American rich people's dilemma: wealth surge, cash shortage

TechFlow Selected TechFlow Selected

American rich people's dilemma: wealth surge, cash shortage

Millions of Americans have crossed the threshold into wealth, yet struggle to enjoy a luxurious life due to constrained assets.

Authors: Andre Tartar, Ben Steverman, Stephanie Davidson

Translated by: TechFlow

The number of millionaire households is rising, but much of their wealth is trapped in assets that are difficult to quickly convert into cash.

According to an 18-month investigation conducted in 1892 by the long-defunct New-York Tribune, at the height of America’s Gilded Age, there were 4,047 millionaires in the United States, and the newspaper even published a special edition listing all their names.

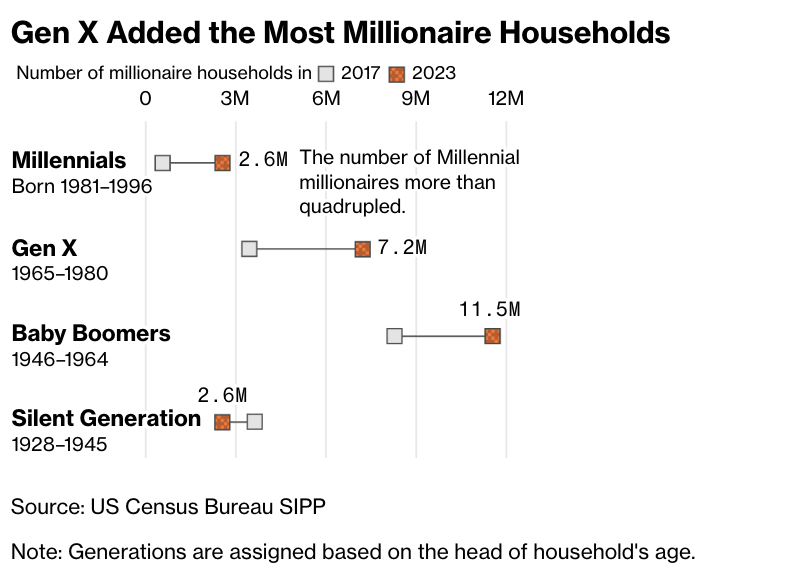

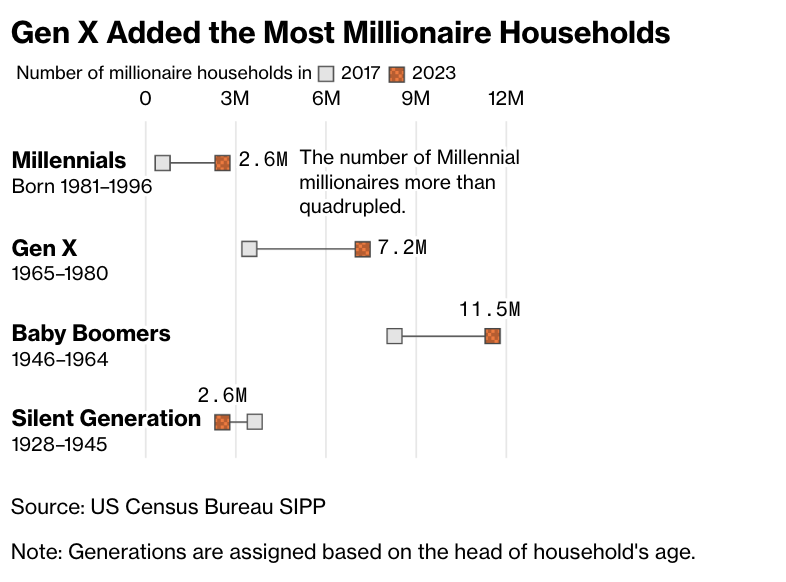

Today, based on Bloomberg's analysis of government survey data through 2023, there are more than 24 million millionaire households in the U.S., accounting for nearly one-fifth of all American households.

Notably, fully one-third of modern millionaires emerged after 2017, primarily driven by rapid increases in home values and stock market gains.

