Cash Flow Valuation HyperLiquid: Could $HYPE's True Value Reach $385?

TechFlow Selected TechFlow Selected

Cash Flow Valuation HyperLiquid: Could $HYPE's True Value Reach $385?

93% of trading fees are directly returned to token holders, and cash flow valuation shows $HYPE is severely undervalued.

Author: G3ronimo

Translation: TechFlow

HyperLiquid has evolved into a mature crypto-native exchange, with the majority of its net fees programmatically distributed directly to token holders via the "Assistance Fund" (AF). This design makes $HYPE one of the few tokens that can be valued based on cash flows. To date, most valuations of HyperLiquid still rely on traditional multiple-based approaches, comparing it to established financial platforms like Coinbase and Robinhood using EBITDA or revenue multiples.

Unlike traditional corporate stocks—where management typically retains and reinvests earnings at their discretion—HyperLiquid systematically returns 93% of trading fees directly to token holders through the Assistance Fund. This model creates predictable and quantifiable cash flows, making it highly suitable for detailed discounted cash flow (DCF) analysis rather than static multiple comparisons.

Our approach first determines the cost of capital for $HYPE, then reverses the current market price to infer the future earnings implied by the market. Finally, we apply growth forecasts to these earnings streams and compare the resulting intrinsic value against today's market price, revealing a valuation gap between current pricing and fundamental worth.

Why Use Discounted Cash Flow (DCF) Instead of Multiples?

While other valuation methods compare HyperLiquid to Coinbase and Robinhood using EBITDA multiples, these approaches have key limitations:

-

Different Structures Between Corporations and Tokens: Coinbase and Robinhood are corporate equities whose capital allocation is guided by boards of directors, with profits retained and reinvested at management’s discretion. In contrast, HyperLiquid systematically returns 93% of trading fees directly to token holders via the Assistance Fund.

-

Direct Cash Flows: HyperLiquid’s design generates predictable cash flows, which are well-suited for DCF modeling rather than static multiple-based approaches.

-

Growth and Risk Characteristics: DCF allows explicit modeling of different growth scenarios and risk adjustments, whereas multiple-based methods may fail to fully capture dynamic growth and risk profiles.

Determining the Appropriate Discount Rate

To estimate our cost of equity, we begin with reference data from public markets and adjust for cryptocurrency-specific risks:

Cost of Equity (r) ≈ Risk-Free Rate + β × Market Risk Premium + Crypto/Illiquidity Premium

Beta Analysis

Based on regression analysis against the S&P 500 index:

-

Robinhood (HOOD): Beta of 2.5, implying a cost of equity of 15.6%;

-

Coinbase (COIN): Beta of 2.0, implying a cost of equity of 13.6%;

-

HyperLiquid (HYPE): Beta of 1.38, implying a cost of equity of 10.5%.

At first glance, $HYPE’s lower beta suggests a lower cost of equity than both Robinhood and Coinbase. However, R² values reveal an important limitation:

-

HOOD: The S&P 500 explains 50% of its returns;

-

COIN: The S&P 500 explains 34% of its returns;

-

HYPE: The S&P 500 explains only 5% of its returns.

The low R² for $HYPE indicates that traditional stock market factors are insufficient in explaining its price movements, necessitating consideration of crypto-native risk factors.

Risk Assessment

Despite $HYPE’s lower beta, we adjust its discount rate upward from 10.5% to 13%—conservative relative to COIN’s 13.6% and HOOD’s 15.6%—based on the following considerations:

-

Lower Governance Risk: The direct, programmable distribution of 93% of fees reduces concerns related to corporate governance. In contrast, COIN and HOOD do not return any earnings to shareholders, with capital allocation determined solely by management.

-

Higher Market Risk: $HYPE is a crypto-native asset exposed to additional regulatory and technological uncertainties.

-

Liquidity Considerations: Token markets are generally less liquid than mature equity markets.

Deriving Market-Implied Price (MIP)

