You Need These Tools to Farm Perp Dex

TechFlow Selected TechFlow Selected

You Need These Tools to Farm Perp Dex

They can give you a head start on the "hustle."

Author: BUBBLE, BlockBeats

As the founder of Binance, CZ has directly declared that the Perp Dex era has arrived—no further words needed. There are many Perp Dex products, yet issues such as funding rate discrepancies, cross-platform exchange rate deviations, and opaque position information persist. To participate in the market more efficiently, auxiliary tools have become essential for many users. TechFlow has compiled several practical PerpDex tools.

On-chain Wallet Analysis

Whether on-chain or on centralized exchanges, the movement of smart money is always a topic of interest. Smart money often brings stronger trading momentum than KOL followers, as tracking them is typically a self-driven behavior—especially with the emergence of on-chain address analysis tools. Such supporting projects tend to emerge first during memecoin trends or prediction market booms, and PerpDex is no exception.

Coinglass

Frequent secondary market traders are surely familiar with this website. As one of the most established data platforms, it covers data from various usage scenarios including FundingRate for tokens across exchanges, institutional ETFs, and options.

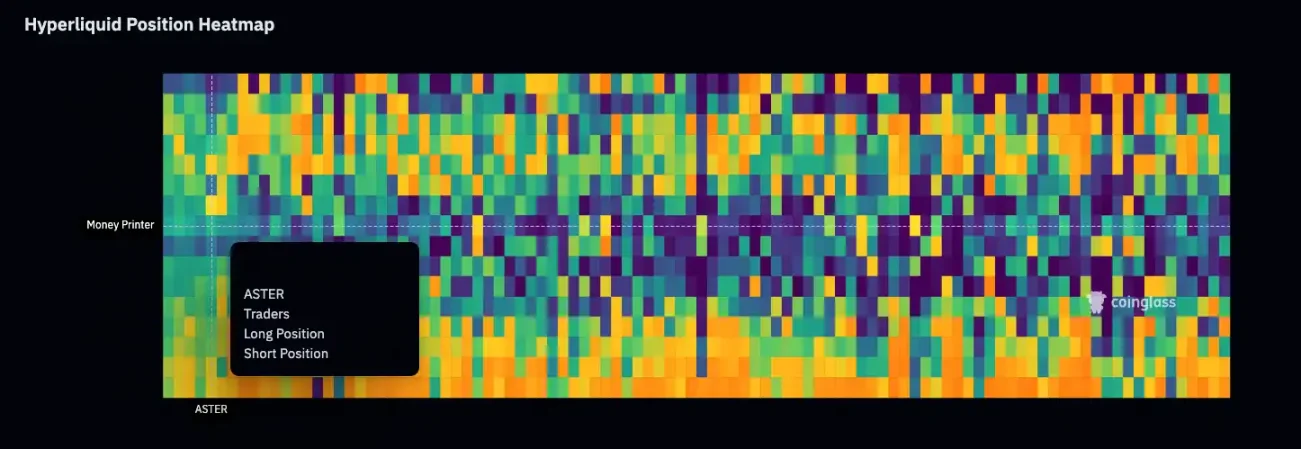

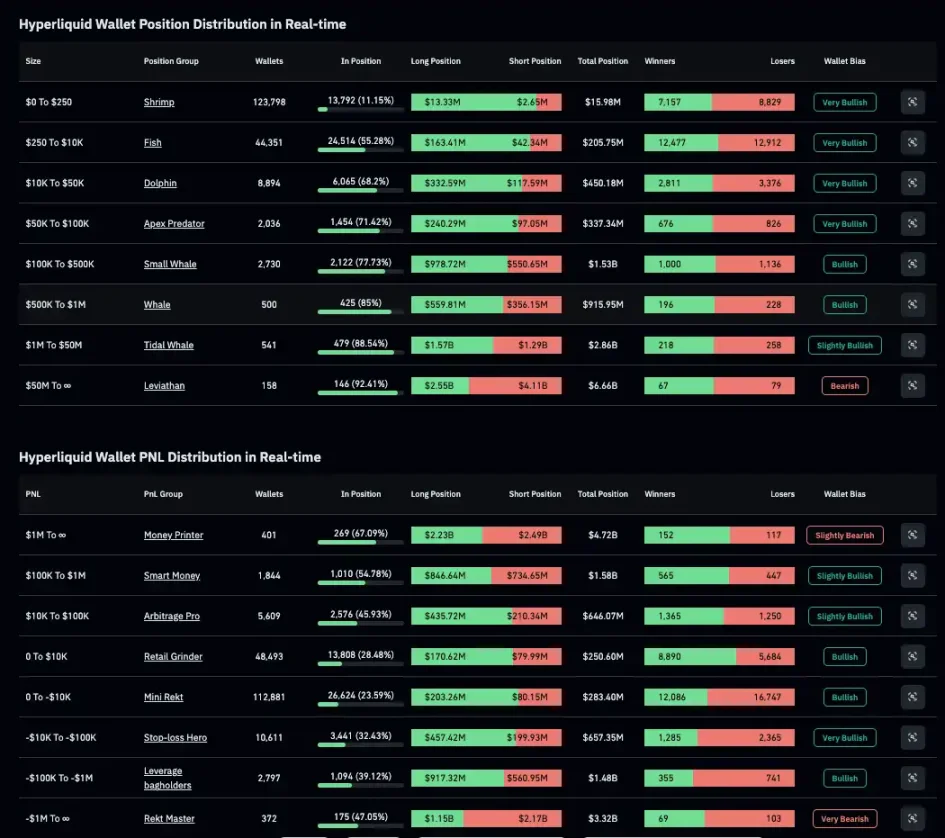

For PerpDex, however, only wallet analysis data related to Hyperliquid is currently publicly available. The way this data is presented is particularly interesting. Coinglass categorizes users into 16 types based on position size and profit/loss status (similar to the 16 MBTI types). A heatmap clearly shows the sentiment (bullish or bearish) of these 16 user types toward a particular mainstream token.

The image shows the current stance of "MoneyPrinter"—users who have earned over $1 million—toward the token Aster

The second visualization presents overall long/short ratios and win/loss proportions across these 16 user types. At a glance, it effectively reflects how players in different positions view the market. For example, small players like myself—Shrimp (0–$250) or Fish ($250–$10,000)—have relatively low opening rates, while those with positions exceeding $10,000 are almost all actively taking positions.

