$ZEC rises 37% amid black swan crash, a deep dive into the privacy sector and related investment opportunities

TechFlow Selected TechFlow Selected

$ZEC rises 37% amid black swan crash, a deep dive into the privacy sector and related investment opportunities

A guide to understanding the cryptocurrency privacy sector.

Author: San, TechFlow

On October 11, 2025, the crypto market experienced the largest derivatives liquidation day in industry history, with a single-day contract liquidation volume reaching $19.1 billion.

This sharp decline served as both a baptism for the crypto market and a mirror, revealing which assets demonstrated greater resilience under such extreme conditions.

One asset that captured significant market attention was $ZEC from the privacy sector. On the day of the crash, $ZEC briefly dropped from $268 to below $200, but recovered rapidly over the following two days, rising to a high of $293—an increase of 37% compared to its pre-crash peak—leading the "post-disaster recovery" after the black swan event.

The swift rebound after the black swan was remarkable, but even more noteworthy is that at the beginning of October, $ZEC was only valued at $74. In less than half a month, $ZEC has surged nearly 400%.

Meanwhile, the broader privacy sector, having endured regulatory crackdowns in 2024, now appears to be showing signs of a strong rebound. At this juncture, analyzing investment opportunities within this sector could potentially yield substantial returns for investors.

Historical Evolution of the Privacy Sector

A review of the privacy sector’s development clearly reveals four distinct phases.

Pre-Crypto Era (1980–2013): The Emergence of Crypto-Punk Philosophy

The concept of privacy-focused currencies was first proposed in the late 1980s.

A loose collective of cryptographers, activists, and technical experts merged "cryptography" with "cypherpunk," advocating the use of strong cryptography to protect personal privacy and challenge centralized surveillance.

