$EIGEN Unlock Wave: 10% Monthly Dilution of Market Cap, Smart Money Exits Early

TechFlow Selected TechFlow Selected

$EIGEN Unlock Wave: 10% Monthly Dilution of Market Cap, Smart Money Exits Early

November 1 is the next monthly test of this supply cycle.

Author: Cryptor

Translation: TechFlow

On October 10, the entire crypto market plummeted due to tariff news, and $EIGEN dropped as much as 53% that day, falling from $1.82 to $0.86. At first glance, this appears to be just another victim of a market flash crash—but the reality is far more nuanced.

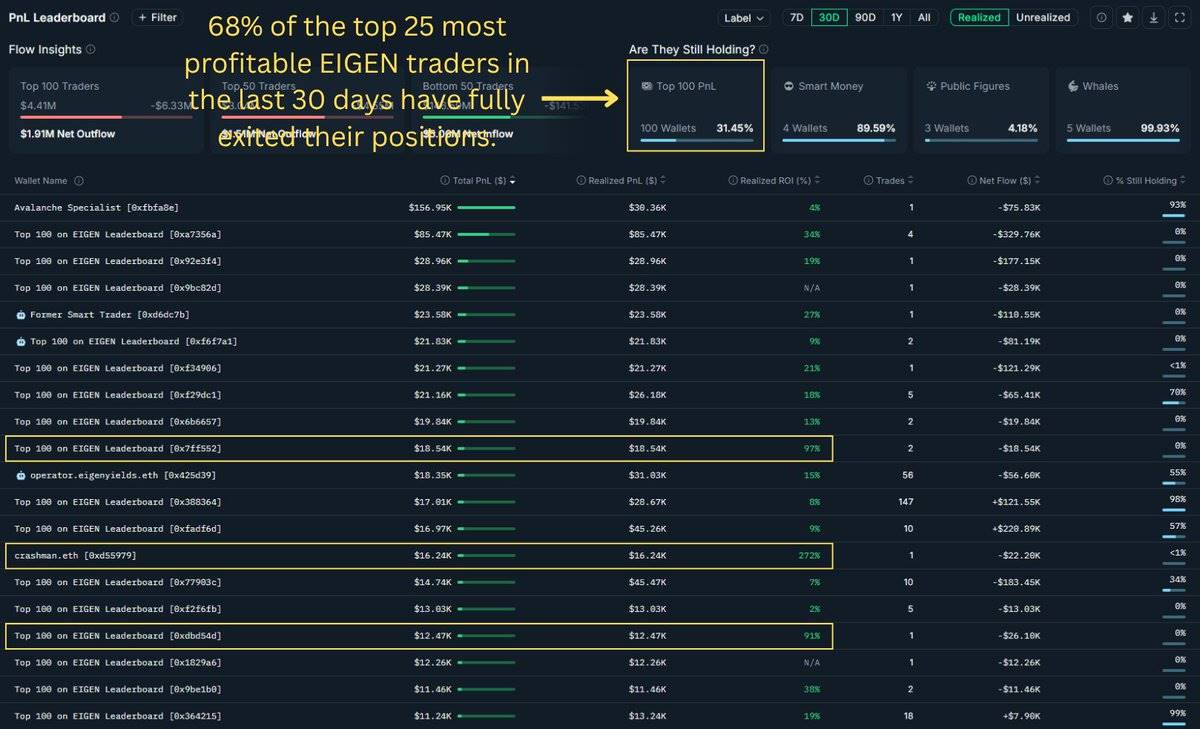

Within the past 30 days, 68% of the most profitable $EIGEN traders have already exited the market. They did not panic-sell due to the October 10 tariff-driven drop, but instead positioned themselves early to avoid an impending 24-month supply shock—the first unlock of which occurred on October 1.

I specifically checked on-chain data because my timeline was flooded with overly optimistic headlines that didn't align with price action.

In reality, EigenCloud is gaining strong momentum: a partnership with Google, total value locked (TVL) growing from $12 billion in August to $17.5 billion, integration with Coinbase AgentKit, and active development on EigenDA V2 and multi-chain expansion.

But here's the issue: starting November 1, approximately $47 million worth of $EIGEN tokens will unlock monthly for the next two years. In other words, every 30 days, an amount equal to 13% of the current market cap enters circulation.

The most profitable traders saw this coming and exited early. Looking back at the last 30 days, we can see that smart money did buy some low positions after the crash, but this was primarily driven by a single whale investor. According to data from @nansen_ai, this whale has since gone silent. Meanwhile, around $12.2 million flowed into exchanges last week.