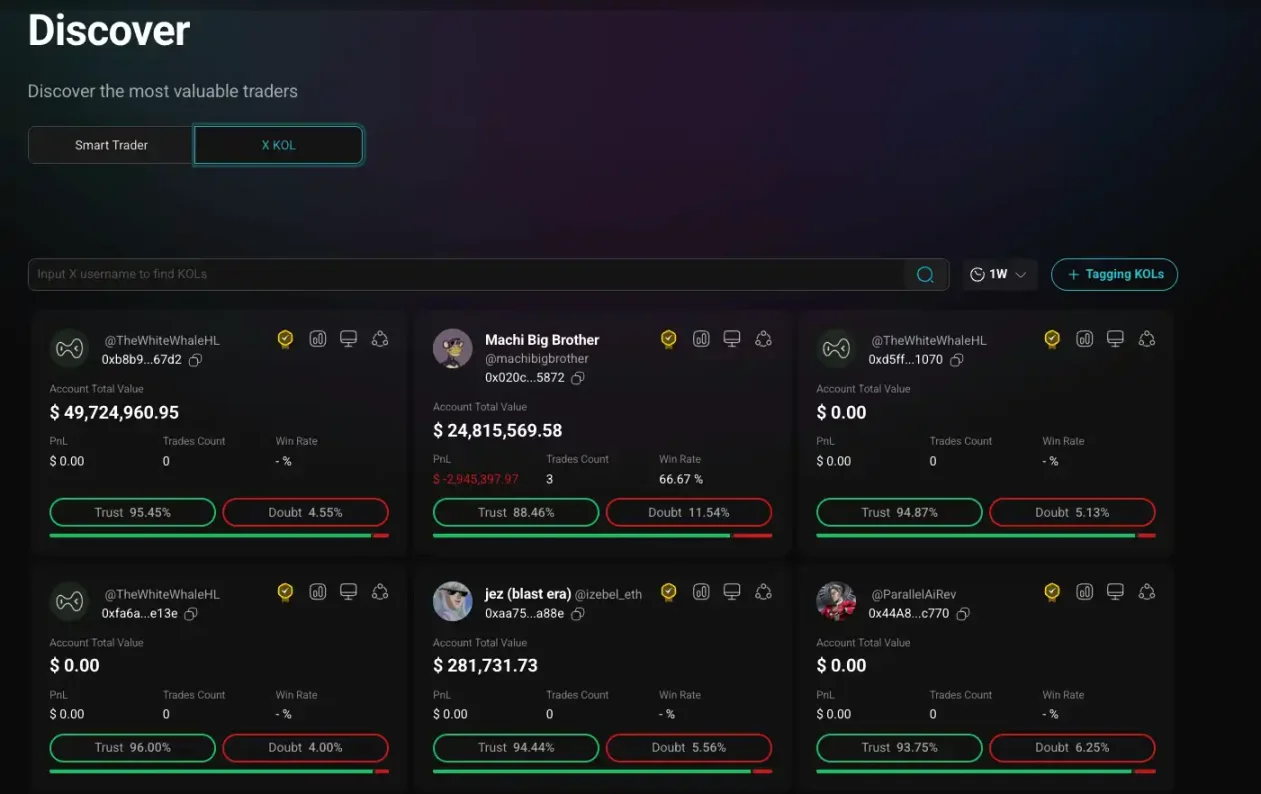

HyperBot

In terms of tracking smart wallets, Hyperbot is undoubtedly a recent hotspot. Originally a tool within the Hyperliquid ecosystem, it later expanded to the Aster platform. More importantly, it provides real-time alerts on large position changes and fund flows, enabling ordinary users to instantly capture smart money movements.

HyperBot's smart money exploration page offers an experience similar to what meme traders get on GMGN or Axiom.

The HyperBot token BOT has launched on Binance Alpha. With Aster's recent surge in popularity and the start of its second airdrop campaign, $BOT’s price performance has been impressive, reaching a market cap of $15 million and an FDV of $140 million. For users monitoring fund behavior, Hyperbot has become a relatively comprehensive assistant.

Further reading: "How to Best Farm the $700 Million Airdrop: Aster S2 Guide"

Arbitrage

As the number of PerpDex platforms grows, price differences and interest rate disparities between platforms create arbitrage opportunities. In today’s PerpDex-dominated landscape, relevant data platforms have started incorporating these metrics into their data collection scope.

