Stablecoin on-chain payments, clearing Web2 mindset

TechFlow Selected TechFlow Selected

Stablecoin on-chain payments, clearing Web2 mindset

Humans don't need banks, payments don't need humans

In 2008, under the shadow of the financial crisis, Bitcoin gained its first batch of ordinary users disillusioned with the fiat system, stepping out from the niche cypherpunk community.

At the same time, the term FinTech (financial technology) also began to grow in popularity from 2008—almost concurrent with Bitcoin—which might be coincidental.

Even more coincidentally, in 2013, Bitcoin’s first bull market arrived as prices broke $1,000, while FinTech started going mainstream. Then-high-flying firms like Wirecard and P2P lending later collapsed, Yu’ebao defined the yield system of the internet era, and Twitter co-founder Jack Dorsey’s payment venture Square reached a valuation exceeding $6 billion.

This wasn’t artificially created. Since 1971, gold prices and U.S. debt growth rates have nearly moved in sync—8.8% vs. 8.7%. After the gold-backed dollar came the petrodollar; will the new energy dollar be stablecoins?

From a regulatory perspective, FinTech is seen as the salvation of banking—a reimagining or supplementing of the financial system through internet thinking, aiming to rebuild an internet-native financial ecosystem amid complex political and commercial ties.

Payment systems became the global consensus starting point. Acquiring, aggregation, P2P, cross-border settlement, and micro-lending—crossing borders and blending industries—created endless prosperity or crises.

Ironically, it was unintentional: what truly transformed banks and the traditional financial system behind them was blockchain practice, moving from the margins to the mainstream—all happening outside regulatory oversight.