The October 10 market crash was merely noise and distraction. The real signal lies in timing: who exited before October 1, who bought during the crash, and who is now silent.

1⃣ Exit Pattern: September to October 2025

First, consider this: within the past 30 days, 68% of the top 25 most profitable $EIGEN traders have fully liquidated their positions. They didn’t partially take profits—they completely exited.

The top performer, “crashman.eth,” achieved a 272% return on investment (ROI) and now holds zero tokens. The second-place trader exited with a 97% return, the third with 91%. This pattern repeats across the leaderboard.

Nansen 🧭 and Ricardo

Only 8 out of the 25 top traders still hold $EIGEN, with an average "still holding" ratio of just 30%. Even among those still holding, they've reduced their peak positions by 70%.

This data is more telling than ROI alone. High returns paired with low holding ratios indicate a shift from early confidence to caution. These exits began in mid-September—weeks before the October 10 flash crash, when prices were still above $2.

These traders clearly anticipated the unlock schedule and left early.

Token Flow

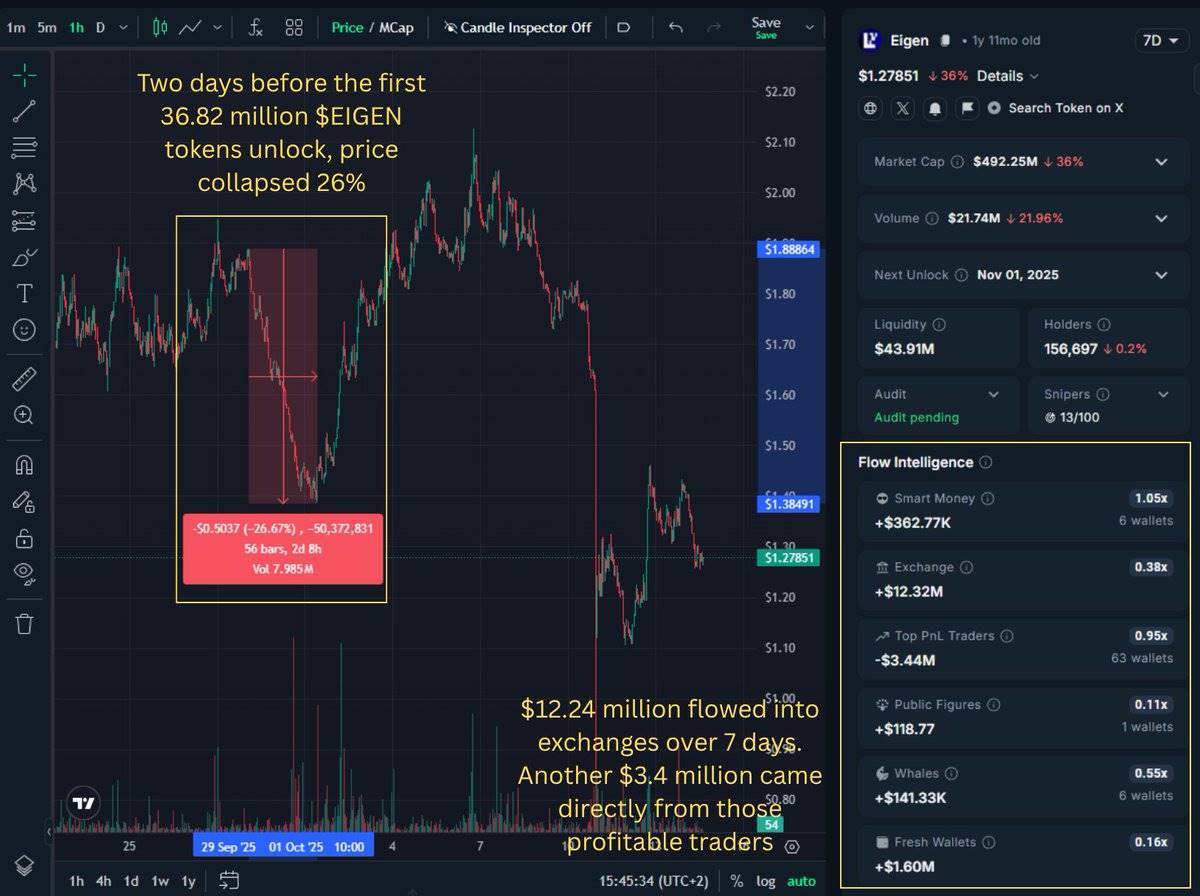

The timeline aligns with the first unlock event on October 1, when $EIGEN became tradable after months of restrictions. Two days before the initial 36.82 million $EIGEN tokens unlocked, the price had already dropped 26%.

