IOSG Weekly Brief|Recreating Ten AirTM, Prospects of Stablecoin Crypto Payments #294

TechFlow Selected TechFlow Selected

IOSG Weekly Brief|Recreating Ten AirTM, Prospects of Stablecoin Crypto Payments #294

Stablecoins are the killer application of crypto; licenses plus corridors equal moats.

Original Author|Frank @IOSG

Key Takeaways TL;DR

-

Stablecoins are crypto's killer app: Not NFTs, not Meme coins. They're already the "daily currency" of the Global South. Market focus is no longer on creating new stablecoins but on integrating existing ones into everyday payment scenarios.

-

Consumer value driven by B2B: While P2P remittances and crypto cards matter, the largest TAM will be in cross-border B2B payments. Crypto orchestration layers and PSPs that abstract stablecoins and directly embed them into corporate transfer systems can capture massive cash flows and additional yield from fund settlements.

-

Licenses + Corridors = Moat: As infrastructure shifts from tech competition to distribution, real barriers in B2B payments lie in regulatory licenses (MSB/EMI/SVF, etc.), banking partnerships, and first-mover advantages in cross-border corridors. (e.g., Bridge holds U.S. MSB/MTL; RD Tech holds Hong Kong SVF).

-

Orchestration > Aggregation: Aggregators are just marketplaces with thin margins; orchestrators control compliance and settlement. True defensibility comes from holding licenses directly and enabling on-the-ground fund movement.

-

Competition intensifying: The focus has shifted from "underlying technology" to "real-world usage": like consumer apps, the market rewards actual adoption and user scale. TRON's rising fees have validated strong demand for stablecoin transactions. Next, native stablecoin chains (like Plasma, Arc—issuers with issuance and distribution channels) will follow application-specific chains such as Hyperliquid, actively guiding users to transact and settle directly on their own stablecoin blockchains, avoiding most fees being captured by general-purpose public chains. Meanwhile, users will be able to pay network fees directly in the transferred stablecoin, unifying payment medium and network incentives.

Introduction

Stablecoins and the blockchains built around them are becoming focal points and headline news almost daily. Initiatives like Tether.io’s Plasma and Stable, Circle’s Arc, Stripe’s Tempo, Codex PBC, 1Money, Google’s next-gen L1 blockchain under development, and many more upcoming projects are accelerating this trend. Meanwhile, MetaMask, one of the world’s most widely used self-custody wallets, has officially announced plans to launch its native stablecoin, marking a further expansion of wallet products into payment and value-bearing functions. On another front, Remitly, a major player in personal cross-border remittances, has announced the launch of a multi-currency fiat and stablecoin wallet—Remitly Wallet—currently in testing and scheduled for official rollout in September in partnership with Circle.

These moves collectively show that an increasing number of large payment companies and Web2/Web3 tech giants are accelerating vertical integration, moving directly into the stablecoin and blockchain payment space. They’re no longer relying solely on third-party infrastructure but choosing instead to issue their own stablecoins, build proprietary wallet products, and even launch dedicated payment blockchains. Stablecoins are rapidly expanding beyond native crypto use cases into broader payment, remittance, and financial services, emerging as one of the most practical applications of blockchain technology.

Therefore, this article offers a timely opportunity to discuss:

-

The current stablecoin payment tech stack

-

Sectors that have achieved PMF

-

An investment framework for each payment segment

Stablecoin Payment Infrastructure

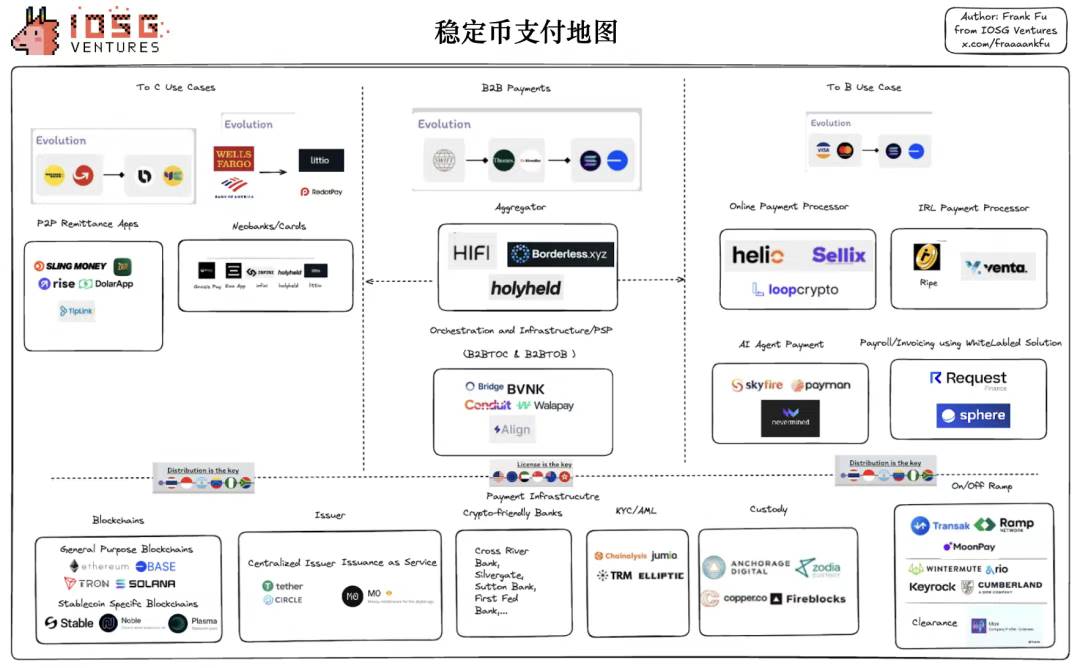

Although various definitions exist in the market, I believe the stablecoin payment tech stack can be broken down as follows:

* The mapping used here is based on my July compilation. For the latest market map, refer to ASXN’s dashboard (https://stablecoins.asxn.xyz/payments-market-map).

At the very bottom of the entire payment landscape lies the blockchain itself—the foundation and core infrastructure.

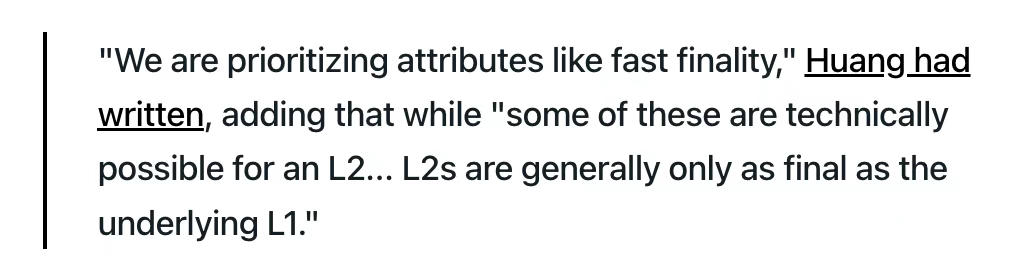

Recently, when Paradigm’s Matt Huang explained why Stripe chose to build a new L1 called Tempo instead of building on an Ethereum L2, he listed several reasons. While many of these were criticized by the Ethereum community and various VCs, one point—Fast Finality—clearly highlighted a real challenge facing Ethereum today.

▲ Source: Matt Huang from Paradigm

In blockchains, "finality" refers to the guarantee that once a transaction is confirmed, it cannot be reversed or altered, nor revoked due to network fluctuations or chain reorganizations. "Fast finality" means providing this guarantee within seconds—or even sub-seconds—rather than making users wait minutes. Moreover, since L2 finality depends on L1, no matter how fast or powerful an L2 is, its security and confirmation speed still rely on the underlying L1.

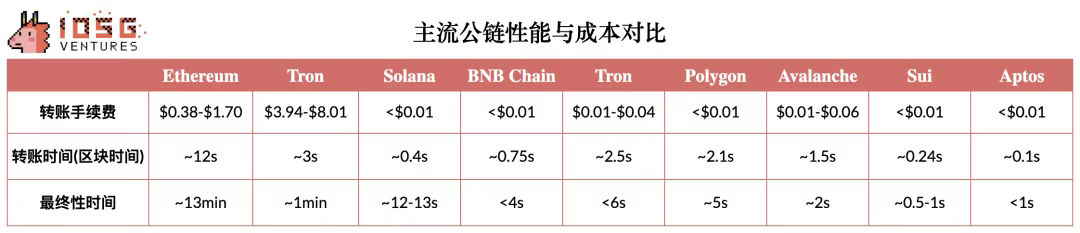

Ethereum’s current mechanism is robust but relatively slow. A block is produced every 12 seconds. Transactions get included quickly, but economic finality takes about 12–15 minutes—two PoS epochs. During this time, validators continuously vote and finalize the result. While sufficient so far, the market increasingly demands finality times under 2 seconds to meet commercial payment and institutional high-frequency settlement needs. If the base layer is slow, high-speed payments can’t be supported; if transfer costs are high, the promise of “low fees” falls apart; even the best UX will be undermined by poor infrastructure.

▲ Source: OKX Gas Tracker (July 23, 2025), Block Time & Finality Time: Token Terminal

Beyond vertical integration, this is also why we’re seeing more stablecoin issuers and traditional payment giants building their own blockchains. Beyond revenue sharing, the core reason is that all upper-layer applications and user experiences ultimately depend on the underlying infrastructure. Only with fees reduced to fractions of a cent, near-instant finality, and token designs allowing gas to be paid in stablecoins can truly seamless, frictionless experiences be delivered.