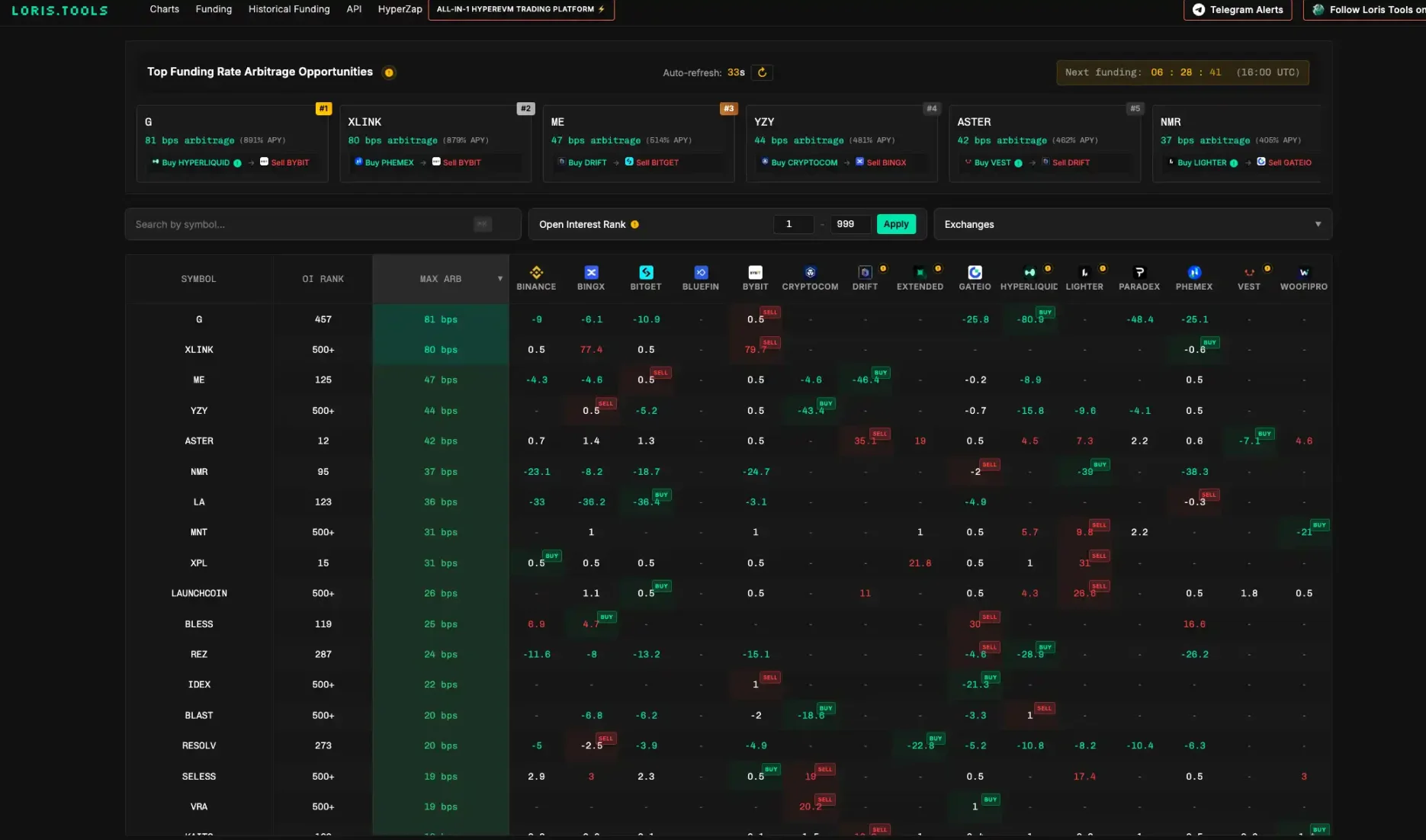

Loris Tools

Loris Tools is a funding rate arbitrage dashboard and market data platform developed by Loris, founder of HyperZap. The data is relatively clear, showing key metrics such as OI, maximum arbitrage basis points, and recommended platforms for execution. It updates automatically every 60 seconds and features a scrolling banner highlighting the best "arbitrage opportunities."

Besides dashboard tracking, users can also set up TG BOT alerts. However, different platforms have varying settlement times, requiring users to thoroughly understand each platform’s settlement mechanisms for optimal use.