Nansen 🧭 and Ricardo

Top traders acted before this event, selling tokens into exchanges. On the surface, it may look like market accumulation, but in reality, it was systematic distribution. At least according to on-chain data, this interpretation seems valid.

Data from the past seven days shows another $12.32 million worth of $EIGEN flowed into exchanges, including $3.44 million from these top-profit traders.

The Contradiction: One Smart Money Whale Buys the Dip

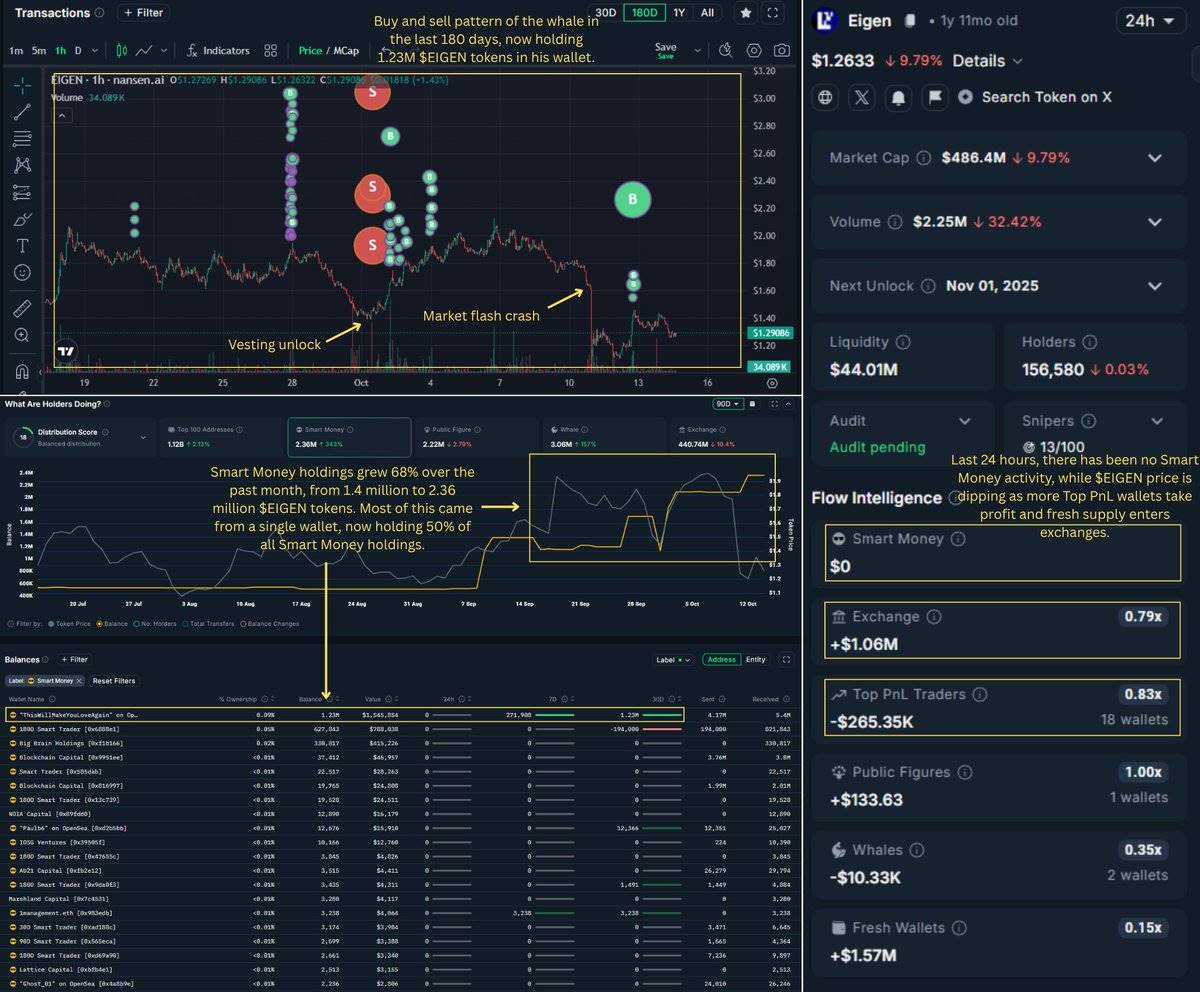

Smart money holdings increased by 68% last month, rising from 1.4 million to 2.36 million tokens. However, the twist is that over half of this increase came from a single wallet, which now holds 1.23 million $EIGEN.