Common core technical features include:

-

Stable and low fees payable directly in stablecoins

-

Permissioned validator sets

-

High throughput (TPS)

-

Interoperability with other blockchains and payment systems

-

Optional privacy features

Yet often, success hinges not on technology alone, but on:

-

Clear go-to-market (GTM) strategy

-

Effective business development execution

-

Robust partner ecosystem

-

Efficient developer onboarding and support

-

Marketing and external communication

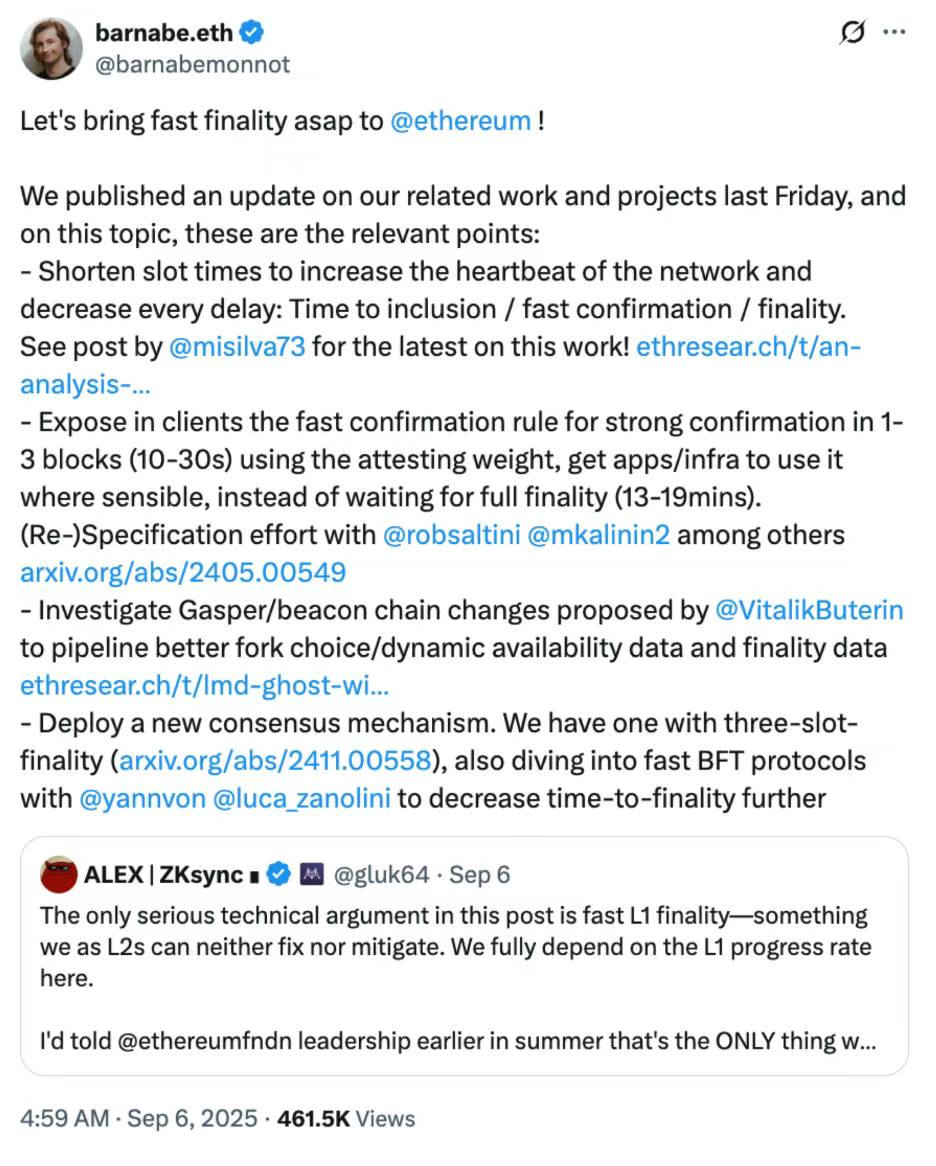

We’ll cover detailed comparisons between different blockchains in a separate future article, so won’t elaborate here. That said, Ethereum has long recognized the importance of Fast Finality without compromising decentralization. Community members are pushing the Ethereum Foundation (EF) to accelerate progress. EF’s Barnabé Monnot shared ongoing initiatives:

-

Block time will shorten from 12 to 6 seconds, with related tests already passed.

-

New “fast confirmation rules” will allow transactions to be strongly confirmed after just 1–3 blocks (~10–30 seconds), eliminating the need to wait for full finality.

-

Work is underway on core protocol optimizations based on Vitalik’s proposals, exploring next-gen consensus mechanisms like “three-slot finality.”

▲ Source: Barnabé Monnot from EF

Beyond rapid growth in stablecoin networks, the issuance scale of stablecoins themselves is also experiencing explosive growth. Stablecoin issuance platform M0 recently closed a $40 million Series B round led by Polychain Capital, Ribbit Capital, and Endeavor Catalyst Fund. M0’s Stablecoin-as-a-Service platform enables institutions and developers to issue highly customizable stablecoins with full control over branding, functionality, and yield. All stablecoins built on M0 are natively interoperable and share unified liquidity. With its open multi-issuer framework and fully transparent on-chain architecture, M0 is breaking through the boundaries of traditional stablecoin issuance.

Since inception, M0 has been adopted by projects including MetaMask, Noble, KAST, PLAYTRON, Usual, USD.AI, and USDhl to issue stablecoins for various purposes. Recently, total issuance volume across M0-based stablecoins surpassed $300 million, a 215% increase since the beginning of 2025.

