Animoca Brands Research Report: A New Era for Exchanges – How to Go Mainstream?

TechFlow Selected TechFlow Selected

Animoca Brands Research Report: A New Era for Exchanges – How to Go Mainstream?

From early enthusiasts to a broader audience, positioning exchanges as the main gateway to the on-chain ecosystem.

Exchanges走向主流

Centralized exchanges (CEX) have played a pivotal role in the development of the crypto industry. They provide core infrastructure for trading and discovering cryptocurrencies, serving as the cornerstone of the entire crypto ecosystem. As early participants with clear business models, CEXs rapidly evolved into large institutions employing hundreds or even thousands of staff. Their efforts to expand user bases significantly drove the mainstream adoption of cryptocurrencies.

The form of crypto exchanges has evolved through multiple stages. Initially, they were merely digital upgrades of over-the-counter (OTC) trading. With the rise of Web3 projects and altcoins, exchanges seized surging trading demand and transformed into professional-grade platforms. Later, they added features such as lending and hedging to meet the needs of professional traders.

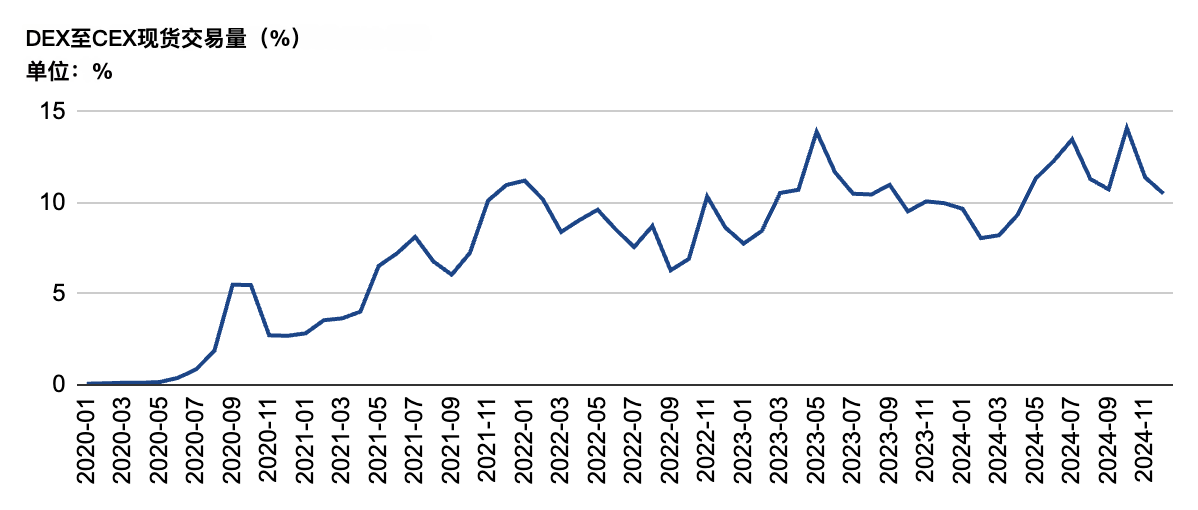

However, CEX growth now faces both challenges and opportunities. On one hand, native crypto users are nearing saturation, leading to slower user acquisition in recent years. Meanwhile, innovations in decentralized trading are diverting users—platforms like meme coin launchers and advanced DEXs such as Hyperliquid offer CEX-like experiences but with greater transparency. This forces exchanges to integrate self-custody wallets and DEX trading to retain native users.

On the other hand, massive incremental user opportunities are emerging. The pro-crypto stance of the new U.S. administration, dollar depreciation, and stablecoin adoption driven by geopolitical competition are all fueling a new wave of mass crypto adoption and on-chain transactions. This implies dual growth in new users and tradable assets. Exchanges can leverage advantages such as 24/7 trading, perpetual contracts, and global access to compete with traditional brokers and attract mainstream users.