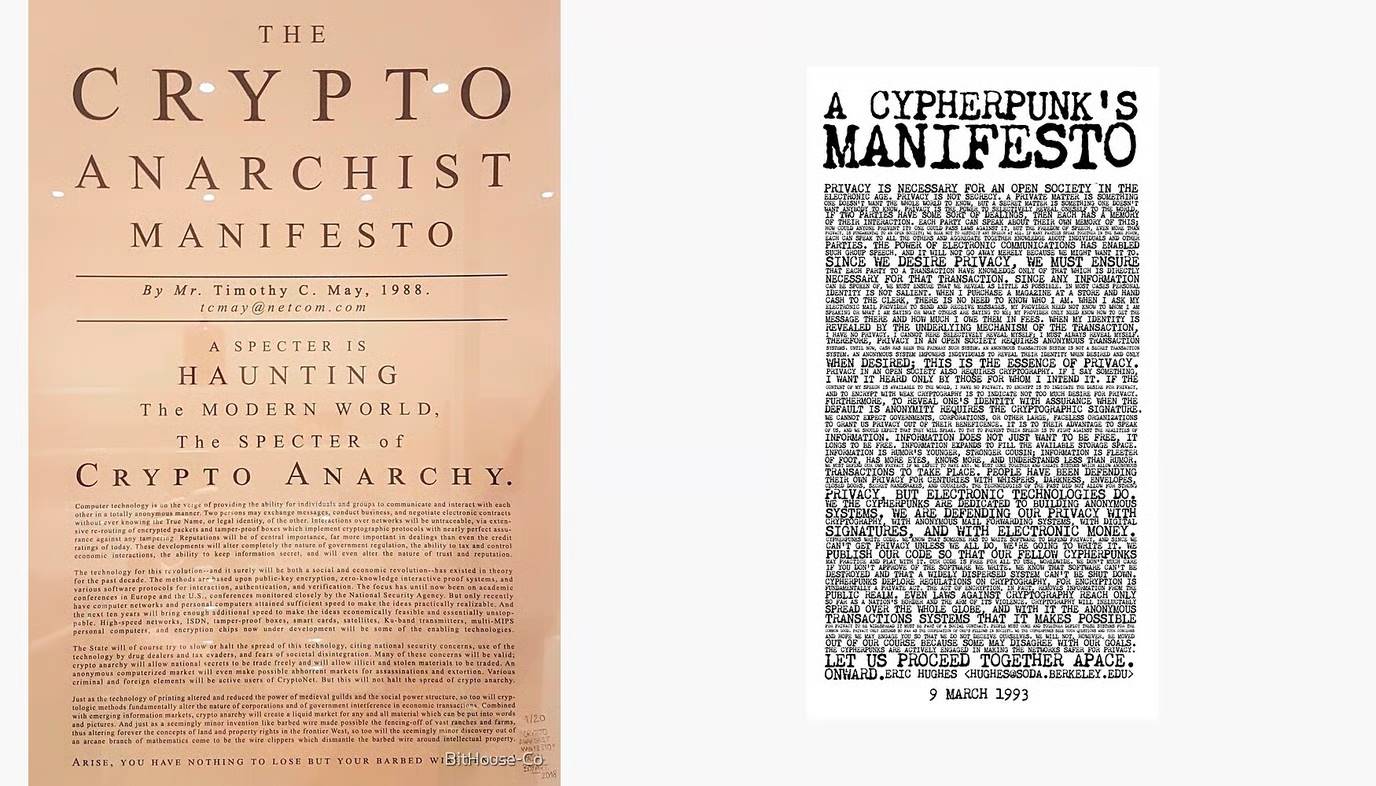

The subsequent publication of two foundational documents—the *Crypto Anarchist Manifesto* and the *Cypherpunk Manifesto*—laid the ideological groundwork for the birth of the privacy sector: "We cypherpunks are dedicated to building anonymous systems. We defend privacy through cryptography."

The Crypto Anarchist Manifesto and The Cypherpunk Manifesto

Phase Two (2014): Initial Appearance

2014 marked the birth year of the privacy coin sector, with the emergence of Dash ($Dash) and Monero ($XMR). Both tokens achieved significant gains that year before quickly correcting and settling into relative calm.

Among them, $XMR, due to its mandatory anonymity feature, became integrated into the notorious darknet economy. While this created a unique use case, it also planted the seeds for the devastating blow the privacy coin sector would later face.

Phase Three (2017–2021): From the Fringes to the Mainstream

During this period, the privacy sector benefited from the rapid growth of the crypto market and an influx of capital.

Privacy coins stood out due to their unique value proposition. The narrative of "privacy as a right" began spreading beyond tech circles into the mainstream crypto investor community.

In this phase, $Dash achieved a maximum gain of 135x, far surpassing $BTC during the same period, reaching a peak market cap of $11 billion. $XMR rose 24x, and due to its central role in the darknet economy, recorded an average daily transaction volume of 450,000 in Q4 2017.

It was also during this time that $ZEC debuted, introducing the concept of zero-knowledge proofs and gaining enthusiastic support from technically-oriented investors and institutions. It surged up to 29x, reaching a peak market cap of $4.2 billion, further demonstrating market interest in the privacy sector.

During this era, major exchanges rushed to list privacy coins, fueling the sector's growth. By the DeFi Summer, the privacy sector had successfully transformed, growing from a $2 billion market cap in early 2020 to $14 billion by mid-2021.

However, the sword of Damocles hanging over the privacy coin sector began to show itself—and ultimately fell in 2022.

Phase Four (2022–2025): Darkest Hour, Survival, and Ongoing Regulatory Pressure

From 2022 to 2024, the privacy coin sector faced unprecedented regulatory crackdowns, marking its darkest period.

On August 8, 2022, the U.S. Treasury sanctioned the Ethereum mixer Tornado Cash, sending a clear regulatory signal and officially moving privacy coins from a "gray area" into the "red zone."

This triggered a wave of exchange delistings—the first domino to fall. On February 6, 2024, Binance announced the delisting of $XMR (Monero), citing "regulatory compliance requirements." Kraken, OKX, and other major exchanges soon followed. By 2024, fewer than 10 global exchanges supported privacy coin trading, all of them small platforms. A full-scale liquidity crisis hit privacy coins.

Just days ago, although Naval’s endorsement drove $ZEC up nearly 400%, the EU simultaneously announced plans to fully ban anonymous cryptocurrency transactions by 2027, indicating that long-term regulatory pressure on privacy coins remains intense.

Drivers Behind the Privacy Sector’s Rebound

Beyond the surface-level market reaction to Naval’s endorsement, deeper forces are driving the privacy sector’s resurgence.

The simplest explanation is a rebound from extreme oversold conditions. The total market cap of the privacy sector dropped from $4 billion to $1 billion—a 75% decline. Under such circumstances, any positive news can trigger outsized price reactions, and Naval’s tweet happened to serve as that catalyst.

Another direct driver is actual buying demand reignited by Grayscale. In early October, Grayscale reopened subscriptions for its Zcash Trust. Though the exact amount was not disclosed, this move attracted a wave of follow-on capital, creating real buying pressure for $ZEC.