Millionaire Households Are On The Rise

Percentage of U.S. Households with Net Worth Over $1 Million

Source: U.S. Census Bureau Survey of Income and Program Participation (SIPP)

This does not mean they have ample cash on hand.

In reality, an increasing number of millionaires have their wealth locked in assets that are hard to quickly or easily liquidate—such as home equity and, increasingly, age-restricted retirement assets like 401(k) plans and individual retirement accounts (IRAs). Combined with inflation and higher interest rates, financial advisors say $1 million is no longer enough to guarantee a secure retirement, let alone serve as a golden ticket into the ranks of the truly wealthy.

"The term 'millionaire' once implied automatic affluence," said Ashton Lawrence, an advisor at Mariner Wealth Advisors in Greenville, South Carolina. "Now the goal has changed. It's still an important milestone, but for most people, it's no longer sufficient."

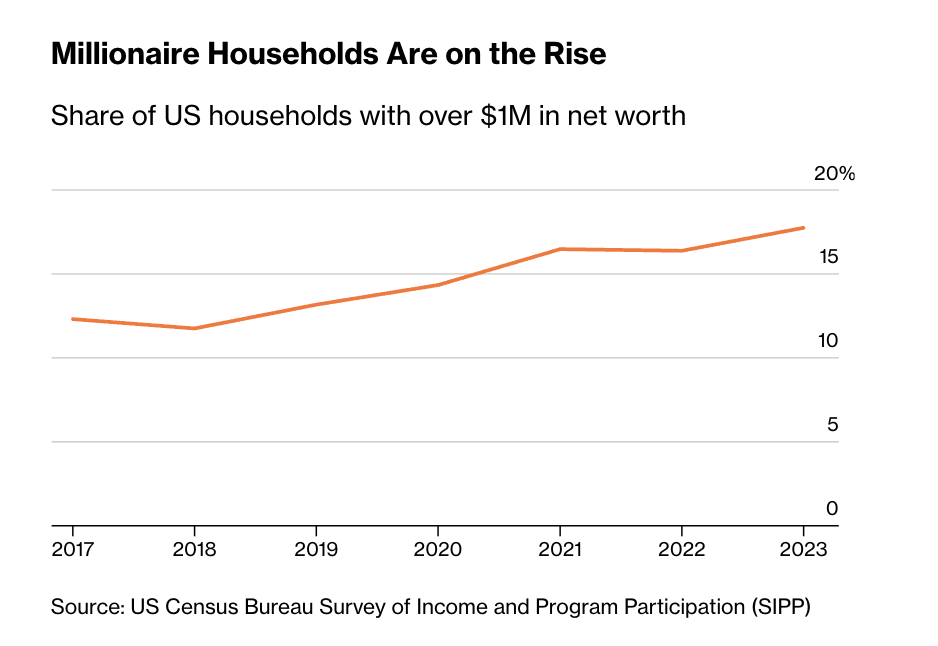

The $1 million threshold used in Bloomberg’s analysis accounts for debt and other liabilities. Even so, today’s millionaires rarely have access to anything close to $1 million in spendable funds. For those “just making the millionaire cutoff”—households with net worth between $1 million and $2 million—most of their wealth is illiquid. In 2023, about 66% of their wealth was tied up in primary residences and retirement accounts, an increase of 8 percentage points since 2017.

To gain greater spending flexibility, millionaires typically need significantly higher asset levels. In 2023, households with $5 million or more in net worth had about 24% of their wealth held in more accessible bank or brokerage accounts, compared to just 17% for those near the $1 million mark.

Less-Wealthy Millionaires Hold More Illiquid Assets

Share of Household Net Worth by Asset Type, 2023

Source: U.S. Census Bureau SIPP

Note: Liquid assets include bank accounts and stocks, mutual funds, and bonds that can be sold immediately.

Bloomberg’s analysis draws on data from the U.S. Census Bureau’s Survey of Income and Program Participation, a study that tracks changes across tens of thousands of households over time. Another analysis of the Federal Reserve’s Survey of Consumer Finances from 1989 to 2022 confirms the same rapid growth in the number and share of millionaire households, along with rising shares of home equity and retirement account balances within millionaires’ net worth.