Just as stablecoin issuers are vertically integrating into underlying blockchain infrastructure, application-specific chains with creative use-case potential are now vertically integrating into stablecoin issuance to deepen ecosystem alignment.

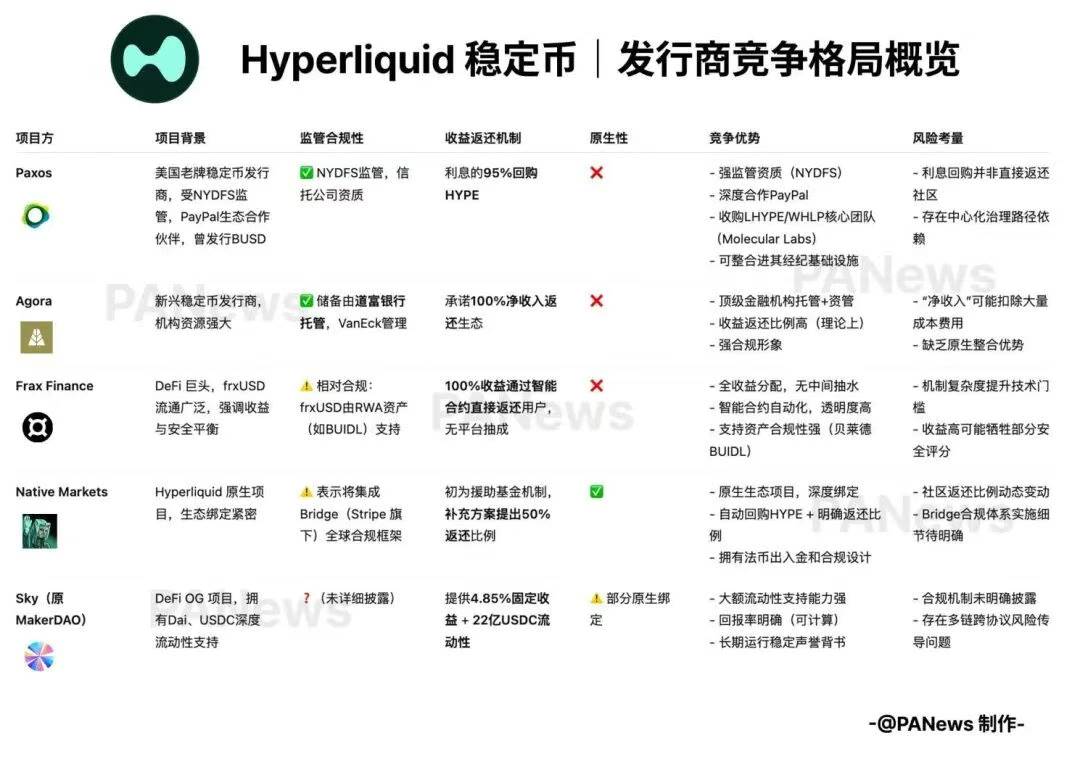

Last Friday, Hyperliquid dropped a bombshell on Discord: plans to launch a native stablecoin USDH within its HyperEVM ecosystem, selecting the issuer via on-chain voting and public bidding. Over the following week, various stablecoin issuers submitted bids, with the winner to be decided by majority vote among $HYPE stakers. To emphasize decentralized governance, despite holding significant $HYPE stakes, the Hyperliquid Foundation chose to abstain, leaving the decision entirely to the community.

