zkSync Top DEX Showdown: SyncSwap vs iZiswap – Who Has the Edge?

TechFlow Selected TechFlow Selected

zkSync Top DEX Showdown: SyncSwap vs iZiswap – Who Has the Edge?

Who will become the leading native DEX on zkSync in the future?

Why Pay Attention to zkSync and Its Dexs?

zkSync: A Strong Contender in the L2 Boom Year

2023 is the year of L2.

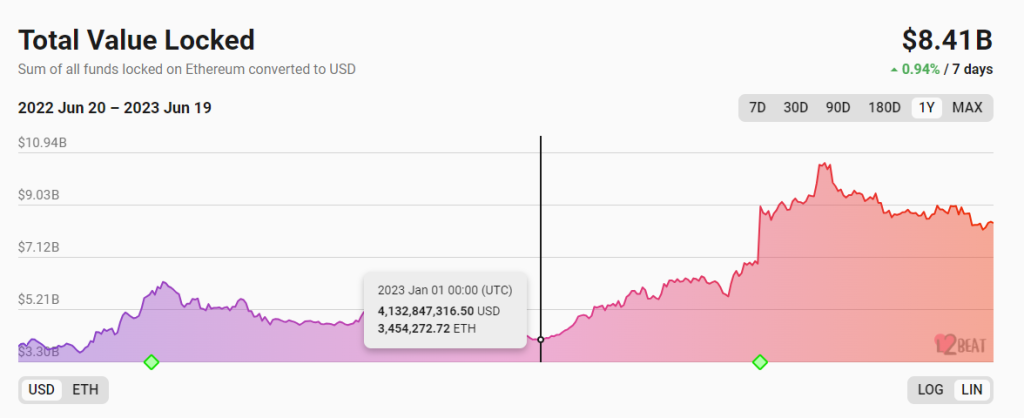

From a business data perspective, while TVL across major public chains represented by Ethereum remains low, L2 TVL has grown rapidly this year, repeatedly hitting new highs.

Source:https://defillama.com/chain/Ethereum?tvl

Source:https://l2beat.com/scaling/tvl

Beyond on-chain capital, active on-chain metrics further confirm this trend. Since October last year, when L2's actual TPS effectively surpassed Ethereum’s, this figure has continued to rise sharply. Currently, L2 networks achieve around three times Ethereum's TPS, and this number will clearly keep climbing.

Below: Comparison of L2 actual TPS vs Ethereum

Source:https://l2beat.com/scaling/activity

In addition to business data, the upcoming Cancun upgrade in October will significantly reduce L2 fees, accelerating user and application migration to L2s.

Regarding competitive dynamics, similar to L1s, the powerful network effects built by users, developers, and capital in L2s rank second only to stablecoins in the Web3 world, with clear first-mover advantages.

In the OP Rollup space, Arbitrum and Optimism have established a dominant duopoly. The only other potential contender might be Coinbase's L2 Base built on OP Stack, but few new players are likely to join the table soon.

The battle in the ZK Rollup arena, however, has just begun. As the long-term direction endorsed by the Ethereum Foundation and Vitalik, ZK is bound to secure a significant position in the intensifying L2 wars. Following Arbitrum’s airdrop earlier this year, zkSync has emerged as the next highly anticipated L2 airdrop project. Its TVL and user activity continue to climb, and within less than three months of launch, it has become the third-largest L2 by TVL after Arbitrum and Optimism—and the largest ZK Rollup by both TVL and user count. The ecosystem is gradually diversifying, featuring not only DeFi infrastructure but also meme projects like Cheems.

Overall, zkSync has gained an early lead in the ZK L2 race.

