Fintech: The Poetry and Promise of the Crypto Realm

TechFlow Selected TechFlow Selected

Fintech: The Poetry and Promise of the Crypto Realm

"FinTech" is the key to breaking out of the niche.

Author: airtightfish

Translation: AididiaoJP, Foresight News

Polaris is the fixed star navigators use to maintain direction—what could be the "Polaris" in the frothy crypto market?

While BTC approaches all-time highs, it's financial technology that holds the key to breaking into the mainstream.

University crypto clubs struggle to attract attendees because nihilism runs rampant across the industry. People see through predatory speculation tactics and have grown tired of them; outside perspectives are even worse.

Yet this misalignment creates massive opportunities: people overvalue short-term speculation while underestimating long-term structural trends—trends that may represent one of the greatest opportunities of our era.

Predatory Market Structures Are the Problem, Not the Future

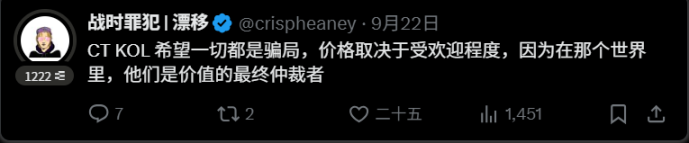

Memecoins reward influence, not insight. When markets are driven by speculation, those with influence control the narrative. In the absence of new external capital (a PvP environment), individuals closely tied to influence maintain persistent advantages over time, leading to extreme wealth disparity. Trump made dozens of wallets earn over $10 million each, while thousands of small retail wallets lost money. This dynamic plays out daily in smaller scales across the trenches. By design, it’s zero-sum and unsustainable. The days of frequent PvE rallies are gone—not just for memecoins, but across the ecosystem.

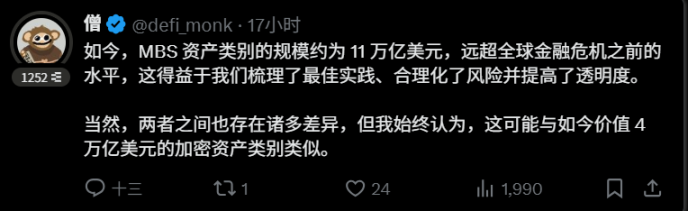

High FDV, low float launches make things worse. High FDV, low circulating supply at launch, structured market-making, exchange listings, paid KOL promotions, team OTC sales at steep discounts, supply manipulation, and now "DATs"...

In too many cases, tokens are merely revenue streams, and retail investors become exit liquidity. If a project has no revenue (or path to revenue), its token likely serves this purpose.

This nihilism stems from crypto’s market model—people understand the game and are tired of it. It’s not anyone’s “fault,” just the result of how the market has evolved over time. These structures are unsustainable. As the industry matures, predatory practices will play an increasingly smaller role because the market is continuously improving.

"In the short run, the market is a voting machine; in the long run, it's a weighing machine."

Revenue Trends

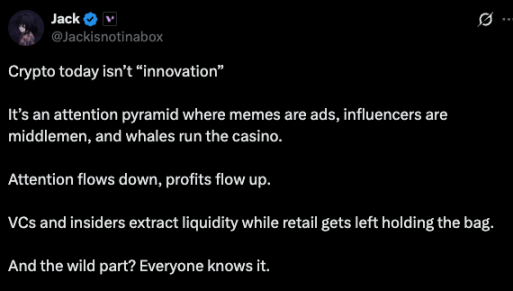

Narratives still drive price increases, but participants now treat them as trades rather than investments. Speculative premiums shrink as wealth shifts from outsiders to insiders, pushing prices lower. For projects without fundamentals, the bottom approaches zero.

BLAST token price chart

Revenue is the baseline. In traditional finance, if a company earns profits, it can and has incentive to conduct buybacks when return on equity exceeds internal rate of return (this holds true at certain valuations, which grow as the company grows). In crypto, it’s more nuanced—you must examine lab versus foundation structures and dig deeper to ensure no one is faking KPIs. Still, cash flow reigns supreme.

The Crypto Market Won’t Be PvP Forever—Scaling Is Coming

Markets Will Expand Faster

Tweet authors, liquidity funds, and proprietary traders replace analysts’ reports as the primary marketing forces in the market.

Companies can be built in weeks, revenues can grow tenfold within months. I wouldn’t be surprised if a fundamentals-focused liquidity fund achieved 1000% returns in a year.