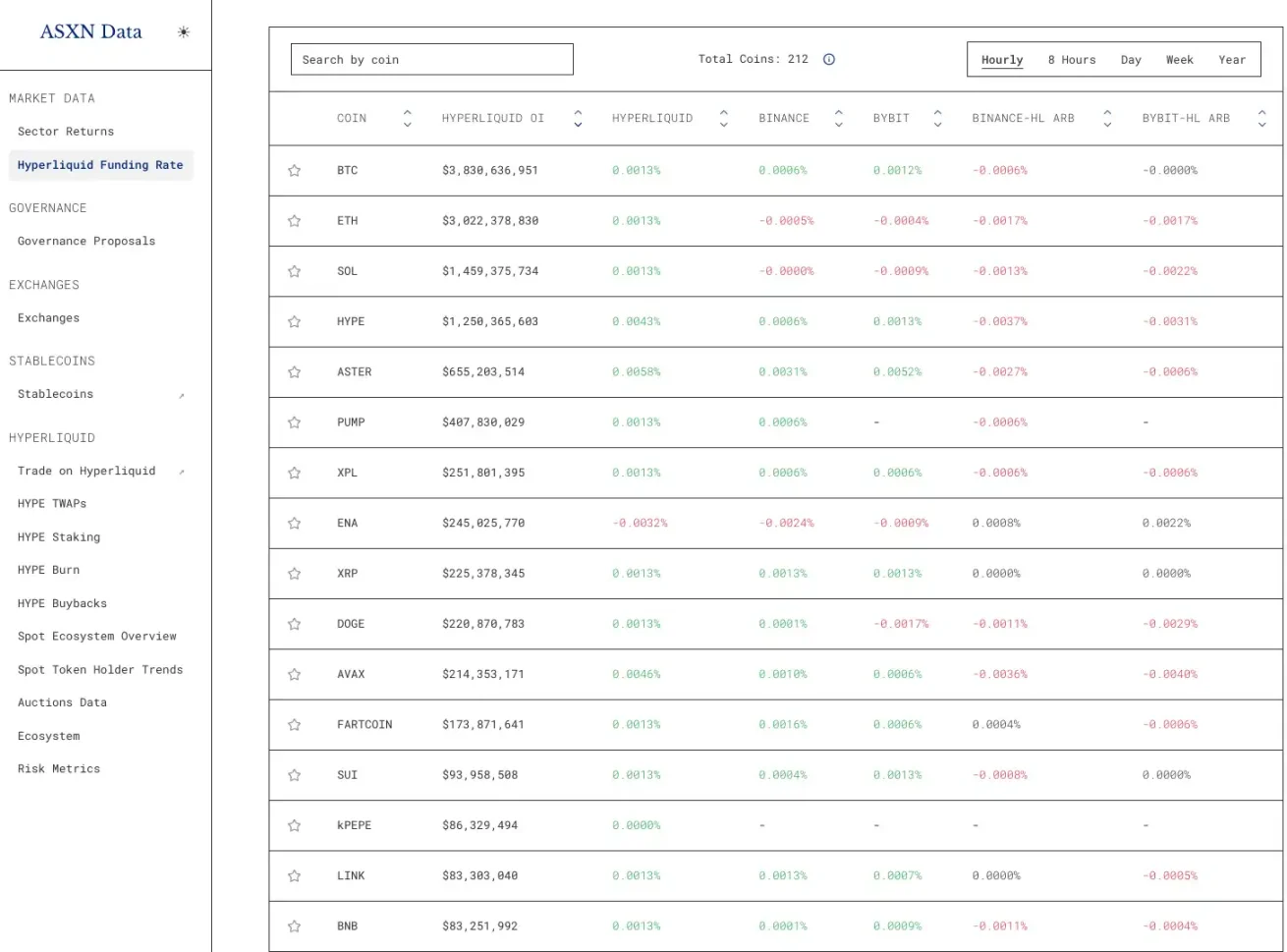

ASXN

While ASXN may not be as strong as Loris in the funding rate data segment, its functionality extends far beyond that. ASXN DATA is a dashboard created by crypto researcher ASXN, offering nearly a full suite of Hyperliquid data analytics.

Users can view overall recent trading activity via the Ecosystem Overview interface, or dive deeper into liquidity risks of specific tokens through Risk Metrics. Furthermore, the TWAPs page provides full visibility into validator distribution and status. These tools consolidate previously scattered on-chain information into actionable data dashboards, providing strong support for sophisticated traders. Unfortunately, the current dashboard only includes PerpDex data from the Hyperliquid ecosystem.