Dexs: Infrastructure for User and Capital Aggregation

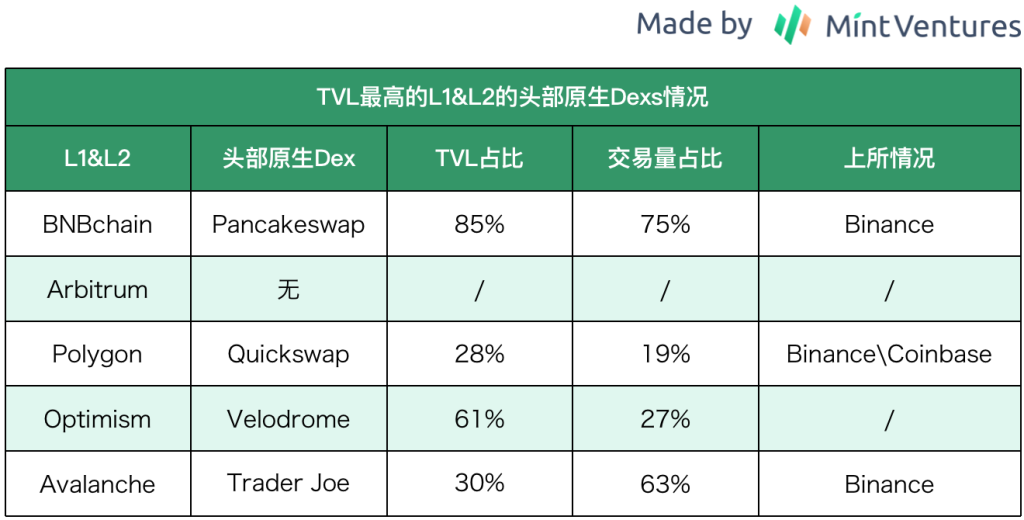

Dexs, lending, and stablecoins form the foundational financial triad on L1s and L2s. Yet, reviewing past development patterns of various chains, we observe that each chain typically hosts only one leading "native Dex." Here, the author defines "leading" by at least one of the following criteria:

-

Business metrics such as TVL and trading volume significantly outperform competitors, with market share exceeding 50% in at least one key metric

-

Token listed on top-tier exchanges like Binance

Data source: Defillama Date: 2023.6.7 Table: Mint Ventures

As the leading Dex on their respective chains, these platforms enjoy multiple advantages over competitors, including:

-

Stronger mindshare, making them the preferred platform for trading and market-making activities, with higher trust levels

-

Commercial edge—more likely to be favored by partners as the primary destination for liquidity deployment or collaboration on launchpad initiatives

-

Traffic advantage—more frequently mentioned and cited in rankings, news, and research reports, gaining free exposure and organic traffic

-

Cross-side network effects from superior liquidity and trading volume

-

Higher likelihood of listing on major CEXs, benefiting from liquidity premiums and broader holder bases

As a relatively new L2 ecosystem, zkSync is still in its early stages, with growing numbers of users, capital, and developers. Market structures across sectors remain fluid, major brand projects from other chains haven’t yet deployed cross-chain (e.g., Uniswap V3 and Aave), leaving native projects time to compete and consolidate their positions.

However, zkSync’s future Dex landscape will likely mirror other L1s and L2s—with only one dominant native Dex (or potentially dominated by Uniswap V3).

So the question becomes: who will emerge as zkSync’s leading native Dex?

zkSync Dex Landscape

Currently, zkSync hosts numerous Dex projects with diverse mechanisms. However, business data already shows signs of market concentration.

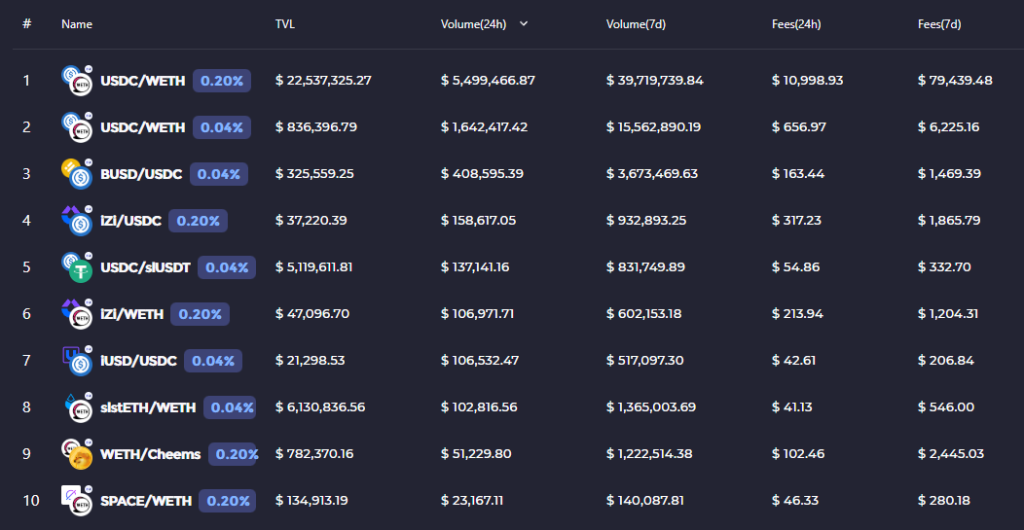

Data source: Defillama and official project data Date: 2023.6.6 Table: Mint Ventures

Note: Market share here is calculated based on total volume among the top five Dexs

In terms of mechanism design, three of the top five Dexs (SyncSwap, Mute, and Velocore) adopt a hybrid model combining V2 dynamic pools and stable pools. Notably, Velocore implements a ve(3,3)-style economic model similar to Velodrome and operates a liquidity marketplace.

Yet, judging by core business metrics such as TVL and trading volume, SyncSwap and iZiswap currently stand out as the first-tier Dexs on zkSync. The future leader is most likely to emerge from these two.

SyncSwap vs iZiswap

Next, we analyze and compare the two leading Dexs on zkSync across several dimensions: mechanism design, business metrics, economic models, and team backgrounds.

