisms and Record-Low Funding Rates. Decentralized platforms use ADL (Auto-Deleveraging) to prevent insolvency, but during extreme events, ADL forces passive position reductions by profitable traders, creating secondary stampedes. Simultaneously, funding rates plunged to multi-year lows after 1011, indicating severely suppressed leverage demand and declining activity. On-chain vs. Centralized: Stress Resistance Differences. CEXs: Thicker liquidity, faster matching—but risk stems from user concentration; systemic stampedes cause massive damage. DEXs: High transparency, yet vulnerable to block throughput and gas fees during crises, ironically weakening resilience. This event showed Perp DEXs have not resolved the “efficiency vs. safety” dilemma, underperforming CEXs in extreme conditions—becoming a market weak link. Future Trends in Derivatives Markets: CEX dominance continues: With superior liquidity and speed, CEXs remain the main battlefield; DEX innovation push: Adoption of off-chain matching with on-chain settlement, cross-chain margining to boost resilience; Hybrid models emerge: New platforms may adopt CEX-DEX hybrid architectures, balancing efficiency and transparency; Regulatory scrutiny rises: Post-1011, liquidation chains drew attention—expect tighter leverage controls going forward.

Repricing Logic Across Three Sectors: Meme: From frenzy to retreat—unlikely to regain broad market liquidity, may shift toward niche culture and branding. DAT: Premium logic compressed—large firms resilient, small ones fragile; ETFs emerge as long-term substitutes. Perp DEX: Extreme conditions expose liquidity and efficiency flaws—requires technological and institutional upgrades to compete with CEXs. The 1011 Incident was not just a market purge but a starting point for sector-wide repricing. Memes lost bubble support, DATs enter rational valuation, Perp DEXs face restructuring challenges. The next phase of crypto expansion will unfold under more complex regulatory and institutional frameworks—and 1011 will stand as a pivotal milestone in this transition.

IV. Investment Outlook and Risk Warnings

The 1011 Incident once again revealed the crypto market’s collective behavior pattern: during bullish phases, leverage usage grows exponentially, with institutions and retail alike maximizing capital efficiency for short-term gains. But when external shocks hit, excessive leverage renders the market extremely fragile. Data shows that in the week before 1011, BTC and ETH perpetual contract open interest (OI) neared all-time highs, with funding rates reaching extreme levels. As prices collapsed, liquidations accumulated to $19 billion within hours—classic “herd stampede”: once sentiment reversed, investors rushed to close positions and flee en masse, worsening the price spiral. The much-debated “TACO trade” (Trump Anticipated China Outcome trade) was essentially speculative positioning based on anticipatory pricing of Trump’s policy signals. Market consensus holds that Trump excels at using extreme rhetoric and surprise policies to create volatility and indirectly shape expectations. Some capital had already established short positions before the announcement, creating asymmetric gameplay: on one side, highly leveraged longs and momentum chasers; on the other, “smart money” playing “expectation trades.” Such politically driven arbitrage intensifies emotional fragmentation and irrational volatility.