This whale steadily bought in September, sold near the October 1 unlock bottom, then repurchased at higher levels and added again after the October 10 crash.

While this staggered buying pattern is somewhat unusual, more importantly, it does not reflect a broad consensus among smart money. The rest of smart money is spread across dozens of wallets totaling about 1.2 million $EIGEN—hardly convincing. Smart money collectively holds only 0.13% of the total supply.

Nansen 🧭 and Ricardo

Moreover, in the past 24 hours, smart money has shown no activity, and there are no other significant inflows. Even the whale remains silent.

Meanwhile, as more top PnL wallets take profits and move tokens to exchanges, $EIGEN’s price continues to fall. This trend is visible in the right-side column of the screenshot above.

There are two ways to interpret this silence:

-

Bullish view: Confidence. Holding through volatility, waiting for fundamentals to catch up.

-

Bearish view: Uncertainty. Even at lower prices, there isn’t enough conviction to add further exposure.

We’ll find out on November 1.

The $47 Million Monthly Challenge

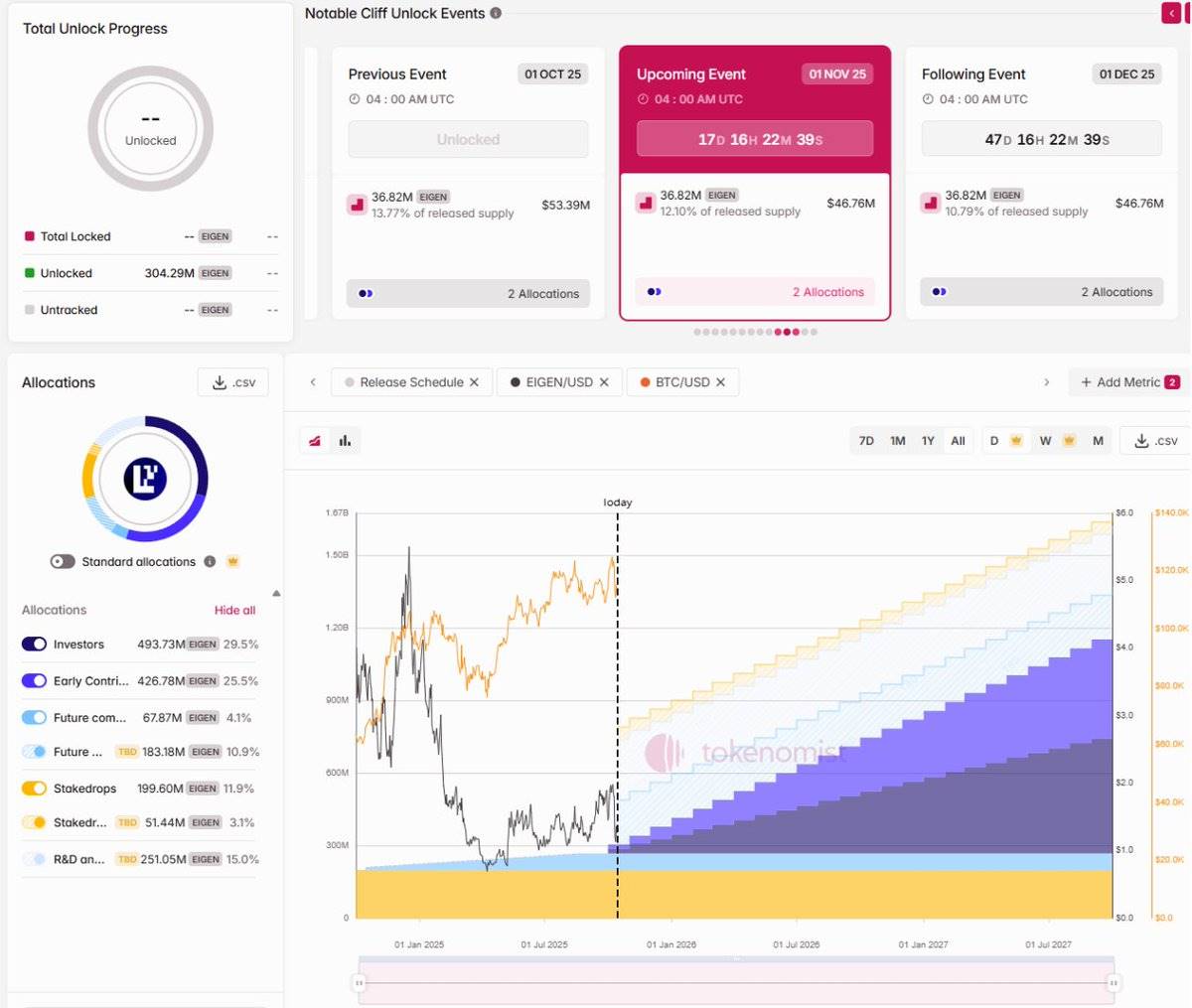

Because on November 1, the next challenge arrives: more unlocks.

The unlock schedule is public information—it’s not a secret. But few seem to truly grasp its practical implications or contextualize it meaningfully.

The October 1, 2024 unlock lifted transfer restrictions and initiated a one-year lock-up cliff.

On October 1, 2025, the first batch of 36.82 million $EIGEN tokens unlocked. Starting November 1, 2025, 36.82 million tokens will unlock monthly for approximately 23 months, continuing until September 2027.

At current prices, $47 million worth of tokens enter circulation every 30 days. Based on the current market cap (~$490 million), this equates to roughly a 10% dilution rate per month—a massive pressure.

Currently, only 23% of tokens are in circulation, with a fully diluted valuation (FDV) to market cap ratio of 4.5x—meaning 77% of tokens remain locked.

The top ten holder addresses control 50% of the supply. Most of these are held in protocol wallets, exchange reserves, and VC allocations—all subject to the same unlock schedule.

This means the next two years will bring continuous selling pressure, not a one-time event.

Those who exited in September weren’t reacting to price action—they were pre-empting a known-date supply shock.

Protocol vs. Token: Why Both Could Still Succeed

Ironically, the EigenCloud protocol itself is actually performing well.

Total Value Locked (TVL) has reached $17.5 billion (up from ~$12 billion in August). A partnership with Google Cloud for AI payment validation. Integration with Coinbase AgentKit enabling verifiable blockchain agents. Slashing launched in April. EigenDA V2 rolled out in July. Active progress on multi-chain expansion.