SyncSwap

Mechanism Design

Pool Types

Overall, SyncSwap doesn't introduce many novel features in its Dex product mechanics. It adopts a multi-pool approach commonly seen in ve(3,3)-style projects, primarily using Classic Pools based on Uniswap V2 (suitable for trading pairs with high exchange rate volatility) and Stable Pools based on Curve (for stable-rate pairs).

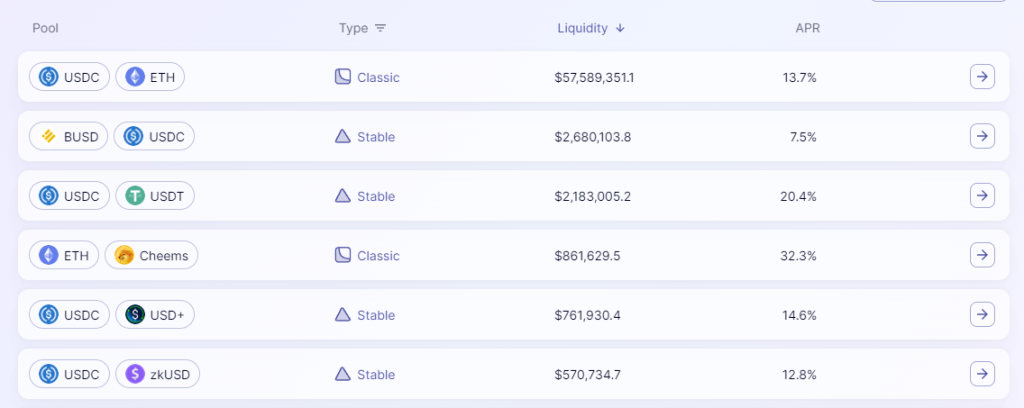

Below: SyncSwap Pool List

Source:https://syncswap.xyz/pools

Trading Fees

SyncSwap calls its fee structure “Dynamic Fees,” but in reality, it does not function as a true dynamic fee mechanism (where fees increase with asset price volatility to compensate LPs for impermanent loss). A more accurate term might be “customizable fees.”

Specifically, SyncSwap’s fee system includes the following features:

-

Adjustable fees: Different pools can set different fee rates, up to 10%

-

Directional fees: Different rates for buy vs sell directions, e.g., 0.1% for buys and 0.5% for sells

-

Fee discounts: Trading fee reductions based on token staking

-

Fee distribution proxy: Direct allocation of pool fees to external addresses

Thus, SyncSwap’s “Dynamic Fees” are unrelated to dynamism per se—rather, they offer richer customization options.

Business Performance

We analyze SyncSwap’s business performance across four metrics: trading volume, user count, liquidity, and fees (LP earnings and protocol revenue).

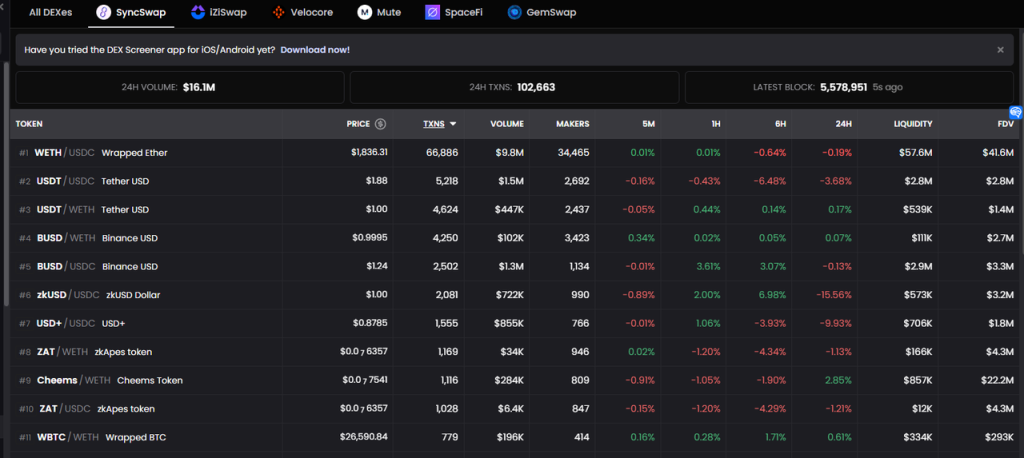

Trading Volume and User Count

SyncSwap does not provide a comprehensive trading volume dashboard. Based on on-chain data, its trading volume over the past 30 days (May 8–June 7, 2023) was $431,351,415, averaging $14,378,380 daily; over the past 7 days (June 1–7), volume reached $103,743,812, averaging $14,820,544 daily.

These figures align roughly with 24-hour volume stats from DexScreener and individual pool data from SyncSwap’s official site.

Below: SyncSwap 24-hour trading volume

Source:https://dexscreener.com/zksync/syncswap

Below: Business data for SyncSwap’s highest-volume pool (~$10M daily)

Source:https://syncswap.xyz/pool

In terms of volume composition, ETH-USDC dominates at 60.8%, followed by stablecoins. Trading volume involving genuine native zkSync assets accounts for less than 5%.

