Binance Airdrops 1.75 Million ENSO: Full Breakdown of Rules and Project Details

TechFlow Selected TechFlow Selected

Binance Airdrops 1.75 Million ENSO: Full Breakdown of Rules and Project Details

Seize the traffic, participate rationally.

By TechFlow

Today, Binance officially announced its 52nd HODLer airdrop project—ENSO—will launch trading on October 14 at 09:00 UTC.

This airdrop distributes 1.75 million ENSO tokens (1.75% of total supply), with an additional 500,000 allocated for post-listing marketing activities. More notably, Binance Alpha will simultaneously open a points-based redemption campaign, offering early participants a dual opportunity to benefit.

While the BNB holding snapshot period (October 7–9) has passed and HODLer airdrop eligibility is finalized, the Binance Alpha points redemption channel remains open. Unlike standard airdrops, ENSO adopts a community-first design:

Public sale buyers receive 100% immediate TGE unlocking, while VC and team allocations face a 1-year cliff followed by 2-year linear vesting—on the surface, at least, prioritizing retail over VC.

Previously, ENSO's public sale price on CoinList was $1.25 per token, corresponding to a $125M fully diluted valuation (FDV).

If you're unfamiliar with this project’s background, here are some key details.

Airdrop Mechanism Explained

-

HODLer Airdrop Eligibility Confirmed

Requirements: Deposit BNB into any of the following products during the October 7–9 snapshot window:

-

Simple Earn flexible/fixed-term products

-

On-chain yield products (e.g., staking)

-

Complete KYC and reside in a supported region

Allocation logic: 1.75 million ENSO distributed proportionally based on average daily BNB balance during the snapshot. No minimum holding requirement—higher balances receive more.

-

Binance Alpha Airdrop (Still Participable)

ENSO is one of five new tokens featured this week on Binance Alpha, alongside CLO, RECALL, WBAI, and LAB. Users can redeem ENSO airdrop shares using Alpha points; exact rules will be available once the event launches.

Participation steps:

-

Ensure Binance KYC completion

-

Earn Alpha points through trading, referrals, and other activities (past threshold ~195 points)

-

After October 14, visit Alpha Events page to redeem ENSO with points

-

First-come, first-served until allocation exhausted (past events typically lasted ~5 hours)

Project Overview

What problem does it solve?

The current blockchain ecosystem suffers from severe fragmentation: 1,000+ chains, over 41 million smart contracts, each with independent standards and interaction methods. Developers integrating DApps across chains face increased development costs and longer integration times. This fragmentation severely hinders Web3 mass adoption.

ENSO’s solution: Abstract all blockchains into unified API/SDK interfaces, enabling “one-click cross-chain operations” via two core concepts:

-

Actions (modular interactions): Abstract each smart contract function into standardized "actions" (e.g., Aave's

deposit, Uniswap'sswap) -

Shortcuts (composite workflows): Combine multiple Actions like LEGO blocks to execute complex cross-chain operations. For example: “Withdraw assets from any chain → Bridge → Deposit into lending protocol on target chain.”

This is akin to iOS unifying app development interfaces—ENSO unifies blockchain interaction methods. Developers no longer need to understand low-level chain specifics; they only express intent (Intent), and the ENSO network automatically plans and executes optimal paths.

Real-world use cases:

-

Berachain mainnet launch: Public data shows that in February 2025, Berachain processed $3.1B in volume via ENSO using 84 pre-built Shortcuts—making it one of the most successful L1 launches.

-

Ether.fi cross-chain vault: Users deposit from any chain (Ethereum, Arbitrum, Base, etc.) in one click, with ENSO automating bridging, swapping, and depositing in the background without manual network switching or multiple signatures.

-

Uniswap LP migration: As reported by The Block here, ENSO partnered with LayerZero to build tools for migrating Uniswap V4 liquidity to Unichain. Users complete the full process—withdraw LP from Uniswap V2/V3 → bridge → redeploy into V4—in a single transaction.

ENSO’s current protocol partnerships summary:

Tokenomics

Supply Structure & Unlock Schedule

Total supply: 100 million at genesis, max supply 127.3 million, calculated with 8% annual inflation initially, tapering to 0.35% after 10 years.

Initial circulation: 20.59 million (20.59%), including:

-

CoinList public sale: 4 million (100% unlocked)

-

Binance HODLer airdrop: 1.75 million (100% unlocked)

-

Additional 500,000 ENSO for post-listing marketing (100% unlocked)

-

~14.34 million released from ecosystem allocation

Based on disclosed terms, public sale buyers (who bought at $1.25 on CoinList) can trade 100% immediately at TGE, while VC/team allocations begin 2-year linear unlocks only after a 1-year cliff.

This means, theoretically, 56.8% of tokens (VC + team + advisors) remain locked until October 2026, limiting market sell pressure primarily to circulating supply.