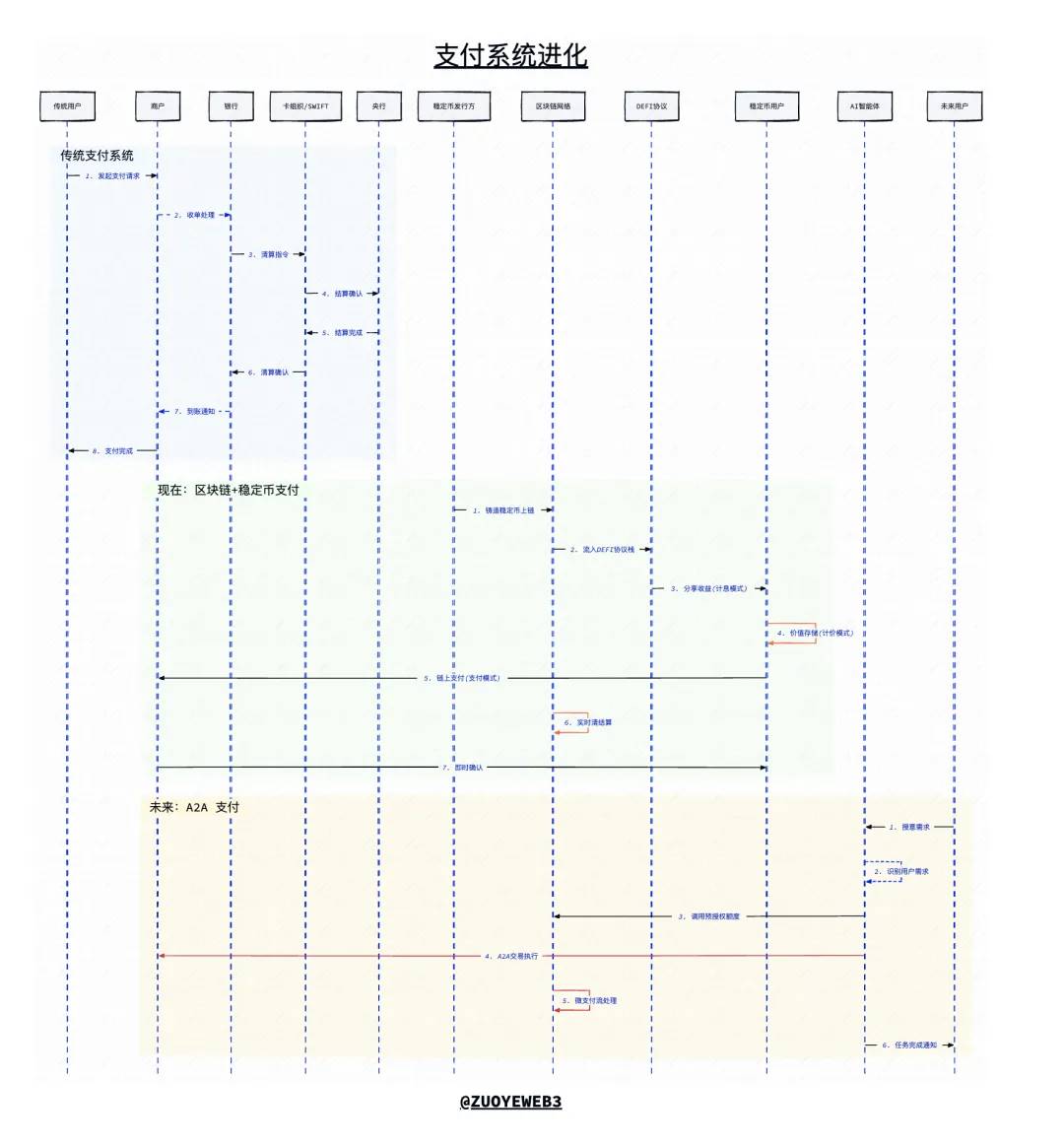

Image caption: Evolution of payment systems

Image source: @zuoyeweb3

Payments rooted in code, not finance

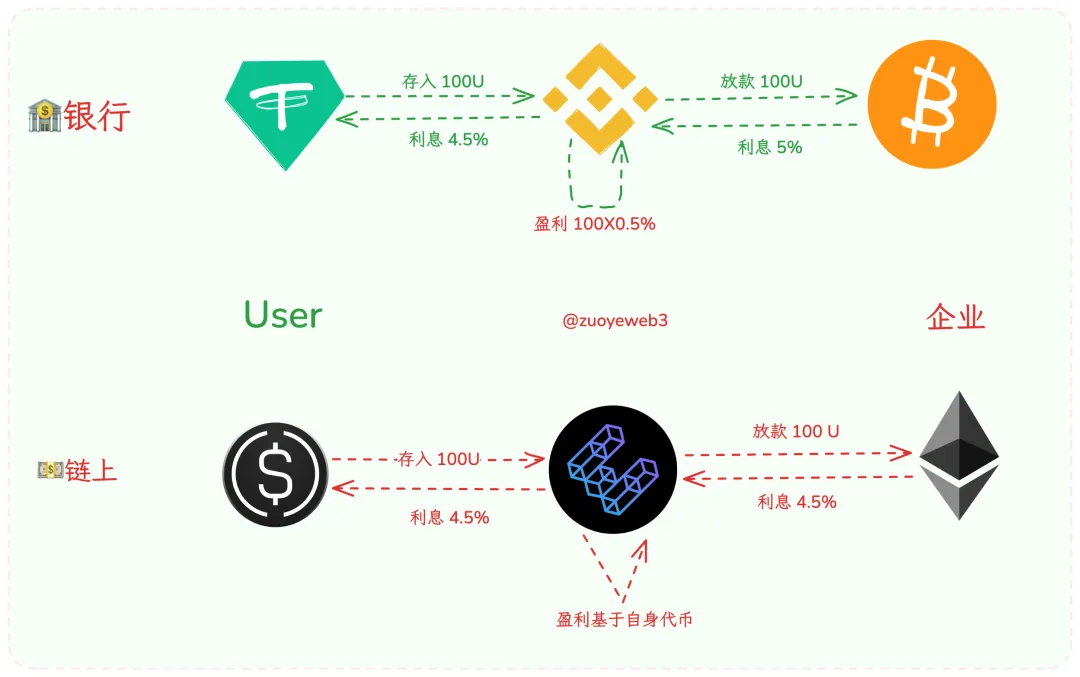

Yield-bearing stablecoins are considered mature when USDT-based dividends become standard.

For centuries, payments have operated around the banking system. All electronic, digital, or internet-based upgrades served only to reinforce banking infrastructure—until the emergence of blockchain.

Blockchain, especially stablecoins, has inverted this world—reversing the order of payment, clearing, and settlement. Only after confirming that clearing and settlement can occur is the payment finalized.

In traditional banking, payment is essentially a two-part process: front-end transfers and back-end clearing, with banks at the absolute center.