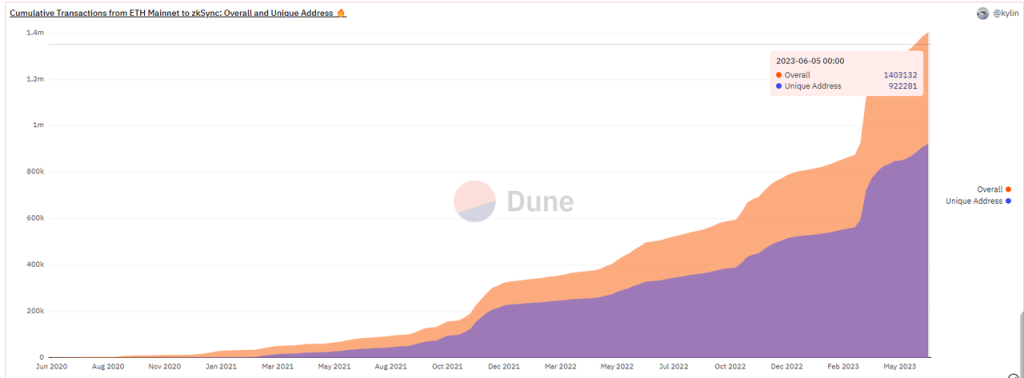

Similarly, based on on-chain data, SyncSwap had 843,692 monthly active addresses (May 8–June 7) and 247,814 weekly active addresses (June 1–7). With zkSync’s total unique addresses reaching 922,000 by June 5, this means approximately 91.4% of addresses interacted with SyncSwap during that month.

Source:https://dune.com/dev_1hermn/zksync-era

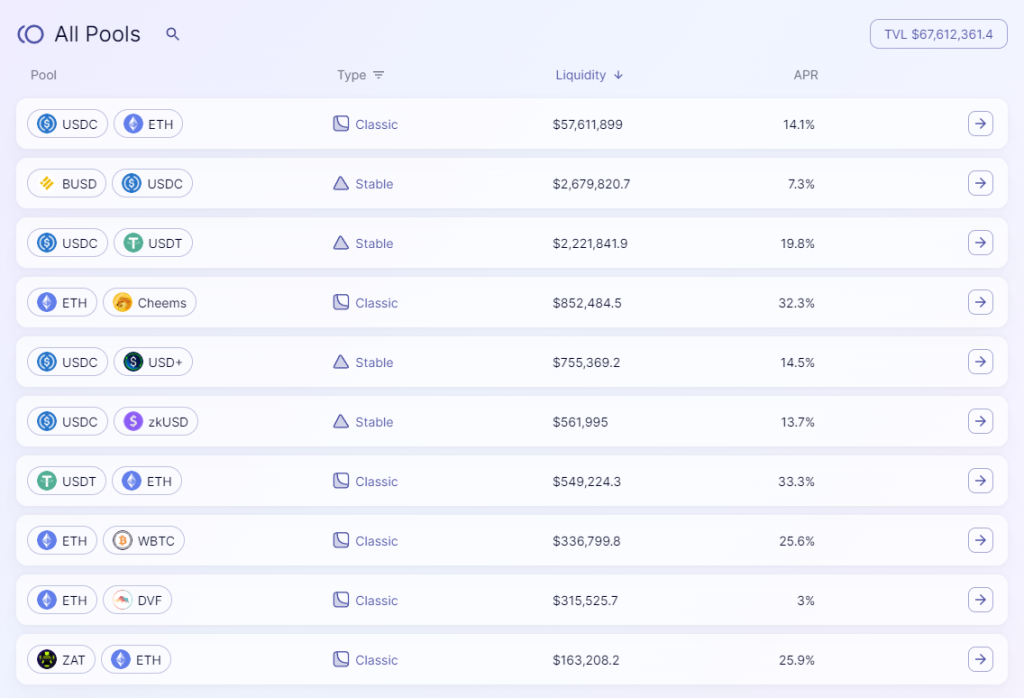

Liquidity

SyncSwap’s total liquidity stands at $67.61 million, with ETH-USDC alone accounting for $57.61 million—or 84.5%.

Source:https://syncswap.xyz/pools

Among the top 10 pools by liquidity, native non-stablecoin zkSync assets include Cheems (meme) and ZAT (NFT), totaling just 1.5%.