Development is real, adoption is growing, and the infrastructure logic is being realized.

But strong fundamentals cannot overcome poor tokenomics. These are separate issues. Just because a token belongs to a project doesn’t mean both will move in sync.

$EIGEN’s growth story is now colliding head-on with a heavy, multi-year unlock cycle that hasn’t even fully begun. That’s why I always separate product analysis from token analysis—they rarely align, especially during vesting periods.

For the token to succeed, the protocol must generate enough real demand to absorb $47 million in new supply each month.

Even for a project with genuine traction and scale like EigenCloud, that’s a high bar.

November 1: The Real Stress Test

I don’t know who will win this battle: protocol growth or supply pressure.

But I do know the data tells us something. Again, my timeline is filled with (only) bullish $EIGEN news. Does this feel familiar? My followers know exactly what cases I’m referring to.

For $EIGEN, profitable traders exited weeks before the first unlock, with the most successful leaving while the price was still above $2. One smart money whale aggressively bought during the crash but has since gone completely silent. Exchange inflows continue rising ahead of the next unlock window.

The October 10 tariff-driven market crash captured everyone’s attention, but the real story is the wallet positioning around a 24-month unlock schedule—one that officially accelerates on November 1.

Pattern Recognition Insight:

When top performers’ “Still Holding %” drops below 30%, when exchange inflows surge relative to market cap, and when major cyclical unlocks approach, this is usually not your entry signal.

November 1 is the next monthly test of this supply cycle. We’ll see whether the whale’s confidence pays off or the early sellers were right.

Watch these indicators:

-

Changes in smart money positions and whether more wallets are increasing exposure.

-

Whether other groups (e.g., top 100 holders, top PnL wallets, whales, and funds) are accumulating.

-

Exchange flow velocity (will the current $12M/week inflow accelerate?)

-

Active wallet count (are new participants entering, or is it just existing holders rotating?)

This framework applies to any token with an unlock schedule. The methodology here matters more than any single trade.

On-chain data gives you access to the same information institutions and funds have. The difference is whether you know where to look before the market figures it out.

If you do? Then you’ve already outperformed 99% of crypto Twitter.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News