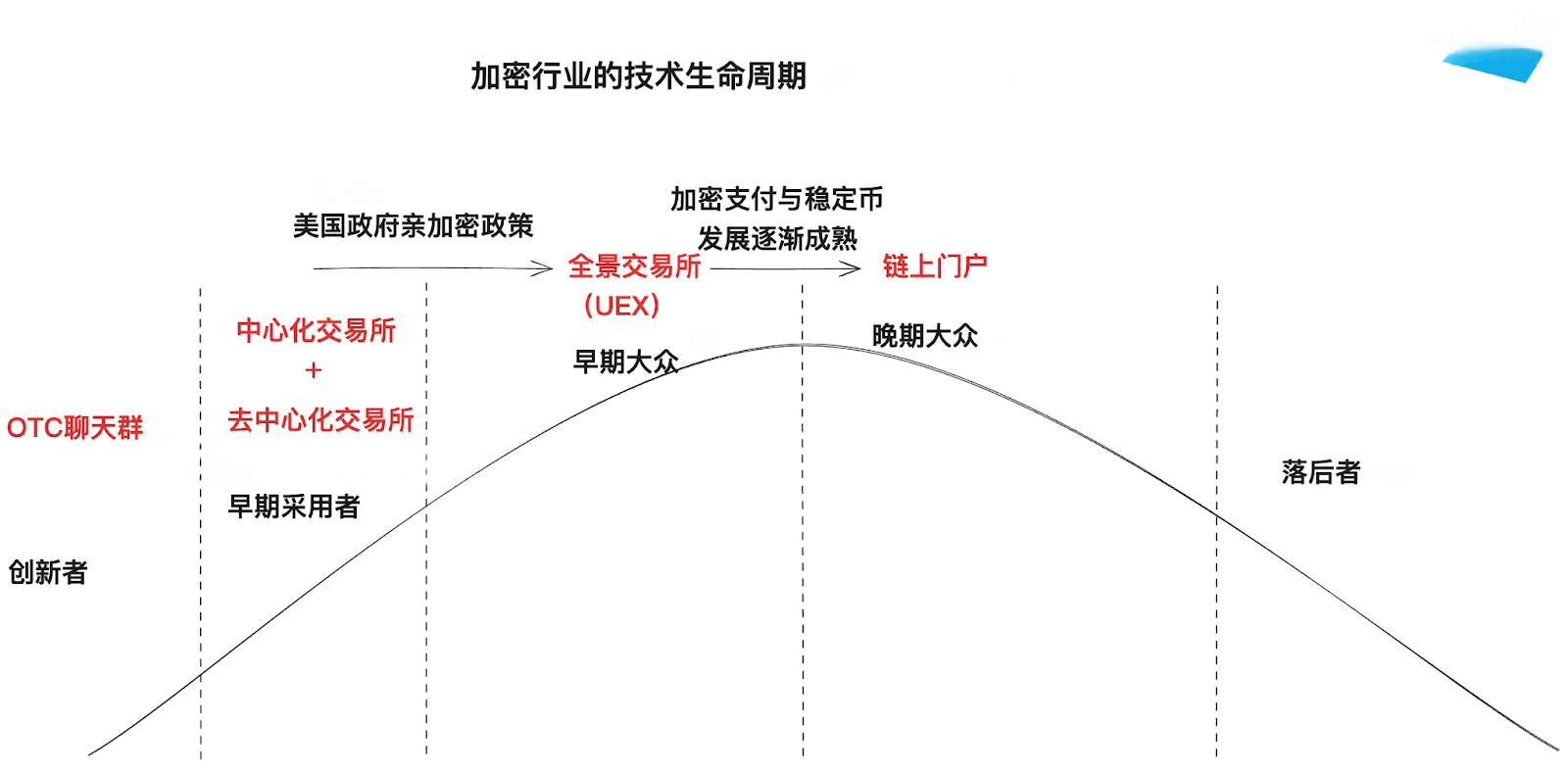

Combining this with the technology adoption lifecycle theory, we are transitioning from the "early adopters" (second stage) to the "early majority" (third stage). Over the past five years, native crypto users and "degens" have driven exchange growth. Now, the early majority—those who only adopt innovation once tangible benefits become visible—will become the new growth engine. To embrace this shift, exchanges are evolving from centralized or decentralized exchanges into universal exchanges (UEX).

We can further predict that driven by the "late majority," the second half of growth will primarily rely on exchanges becoming the main gateway to the on-chain world. Mainstream users may not need complex trading functions, but they do require financial services such as payments, deposits, and yield. With existing wallet and custody services and strong organizational capabilities, exchanges are well-positioned to become unified entry points for on-chain services.

Early Development of Exchanges

In the early days, crypto-related activities were mainly driven by tech enthusiasts and miners. They were the first to experiment with new tools and quickly adopted use cases such as trading, token sales, and payments. At the time, forums or OTC chat groups were the primary trading venues. BitcoinMarket, launched in March 2010, was the first exchange focused on crypto assets. Mt. Gox later rose to prominence, handling over 70% of Bitcoin transactions at its peak in 2013.

In 2013, Bitcoin prices began rising and attracted media attention. Demand grew for secure and convenient Bitcoin-to-fiat conversion. While OTC remained functional, it was slow and risky. More centralized exchanges emerged, offering order books and custodial services, freeing users from managing transaction details themselves.