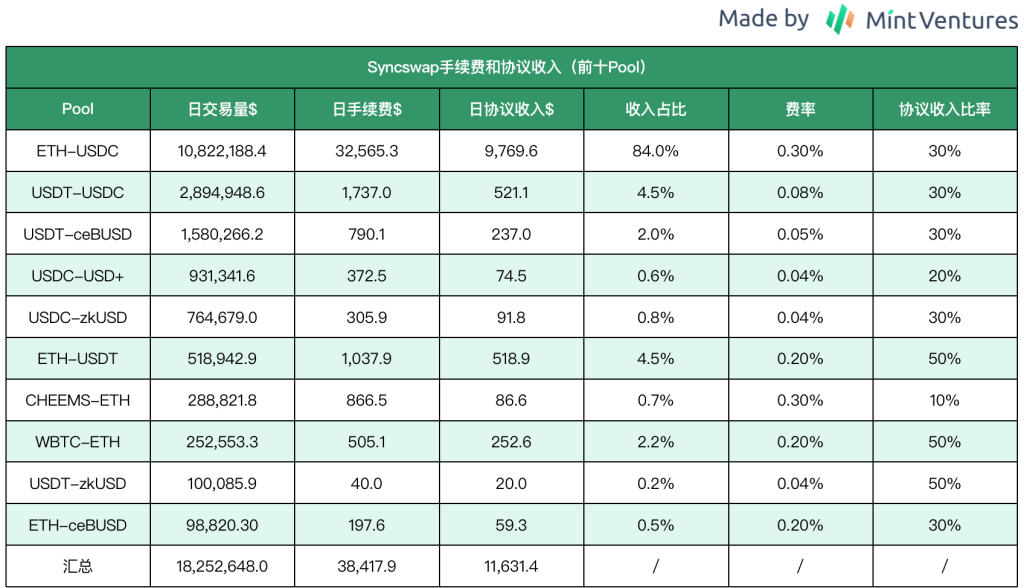

Trading Fees and Protocol Revenue

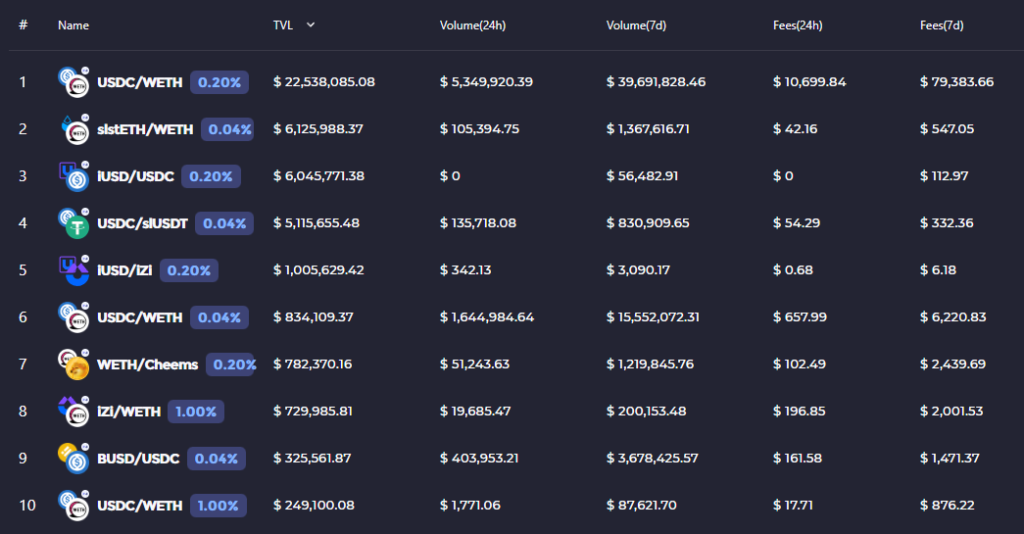

The author analyzed protocol revenues from SyncSwap’s top 10 pools by trading volume on June 9:

Data source: SyncSwap official Date: 2023.6.9 Table: Mint Ventures

From the table, ETH pairs contribute 90.6% of protocol revenue—the vast majority. Additionally, SyncSwap shares only 10% and 20% of fees with LPs for Cheems and USD+ (Tangible’s stablecoin), respectively, clearly aiming to attract liquidity in these pools.

Notably, SyncSwap has not issued a token nor launched liquidity or trading incentives, making it a rare profitable DeFi project. Of course, this is partly due to both zkSync and SyncSwap not having launched tokens yet, attracting many airdrop farmers.

Economic Model

Although SyncSwap hasn’t officially launched its token, it has disclosed partial details. The token, SYNC, has a total supply of 100 million.

In terms of token mechanics, SyncSwap partially follows Curve’s ve model: users must convert SYNC into veSYNC to unlock utility, including:

-

Governance voting

-

Protocol fee dividends

-

Trading fee discounts

However, its unlocking mechanism differs from Curve: veSYNC has a six-month linear unlock period after selection, with 50% available 20 days after initiation and the remaining 50% unlocking linearly thereafter.

Despite this, SyncSwap’s full tokenomics remain incomplete—details such as allocation ratios, release schedules, and whether the ve model guides pool emissions are still undisclosed. Overall, SyncSwap resembles a ve(3,3)-style Dex project.