Investor Stratification: Old-era “Hope Strategy” vs. New-era “Narrative Arbitrage.” The 1011 Incident highlighted a split in investor profiles: Traditional investors rely on the “hope strategy”—long-term holding based on beliefs in macro liquidity or halving cycles, often blind to structural risks; New-era investors master “narrative arbitrage”—using policy news, macro signals, or on-chain flow data to swiftly rotate positions and maximize short-term risk-adjusted returns. This stratification removes moderating forces in extreme markets: either overly optimistic long-term holders passively absorb losses, or high-frequency arbitrageurs dominate short-term moves—amplifying overall volatility. 1011 reaffirmed that crypto markets are now fully financialized and cannot exist independently of macro conditions. Fed rate decisions, USD liquidity, and U.S.-China geopolitical tensions actively shape crypto pricing. From a regulatory standpoint, governments globally are increasingly aware of three latent risks: Lack of transparency: Limited disclosure of stablecoin and derivatives collateral easily triggers trust crises; User protection gaps: Opaque leverage and liquidation mechanisms expose retail to asymmetric risks; Financial stability threats: Chain-reaction stampedes in crypto have begun spilling over into U.S. equities and commodities. Going forward, regulation will likely focus on enhancing transparency, protecting users, and establishing stable bridges to traditional finance. In the short term, the market will enter a “deleveraging phase.” Funding rates have turned negative, signaling sharply reduced long-side momentum. After leverage unwinds, BTC and ETH may gradually stabilize near key supports, with volatility staying high but trending lower. High-risk assets like Meme coins have limited recovery potential, while staking derivatives with reliable cash flows and the stablecoin ecosystem could serve as safe harbors during recovery. The pace of market healing depends on two factors: speed of on-chain leverage digestion, and whether macro conditions show marginal improvement. Fed Liquidity and Crypto Market Correlation. Over the past two years, the correlation between Fed liquidity and crypto prices has strengthened significantly. Tighter dollar conditions slow stablecoin issuance and thin on-chain pools, weakening market resilience. Conversely, expectations of looser liquidity or peak rates often trigger early crypto rebounds. Thus, the coming months’ trajectory hinges largely on the Fed’s policy moves before year-end. If the hiking cycle truly ends, the market may see a relief rally; if the dollar stays strong, risk assets will remain under pressure.

Regulatory Trends: Transparency, User Protection, Financial Stability Frameworks. Regulatory priorities will include: Stablecoin reserve transparency: Require full disclosure of asset composition to avoid “shadow banking”; Leverage and liquidation oversight: Set reasonable leverage caps and strengthen risk buffers; Systemic risk firewalls: Establish cross-market monitoring to prevent crypto contagion spreading to banks. For investors, regulation may bring short-term uncertainty, but long-term benefits include reduced systemic risk and increased institutional participation. Near-term Risks and Opportunities. Risks: Escalating U.S.-China trade tensions further weighing on risk assets; Localized depegs in stablecoins or derivatives reigniting panic; Hawkish Fed stance worsening funding conditions and dragging down crypto valuations. Opportunities: High-quality staking derivatives (e.g., LSTs, restaking protocols) may benefit from flight-to-safety demand; Stablecoin regulatory clarity could unlock long-term inflows from institutions and compliant capital; Top-tier blockchains and DeFi blue-chips may offer attractive long-term entry points after valuation corrections. The 1011 bloodbath served as a collective wake-up call, reminding investors that crypto assets are now deeply embedded in global financial logic—leverage overextension and herd mentality magnify risks during extreme events. In the coming months, market recovery will depend on deleveraging progress and macro policy shifts, while regulatory direction will gradually clarify around transparency and financial stability. For investors, risk management and narrative discernment will be key to surviving high-volatility cycles.

V. Conclusion

In the aftermath of the 1011 Incident, crypto investment logic is undergoing profound repricing. For investors across different sectors, this crisis was not merely a loss but a mirror reflecting the strengths and flaws of each model. First, Meme investors must recognize that Memes are fundamentally “short-cycle, narrative-driven traffic assets.” During bull markets, social dynamics and FOMO amplify price gains, but under systemic shocks, their lack of cash flows and intrinsic value becomes glaringly apparent. Second, DAT investors should beware of shrinking premium logic. Large treasury models like MicroStrategy, backed by financing capacity and brand strength, retain resilience; but smaller DATs, overly reliant on token issuance and restaking yields, often face steep discounts during liquidity shocks. Third, Perp DEX investors must confront the limitations of on-chain liquidity during extreme events. Finally, from a macro perspective, fragmented liquidity will be the new norm. Under high U.S. rates, tightening regulations, and complex cross-chain ecosystems, capital will be more dispersed and volatility more frequent. Investors need to build “resilient portfolios”: managing leverage and diversifying exposure to weather volatility, while anchoring into assets with cash flows, institutional robustness, and ecosystem integration. 1011 teaches us that crypto investing is evolving from “pure speculation” to “adaptive survival”: those who can adjust strategies and identify structural value will thrive; those blindly chasing bubbles and leverage are destined to be eliminated in the next systemic shock.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News