The ICO boom of 2017 brought a surge of new tokens. Traders needed better tools to keep up. Exchanges thus became the go-to venue, and users began experimenting with more complex strategies like hedging and leverage. To support these needs, exchanges introduced perpetual contracts and margin trading.

By 2020, declining U.S. interest rates led more investors to explore crypto. They saw opportunities and sought professional tools for asset management. Meanwhile, DeFi projects and new narratives maintained high liquidity, attracting more experienced investors.

As retail and early adopters drove demand, professional market makers and trading firms followed. Competition intensified, forcing exchanges to evolve by supporting more complex strategies and introducing structured products and yield-earning options. The user experience gradually approached that of traditional markets, equipping users with a full suite of tools for the fast-moving crypto world.

From Early Adopters to the Mass Market

Slowing Growth

After surges in 2020 and 2021, exchange user growth entered a slowdown phase. Early adopters had already entered, viewing crypto assets as a new investment frontier, but this wasn't enough to convince the broader public. The collapses of FTX and Luna pushed the industry into a "crypto winter" in 2022, with effects lasting into late 2023. During this period, exchange user growth stagnated. Early adopters were largely onboarded, while the early majority remained cautious, waiting for clearer returns before participating.

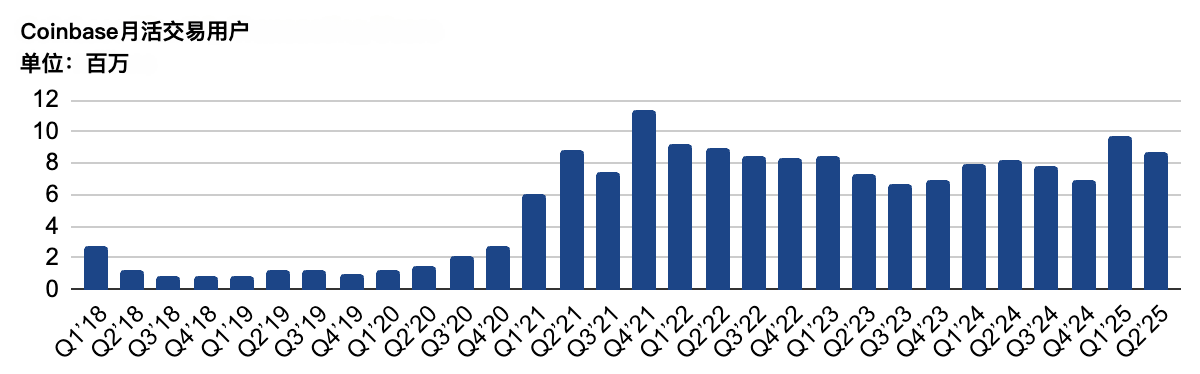

This stagnation was evident on top platforms. For example, Coinbase's monthly active traders have remained between 8–9 million since 2021. Growth driven by new token launches or narratives has nearly disappeared. Slowing growth highlights the urgency for exchanges to expand functionality and reach wider audiences.

Meanwhile, the rise of DEX token trading, especially the popularity of meme coin launch platforms, drew more risk-seeking users away from centralized exchanges, keeping more liquidity and users on-chain. Meme coin platforms like Pump.fun became focal points in 2024. On-chain launchpads made creating new tokens extremely easy and increasingly tied everything to tokens. Platforms like Zora tokenized every piece of social content, turning social traffic directly into token trading.

During this slow-growth phase, leading exchanges focused on deepening engagement with existing users through on-chain and in-exchange activities. They pursued three main strategies: building on-chain ecosystems, promoting self-custody wallets, and integrating DEX token trading into wallets and exchanges.

Public Chains and Ecosystem Development

Several exchanges launched their own public chains and platform tokens. These chains help exchanges retain crypto-native users familiar with on-chain functions, while the exchanges themselves serve broader mainstream audiences. Tokens act as bridges connecting on-chain ecosystems with exchange user bases. This model also allows exchanges to combine token issuance with listing events, enabling more creative marketing and ecosystem building.

Take BNB Chain as an example—it is central to Binance’s on-chain strategy. The Meme Rush page within Binance Wallet leverages BNB Chain, allowing users to trade newly issued meme coins directly on the on-chain launchpad Four.Meme.

At the same time, the BNB token plays a key role in bridging the exchange and on-chain worlds. Users can stake BNB in Binance’s Launchpool events or participate in new token offerings on PancakeSwap via the Binance MPC wallet.