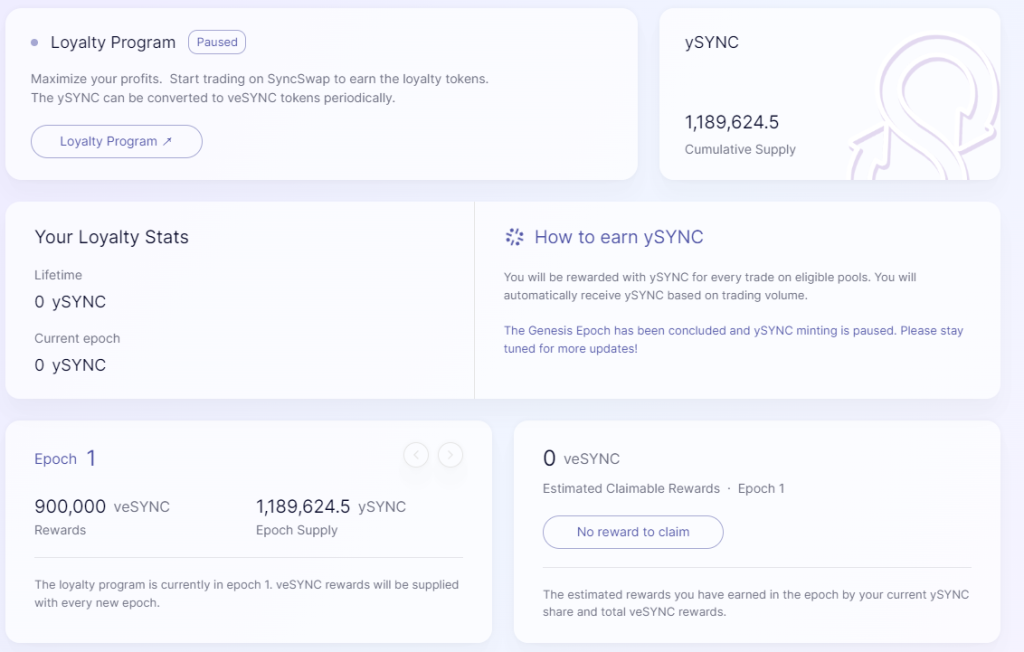

Additionally, although the SYNC token isn’t live, SyncSwap has introduced an incentive campaign called the “Loyalty Program,” targeting fees generated from specific trading pairs—essentially a “trading mining” scheme.

Source:https://syncswap.xyz/rewards

Rules of the Loyalty Program:

-

Users earn ySYNC tokens proportional to fees paid on designated pairs—ySYNC earned = transaction fees contributed

-

Each cycle is called an epoch; the genesis epoch (epoch 1) lasted one month, subsequent epochs last one day

-

Rewards are distributed in veSYNC; users must unlock veSYNC before selling

The genesis epoch ran from April 10 to May 10, distributing 900,000 veSYNC. Participants earned 1,189,624.5 ySYNC, meaning users paid $1,189,624.5 in fees on designated pairs—equivalent to ~$1.32 per veSYNC earned.

However, the Loyalty Program is currently paused after just one round.

Team and Funding

SyncSwap’s team remains anonymous, with no information about size or members, and no funding announcements disclosed.

iZiswap

Mechanism Design

iZiswap is one of iZUMi Finance’s products. iZUMi is a DeFi project offering multi-chain liquidity-as-a-service (LaaS). Beyond iZiswap, its other launched products include:

-

LiquidBox: A liquidity incentive service centered on concentrated liquidity (Uni V3 and derivatives), allowing projects to customize incentives by price range

-

Bond financing service: Offers convertible bond-style fundraising for projects

This article focuses on the competition for dominance among zkSync’s top Dexs, so we’ll concentrate on iZiswap’s presence within the zkSync ecosystem.

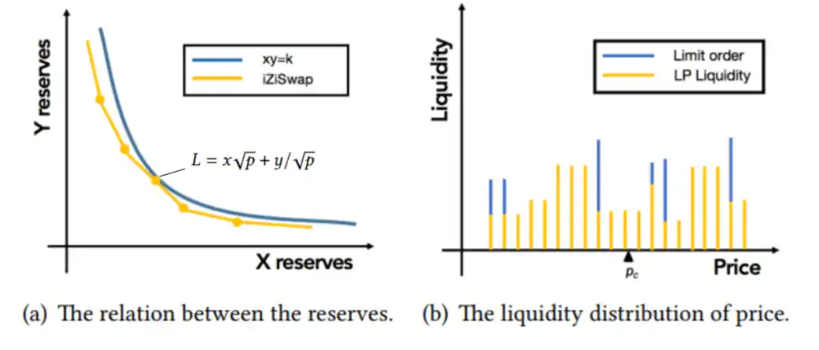

iZiswap’s main innovation lies in proposing and implementing DL-AMM.

DL stands for Discretized Concentrated Liquidity. Instead of using the constant product formula, DL-AMM places liquidity at discrete price points, each governed by the constant sum formula: L = X*√P + Y/√P.