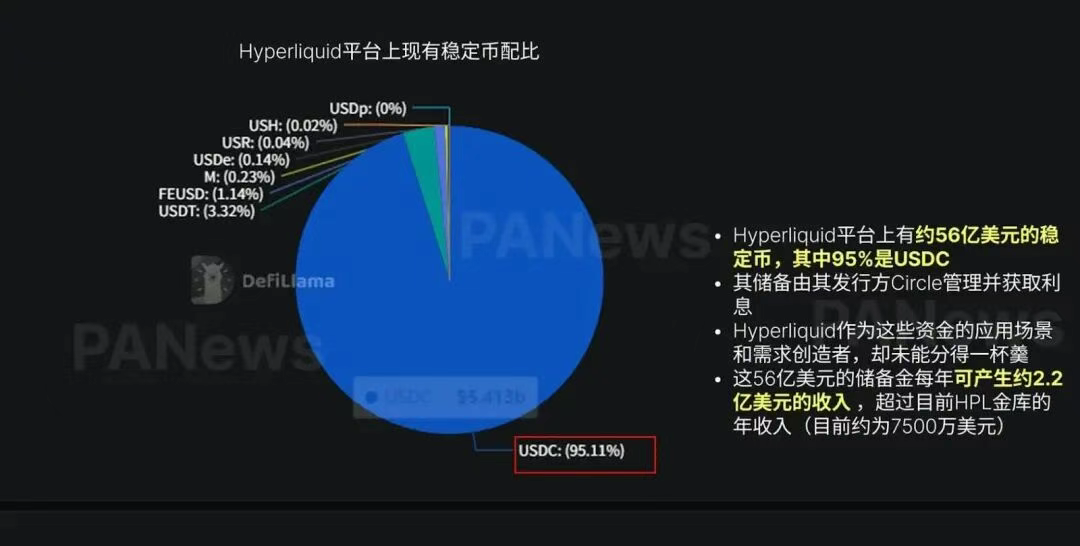

Hyperliquid’s motivation for launching USDH is straightforward: the platform currently holds approximately $5.6 billion in stablecoin assets, of which 95% is USDC. This reserve is custodied and earning interest for Circle, the issuer, while Hyperliquid—the application and demand generator—earns nothing. If this $5.6 billion could be replaced with USDH, generating returns at Treasury rates, it would yield over $220 million annually in interest—far exceeding the platform’s current HLP annual revenue (~$75 million). This new income would be used to buy back and distribute $HYPE, feeding back into the ecosystem.

▲ Source: PA News

Among the bid submissions, the proposal from Native Markets, a native Hyperliquid project, emerged victorious. Details available here: https://www.theblock.co/post/370570/native-markets-team-wins-hyperliquid-usdh-stablecoin-bid-eyes-test-phase-within-days

▲ Source: PA News

Beyond blockchains and stablecoins, the critical role of on/off ramps (fiat-to-crypto gateways) in user experience is equally evident. Whether users can seamlessly and affordably convert fiat to stablecoins or other crypto assets often determines whether an application achieves true mass adoption.

IOSG invested in Transak five years ago—a global leader in on/off ramp services. Transak provides seamless fiat onramp and offramp solutions for wallets, exchanges, and payment apps, supporting users in over 150 countries and regions. Recently, Transak raised $16 million in its latest round led by Tether (the parent company of USDT) and IDG. In addition to Transak, IOSG has also invested in Kravata, a Latin America-focused fiat/crypto on/off ramp offering B2B APIs to enterprise clients and B2B2C APIs integrable into third-party apps. As of Q2 2025, Kravata serves over 90 clients operating across three countries. These moves not only confirm long-term market confidence in the on/off ramp sector but also reaffirm IOSG’s early-stage ability to identify the foundational value of infrastructure.

As stablecoins and blockchain payments move toward mainstream adoption, infrastructure providers like Transak will become pivotal hubs—gateways for users entering the crypto world and bridges connecting stablecoins to the global payment system.

Sectors with PMF

Once payment infrastructure matures, cross-border payments will be the most direct and obvious breakthrough. Global cross-border capital flows exceed $150 trillion annually, yet the current system typically takes 3 days and charges ~3% in fees, involving multiple intermediaries. Using efficient stablecoin “rails,” the same process could take just 3 seconds, cost as little as 0.01%, and enable peer-to-peer direct settlement. The efficiency gap is so vast that adoption seems inevitable.

B2B enterprise cross-border payments represent a perfect product-market fit (PMF) in crypto today. Currently, 40% of all blockchain fees come from USDT transfers, and hundreds of millions of users in emerging markets use it daily to hedge against local currency depreciation and inflation. Setting aside infrastructure and speculative cycles, payments—especially B2B cross-border payments—are the area where crypto can most realistically complement SWIFT. The real winners may not be new chains or general-purpose stablecoin issuers, but orchestrators who hold licenses and possess distribution capabilities across key cross-border corridors.

This explains why Airwallex, a Web2 giant in enterprise cross-border transfers, recently felt tangible pressure from stablecoin-based payment firms, prompting defensive statements on Twitter—even as they publicly posted job listings seeking stablecoin developers.

A “Payment Orchestration Layer” integrates fiat and stablecoins, multiple payment methods, channels, and processors to deliver end-to-end payment/settlement solutions. It emphasizes “stablecoin compatibility”: supporting not only fiat collection/payment but also stablecoin collection, cross-border transfers, and conversion back to fiat.

Cross-border payments often follow a “fiat → stablecoin → fiat” path: local fiat converted to stablecoin → stablecoin used for international transfer/settlement → recipient converts back to local fiat. The payment orchestration layer optimizes this flow, reducing friction, saving time, and boosting efficiency.

While traditional giants like Airwallex and Stripe are actively building stablecoin payment capabilities, startups often have an edge in innovation and execution speed. For example, Align focuses on cross-border remittance needs for large multinationals, while ArrivalX targets payment scenarios for Chinese merchants expanding overseas. I believe the future will likely see region-centric solutions rather than a single global model—similar to the competitive landscape on the on/off ramp side.

Each region is heavily influenced by local regulations, laws, and banking/financial infrastructure. Against the backdrop of rapid stablecoin payment growth, small and mid-sized startups that nail the “local + regional + orchestration layer” positioning still have ample room to grow within specific payment corridors. Key advantages extend beyond licenses to delivering stablecoin-fiat two-way circulation and highly compatible payment/settlement services—a crucial differentiator—where compliance and risk management will determine long-term success.