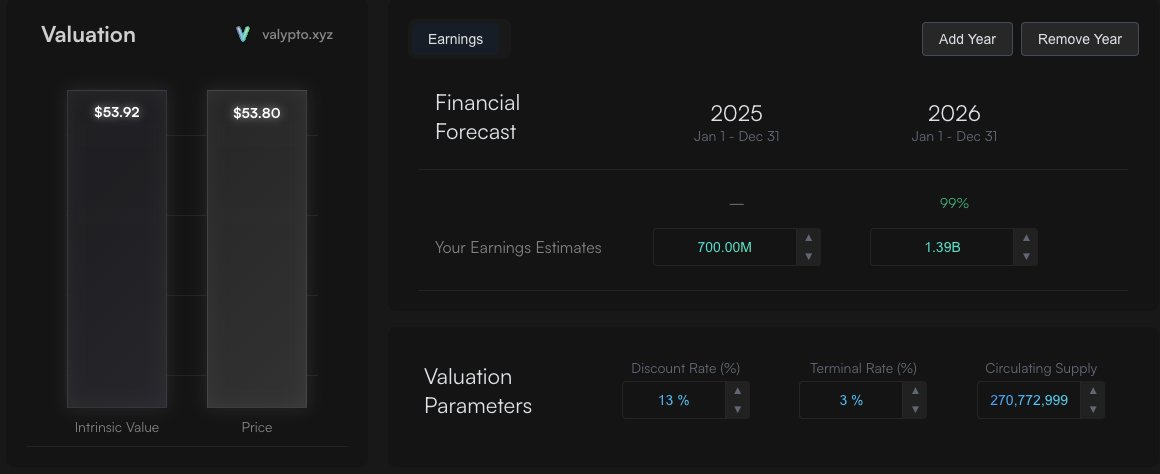

Using our assumed 13% discount rate, we reverse-engineer the earnings expectations implied by the market at the current $HYPE token price of approximately $54:

Current Market Expectations:

-

2025: Total earnings of $700 million

-

2026: Total earnings of $1.4 billion

-

Terminal Growth: Ongoing annual growth of 3% thereafter

These assumptions yield an intrinsic value of approximately $54, aligning with the current market price. This suggests the market is pricing in modest growth based on current fee levels.

At this point, we must ask: Does the Market-Implied Price (MIP) reflect future cash flows?

Alternative Growth Scenarios

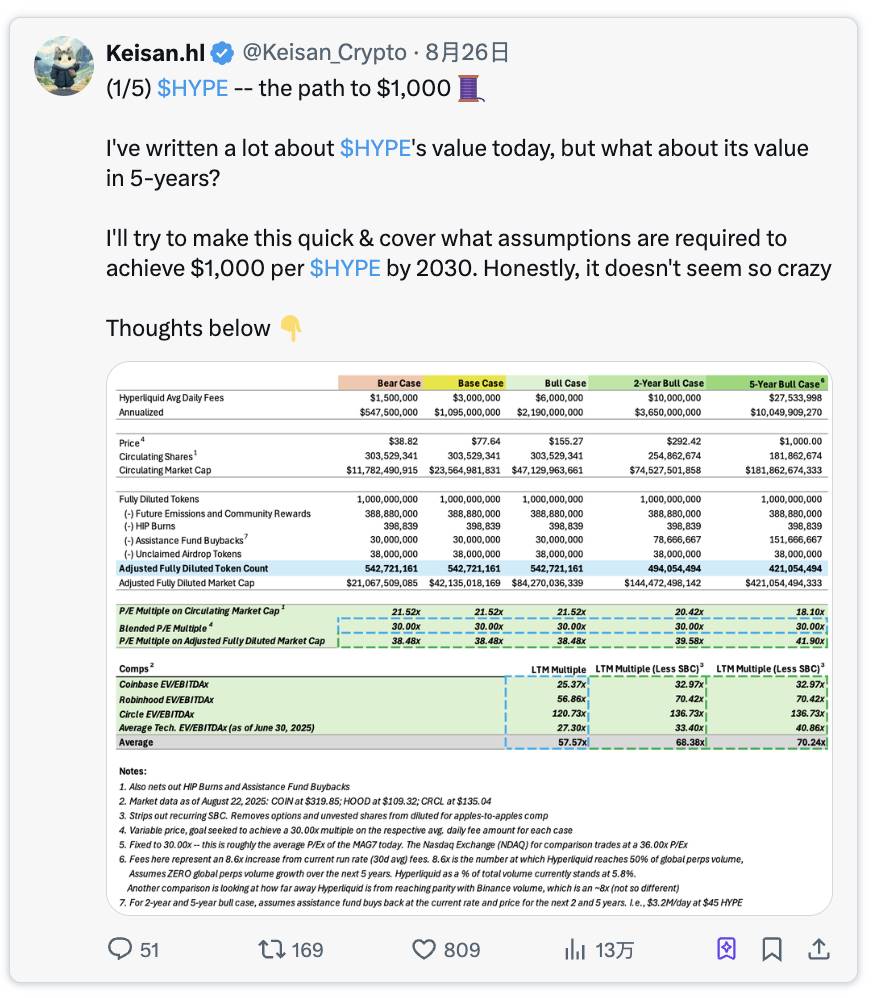

@Keisan_Crypto proposed compelling two-year and five-year bull case scenarios.