Connecting countless discrete price points forms a complete AMM price curve similar to Uniswap (left image below).

Source:https://assets.iZUMi.finance/paper/dswap.pdf

In DL-AMM, liquidity is divided into two types: LP liquidity and limit-order liquidity. Together, they overlap across different price zones (right image above).

The former involves dual-token liquidity, while the latter uses single-token deposits aimed at acquiring another token at a specific price. Once the target price is reached, the swap executes and remains in the contract until withdrawn (in contrast, Uni V3 can simulate limit orders via narrow-range unilateral liquidity, but swaps reverse if prices return).

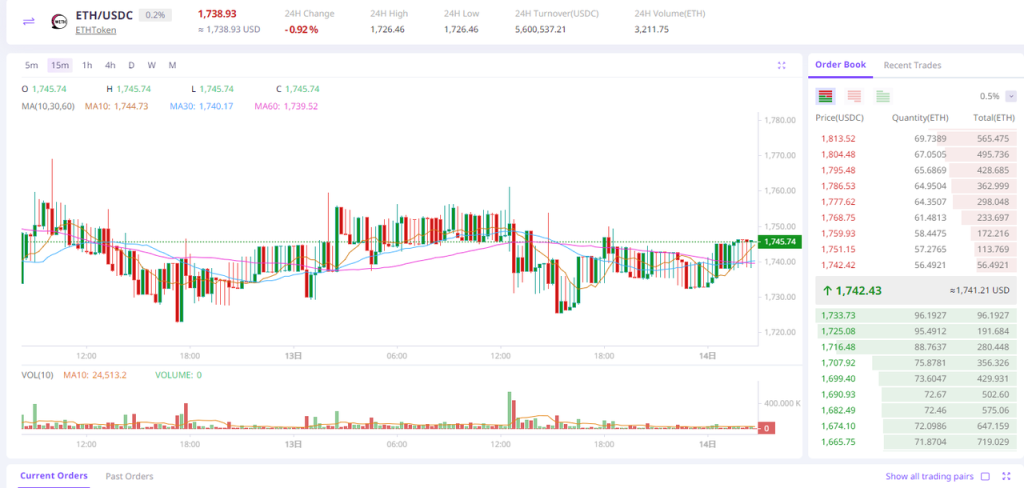

Additionally, leveraging the point-distributed nature of iZiswap’s liquidity, it offers an order-book-style trading interface (iZiswap Pro), delivering a near-CEX trading experience.

Source:https://iZUMi.finance/trade

When discussing liquidity order books, one often thinks of the well-known Dex Trader Joe, which launched its Liquidity Book (LB) in November 2022. LB similarly distributes liquidity across discrete points, using constant sum formulas instead of constant product.

For details on Trader Joe, see the author’s report: “The Second Wind Ignited by Arbitrum? Unveiling Trader Joe’s Fundamentals, Token Model, and Valuation”.

In fact, Trader Joe’s liquidity book concept may originate from iZUMi’s DL-AMM. iZUMi published its paper “iZiSwap: Building Decentralized Exchange with Discretized Concentrated Liquidity and Limit Order” in November 2021, and iZiswap launched in May 2022 (initially on BNB Chain)—both well before Trader Joe’s LB rollout. Trader Joe even acknowledges and references iZUMi in its V2 whitepaper.

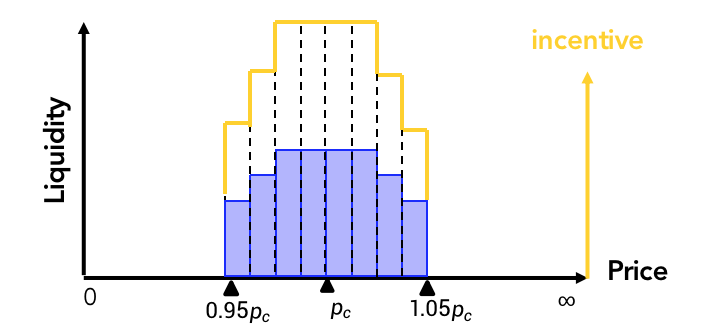

Beyond DL-AMM, iZUMi designed LiquidBox—a liquidity incentive service based on concentrated liquidity. Traditional V2-style liquidity mining is simple: users stake LP tokens to earn rewards, incentivizing liquidity across all price ranges. But designing incentives for concentrated liquidity models like V3, DL-AMM, or LB is far more complex.

Consider a $100 token: one LP provides $1,000 in liquidity between $95–$105, while another provides $1,000 between $10–$20 (one-sided order). The former uses capital much more efficiently. Rewarding both equally based solely on value would be unreasonable.

For users, LiquidBox is where they deposit liquidity and claim rewards. For reward providers (usually token projects or iZUMi), it allows differentiated allocation of received liquidity to meet desired goals.