Social media continues to shorten the time required to reach 100 million users

Internet-Native Distribution

Social platforms have eliminated market entry friction. People spend more time online than ever before. We’ve already seen applications reach 100 million users within weeks (ChatGPT, Threads). Remini’s AI avatar app surpassed tens of millions of downloads in about 30 days. Crypto amplifies this further: programmable incentives reward users, creators, and referrers. Small teams with strong products can scale faster than ever.

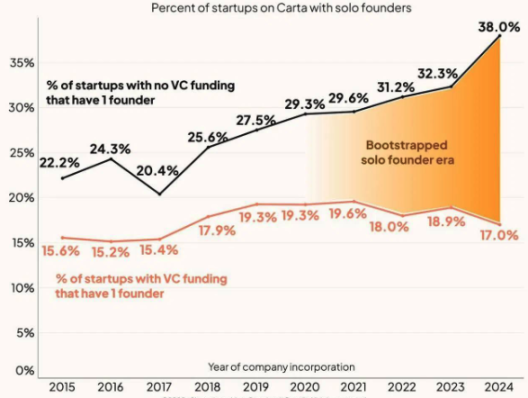

Less resources needed to start up, less funding required, more independent founders emerging

AI Accelerates Startup Building

AI has shifted the production possibility frontier. "Vibe coders" can now build highly complex businesses. Agents handle coding, marketing setup, support, analytics, and even parts of operations. These tools accelerate changes in market structure—over 60% of adults say they want to build something of their own. Tools lower barriers; ambition fills the gap. The startup long tail is growing rapidly, and crypto can help solve early-stage capital formation for this new cohort of entrepreneurs. More ideas are entering the market than ever before, and smaller teams can achieve scale.

Crypto Is the Foundation for Scaling

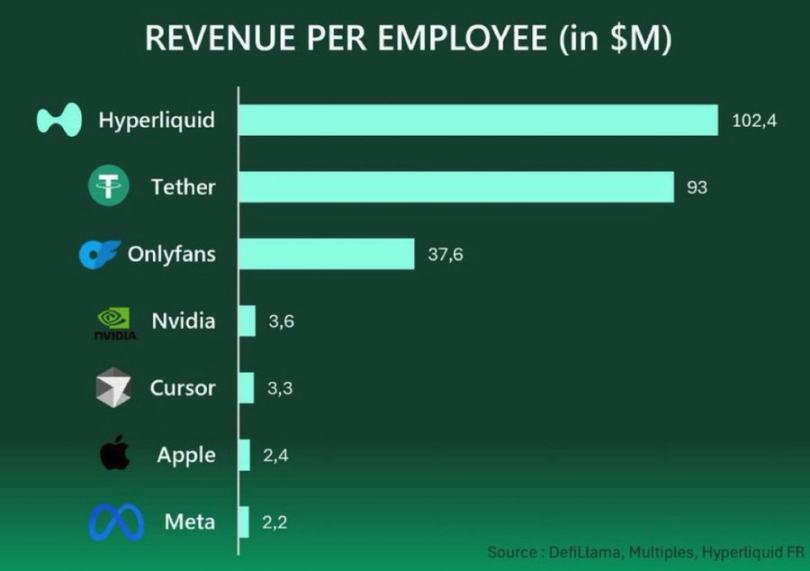

The world’s highest revenue-per-employee companies are Tether and Hyperliquid (both exceeding $100 million per employee), with others like PUMP and Axiom also in the top ten. Compared to other industries, the crypto market remains relatively small, but I expect many more crypto firms to appear on this list in the coming years. Crypto infrastructure enables trustless, scalable automation. It’s composable and globally borderless. Teams can be tiny yet achieve massive scale. Add in early-stage capital formation advantages and powerful incentive mechanisms, and you get companies that go from idea (optional fundraising) to $1 million in daily revenue in just weeks. This trend will only accelerate. In the next decade, hundreds or even thousands of unicorns will be created on-chain.

Internet Capital Markets (ICM)

Believe led the first wave of ICM with the right direction but poor execution. Mechanism design was flawed, and more importantly, the "companies" launched were closer to memecoins than real businesses. Nevertheless, ICM is inevitable.

If you were to redesign markets from scratch, you’d build a single universal layer enabling native issuance, trading, and settlement of any asset on public chains, accessible to anyone worldwide. I firmly believe this is the end state of markets, and crypto provides a clear path to get there. Combine internet-native distribution, accelerating business growth, and falling startup costs, and you begin to see a future where millions of internet-native businesses can be built and funded on-chain. Implementation may take time, but I truly believe people underestimate the scale of opportunity here.

"We tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run." —Amara's Law

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News