Data Dashboards

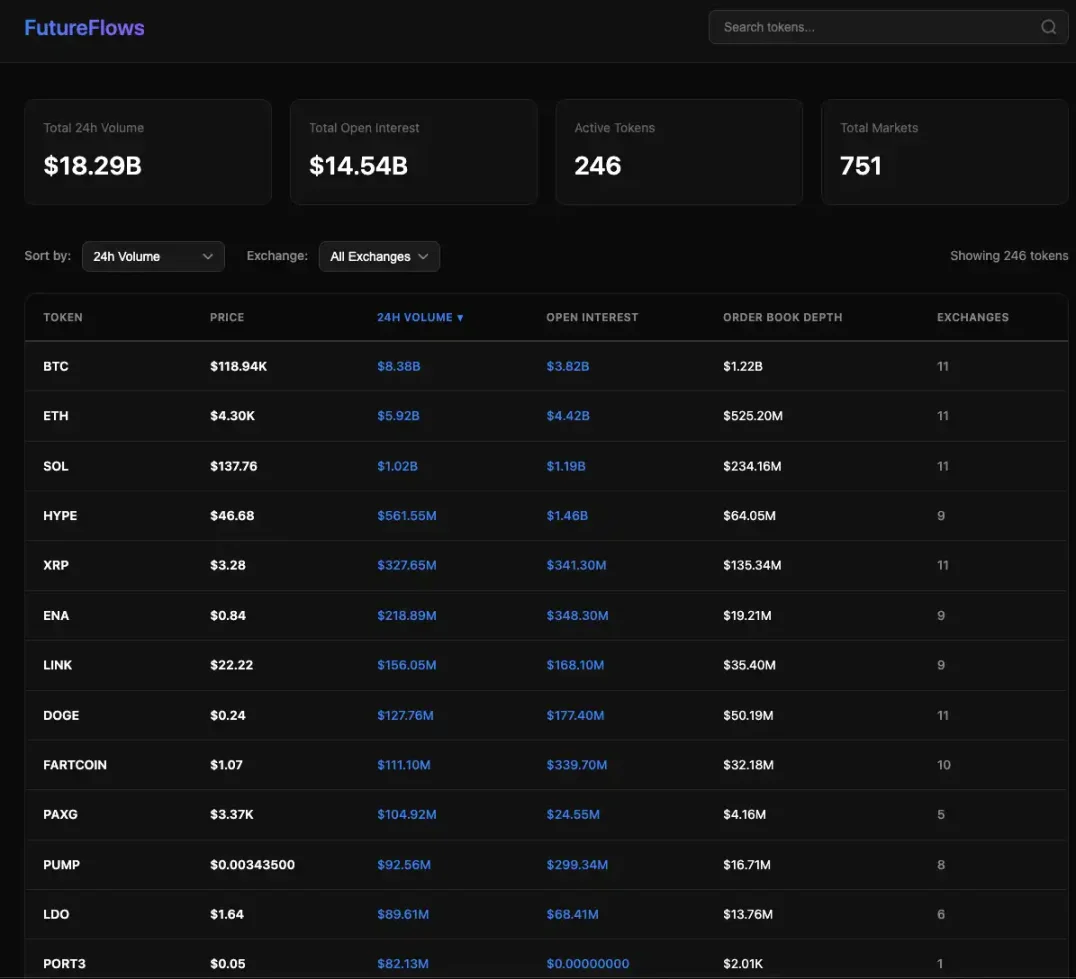

FutureFlows

Unlike Coinglass’s token trading volume heatmap, FutureFlows provides more holistic data, aggregating PerpDex data from most major platforms. From this dashboard, users can gain insights into the overall on-chain trading activity of most tokens.