Recently, the Ethereum Foundation has also stepped in to support privacy projects. On October 9, the Ethereum Foundation announced that the Kohaku roadmap requires integration with Railgun technology. Additionally, Vitalik’s earlier transfer of $300,000 to Railgun boosted market confidence in the privacy sector. $RAIL surged 270% that day, validating the underlying logic.

The liquidity scarcity caused by widespread exchange delistings has made tokens extremely scarce. With limited supply, even minor increases in demand can drive rapid price appreciation.

On a broader scale, escalating geopolitical conflicts and uncertainty fueled by figures like Trump have indirectly amplified institutional and investor demand for financial privacy. The recent black swan crash brought this need directly into the spotlight.

Current Investment Opportunities in the Privacy Sector

$ZEC

As the standout performer recently, $ZEC is undoubtedly the leading project in the sector. It reached a multi-year high of $293 yesterday, with a 7-day gain of 295% and a market cap of $4.26 billion.

However, its rapid rise across the entire cycle has seen a slight pullback recently, with the current price retreating to $262. Moreover, much of $ZEC’s surge stems from Naval’s influence. Given that Naval is an early investor in Zcash, there are undisclosed利益 ties involved. This may lead to significant downward pressure in the short term.

$XMR

Compared to $ZEC’s dramatic recent gains, $XMR—another flagship privacy coin—may offer even greater upside potential.

Currently priced at $305, $XMR has a market cap of approximately $5.64 billion and a 7-day gain of just 48%, clearly lagging behind $ZEC, yet showing signs of catching up.

Furthermore, as the most "pure" privacy-focused project, $XMR is committed to enabling strong anonymous transactions, giving it a unique narrative appeal within the sector.

According to CoinGecko data, $XMR’s trading volume over the past 10 days increased nearly 170% compared to the previous cycle, suggesting latent upward momentum.

$Dash

As a veteran project that emerged alongside $XMR, Dash focuses on combining privacy with payment functionality—a direction closely aligned with the currently popular stablecoin and crypto payment sectors. These overlapping themes increase Dash’s chances of gaining market attention.

Unlike Monero’s mandatory anonymity, Dash offers optional privacy features, making it one of the few "regulation-friendly" assets in the privacy coin space and giving it a clear advantage in regulatory sensitivity.

Currently priced at $38.20, Dash has a market cap of about $655 million and a 7-day gain of 48.5%, nearly matching $XMR, while also showing signs of catch-up growth.

Other Small-Cap Projects

Besides the high-market-cap projects mentioned above, several smaller-cap projects in the privacy sector are also worth watching. Theoretically, they offer greater price upside potential, though current performance varies significantly, requiring careful evaluation by investors.

Secret Network ($SCRT)

Secret Network is a privacy-focused Layer 1 blockchain that provides customizable privacy features for dApps via encrypted smart contracts.

Its core strength lies in combining privacy with the trending theme of AI. Its 2025 roadmap emphasizes the integration of infrastructure, AI models, and privacy computing, aiming to build decentralized, privacy-first AI applications.

Currently, $SCRT trades at $0.19, with a market cap of approximately $61.84 million, a 24-hour trading volume of $14.85 million, and a 7-day price change of -10.91%.

Further reading:Secret Labs Mid-Year Roadmap Update

Pirate Chain ($ARRR)

Pirate Chain is a pure privacy blockchain dedicated to enabling fully anonymous transactions.

Currently, $ARRR trades at $0.4316, with a market cap of approximately $84.69 million, a 24-hour trading volume of $588,800, and a 7-day price change of +41.02%.

Built as an asset chain on Komodo’s platform, PirateChain combines Zcash’s zero-knowledge proofs with Monero’s privacy features. All transactions default to shielded addresses, ensuring the highest level of financial anonymity.

During the recent black swan crash, $ARRR demonstrated strong resilience like other major privacy coins—after a nearly 10% drop, it rebounded 37% by the 12th. Combined with its small market cap, it may deliver outsized returns for investors.

Outlook: Moving Forward Amid Contradictions

Despite the current strong rebound in the privacy sector, investors should remain cautious. Naval’s role as a former Zcash Foundation board member and his other利益 affiliations may have influenced this rally, and the shadow of regulation has never truly lifted from privacy coins.

The investment thesis for the privacy sector has shifted from idealism to practical application—only projects that genuinely solve user pain points will possess lasting vitality.

Investors must first decide whether to back highly anonymous projects that face regulatory pressure but embody the true essence of "privacy," or opt for regulation-friendly alternatives.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News