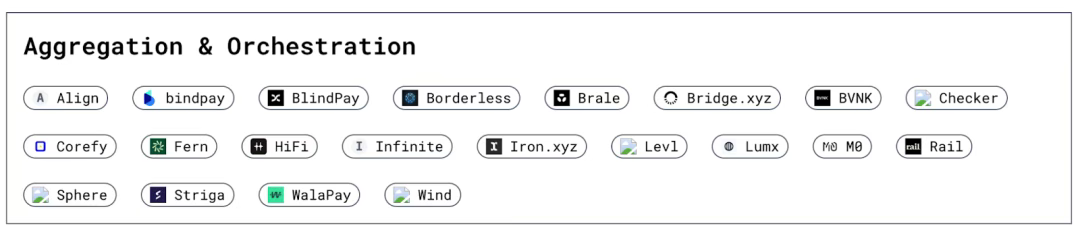

▲ Source: ASXN

https://stablecoins.asxn.xyz/payments-market-map

Additionally, in many market analyses on payments, Aggregation and Orchestration are grouped into the same quadrant. However, we believe there’s a meaningful difference in B2B transaction value capture between aggregation and orchestration layers. Aggregation layers, lacking licenses, can be seen as wrappers (or packaging layers) atop orchestration layers. Despite access to more regional platforms, their pricing power is constrained by revenue-sharing models—resembling Circle’s business model: the larger the scale, the harder it becomes to maintain high margins.

Beyond serving as backend infrastructure for B2B aggregation, these orchestrators also support application-layer use cases across both To C and To B segments.

To C applications primarily include P2P payment apps like Sling, neobanks offering yield-generating opportunities for stablecoin holders such as infini and Yuzu.Money, and stablecoin cards addressing real-world usability challenges for stablecoin consumers.

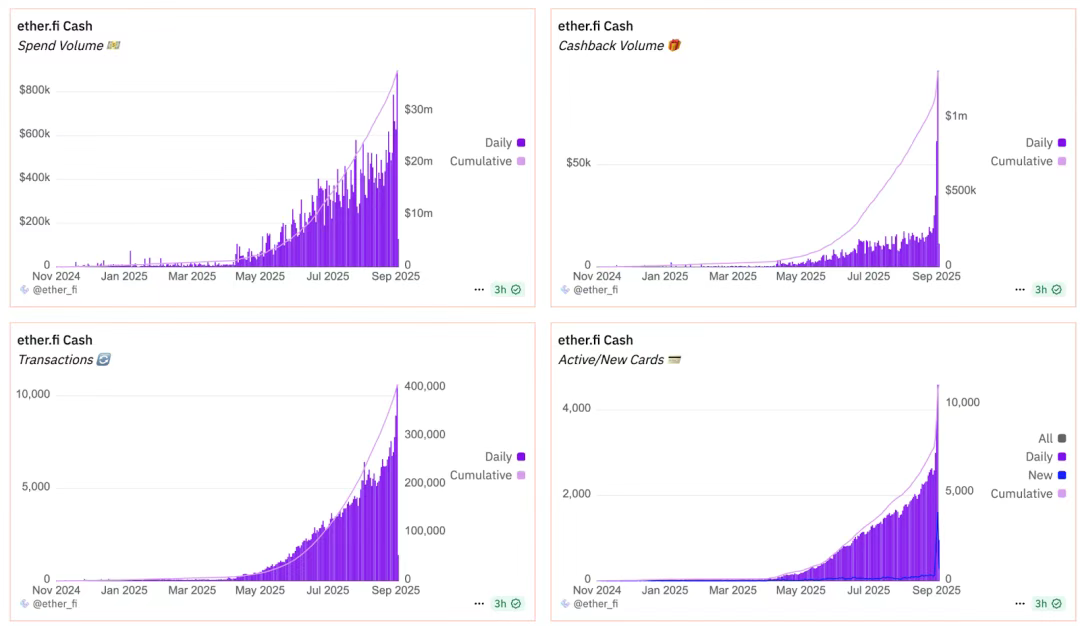

IOSG has already made strategic investments in To C applications, including Ether.fi. A yield-generating super app whose card transaction volume, cashback amounts, transaction count, and number of issued cards all reached record highs in September.

▲ Source: Ether.fi Dune Dashboard

On-chain capital clearly chases yield: approximately 45% of DeFi TVL (~$56 billion) is yield-seeking, concentrated in protocols like Aave, Morpho, and Spark. The market cap of yield-bearing stablecoins has surged from $1.5 billion to $11 billion, now representing 4–4.5% of the total stablecoin market ($255 billion). Projects centered on DeFi yield continue to attract attention, including Ethena, Pendle, Aave, Spark, Syrup, and others.