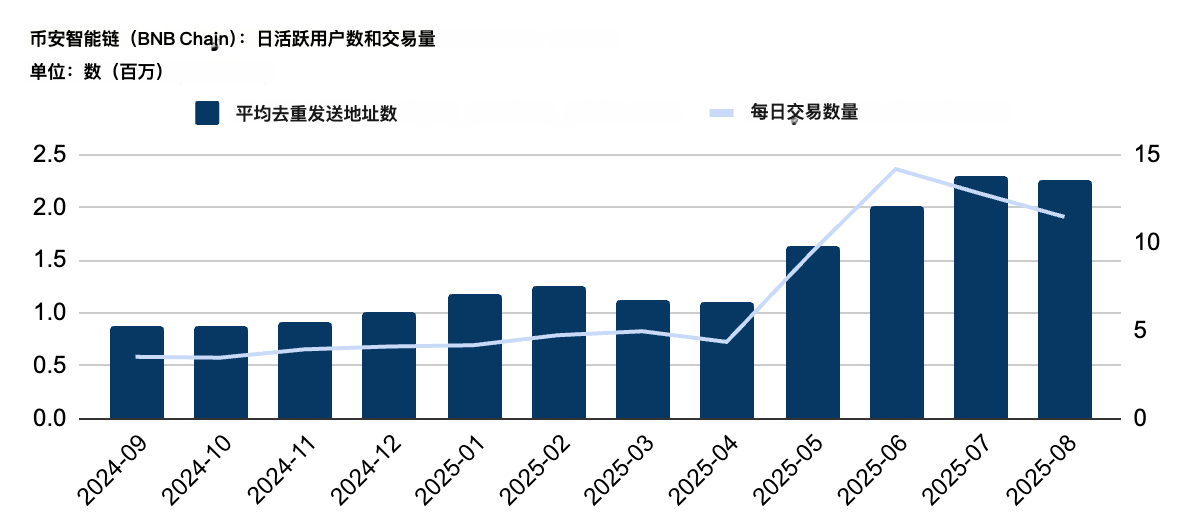

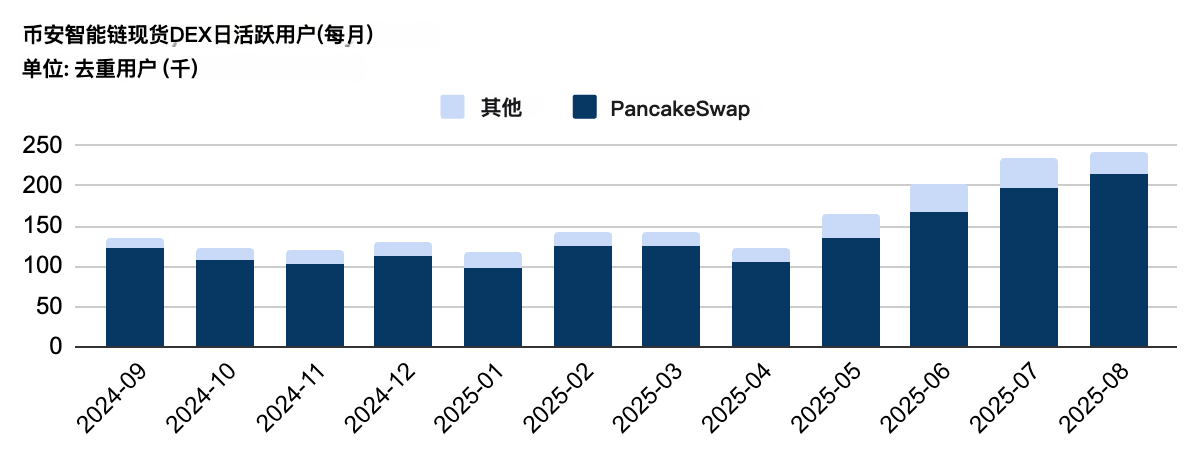

Over the past year, BNB Chain’s monthly active users doubled from 1 million to over 2 million, daily transactions surged from 1 million to 10 million, and DEX activity increased from 120,000 to over 200,000 daily active traders. These figures reflect how integration with exchanges drives stronger user adoption and deeper ecosystem engagement as on-chain functionality matures.

Moreover, exchanges began exploring integration with social platforms. Coinbase’s Base App is a prime example. On February 5, 2025, it integrated Farcaster, allowing users to post directly within the app and leverage Farcaster’s social graph. This likely brought millions of new users to Base App. Subsequently, Zora introduced content tokenization within the app, embedding creator economies more directly into the exchange ecosystem.