Valuation benchmark:

Funding Background & Team

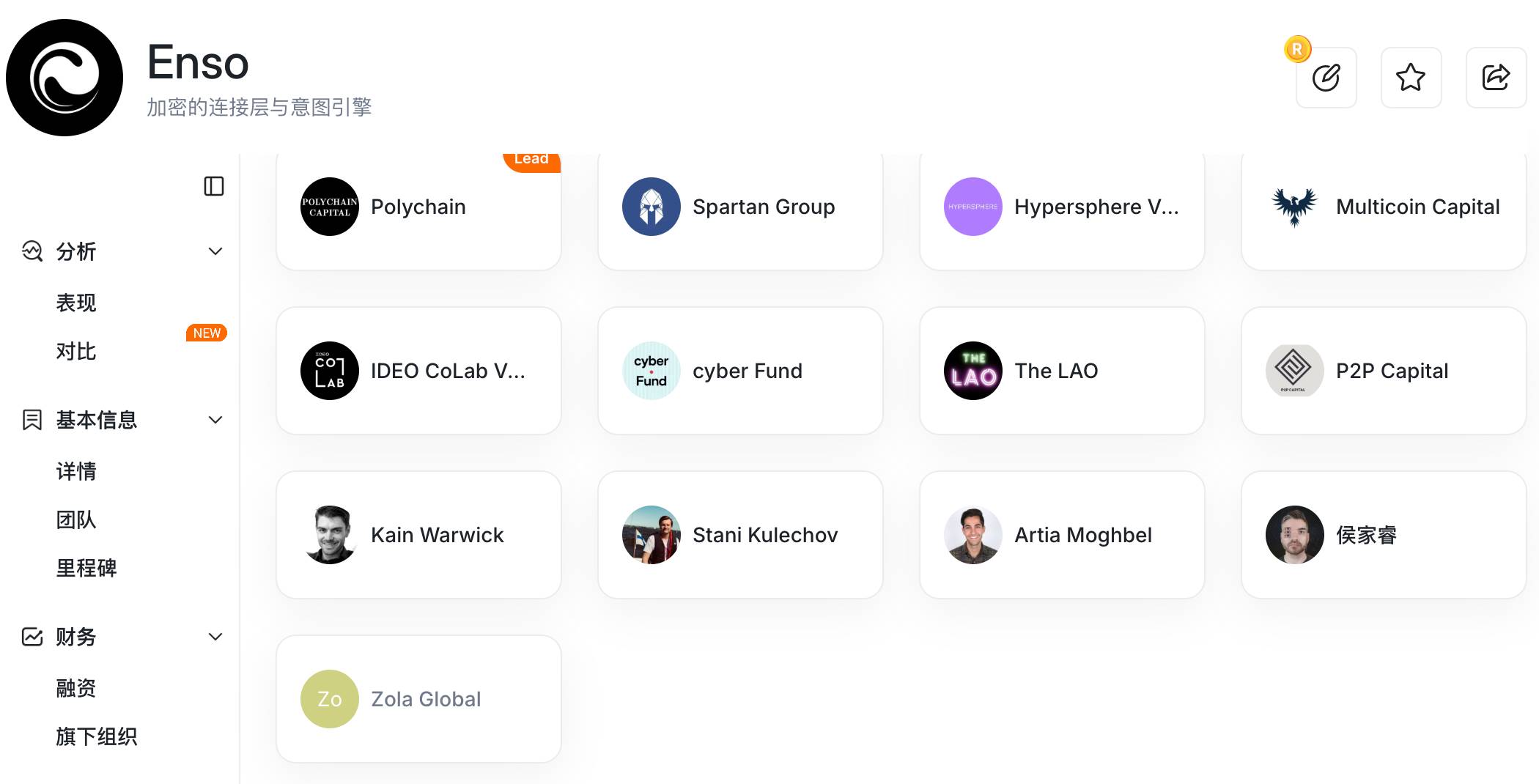

VC Backers & Funding History

Total disclosed funding: $14.2M across three rounds

-

2021 Strategic Round ($5M): Led by Spartan Group, with participation from Polychain Capital, Multicoin Capital, The LAO, P2P Capital, Zora. Funded core engine development

-

2024 Undisclosed Round ($4.2M): Led by IDEO CoLab Ventures and Hypersphere Ventures. Focused on intent-centric scaling

-

2025 CoinList Public Sale ($5M): Community round, 4% of tokens sold at $1.25

Angel investors (70+): Include Naval Ravikant (AngelList founder) and core members from LayerZero, Safe, 1inch, Yearn, Flashbots, Dune, Pendle, and others.

Team: Ethereum Purists

Connor Howe (Founder/CEO): Early Bitcoin developer since 2012, contributed to early Ethereum development in 2016; previously at Sygnum (Switzerland’s first digital asset bank), leading digital asset banking services including stablecoins, multisig, and tokenization products.

Core tech team includes Milos Costantini (Solidity core development), Peter Phillips (backend architect), and Lindy Han (business development lead).

The team combines strong Ethereum roots with traditional finance compliance expertise, giving ENSO advantages in both technical innovation and institutional integration.

Connor’s custody experience in crypto banking is particularly crucial—explaining why institutional-grade projects like Ether.fi and Infinex chose ENSO as their underlying infrastructure.

Capture Traffic, Participate Rationally

For different participants: If you held BNB and participated in the snapshot, consider retaining part of your airdropped tokens to observe further project developments. If participating via Alpha, chasing high prices on day one may not be wise—consider waiting until post-airdrop selling pressure subsides before positioning.

Cross-chain abstraction isn’t a new narrative nor currently in the market spotlight. If bullish on this sector, treat ENSO as part of a broader chain abstraction portfolio rather than an all-in bet on a single token.

Remember, every new listing brings extreme volatility. Binance’s Seed tag is a double-edged sword. Practice sound risk management—only invest what you can afford to lose.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News