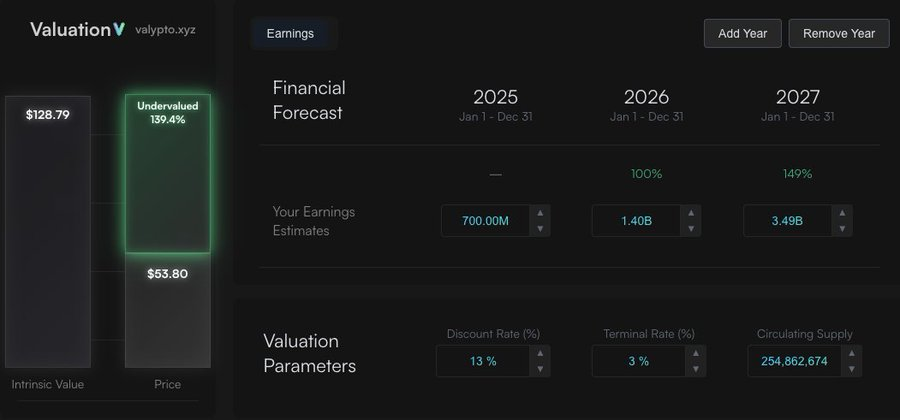

Two-Year Bull Case Forecast

According to @Keisan_Crypto's analysis, if HyperLiquid achieves the following targets:

-

Annualized Fees: $3.6 billion

-

Assistance Fund Earnings: $3.35 billion (93% of fees)

Result: HYPE’s intrinsic value reaches $128 (implying a 140% undervaluation at current prices)

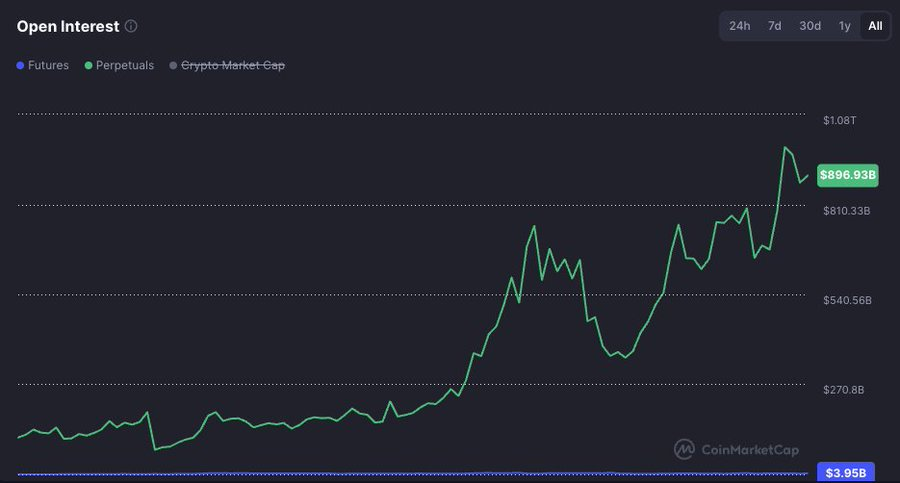

Five-Year Bull Case Scenario

In the five-year bull case (related link), he forecasts annual fees reaching $10 billion, with $9.3 billion flowing to $HYPE. He assumes HyperLiquid’s global market share will grow from the current 5% to 50% by 2030. Even without reaching 50% market share, these figures could still be achievable via smaller market shares if overall trading volume continues to expand.

Five-Year Bull Case Forecast

-

Annualized Fees: $10 billion

-

Assistance Fund Earnings: $9.3 billion

Result: HYPE’s intrinsic value reaches $385 (implying a 600% undervaluation at current prices)

Although this valuation falls short of Keisan’s $1,000 target, the difference arises because we assume earnings growth normalizes to 3% annually beyond the forecast period, while Keisan’s model uses cash flow multiples. We believe projecting long-term value using multiples is problematic, as market multiples are volatile and can shift significantly over time. Moreover, multiples inherently embed growth assumptions, and applying the same cash flow multiple beyond year five implicitly assumes growth rates post-2030 match those of 2026–2027. Therefore, multiples are better suited for short-term asset pricing. Nevertheless, regardless of the model used, $HYPE remains undervalued—the difference is merely a matter of nuance.

Additional Value Driver: USDH

Under the Native Market model, USDH will allocate 50% of stablecoin revenues to buybacks similar to the Assistance Fund. As such, $HYPE could gain an additional $100 million in free cash flow annually (50% of $200 million).

Looking ahead five years, if USDH’s market cap reaches $25 billion (currently just one-third of USDC and an even smaller fraction of the projected stablecoin market size by 2030), its annual revenue could reach $1 billion. With the same 50% distribution mechanism, this would add $500 million in annual free cash flow to the Assistance Fund, pushing per-token value above $400.

Excluded Value Drivers: HIP-3 and HyperEVM

This DCF analysis intentionally excludes two significant potential value drivers that are unsuitable for cash flow modeling. Clearly, they would provide additional incremental value and can be assessed separately using alternative valuation methods, then added to the results of this analysis.

Conclusion

Our DCF analysis indicates that $HYPE tokens are significantly undervalued if HyperLiquid maintains its growth trajectory and market position. The token’s unique feature of programmable fee distribution makes it particularly suitable for cash-flow-based valuation methodologies.

Methodological Note

This analysis builds upon research by @Keisan_Crypto and @GLC_Research.

The DCF model is open-source and can be modified via the following link:

https://valypto.xyz/project/hyperliquid/oNQraQIg

Market data and forecasts may change and should be updated with the latest information.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News