Decentralized Wallets

With the growth of DEXs, CEXs have gradually moved on-chain products to the forefront, making wallets and chain ecosystems key entry points. Decentralized wallets serve as direct gateways to Web3, enabling users to manage assets, explore dApps via integrated "app stores," and gradually engage in on-chain activities through token incentives.

In recent years, wallets developed by exchanges often unify multi-chain accounts, streamlining fund transfers and cross-chain swaps. They support not only spot and meme coin trading but also integrate staking and DeFi yield features to keep assets productive. Task-based reward mechanisms further encourage users to explore new features and deepen ecosystem interaction.

OKX Wallet is a typical case. Initially focused on multi-chain asset management, it has expanded to support over 150 blockchains, eliminating the need for multiple wallets. In terms of security, it uses multi-party computation (MPC) to enhance safety for on-chain staking, token swaps, NFT trading, and dApp usage, gradually forming a complete Web3 ecosystem.

For trading and yield, it supports spot, staking, and meme coin markets, allowing users to operate directly within the wallet. OKX Wallet also launched its DeFi Earn product.

To boost engagement, OKX Wallet introduced task incentives such as Crypto Quests and interactive trading challenges, rewarding users for completing tasks and encouraging deeper usage.

Integrating DEX Trading

In the first and second quarters of 2025, several exchanges launched on-chain trading features within their platforms. Users could directly trade on-chain assets using their CEX spot accounts without needing to understand complex on-chain concepts or pay gas fees.

This design is particularly attractive to "degens," as it allows them to access a broader range of on-chain assets on the same platform. Exchanges that have launched similar features include:

- Binance (assets selected by listing team)

- OKX (assets selected by listing team)

- Coinbase (supports all on-chain assets on Base chain)

- Bitget (supports all on-chain assets on ETH, SOL, BSC, and Base chains)

Taking Binance as an example, it named this feature Binance Alpha, aiming to let users access high-potential early-stage projects without leaving Binance. To ensure quality and growth potential, Binance’s listing team carefully selects which tokens can be listed on Alpha.

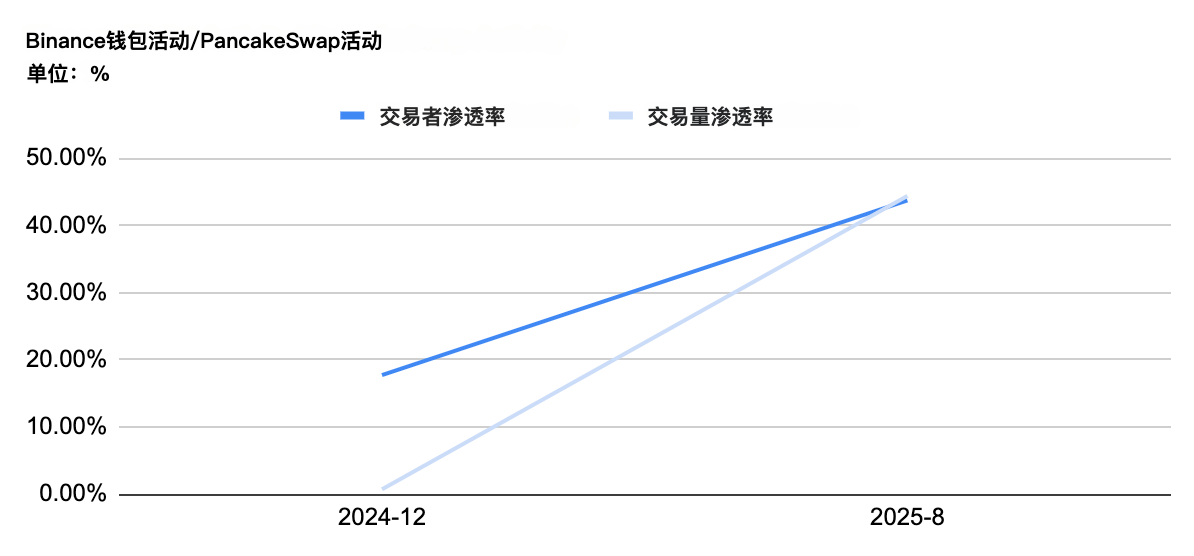

Additionally, users earn points by trading or providing liquidity with Alpha tokens on PancakeSwap. These points determine eligibility for new project activities on Binance Alpha, creating a continuous incentive loop that promotes exploration and participation in emerging tokens. This strategy boosted rapid adoption of Binance Wallet.

In December 2024, when Binance Wallet relaunched, PancakeSwap’s average daily trading volume was around $800 million, while Binance Wallet stood at approximately $5 million. PancakeSwap had about 48,000 daily active traders versus 8,500 for Binance Wallet, with penetration rates of 17% (traders) and 0.7% (volume), respectively.