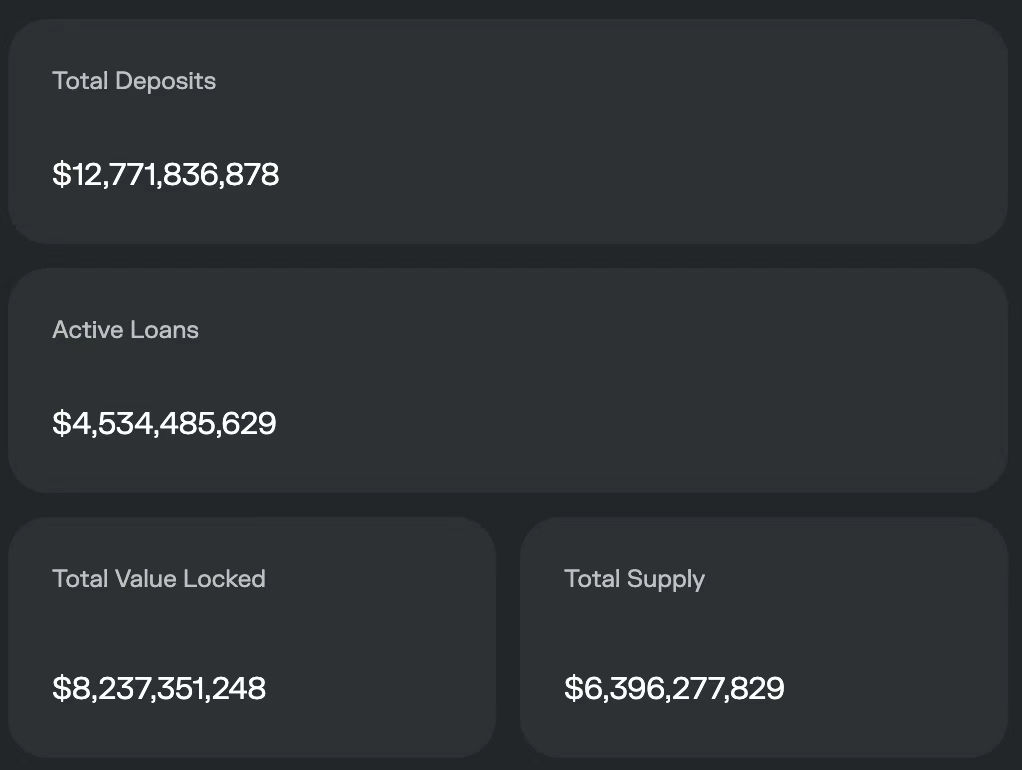

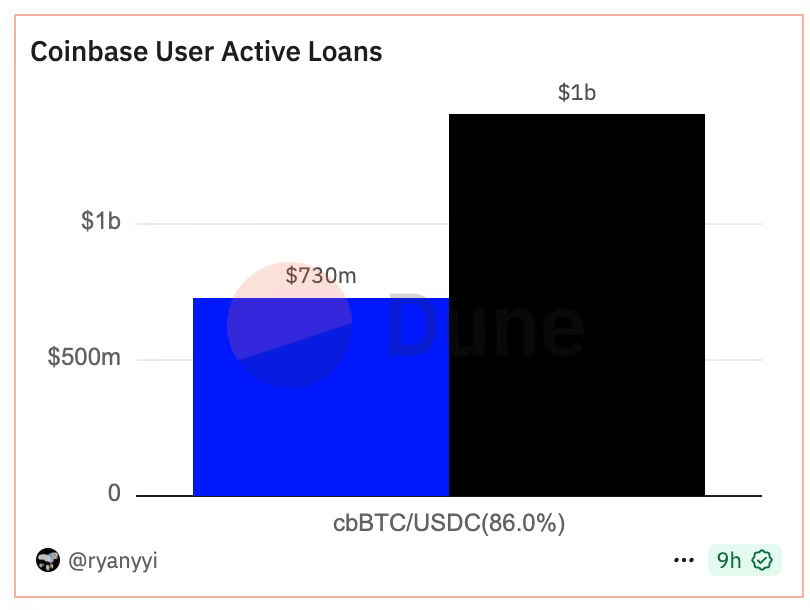

As the number of DeFi protocols grows, operational complexity increases, degrading user experience. To address this pain point, Coinbase has integrated Morpho directly into its exchange and launched Coinbase Onchain Borrow, a lending product blending CeFi and DeFi. Users simply complete collateralization and borrowing with one click in the frontend, powered behind the scenes by Coinbase Smart Wallet, which fully abstracts wallet creation and interaction with Morpho, dramatically simplifying the experience. Coinbase Onchain Borrow has provided Morpho with $1.4 billion in deposits and $730 million in active loans, accounting for 11% and 16% of Morpho’s totals respectively. This helped push Morpho’s total deposits to $12.7 billion and active loans to $4.5 billion.

▲ Source: https://app.morpho.org/ethereum/explore https://dune.com/ryanyyi/coinbase-onchain-loans

Based on the same investment thesis of simplifying on-chain user experience, we invested early in Ether.fi. Starting with ETH staking yields, it has expanded into complex third-party vault strategies, significantly lowering the barrier for stablecoin users to engage with DeFi, enabling effortless yield generation—and even launching a DeFi credit card allowing users to repay loans with future interest earnings, realizing true “Buy Now, Pay Never.”

The immense potential of stablecoin digital banks and stablecoin credit cards lies in bringing credit issuance directly on-chain, fundamentally weakening—or even replacing—the intermediary role of traditional banks. In the traditional model, banks earn core profits from the spread between deposits and loans, forming the basis of the entire system. But this model grants banks excessive “gatekeeping power”: excluding unbanked populations unable to enter the deposit system, and denying loans or credit cards to individuals and businesses that don’t meet lending criteria.