Under the FinTech mindset, payment becomes aggregation and B2B service. Internet customer acquisition demands capturing every possible transaction flow, where traffic determines a FinTech firm’s leverage against banks. Fake it till you make it—the formation of network alliances and reserve funds are accepted outcomes.

Under the blockchain mindset, stablecoin systems like USDT, with Tron as the earliest stablecoin L1 and Ethereum serving as a large-scale clearing and settlement layer, have achieved the "programmability" that the internet was supposed to deliver.

The lack of interconnectivity among platforms reflects territorial competition, but the core issue is insufficient dollar digitization. Going online remains merely a supplement to the fiat system, whereas stablecoins are native assets on blockchain—any USDT on any public chain can be exchanged, with friction costs determined solely by liquidity.

Thus, based on blockchain's characteristics, payment confirmation only occurs after verifying that clearing and settlement are possible. Gas fees are determined by market mechanisms, and once confirmed, value flows instantly.

A counterintuitive insight: stablecoin systems weren't born from unregulated arbitrage but from programmability-driven efficiency that overwhelmed traditional finance.

Important

Payment is an open system rooted in code, not finance.

We can illustrate this with a counterexample: traditional bank wire transfers are slow not just due to compliance or outdated network architecture, but fundamentally because banks have an incentive to "hold" funds—massive capital pools generate continuous returns. User time becomes passive compound interest for banks.

From this perspective, even after Genius Act, banks continue fiercely resisting yield systems entering their domain. The stated reason remains yield—paying interest to users would distort deposit-loan mechanisms, potentially triggering systemic financial crises.

The on-chain programmability of yield systems will ultimately replace banking itself—not create more problems than banking—because it forms an open system.

Traditional banks profit from the interest rate spread between user deposits and loans to businesses or individuals. This spread is the foundation of all banking operations.

The spread mechanism gives banks dual power to select users—creating unbanked populations on one side and excluding non-"standard" enterprises on the other.

Ultimately, losses caused by banks—such as triangular debt or financial crises—are borne by ordinary users. In a sense, USDT operates similarly: users bear the risk of USDT, while Tether captures the issuance yield.

Ethena and other YBS (yield-bearing stablecoins) neither rely on the dollar for issuance nor operate within traditional banking spreads. Instead, they run entirely on on-chain infrastructures like Aave and public chains like TON for payment experimentation.

Now, yield-bearing stablecoin systems are building a globally liquid framework for payment, interest accrual, and pricing—making banks the target of transformation, not by altering how they participate in payments, but by dismantling their intermediary role in credit creation.

Facing the offensive of yield-bearing stablecoins, small banks are hit first. Minnesota Credit Union has already attempted issuing its own stablecoin, and former Neo Banks are rapidly going on-chain—Nubank, for example, is revisiting stablecoins.

Even SuperForm is transforming itself into a stablecoin banking system, allowing users to share in the yields generated by banks—correcting the distorted banking model.

Image caption: YBS impact on banking

Image source: @zuoyeweb3

In short, yield-bearing stablecoins (YBS) are not customer acquisition tools but harbingers of banking reinvention. The migration of credit creation onto the blockchain is a deeper transformation than stablecoin payments.

FinTech did not replace banks—it improved areas banks were unwilling or unable to serve. But blockchain and stablecoins will redefine both banks and money.

Suppose YBS becomes the new dollar circulation system, where payment becomes synonymous with on-chain payment. Again, note: this is not merely digitizing dollars, nor equivalent to dollar internetization. On-chain dollars are the fiat system.

Currently, traditional payment systems view stablecoins only through clearing, settlement, and cross-border use—this is completely misguided thinking. Grant stablecoins freedom; stop embedding them into outdated, obsolete payment systems.

Blockchain naturally has no distinction between domestic/international, card/account, individual/business, or receivables/payables—everything is simply a natural extension or variant of transactions. Corporate accounts or private transfers on stablecoin L1s are merely programming adaptations, still adhering to core blockchain principles: atomicity, irreversibility, and immutability.

Existing payment systems remain closed or semi-closed: SWIFT excludes certain regions, Visa/Mastercard require specific hardware/software qualifications. Consider this analogy: banks exclude low-profit individuals (the unbanked), Square/PayPal reject certain customer groups, while blockchain accepts all.