By August 2025, PancakeSwap’s average daily volume grew to $3 billion, while Binance Wallet reached $1.4 billion. PancakeSwap averaged 53,900 daily active traders compared to 21,400 for Binance Wallet, with both penetration rates surpassing 40%.

Meanwhile, AI-assisted trading features are being continuously introduced to drive user growth. For instance, Bitget launched GetAgent—an AI trading assistant. Users can analyze tokens, receive trading signals, and build strategies through conversations with AI—all within the same app.

Despite these ongoing efforts bringing incremental growth, the next major user growth curve (the next S-curve) remains to be unlocked. As of Q2 2025, only 6.9% of the global population holds cryptocurrency, compared to 15–30% who participate in stock trading.

New Directions

In early 2025, a change in the U.S. government shifted its stance from "anti-crypto" to "pro-crypto." SEC Chair Paul Atkins announced "Project Crypto," rolling out a series of pro-crypto regulatory policies. This aligns with the Trump administration’s goal of positioning the U.S. as a global crypto hub.

This policy shift not only boosted confidence among native crypto users but, more importantly, enabled traditional financial institutions to explore crypto as a new channel for financial services. An increasing number of real-world assets (RWA) are being tokenized, including money market funds, private credit, gold, stocks, and even shares in private companies.

For crypto exchanges, these on-chain assets create opportunities to compete with traditional brokers and attract users familiar with stocks but not yet in crypto. Exchanges already have natural advantages in 24/7 trading, borderless access, and perpetual contracts.

Tokenized RWAs can also unlock illiquid assets like private company shares, expanding accessibility for investors. Combined with other on-chain traditional assets (debt, stocks, money market funds), crypto exchanges can deliver superior trading experiences compared to traditional markets, bringing these assets to a broader investor base.

Mutual Penetration

In 2025, crypto exchanges introduced more assets and features tailored to traditional finance users, lowering barriers for mainstream adoption. On the asset side, exchanges launched tokenized stocks and RWA-backed products. For example:

- Binance and Bitget launched money-market-backed tokens, RWUSD and BGUSD, respectively.

- Bitget also listed stock tokens and partnered with Ondo Finance, enabling users to trade directly without a traditional brokerage account.

Ondo Finance’s tokenized stock market already supports over $180 million in assets, with minting and redemption volumes exceeding $190 million. By offering services comparable to—or even better than—traditional brokers, crypto exchanges have gained an early advantage with global accessibility.

Leveraging On-Chain Trading Advantages

Compared to traditional financial platforms, crypto exchanges extend asset coverage in two main ways: stock perpetual contracts and tokenized private company shares.

- Stock Perpetual Contracts

In traditional stock markets, trading is constrained by settlement requirements and leverage limits. In the U.S., for example, Regulation T caps margin borrowing at 50% of stock value—roughly 2x leverage. Portfolio margin accounts may offer higher leverage, sometimes up to 6–7x, depending on risk profiles. Traditional exchanges also have limited trading hours; Nasdaq trades Monday to Friday from 9:30 AM to 4:00 PM ET. Although pre- and post-market trading exist, they suffer from low liquidity and high volatility.

Crypto exchanges break these constraints, albeit in legal and regulatory gray areas. Users can trade stock perpetuals anytime on crypto exchanges with higher leverage. For instance, MyStonks offers up to 20x leverage on stock perpetuals, while Bitget currently supports up to 25x. These setups offer investors unmatched global access and flexibility compared to traditional markets.

- Private Company Shares

Another innovation by crypto exchanges is tokenizing private company shares, enabling retail investors to participate. In contrast, traditional private equity markets remain restricted to institutions or accredited investors, with high entry barriers and limited liquidity. Exchanges allowing trading of tokenized private shares introduce price discovery and secondary market liquidity for these assets. For example, Robinhood recently opened access for retail investors to invest in OpenAI’s private equity. However, such products remain hard to scale widely due to legal and regulatory constraints.

Traditional Players Catching Up

While native crypto exchanges expand into traditional assets, traditional exchanges and brokers are also working to close the gap with the crypto world.

- Robinhood

Robinhood is a U.S. financial services company known for its commission-free stock trading platform, emphasizing simple interfaces and low-barrier investing.

Building on this, Robinhood expanded into crypto, allowing users to buy, sell, and hold major crypto assets like Bitcoin, Ethereum, and Dogecoin. The platform also includes a crypto wallet for sending and receiving assets. It has introduced staking for Ethereum and Solana, enabling users to earn yield directly within the app.