In contrast, the stablecoin system completely reshapes this logic. Leveraging blockchain programmability, atomic settlement, and immutability, lenders and borrowers can interact directly on-chain, bypassing traditional bank eligibility standards, thus rewriting participation in payments and credit. Stablecoin neobanks encapsulate stablecoins, cryptocurrencies, and DeFi lending protocols, combining trustless over-collateralization models to build nearly risk-free lending products atop lending pools. This can manifest as innovative lending banks like Coinbase Onchain Borrow or as stablecoin credit cards like Ether.fi.

In the To B commercial space, we’re also seeing new opportunities—for example, helping online and offline merchants accept stablecoin payments directly, bypassing interchange fees from acquiring banks. Additionally, streamlined invoicing and global payout platforms for enterprise clients hold significant growth potential. However, especially for products emphasizing enterprise user experience, they may face increasing competition as payment orchestration layers undergo vertical integration.

New AI-Driven On-Chain Payment Paradigms

Looking ahead, another intriguing potential domain within To B applications is AI Agents as customers of payment apps. With the emergence of automated AI agents for trading and yield farming—such as Theoriq, Giza, and Almanak—we can expect to see more fully autonomous AI agents constantly searching 24/7 for new yield opportunities. These automated AI agents will need wallets to purchase data, compute power, or even human services.

The evolution of AI Agents requires new on-chain infrastructure—an emerging investment opportunity. Traditional payment systems are too slow, have high chargeback rates, and rely heavily on manual processes—unsuitable for autonomous agents. To address this, Google launched the AP2 protocol and partnered with Coinbase to release A2A x402. If MCP is the “arm,” A2A the “language,” then AP2 and x402 represent the “last mile” of AI automation—autonomous payment and value exchange.

AP2 aims to make AI trustworthy, controllable, and auditable in financial transactions. It doesn't aim to replace Visa or Mastercard but to build a universal trust layer atop them. Through authorization mechanisms based on Verifiable Credentials, AI can hold cryptographically signed digital mandates, ensuring secure and auditable transactions.

Its Mandates system has two modes:

-

Real-time authorization: After finding an item, the AI must request immediate user approval.

-

Delegated authorization: Users can pre-define complex conditions (e.g., “hotels under $200”), allowing the AI to execute automatically when triggered.

All transactions generate immutable audit trails, secured by Verifiable Credentials to prevent “black-box” payments. Google’s strategy is clear: collaborate with financial and crypto leaders to define “trust” rules—not issuing currencies or clearing payments directly.

Most notably, A2A x402 is Google’s extension specifically designed for crypto payments, developed in deep collaboration with Coinbase and the Ethereum Foundation, enabling AI to seamlessly handle stablecoins, ETH, and other on-chain assets, supporting Web3-native payments. In a way, Google’s AP2 seeks to integrate AI into the existing financial system, while Coinbase and the Ethereum Foundation’s A2A x402 extension aims to build a crypto-native economic environment for AI.

Google’s A2A standard allows AI agents from different projects to interoperate—but only within a “trusted environment.” To enable this, the Ethereum Foundation introduced ERC-8004, adding a trust layer akin to a digital passport system, allowing agents to securely discover, verify, and interact with unknown counterparties on Ethereum or other L2s.

The name x402 derives from the HTTP status code “402 Payment Required.” Its vision is to embed payments into internet communications: when an AI calls an API, the server responds with a “402 invoice,” and the AI can instantly pay in stablecoins on-chain to access the service. This not only enables machine-to-machine automation and high-frequency transactions but also allows AI services to be billed precisely per request, duration, or compute usage—something traditional payments struggle to achieve.

▲ Source: Google

Onchain Agentic Commerce is accelerating under the dual innovations of stablecoin payments and AI Agents. Today, emerging companies like Skyfire and Crossmint are already abstracting AP2 and x402 standards into SDKs and APIs for easy developer integration. ChaosChain has already completed a prototype combining AP2 with Ethereum’s latest ERC-8004 “trustless agent” standard—just the beginning. The dAI team at Ethereum, led by Davide Crapis, is driving this forward. As foundational infrastructure for future AI agent collaboration, Ethereum could help transition us from today’s highly centralized AI systems to a censorship-resistant, truly decentralized future. From payment rails and stablecoin settlements to AI-driven value innovation, this convergence will give rise to even more compelling SuperApps.

References:

-

Designing the Ultimate Stablecoin Credit Card - Doğan Alpaslan, Cyber Fund (https://cyber.fund/content/stablecoincreditcard)

-

Stablecoin On-Chain Payments: Clearing Web2 Thinking – Zuoye (https://x.com/zuoyeweb3/status/1969367029011644804)

-

The Final Battle for AI Payments: Google, Coinbase, and Stripe’s Three-Body Game - Luke, Marsbit (https://news.marsbit.co/20250919092805091063.html?utm_source=substack&utm_medium=email)

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News