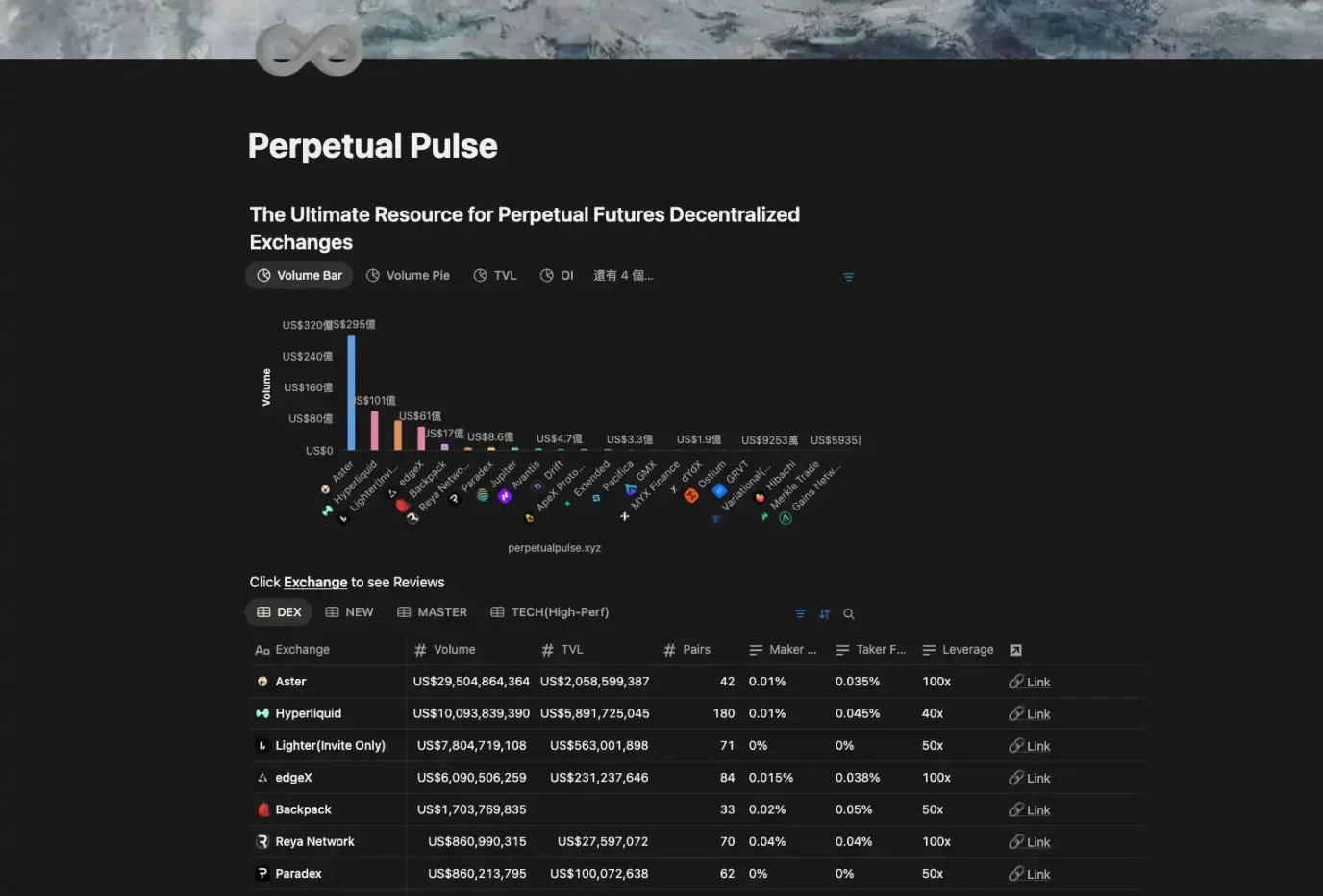

Perpetual Pulse

Perpetual Pulse is a PerpDex data dashboard built by hansolar, a member of the Lighter team. It offers similar overall market monitoring capabilities, tracking multi-chain contract volumes, TVL, and OI with real-time market updates.

Traders can use this platform to review trading volume trends and fund flows across different projects, helping assess market sentiment and identify trending sectors.

Trading Tools

Pear Protocol

Pear Protocol is a derivatives trading aggregation tool supporting two major ecosystems: SYMM (Symmetric Network) and Hyperliquid. It has already accumulated nearly $1 billion in trading volume.

Users can access contract markets on both networks through the Pear platform, eliminating the need to manually switch wallets and exchanges. It is ideal for active derivatives traders. Its biggest product advantage is the ability to open both long and short positions simultaneously on trading pairs, with Pair Markets providing real-time updates on suitable hedging pairs.

In the image, BNB/FTT on Hyperliquid supports up to 3x leverage, while pairs like BTC/ETH on SYMM can go as high as 54x leverage

The platform token $Pear is currently issued on Arbitrum, with a market cap of $4.2 million and an FDV of $15 million.