Closed and semi-open systems will eventually yield to open systems—either Ethereum becomes the stablecoin L1, or the stablecoin L1 becomes the new Ethereum.

This isn’t regulatory arbitrage by blockchain, but a dimensional downgrade driven by efficiency gains. Closed systems cannot form self-sustaining loops—fees decay across stages as players compete for users, either leveraging monopolies for higher profits or using regulation to exclude competitors.

Under an open system, users have absolute control. Aave didn’t become the industry standard through monopoly, but because Fluid and Euler’s DEX and lending models haven’t fully emerged yet.

But regardless, on-chain banking won’t be tokenized bank deposits, but tokenized protocols rewriting the definition of banking.

Warning

Replacing banks and payment systems won’t happen overnight. PayPal, Stripe, and USDT were products of 20, 15, and 10 years ago, respectively.

Current stablecoin issuance stands around $260 billion—we’ll see $1 trillion within the next five years.

Web2 payments are non-renewable resources

Credit card fraud handling relies heavily on experience and manual intervention.

Web2 payments will fuel Web3 payments, eventually being fully replaced—not supplemented or coexisting.

Stripe’s move into the future via Tempo is the only correct choice. Any attempt to integrate stablecoin technology into existing payment stacks will be crushed by the flywheel—again, it’s about efficiency. On-chain YBS separates ownership and usage rights; off-chain stablecoins only offer usage rights. Capital naturally flows toward增值 tracks.

As stablecoins strip banking of its social status, they simultaneously dismantle Web2 payment paradigms.

Earlier mentioned: stablecoin issuance is gradually moving beyond mere imitation of USDT. While complete independence from the dollar and banking system remains distant, it’s no longer pure fantasy. From SVB to Lead Bank, there will always be banks willing to serve crypto businesses—a long-term journey.

By 2025, it’s not just banks embracing stablecoins. Major obstacles previously hindering blockchain payments are thawing—Bitcoin’s resonance has become the thunderous voice of stablecoins.

-

• On/off ramps: No longer demanding fiat finality. People are willing or prefer holding USDC/USDT for yield, direct spending, or inflation hedging. For example, MoneyGram partners with Crossmint for USDC remittances.

-

• Clearing & settlement: Visa completed $1 billion in stablecoin settlements, with Rain as its pilot unit—and Samsung investing in Rain. Legacy giants’ anxiety will become funding sources for stablecoin payments.

-

• Big banks: RWA or tokenized deposits are just appetizers. Competing with DeFi is not far off—evolution is traditional finance’s passive adaptation. Google AP2, GCUL, and other internet alliances represent old-era dominance struggling to accept defeat.

-

• Issuance: From Paxos to M0, traditional compliance and on-chain wrapped models advance together—but yield systems are now factored in. Though Paxos’ USDH failed, empowering users and tokens is a shared direction.

To summarize: the positioning race for stablecoin on-chain payments has ended. The relay race begins—how to scale stablecoin network effects globally.

In a way, USDT has already brought stablecoins to Africa, Asia, and Latin America. Geographic expansion offers no new room—only “use cases” remain. If current use cases adopt “+blockchain,”

Then we must seek new “blockchain+” or “stablecoin+” scenarios—a clever Web3 application of internet tactics. Buy traffic for growth, cultivate new behaviors. The future will define today’s history—Agentic Payment will surely arrive.

After transforming banking and payment systems, let’s delve into the future of agent-driven payments. Note: the following discussion completely ignores “+blockchain” or “+stablecoin”—considering such additions would be a waste of words. Future payment landscapes leave no space for existing giants.

Yield systems can incentivize end-user adoption, but new payment behaviors require supporting consumption scenarios. For instance, using cryptocurrency in Binance’s mini-programs makes perfect sense, but using bank cards in WeChat mini-programs feels odd.