Of course, for most Americans, $1 million remains a life-changing sum. In 2024, the U.S. median household income was $83,730, while the median balance in 4.8 million retirement plans managed by the Vanguard Group was just $38,000 last year.

Despite recent data showing a 50% surge in U.S. millionaires over six years, they still face numerous barriers to accessing their wealth. High interest rates, for example, have worsened liquidity challenges. Investors and homeowners who need cash for major expenses typically borrow against their assets, but borrowing costs have risen sharply. According to Bankrate’s latest survey of major lenders, the average interest rate on home equity lines of credit (HELOCs) is now 7.89%, nearly double what homeowners paid in early 2022. Margin loan rates at major retail brokerages like Fidelity, Vanguard, and Charles Schwab now start at 10% or 11%, depending on portfolio size.

"When interest rates are high, we feel less wealthy regardless of our asset values," said Nicole Gopoian Wirick, president of Prosperity Wealth Strategies and a financial planner.

So-called "paper millionaires" could always sell assets outright. Yet now they have more reasons to hesitate. Selling a home involves significant hassle and transaction costs, and sellers must find new housing amid a steep decline in U.S. housing affordability. Moving may also mean giving up a mortgage rate far below current market levels. Even if they hold substantial assets beyond homes and age-restricted retirement accounts, accessing that wealth isn’t easy. Advisors warn clients that selling large stock positions could trigger hefty tax bills.

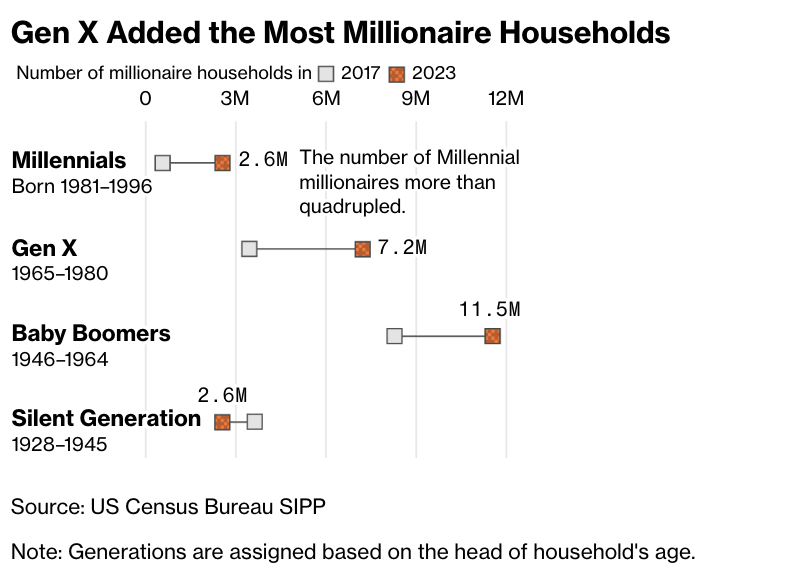

There are notable generational differences in both the number of millionaires and how their wealth is distributed. As members of the Silent Generation pass away, millionaires born before 1946 are the only group seeing a decline in numbers. Meanwhile, older Americans have had more time to accumulate savings in 401(k) or IRA retirement accounts and can begin withdrawing funds freely six months before turning 60. According to Bloomberg’s analysis, only about 27% of millennial millionaires’ wealth is held in retirement accounts, compared to 37% for Baby Boomers.

X Generation Adds Most New Millionaire Households

Source: U.S. Census Bureau SIPP

Note: Generations are defined by the age of the household head.

Advisors say even having millionaire status isn't enough for affluent clients to consider quitting work. However, the amount needed to stop working and maintain a pre-retirement lifestyle varies widely. "Inflation, longevity, taxes, and location all affect how much you need," said Ashton Lawrence.