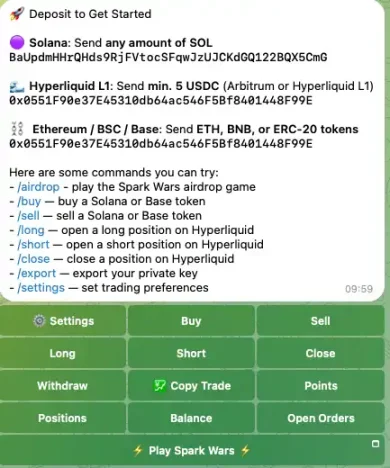

Spark

Spark is a multi-chain trading terminal based on Telegram. Recently, it began supporting contract opening, closing, and copying smart wallet trades across multiple PerpDex platforms. Its all-in-one interface greatly simplifies switching between different PerpDex platforms.

The tool currently supports major PerpDex platforms on several leading chains, including Hyperliquid and Aster, and also provides real-time depth order books, funding rates, and other quotes. While the advantage of Telegram bots is less pronounced now that many platforms offer mobile apps, Spark still brings convenience for multi-platform traders.

A Live Streaming Platform for PerpDex?

Recently, during a KBW SideEvent (Perp-Dex Day), traders live-streamed their activities across four major PerpDex platforms—an event that gained significant traction and was widely interpreted as "Koreans turning trading into a live-streamed game."

In terms of reach, the event organizers par_D & Magon were undeniably successful. This also suggests that such a trading format is increasingly accepted among crypto users. During the peak of live streaming, besides various eccentric streamers, trading live streams were among the most popular, helping many late-night "dog hunters" accidentally discover some golden gems.