Robinhood is further expanding in Europe, offering over 200 tokenized U.S. stocks and ETFs. These tokens support 24/5 trading, with dividends paid directly into the app, and no commissions or additional spreads.

To support tokenization and seamless trading, Robinhood is building Robinhood Chain—a Layer 2 blockchain based on Arbitrum’s tech stack. Tokenized stocks will initially launch on Arbitrum, with plans to migrate to Robinhood Chain, giving users greater control, enhanced security, and a more integrated experience between traditional and decentralized finance.

Launching Robinhood Chain opens new possibilities: attracting liquidity beyond Europe and connecting global users with tokenized assets.

- PNC Bank

In July 2025, PNC Bank announced a strategic partnership with Coinbase to enhance customers’ digital asset services. Through Coinbase’s “Crypto-as-a-Service” (CaaS) platform, PNC will offer secure, scalable crypto trading and custody solutions. This allows PNC customers to buy, sell, and hold digital assets directly within their banking interface. Simultaneously, PNC will provide certain banking services to Coinbase, reflecting a shared commitment to building a more robust digital financial system.

- Stock Exchanges

Although crypto markets have long operated 24/7, some stock exchanges are now following suit. In March 2025, Nasdaq announced plans to introduce 24-hour trading on its U.S. main board to meet growing global demand for round-the-clock U.S. stock access.

The Next Era: Universal Exchanges and Gateways to the On-Chain World

Considering current trends, two major evolutionary directions for exchanges emerge:

- Universal Exchange (UEX)—a platform for everyone, trading all assets. Serving both native crypto users and mainstream audiences, unrestricted by geography or time.

- Gateway to the On-Chain World—building super apps that connect users to broader crypto ecosystems through everyday on-chain services like payments, and fostering vibrant on-chain application ecosystems.

Universal Exchange (UEX)

