Bitfinex Securities nears $250 million tokenized securities milestone and plans to obtain full license from Astana International Financial Centre

TechFlow Selected TechFlow Selected

Bitfinex Securities nears $250 million tokenized securities milestone and plans to obtain full license from Astana International Financial Centre

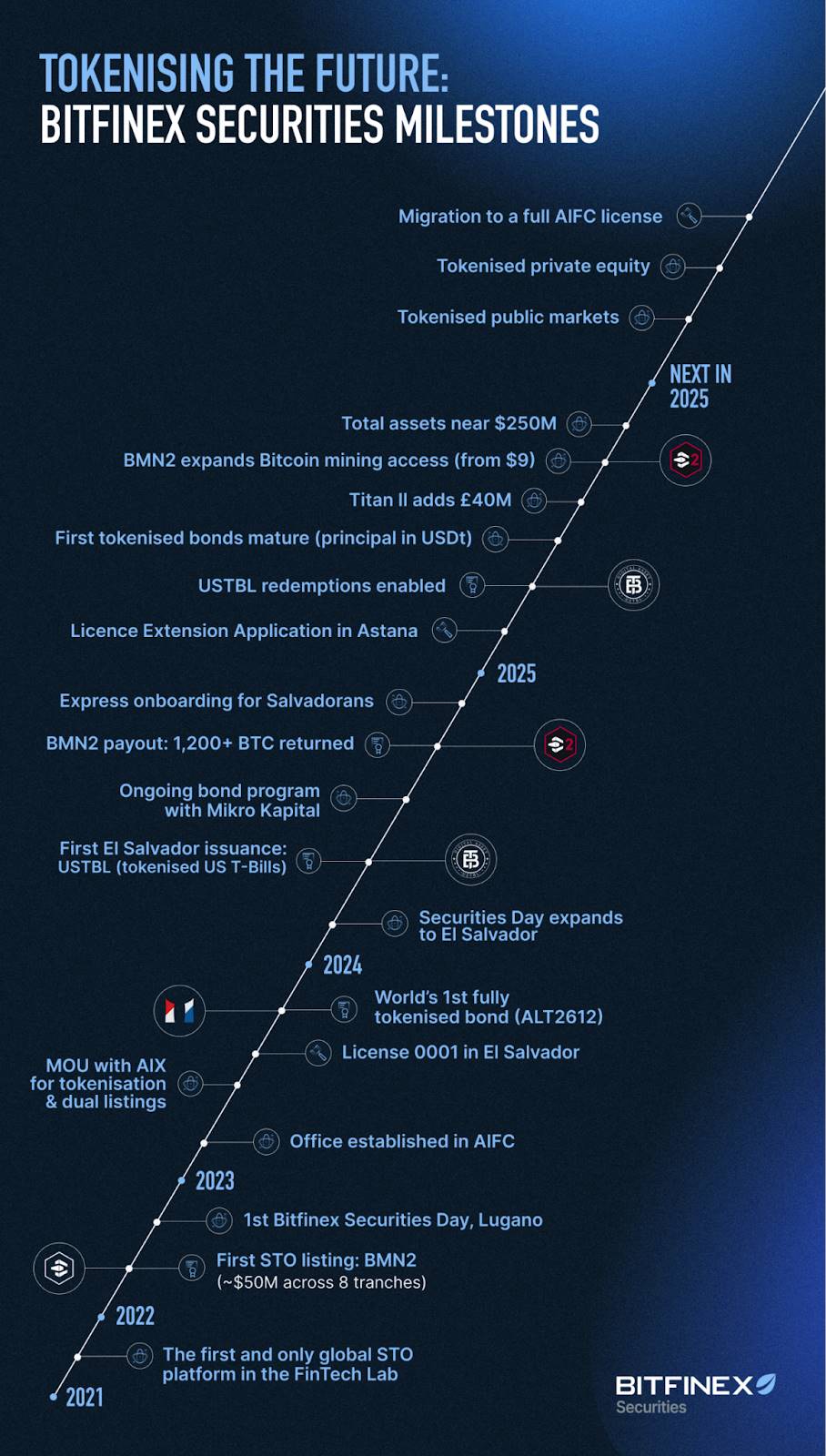

Bitfinex Securities was established in 2021 with the mission of leveraging technological advancements in the digital asset industry to transform global capital markets.

Bitfinex Securities is a regulated platform enabling institutions to raise capital through the issuance of tokenized securities. The platform today confirmed it has submitted an application to the Astana International Financial Center (AIFC) to upgrade from its current status in the FintechLab to become an Authorised Investment Exchange.

Bitfinex Securities joined the AIFC FintechLab in September 2021, a regulatory sandbox designed to advance financial industry development in the region. Since joining, the platform has issued $206 million worth of tokenized securities within the sandbox, including Mikro Kapital's recurring tokenized bond program and the first Blockstream Mining Note. Additionally, since April 2023, Bitfinex Securities has also held a separate license from El Salvador’s National Digital Assets Commission.

As the platform nears $250 million in tokenized assets under management, its licensing expansion plans in Astana are progressing accordingly, marking continued rapid growth.

Key milestones achieved this year include:

-

The direct listing of TITAN1 and TITAN2 — Bitfinex Securities’ first tokenized equities, with a combined value of £143 million;

-

The successful full redemption of Mikro Kapital’s first tokenized bond, with total payments amounting to $630,000 in USDt;

-

The direct listing of Blockstream Mining Note 2 (BMN2) — offering investors secondary market trading opportunities at an entry price below $9, based on fair value.

Paolo Ardoino, Chief Technology Officer at Bitfinex Securities, said:

"We continue to appreciate the support of the AIFC, who have demonstrated leadership as innovators in digital asset regulation. Having successfully completed our initial licensing period, we are pleased to confirm our application this year for a full license in Astana. Forward-thinking jurisdictions like the AIFC provide clear and robust regulatory frameworks that not only attract and nurture companies such as Bitfinex Securities but also demonstrate the tangible value of regulatory innovation."

Jesse Knutson, Head of Operations at Bitfinex Securities, commented:

"Approaching $250 million in tokenized assets on our platform marks a significant milestone and reflects the trust built with issuers. Given that all our listed offerings are built on the Liquid Network, this also highlights Bitcoin's ecosystem as a critical driver in advancing tokenized financial markets. As demand for tokenized securities continues to grow, we look forward to expanding our listing pipeline and establishing Bitfinex Securities as the leading platform for diversified tokenized assets."

Bitfinex Securities is also regulated in El Salvador and became the first international digital asset platform licensed under the country’s Digital Assets Issuance Law framework.

About Bitfinex Securities

Founded in 2021, Bitfinex Securities leverages technological advancements in the digital asset industry to transform global capital markets. With features including real-time settlement, 7×24 year-round trading, access to global liquidity, and support for self-custody, Bitfinex Securities aims to deliver a more efficient, cost-effective, and seamless experience for interactions between investors and issuers. Bitfinex Securities is licensed and regulated by both the Astana International Financial Center (AIFC) in Kazakhstan and El Salvador.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News