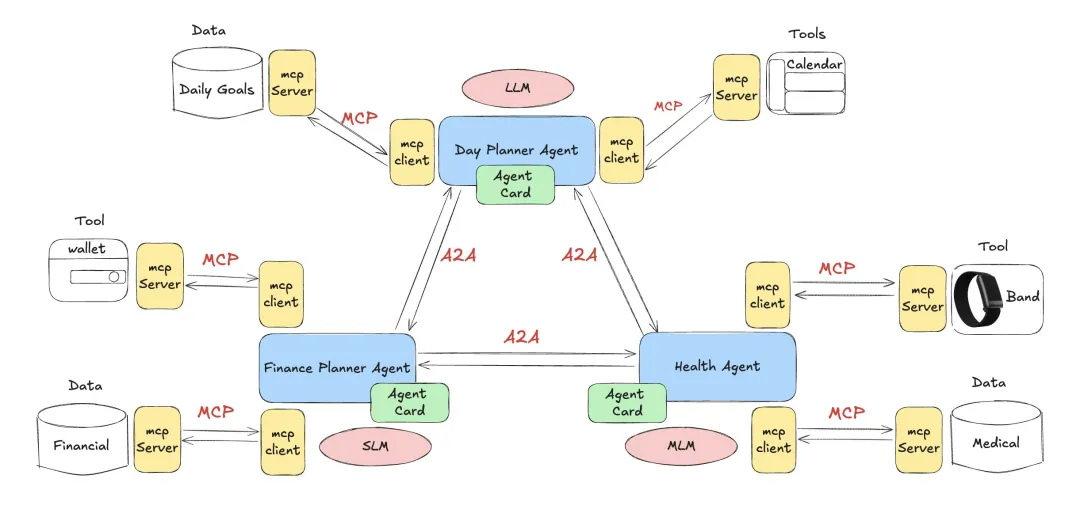

Truly new scenarios—in Google, Coinbase, or even Ethereum’s view—can only be A2A (Agent-to-Agent), requiring minimal human involvement. Web2 payments are non-renewable because payments will be everywhere in the future.

Briefly, people will have multiple Agents handling different tasks. MCP (Model Context Protocol) will allocate resources or call APIs within Agents, ultimately presenting matched Agents creating economic value.

Image caption: A2A and MCP connection

Image source: @DevSwayam

Human behavior will manifest more as intent rather than authorization—requiring surrender of multidimensional data so AI Agents can fulfill intrinsic needs.

Note

• Human value lies in authorization

• Machines operate tirelessly

Existing pre-authorizations, prepayments, buy-now-pay-later, acquiring/issuing, clearing/settlement will occur on-chain—but executed by Agents. Traditional credit card fraud requires manual review, but Agents will smartly detect malicious activity.

From the standpoint of current payment stacks and the “central bank–bank” hierarchy, these ideas may seem delusional. But don’t forget: China’s digital yuan’s “immediate payment and transfer” also originated from yield considerations, ultimately compromising with the banking system.

Not because they couldn’t, but because they couldn’t.

Google’s AP2 protocol, built with Coinbase, EigenCloud, and Sui, is already deeply integrated with Coinbase’s x402 gateway. Blockchain + stablecoins + internet is currently the optimal solution, targeting microtransactions. Real-world applications include real-time cloud usage and article paywalls.

How to put it—we can confidently say the future belongs to AI Agents, transcending clearing channels. But the exact path of how they transform humanity remains unknown.

DeFi still lacks a credit market—naturally suitable for enterprise development. Yet long-term, retail or individual markets relying on over-collateralization dominate—this is inherently abnormal.

Technological evolution never reveals its implementation path—only outlines basic definitions. This holds true for FinTech, DeFi, and Agentic Payment alike.

Caution

The irreversible nature of stablecoin payments may spawn new arbitrage models, whose risks we cannot yet imagine.

Moreover, existing distribution channels won’t be the core battleground for mass stablecoin adoption. High usage volume alone damages their potential yield from interacting with on-chain DeFi stacks—still akin to imagining emperors farming with golden hoes.

Only when stablecoin payments replace banks and existing distribution channels can we call it a true Web3 payment system.

Conclusion

The path I envision for a future non-bank payment system: yield + clearing & settlement + retail users (network effects) + Agent-driven streaming payments (after self-rescue beyond old giants).

Current disruptions still focus on FinTech and banking, rarely replacing central bank systems—not because it’s technologically impossible, but because the Federal Reserve still plays the role of lender of last resort (the scapegoat).

In the long run, distribution channels are intermediate steps. If stablecoins can replace bank deposits, no channel can lock liquidity. But with DeFi’s permissionless access and unrestricted users, could this trigger even fiercer financial crises?

The Soviet Union couldn’t eliminate black markets; the U.S. cannot ban Bitcoin. Whether floodwaters or promised shores, humanity has no turning back.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News