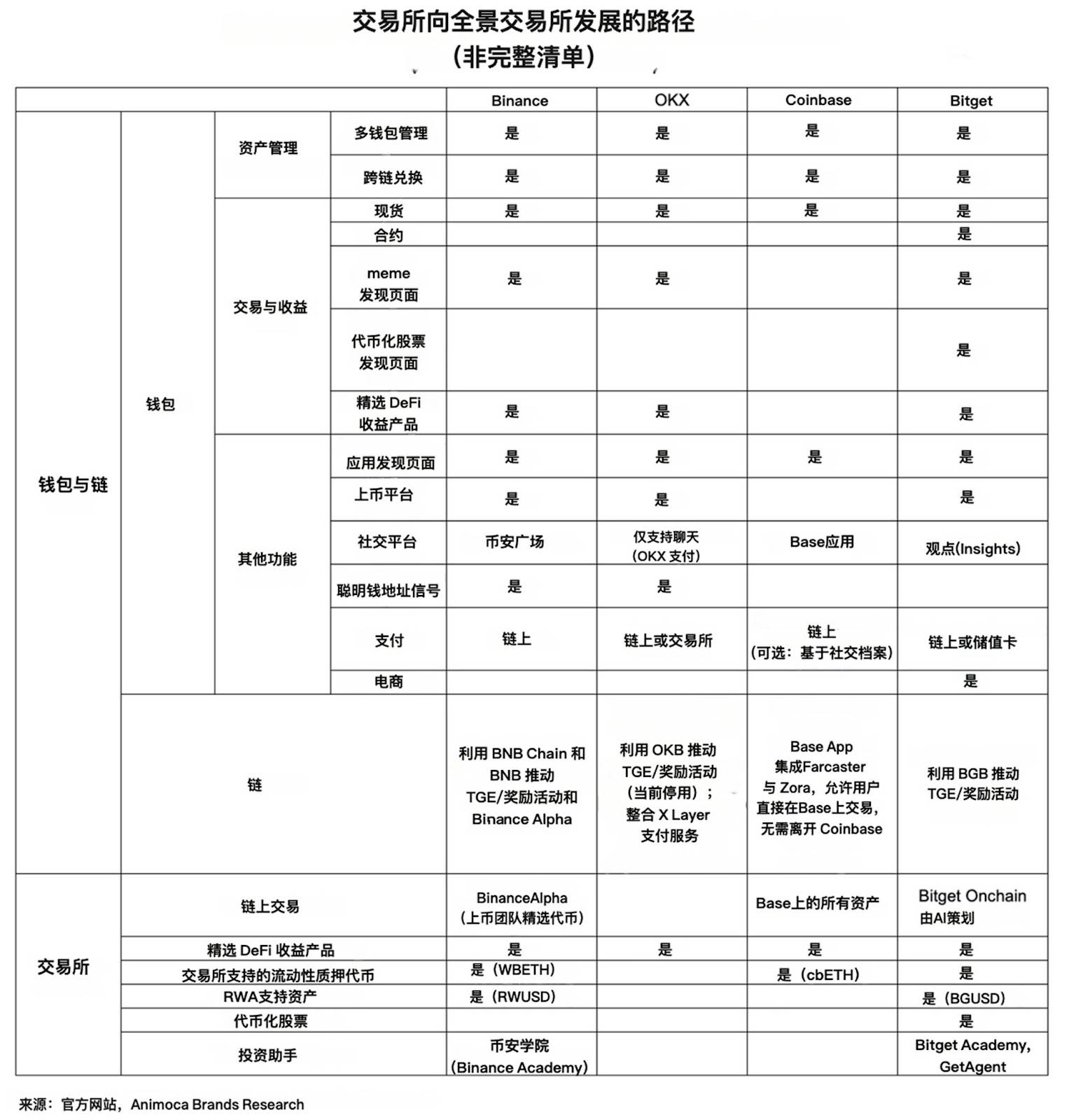

As CEXs aim to serve both native crypto users and mainstream audiences, they are expanding from single trading platforms into full ecosystems. Bitget’s concept of "UEX" exemplifies this trend.

A key component is integrating DEX tokens. Features like Binance Alpha and Bitget Onchain allow users to access tokens previously exclusive to DEXs—all within the exchange platform.

Exchanges are also broadening the range of tradable assets. For example, Zora tokenizes social media posts, bringing creator economies directly into exchange interfaces.

Meanwhile, pro-crypto policies in the U.S. are accelerating the on-chain migration of real-world assets. Money-market-backed tokens, tokenized stocks, and even private company shares are now tradable on platforms like Binance, Bitget, and Robinhood. With global reach and 24/7 trading, exchanges hold a clear edge over traditional brokers.

All of this makes crypto more accessible. By combining DEX tokens, novel assets, and tokenized real-world assets, exchanges are creating unified platforms serving both newcomers and veterans.

Gateway to the On-Chain World

With pro-crypto policies taking effect, stablecoins are rapidly developing, and issuers from home and abroad are entering the space. Banks issue stablecoins to protect liquidity, while market platforms use them to attract capital and business. Exchanges play a key distribution role—for example, USDC on Coinbase or USDT across various platforms.

At the same time, exchanges and wallets are building payment and transfer infrastructure. Examples include:

- OKX Pay—offering zero gas fee payments on X Layer without requiring OKB holdings;

- Bitget Wallet PayFi—supporting QR code payment networks in countries like Vietnam and Brazil, enabling direct consumer spending with stablecoins.

As these systems mature, stablecoins are entering everyday transactions. However, since holding stablecoins yields no return, users seek interest-bearing alternatives, driving demand for "crypto banks." Binance, OKX, and Bitget have all integrated DeFi yields and RWA-backed assets into their wallets, allowing users to earn yield while keeping funds deposited.

This mirrors traditional financial paths: Alipay first attracted users with payments, then added wealth products; Ping An started with insurance, then expanded into comprehensive finance. Crypto exchanges are similarly combining payments, deposits, and yield—with some positioning as universal exchanges, others evolving into super apps (like Coinbase Base App), integrating payments, social features, MiniApps, and tokenized content (Zora, Farcaster).

By integrating trading, payments, and content, exchanges are gradually becoming ecosystem hubs. Projects can directly reach users, tokens circulate within apps, and AI tools assist trading decisions—lowering barriers and deepening user engagement.

Conclusion

From current trends, the momentum driving exchanges toward Universal Exchanges (UEX) comes from three main sources:

- Integration of CEX and DEX trading;

- Launchpad-driven "tokenization of everything";

- On-chain migration of real-world assets driven by the Trump administration.

The transformation into UEX is not just about capturing on-chain innovation, but also about attracting mainstream users in the "early majority" phase.

After UEX attracts the early majority, the "gateway to the on-chain world" will bring in the "late majority." These users don’t need complex trading features, but they still value convenient financial services like payments, deposits, and yield.

These two paths together define the next phase of growth: expanding from early enthusiasts to broader populations, positioning exchanges as the primary entry point to the on-chain ecosystem.

However, despite the immense potential of universal exchanges and on-chain gateways, realization is far from easy. Mainstream adoption still depends on exchanges building trust and reliability. Regulatory barriers add complexity, with varying licensing requirements across jurisdictions—and some may even ban integrated financial services, requiring business separation. Despite these challenges, the trend will continue pushing exchanges toward this ultimate goal—even if not every exchange can achieve it alone.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News