LiquidBox offers three models, chosen jointly by the incentive provider and iZUMi:

1. OneSide Mode: The project token portion of deposited liquidity is not added to the pool but staked separately, reducing circulating supply and resistance during price increases. The paired asset (ETH or stablecoin) is allocated left of the current market price to strengthen buying support during downturns. This effectively achieves “increased buying pressure, reduced selling pressure.” For users, if the token rises, they avoid impermanent loss from “selling while rising.” However, if the token falls, since the high-position tokens weren’t sold earlier, losses from falling prices are amplified. This can thus be seen as a mechanism encouraging users to stake tokens rather than sell, enabling cooperative (3,3) market making.

Below: OneSide vs V2 comparison

Source: iZUMi documentation

2. Fixed Range Mode: Incentivizes liquidity within fixed price ranges—ideal for stablecoins and wrapped assets.

Fixed-range incentive Source: iZUMi documentation

3. Dynamic Range Mode: Users participate by providing liquidity within a range around the current price (e.g., 0.25Pc to 4Pc). The range width can be customized (e.g., 0.5Pc to 2Pc). Benefits include better liquidity near market prices, but if price swings exceed initial ranges, users face impermanent loss plus operational costs from frequent LP repositioning.

In practice, most active LiquidBox pools currently use Dynamic Range mode.

Moreover, LiquidBox supports LP token staking from both Uniswap V3 and iZiswap, with most active incentive pools located on zkSync.

Business Performance

Trading Volume and User Count

Using on-chain data, we compare iZiswap’s同期 figures with SyncSwap’s. Over the past 30 days (May 8–June 7, 2023), iZiswap recorded $195,025,494 in volume ($6.5M average daily); over the past 7 days (June 1–7), volume was $60,007,769 ($8.57M average daily).

These numbers align roughly with DexScreener’s 24-hour volume stats and official pool-level data.

Source:https://dexscreener.com/zksync/iziswap

Source:https://analytics.iZUMi.finance/Dashboard

Similar to SyncSwap, iZiswap’s ETH-USDC pair dominates even more extremely—two pools account for 85.8% of daily volume, followed by stablecoins and IZI, its native token.

Based on on-chain data, iZiswap had 301,993 monthly active addresses (May 8–June 7) and 102,938 weekly active addresses (June 1–7)—about 35–40% of SyncSwap’s user base.

Liquidity

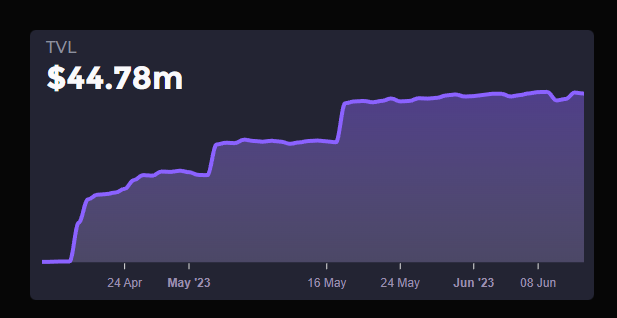

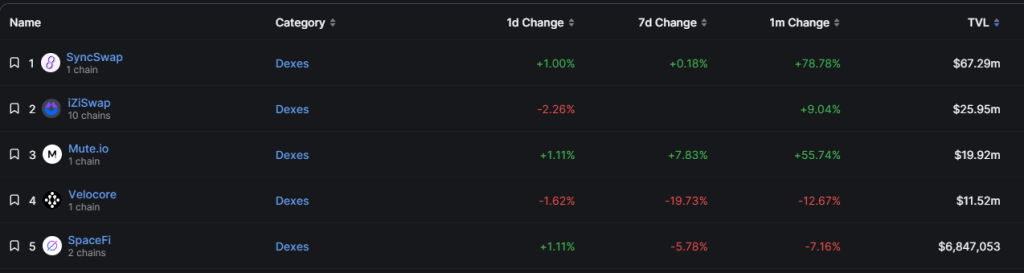

There’s a large discrepancy between iZiswap’s official liquidity data and Defillama’s figures: official dashboards show $44.78M, while Defillama reports $25.95M.

iZiswap’s officially disclosed liquidity data

Defillama ranking of Dex TVL on zkSync

The reason is that iZiswap’s official tally includes self-issued stablecoins and wrapped assets like iUSD (debt-backed stablecoin) and slstETH/slUSDT (wrapped assets bridged from Ethereum collateral), as shown below.

However, in the current market environment, proprietary stablecoins and wrapped assets face significant adoption hurdles due to counterparty risk concerns. Most users and mainstream DeFi protocols are reluctant to accept third-party issued wrapped assets. According to iZUMi, assets like slstETH are still in preparation and haven’t gone live. Therefore, for TVL analysis, Defillama’s figures are more reliable and meaningful.

Join TechFlow official community to stay tuned Telegram:https://t.me/TechFlowDaily X (Twitter):https://x.com/TechFlowPost X (Twitter) EN:https://x.com/BlockFlow_News