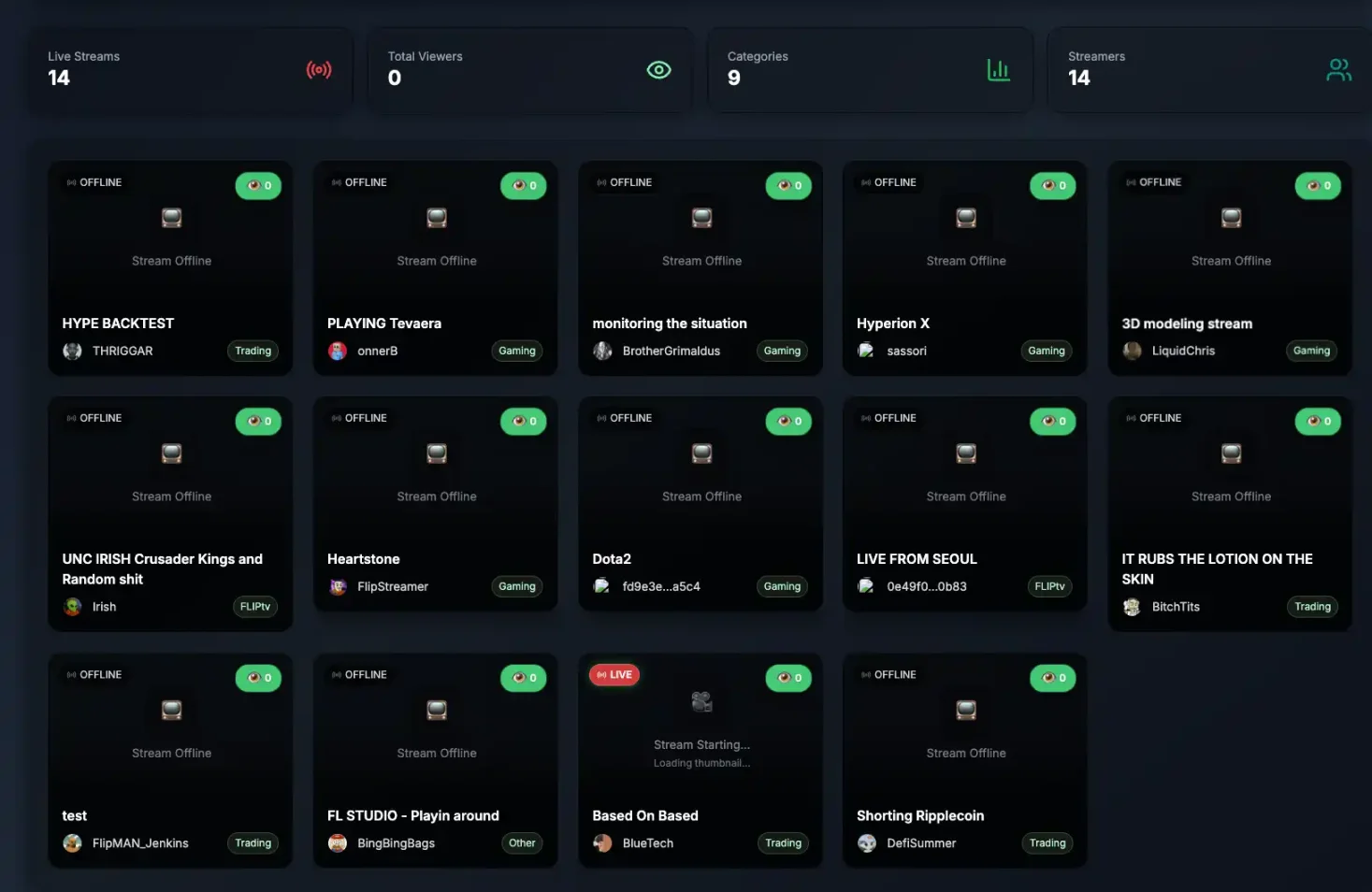

FLIPgo

Beyond Solana, Base, and BSC, there is actually a live streaming platform on Hyperliquid—FLIPgo. Although it is still immature in terms of stream count and UI design, if it can successfully develop the vertical PerpDex niche, its potential as an "e-sports platform" could be substantial.

Naturally, FLIPgo also has its own streaming token $FLIP, currently issued on HyperEVM, with a market cap of $1.5 million.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News