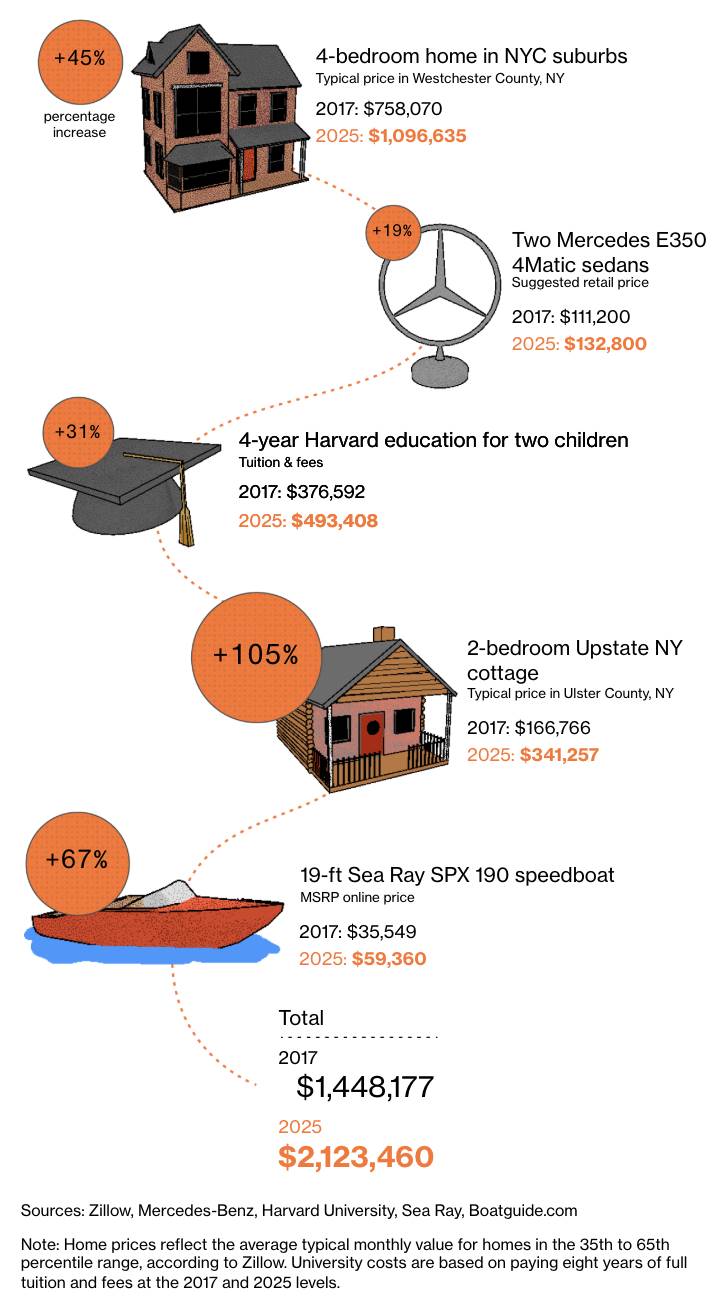

Millionaires may still afford a comfortable middle-class life, but for many, the classic millionaire lifestyle—second homes, private jets, yacht charters, luxury fashion shopping—is becoming increasingly out of reach.

Consider the lifestyle of a wealthy family in New York: a four-bedroom home, two new Mercedes sedans, Ivy League education for two children, a small vacation home up north, and a 19-foot speedboat. Less than a decade ago, these expenses totaled about $1.4 million. By 2023, the same lifestyle cost had climbed to $2.1 million.

The Millionaire Lifestyle Is No Longer What It Used To Be

Signature Expenses of an Affluent Lifestyle Have Nearly Doubled Since 2017

Source: Zillow, Mercedes-Benz, Harvard University, Sea Ray, Boatguide.com

Note: Home price data based on Zillow’s typical monthly value averages for homes in the 35th to 65th percentile range. College costs based on full eight-year tuition and fees at 2017 and 2025 levels.

"This is an indirect reason why some younger people feel frustrated that they can’t enjoy the same standard of living as their parents," said Thomas Murphy, senior financial planner at Murphy & Sylvest Wealth Management in Dallas. "They think $1 million should solve all their financial problems, but now the number they really need to focus on is $10 million."

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News